J. Allen Fine, Chairman of Investors Title Company, (NASDAQ: ITIC)

announced that for the second quarter ended June 30, 2006, the

Company reported net income of $4,315,537, an increase of 11.7%

compared with $3,861,998 for the prior year period. Net income per

diluted share equaled $1.68, an increase of 13.5% compared with

$1.48 per diluted share in the same period last year. Net premiums

written decreased 4.4% to $19,123,591 and revenues increased 1.2%

to $23,126,621 compared with the prior year period. For the

six-month period ended June 30, 2006, the Company reported net

income $7,190,478, an increase of 32.1%, compared with $5,442,492

for the same six-month period in 2005. Diluted earnings per share

were $2.79, an increase of 34.1% compared with $2.08 for the same

six-month ended period in 2005. Net premiums written decreased 3.7%

to $35,755,217 and revenues increased 2.7% to $43,305,469 compared

with the prior year. Growth in the fee income generated in the

exchange services segment and the Trust division coupled with an

increase in investment income drove the overall increase in total

revenue. Offsetting these increases was a decline in premiums

written resulting primarily from a lower level of real estate

activity. Operating expenses remained flat as the decline in

commissions paid to agents was offset by an increase in personnel

costs. The effective tax rate declined resulting primarily from

higher interest rates and higher balances invested in tax-exempt

securities. Chairman Fine added, "The decline in our premium

revenue has followed the overall softening in the residential

housing market this year. As generally expected, transaction volume

and mortgage loan originations have trended down as a result of

higher mortgage rates. Countering this trend slightly has been

ongoing strength in the commercial real estate sector." Investors

Title Company is engaged through its subsidiaries in the business

of issuing and underwriting title insurance policies. The Company

also provides services in connection with tax-deferred exchanges of

like-kind property as well as investment management services to

individuals, trusts, foundations and businesses. Certain statements

contained herein may constitute forward-looking statements within

the meaning of the Private Securities Litigation Reform Act of

1995. Such statements include any predictions regarding activity in

the U.S. real estate market. These statements involve a number of

risks and uncertainties that could cause actual results to differ

materially from anticipated and historical results. For more

details on risk, uncertainties and other factors that could affect

expectations, refer to the Company's Annual Report on Form 10-K for

the year ended December 31, 2005, as filed with the Securities and

Exchange Commission. -0- *T Investors Title Company and

Subsidiaries Consolidated Statements of Income June 30, 2006 and

2005 (Unaudited) For The For The Three Months Six Months Ended

Ended June 30 June 30 -------------------- --------------------

2006 2005 2006 2005 --------- --------- --------- -----------

Revenues: Underwriting income: Premiums Written $19,222,175

$20,052,131 $35,968,444 $37,298,168 Less-premiums for reinsurance

ceded 98,584 45,736 213,227 184,815 ----------- -----------

----------- ----------- Net premiums written 19,123,591 20,006,395

35,755,217 37,113,353 Investment income- interest and dividends

1,034,696 808,559 2,028,750 1,561,324 Net realized gain (loss) on

sales of investments (17,190) 30,801 544,457 19,907 Exchange

services revenue 1,908,357 1,239,793 2,936,089 2,049,432 Other

1,077,167 768,514 2,040,956 1,439,625 ----------- -----------

----------- ----------- Total 23,126,621 22,854,062 43,305,469

42,183,641 ----------- ----------- ----------- -----------

Operating Expenses: Commissions to agents 7,289,322 7,848,781

13,572,718 14,840,530 Provision for claims 2,030,412 2,172,108

3,885,691 4,071,113 Salaries, employee benefits and payroll taxes

4,917,022 4,413,567 9,922,869 9,780,879 Office occupancy and

operations 1,266,042 1,239,870 2,731,355 2,589,076 Business

development 547,505 464,388 1,053,163 891,861 Taxes, other than

payroll and income 146,007 209,230 296,892 319,984 Premium and

retaliatory taxes 328,542 393,770 670,610 793,315 Professional fees

737,534 653,251 1,325,156 1,091,181 Other 219,728 66,099 438,567

111,210 ----------- ----------- ----------- ----------- Total

17,482,114 17,461,064 33,897,021 34,489,149 ----------- -----------

----------- ----------- Income Before Income Taxes 5,644,507

5,392,998 9,408,448 7,694,492 ----------- ----------- -----------

----------- Provision For Income Taxes 1,328,970 1,531,000

2,217,970 2,252,000 ----------- ----------- ----------- -----------

Net Income $ 4,315,537 $ 3,861,998 $ 7,190,478 $ 5,442,492

=========== =========== =========== =========== Basic Earnings Per

Common Share $ 1.70 $ 1.51 $ 2.83 $ 2.12 =========== ===========

=========== =========== Weighted Average Shares Outstanding - Basic

2,537,883 2,563,094 2,543,475 2,563,793 =========== ===========

=========== =========== Diluted Earnings Per Common Share $ 1.68 $

1.48 $ 2.79 $ 2.08 =========== =========== =========== ===========

Weighted Average Shares Outstanding - Diluted 2,572,062 2,607,611

2,578,743 2,616,418 =========== =========== =========== ===========

Investors Title Company and Subsidiaries Consolidated Balance

Sheets As of June 30, 2006 and December 31, 2005 (Unaudited) June

30, Dec. 31, 2006 2005 -------------------------- Assets Cash and

cash equivalents $ 3,691,551 $ 14,608,481 Investments in

securities: Fixed maturities: Held-to-maturity, at amortized cost

1,199,924 1,648,708 Available-for-sale, at fair value 91,429,904

75,472,342 Equity securities, available-for-sale at fair value

11,872,205 9,437,678 Short-term investments 4,386,825 7,257,734

Other investments 1,662,557 1,336,111 ------------ ------------

Total investments 110,551,415 95,152,573 Premiums receivable, net

7,680,380 7,818,558 Accrued interest and dividends 1,102,015

1,010,198 Prepaid expenses and other assets 2,021,482 1,592,326

Property acquired in settlement of claims 413,480 359,980 Property,

net 5,907,523 5,466,765 Deferred income taxes, net 2,917,684

2,462,647 ------------ ------------ Total Assets $134,285,530

$128,471,528 ============ ============ Liabilities and

Stockholders' Equity Liabilities: Reserves for claims $ 35,866,000

$ 34,857,000 Accounts payable and accrued liabilities 8,579,869

7,928,384 Commissions and reinsurance payables 358,385 442,098

Current income taxes payable 279,123 946,790 ------------

------------ Total liabilities 45,083,377 44,174,272 ------------

------------ Stockholders' Equity: Common stock - no par value

(shares authorized 10,000,000; 2,534,036 and 2,549,434 shares

issued and outstanding 2006 and 2005, respectively, excluding

291,792 and 297,783 shares 2006 and 2005, respectively, of common

stock held by the Company's subsidiary) 1 1 Retained earnings

87,591,774 81,477,022 Accumulated other comprehensive income (net

unrealized gain on investments) 1,610,378 2,820,233 ------------

------------ Total stockholders' equity 89,202,153 84,297,256

------------ ------------ Total Liabilities and Stockholders'

Equity $134,285,530 $128,471,528 ============ ============

Investors Title Company and Subsidiaries Net Premiums Written By

State June 30, 2006 and 2005 (Unaudited) For the Three Months For

the Six Months Ended Ended June 30 June 30 -----------------------

----------------------- State 2006 2005 2006 2005

----------------------------------------------

----------------------- Alabama $ 330,545 $ 379,273 $ 574,181 $

730,003 Florida 327,956 462,331 606,291 771,940 Illinois 280,013

278,550 527,908 491,330 Kentucky 583,539 545,873 1,157,037 984,840

Maryland 407,905 487,882 781,674 860,528 Michigan 881,521 1,273,971

1,758,830 2,385,378 Minnesota 304,900 259,992 642,069 528,792

Mississippi 167,225 298,242 301,677 561,593 Nebraska 197,136

180,377 331,446 385,695 New York 709,195 774,372 1,212,791

1,360,377 North Carolina 9,773,452 9,606,689 18,214,934 17,365,468

Pennsylvania 410,595 448,823 726,507 827,648 South Carolina

1,536,781 1,340,095 2,938,854 3,387,988 Tennessee 614,769 722,736

1,281,092 1,290,584 Virginia 1,897,939 2,211,161 3,572,042

3,954,013 West Virginia 640,423 582,511 1,095,841 1,012,065 Other

158,281 199,253 238,844 385,880 ----------- ----------- -----------

----------- Direct Premiums 19,222,175 20,052,131 35,962,018

37,284,122 Reinsurance Assumed - - 6,426 14,046 Reinsurance Ceded

(98,584) (45,736) (213,227) (184,815) ----------- -----------

----------- ----------- Net Premiums Written $19,123,591

$20,006,395 $35,755,217 $37,113,353 =========== ===========

=========== =========== Investors Title Company and Subsidiaries

Net Premiums Written By Branch and Agency June 30, 2006 and 2005

(Unaudited) For The Three Months Ended June 30

------------------------------------------ 2006 % 2005 %

------------------------------------------ Branch $9,004,581 47

$9,131,282 46 Agency 10,119,010 53 10,875,113 54

------------------------------------------ Total $19,123,591 100

$20,006,395 100 ==========================================

Investors Title Company and Subsidiaries Net Premiums Written By

Branch and Agency June 30, 2006 and 2005 (Unaudited) For The Six

Months Ended June 30

----------------------------------------------- 2006 % 2005 %

----------------------------------------------- Branch $16,730,965

47 $16,381,111 44 Agency 19,024,252 53 20,732,242 56

------------------------- ----------------------- Total $35,755,217

100 $37,113,353 100

================================================== *T

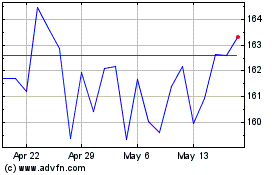

Investors Title (NASDAQ:ITIC)

Historical Stock Chart

From Jun 2024 to Jul 2024

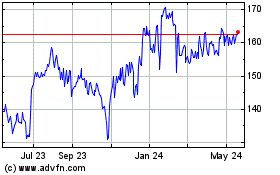

Investors Title (NASDAQ:ITIC)

Historical Stock Chart

From Jul 2023 to Jul 2024