Q32 Bio Inc., a clinical stage biotechnology company developing

biologic therapeutics to restore immune homeostasis, and Homology

Medicines, Inc. (Nasdaq: FIXX), today announced they have entered

into a definitive merger agreement to combine the companies in an

all-stock transaction. The combined company will focus on advancing

Q32 Bio’s wholly owned clinical development candidates for the

treatment of autoimmune and inflammatory diseases. Upon completion

of the merger, the combined company will operate as Q32 Bio,

headquartered in Waltham, Massachusetts, and is expected to trade

under the Nasdaq ticker symbol “QTTB”.

In support of the merger agreement, Q32 Bio has entered into an

agreement for a $42 million private placement with participation

from existing and new investors including OrbiMed, Atlas Venture,

Abingworth, Bristol Myers Squibb, Acorn Bioventures, Osage

University Partners (OUP), CU Healthcare Innovation Fund, Sanofi

Ventures, Agent Capital and other undisclosed investors.

“The proposed merger with Homology Medicines and concurrent

private placement is expected to provide Q32 Bio with the capital

to drive development of our autoimmune and inflammatory pipeline

through multiple clinical milestones,” said Jodie Morrison, Chief

Executive Officer of Q32 Bio. “This funding is expected to enable

us to deliver two Phase 2 readouts for bempikibart in the second

half of 2024, proof-of-concept data for ADX-097, a tissue-targeted

inhibitor of complement activation, by year-end 2024, and topline

ADX-097 clinical results in the second half of 2025.”

“Following a comprehensive assessment of our strategic options,

management and the Board of Directors believe the merger with Q32

Bio is in the best interest of our shareholders," said Albert

Seymour, President and Chief Executive Officer of Homology

Medicines. "The Q32 Bio management team’s extensive track record,

deep biopharmaceutical expertise and the potential of its clinical

development pipeline provide a compelling opportunity to deliver

meaningful treatments to patients with critical unmet needs.”

Proceeds from the proposed transactions will be used to advance

the clinical development of Q32 Bio’s two wholly owned assets,

bempikibart (ADX-914), for which Q32 Bio earlier today announced it

regained all rights from Amgen, and ADX-097.

Bempikibart, Q32 Bio’s lead program, is a fully human

anti-IL-7Rα antibody that re-regulates adaptive immune function by

blocking signaling mediated by both IL-7 and TSLP and is currently

being evaluated in two Phase 2 trials, with one clinical trial

evaluating the use in atopic dermatitis (AD) and one evaluating the

use in alopecia areata (AA). All data from the Phase 2 trials

remain blinded and Q32 Bio remains on track to report topline Phase

2 results in the second half of 2024.

ADX-097 is based on a novel platform enabling tissue-targeted

regulation of the complement system without long-term systemic

blockade, a key differentiator from current complement

therapeutics. Q32 Bio recently completed a first-in-human, Phase 1

ascending dose clinical study of ADX-097 in healthy volunteers.

Results from the Phase 1 clinical trial demonstrated a favorable

tolerability and immunogenicity profile across all single and

multiple dose cohorts and weekly subcutaneous dosing met exposures

for predicted complete complement inhibition in the tissue with no

systemic inhibition. Q32 Bio will be commencing an open-label Phase

2 basket clinical trial, with initial data expected by year-end

2024, and a Phase 2 clinical trial in ANCA-Associated Vasculitis

(AAV), with topline results from the AAV and basket trials expected

in the second half of 2025.

About the Proposed Merger

Under the terms of the merger agreement, Homology Medicines will

issue to pre-merger Q32 Bio stockholders shares of Homology

Medicines common stock as merger consideration in exchange for the

cancellation of shares of capital stock of Q32 Bio, and Q32 Bio

will become a wholly owned subsidiary of Homology Medicines.

Stockholders of Q32 Bio will receive newly issued shares of

Homology Medicines common stock pursuant to a formula set forth in

the merger agreement. Pre-merger Homology Medicines stockholders

are expected to own approximately 25% of the combined company and

pre-merger Q32 Bio stockholders (including those purchasing Q32 Bio

shares in the concurrent private financing discussed above) are

expected to own approximately 75% of the combined company. The

percentage of the combined company that pre-merger Q32 Bio

stockholders and pre-merger Homology Medicines will own upon the

closing of the merger is further subject to adjustment based on the

amount of Homology Medicines’ net cash at the time of closing. In

connection with the closing of the proposed transactions, Homology

Medicines stockholders will also be issued a contingent value right

(CVR) representing the right to receive certain payments from

proceeds received by the combined company, if any, related to

dispositions of Homology Medicines’ pre-transaction legacy

assets.

Homology Medicines has discontinued development of its R&D

programs, including HMI-103 for the treatment of PKU, and has been

exploring strategic alternatives for its programs and platform

technology. If Homology Medicines has not otherwise disposed of its

ownership position in Oxford Biomedica Solutions, LLC (Oxford

Solutions), a contract development and manufacturing organization

(CDMO) jointly established by Homology Medicines and Oxford

Biomedica plc, and monetized its development programs, including

HMI-103 for the treatment of PKU, Homology Medicines stockholders

of record will be issued a CVR for each outstanding share of

Homology Medicines common stock held by such Homology Medicines

stockholder prior to the closing of the proposed merger. The CVR

would represent the right to receive certain cash payments from

proceeds received by Homology Medicines related to the sale or

license of its development programs and platform technology and the

exercise of a put/call option or other sale or disposition of

Homology Medicines’ minority ownership position in Oxford

Solutions.

The merger agreement has been approved by the

boards of directors of both companies. Additional information about

the transaction will be provided in a Current Report on Form 8-K

that will be filed by Homology Medicines with the Securities and

Exchange Commission (SEC) and will be available

at www.sec.gov.

Leerink Partners is serving as the exclusive financial advisor

to Q32 Bio. Leerink Partners and Piper Sandler are serving as

placement agents for Q32 Bio’s planned private placement. Goodwin

Procter LLP is serving as legal counsel to Q32 Bio. TD Cowen is

serving as the exclusive financial advisor and Latham & Watkins

LLP is serving as legal counsel to Homology Medicines.

Management and Organization

Upon closing of the proposed transaction, the combined company

will be led by current members of the Q32 Bio leadership team

including:

- Jodie Morrison, Chief Executive Officer

- Shelia Violette, PhD, Founder & Chief Scientific

Officer

- Jason Campagna, MD, PhD, Chief Medical Officer

- Saul Fink, PhD, Chief Technology Officer

- Maria Marzilli, MPH, Executive Vice President, Corporate

Strategy & Program Operations

- David Appugliese, JD, Senior Vice President, Head of

People

The Board of Directors of the combined company is expected to be

comprised of nine members, consisting of seven members designated

by Q32 Bio and two members designated by Homology Medicines. The

transaction has been approved by the Board of Directors of each

company and is expected to close in the first quarter of 2024,

subject to customary closing conditions, including the approval of

the transaction by the stockholders of each company.

About Q32 Bio

Q32 Bio is a clinical stage biotechnology company developing

biologic therapeutics targeting potent regulators of the innate and

adaptive immune systems to re-balance immunity in autoimmune and

inflammatory diseases. Q32 Bio’s lead programs, focused on the IL-7

/ TSLP receptor pathways and complement system, address immune

dysregulation to help patients take back control of their

lives.

Q32 Bio’s program for adaptive immunity, bempikibart (ADX-914),

is a fully human anti-IL-7Rα antibody that re-regulates adaptive

immune function for the treatment of autoimmune diseases. It is

being evaluated in two Phase 2 trials for the treatment of atopic

dermatitis and alopecia areata. The IL-7 and TSLP pathways have

been genetically and biologically implicated in driving several T

cell-mediated pathological processes in numerous autoimmune

diseases. Q32 Bio’s program for innate immunity, ADX-097, is based

on a novel platform enabling tissue-targeted regulation of the

complement system without long-term systemic blockade – a key

differentiator versus current complement therapeutics. Q32 Bio has

recently completed a first-in-human, Phase 1 ascending dose

clinical study of ADX-097 in healthy volunteers.

About Homology Medicines

Homology Medicines, Inc. is a clinical-stage genetic medicines

company historically focused on transforming the lives of patients

suffering from rare diseases by addressing the underlying cause of

the disease. Homology Medicines has gene editing and gene therapy

clinical-stage programs in PKU and Hunter syndrome (MPS II), a

preclinical pipeline that includes a gene therapy candidate for

metachromatic leukodystrophy and a GTx-mAb (vectorized antibody)

candidate for paroxysmal nocturnal hemoglobinuria, as well as

intellectual property on its family of 15 adeno-associated viruses

(AAVHSCs). Homology Medicines is not currently pursuing further

development of these programs and is pursuing strategic options for

the Company and its programs and platform technology. Additionally,

the Company has an ownership stake in Oxford Solutions, an AAV

manufacturing company based on Homology Medicines’ internal process

development and manufacturing formed as a joint venture between

Homology Medicines and Oxford Biomedica plc.

Cautionary Statement Regarding Forward-Looking

Statements

This communication contains forward-looking statements within

the meaning of the U.S. Private Securities Litigation Reform Act of

1995, including statements regarding the proposed transaction

involving Homology Medicines and Q32 Bio, including the conditions

to, and timing of, closing of the proposed transaction, the

location and management of the combined company, the percentage

ownership of the combined company, and the parties’ ability to

consummate the proposed transaction and private placement

financing, including the intended use of net proceeds from the

private placement financing and the expected timing of closing and

completion of the private placement financing, the composition of

the Board of Directors of the combined company, the expected

issuance of the CVR and the contingent payments contemplated by the

CVR, the combined company’s expected cash and the sufficiency of

the combined company’s cash, cash equivalents and short-term

investments to fund operations into mid-2026, the listing of the

combined company’s shares on Nasdaq, the expectations surrounding

the potential, safety, efficacy, and regulatory and clinical

progress of Q32 Bio’s product candidates, including bempikibart and

ADX-097, and anticipated milestones and timing, among

others.

Forward-looking statements generally include statements that are

predictive in nature and depend upon or refer to future events or

conditions, and include words such as “may,” “will,” “should,”

“would,” “expect,” “anticipate,” “plan,” “likely,” “believe,”

“estimate,” “project,” “intend,” and other similar expressions

among others. Statements that are not historical facts are

forward-looking statements. Forward-looking statements are based on

current beliefs and assumptions that are subject to risks and

uncertainties and are not guarantees of future performance. Actual

results could differ materially from those contained in any

forward-looking statement as a result of various factors,

including, without limitation: (i) the risk that the conditions to

the closing of the proposed transaction are not satisfied,

including the failure to timely or at all obtain stockholder

approval for the proposed transaction or the failure to timely or

at all obtain any required regulatory clearances; (ii)

uncertainties as to the timing of the consummation of the proposed

transaction and the ability of each of Homology Medicines and Q32

Bio to consummate the proposed transaction; (iii) the ability of

Homology Medicines and Q32 Bio to integrate their businesses

successfully and to achieve anticipated synergies; (iv) the

possibility that other anticipated benefits of the proposed

transaction will not be realized, including without limitation,

anticipated revenues, expenses, earnings and other financial

results, and growth and expansion of the combined company’s

operations, and the anticipated tax treatment of the combination;

(v) potential litigation relating to the proposed transaction that

could be instituted against Homology Medicines, Q32 Bio or their

respective directors; (vi) possible disruptions from the proposed

transaction that could harm Homology Medicines’ and/or Q32 Bio’s

respective businesses; (vii) the ability of Homology Medicines and

Q32 Bio to retain, attract and hire key personnel; (viii) potential

adverse reactions or changes to relationships with customers,

employees, suppliers or other parties resulting from the

announcement or completion of the proposed transaction; (ix)

potential business uncertainty, including changes to existing

business relationships, during the pendency of the proposed

transaction that could affect Homology Medicines’ or Q32 Bio’s

financial performance; (x) certain restrictions during the pendency

of the proposed transaction that may impact Homology Medicines’ or

Q32 Bio’s ability to pursue certain business opportunities or

strategic transactions; (xi) the combined company’s need for

additional funding, which may not be available; (xii) failure to

identify additional product candidates and develop or commercialize

marketable products; (xiii) the early stage of the combined

company’s development efforts; (xiv) potential unforeseen events

during clinical trials could cause delays or other adverse

consequences; (xv) risks relating to the regulatory approval

process; (xvi) interim, topline and preliminary data may change as

more patient data become available, and are subject to audit and

verification procedures that could result in material changes in

the final data; (xvii) Q32 Bio’s product candidates may cause

serious adverse side effects; (xviii) inability to maintain our

collaborations, or the failure of these collaborations; (xix) the

combined company’s reliance on third parties, including for the

manufacture of materials for our research programs, preclinical and

clinical studies; (xx) failure to obtain U.S. or international

marketing approval; (xxi) ongoing regulatory obligations; effects

of significant competition; (xxii) unfavorable pricing regulations,

third-party reimbursement practices or healthcare reform

initiatives; (xxiii) product liability lawsuits; (xxiv) securities

class action litigation; (xxv) the impact of the COVID-19 pandemic

and general economic conditions on our business and operations,

including the combined company’s preclinical studies and clinical

trials; (xxvi) the possibility of system failures or security

breaches; risks relating to intellectual property; (xxvii)

significant costs incurred as a result of operating as a public

company; and (xxviii) such other factors as are set forth in

Homology Medicines’ periodic public filings with the SEC, including

but not limited to those described under the heading “Risk Factors”

in Homology Medicines’ Form 10-Q for the period ended September 30,

2023. Homology Medicines can give no assurance that the conditions

to the proposed transaction will be satisfied. Except as required

by applicable law, Homology Medicines undertakes no obligation to

revise or update any forward-looking statement, or to make any

other forward-looking statements, whether as a result of new

information, future events or otherwise.

Important Information about the Merger

and Where to Find It

This communication relates to a proposed transaction between

Homology Medicines and Q32 Bio. In connection with the proposed

transaction, Homology Medicines intends to file with the SEC a

registration statement on Form S-4 that will include a proxy

statement of Homology Medicines and that will constitute a

prospectus with respect to shares of Homology Medicines’ common

stock to be issued in the proposed transaction (Proxy

Statement/Prospectus). Homology Medicines may also file other

documents with the SEC regarding the proposed transaction. This

document is not a substitute for the Proxy Statement/Prospectus or

any other document which Homology Medicines may file with the SEC.

INVESTORS, Q32 BIO STOCKHOLDERS AND HOMOLOGY MEDICINES STOCKHOLDERS

ARE URGED TO READ THE PROXY STATEMENT/PROSPECTUS AND ANY OTHER

RELEVANT DOCUMENTS THAT ARE OR WILL BE FILED BY HOMOLOGY MEDICINES

WITH THE SEC, AS WELL AS ANY AMENDMENTS OR SUPPLEMENTS TO THESE

DOCUMENTS, CAREFULLY AND IN THEIR ENTIRETY BECAUSE THEY CONTAIN OR

WILL CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION

AND RELATED MATTERS. Investors, Q32 Bio stockholders and Homology

Medicines stockholders will also be able to obtain free copies of

the Proxy Statement/Prospectus (when available) and other documents

containing important information about Homology Medicines, Q32 Bio

and the proposed transaction that are or will be filed with the SEC

by Homology Medicines through the website maintained by the SEC at

www.sec.gov. Copies of the documents filed with the SEC by Homology

Medicines will also be available free of charge on Homology

Medicines’ website at

https://investors.homologymedicines.com/financial-information/sec-filings

or by contacting Homology Medicines’ investor relations department

by email at IR@homologymedicines.com.

No Offer or Solicitation

This communication is not intended to and shall

not constitute an offer to buy or sell or the solicitation of an

offer to buy or sell any securities, or a solicitation of any vote

or approval, nor shall there be any sale of securities in any

jurisdiction in which such offer, solicitation or sale would be

unlawful prior to registration or qualification under the

securities laws of any such jurisdiction. No offer of securities

shall be made, except by means of a prospectus meeting the

requirements of Section 10 of the Securities Act.

Participants in the

Solicitation

Homology Medicines and certain of its directors

and executive officers may be deemed under SEC rules to be

participants in the solicitation of proxies of Homology Medicines

stockholders in connection with the proposed transaction.

Information regarding the persons who may, under SEC rules, be

deemed participants in the solicitation of proxies to Homology

Medicines’ stockholders in connection with the proposed transaction

will be set forth in the Proxy Statement/Prospectus on Form S-4 for

the proposed transaction, which is expected to be filed with the

SEC by Homology Medicines. Investors and security holders of Q32

Bio and Homology Medicines are urged to read the Proxy

Statement/Prospectus and other relevant documents that will be

filed with the SEC by Homology Medicines carefully and in their

entirety when they become available because they will contain

important information about the proposed transaction. Investors and

security holders will be able to obtain free copies of the Proxy

Statement/Prospectus and other documents containing important

information about Q32 Bio and Homology Medicines through the

website maintained by the SEC at www.sec.gov. Copies of the

documents filed with the SEC by Homology Medicines can be obtained

free of charge by directing a written request to Homology

Medicines, Inc., One Patriots Park, Bedford, MA 01730.

Contacts:For Q32 Bio:Investors: Brendan

BurnsMedia: Sarah SuttonArgot

Partners212.600.1902Q32Bio@argotpartners.com

For Homology Medicines:Brad SmithChief Financial and Business

Officer781-691-3519bsmith@homologymedicines.com

Homology Medicines (NASDAQ:FIXX)

Historical Stock Chart

From Oct 2024 to Nov 2024

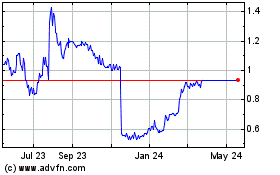

Homology Medicines (NASDAQ:FIXX)

Historical Stock Chart

From Nov 2023 to Nov 2024