false000086041300008604132024-01-302024-01-30

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington D.C. 20549

------------------------------

FORM 8-K

------------------------------

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (date of earliest event reported): January 30, 2024

------------------------------

FIRST INTERSTATE BANCSYSTEM, INC.

(Exact name of registrant as specified in its charter)

------------------------------

| | | | | | | | | | | | | | |

| | | | |

| Delaware | 001-34653 | | 81-0331430 |

(State or other jurisdiction of

incorporation or organization) | (Commission

File No.) | | (IRS Employer

Identification No.) |

| | | | |

401 North 31st Street | | | |

Billings, | MT | | | 59101 |

| (Address of principal executive offices) | | | (zip code) |

| | | | | | | | | | | | | | |

| (406) | 255-5311 | |

| (Registrant’s telephone number, including area code) |

| | | | |

| Not Applicable | |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2. below):

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a- 12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

* * * * *

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of exchange on which registered |

| Common stock, $0.00001 par value | FIBK | NASDAQ |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

* * * * *

Item 2.02 Results of Operations and Financial Condition.

On January 30, 2024, First Interstate BancSystem, Inc. (the “Company”) issued a press release regarding its financial results for the quarter ended December 31, 2023. A copy of the press release is furnished herewith as Exhibit 99.1 and is incorporated by reference herein. Neither the information included or incorporated by reference under this Item 2.02, nor the press release furnished herewith, shall be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934 (the “Exchange Act”) or incorporated by reference into any registration statement or other document filed pursuant to the Securities Act of 1933 (the “Securities Act”) or the Exchange Act, except as expressly set forth by specific reference in such filing.

Item 7.01 Regulation FD Disclosure.

On January 30, 2024, the Company posted a new corporate presentation (the “Presentation”) on the News and Events page of the Company’s website at https://www.fibk.com. The Presentation, which is furnished with this Current Report as Exhibit 99.2 and incorporated herein by reference, updates previously furnished presentations and provides an overview of the Company and its operations. Neither the information included or incorporated by reference under this Item 7.01, nor the Presentation furnished herewith, shall be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act or incorporated by reference into any filing under the Securities Act or the Exchange Act, except as expressly set forth by specific reference in such a filing.

Item 8.01 Other Events.

On January 30, 2024, the Company also announced that the Board of Directors of the Company declared, on January 26, 2024, a dividend of $0.47 per share, that is payable February 19, 2024 to shareholders of record of the Company as of February 9, 2024.

Item 9.01 Financial Statements and Exhibits.

| | | | | | | | | | | |

| (d) | Exhibit Number | | Description |

| | | |

| | | Press Release dated January 30, 2024. |

| | | |

| | | Presentation |

| | | |

| 104 | | Cover Page Interactive Data File (embedded within Inline XBRL document). |

| | | |

SIGNATURES

Pursuant to the requirements of the Securities and Exchange Act of 1934, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: January 30, 2024

| | | | | | | | |

| | |

| FIRST INTERSTATE BANCSYSTEM, INC. |

| | |

| By: | /s/ KEVIN P. RILEY |

| | Kevin P. Riley |

| | President and Chief Executive Officer |

Exhibit 99.1

For Immediate Release

First Interstate BancSystem, Inc. Reports Fourth Quarter Earnings

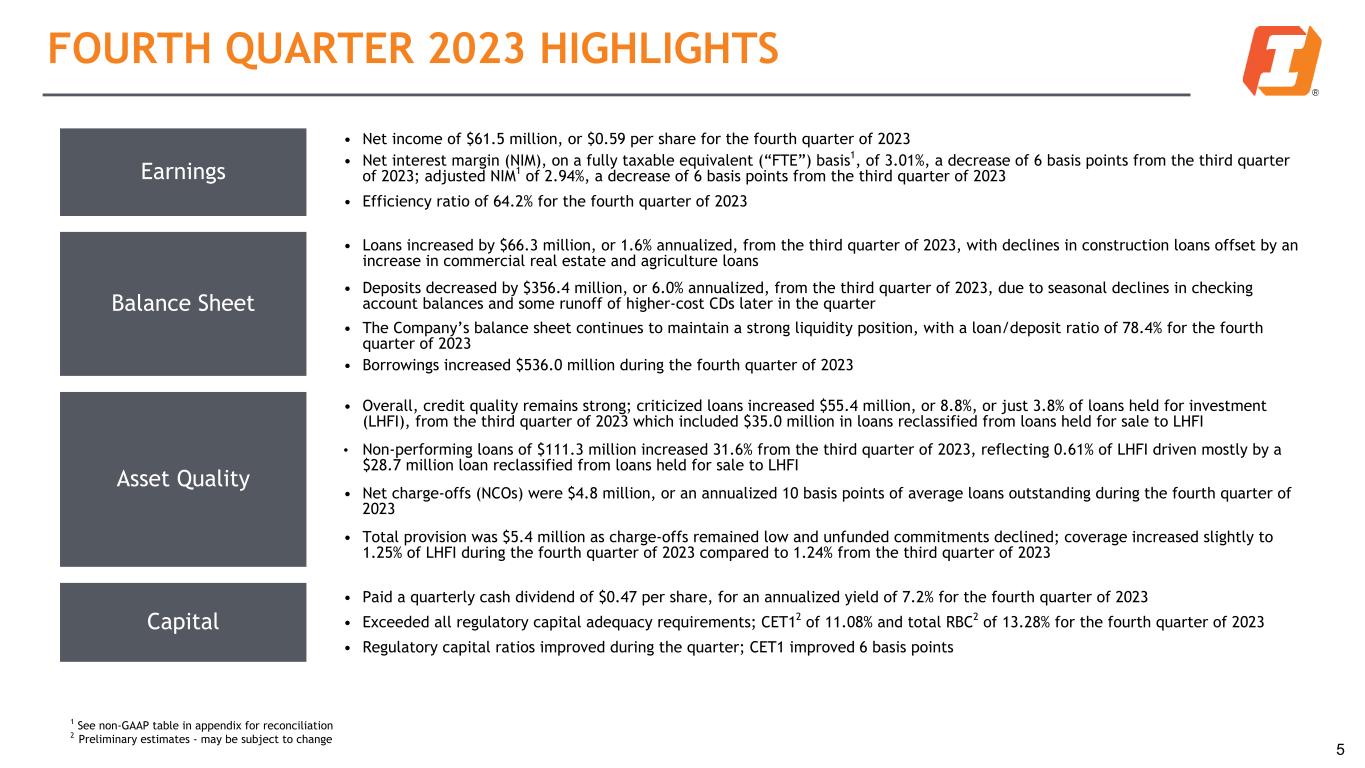

Billings, MT - January 30, 2024 - First Interstate BancSystem, Inc. (NASDAQ: FIBK) (the “Company”) today reported financial results for the fourth quarter of 2023. For the quarter, the Company reported net income of $61.5 million, or $0.59 per share, which compares to net income of $72.7 million, or $0.70 per share, for the third quarter of 2023, and net income of $85.8 million, or $0.82 per share, for the fourth quarter of 2022. Results in the fourth quarter of 2022 include pre-tax acquisition costs of $3.9 million, which reduced earnings by $0.03 per share.

For the year ending December 31, 2023, the Company reported net income of $257.5 million, or $2.48 per share, compared to $202.2 million, or $1.96 per share, in 2022. Results in the 2022 period include pre-tax acquisition costs related to the Great Western acquisition of $118.9 million, which reduced earnings by $0.90 per share.

HIGHLIGHTS

•Net income of $61.5 million, or $0.59 per share, for the fourth quarter of 2023, compared to net income of $72.7 million, or $0.70 per share, for the third quarter of 2023. The fourth quarter of 2023 includes a $10.5 million pre-tax accrual for the FDIC special assessment.

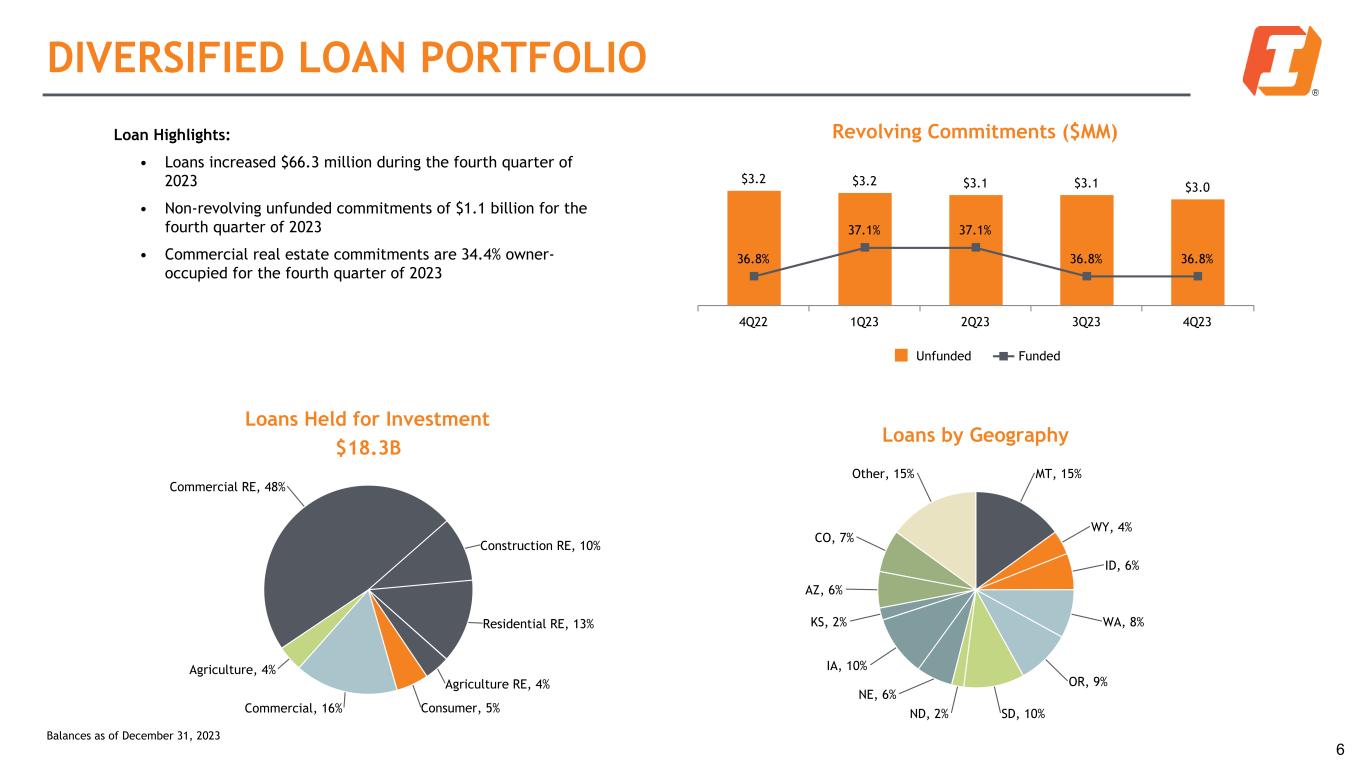

•Loans held for investment increased $66.3 million at December 31, 2023, compared to September 30, 2023 and increased $180.4 million, compared to December 31, 2022.

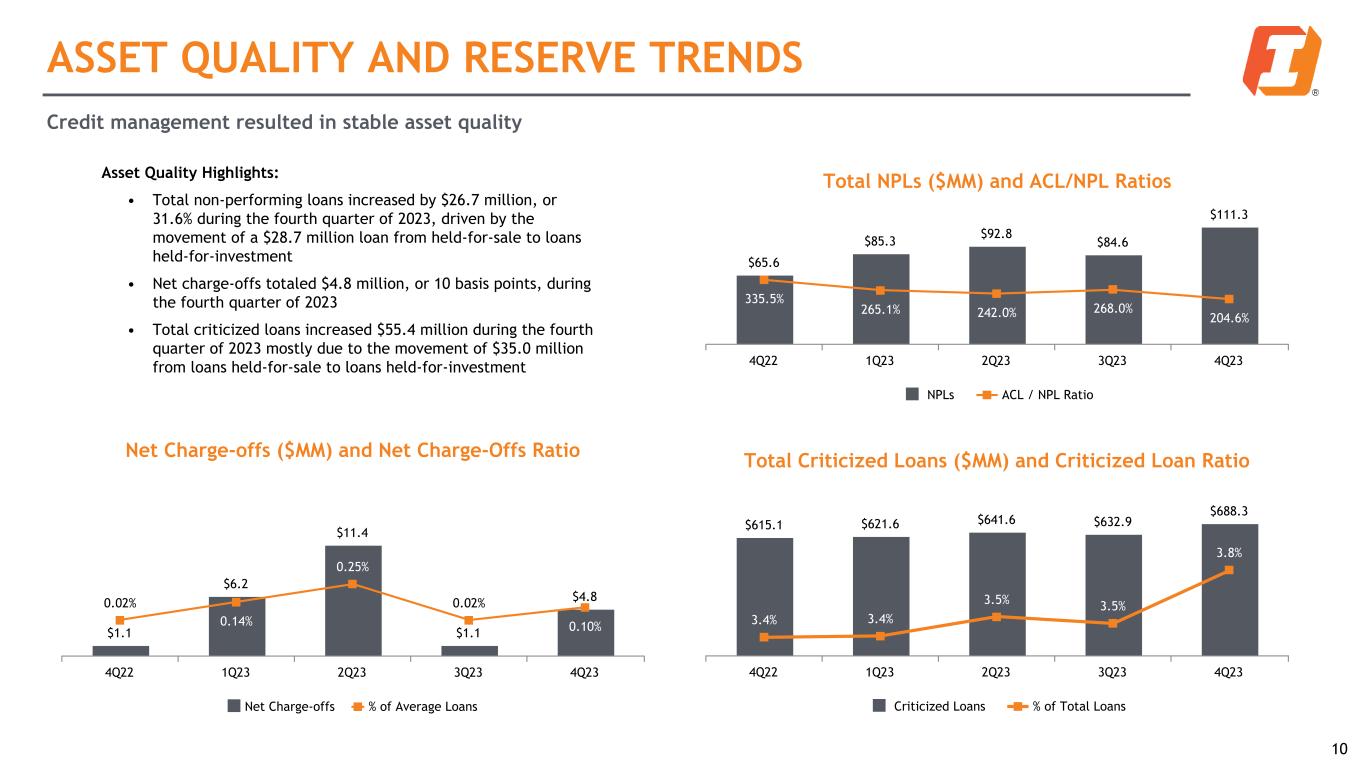

•Non-performing assets increased $31.6 million at December 31, 2023, compared to September 30, 2023 and increased $49.5 million, compared to December 31, 2022. The increase is primarily due to a $28.7 million loan transferred from loans held for sale to loans held for investment and the transfer of a loan held for sale of $5.8 million into OREO in the fourth quarter of 2023.

•Net interest margin decreased to 2.99% for the fourth quarter of 2023, a 6 basis point decrease from the third quarter of 2023. Net interest margin, on a fully taxable equivalent (“FTE”) basis,1 decreased to 3.01% for the fourth quarter of 2023, a 6 basis point decrease from the third quarter of 2023.

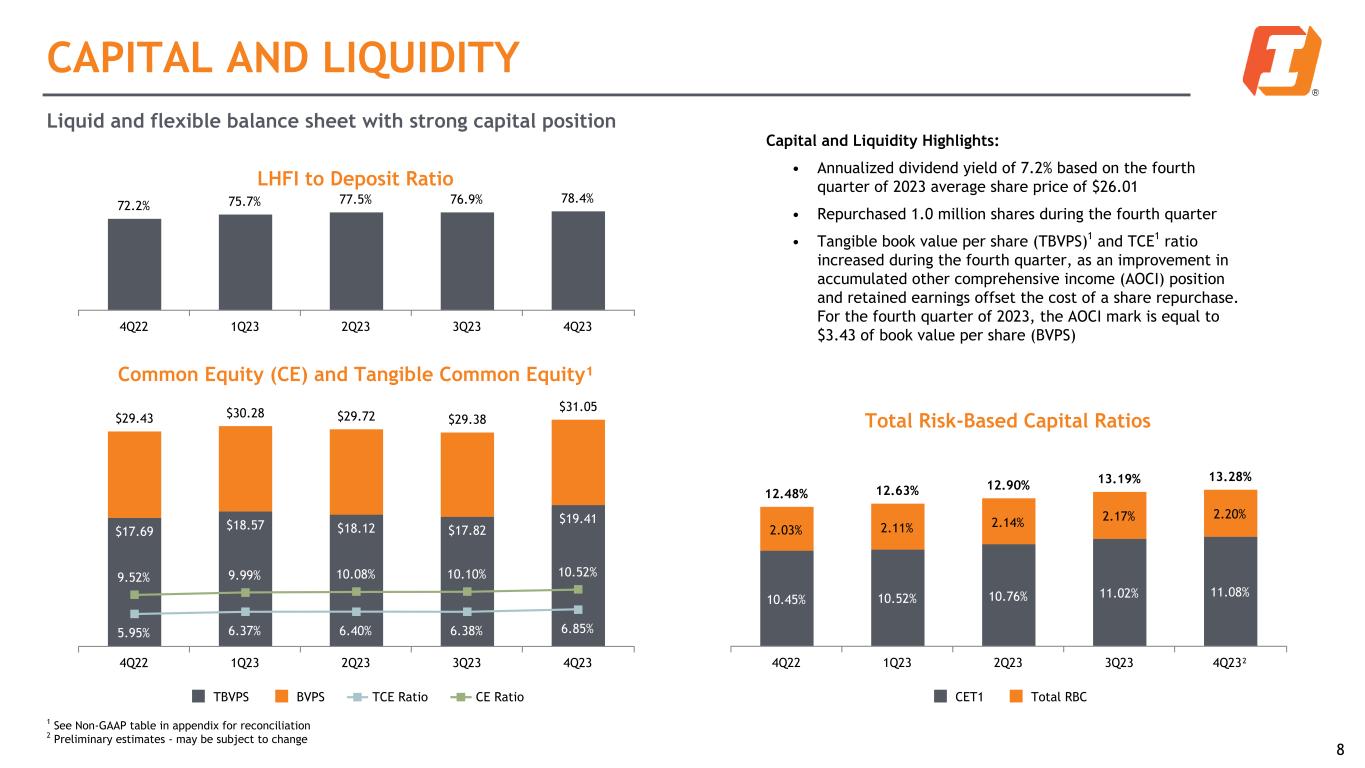

•The Company completed the purchase of 1.0 million of its common shares from the estate of a stockholder at $32.14 per share during the fourth quarter of 2023.

•Book value per common share increased to $31.05 as of December 31, 2023, compared to $29.38 as of September 30, 2023, and $29.43 as of December 31, 2022, resulting from changes in accumulated other comprehensive loss related to unrealized gains on available-for-sale securities and an increase in retained earnings, partially offset by a decrease in common stock and reduction in common shares outstanding. As of December 31, 2023, the accumulated other comprehensive loss position was equal to $3.43 of book value per common share, which is an improvement from $4.97 of book value per common share as of September 30, 2023. Tangible book value per common share1 was $19.41 as of December 31, 2023, compared to $17.82 as of September 30, 2023 and $17.69 as of December 31, 2022.

“We executed well in the fourth quarter, completing a share repurchase and accomplishing the cost savings initiative we mentioned last quarter,” said Kevin P. Riley, President and Chief Executive Officer of First Interstate BancSystem, Inc. “Even in this challenging environment, we saw attractive lending opportunities which generated a modest level of loan growth. With our strong financial performance, we had increases in our capital ratios and were able to maintain a healthy dividend, providing value for our shareholders.”

“Given our high level of capital, liquidity, adequate allowance for credit losses, and the work we are doing to control expenses, we believe we are well positioned coming into 2024. Should a more favorable, stable economic environment create higher loan demand, we have the ability and willingness to meet those needs. Given the breadth of products and services, and superior level of service that we offer, our focus will continue to be on growing our client base in 2024 and delivering another year of solid financial performance for our shareholders.” said Mr. Riley.

1 Non-GAAP financial measure - see Non-GAAP Financial Measures included herein for a reconciliation to GAAP measures.

DIVIDEND DECLARATION

On January 26, 2024, the Company’s board of directors declared a dividend of $0.47 per common share, payable on February 19, 2024, to common stockholders of record as of February 9, 2024. The dividend equates to a 7.2% annualized yield based on the $26.01 per share average closing price of the Company’s common stock as reported on NASDAQ during the fourth quarter of 2023.

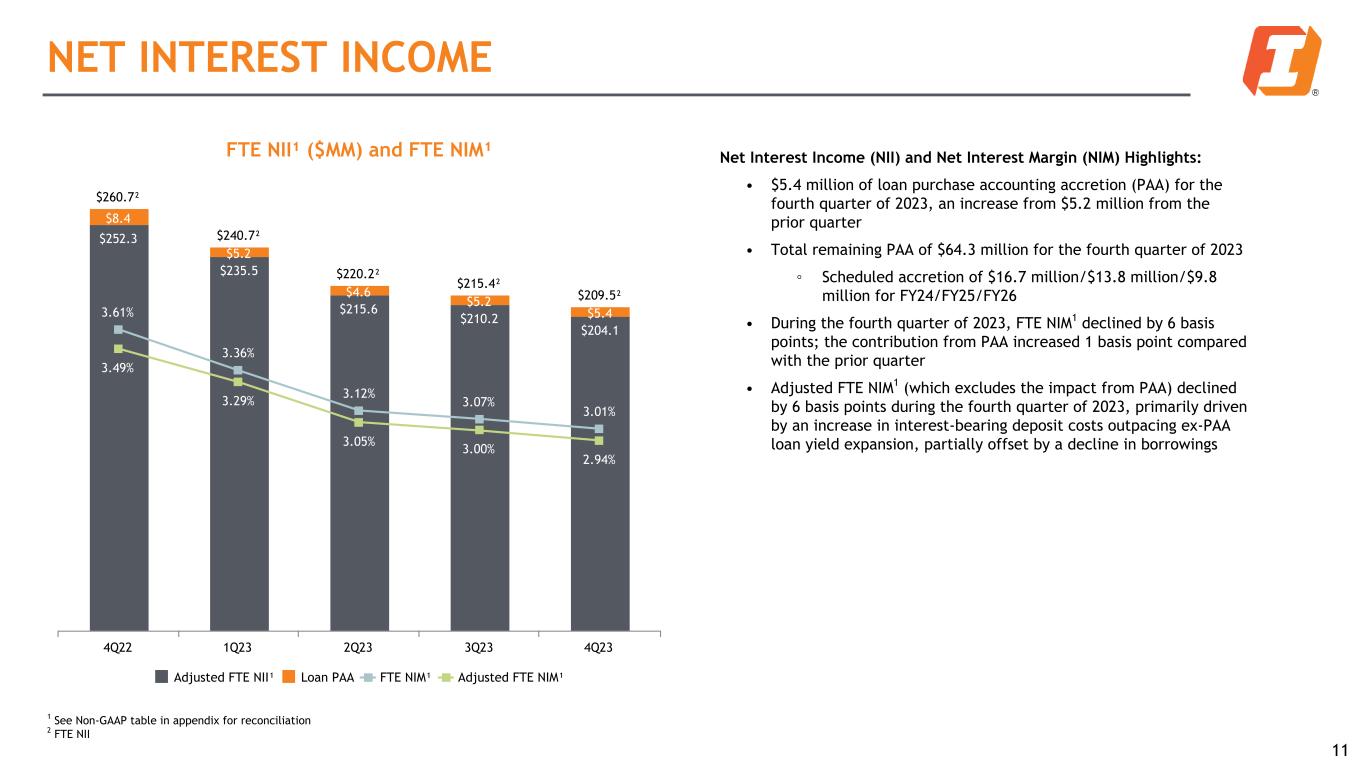

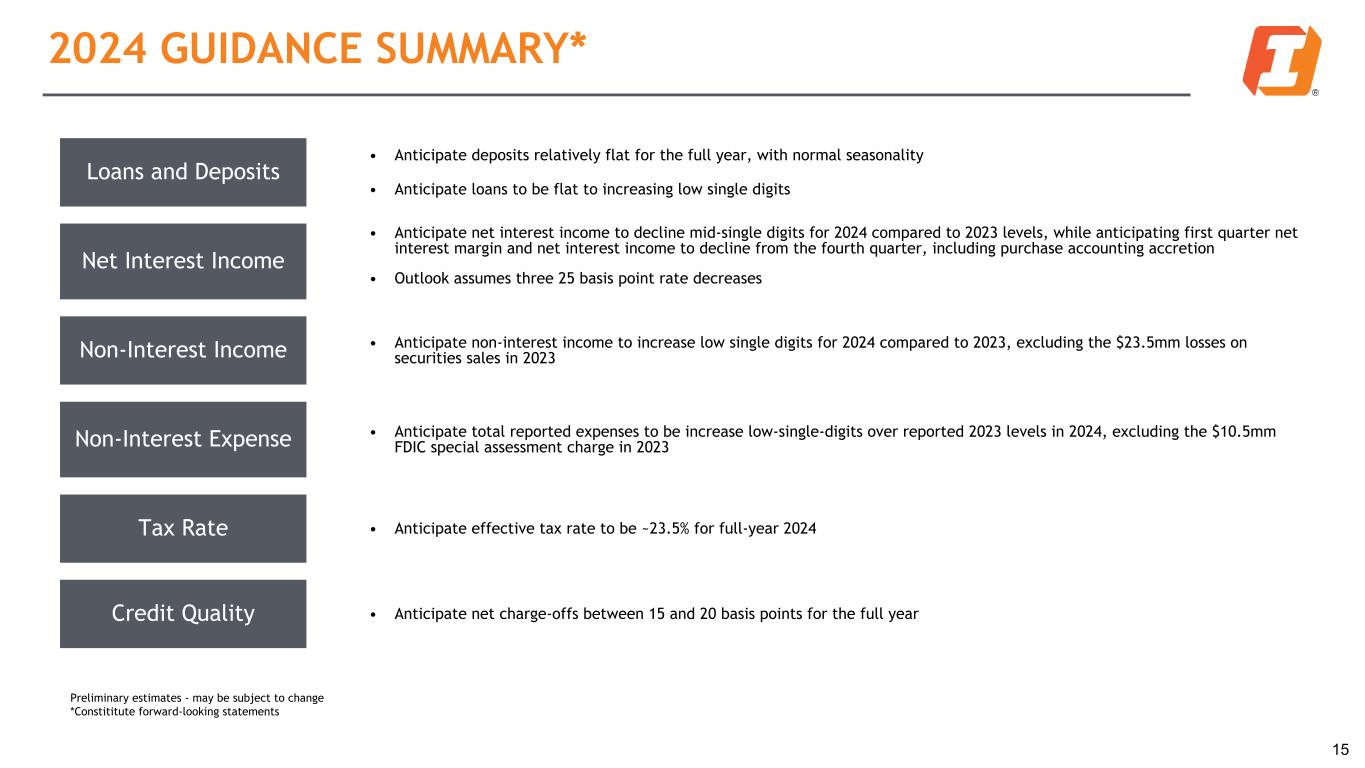

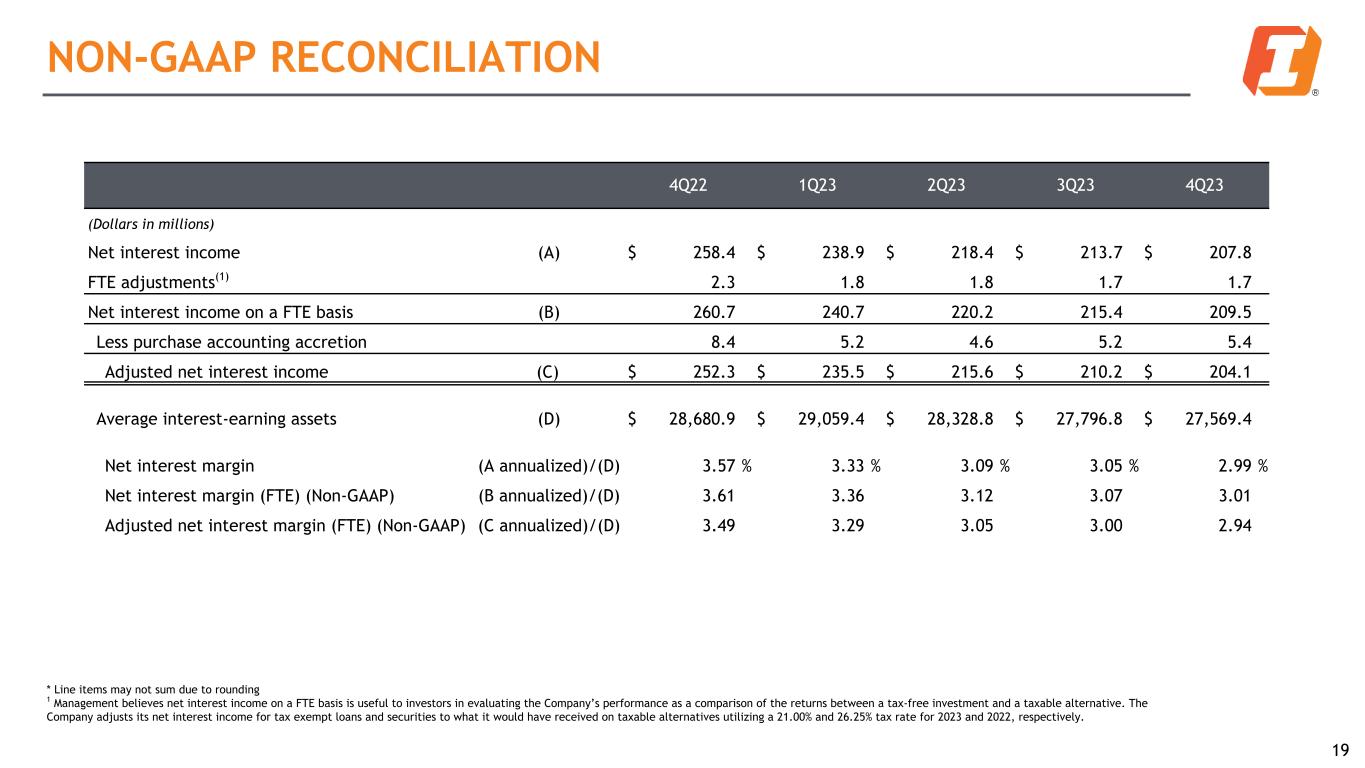

NET INTEREST INCOME

Net interest income decreased $5.9 million, or 2.8%, to $207.8 million, during the fourth quarter of 2023, compared to net interest income of $213.7 million during the third quarter of 2023 and decreased $50.6 million, or 19.6%, during the fourth quarter of 2023 from the fourth quarter of 2022, primarily due to an increase in interest expense as a result of a higher costs of interest-bearing liabilities.

•Interest accretion attributable to the fair valuation of acquired loans from acquisitions contributed to net interest income during the fourth quarter of 2023, the third quarter of 2023, and the fourth quarter of 2022, in the amounts of $5.4 million, $5.2 million, and $8.4 million, respectively.

The net interest margin ratio was 2.99% for the fourth quarter of 2023, compared to 3.05% during the third quarter of 2023, and 3.57% during the fourth quarter of 2022. The net FTE interest margin ratio2, a non-GAAP measure, was 3.01% for the fourth quarter of 2023, compared to 3.07% during the third quarter of 2023, and 3.61% during the fourth quarter of 2022. Excluding interest accretion from the fair value of acquired loans, on a quarter-over-quarter basis, the adjusted net FTE interest margin ratio2, a non-GAAP measure, was 2.94%, a decrease of 6 basis points from the prior quarter, primarily driven by higher interest-bearing deposit costs, which was partially offset by loan yield expansion. Excluding interest accretion from the fair value of acquired loans, on a year-over-year basis, the net interest margin ratio decreased 55 basis points, primarily as a result of higher short-term borrowing costs, and higher interest-bearing deposit costs, which was partially offset by loan yield expansion and a modestly favorable change in the mix of earning assets.

PROVISION FOR (REDUCTION OF) CREDIT LOSSES

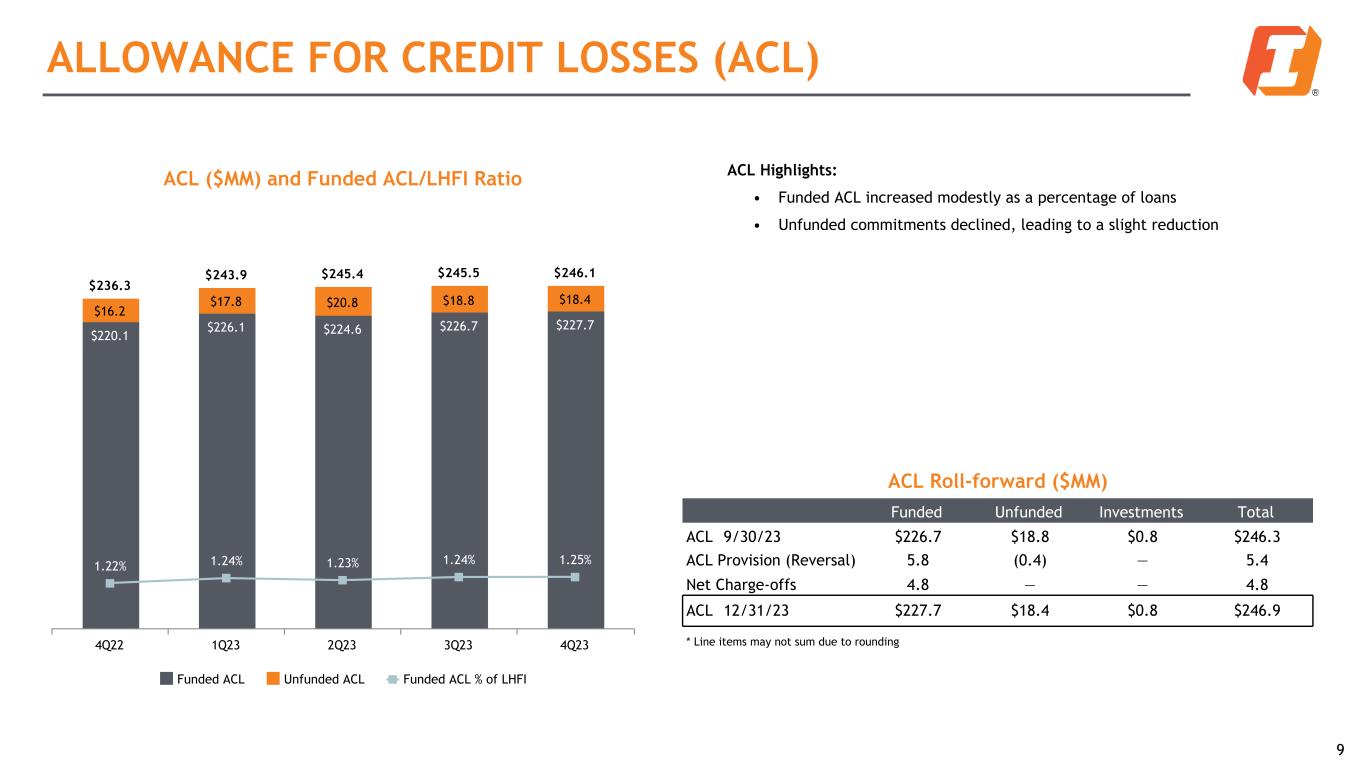

During the fourth quarter of 2023, the Company recorded a provision for credit losses of $5.4 million, which included a provision for credit losses of $5.8 million on loans held for investment and a reduction of provision for credit losses for unfunded commitments of $0.4 million. This compares to a reduction of provision for credit losses of $0.1 million during the third quarter of 2023 and a provision for credit losses of $14.7 million during the fourth quarter of 2022.

For the fourth quarter of 2023, the allowance for credit losses included net charge-offs of $4.8 million, or an annualized 0.10% of average loans outstanding, compared to net charge-offs of $1.1 million, or an annualized 0.02% of average loans outstanding, for both the third quarter of 2023 and the fourth quarter of 2022. Net loan charge-offs in the fourth quarter of 2023 were composed of charge-offs of $6.7 million and recoveries of $1.9 million.

The Company’s allowance for credit losses as a percentage of period-end loans held for investment increased modestly to 1.25% at December 31, 2023 from 1.24% at September 30, 2023, and from 1.22% at December 31, 2022. Coverage of non-performing loans decreased to 204.6% at December 31, 2023, compared to 268.0% at September 30, 2023 and 335.5% at December 31, 2022.

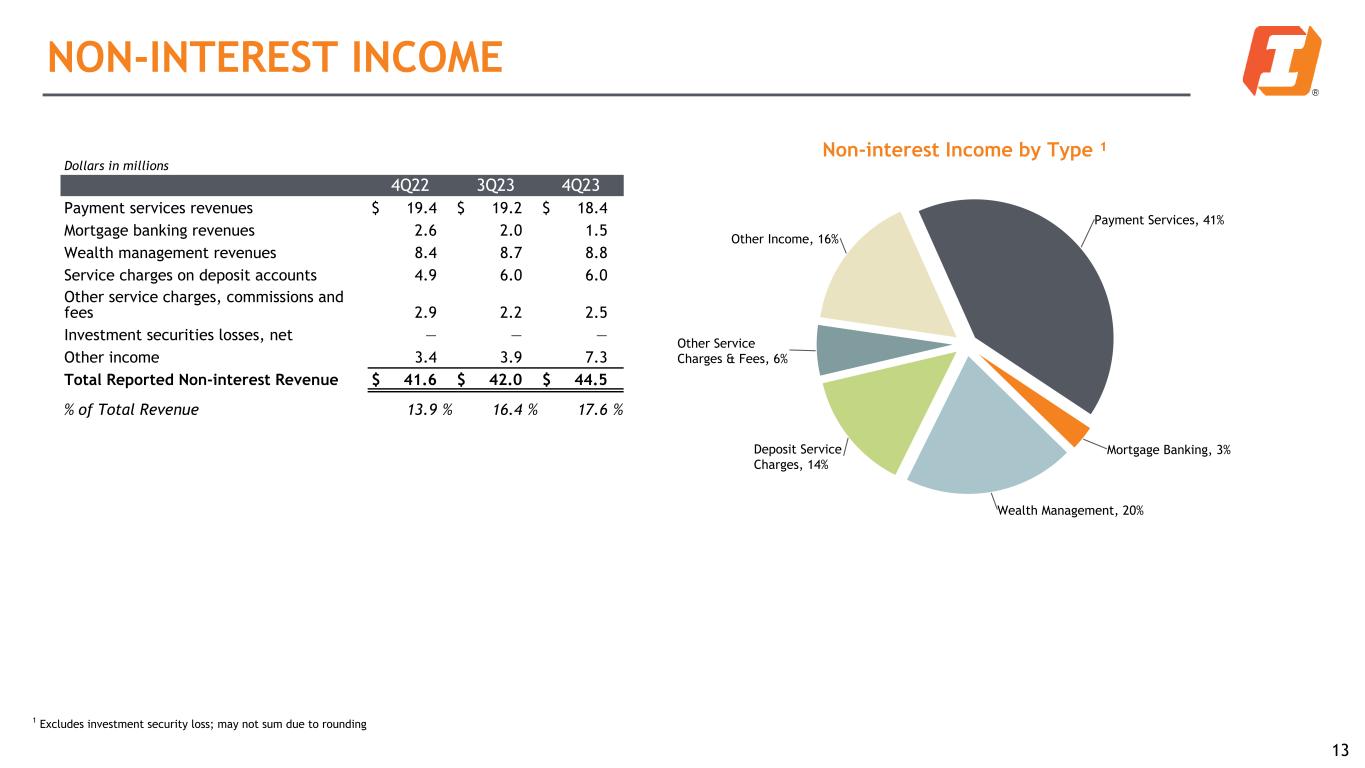

NON-INTEREST INCOME

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Quarter Ended | Dec 31, 2023 | | Sep 30, 2023 | | $ Change | % Change | | Dec 31, 2022 | | $ Change | % Change |

| (Dollars in millions) | | | | |

| Payment services revenues | $ | 18.4 | | | $ | 19.2 | | | $ | (0.8) | | (4.2) | % | | $ | 19.4 | | | $ | (1.0) | | (5.2) | % |

| Mortgage banking revenues | 1.5 | | | 2.0 | | | (0.5) | | (25.0) | | | 2.6 | | | (1.1) | | (42.3) | |

| Wealth management revenues | 8.8 | | | 8.7 | | | 0.1 | | 1.1 | | | 8.4 | | | 0.4 | | 4.8 | |

| Service charges on deposit accounts | 6.0 | | | 6.0 | | | — | | — | | | 4.9 | | | 1.1 | | 22.4 | |

| Other service charges, commissions, and fees | 2.5 | | | 2.2 | | | 0.3 | | 13.6 | | | 2.9 | | | (0.4) | | (13.8) | |

| | | | | | | | | | | |

| Other income | 7.3 | | | 3.9 | | | 3.4 | | 87.2 | | | 3.4 | | | 3.9 | | 114.7 | |

| | | | | | | | | | | |

| Total non-interest income | $ | 44.5 | | | $ | 42.0 | | | $ | 2.5 | | 6.0 | % | | $ | 41.6 | | | $ | 2.9 | | 7.0 | % |

2 Non-GAAP financial measure - see Non-GAAP Financial Measures included herein for a reconciliation to GAAP measures.

Non-interest income was $44.5 million for the fourth quarter of 2023, increasing $2.5 million and $2.9 million compared to the third quarter of 2023 and the fourth quarter of 2022, respectively. The increases were primarily the result of the disposition of premises and equipment during the fourth quarter of 2023, which resulted in a net gain of $2.9 million compared to the third quarter of 2023 and the fourth quarter of 2022.

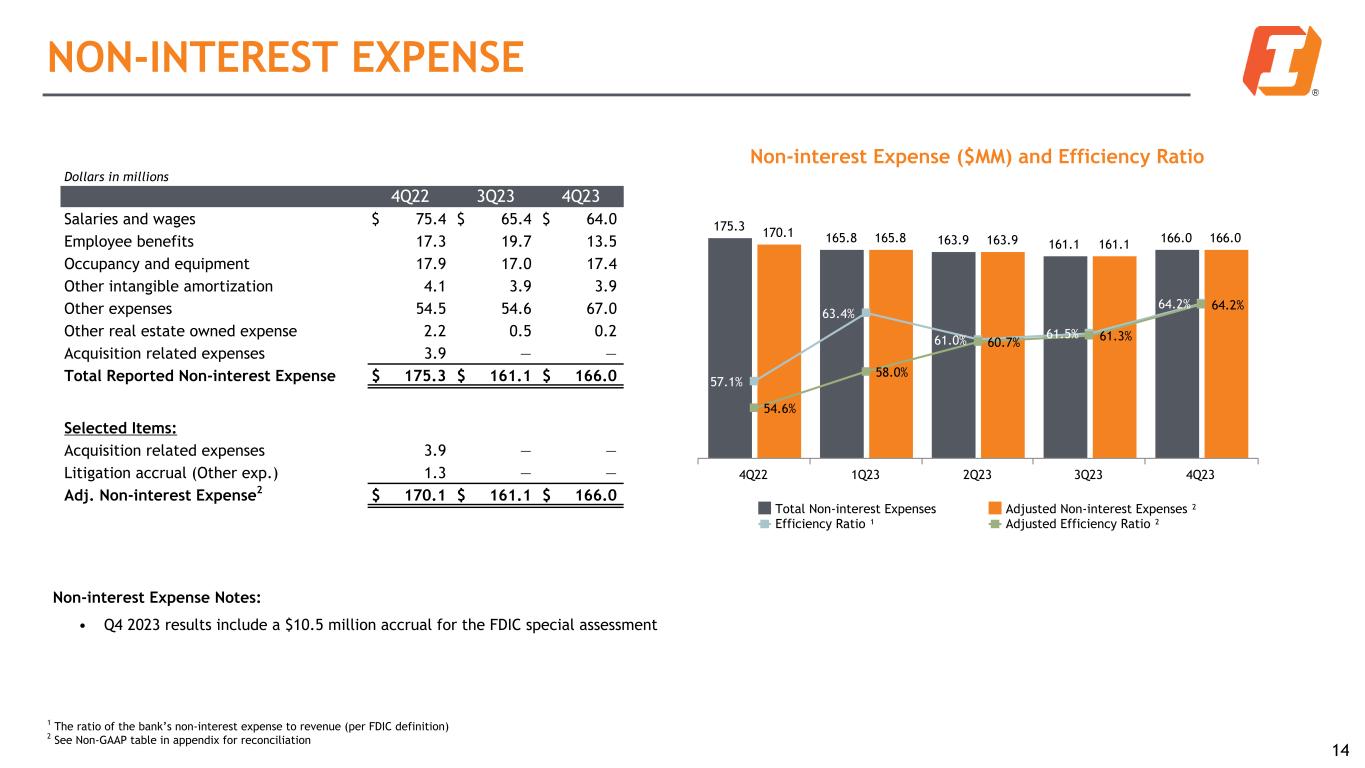

NON-INTEREST EXPENSE

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For the Quarter Ended | Dec 31, 2023 | | Sep 30, 2023 | | $ Change | % Change | | Dec 31, 2022 | | $ Change | % Change |

| (Dollars in millions) | | | | |

| Salaries and wages | $ | 64.0 | | | $ | 65.4 | | | $ | (1.4) | | (2.1) | % | | $ | 75.4 | | | $ | (11.4) | | (15.1) | % |

| Employee benefits | 13.5 | | | 19.7 | | | (6.2) | | (31.5) | | | 17.3 | | | (3.8) | | (22.0) | |

| Occupancy and equipment | 17.4 | | | 17.0 | | | 0.4 | | 2.4 | | | 17.9 | | | (0.5) | | (2.8) | |

| Other intangible amortization | 3.9 | | | 3.9 | | | — | | — | | | 4.1 | | | (0.2) | | (4.9) | |

| Other expenses | 67.0 | | | 54.6 | | | 12.4 | | 22.7 | | | 54.5 | | | 12.5 | | 22.9 | |

| Other real estate owned expense | 0.2 | | | 0.5 | | | (0.3) | | (60.0) | | | 2.2 | | | (2.0) | | NM |

| Acquisition related expenses | — | | | — | | | — | | — | | | 3.9 | | | (3.9) | | NM |

| Total non-interest expense | $ | 166.0 | | | $ | 161.1 | | | $ | 4.9 | | 3.0 | % | | $ | 175.3 | | | $ | (9.3) | | (5.3) | % |

The Company’s non-interest expense was $166.0 million for the fourth quarter of 2023, an increase of $4.9 million from the third quarter of 2023 and decrease of $9.3 million from the fourth quarter of 2022. The decrease is partially due to the acquisition expenses incurred during the fourth quarter of 2022 related to the acquisition of Great Western Bank.

The quarter-over-quarter increase was primarily due to a $10.5 million accrual for the FDIC special assessment included in other expenses, and an increase in severance costs of $3.6 million, included in salaries and wages. Additionally, we saw higher engagement by our clients in our rewards program, resulting in an increase in our credit card rewards accrual of $2.1 million, included in other expenses. These increases were partially offset by decreases in salaries and wages and short and long-term incentive accruals of $12.3 million.

Salary and wage expenses decreased $1.4 million during the fourth quarter of 2023 compared to the third quarter of 2023, primarily due to lower salaries and wages and short-term incentive accruals of $4.8 million, partially offset by $3.6 million of severance costs incurred during the fourth quarter of 2023. Salaries and wage expenses decreased $11.4 million during the fourth quarter of 2023 compared to the fourth quarter of 2022, primarily due to lower short-term incentive accruals of $13.8 million, and lower salaries and wages which were partially offset by higher net severance costs of $1.9 million in the fourth quarter of 2023.

Employee benefit expenses decreased $6.2 million during the fourth quarter of 2023 compared to the third quarter of 2023, primarily due to lower long-term incentive accruals of $7.5 million, partially offset by higher health insurance costs of $1.0 million. Employee benefit expenses decreased $3.8 million during the fourth quarter of 2023 compared to the fourth quarter of 2022, primarily due to lower long-term incentive accruals of $4.9 million, partially offset by higher health insurance costs of $1.2 million.

Other expenses increased $12.4 million during the fourth quarter of 2023 compared to the third quarter of 2023, and increased $12.5 million as compared to the fourth quarter of 2022. The increase in other expenses was primarily due to an accrual for the FDIC special assessment of $10.5 million and higher engagement by our clients in our rewards program, resulting in an increase in credit card rewards accrual of $2.1 million during the fourth quarter of 2023.

BALANCE SHEET

Total assets increased $130.4 million, or 0.4%, to $30,671.2 million as of December 31, 2023, from $30,540.8 million as of September 30, 2023, primarily due to an increase in investment securities as a result of changes in the unrealized fair value of investment securities and the Company’s decision to reinvest cash flows of the portfolio at higher yields, along with a modest increase in loans. These increases were partially offset by a decrease in other assets driven by a decrease in interest rate swap contracts and deferred tax assets related to the unrealized loss of investment securities and interest rate swap contracts. Total assets decreased $1,616.6 million, or 5.0%, from $32,287.8 million as of December 31, 2022, primarily due to declines in deposits and securities sold under repurchase agreements, partially offset by an increase in other borrowed funds.

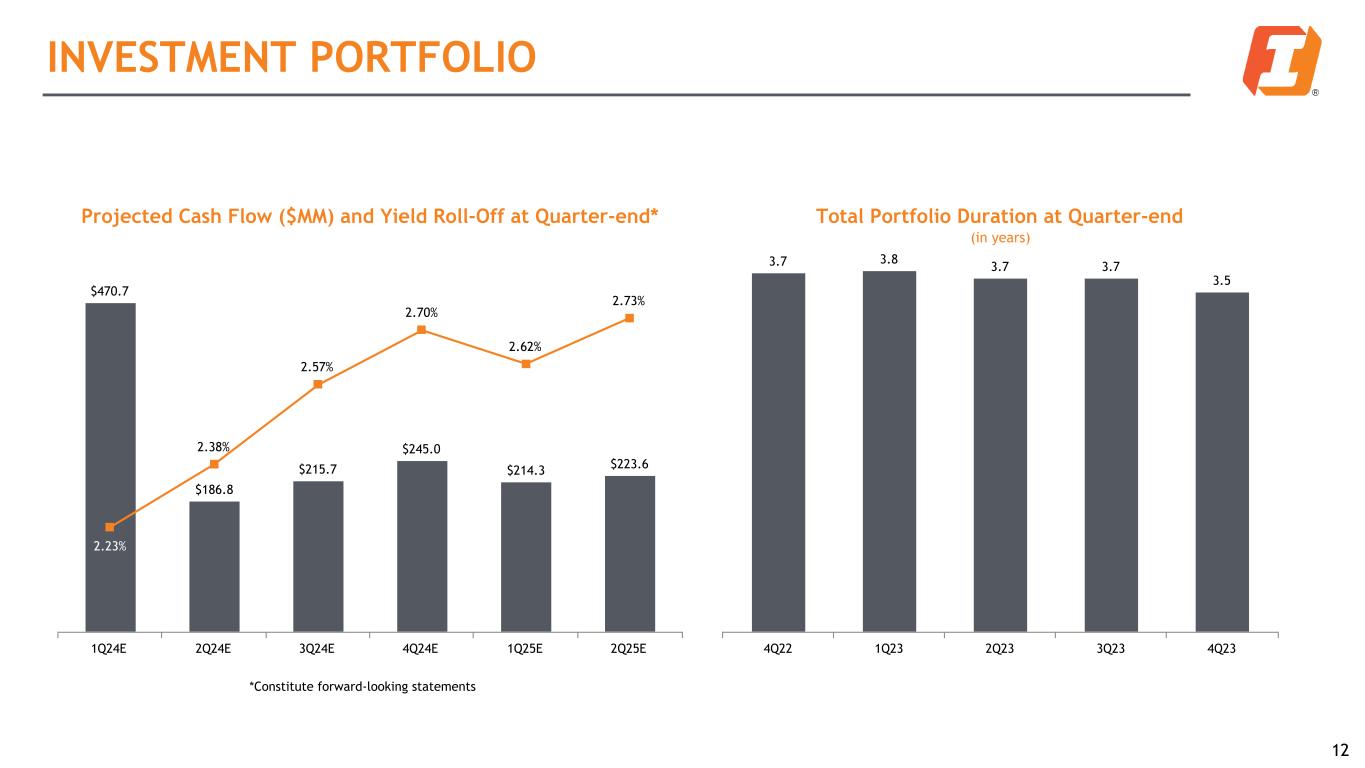

Investment securities increased $162.2 million, or 1.8%, to $9,049.4 million as of December 31, 2023, from $8,887.2 million as of September 30, 2023, primarily as a result of increases in fair market values. Investment securities decreased $1,348.5 million, or 13.0%, from $10,397.9 million as of December 31, 2022, which was primarily the result of the disposition of $853.0 million of investment securities during the first quarter of 2023 and normal cash flow activity, partially offset by increases in fair market values and a reduction of $1.1 million in allowance for credit losses on held-to-maturity securities during the period.

The following table presents the composition and comparison of loans held for investment as of the quarters-ended:

| | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | | | |

| Dec 31, 2023 | Sep 30, 2023 | $ Change | % Change | Dec 31, 2022 | $ Change | % Change | |

| Real Estate: | | | | | | | | |

| Commercial | $ | 8,869.2 | | $ | 8,766.2 | | $ | 103.0 | | 1.2 | % | $ | 8,528.6 | | $ | 340.6 | | 4.0 | % | |

| Construction | 1,826.5 | | 1,930.3 | | (103.8) | | (5.4) | | 1,944.4 | | (117.9) | | (6.1) | | |

| Residential | 2,244.3 | | 2,212.2 | | 32.1 | | 1.5 | | 2,188.3 | | 56.0 | | 2.6 | | |

| Agricultural | 716.8 | | 731.5 | | (14.7) | | (2.0) | | 794.9 | | (78.1) | | (9.8) | | |

| Total real estate | 13,656.8 | | 13,640.2 | | 16.6 | | 0.1 | | 13,456.2 | | 200.6 | | 1.5 | | |

| Consumer: | | | | | | | | |

| Indirect | 740.9 | | 751.7 | | (10.8) | | (1.4) | | 829.7 | | (88.8) | | (10.7) | | |

| Direct and advance lines | 141.6 | | 142.3 | | (0.7) | | (0.5) | | 152.9 | | (11.3) | | (7.4) | | |

| Credit card | 76.5 | | 71.6 | | 4.9 | | 6.8 | | 75.9 | | 0.6 | | 0.8 | | |

| Total consumer | 959.0 | | 965.6 | | (6.6) | | (0.7) | | 1,058.5 | | (99.5) | | (9.4) | | |

| Commercial | 2,906.8 | | 2,925.1 | | (18.3) | | (0.6) | | 2,882.6 | | 24.2 | | 0.8 | | |

| Agricultural | 769.4 | | 690.5 | | 78.9 | | 11.4 | | 708.3 | | 61.1 | | 8.6 | | |

| Other, including overdrafts | 0.1 | | 5.0 | | (4.9) | | (98.0) | | 9.2 | | (9.1) | | (98.9) | | |

| Deferred loan fees and costs | (12.5) | | (13.1) | | 0.6 | | (4.6) | | (15.6) | | 3.1 | | (19.9) | | |

| Loans held for investment, net of deferred loan fees and costs | $ | 18,279.6 | | $ | 18,213.3 | | $ | 66.3 | | 0.4 | % | $ | 18,099.2 | | $ | 180.4 | | 1.0 | % | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | |

The ratio of loans held for investment to deposits increased to 78.4%, as of December 31, 2023, compared to 76.9% as of September 30, 2023 and 72.2% as of December 31, 2022.

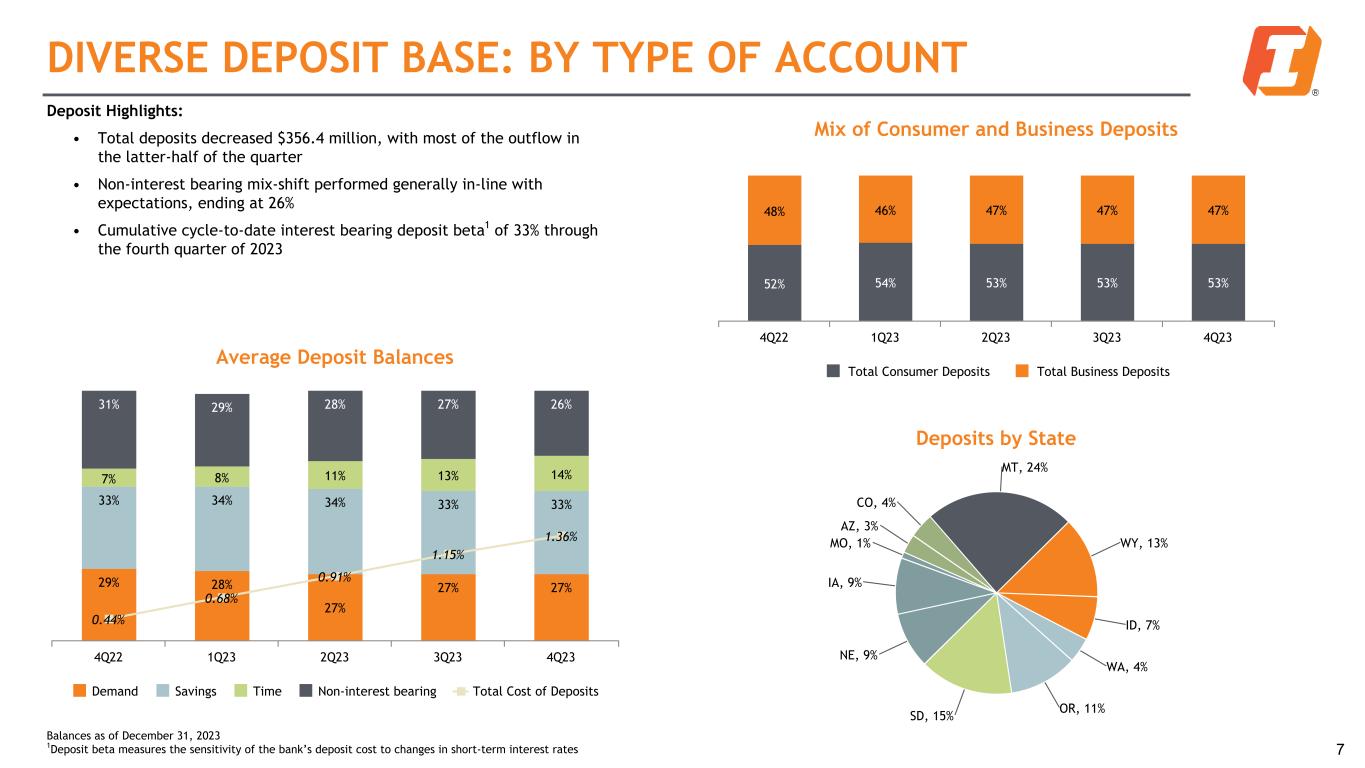

Total deposits decreased $356.4 million, or 1.5%, to $23,323.1 million as of December 31, 2023, from $23,679.5 million as of September 30, 2023, with decreases in all categories with the exception of demand deposits. Total deposits decreased $1,750.5 million, or 7.0%, from $25,073.6 million as of December 31, 2022, with decreases in all types of deposits with the exception of time deposits.

Securities sold under repurchase agreements decreased $106.8 million, or 12.0%, to $782.7 million as of December 31, 2023, from $889.5 million as of September 30, 2023, and decreased $270.2 million, or 25.7%, from $1,052.9 million as of December 31, 2022, as a result of normal fluctuations in the liquidity needs of the Company’s clients.

Other borrowed funds is comprised of Federal Home Loan Bank variable rate overnight and fixed rate borrowings with contractual tenors of up to three-months. Other borrowed funds increased $536.0 million, or 25.9%, to $2,603.0 million as of December 31, 2023, from $2,067.0 million as of September 30, 2023, and increased $276.0 million from December 31, 2022, as a result of changes in total deposits, investment securities, securities sold under repurchase agreements, and cash and cash equivalents.

The Company is considered to be “well-capitalized” as of December 31, 2023, having exceeded all regulatory capital adequacy requirements. During the fourth quarter of 2023, the Company paid regular common stock dividends of approximately $48.7 million, or $0.47 per share.

CREDIT QUALITY

As of December 31, 2023, non-performing assets increased $31.6 million, or 32.8%, to $127.8 million, compared to $96.2 million as of September 30, 2023, primarily due to an increase in non-accrual loans of $25.0 million driven by agricultural loans that were reclassified from loans held for sale to loans held for investment, an increase in accruing loans past due 90 days or more of $1.7 million, and an increase in property classified as other real estate owned of $4.9 million driven by a commercial loan transferred to other real estate owned from loans held for sale of $5.8 million, partially offset by a disposition.

Criticized loans increased $55.4 million, or 8.8%, to $688.3 million as of December 31, 2023, from $632.9 million as of September 30, 2023 driven by $35.0 million in agricultural loans that were reclassified from loans held for sale to loans held for investment and other downgrades, including $27.4 million related to four commercial real estate loans, which were offset by upgrades and paydowns.

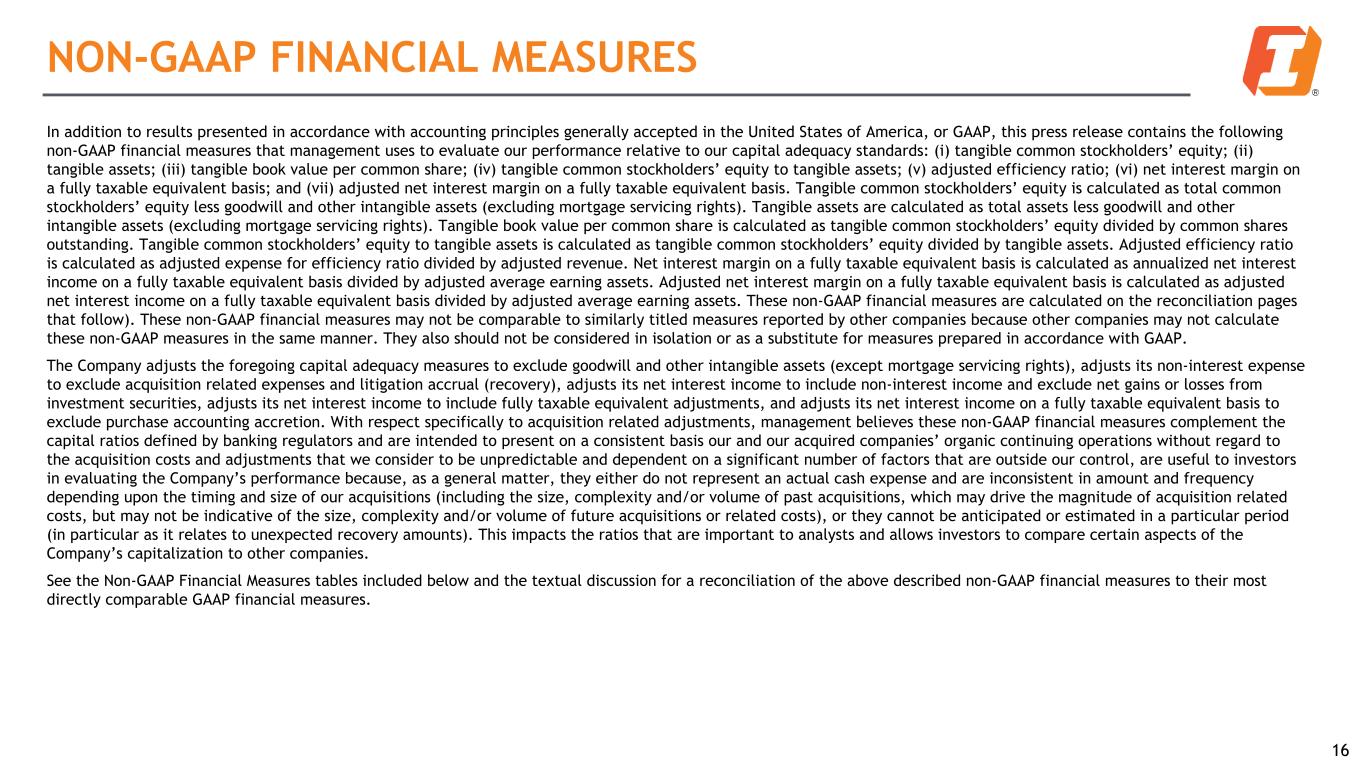

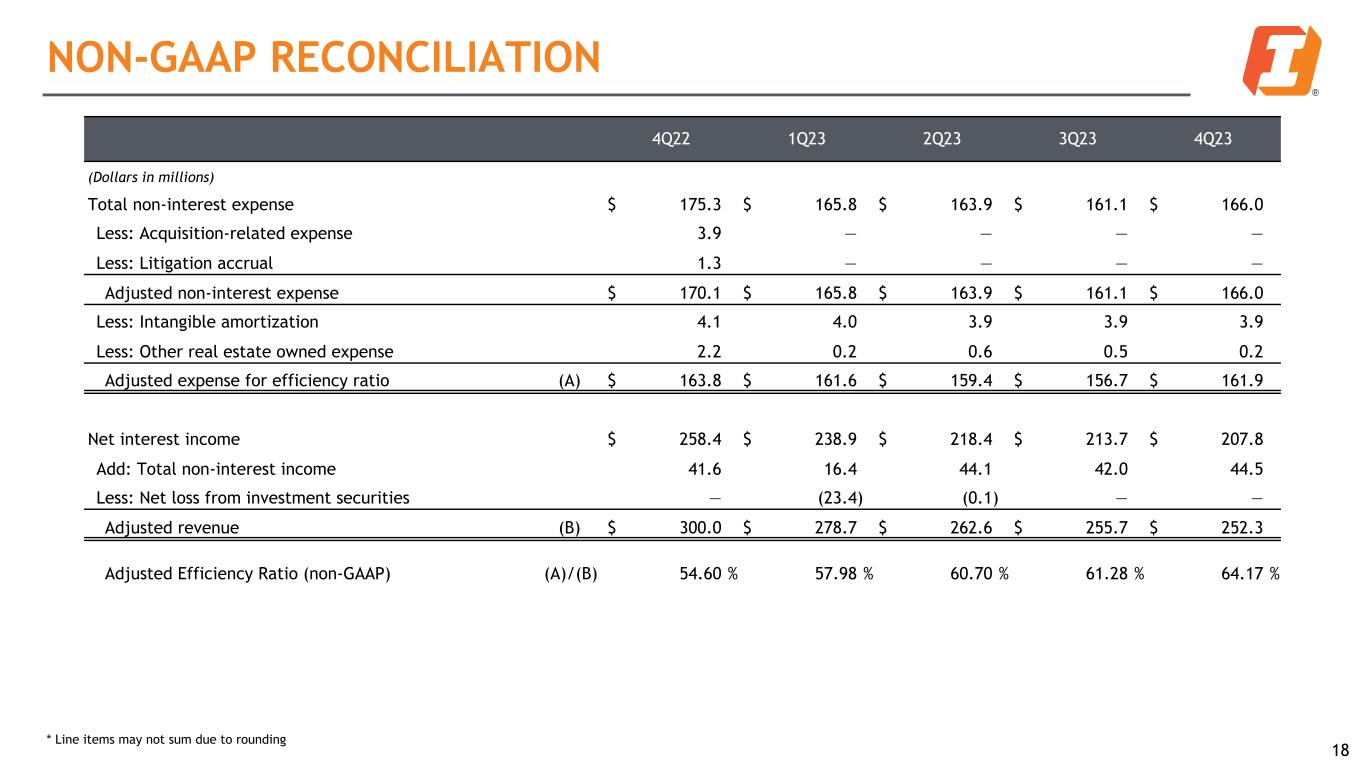

NON-GAAP FINANCIAL MEASURES

In addition to results presented in accordance with accounting principles generally accepted in the United States of America, or GAAP, this press release contains the following non-GAAP financial measures that management uses to evaluate our performance relative to our capital adequacy standards: (i) tangible common stockholders’ equity; (ii) tangible assets; (iii) tangible book value per common share; (iv) tangible common stockholders’ equity to tangible assets; (v) average tangible common stockholders’ equity; (vi) return on average tangible common stockholders’ equity; and (vii) adjusted net interest margin ratio (FTE). Tangible common stockholders’ equity is calculated as total common stockholders’ equity less goodwill and other intangible assets (excluding mortgage servicing rights). Tangible assets are calculated as total assets less goodwill and other intangible assets (excluding mortgage servicing rights). Tangible book value per common share is calculated as tangible common stockholders’ equity divided by common shares outstanding. Tangible common stockholders’ equity to tangible assets is calculated as tangible common stockholders’ equity divided by tangible assets. Average tangible common stockholders’ equity is calculated as average stockholders’ equity less average goodwill and other intangible assets (excluding mortgage servicing rights). Return on average tangible common stockholders’ equity is calculated as net income available to common shareholders divided by average tangible common stockholders’ equity. Adjusted net interest margin ratio (FTE) is calculated as adjusted net FTE interest income divided by adjusted average interest earning assets. These non-GAAP financial measures may not be comparable to similarly titled measures reported by other companies because other companies may not calculate these non-GAAP measures in the same manner. They also should not be considered in isolation or as a substitute for measures prepared in accordance with GAAP.

The Company adjusts the most directly comparable capital adequacy GAAP financial measures to the non-GAAP financial measures described in subclauses (i) through (vi) above to exclude goodwill and other intangible assets (except mortgage servicing rights). To derive the non-GAAP financial measure identified in subclause (vii) above, the Company adjusts its net interest income to include its FTE interest income and exclude purchase accounting interest accretion on acquired loans. Management believes these non-GAAP financial measures, which are intended to complement the capital ratios defined by banking regulators and to present on a consistent basis our and our acquired companies’ organic continuing operations without regard to acquisition costs and other adjustments that we consider to be unpredictable and dependent on a significant number of factors that are outside our control, are useful to investors in evaluating the Company’s performance because, as a general matter, they either do not represent an actual cash expense and are inconsistent in amount and frequency depending upon the timing and size of our acquisitions (including the size, complexity and/or volume of past acquisitions, which may drive the magnitude of acquisition related costs, but may not be indicative of the size, complexity and/or volume of future acquisitions or related costs), or they cannot be anticipated or estimated in a particular period (in particular as it relates to unexpected recovery amounts). This impacts the ratios that are important to analysts and allows investors to compare certain aspects of the Company’s capitalization to other companies.

See the Non-GAAP Financial Measures table included herein and the textual discussion for a reconciliation of the above described non-GAAP financial measures to their most directly comparable GAAP financial measures.

Cautionary Note Regarding Forward-Looking Statements and Factors that Could Affect Future Results

This press release contains “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, as amended, and Rule 175 promulgated thereunder, and Section 21E of the Securities Exchange Act of 1934, as amended, or the Exchange Act, and Rule 3b-6 promulgated thereunder, that involve inherent risks and uncertainties. Any statements about our, Great Western’s or the combined company’s plans, objectives, expectations, strategies, beliefs, or future performance or events constitute forward-looking statements. Such statements are identified by words or phrases such as “believes,” “expects,” “anticipates,” “plans,” “trends,” “objectives,” “continues” or similar expressions, or future or conditional verbs such as “will,” “would,” “should,” “could,” “might,” “may,” or similar expressions. Forward-looking statements involve known and unknown risks, uncertainties, assumptions, estimates and other important factors that change over time and could cause actual results to differ materially from any results, performance or events expressed or implied by such forward-looking statements. Furthermore, the following factors, among others, may cause actual results to differ materially from current expectations in the forward-looking statements, including those set forth in this press release:

•new, or changes in existing, governmental regulations;

•negative development in the banking industry and increased regulatory scrutiny;

•tax legislative initiatives or assessments;

•more stringent capital requirements, to the extent they may become applicable to us;

•changes in accounting standards;

•any failure to comply with applicable laws and regulations, including, but not limited to, the Community Reinvestment Act and fair lending laws, the USA PATRIOT ACT of 2001, the Office of Foreign Asset Control guidelines and requirements, the Bank Secrecy Act, and the related Financial Crimes Enforcement Network and Federal Financial Institutions Examination Council Guidelines and regulations;

•federal deposit insurance increases;

•lending risks and risks associated with loan sector concentrations;

•a decline in economic conditions that could reduce demand for our products and services and negatively impact the credit quality of loans;

•loan credit losses exceeding estimates;

•exposure to losses in collateralized loan obligation securities;

•the soundness of other financial institutions;

•the ability to meet cash flow needs and availability of financing sources for working capital and other needs;

•a loss of deposits or a change in product mix that increases the Company’s funding costs;

•inability to access funding or to monetize liquid assets;

•changes in interest rates;

•changes to United States trade policies, including the imposition of tariffs and retaliatory tariffs;

•interest rate effect on the value of our investment securities;

•cyber-security risks, including “denial-of-service attacks,” “hacking,” and “identity theft” that could result in the disclosure of confidential information;

•privacy, information security, and data protection laws, rules, and regulations that affect or limit how we collect and use personal information;

•the potential impairment of our goodwill and other intangible assets;

•our reliance on other companies that provide key components of our business infrastructure;

•events that may tarnish our reputation;

•the loss of the services of key members of our management team and directors;

•our ability to attract and retain qualified employees to operate our business;

•costs associated with repossessed properties, including environmental remediation;

•the effectiveness of our systems of internal operating and accounting controls;

•our ability to implement technology-facilitated products and services or be successful in marketing these products and services to our clients;

•difficulties we may face in combining the operations of acquired entities or assets with our own operations or assessing the effectiveness of businesses in which we make strategic investments or with which we enter into strategic contractual relationships;

•competition from new or existing financial institutions and non-banks;

•investing in technology;

•incurrence of significant costs related to mergers and related integration activities;

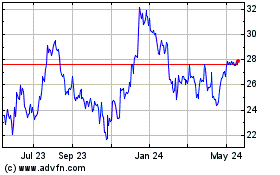

•the volatility in the price and trading volume of our common stock;

•“anti-takeover” provisions in our certificate of incorporation and regulations, which may make it more difficult for a third party to acquire control of us even in circumstances that could be deemed beneficial to stockholders;

•changes in our dividend policy or our ability to pay dividends;

•our common stock not being an insured deposit;

•the potential dilutive effect of future equity issuances;

•the subordination of our common stock to our existing and future indebtedness;

•the effect of global conditions, earthquakes, volcanoes, tsunamis, floods, fires, drought, and other natural catastrophic events; and

•the impact of climate change and environmental sustainability matters.

These factors are not necessarily all the factors that could cause our actual results, performance or achievements to differ materially from those expressed in or implied by any of our forward-looking statements. Other unknown or unpredictable factors also could harm our results.

All forward-looking statements attributable to us or persons acting on our behalf are expressly qualified in their entirety by the cautionary statements set forth above and included and described in more detail in our periodic reports filed with the Securities and Exchange Commission, or SEC, under the Securities Exchange Act of 1934, as amended, under the caption “Risk Factors.” Interested parties are urged to read in their entirety such risk factors prior to making any investment decision with respect to the Company. Forward-looking statements speak only as of the date they are made, and we do not undertake or assume any obligation to update publicly any of these statements to reflect actual results, new information or future events, changes in assumptions or changes in other factors affecting forward-looking statements, except to the extent required by applicable laws. If we update one or more forward-looking statements, no inference should be drawn that we will make additional updates with respect to those or other forward-looking statements.

Fourth Quarter 2023 Conference Call for Investors

First Interstate BancSystem, Inc. will host a conference call to discuss the results for the fourth quarter of 2023 at 11 a.m. Eastern Time (9 a.m. Mountain Time) on Wednesday, January 31, 2024. The conference call will be accessible by telephone and through the Internet. Participants may join the call by dialing 1-888-259-6580; the access code is 16247616. To participate via the Internet, visit www.FIBK.com. The call will be recorded and made available for replay on January 31, 2024, after 1 p.m. Eastern Time (11 a.m. Mountain Time), through March 1, 2024, prior to 9 a.m. Eastern Time (7 a.m. Mountain Time), by dialing 1-877-674-7070. The replay access code is 247616. The call will also be archived on our website, www.FIBK.com, for one year.

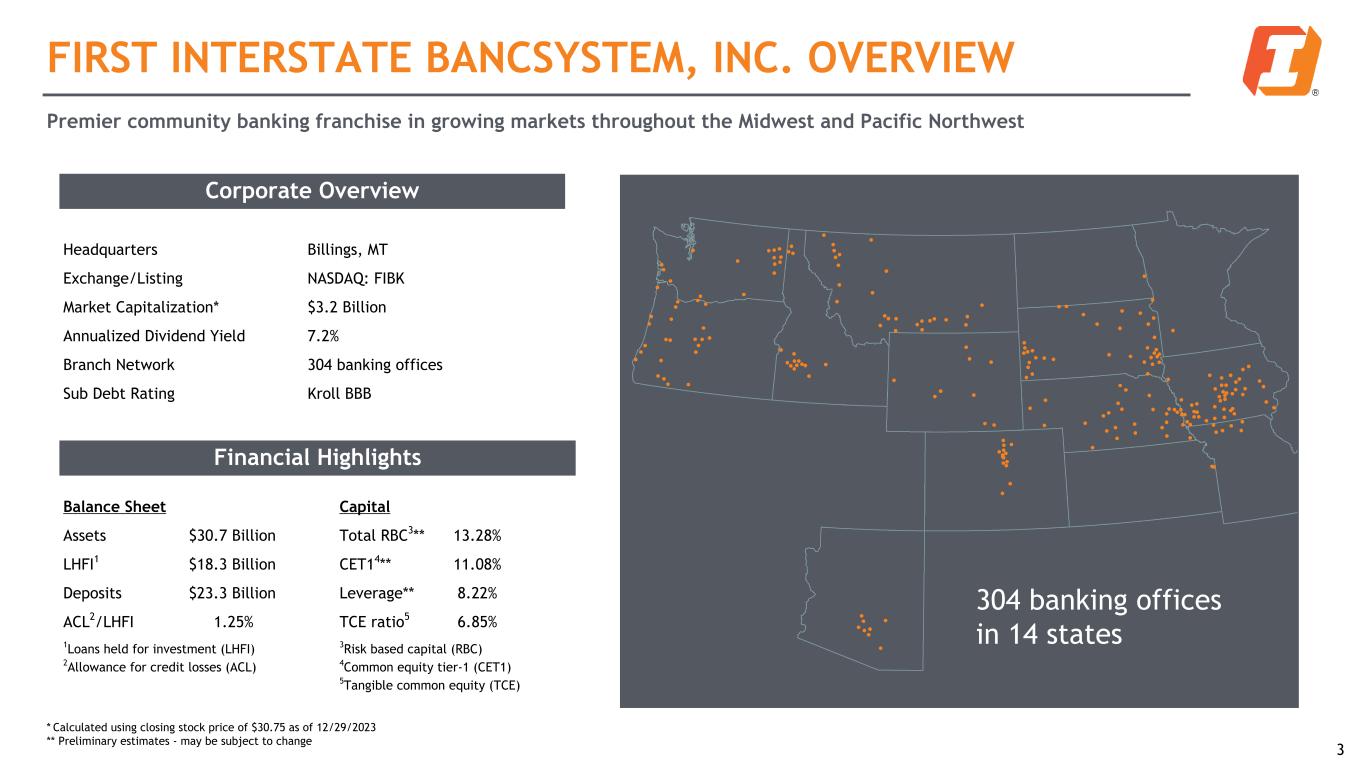

About First Interstate BancSystem, Inc.

First Interstate BancSystem, Inc. is a financial and bank holding company focused on community banking. Incorporated in 1971 and headquartered in Billings, Montana, the Company operates banking offices, including detached drive-up facilities, in communities across Arizona, Colorado, Idaho, Iowa, Kansas, Minnesota, Missouri, Montana, Nebraska, North Dakota, Oregon, South Dakota, Washington, and Wyoming, in addition to offering online and mobile banking services. Through our bank subsidiary, First Interstate Bank, the Company delivers a comprehensive range of banking products and services to individuals, businesses, municipalities, and others throughout the Company’s market areas.

| | | | | | | | | | | | | | |

| Contact: | | David Della Camera, CFA | | NASDAQ: FIBK |

| | Director of Corporate Development and Financial Strategy

First Interstate BancSystem, Inc.

(406) 255-5363

david.dellacamera@fib.com | | www.FIBK.com

(FIBK-ER) |

FIRST INTERSTATE BANCSYSTEM, INC. AND SUBSIDIARIES

Consolidated Statements of Income

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Quarter Ended | | % Change | |

| (In millions, except % and per share data) | Dec 31,

2023 | Sep 30,

2023 | Jun 30,

2023 | Mar 31,

2023 | Dec 31,

2022 | | 4Q23 vs 3Q23 | 4Q23 vs 4Q22 | |

| Net interest income | $ | 207.8 | | $ | 213.7 | | $ | 218.4 | | $ | 238.9 | | $ | 258.4 | | | (2.8) | % | (19.6) | % | |

| Net interest income on a fully-taxable equivalent ("FTE") basis | 209.5 | | 215.4 | | 220.2 | | 240.7 | | 260.7 | | | (2.7) | | (19.6) | | |

| Provision for (reduction in) credit losses | 5.4 | | (0.1) | | 11.7 | | 15.2 | | 14.7 | | | NM | NM | |

| Non-interest income: | | | | | | | | | |

| Payment services revenues | 18.4 | | 19.2 | | 20.1 | | 18.7 | | 19.4 | | | (4.2) | | (5.2) | | |

| Mortgage banking revenues | 1.5 | | 2.0 | | 2.6 | | 2.3 | | 2.6 | | | (25.0) | | (42.3) | | |

| Wealth management revenues | 8.8 | | 8.7 | | 8.8 | | 9.0 | | 8.4 | | | 1.1 | | 4.8 | | |

| Service charges on deposit accounts | 6.0 | | 6.0 | | 5.8 | | 5.2 | | 4.9 | | | — | | 22.4 | | |

| Other service charges, commissions, and fees | 2.5 | | 2.2 | | 2.4 | | 2.4 | | 2.9 | | | 13.6 | | (13.8) | | |

| Total fee-based revenues | 37.2 | | 38.1 | | 39.7 | | 37.6 | | 38.2 | | | (2.4) | | (2.6) | | |

| Investment securities loss | — | | — | | (0.1) | | (23.4) | | — | | | — | | — | | |

| Other income | 7.3 | | 3.9 | | 4.5 | | 2.2 | | 3.4 | | | 87.2 | | 114.7 | | |

| | | | | | | | | |

| Total non-interest income | 44.5 | | 42.0 | | 44.1 | | 16.4 | | 41.6 | | | 6.0 | | 7.0 | | |

| Non-interest expense: | | | | | | | | | |

| Salaries and wages | 64.0 | | 65.4 | | 68.1 | | 65.6 | | 75.4 | | | (2.1) | | (15.1) | | |

| Employee benefits | 13.5 | | 19.7 | | 19.3 | | 22.8 | | 17.3 | | | (31.5) | | (22.0) | | |

| Occupancy and equipment | 17.4 | | 17.0 | | 17.3 | | 18.4 | | 17.9 | | | 2.4 | | (2.8) | | |

| Other intangible amortization | 3.9 | | 3.9 | | 3.9 | | 4.0 | | 4.1 | | | — | | (4.9) | | |

| Other expenses | 67.0 | | 54.6 | | 54.7 | | 54.8 | | 54.5 | | | 22.7 | | 22.9 | | |

| Other real estate owned expense | 0.2 | | 0.5 | | 0.6 | | 0.2 | | 2.2 | | | (60.0) | | NM | |

| Acquisition related expenses | — | | — | | — | | — | | 3.9 | | | — | | NM | |

| Total non-interest expense | 166.0 | | 161.1 | | 163.9 | | 165.8 | | 175.3 | | | 3.0 | | (5.3) | | |

| Income before income tax | 80.9 | | 94.7 | | 86.9 | | 74.3 | | 110.0 | | | (14.6) | | (26.5) | | |

| Provision for income tax | 19.4 | | 22.0 | | 19.9 | | 18.0 | | 24.2 | | | (11.8) | | (19.8) | | |

| Net income | $ | 61.5 | | $ | 72.7 | | $ | 67.0 | | $ | 56.3 | | $ | 85.8 | | | (15.4) | % | (28.3) | % | |

| | | | | | | | | |

| Weighted-average basic shares outstanding | 103,629 | | 103,822 | | 103,821 | | 103,738 | | 104,445 | | | (0.2) | % | (0.8) | % | |

| Weighted-average diluted shares outstanding | 103,651 | | 103,826 | | 103,823 | | 103,819 | | 104,548 | | | (0.2) | | (0.9) | | |

| Earnings per share - basic | $ | 0.59 | | $ | 0.70 | | $ | 0.65 | | $ | 0.54 | | $ | 0.82 | | | (15.7) | | (28.0) | | |

| Earnings per share - diluted | 0.59 | | 0.70 | | 0.65 | | 0.54 | | 0.82 | | | (15.7) | | (28.0) | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| | | | | | | | | |

| |

| |

| |

| NM - not meaningful | | | | | | | | | |

| |

| | | | | | | | | | | | | | | | | | | | |

FIRST INTERSTATE BANCSYSTEM, INC. AND SUBSIDIARIES Consolidated Statements of Income (Unaudited) |

| | | | | | |

| Year Ended December 31, | | % Change | |

| (In millions, except % and per share data) | 2023 | | 2022 | | 2023 vs 2022 | |

| Net interest income | $ | 878.8 | | | $ | 942.6 | | | (6.8) | | |

| Net interest income on a FTE basis | 885.8 | | | 950.7 | | | (6.8) | | |

| Provision for credit losses | 32.2 | | | 82.7 | | | (61.1) | | |

| Non-interest income: | | | | | | |

| Payment services revenues | 76.4 | | | 74.1 | | | 3.1 | | |

| Mortgage banking revenues | 8.4 | | | 18.7 | | | (55.1) | | |

| Wealth management revenues | 35.3 | | | 34.3 | | | 2.9 | | |

| Service charges on deposit accounts | 23.0 | | | 24.6 | | | (6.5) | | |

| Other service charges, commissions, and fees | 9.5 | | | 15.5 | | | (38.7) | | |

| Total fee-based revenues | 152.6 | | | 167.2 | | | (8.7) | | |

| Investment securities loss | (23.5) | | | (24.4) | | | NM | |

| Other income | 17.9 | | | 20.4 | | | (12.3) | | |

| | | | | | |

| Total non-interest income | 147.0 | | | 163.2 | | | (9.9) | | |

| Non-interest expense: | | | | | | |

| Salaries and wages | 263.1 | | | 282.1 | | | (6.7) | | |

| Employee benefits | 75.3 | | | 77.5 | | | (2.8) | | |

| Occupancy and equipment | 70.1 | | | 67.4 | | | 4.0 | | |

| Other intangible amortization | 15.7 | | | 15.9 | | | (1.3) | | |

| Other expenses | 231.1 | | | 201.9 | | | 14.5 | | |

| Other real estate owned expense | 1.5 | | | 2.3 | | | NM | |

| Acquisition related expenses | — | | | 118.9 | | | NM | |

| Total non-interest expense | 656.8 | | | 766.0 | | | (14.3) | | |

| Income before income tax | 336.8 | | | 257.1 | | | 31.0 | | |

| Provision for income tax | 79.3 | | | 54.9 | | | 44.4 | | |

| Net income | $ | 257.5 | | | $ | 202.2 | | | 27.3 | | |

| | | | | | |

| Weighted-average basic shares outstanding | 103,752 | | | 103,274 | | | 0.5 | | |

| Weighted-average diluted shares outstanding | 103,780 | | | 103,341 | | | 0.4 | | |

| Earnings per share - basic | $ | 2.48 | | | $ | 1.96 | | | 26.5 | | |

| Earnings per share - diluted | 2.48 | | | 1.96 | | | 26.5 | | |

| | | | | | |

| | | | | | |

| | | | | | |

|

| NM - not meaningful | | | | | | |

| | | | | | |

| |

| |

FIRST INTERSTATE BANCSYSTEM, INC. AND SUBSIDIARIES

Consolidated Balance Sheets

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | % Change |

| (In millions, except % and per share data) | Dec 31,

2023 | Sep 30,

2023 | Jun 30,

2023 | Mar 31,

2023 | Dec 31,

2022 | | 4Q23 vs 3Q23 | 4Q23 vs 4Q22 |

| Assets: | | | | | | | | |

| Cash and due from banks | $ | 378.2 | | $ | 371.5 | | $ | 479.0 | | $ | 332.9 | | $ | 349.2 | | | 1.8 | % | 8.3 | % |

| Interest-bearing deposits in banks | 199.7 | | 219.5 | | 201.4 | | 747.7 | | 521.2 | | | (9.0) | | (61.7) | |

| Federal funds sold | 0.1 | | 2.1 | | 0.1 | | 0.1 | | 0.1 | | | NM | — | |

| Cash and cash equivalents | 578.0 | | 593.1 | | 680.5 | | 1,080.7 | | 870.5 | | | (2.5) | | (33.6) | |

| | | | | | | | |

| Investment securities, net | 9,049.4 | | 8,887.2 | | 9,175.6 | | 9,425.5 | | 10,397.9 | | | 1.8 | | (13.0) | |

| Investment in Federal Home Loan Bank and Federal Reserve Bank stock | 223.2 | | 189.5 | | 210.4 | | 214.5 | | 198.6 | | | 17.8 | | 12.4 | |

| Loans held for sale, at fair value | 47.4 | | 59.1 | | 76.5 | | 80.9 | | 79.9 | | | (19.8) | | (40.7) | |

| Loans held for investment | 18,279.6 | | 18,213.3 | | 18,263.4 | | 18,245.7 | | 18,099.2 | | | 0.4 | | 1.0 | |

| Allowance for credit losses | (227.7) | | (226.7) | | (224.6) | | (226.1) | | (220.1) | | | 0.4 | | 3.5 | |

| Net loans held for investment | 18,051.9 | | 17,986.6 | | 18,038.8 | | 18,019.6 | | 17,879.1 | | | 0.4 | | 1.0 | |

| Goodwill and intangible assets (excluding mortgage servicing rights) | 1,210.3 | | 1,214.1 | | 1,218.0 | | 1,221.9 | | 1,225.9 | | | (0.3) | | (1.3) | |

| Company owned life insurance | 502.4 | | 500.8 | | 502.0 | | 499.4 | | 497.9 | | | 0.3 | | 0.9 | |

| Premises and equipment | 444.3 | | 446.3 | | 443.7 | | 443.4 | | 444.7 | | | (0.4) | | (0.1) | |

| Other real estate owned | 16.5 | | 11.6 | | 14.4 | | 13.4 | | 12.7 | | | 42.2 | | 29.9 | |

| Mortgage servicing rights | 28.3 | | 29.1 | | 29.8 | | 30.1 | | 31.1 | | | (2.7) | | (9.0) | |

| Other assets | 519.5 | | 623.4 | | 586.6 | | 608.3 | | 649.5 | | | (16.7) | | (20.0) | |

| Total assets | $ | 30,671.2 | | $ | 30,540.8 | | $ | 30,976.3 | | $ | 31,637.7 | | $ | 32,287.8 | | | 0.4 | % | (5.0) | % |

| | | | | | | | |

| Liabilities and stockholders' equity: | | | | | | | | |

| Deposits | $ | 23,323.1 | | $ | 23,679.5 | | $ | 23,579.2 | | $ | 24,107.0 | | $ | 25,073.6 | | | (1.5) | % | (7.0) | % |

| Securities sold under repurchase agreements | 782.7 | | 889.5 | | 929.9 | | 970.8 | | 1,052.9 | | | (12.0) | | (25.7) | |

| Long-term debt | 120.8 | | 120.8 | | 120.8 | | 120.8 | | 120.8 | | | — | | — | |

| Other borrowed funds | 2,603.0 | | 2,067.0 | | 2,589.0 | | 2,710.0 | | 2,327.0 | | | 25.9 | | 11.9 | |

| Subordinated debentures held by subsidiary trusts | 163.1 | | 163.1 | | 163.1 | | 163.1 | | 163.1 | | | — | | — | |

| Other liabilities | 451.0 | | 535.4 | | 473.1 | | 405.7 | | 476.6 | | | (15.8) | | (5.4) | |

| Total liabilities | 27,443.7 | | 27,455.3 | | 27,855.1 | | 28,477.4 | | 29,214.0 | | | — | | (6.1) | |

| Stockholders' equity: | | | | | | | | |

| Common stock | 2,448.9 | | 2,484.9 | | 2,481.4 | | 2,478.7 | | 2,478.2 | | | (1.4) | | (1.2) | |

| Retained earnings | 1,135.1 | | 1,122.3 | | 1,098.8 | | 1,080.7 | | 1,072.7 | | | 1.1 | | 5.8 | |

| Accumulated other comprehensive loss | (356.5) | | (521.7) | | (459.0) | | (399.1) | | (477.1) | | | (31.7) | | (25.3) | |

| Total stockholders' equity | 3,227.5 | | 3,085.5 | | 3,121.2 | | 3,160.3 | | 3,073.8 | | | 4.6 | | 5.0 | |

| Total liabilities and stockholders' equity | $ | 30,671.2 | | $ | 30,540.8 | | $ | 30,976.3 | | $ | 31,637.7 | | $ | 32,287.8 | | | 0.4 | % | (5.0) | % |

| | | | | | | | |

| Common shares outstanding at period end | 103,942 | | 105,011 | | 105,021 | | 104,382 | | 104,442 | | | (1.0) | % | (0.5) | % |

| Book value per common share at period end | $ | 31.05 | | $ | 29.38 | | $ | 29.72 | | $ | 30.28 | | $ | 29.43 | | | 5.7 | | 5.5 | |

| Tangible book value per common share at period end** | 19.41 | | 17.82 | | 18.12 | | 18.57 | | 17.69 | | | 8.9 | | 9.7 | |

| | | | | | | | |

| | | | | | | | |

|

|

| **Non-GAAP financial measure - see Non-GAAP Financial Measures included herein for a reconciliation of book value per common share (GAAP) at period end to tangible book value per common share (non-GAAP) at period end. |

| NM - not meaningful | | | | | | | | |

| | | | | | | | |

FIRST INTERSTATE BANCSYSTEM, INC. AND SUBSIDIARIES

Loans and Deposits

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | % Change |

| (In millions, except %) | Dec 31,

2023 | Sep 30,

2023 | Jun 30,

2023 | Mar 31,

2023 | Dec 31,

2022 | | 4Q23 vs 3Q23 | 4Q23 vs 4Q22 |

| | | | | | | | |

| Loans held for investment: | | | | | | | | |

| Real Estate: | | | | | | | | |

| Commercial | $ | 8,869.2 | | $ | 8,766.2 | | $ | 8,813.9 | | $ | 8,680.8 | | $ | 8,528.6 | | | 1.2 | % | 4.0 | % |

| Construction | 1,826.5 | | 1,930.3 | | 1,836.5 | | 1,893.0 | | 1,944.4 | | | (5.4) | | (6.1) | |

| Residential | 2,244.3 | | 2,212.2 | | 2,198.3 | | 2,191.1 | | 2,188.3 | | | 1.5 | | 2.6 | |

| Agricultural | 716.8 | | 731.5 | | 755.7 | | 769.7 | | 794.9 | | | (2.0) | | (9.8) | |

| Total real estate | 13,656.8 | | 13,640.2 | | 13,604.4 | | 13,534.6 | | 13,456.2 | | | 0.1 | | 1.5 | |

| Consumer: | | | | | | | | |

| Indirect | 740.9 | | 751.7 | | 764.1 | | 817.3 | | 829.7 | | | (1.4) | | (10.7) | |

| Direct | 141.6 | | 142.3 | | 144.0 | | 146.9 | | 152.9 | | | (0.5) | | (7.4) | |

| Credit card | 76.5 | | 71.6 | | 72.1 | | 71.5 | | 75.9 | | | 6.8 | | 0.8 | |

| Total consumer | 959.0 | | 965.6 | | 980.2 | | 1,035.7 | | 1,058.5 | | | (0.7) | | (9.4) | |

| Commercial | 2,906.8 | | 2,925.1 | | 3,002.7 | | 3,028.0 | | 2,882.6 | | | (0.6) | | 0.8 | |

| Agricultural | 769.4 | | 690.5 | | 688.0 | | 660.4 | | 708.3 | | | 11.4 | | 8.6 | |

| Other | 0.1 | | 5.0 | | 1.7 | | 1.6 | | 9.2 | | | (98.0) | | (98.9) | |

| Deferred loan fees and costs | (12.5) | | (13.1) | | (13.6) | | (14.6) | | (15.6) | | | (4.6) | | (19.9) | |

| Loans held for investment | $ | 18,279.6 | | $ | 18,213.3 | | $ | 18,263.4 | | $ | 18,245.7 | | $ | 18,099.2 | | | 0.4 | % | 1.0 | % |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

|

| | | | | | | | |

| | | | | | | | |

| Deposits: | | | | | | | | |

| Non-interest-bearing | $ | 6,029.6 | | $ | 6,402.6 | | $ | 6,518.2 | | $ | 6,861.1 | | $ | 7,560.0 | | | (5.8) | % | (20.2) | % |

| Interest-bearing: | | | | | | | | |

| Demand | 6,507.8 | | 6,317.9 | | 6,481.9 | | 6,714.1 | | 7,205.9 | | | 3.0 | | (9.7) | |

| Savings | 7,775.8 | | 7,796.3 | | 7,836.7 | | 8,282.9 | | 8,379.3 | | | (0.3) | | (7.2) | |

| Time, $250 and over | 811.6 | | 817.1 | | 657.9 | | 526.5 | | 438.0 | | | (0.7) | | 85.3 | |

| Time, other | 2,198.3 | | 2,345.6 | | 2,084.5 | | 1,722.4 | | 1,490.4 | | | (6.3) | | 47.5 | |

| Total interest-bearing | 17,293.5 | | 17,276.9 | | 17,061.0 | | 17,245.9 | | 17,513.6 | | | 0.1 | | (1.3) | |

| Total deposits | $ | 23,323.1 | | $ | 23,679.5 | | $ | 23,579.2 | | $ | 24,107.0 | | $ | 25,073.6 | | | (1.5) | % | (7.0) | % |

| | | | | | | | |

Total core deposits (1) | $ | 22,511.5 | | $ | 22,862.4 | | $ | 22,921.3 | | $ | 23,580.5 | | $ | 24,635.6 | | | (1.5) | % | (8.6) | % |

| | | | | | | | |

(1) Core deposits are defined as total deposits less time deposits, $250 and over, and brokered deposits. |

|

FIRST INTERSTATE BANCSYSTEM, INC. AND SUBSIDIARIES

Credit Quality

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | | | | % Change |

| (In millions, except %) | Dec 31,

2023 | Sep 30,

2023 | Jun 30,

2023 | Mar 31,

2023 | Dec 31,

2022 | | 4Q23 vs 3Q23 | 4Q23 vs 4Q22 |

| | | | | | | | |

| Allowance for Credit Losses: | | | | | | | | |

| Allowance for credit losses | $ | 227.7 | | $ | 226.7 | | $ | 224.6 | | $ | 226.1 | | $ | 220.1 | | | 0.4 | % | 3.5 | % |

| As a percentage of loans held for investment | 1.25 | % | 1.24 | % | 1.23 | % | 1.24 | % | 1.22 | % | | | |

| As a percentage of non-accrual loans | 214.00 | | 278.50 | | 260.86 | | 279.83 | | 371.79 | | | | |

| | | | | | | | |

| Net loan charge-offs during quarter | $ | 4.8 | | $ | 1.1 | | $ | 11.4 | | $ | 6.2 | | $ | 1.1 | | | 336.4 | % | 336.4 | % |

| Annualized as a percentage of average loans | 0.10 | % | 0.02 | % | 0.25 | % | 0.14 | % | 0.02 | % | | | |

| | | | | | | | |

| Non-Performing Assets: | | | | | | | | |

| Non-accrual loans | $ | 106.4 | | $ | 81.4 | | $ | 86.1 | | $ | 80.8 | | $ | 59.2 | | | 30.7 | % | 79.7 | % |

| Accruing loans past due 90 days or more | 4.9 | | 3.2 | | 6.7 | | 4.5 | | 6.4 | | | 53.1 | | (23.4) | |

| Total non-performing loans | 111.3 | | 84.6 | | 92.8 | | 85.3 | | 65.6 | | | 31.6 | | 69.7 | |

| Other real estate owned | 16.5 | | 11.6 | | 14.4 | | 13.4 | | 12.7 | | | 42.2 | | 29.9 | |

| Total non-performing assets | $ | 127.8 | | $ | 96.2 | | $ | 107.2 | | $ | 98.7 | | $ | 78.3 | | | 32.8 | % | 63.2 | % |

| | | | | | | | |

| Non-performing assets as a percentage of: | | | | | | | | |

| Loans held for investment and OREO | 0.70 | % | 0.53 | % | 0.59 | % | 0.54 | % | 0.43 | % | | | |

| Total assets | 0.42 | | 0.31 | | 0.35 | | 0.31 | | 0.24 | | | | |

| | | | | | | | |

| Non-accrual loans to loans held for investment | 0.58 | | 0.45 | | 0.47 | | 0.44 | | 0.33 | | | | |

| | | | | | | | |

| Accruing Loans 30-89 Days Past Due | $ | 67.3 | | $ | 51.2 | | $ | 49.5 | | $ | 52.3 | | $ | 62.3 | | | 31.4 | % | 8.0 | % |

| | | | | | | | |

| | | | | | | | |

| Criticized Loans: | | | | | | | | |

| Special Mention | $ | 210.5 | | $ | 197.3 | | $ | 221.9 | | $ | 243.8 | | $ | 290.4 | | | 6.7 | % | (27.5) | % |

| Substandard | 457.1 | | 414.6 | | 386.9 | | 355.0 | | 316.2 | | | 10.3 | | 44.6 | |

| Doubtful | 20.7 | | 21.0 | | 32.8 | | 22.8 | | 8.5 | | | (1.4) | | 143.5 | |

| Total | $ | 688.3 | | $ | 632.9 | | $ | 641.6 | | $ | 621.6 | | $ | 615.1 | | | 8.8 | % | 11.9 | % |

| | | | | | | | |

|

| | | | | | | | |

FIRST INTERSTATE BANCSYSTEM, INC. AND SUBSIDIARIES

Selected Ratios - Annualized

(Unaudited)

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| At or for the Quarter ended: | |

| Dec 31,

2023 | | Sep 30,

2023 | | Jun 30,

2023 | | Mar 31,

2023 | | Dec 31,

2022 | |

| Annualized Financial Ratios (GAAP) | |

| Return on average assets | 0.80 | % | | 0.94 | % | | 0.86 | % | | 0.71 | % | | 1.07 | % | |

| Return on average common stockholders' equity | 7.77 | | | 9.20 | | | 8.44 | | | 7.25 | | | 11.16 | | |

| Yield on average earning assets | 4.69 | | | 4.63 | | | 4.52 | | | 4.43 | | | 4.24 | | |

| Cost of average interest-bearing liabilities | 2.24 | | | 2.09 | | | 1.88 | | | 1.46 | | | 0.89 | | |

| Interest rate spread | 2.45 | | | 2.54 | | | 2.64 | | | 2.97 | | | 3.35 | | |

| Efficiency ratio | 64.25 | | | 61.48 | | | 60.95 | | | 63.38 | | | 57.07 | | |

| Loans held for investment to deposit ratio | 78.38 | | | 76.92 | | | 77.46 | | | 75.69 | | | 72.18 | | |

| | | | | | | | | | |

| Annualized Financial Ratios - Operating** (Non-GAAP) | |

| Net FTE interest margin ratio | 3.01 | % | | 3.07 | % | | 3.12 | % | | 3.36 | % | | 3.61 | % | |

| Tangible book value per common share | $ | 19.41 | | | $ | 17.82 | | | $ | 18.12 | | | $ | 18.57 | | | $ | 17.69 | | |

| Tangible common stockholders' equity to tangible assets | 6.85 | % | | 6.38 | % | | 6.40 | % | | 6.37 | % | | 5.95 | % | |

| Return on average tangible common stockholders' equity | 12.65 | | | 15.04 | | | 13.69 | | | 11.87 | | | 18.67 | | |

| | | | | | | | | | |

| Consolidated Capital Ratios | |

| Total risk-based capital to total risk-weighted assets | 13.28 | % | * | 13.19 | % | | 12.90 | % | | 12.63 | % | | 12.48 | % | |

| Tier 1 risk-based capital to total risk-weighted assets | 11.08 | | * | 11.02 | | | 10.76 | | | 10.52 | | | 10.45 | | |

| Tier 1 common capital to total risk-weighted assets | 11.08 | | * | 11.02 | | | 10.76 | | | 10.52 | | | 10.45 | | |

| Leverage Ratio | 8.22 | | * | 8.22 | | | 7.99 | | | 7.72 | | | 7.75 | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| | | | | | | | | | |

| *Preliminary estimate - may be subject to change. The regulatory capital ratios presented include the assumption of the transitional method as a result of legislation by the United States Congress to provide relief for the economy and financial institutions in the United States from the COVID‑19 pandemic. The referenced relief ends on December 31, 2024 which allows a total five-year phase-in of the impact of CECL on capital and relief over the next two years for the impact on the allowance for credit losses resulting from the COVID‑19 pandemic. | |

| **Non-GAAP financial measures - see Non-GAAP Financial Measures included herein for a reconciliation of net interest margin to net FTE interest margin, book value per common share to tangible book value per common share, return on average common stockholders’ equity (GAAP) to return on average tangible common stockholders’ equity, and tangible common stockholders’ equity to tangible assets (non-GAAP). | |

| |

| | | | | | | | | | | | | | |

| FIRST INTERSTATE BANCSYSTEM, INC. AND SUBSIDIARIES |

| Selected Ratios |

| (Unaudited) |

| At or for the Year ended: | |

| Dec 31,

2023 | | Dec 31,

2022 | |

| Financial Ratios (GAAP) | |

| Return on average assets | 0.83 | % | | 0.65 | % | |

| Return on average common stockholders' equity | 8.17 | | | 6.34 | | |

| Yield on average earning assets | 4.57 | | | 3.63 | | |

| Cost of average interest-bearing liabilities | 1.91 | | | 0.40 | | |

| Interest rate spread | 2.66 | | | 3.23 | | |

| Efficiency ratio | 62.50 | | | 67.83 | | |

| | | | |

| Financial Ratios - Operating** (Non-GAAP) | |

| Net FTE interest margin ratio | 3.14 | | | 3.36 | | |

| Return on average tangible common stockholders' equity | 13.32 | | | 10.09 | | |

| | | | |

| | | | |

| | | | |

| | | | |

| | | | |

| |

| | | | |

| **Non-GAAP financial measures - see Non-GAAP Financial Measures included herein for a reconciliation of net interest margin to net FTE interest margin and return on average common stockholders’ equity (GAAP) to return on average tangible common stockholders’ equity (non-GAAP). | |

| | | | |

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| FIRST INTERSTATE BANCSYSTEM, INC. AND SUBSIDIARIES |

| Average Balance Sheets |

| (Unaudited) |

| | | | | | | | | | | |

| Three Months Ended |

| December 31, 2023 | | September 30, 2023 | | December 31, 2022 |

| (In millions, except %) | Average

Balance | Interest(2) | Average

Rate | | Average

Balance | Interest(2) | Average

Rate | | Average

Balance | Interest(2) | Average

Rate |

| Interest-earning assets: | | | | | | | | | | | |

Loans (1) | $ | 18,255.9 | | $ | 254.1 | | 5.52 | % | | $ | 18,317.4 | | $ | 251.5 | | 5.45 | % | | $ | 17,920.5 | | $ | 230.5 | | 5.10 | % |

| Investment securities | | | | | | | | | | | |

| Taxable | 8,710.1 | | 64.8 | | 2.95 | | | 8,877.6 | | 66.0 | | 2.95 | | | 10,148.0 | | 70.4 | | 2.75 | |

| Tax-exempt | 190.0 | | 0.9 | | 1.88 | | | 190.4 | | 0.9 | | 1.88 | | | 235.8 | | 1.2 | | 2.02 | |

| Investment in FHLB and FRB stock | 192.1 | | 3.1 | | 6.40 | | | 202.6 | | 2.9 | | 5.68 | | | 156.4 | | 2.0 | | 5.07 | |

| Interest-bearing deposits in banks | 221.0 | | 3.1 | | 5.57 | | | 208.5 | | 3.0 | | 5.71 | | | 220.1 | | 2.2 | | 3.97 | |

| Federal funds sold | 0.3 | | — | | — | | | 0.3 | | — | | — | | | 0.1 | | — | | — | |

| Total interest-earning assets | $ | 27,569.4 | | $ | 326.0 | | 4.69 | % | | $ | 27,796.8 | | $ | 324.3 | | 4.63 | % | | $ | 28,680.9 | | $ | 306.3 | | 4.24 | % |

| Non-interest-earning assets | 2,938.3 | | | | | 2,955.5 | | | | | 3,035.1 | | | |

| Total assets | $ | 30,507.7 | | | | | $ | 30,752.3 | | | | | $ | 31,716.0 | | | |

| Interest-bearing liabilities: | | | | | | | | | | | |

| Demand deposits | $ | 6,469.1 | | $ | 15.3 | | 0.94 | % | | $ | 6,361.5 | | $ | 13.3 | | 0.83 | % | | $ | 7,412.7 | | $ | 7.9 | | 0.42 | % |

| Savings deposits | 7,769.3 | | 37.4 | | 1.91 | | | 7,838.4 | | 33.6 | | 1.70 | | | 8,446.7 | | 14.8 | | 0.70 | |

| Time deposits | 3,179.4 | | 27.2 | | 3.39 | | | 2,938.0 | | 21.9 | | 2.96 | | | 1,848.6 | | 5.0 | | 1.07 | |

| Repurchase agreements | 842.2 | | 2.1 | | 0.99 | | | 895.2 | | 1.7 | | 0.75 | | | 1,091.2 | | 1.1 | | 0.40 | |

| Other borrowed funds | 2,087.6 | | 29.7 | | 5.64 | | | 2,396.3 | | 33.6 | | 5.56 | | | 1,260.0 | | 12.9 | | 4.06 | |

| Long-term debt | 120.8 | | 1.4 | | 4.60 | | | 120.8 | | 1.5 | | 4.93 | | | 120.8 | | 1.4 | | 4.60 | |

| Subordinated debentures held by subsidiary trusts | 163.1 | | 3.4 | | 8.27 | | | 163.1 | | 3.3 | | 8.03 | | | 163.1 | | 2.5 | | 6.08 | |

| Total interest-bearing liabilities | $ | 20,631.5 | | $ | 116.5 | | 2.24 | % | | $ | 20,713.3 | | $ | 108.9 | | 2.09 | % | | $ | 20,343.1 | | $ | 45.6 | | 0.89 | % |

| Non-interest-bearing deposits | 6,222.1 | | | | | 6,401.2 | | | | | 7,871.8 | | | |

| Other non-interest-bearing liabilities | 513.8 | | | | | 504.0 | | | | | 451.0 | | | |

| Stockholders’ equity | 3,140.3 | | | | | 3,133.8 | | | | | 3,050.1 | | | |

| Total liabilities and stockholders’ equity | $ | 30,507.7 | | | | | $ | 30,752.3 | | | | | $ | 31,716.0 | | | |

Net FTE interest income (non-GAAP)(3) | | $ | 209.5 | | | | | $ | 215.4 | | | | | $ | 260.7 | | |

Less FTE adjustments (2) | | (1.7) | | | | | (1.7) | | | | | (2.3) | | |

| Net interest income from consolidated statements of income | | $ | 207.8 | | | | | $ | 213.7 | | | | | $ | 258.4 | | |

| Interest rate spread | | | 2.45 | % | | | | 2.54 | % | | | | 3.35 | % |

| Net interest margin | | | 2.99 | | | | | 3.05 | | | | | 3.57 | |

Net FTE interest margin (non-GAAP)(3) | | | 3.01 | | | | | 3.07 | | | | | 3.61 | |

Cost of funds, including non-interest-bearing demand deposits (4) | | | 1.72 | | | | | 1.59 | | | | | 0.64 | |

| | | | | | | | | | | |

(1) Average loan balances include loans held for sale and loans held for investment, net of deferred fees and costs, which include non-accrual loans. Interest income includes amortization of deferred loan fees net of deferred loan costs, which is not material. |

(2) Management believes fully taxable equivalent, or FTE, interest income is useful to investors in evaluating the Company’s performance as a comparison of the returns between a tax-free investment and a taxable alternative. The Company adjusts interest income and average rates for tax exempt loans and securities to an FTE basis utilizing a 21.00% and 26.25% tax rate for 2023 and 2022, respectively. |

(3) Non-GAAP financial measure - see Non-GAAP Financial Measures included herein for a reconciliation to GAAP measures. |

(4) Calculated by dividing total annualized interest on interest-bearing liabilities by the sum of total interest-bearing liabilities plus non-interest-bearing deposits. |

| | | | | | | | | | | | | | | | | | | | | | | |

| FIRST INTERSTATE BANCSYSTEM, INC. AND SUBSIDIARIES |

| Average Balance Sheets |

| (Unaudited) |

| | | | | | | |

| Year Ended December 31, |

| 2023 | | 2022 |

| (In millions, except %) | Average

Balance | Interest(2) | Average

Rate | | Average

Balance | Interest(2) | Average

Rate |

| Interest earning assets: | | | | | | | |

Loans (1) | $ | 18,299.6 | | $ | 986.0 | | 5.39 | % | | $ | 16,802.2 | | $ | 797.2 | | 4.74 | % |

| Investment securities | | | | | | | |

| Taxable | 9,173.1 | | 269.1 | | 2.93 | | | 9,729.8 | | 213.9 | | 2.20 | |

| Tax-exempt | 199.7 | | 3.9 | | 1.95 | | | 243.6 | | 5.0 | | 2.05 | |

| Investment in FHLB and FRB stock | 207.5 | | 12.4 | | 5.98 | | | 116.6 | | 4.8 | | 4.12 | |

| Interest-bearing deposits in banks | 303.0 | | 15.7 | | 5.18 | | | 1,432.8 | | 8.7 | | 0.61 | |

| Federal funds sold | 0.5 | | — | | — | | | 0.5 | | — | | — | |

| Total interest-earning assets | $ | 28,183.4 | | $ | 1,287.1 | | 4.57 | % | | $ | 28,325.5 | | $ | 1,029.6 | | 3.63 | % |

| Non-interest-earning assets | 2,951.1 | | | | | 2,804.2 | | | |

| Total assets | $ | 31,134.5 | | | | | $ | 31,129.7 | | | |

| Interest-bearing liabilities: | | | | | | | |

| Demand deposits | $ | 6,553.3 | | $ | 47.2 | | 0.72 | % | | $ | 7,549.8 | | $ | 15.7 | | 0.21 | % |

| Savings deposits | 7,989.3 | | 122.2 | | 1.53 | | | 8,732.7 | | 24.5 | | 0.28 | |

| Time deposits | 2,676.3 | | 73.2 | | 2.74 | | | 1,577.0 | | 8.1 | | 0.51 | |

| Repurchase agreements | 940.4 | | 6.4 | | 0.68 | | | 1,114.5 | | 2.5 | | 0.22 | |

| Other borrowed funds | 2,514.6 | | 133.8 | | 5.32 | | | 411.1 | | 15.3 | | 3.72 | |

| Long-term debt | 120.8 | | 5.8 | | 4.80 | | | 122.2 | | 6.0 | | 4.91 | |

| Subordinated debentures held by subsidiary trusts | 163.1 | | 12.7 | | 7.79 | | | 156.6 | | 6.8 | | 4.34 | |

| Total interest-bearing liabilities | $ | 20,957.8 | | $ | 401.3 | | 1.91 | % | | $ | 19,663.9 | | $ | 78.9 | | 0.40 | % |

| Non-interest-bearing deposits | 6,549.9 | | | | | 7,911.6 | | | |

| Other non-interest-bearing liabilities | 475.9 | | | | | 364.7 | | | |

| Stockholders’ equity | 3,150.9 | | | | | 3,189.5 | | | |

| Total liabilities and stockholders’ equity | $ | 31,134.5 | | | | | $ | 31,129.7 | | | |

Net FTE interest income (non-GAAP)(3) | | $ | 885.8 | | | | | $ | 950.7 | | |

Less FTE adjustments (2) | | (7.0) | | | | | (8.1) | | |

| Net interest income from consolidated statements of income | | $ | 878.8 | | | | | $ | 942.6 | | |

| Interest rate spread | | | 2.66 | % | | | | 3.23 | % |

| Net interest margin | | | 3.12 | | | | | 2.84 | |

Net FTE interest margin (3) | | | 3.14 | | | | | 3.36 | |

Cost of funds, including non-interest-bearing demand deposits (4) | | | 1.46 | | | | | 0.29 | |

| | | | | | | |

(1) Average loan balances include mortgage loans held for sale and non-accrual loans. Interest income on loans includes amortization of deferred loan fees net of deferred loan costs of $1.3 million and $7.5 million at December 31, 2023 and December 31, 2022, respectively. |

(2) Management believes fully taxable equivalent, or FTE, interest income is useful to investors in evaluating the Company’s performance as a comparison of the returns between a tax-free investment and a taxable alternative. The Company adjusts interest income and average rates for tax exempt loans and securities to an FTE basis utilizing a 21.00% and 26.25% tax rate for 2023 and 2022, respectively. |

(3) Non-GAAP financial measure - see Non-GAAP Financial Measures included herein for a reconciliation to GAAP measures. |

(4) Calculated by dividing total annualized interest on interest-bearing liabilities by the sum of total interest-bearing liabilities plus non-interest-bearing deposits. |

| | | | | | | |

| | | | | | | | | | | | | | | | | | | | |

| FIRST INTERSTATE BANCSYSTEM, INC. AND SUBSIDIARIES |

| Non-GAAP Financial Measures |

| (Unaudited) |

| | | | | | |

| | As of or For the Quarter Ended |

| (In millions, except % and per share data) | | Dec 31, 2023 | Sep 30, 2023 | Jun 30, 2023 | Mar 31, 2023 | Dec 31, 2022 |

| Total common stockholders' equity (GAAP) | (A) | $ | 3,227.5 | | $ | 3,085.5 | | $ | 3,121.2 | | $ | 3,160.3 | | $ | 3,073.8 | |

| Less goodwill and other intangible assets (excluding mortgage servicing rights) | | 1,210.3 | | 1,214.1 | | 1,218.0 | | 1,221.9 | | 1,225.9 | |

| Tangible common stockholders' equity (Non-GAAP) | (B) | $ | 2,017.2 | | $ | 1,871.4 | | $ | 1,903.2 | | $ | 1,938.4 | | $ | 1,847.9 | |

| | | | | | |

| Total assets (GAAP) | | $ | 30,671.2 | | $ | 30,540.8 | | $ | 30,976.3 | | $ | 31,637.7 | | $ | 32,287.8 | |

| Less goodwill and other intangible assets (excluding mortgage servicing rights) | | 1,210.3 | | 1,214.1 | | 1,218.0 | | 1,221.9 | | 1,225.9 | |

| Tangible assets (Non-GAAP) | (C) | $ | 29,460.9 | | $ | 29,326.7 | | $ | 29,758.3 | | $ | 30,415.8 | | $ | 31,061.9 | |

| | | | | | |

| Average Balances: | | | | | | |

| Total common stockholders' equity (GAAP) | (D) | $ | 3,140.3 | | $ | 3,133.8 | | $ | 3,182.9 | | $ | 3,147.0 | | $ | 3,050.1 | |

| Less goodwill and other intangible assets (excluding mortgage servicing rights) | | 1,212.1 | | 1,216.0 | | 1,219.8 | | 1,223.8 | | 1,226.9 | |

| Average tangible common stockholders' equity (Non-GAAP) | (E) | $ | 1,928.2 | | $ | 1,917.8 | | $ | 1,963.1 | | $ | 1,923.2 | | $ | 1,823.2 | |

| | | | | | |

| Net interest income | (F) | $ | 207.8 | | $ | 213.7 | | $ | 218.4 | | $ | 238.9 | | $ | 258.4 | |

| FTE interest income | | 1.7 | | 1.7 | | 1.8 | | 1.8 | | 2.3 | |

| Net FTE interest income | (G) | 209.5 | | 215.4 | | 220.2 | | 240.7 | | 260.7 | |

| Less purchase accounting accretion | | 5.4 | | 5.2 | | 4.6 | | 5.2 | | 8.4 | |

| | | | | | |

| Adjusted net FTE interest income | (H) | $ | 204.1 | | $ | 210.2 | | $ | 215.6 | | $ | 235.5 | | $ | 252.3 | |

| | | | | | |

| Average interest-earning assets | (I) | $ | 27,569.4 | | $ | 27,796.8 | | $ | 28,328.8 | | $ | 29,059.4 | | $ | 28,680.9 | |

| | | | | | |

| | | | | | |

| | | | | | |

| Total quarterly average assets | (J) | 30,507.7 | | 30,752.3 | | 31,287.6 | | 32,010.9 | | 31,716.0 | |

| Annualized net income available to common shareholders | (K) | 244.0 | | 288.4 | | 268.7 | | 228.3 | | 340.4 | |

| Common shares outstanding | (L) | 103,942 | | 105,011 | | 105,021 | | 104,382 | | 104,442 | |

| | | | | | |

| Return on average assets (GAAP) | (K) / (J) | 0.80 | % | 0.94 | % | 0.86 | % | 0.71 | % | 1.07 | % |

| Return on average common stockholders' equity (GAAP) | (K) / (D) | 7.77 | | 9.20 | | 8.44 | | 7.25 | | 11.16 | |

| Average common stockholders' equity to average assets (GAAP) | (D) / (J) | 10.29 | | 10.19 | | 10.17 | | 9.83 | | 9.62 | |

| Book value per common share (GAAP) | (A) / (L) | $ | 31.05 | | $ | 29.38 | | $ | 29.72 | | $ | 30.28 | | $ | 29.43 | |

| Tangible book value per common share (Non-GAAP) | (B) / (L) | 19.41 | | 17.82 | | 18.12 | | 18.57 | | 17.69 | |

| Tangible common stockholders' equity to tangible assets (Non-GAAP) | (B) / (C) | 6.85 | % | 6.38 | % | 6.40 | % | 6.37 | % | 5.95 | % |

| Return on average tangible common stockholders' equity (Non-GAAP) | (K) / (E) | 12.65 | | 15.04 | | 13.69 | | 11.87 | | 18.67 | |

| Net interest margin (GAAP) | (F*) / (I) | 2.99 | | 3.05 | | 3.09 | | 3.33 | | 3.57 | |

| Net interest margin (FTE) (Non-GAAP) | (G*) / (I) | 3.01 | | 3.07 | | 3.12 | | 3.36 | | 3.61 | |

| Adjusted net interest margin (FTE) (Non-GAAP) | (H*) / (I) | 2.94 | | 3.00 | | 3.05 | | 3.29 | | 3.49 | |

| | | | | | |

| *Annualized |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

|

|

| | | | | | | | | | | | | | | | | | |

| FIRST INTERSTATE BANCSYSTEM, INC. AND SUBSIDIARIES |

| Non-GAAP Financial Measures |

| (Unaudited) |

| | | | | | |

| | | | | For the Year Ended |

| (In millions, except % and per share data) | | | | | Dec 31, 2023 | Dec 31, 2022 |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| Average Balances: | | | | | | |

| Total common stockholders' equity (GAAP) | | | | (A) | $ | 3,150.9 | | $ | 3,189.5 | |

| Less goodwill and other intangible assets (excluding mortgage servicing rights) | | | | | 1,217.9 | | 1,186.5 | |

| Average tangible common stockholders' equity (Non-GAAP) | | | | (B) | $ | 1,933.0 | | $ | 2,003.0 | |

| | | | | | |

| Net interest income | | | | (C) | $ | 878.8 | | $ | 942.6 | |

| FTE interest income | | | | | 7.0 | | 8.1 | |

| Net FTE interest income | | | | (D) | 885.8 | | 950.7 | |

| Less: Purchase accounting accretion | | | | | 20.4 | | 50.4 | |

| | | | | | |

| Adjusted net interest income (FTE) | | | | (E) | $ | 865.4 | | $ | 900.3 | |

| | | | | | |

| Average interest-earning assets | | | | (F) | $ | 28,183.4 | | $ | 28,325.5 | |

| | | | | | |

| | | | | | |

| | | | | | |

| Total average assets | | | | (G) | 31,134.5 | | 31,129.7 | |

| Net income available to common shareholders | | | | (H) | 257.5 | | 202.2 | |

| | | | | | |

| | | | | | |

| Return on average assets (GAAP) | | | | (H) / (G) | 0.83 | % | 0.65 | % |

| Return on average common stockholders' equity (GAAP) | | | | (H) / (A) | 8.17 | | 6.34 | |

| Average common stockholders' equity to average assets (GAAP) | | | | (A) / (G) | 10.12 | | 10.25 | |

| | | | | | |

| | | | | | |

| | | | | | |

| Return on average tangible common stockholders' equity (Non-GAAP) | | | | (H) / (B) | 13.32 | | 10.09 | |

| Net interest margin (GAAP) | | | | (C) / (F) | 3.12 | | 3.33 | |

| Net interest margin (FTE) (Non-GAAP) | | | | (D) / (F) | 3.14 | | 3.36 | |

| Adjusted net interest margin (FTE) (Non-GAAP) | | | | (E) / (F) | 3.07 | | 3.18 | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

| | | | | | |

|

|

First Interstate BancSystem, Inc.

P.O. Box 30918 Billings, Montana 59116 (406) 255-5311

www.FIBK.com

4Q 2023 Investor Presentation Exhibit 99.2 January 30, 2024