Additional Proxy Soliciting Materials (definitive) (defa14a)

12 October 2019 - 4:10AM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

Proxy Statement Pursuant to Section 14(a) of

the Securities Exchange Act of 1934

Filed by the Registrant ☒

Filed by a Party other than the Registrant ☐

Check the appropriate box:

|

☐

|

Preliminary Proxy Statement

|

|

☐

|

Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2))

|

|

☐

|

Definitive Proxy Statement

|

|

☒

|

Definitive Additional Materials

|

|

☐

|

Soliciting Material under §240.14a-12

|

|

ISRAMCO, INC.

|

|

(Name of Registrant as Specified In Its Charter)

|

|

N/A

|

|

(Name of Person(s) Filing Proxy Statement, if other than the Registrant)

|

|

Payment of Filing Fee (Check the appropriate box):

|

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act Rules 14a-6(i)(1) and 0-11.

|

|

|

(1)

|

Title of each class of securities to which transaction applies:

|

|

|

|

|

|

|

(2)

|

Aggregate number of securities to which transaction applies:

|

|

|

|

|

|

|

(3)

|

Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined):

|

|

|

|

|

|

|

(4)

|

Proposed maximum aggregate value of transaction:

|

|

|

|

|

|

|

(5)

|

Total fee paid:

|

|

|

|

|

|

☐

|

Fee paid previously with preliminary materials.

|

|

☐

|

Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

(1)

|

Amount Previously Paid:

|

|

|

(2)

|

Form, Schedule or Registration Statement No.:

|

|

|

(3)

|

Filing Party:

|

|

|

(4)

|

Date Filed:

|

**IMPORTANT MESSAGE FOR ISRAMCO STOCKHOLDERS**

October 11, 2019

Dear Stockholder:

We recently mailed proxy materials to you for the Special Meeting of Stockholders of Isramco, Inc. (“Isramco,” “we,” “us or “our”) scheduled to be held on October 22, 2019 to consider and vote upon, among other things, the Agreement and Plan of Merger detailed in the proxy materials. The terms of the agreement and plan of merger to be approved at the Special Meeting are fully described in the proxy materials that were previously sent to you.

At the time of the mailing of this reminder letter, our records indicate you may have not yet voted your shares. If you already have voted, we thank you for your prompt response. If you have not voted your shares, the Board of Directors encourages you to submit your vote in favor of the proposals as soon as possible.

Please let us remind you that there are a several ways to vote:

|

|

1.

|

Internet — By logging into the secure website at www.proxyvote.com; please have the control number located on the enclosed vote instruction form available; or

|

|

|

2.

|

Telephone — By calling the toll free number indicated on the enclosed voting instruction form; please have the control number located on the enclosed vote instruction form available; or

|

|

|

3.

|

Mail — By signing, dating, and returning the enclosed proxy card in the envelope provided or return it to Vote Processing, c/o Broadridge, 51 Mercedes Way, Edgewood, New York 11717.

|

In order for you to receive US$121.40 in cash for each share that you own, we need your vote. If you do not vote, it will have the same effect as a vote “AGAINST” the merger in connection with the proposed “going private” transaction of the Company. No matter how many shares you hold, your vote is very important.

If you need assistance in voting your shares or have questions regarding the Special Meeting of Shareholders, please contact our proxy solicitor, D.F. King & Co. Inc., toll-free at 1-866-745-0267 between 9:00 a.m. and 10:00 p.m. Eastern time Monday through Friday or by email at isramco@dfking.com.

Sincerely,

Edy Francis

Co-CEO & CFO

Isramco, Inc.

IF YOU HAVE RECENTLY MAILED YOUR PROXY OR CAST YOUR VOTE BY TELEPHONE OR OVER THE INTERNET, PLEASE ACCEPT OUR THANKS AND DISREGARD THIS REQUEST.

* * * *

Additional Information and Where to Find It

This communication may be deemed to be solicitation material in respect of the proposed acquisition of Isramco, Inc. (the “Company” or “Isramco”) by Naphtha Israel Petroleum Corporation Ltd., an Israeli public company (“Naphtha”), Naphtha Holding Ltd., an Israeli private company and a direct wholly owned subsidiary of Naphtha, I.O.C. Israel Oil Company, Ltd., an Israeli private company and a subsidiary of Naphtha and their affiliates (the “Transaction”). In connection with the proposed Transaction, Isramco has filed with the Securities and Exchange Commission (the “SEC”), and furnished to Isramco’s stockholders, a definitive proxy statement and other relevant documents. BEFORE MAKING ANY VOTING DECISION, ISRAMCO’S STOCKHOLDERS ARE URGED TO CAREFULLY READ THE DEFINITIVE PROXY STATEMENT IN ITS ENTIRETY AND ANY OTHER DOCUMENTS FILED WITH THE SEC IN CONNECTION WITH THE PROPOSED TRANSACTION OR INCORPORATED BY REFERENCE THEREIN BECAUSE THEY CONTAIN IMPORTANT INFORMATION ABOUT THE PROPOSED TRANSACTION AND THE PARTIES TO THE PROPOSED TRANSACTION.

Investors are able to obtain a free copy of the definitive proxy statement and other relevant documents filed by Isramco with the SEC at the SEC’s website at www.sec.gov. In addition, requests for additional copies of the definitive proxy statement should be directed to D.F. King & Co., Inc., toll free at 1-(866) 745-0267 or by email at isramco@dfking.com.

Participants in the Solicitation

Isramco and its directors, executive officers and certain other members of management and employees of Isramco may be deemed to be “participants” in the solicitation of proxies from the stockholders of Isramco in connection with the proposed Transaction. Information regarding the interests of the persons who may, under the rules of the SEC, be considered participants in the solicitation of the stockholders of Isramco in connection with the proposed Transaction, which may be different than those of Isramco’s stockholders generally, is set forth in the definitive proxy statement and the other relevant documents filed with the SEC. Stockholders can find information about Isramco and its directors and executive officers and their ownership of Isramco’s common stock in Isramco’s Annual Report on Form 10-K, filed with the SEC on March 18, 2019, as amended on April 30, 2019, and additional information about the ownership of Isramco’s common stock by Isramco’s directors and executive officers is included in their Forms 3, 4 and 5 filed with the SEC.

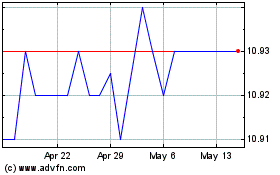

Israel Acquisitions (NASDAQ:ISRL)

Historical Stock Chart

From Apr 2024 to May 2024

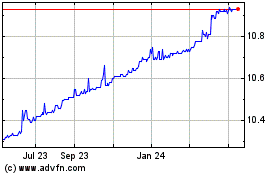

Israel Acquisitions (NASDAQ:ISRL)

Historical Stock Chart

From May 2023 to May 2024