0001433642false00014336422023-07-142023-07-14

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 14, 2023

Hamilton Lane Incorporated

(Exact Name of Registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-38021 | | 26-2482738 |

(State or other jurisdiction of incorporation) | | (Commission File No.) | | (IRS Employer Identification No.) |

| | | | | | | | | | | | | | | | | |

| 110 Washington Street, | Suite 1300 | | | | |

| Conshohocken, | PA | | | | 19428 |

(Address of principal executive offices) | | | | (Zip Code) |

(610) 934-2222

(Registrant’s telephone number, including area code)

Not Applicable

(Former Name or Former Address, if Changed Since Last Report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

| | | | | | | | | | | | | | | | | | | | |

| Title of each class | | Trading Symbol(s) | | Name of each exchange on which registered |

| Class A Common Stock, $0.001 par value per share | | HLNE | | The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02. Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

On July 14, 2023, Atul Varma and Hamilton Lane Incorporated (the “Company”) reached mutual agreement that Mr. Varma will resign from his position as Chief Financial Officer and Treasurer of the Company, effective August 8, 2023. On the same day and in connection with Mr. Varma’s resignation, the Company appointed Jeffrey Armbrister as Chief Financial Officer and Treasurer, also effective as of August 8, 2023. Mr. Varma’s resignation was not the result of any dispute or disagreement with the Company, the Company’s management or the Board of Directors of the Company on any matter relating to the Company’s operations, policies or practices.

On July 18, 2023, Mr. Varma and the Company entered into a Confidential Separation Agreement and General Release (the “Agreement”). The Agreement provides that, immediately upon his resignation as Chief Financial Officer and Treasurer and in order to transition his duties to Mr. Armbrister, Mr. Varma will serve as a senior advisor to the Company until the earlier of (i) January 31, 2024 or (ii) the date on which Mr. Varma secures new employment (the “Termination Date”). As consideration for his transition services, Mr. Varma will (i) continue to receive his base salary until the Termination Date and (ii) will receive a one-time, lump sum payment of $375,000. If the Termination Date occurs before January 31, 2024, the remaining base salary payments will accelerate and be paid as a lump sum. Mr. Varma’s awards of carried interest under the Hamilton Lane Advisors, L.L.C. 2016 Carried Interest Plan (amended and restated, effective as of January 1, 2018) (the “Carried Interest Plan”) will continue to vest through March 31, 2024, at which point any remaining unvested awards under the Carried Interest Plan will be forfeited. The Company’s Board of Directors approved a modification to Mr. Varma’s outstanding time-based restricted stock awards under the Company’s Amended and Restated 2017 Equity Incentive Plan (the “2017 Equity Plan”) to accelerate the vesting of unvested awards as of January 31, 2024, comprising 6,682 shares. Mr. Varma will forfeit all 6,522 unvested performance stock awards under the 2017 Equity Plan as of the Termination Date.

The foregoing summary of the terms of the Agreement is qualified in its entirety by reference to the complete text of the Agreement, a copy of which is filed as Exhibit 10.1 to this Current Report on Form 8-K and incorporated by reference herein.

Mr. Armbrister, 50, joined the Company in November 2018 as a Managing Director and has served as Global Head of Direct Equity Investments since September 2019 where he has been responsible for direction and oversight of the firm’s direct equity / co-investment platform, a role that includes service on the boards of companies in which the Company has invested on behalf of clients. Prior to joining the Company, Mr. Armbrister worked for Versa Capital Management from 2003 to 2018, serving as a Managing Director from 2013 to 2018, where he focused on making control-oriented, special situations, debt and equity investments in middle market companies across a variety of industries. While at Versa, Mr. Armbrister participated in all major investment functions, and his responsibilities included origination, underwriting, transaction execution and portfolio company development. He also performed and provided oversight for certain finance-related operational activities, including financial analysis and reporting and cash flow management for a number of portfolio companies while at Versa and in prior roles. Prior to joining Versa in 2003, Mr. Armbrister was an Equity Research analyst at Oppenheimer + Close. He has also held private equity, venture capital, corporate development and investment banking positions at Berwind Financial Group, Redleaf Group, ICG Commerce and Wheat First Butcher Singer, respectively. Mr. Armbrister currently serves on the boards of directors or similar bodies of several charitable and non-profit organizations. He received a B.A. in Economics from the University of Virginia.

In connection with his appointment, Mr. Armbrister will continue to be eligible to participate in the Company’s 2017 Equity Plan and Carried Interest Plan and has been approved for the following new compensation arrangements: (i) a target discretionary bonus of $900,000 for fiscal 2024 service and (ii) a target fiscal 2024 award under the Carried Interest Plan valued at $1 million. He will continue to receive an annual base salary of $325,000 and be entitled to participate in other health and welfare benefits made available to employees.

There is no arrangement or understanding between Mr. Armbrister and any other persons or entities pursuant to which he has been appointed as Chief Financial Officer and Treasurer, and there is no family relationship between Mr. Armbrister and any directors or executive officers of the Company. Mr. Armbrister is not currently engaged, and has not during the last fiscal year been engaged, in any transactions with the Company or its subsidiaries that are required to be disclosed under Item 404(a) of Regulation S-K, nor have any such transactions been proposed. Mr. Armbrister has

previously signed the Company’s standard form of confidentiality and non-disclosure agreement and is expected to enter into the Company’s standard form of indemnification agreement as well.

A copy of the press release announcing the transition of the Chief Financial Officer role from Mr. Varma to Mr. Armbrister is attached as Exhibit 99.1 to this Current Report on Form 8-K.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| |

| HAMILTON LANE INCORPORATED |

| |

| Date: July 20, 2023 | |

| |

| By: | /s/ Lydia A. Gavalis |

| | Name: | Lydia A. Gavalis |

| | Title: | General Counsel and Secretary |

CONFIDENTIAL SEPARATION AGREEMENT AND GENERAL RELEASE

This Confidential Separation Agreement and General Release (the "Agreement") is entered into in full and final settlement of the issues, described more fully herein, between Atul Varma, the employee (hereafter referred to as "you" or "your"), and Hamilton Lane Advisors, L.L.C. (hereafter referred to as "Hamilton Lane").

WHEREAS, the parties desire to amicably, fully, and finally settle all matters between you and Hamilton Lane, including the termination of your employment with Hamilton Lane, and

NOW, THEREFORE, in consideration of the mutual covenants and undertakings contained herein and for good and valuable consideration, the receipt and sufficiency of which are hereby acknowledged, and intending to be legally bound hereby, you and Hamilton Lane hereby agree as follows:

1. End of Employment/Payment and Compensation. Regardless of whether you elect to sign this Agreement, the following provisions in this Paragraph 1 shall apply:

(a) Separation Date. You and Hamilton Lane have agreed that your provision of services to Hamilton Lane will end effective as of the close of business on August 8, 2023 ("Separation Date"), If you do not sign this Agreement, the Separation Date will be deemed the official termination date regarding your employment, and not the date as reflected in Paragraph 2(a) below.

(b) Payment & Compensation/Benefits.

(i) You will be paid for all work performed up through the Separation Date as well as receive payment of any accrued but unused vacation days in accordance with Hamilton Lane policy.

(ii) If you do not sign this Agreement, your eligibility to participate in Hamilton Lane sponsored health insurance, including medical, dental and prescription, as an employee of Hamilton Lane, will end as of the Separation Date. However, you will be eligible to continue to participate in this insurance in accordance with a federal law called the Consolidated Omnibus Budget Reconciliation Act ("COBRA"), subject to COBRA's terms, conditions and restrictions. You will receive information about COBRA under separate cover.

(c) You are required to comply with Paragraphs 4 and 9 below.

2. If you sign this Agreement, agreeing to be bound by the General Release in Paragraph 5 below and all of the other terms and conditions of this Agreement, Hamilton Lane shall provide you with the following:

a) Your official employment termination date will be the earlier of January 31, 2024, or the date you begin full-time employment for an entity not associated or affiliated with Hamilton Lane (“Termination Date”).

(b) If you begin full-time employment with an employer not associated or affiliated with Hamilton Lane before January 31, 2024, you will receive a lump sum payment in a total gross amount representing the portion of annual salary attributable to the period of the time you begin your new full-time employment and January 31, 2024, less withholding of all applicable federal, state and local taxes. Upon satisfaction of the conditions contained in this Agreement this one-time payment will be made in the next regular payroll cycle following the Termination Date.

(c) You will also receive a one-time, lump sum payment in the total gross amount of $375,000 less withholding of all applicable federal, state, and local taxes. This one-time payment will be made in the next regular payroll cycle following the Termination Date.

(d) The unvested HLNE restricted stock awarded to you (excluding any performance stock awards) shall immediately vest on January 31, 2024, and the unvested HLA carried interest awarded to you will be permitted to continue to vest until March 31, 2024, and thereafter any unvested amounts will be forfeited, in accordance with the terms of the respective plan documents.

(e) Your eligibility to participate in Hamilton Lane sponsored health insurance, including medical, dental and prescription, as an employee of Hamilton Lane, will end the earlier of your securing new employment or July 31, 2024, including Hamilton Lane’s contribution to premiums. However, thereafter you will be eligible to continue to participate in this insurance in accordance with a federal law called the Consolidated Omnibus Budget Reconciliation Act ("COBRA"), subject to COBRA's terms, conditions and restrictions. You will receive information about COBRA under separate cover.

(f) You will be deemed a Senior Advisor to the Company, effective August 8, 2024 and shall make yourself available as needed to ensure a smooth transition to your successor and support the needs of the business until your Termination Date.

(g) You shall not be eligible for any of the payments and other benefits described in this Paragraph 2 until: (i) Hamilton Lane has received an executed copy of this Agreement, (ii) the revocation time period in Paragraph 23 below has passed, (iii) you have fully cooperated with Hamilton Lane regarding a smooth transition and have been available for all consultations through January 31, 2024, (iv) you have complied with all of the terms and conditions of this Agreement; and (v) you have returned all Hamilton Lane property and documents in accordance with Paragraph 4 below.

(h) The respective non-competition and non-solicitation obligations and restrictive covenants, as set forth in the equity and carried interest plans as above-referenced, and in your Confidentiality and Non-Solicitation Agreement, shall

continue to apply to you for a period of six (6) months following the Separation Date. All confidentiality and non-disclosure obligations shall remain in effect.

3. Tax Withholding. You acknowledge and agree that you are solely responsible for paying any federal, state or local taxes on the payments made pursuant to paragraph 2 above to the extent not withheld and that you shall defend, indemnify and hold harmless Hamilton Lane and the other Releasees, as defined below, for your failure to pay any taxes owed, if any, on a timely basis. You further acknowledge and agree that you have not received any tax advice from Hamilton Lane or any Releasee, that you are not relying upon any representation made by Hamilton Lane or any Releasee, or any attorney for Hamilton Lane or any Releasee, with regard to the taxability or non-taxability or the characterization of all or any portion of the payments made under Paragraph 2 above.

4. Return of Hamilton Lane Property. On or as soon as possible after the Termination Date you shall return to your supervisor, retaining no copies, all Hamilton Lane property, including without limitation, equipment, office keys, identification cards or badges, parking passes, cell phone, pagers, computer, billing, operational, financial or other records or documents, including all documents concerning former or pending investigations you were conducting, including those containing confidential or proprietary information of Hamilton Lane, and our clients and/or investors. You will also destroy all copies of all documents, email messages, attachments, or other paper or electronic records made available to you as part of your employment with the Hamilton Lane.

5. General Release.

(a) In exchange for Hamilton Lane's payments and benefits described in Paragraph 2, you release and forever discharge, to the maximum extent permitted by law, Hamilton Lane and each of the other Releasees, from and against any and all known or unknown claims, causes of action, complaints, lawsuits, damages, liabilities and expenses of any kind (collectively "Claims") as described below which you, your heirs, agents, administrators or executors have or may have against Hamilton Lane or any of the other Releasees.

(b) By agreeing to this General Release, you are waiving, to the maximum extent permitted by law, any and all Claims which you have or may have against Hamilton Lane or any of the other Releasees arising out of or relating to any conduct, matter, event or omission existing or occurring before you sign this Agreement, including but not limited to the following:

(i) any Claims having anything to do with your employment with Hamilton Lane and/or any of its parent, subsidiary, related and/or affiliated entities, programs and/or institutions;

(ii) any Claims having anything to do with your separation from employment with Hamilton Lane, effective on the Separation Date /

Termination Date, and/or any of its parent, subsidiary, related and/or affiliated entities, programs and/or institutions;

(iii) any Claims for unpaid or withheld wages, severance, benefits, bonuses, commissions, incentive pay, disability pay, pay differential, pay continuation and/or other benefits or compensation of any kind;

(iv) any Claims for reimbursement of expenses of any kind;

(v) any Claims for attorneys' fees or costs;

(vi) any Claims under the Employee Retirement Income Security Act ("ERISA"); any Claims of discrimination and/or harassment based on age, sex, race, religion, color, creed, disability, handicap, citizenship, national origin, ancestry, sexual orientation, or any other factor protected by Federal, State or Local law as enacted or amended (such as the Age Discrimination in Employment Act, 29 U.S.C. §621 et. seq., the Older Workers Benefit Protection Act, Title VII of the Civil Rights Act of 1964, the Americans with Disabilities Act, Section 504 of the Rehabilitation Act, the Equal Pay Act, the Pennsylvania Human Relations Act and any Claims for retaliation under any of the foregoing laws;

(vii) any Claims regarding leaves of absence;

(viii) any Claims under the National Labor Relations Act;

(ix) any Claims under the Sarbanes-Oxley Act to the extent permissible;

(x) any Claims for violation of public policy;

(xi) any whistleblower or retaliation Claims;

(xii) any Claims for emotional distress or pain and suffering; and/or

(xiii) any other statutory, regulatory, common law or other Claims of any kind, including, but not limited to, Claims for breach of contract, libel, slander, fraud, wrongful discharge, promissory estoppel, equitable estoppel and misrepresentation.

(c) You acknowledge that your employment relationship with Hamilton Lane has been permanently severed effective as of the Termination Date, that Hamilton Lane has no obligation, contractual or otherwise, to rehire, reemploy, recall or hire you in the future and you agree not to seek reemployment with the Company or any of its affiliates.

(d) The term "Releasees" includes: Hamilton Lane, its parent, any subsidiary, related or affiliated entities or companies, and each of their past and present employees, officers, board members, trustees, directors, attorneys, owners,

partners, insurers, benefit plan fiduciaries, and agents, and all of their respective successors and assigns.

(e) It is important that you understand that this General Release includes all Claims known or unknown by you, those that you may have already asserted or raised as well as those that you have never asserted or raised.

(f) To the extent that you are not permitted by law from granting a full and complete release as to any of the above Claims, and/or to the extent that Hamilton Lane is not permitted by law from receiving a full and complete release as to any of the above Claims, this General Release is intended, and shall operate, to prevent you, to the maximum extent permitted by law, from obtaining any monetary or other personal relief for any of the Claims, and shall constitute a full and complete waiver and release of all claims for attorney fees or costs associated with any such legally un-waived and unreleased claims, as below defined.

6. Non-Released Claims. The General Release in Paragraph 5 above does not apply to:

(a) Any claims for vested retirement benefits;

(b) Any claims to require either party to honor its respective commitments set forth in this Agreement;

(c) Any claims to interpret or to determine the scope, meaning or effect of this Agreement;

(d) Any claims relating to any conduct, matter, event or omission occurring after you received the payments and benefits set forth in Paragraph 2.

7. Adequacy of Consideration. You acknowledge and agree that Hamilton Lane's payments and benefits under Paragraph 2 above:

(a) Are not required by any policy, plan or prior agreement;

(b) Constitute adequate consideration to support your General Release in Paragraph 5 above; and

(c) Fully compensate you for the Claims you are releasing.

For purposes of this paragraph, "consideration" means something of value to which you are not already entitled.

8. Other Proceedings. By signing this Agreement and General Release, you represent and warrant that as of the date of this Agreement and General Release, you have no complaints, charges and grievances filed or pending internally within Hamilton Lane or externally with any judicial, administrative, executive, regulatory or legislative body.

9. Prohibition on Using or Disclosing Confidential Information

(a) Regardless of whether you sign this Agreement, you are prohibited from using or disclosing confidential and/or proprietary information which you acquired in the course of your employment with Hamilton Lane, and which is not generally known by or readily accessible to the public. In particular, and by way of example only, such confidential and/or proprietary information cannot be disclosed to other financial institutions or fund managers or any other entity with whom Hamilton Lane does now or later may do business or compete for business.

(b) In addition, you are reminded that you are prohibited from having access to, attempting to gain access to, manipulating, damaging, destroying or interfering in any way with Hamilton Lane's data, computer and operating systems or business operations.

10. Confidentiality. You agree and understand that confidentiality is of the utmost importance to Hamilton Lane and that an essential term of this Agreement is that its specific terms shall remain confidential. The specific terms of this Agreement may not be disclosed to any person other than as specified herein, except to the extent required by law. Neither you nor any of your agents or representatives will disclose directly or indirectly any information concerning the terms of this Agreement including the General Release or such subject matter to anyone except your spouse, personal financial tax advisors and/or attorneys, if any, and upon request and if necessary to the Internal Revenue Service or other requesting legal authority (e.g. Tax Court). You will inform those persons that they, as your representatives, are also bound by this confidentiality requirement. This contractual commitment to confidentiality extends to your lawyer, accountant and all with whom they have consulted or worked with about this matter, none of whom may voluntarily disclose any of the terms of this Agreement to anyone. Hamilton Lane may disclose the terms of this Agreement to its attorneys as it deems necessary, including (but not limited) to all who need to know about it in order to approve or implement its provisions, senior management, fiduciaries of the corporation, auditors, accountants and other professionals involved in preparing Hamilton Lane’s financial statements and or tax returns, and government agencies. You acknowledge that this confidentiality provision is a material term of this Agreement and that Hamilton Lane will suffer irreparable harm if a breach of confidentiality occurs. You further acknowledge that in the event that it is proved that you or any of your representatives have breached this confidentiality requirement, you agree to return to Hamilton Lane within five (5) days of such breach the entire amount of all payments and the value of any benefits received under this Agreement and General Release. You agree that this sum constitutes reasonable liquidated damages and does not constitute a penalty. In the event Hamilton Lane is required to sue to enforce these confidentiality provisions, Hamilton Lane may recover reasonable attorneys' fees and costs.

11. Non-disparagement. Each of Company and you agree not to make any negative comments or disparaging remarks, in writing, orally or electronically, about the other

party, and/or any Company Releasee or its business practices and services, including any Company clients, investors and/or service providers. However, nothing in this Agreement is intended to or shall be interpreted to restrict either party’s right and/or obligation to testify truthfully in any forum, or to contact, cooperate with or provide information to any government agency or regulatory commission.

Further, the Company’s Chief Executive Officer agrees to provide a positive reference to any prospective employer of Mr. Varma.

12. Statement of Non-Admission. It is understood and agreed that neither the execution of this Agreement and General Release nor its terms constitute an admission or concession of liability or wrongdoing by Hamilton Lane or any other Releasee. Rather, it is understood and agreed that this Agreement and its General Release is being offered for the sole purpose of settling cooperatively and amicably any and all possible disputes between the parties and that Hamilton Lane specifically disclaims liability to you.

13. Cooperation in Future Matters. You agree that you will cooperate with Hamilton Lane with respect to any administrative or litigation matter which involves you or the responsibilities you fulfilled while employed by Hamilton Lane, for which Hamilton Lane will cover reasonable legal fees and expense of the Company approved law firm. However, you are reminded that nothing in this Agreement shall be interpreted to restrict your right and obligation to testify truthfully in any forum, or to cooperate fully in any investigation by a governmental agency which regulates Hamilton Lane or its operations.

14. Effect and Construction of the Agreement and Release. This Agreement, General Release, the equity and carried interest plans referenced in Paragraph 2 above, all together with the Confidentiality and Non-Solicitation Agreement also referenced in Paragraph 2 above, represent the entire agreement between you and Hamilton Lane and supersedes any and all prior agreements between the parties, oral, written, express, or implied. Any amendments hereto shall not be effective unless they are in writing signed by you and a duly authorized representative of Hamilton Lane.

15. Binding Agreement. The parties understand and acknowledge that said Agreement and General Release are contractual and not a mere recital. Consequently, they expressly consent that said Agreement and General Release shall be given full force and effect according to each and all of its express terms and provisions, and that they shall be binding upon the respective parties as well as their heirs, executors, successors, administrators and assigns.

16. Acknowledgment. You acknowledge and agree that subsequent to the termination of your employment, you shall not be eligible for any payments from Hamilton Lane or Hamilton Lane-paid benefits, except as expressly set forth in this Agreement. You also acknowledge and agree that you have been paid for all time worked and have received all other compensation owed to you, except for any payments and benefits owed to you pursuant to Paragraph 1 which shall be paid to you regardless of whether you sign this Agreement.

17. Severability. Nothing in this Agreement is intended to violate any law or shall be interpreted to violate any law. If any paragraph or part or subpart of any paragraph in this Agreement or the application thereof is construed to be overbroad and/or unenforceable, then the court making such determination shall have the authority to narrow the paragraph or part or subpart of the paragraph as necessary to make it enforceable and the paragraph or part or subpart of the paragraph shall then be enforceable in its/their narrowed form. Moreover, each paragraph or part or subpart of each paragraph in this Agreement is independent of and severable (separate) from each other. In the event that any paragraph or part or subpart of any paragraph in this Agreement is determined to be legally invalid or unenforceable by a court and is not modified by a court to be enforceable, the affected paragraph or part or subpart of such paragraph shall be stricken from the Agreement, and the remaining paragraphs or parts or subparts of such paragraphs of this Agreement shall remain in full, force and effect.

18. Governing Law and Forum. The parties agree that this Agreement and General Release shall be governed and construed under the laws of the Commonwealth of Pennsylvania and that they will submit all disputes concerning this interpretation or enforcement of this Agreement and General Release to the exclusive jurisdiction of the state and/or federal courts located within the Eastern District of the Commonwealth of Pennsylvania. All remedies in law or in equity shall be available for the enforcement of this Agreement and its General Release.

19. Headings. The headings contained in this Agreement are for convenience of reference only and are not intended, and shall not be construed, to modify, define, limit, or expand the intent of the parties as expressed in this Agreement, and they shall not affect the meaning or interpretation of this Agreement.

20. Days. All references to a number of days throughout this Agreement refer to calendar days.

21. Execution. This Agreement may be executed in one or more counterparts, each of which shall constitute an original instrument, but all of which together shall constitute the same Agreement.

22. Representations. You agree and represent that:

(a) You have read carefully the terms of this Agreement, including the General Release set forth in Paragraph 5;

(b) You have reviewed this Agreement, including the General Release, with your attorney;

(c) You understand the meaning and effect of the terms of this Agreement, including the General Release;

(d) You acknowledge that, at the time you were given this Agreement, you were provided at least twenty-one (21) days in which to consider whether you would sign this Agreement;

(e) Your decision to sign this Agreement, including the General Release, is of your own free and voluntary act without compulsion of any kind;

(f) No promise or inducement not expressed in this Agreement has been made to your; and

(g) You have adequate information to make a knowing and voluntary waiver.

23. Revocation Period and Effective Date. If you sign this Agreement, you will retain the right to revoke it for seven (7) days. If you revoke this Agreement, you are indicating that you have changed your mind and do not want to be legally bound by this Agreement. The Agreement shall not be effective until after the Revocation Period has expired without your having properly revoked it. To revoke this Agreement, you must send a letter to the attention of Lydia Gavalis, General Counsel. The letter must be post-marked within seven (7) days of your execution of this Agreement. If the seventh day is a Sunday or federal holiday, then the letter must be post-marked on the following business day. If you revoke this Agreement on a timely basis, you shall not be eligible for any of the payments or benefits set forth in Paragraph 2.

24. Offer Expiration Date. As noted above, you have up to twenty-one (21) days to decide whether you wish to sign this Agreement. If you do not sign this Agreement within twenty-one (21) days of your receipt of it, then this offer is withdrawn and you will not be eligible for the payments and other benefits set forth in Paragraph 2 above.

IN WITNESS WHEREOF, intending to be legally bound hereby, the parties have caused this Confidential Separation Agreement and General Release to be electronically executed on the day and year first below written.

| | | | | | | | | | | | | | |

| EMPLOYEE | | HAMILTON LANE ADVISORS, L.L.C. |

| | | | |

| By: | /s/ Atul Varma | | By: | /s/ Lydia Gavalis |

| Atul Varma | | | Lydia Gavalis, General Counsel |

| | | | |

| Date: | July 18, 2023 | | Date: | July 18, 2023 |

HAMILTON LANE ANNOUNCES STRATEGIC LEADERSHIP CHANGES

•Reflects Next Stage of Growth for Industry-Leading Private Markets Investment Management Firm

•Elevates Several Key Professionals, Highlighting Firm’s Deep Reserve of Talent

CONSHOHOCKEN, PA – JULY 20, 2023 – Hamilton Lane (Nasdaq: HLNE), a leading global private markets investment management firm, today announced a series of senior leadership changes designed to position the firm for continued growth and long-term success on a global scale. The elevation of these key professionals to take on more expansive roles illustrates the firm’s strong operational foundation, investment expertise and collaborative, performance-driven culture.

“We are delighted to strengthen Hamilton Lane’s leadership team with a group of long-tenured, experienced professionals who bring innovative perspectives, strategic insights and a forward-looking, global mindset to our firm,” said Hamilton Lane CEO Mario Giannini. “In recognizing and elevating this talented group, we are helping to ensure that Hamilton Lane continues to serve as a valued partner to our clients around the world, and as a steady engine of transformation and growth within our asset class.”

•Jeffrey Armbrister has been appointed to serve as Hamilton Lane’s Chief Financial Officer, succeeding Atul Varma, who is leaving the firm to pursue other interests. Varma will continue in his role as CFO until August 8 and will remain with the firm as a senior advisor over the next several months to facilitate an orderly transition. For the last five years, Armbrister has led the firm’s Direct Equity investment business, which earlier this year closed its latest fund on more than $2 billion of investor commitments. He has been with Hamilton Lane since 2018 and brings a proven track record of transaction-based investing and operational experience leading both investment and finance teams, and working with management teams and corporate boards to execute strategic initiatives, grow businesses and solve complex problems.

•Andrew (Drew) Schardt will become a Vice Chairman of Hamilton Lane, while retaining his role as Head of Investment Strategy. In both of these capacities Schardt will continue to implement executive-level initiatives while maintaining broader leadership responsibilities across the firm’s global investment platform. Schardt will also step into the role of Head of Direct Equity, replacing Armbrister. Schardt has held a number of senior investment positions at Hamilton Lane, including on the Direct Equity team, where he began his 15-year career at the firm.

•In addition, Hamilton Lane is pleased to announce that, effective September 5, Ken Binick will join the firm as Managing Director and Head of Execution on the Direct Equity team, reporting to Schardt. Binick, who most recently served as Co-Head of the Co-Investment business at Portfolio Advisors, brings a distinguished investment track record and extensive operational, team management and transactional experience to the Direct Equity team.

• Richard Hope, Hamilton Lane’s Head of EMEA, will assume the additional role of Co-Head of Investments, alongside Tom Kerr. In this new capacity, Hope, who is based in London, will take on broad leadership and management responsibilities across the global investment platform. Hope joined Hamilton Lane in 2011 and has led the firm’s efforts

across Europe, the Middle East and Africa, playing an instrumental role in advancing Hamilton Lane’s geographic expansion and in broadening its investment activities outside the U.S. Hope’s continued leadership is complementary to those ongoing expansionary efforts.

•Nayef Perry will assume sole leadership of the firm’s credit business as Head of Direct Credit, after previously serving as Co-Head alongside Schardt. Since joining Hamilton Lane in 2013, Perry has been instrumental in building the firm’s credit platform and capabilities, including management of its 25+ person global Direct Credit team. Most recently, Perry was a key driver behind the launch of the Senior Credit Opportunities Fund, an evergreen credit vehicle. His leadership mandate will include seeking new opportunities to build on Hamilton Lane’s success and continue to expand its credit platform.

The changes are effective as of August 8, 2023.

The most recent senior leadership changes follow Hamilton Lane’s appointment in May of Andrea Kramer as Chief Operating Officer. She joined the firm in 2005 and has significant experience across every facet of the business, serving as Head of the Fund Investment team, an Investment Committee member, and on a number of fund advisory boards. Prior to Hamilton Lane, Kramer worked as a General Partner at Exelon Capital Partners; as a Senior Business Development Manager for Philadelphia Gas Works; and as a Fund Manager for Murex Corporation.

“We wish Atul well on his future endeavors and thank him for his contributions to our firm,” Giannini said. “Today, we remain focused on growing our organization thoughtfully and strategically, on staying competitive in an ever-changing environment, and on continuing to challenge, develop and retain our talented bench of professionals to help create even greater long-term value for our clients, investors, shareholders and employees.”

ABOUT HAMILTON LANE

Hamilton Lane (Nasdaq: HLNE) is one of the largest private markets investment firms globally, providing innovative solutions to institutional and private wealth investors around the world. Dedicated exclusively to private markets investing for more than 30 years, the firm currently employs approximately 600 professionals operating in offices throughout North America, Europe, Asia Pacific and the Middle East. Hamilton Lane has nearly $857 billion in assets under management and supervision, composed of $112 billion in discretionary assets and approximately $745 billion in non-discretionary assets, as of March 31, 2023. Hamilton Lane specializes in building flexible investment programs that provide clients access to the full spectrum of private markets strategies, sectors and geographies. For more information, please visit www.hamiltonlane.com or follow Hamilton Lane on LinkedIn: https://www.linkedin.com/company/hamilton-lane/.

Forward-Looking Statements

Some of the statements in this release may constitute “forward-looking statements” within the meaning of Section 27A of the Securities Act of 1933, Section 21E of the Securities Exchange Act of 1934 and the Private Securities Litigation Reform Act of 1995. Words such as “will”, “expect”, “believe”, “estimate”, “continue”, “anticipate”, “intend”, “plan” and similar expressions are intended to identify these forward-looking statements. Forward-looking statements discuss

management’s current expectations and projections relating to our financial position, results of operations, plans, objectives, future performance and business. All forward-looking statements are subject to known and unknown risks, uncertainties and other important factors that may cause actual results to be materially different, including risks relating to: our ability to manage growth, fund performance, competition in our industry, changes in our regulatory environment and tax status; market conditions generally; our ability to access suitable investment opportunities for our clients; our ability to maintain our fee structure; our ability to attract and retain key employees; our ability to manage our obligations under our debt agreements; defaults by clients and third-party investors on their obligations to fund commitments; our exposure and that of our clients and investors to the credit risks of financial institutions at which we and they hold accounts; our ability to comply with investment guidelines set by our clients; our ability to successfully integrate acquired businesses with ours; our ability to manage risks associated with introducing new types of investment structures, products or services or entering into strategic partnerships; our ability to manage redemption or repurchase rights in certain of our funds; our ability to manage, identify and anticipate risks we face; our ability to manage the effects of events outside of our control; and our ability to receive distributions from Hamilton Lane Advisors, L.L.C. to fund our payment of dividends, taxes and other expenses.

The foregoing list of factors is not exhaustive. For more information regarding these risks and uncertainties as well as additional risks that we face, you should refer to the “Risk Factors” detailed in Part I, Item 1A of our Annual Report on Form 10-K for the fiscal year ended March 31, 2023 and our subsequent reports filed from time to time with the Securities and Exchange Commission. The forward-looking statements included in this release are made only as of the date hereof. We undertake no obligation to update or revise any forward-looking statement as a result of new information or future events, except as otherwise required by law.

Media Contact

Kate McGann

kmcgann@hamiltonlane.com

+1 240-888-4078

Investor Contact

John Oh

joh@hamiltonlane.com

+1 610 617 6026

###

v3.23.2

Cover Page

|

Jul. 14, 2023 |

| Cover [Abstract] |

|

| Document Type |

8-K

|

| Document Period End Date |

Jul. 14, 2023

|

| Entity Registrant Name |

Hamilton Lane Inc

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-38021

|

| Entity Tax Identification Number |

26-2482738

|

| Entity Address, Address Line One |

110 Washington Street,

|

| Entity Address, Address Line Two |

Suite 1300

|

| Entity Address, City or Town |

Conshohocken,

|

| Entity Address, State or Province |

PA

|

| Entity Address, Postal Zip Code |

19428

|

| City Area Code |

610

|

| Local Phone Number |

934-2222

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Title of 12(b) Security |

Class A Common Stock, $0.001 par value per share

|

| Trading Symbol |

HLNE

|

| Security Exchange Name |

NASDAQ

|

| Entity Emerging Growth Company |

false

|

| Entity Central Index Key |

0001433642

|

| Amendment Flag |

false

|

| Pre-commencement Tender Offer |

false

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

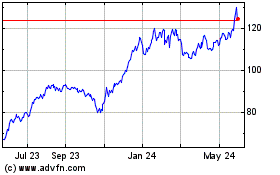

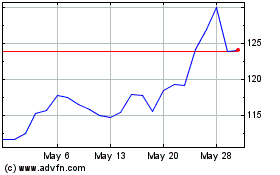

Hamilton Lane (NASDAQ:HLNE)

Historical Stock Chart

From Apr 2024 to May 2024

Hamilton Lane (NASDAQ:HLNE)

Historical Stock Chart

From May 2023 to May 2024