Investors Title Company today announced its results for the

quarter ended March 31, 2013. The Company reported net income of

$3,376,730, or $1.62 per diluted share, compared with $1,432,139,

or $0.67 per diluted share, for the prior year period.

The Company achieved record first quarter revenues totaling

$26,848,273, an increase of 19.8% versus the prior year period,

resulting from a 21.7% increase in net premiums written.

Historically low interest rates continue to help drive increases in

mortgage lending activity. Various new premium charges and rate

increases which became effective during the preceding twelve months

also contributed to the increase.

Operating expenses increased 8.0% versus the prior year period,

primarily due to increases in commissions to agents and payroll

expense. Commissions to agents increased commensurate with the

increase in agency premiums. The increase in payroll expense was

largely driven by higher staffing levels to support ongoing

software development initiatives. Positive legal developments in

several claim matters, coupled with a significant current quarter

recovery of a claim payment made in a prior period, contributed to

a benefit in the claims provision during the quarter. In addition,

claims experience for several recent policy years continued to

emerge favorably in comparison with prior expectations.

Chairman J. Allen Fine added, “We are pleased to see continued

strength in mortgage lending activity. Premiums written from

purchase transactions increased substantially versus the prior year

period, while the level of refinance activity has trended slightly

downward. Positive revenue trends, coupled with favorable claims

experience, led to very strong results for the first quarter.”

Investors Title Company is engaged through its subsidiaries in

the business of issuing and underwriting title insurance policies.

The Company also provides investment management services to

individuals, companies, banks and trusts, as well as services in

connection with tax-deferred exchanges of like-kind property.

Certain statements contained herein may constitute

forward-looking statements within the meaning of the Private

Securities Litigation Reform Act of 1995. Such statements include,

among other statements, any predictions regarding future agency

base expansion or increasing operational efficiency. These

statements involve a number of risks and uncertainties that could

cause actual results to differ materially from anticipated and

historical results. Such risks and uncertainties include, without

limitation: the cyclical demand for title insurance due to changes

in the residential and commercial real estate markets; the

occurrence of fraud, defalcation or misconduct; variances between

actual claims experience and underwriting and reserving

assumptions; declines in the performance of the Company’s

investments; government regulation; and other considerations set

forth under the caption “Risk Factors” in the Company’s Annual

Report on Form 10-K for the year ended December 31, 2012, as filed

with the Securities and Exchange Commission, and in subsequent

filings.

Investors Title Company and Subsidiaries

Consolidated Statements of Income For the Three Months

Ended March 31, 2013 and 2012 (Unaudited)

Three Months Ended March 31

2013

2012

Revenues: Net premiums written $

23,925,997 $

19,667,420 Investment income - interest and dividends

920,485 977,261 Net realized gain on investments

16,344 192,881 Other

1,985,447 1,576,712 Total

Revenues

26,848,273 22,414,274

Operating

Expenses: Commissions to agents

13,489,431 11,192,127

(Benefit) provision for claims

(389,058 ) 1,631,359

Salaries, employee benefits and payroll taxes

6,149,661

4,990,632 Office occupancy and operations

1,048,665 927,038

Business development

425,033 393,447 Filing fees, franchise

and local taxes

180,570 351,922 Premium and retaliatory

taxes

440,523 414,794 Professional and contract labor fees

614,443 400,537 Other

137,587 167,279 Total

Operating Expenses

22,096,855 20,469,135

Income Before Income Taxes 4,751,418 1,945,139

Provision For Income Taxes 1,365,000

513,000

Net Income 3,386,418 1,432,139

Less: Net Income Attributable to Redeemable Noncontrolling

Interests (9,688 ) -

Net Income

Attributable to the Company $

3,376,730 $

1,432,139

Basic Earnings Per Common Share $

1.65 $ 0.68

Weighted Average Shares

Outstanding - Basic 2,044,801 2,100,835

Diluted Earnings Per Common Share $

1.62 $

0.67

Weighted Average Shares Outstanding - Diluted

2,083,999 2,128,788

Investors

Title Company and Subsidiaries Consolidated Balance

Sheets As of March 31, 2013 and December 31, 2012

(Unaudited) March 31, 2013 December 31,

2012

Assets Investments in securities: Fixed maturities,

available-for-sale, at fair value $

77,498,573 $ 81,936,978

Equity securities, available-for-sale, at fair value

30,809,436 28,510,933 Short-term investments

19,839,497 13,567,648 Other investments

6,941,042

6,763,100 Total investments

135,088,548 130,778,659

Cash and cash equivalents

20,501,601 20,810,018 Premiums and

fees receivable, net

9,404,229 11,037,714 Accrued interest

and dividends

882,517 1,037,447 Prepaid expenses and other

assets

4,521,774 4,651,115 Property, net

3,737,380

3,603,323

Total Assets $

174,136,049 $

171,918,276

Liabilities and Stockholders' Equity

Liabilities: Reserves for claims $

38,308,000 $

39,078,000 Accounts payable and accrued liabilities

12,929,995 15,477,545 Current income taxes payable

374,766 1,336,824 Deferred income taxes, net

2,516,444 893,156 Total liabilities

54,129,205

56,785,525

Redeemable Noncontrolling Interest

503,549 493,861

Stockholders' Equity:

Common stock - no par value (shares

authorized 10,000,000; 2,045,968 and 2,043,359 shares issued and

outstanding as of March 31, 2013 and December 31, 2012,

respectively, excluding 291,676 shares for 2013 and 2012 of common

stock held by the Company's subsidiary)

1 1 Retained earnings

109,125,314 105,820,459

Accumulated other comprehensive income

10,377,980 8,818,430

Total stockholders' equity

119,503,295 114,638,890

Total Liabilities and Stockholders' Equity $

174,136,049 $ 171,918,276

Investors Title Company

and Subsidiaries Net Premiums Written By Branch and

Agency For the Three Months Ended March 31, 2013 and

2012 (Unaudited)

Three Months Ended March 31

2013 %

2012 %

Branch $ 5,783,629

24.2 $ 4,822,792 24.5

Agency

18,142,368 75.8 14,844,628

75.5

Total $ 23,925,997

100.0 $ 19,667,420 100.0

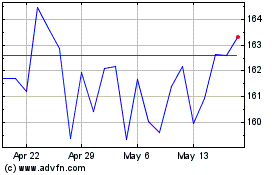

Investors Title (NASDAQ:ITIC)

Historical Stock Chart

From Jun 2024 to Jul 2024

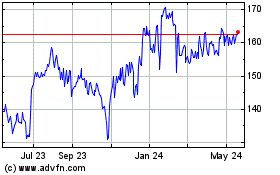

Investors Title (NASDAQ:ITIC)

Historical Stock Chart

From Jul 2023 to Jul 2024