UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

8-K

CURRENT

REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

Date of report (Date of earliest event reported):

October 2, 2023

Jupiter Acquisition Corporation

(Exact name of registrant as specified in its charter)

| Delaware |

|

001-39505 |

|

85-1508739 |

(State or other jurisdiction

of incorporation)

|

|

(Commission File Number) |

|

(I.R.S. Employer

Identification No.) |

| 11450 SE Dixie Hwy, Suite 105 |

|

|

| Hobe Sound,

FL |

|

33455 |

| (Address of principal executive offices) |

|

(Zip Code) |

(212) 207-8884

(Registrant’s telephone number, including area code)

Not Applicable

(Former

name or former address, if changed since last report)

Check the appropriate box

below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following

provisions:

| ☒ | Written communications pursuant

to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ | Soliciting material pursuant

to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ | Pre-commencement communications

pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ | Pre-commencement communications

pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b)

of the Act:

|

Title of each class |

|

Trading Symbol(s) |

|

Name of each exchange on which registered |

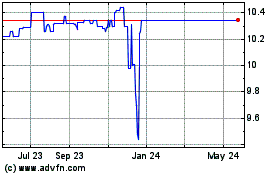

| Units, each consisting of one share of Class A Common Stock and one-half of one Warrant |

|

JAQCU |

|

The Nasdaq Stock Market LLC |

| Class A Common Stock, par value $0.0001 per share |

|

JAQC |

|

The Nasdaq Stock Market LLC |

| Warrants, each whole warrant exercisable for one share of Class A Common Stock at an exercise price of $11.50 |

|

JAQCW |

|

The Nasdaq Stock Market LLC |

Indicate by check mark whether the registrant

is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2

of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☒

If an emerging growth

company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or

revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

Item 7.01. Regulation FD Disclosure.

As

previously announced, on July 18, 2023, Jupiter Acquisition Corporation, a Delaware corporation (“Jupiter”), 1427702 B.C.

Ltd., a corporation organized under the laws of British Columbia (“TopCo”), Filament Merger Sub LLC, a Delaware limited liability

company and a direct, wholly-owned subsidiary of TopCo, and Filament Health Corp., a corporation organized under the laws of British Columbia

(“Filament”), entered into a definitive business combination agreement, which provides for a proposed business combination

through a series of related transactions (collectively, the “Proposed Business Combination”).

Attached

hereto as Exhibit 99.1 and incorporated by reference herein is an updated presentation dated

October 2023 to be used by Jupiter and Filament in presentations for certain of Jupiter’s stockholders and other persons in connection

with the Proposed Business Combination.

The

foregoing (including the information presented in Exhibit 99.1 hereto) is being furnished pursuant to Item 7.01 and shall not be deemed

“filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”),

or otherwise be subject to the liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities

Act of 1933, as amended (the “Securities Act”), or the Exchange Act. The submission of the information set forth in this Item

7.01 shall not be deemed an admission as to the materiality of any information in this Item 7.01, including the information presented

in Exhibit 99.1 hereto that is provided solely in connection with Regulation FD.

Important Information About the Proposed

Business Combination and Where to Find It

This

Current Report on Form 8-K relates to the Proposed Business Combination and may be deemed to be solicitation material in respect of the

Proposed Business Combination. The Proposed Business Combination will be submitted to Jupiter’s stockholders for their consideration

and approval. TopCo has filed a registration statement on Form F-4 (File No. 333-273972) and amendments and supplements thereto (the “Registration

Statement”) with the U.S. Securities and Exchange Commission (the “SEC”), which contains a preliminary proxy statement/prospectus

that constitutes (i) a preliminary proxy statement in connection with Jupiter’s solicitation of proxies for the vote by Jupiter’s

stockholders to approve the Proposed Business Combination and other matters as described in the Registration Statement and (ii) a preliminary

prospectus relating to the offer of TopCo securities to be issued in the Proposed Business Combination. Jupiter and TopCo also intend

to file other relevant documents with the SEC and, in the case of Filament and TopCo, with the applicable Canadian securities regulatory

authorities, regarding the Proposed Business Combination. After the Registration Statement has been declared effective, Jupiter will mail

the definitive proxy statement/prospectus and other relevant documents to its stockholders as of the record date established for voting

on the Proposed Business Combination. The Proposed Business Combination will also be submitted to the securityholders of Filament for

their consideration and approval. JUPITER’S STOCKHOLDERS AND OTHER INTERESTED PERSONS ARE ADVISED TO READ THE REGISTRATION STATEMENT,

THE PRELIMINARY PROXY STATEMENT/PROSPECTUS, ANY AMENDMENTS OR SUPPLEMENTS THERETO AND, ONCE AVAILABLE, THE DEFINITIVE PROXY STATEMENT/PROSPECTUS

IN CONNECTION WITH JUPITER’S SOLICITATION OF PROXIES FOR ITS SPECIAL MEETING OF STOCKHOLDERS TO BE HELD TO APPROVE, AMONG OTHER

THINGS, THE PROPOSED BUSINESS COMBINATION, BECAUSE THESE DOCUMENTS CONTAIN OR WILL CONTAIN IMPORTANT INFORMATION ABOUT JUPITER, FILAMENT,

TOPCO AND THE PROPOSED BUSINESS COMBINATION.

Jupiter’s

stockholders and other interested parties may also obtain a copy of the Registration Statement, the preliminary proxy statement/prospectus,

any amendments or supplements thereto and, once available, the definitive proxy statement/prospectus, as well as other documents filed

with the SEC regarding the Proposed Business Combination and other documents filed with the SEC by Jupiter, without charge, at the SEC’s

website located at www.sec.gov, or by directing a request to: Jupiter Acquisition Corporation, 11450 SE Dixie Hwy, Suite 105, Hobe Sound,

FL 33455. As the Registration Statement contains certain information about Filament, the Registration Statement has also been made available

under Filament’s profile on SEDAR at www.sedar.com.

INVESTMENT

IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY, NOR HAS ANY AUTHORITY

PASSED UPON OR ENDORSED THE MERITS OF THE PROPOSED BUSINESS COMBINATION PURSUANT TO WHICH ANY SECURITIES ARE TO BE OFFERED OR THE ACCURACY

OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE.

Forward-Looking Statements

This

Current Report on Form 8-K includes “forward-looking statements” within the meaning of the “safe harbor” provisions

of the United States Private Securities Litigation Reform Act of 1995 and forward-looking information within the meaning of applicable

Canadian securities laws. Forward-looking statements may be identified by the use of words such as “estimate,” “plan,”

“project,” “forecast,” “intend,” “will,” “expect,” “anticipate,”

“believe,” “could,” “continue,” “may,” “might,” “outlook,” “possible,”

“potential,” “predict,” “scheduled,” “should,” “would.” “seek,”

“target” or other similar expressions that predict or indicate future events or trends or that are not statements of historical

matters, but the absence of these words does not mean that a statement is not forward-looking. Generally, statements that are not historical

facts, including statements concerning possible or assumed future actions, business strategies, events or results of operations, and any

statements that refer to projections, forecasts or other characterizations of future events or circumstances, including any underlying

assumptions, are forward-looking statements. These statements are based on various assumptions, whether or not identified in this Current

Report on Form 8-K, and on the current beliefs and expectations of Filament’s, TopCo’s and Jupiter’s management and

are not predictions of actual performance. These forward-looking statements are provided for illustrative purposes only and are not intended

to serve as and must not be relied on by any investor as a guarantee, an assurance, a prediction, or a definitive statement of fact or

probability. Although Filament, TopCo and Jupiter believe that their respective plans, intentions, and expectations reflected in or suggested

by these forward-looking statements are reasonable, none of Filament, TopCo or Jupiter can assure you that any of them will achieve or

realize these plans, intentions, or expectations. Actual events and circumstances are difficult or impossible to predict and will differ

from assumptions. Many actual events and circumstances are beyond the control of Filament, TopCo and Jupiter. These forward-looking statements

are subject to a number of risks and uncertainties, including (i) the occurrence of any event, change or other circumstances that could

give rise to the termination of the Proposed Business Combination; (ii) the failure of either Jupiter or Filament prior to the Proposed

Business Combination, or TopCo after the Proposed Business Combination, to execute their business strategy; (iii) the outcome of any legal

proceedings that may be instituted against Filament, TopCo or Jupiter or others following the announcement of the Proposed Business Combination;

(iv) the inability to complete the Proposed Business Combination due to the failure to obtain any necessary interim order or other required

court orders in respect of Filament’s statutory plan of arrangement under the Business Corporations Act (British Columbia) with

respect to the Proposed Business Combination or the failure to obtain the approval of Filament’s shareholders or Jupiter’s

stockholders or to satisfy other conditions to closing; (v) changes to the proposed structure of the Proposed Business Combination that

may be required or appropriate as a result of applicable laws or regulations or as a condition to obtaining regulatory approval of the

Proposed Business Combination; (vi) the ability to meet stock exchange listing standards prior to and following the consummation of the

Proposed Business Combination; (vii) the risk that the Proposed Business Combination disrupts current plans and operations of Filament

as a result of the announcement and consummation of the Proposed Business Combination; (viii) the ability to recognize the anticipated

benefits of the Proposed Business Combination, which may be affected by, among other things, competition and the ability of TopCo to grow

and manage growth profitably, maintain relationships with customers and retain its management and key employees; (ix) costs related to

the Proposed Business Combination; (x) failure to comply with and stay abreast of changes in laws or regulations applicable to Filament’s

business, including health and safety regulations and policies; (xi) Filament’s estimates of expenses and profitability and underlying

assumptions with respect to redemptions by Jupiter’s stockholders and purchase price and other adjustments; (xii) any downturn or

volatility in economic or business conditions; (xiii) the effects of COVID-19 or other epidemics or pandemics; (xiv) changes in the competitive

environment affecting Filament or its customers, including Filament’s inability to introduce, or obtain regulatory approval for,

new products; (xv) the failure to obtain additional capital on acceptable terms; (xvi) the impact of pricing pressure and erosion; (xvii)

failures or delays in Filament’s supply chain; (xviii) Filament’s ability to protect its intellectual property and avoid infringement

by others, or claims of infringement against Filament; (xix) the possibility that Filament, TopCo or Jupiter may be adversely affected

by other economic, business and/or competitive factors; (xx) the failure of Filament or TopCo to respond to fluctuations in foreign currency

exchange rates; and (xxi) Filament’s estimates of its financial performance; and those factors discussed in documents of Jupiter

or TopCo filed, or to be filed, with the SEC. If any of these risks materialize or any assumptions prove incorrect, actual results could

differ materially from the results implied by these forward-looking statements. There may be additional risks that none of Filament, TopCo

or Jupiter presently knows or that Filament, TopCo and Jupiter currently believe are immaterial that could also cause actual results to

differ from those contained in the forward-looking statements. In addition, forward-looking statements reflect Filament’s, TopCo’s

and Jupiter’s expectations, plans, or forecasts of future events and views as of the date of this Current Report on Form 8-K. Filament,

TopCo and Jupiter anticipate that subsequent events and developments will cause Filament’s, TopCo’s and Jupiter’s assessments

to change. However, while Filament, TopCo and Jupiter may elect to update these forward-looking statements at some point in the future,

Filament, TopCo and Jupiter specifically disclaim any obligation to do so. These forward-looking statements should not be relied upon

as representing Filament’s, TopCo’s or Jupiter’s assessments as of any date after the date of this Current Report on

Form 8-K. Accordingly, undue reliance should not be placed upon the forward-looking statements.

No Offer or Solicitation

This

Current Report on Form 8-K does not constitute an offer to sell or the solicitation of an offer to buy any securities or a solicitation

of any vote or approval, nor shall there be any sale of securities in any jurisdiction in which such offer, solicitation, or sale would

be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. No offering of securities shall

be made except by means of a prospectus meeting the requirements of Section 10 of the Securities Act or pursuant to an exemption from

the Securities Act. In Canada, no offering of securities shall be made except by means of a prospectus in accordance with the requirements

of applicable Canadian securities laws or an exemption therefrom. This Current Report on Form 8-K is not, and under no circumstances is

it to be construed as, a prospectus, offering memorandum, an advertisement or a public offering in any province or territory of Canada.

In Canada, no prospectus has been filed with any securities commission or similar regulatory authority in respect of any of the securities

referred to herein.

Participants in Solicitation

Jupiter,

Filament, TopCo and certain of their respective directors, executive officers, and other members of management and employees may, under

SEC rules, be deemed to be participants in the solicitations of proxies from Jupiter’s stockholders in connection with the Proposed

Business Combination. Information regarding Jupiter’s directors and executive officers is available in its Annual Report on Form

10-K for the fiscal year ended December 31, 2022, which was filed with the SEC on March 10, 2023. Information regarding the persons who

may, under SEC rules, be deemed participants in the solicitation of proxies from Jupiter’s stockholders in connection with the Proposed

Business Combination is set forth in the Registration Statement, and the preliminary proxy statement/prospectus included therein, and

will be set forth in the definitive proxy statement/prospectus when it is filed with the SEC. Additional information regarding the participants

in the proxy solicitation and a description of their direct and indirect interests is included in the Registration Statement, and the

proxy statement/prospectus included therein, and will be included in the definitive proxy statement/prospectus when it becomes available.

Jupiter’s stockholders, potential investors, and other interested persons should carefully read the Registration Statement, the

preliminary proxy statement/prospectus, any amendments or supplements thereto and, once available, the definitive proxy statement/prospectus,

and related documents filed with the SEC, before making any voting or investment decisions. These documents, once available, can be obtained

free of charge from the sources indicated above.

No Assurances

There

can be no assurance that the Proposed Business Combination will be completed, nor can there be any assurance, if the Proposed Business

Combination is completed, that the potential benefits of the Proposed Business Combination will be realized.

Item 9.01. Financial Statements and Exhibits.

(d) Exhibits.

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto

duly authorized.

| |

Jupiter Acquisition Corporation |

| |

|

| |

By: |

/s/ James N. Hauslein |

| |

|

Name: |

James N. Hauslein |

| |

|

Title: |

Chief Executive Officer |

Date: October 2, 2023

5

Exhibit 99.1

Corporate Presentation - July 2023 Psychedelic Medicines Naturally Derived October 2023 Investor Presentation Proposed Business Combination with Jupiter Acquisition Corporation

Investor Presentation - October 2023 FILAMENT HEALTH Disclaimer This presentation (this “Presentation”) is provided for informational purposes only and has been prepared to assist interested parties in making their own evaluation with respect to the proposed business combination between Filament Corp. (“Filament”) and Jupiter Acquisition Corporation (“Jupiter”) and related transactions (the “Proposed Transactions”) and for no other purpose. No representations or warranties, express or implied are given in, or in respect of, this Presentation. To the fullest extent permitted by law, in no circumstances will Jupiter, Filament, 1427702 B.C. Ltd. (a new holding company created in connection with the Proposed Transactions, or “TopCo”) or any of their respective subsidiaries, stockholders, affiliates, representatives, partners, directors, officers, employees, advisers or agents be responsible or liable for any direct, indirect or consequential loss or loss of profit arising from the use of this Presentation, its contents (including the internal economic models), its omissions, reliance on the information contained within it, or on opinions communicated in relation thereto or otherwise arising in connection therewith. Industry and market data used in this Presentation have been obtained from third - party industry publications and sources as well as from research reports prepared for other purposes. None of Jupiter, Filament or TopCo has independently verified the data obtained from these sources and cannot assure you of the data’s accuracy or completeness. This data is subject to change, and none of Jupiter, Filament, TopCo or any of their respective representatives or affiliates have any obligation to update this Presentation. Recipients of this Presentation are not to construe its contents, or any prior or subsequent communications from or with Jupiter, Filament, TopCo or their respective representatives or affiliates, as investment, legal or tax advice. In addition, this Presentation does not purport to be all - inclusive or to contain all of the information that may be required to make a full analysis of Filament, TopCo or the Proposed Transactions. Recipients of this Presentation should each make their own evaluation of Filament, TopCo and the Proposed Transactions and of the relevance and adequacy of the information and should make such other investigations as they deem necessary. No assurances can be given that the Proposed Transactions will be consummated on the terms or in the timeframe currently contemplated, if at all. Important Information and Where to Find It In connection with the Proposed Transactions described herein, TopCo has filed a registration statement on Form F - 4 (File No. 333 - 273972) (the "Form F - 4") with the U.S. Securities and Exchange Commission (the “SEC”) that includes a proxy statement of Jupiter and also constitutes a prospectus of TopCo. Jupiter, Filament and TopCo urge investors, stockholders and other interested persons to read the Form F - 4, the proxy statement/prospectus included therein and any amendments or supplements thereto, as well as other documents filed with the SEC, because these documents will contain important information about the Proposed Transactions. Such persons can also read Jupiter’s Annual Report on Form 10 - K for the fiscal year ended December 31, 2022 filed with the SEC on March 10, 2023 (the “Jupiter Annual Report”) for a description of the security holdings of its officers and directors and their respective interests as security holders in the consummation of the Proposed Transactions described herein. After the Form F - 4 has been declared effective, the definitive proxy statement/prospectus will be mailed to Jupiter’s stockholders as of a record date to be established for voting on the Proposed Transactions and related matters described in the Form F - 4. Jupiter’s stockholders will also be able to obtain a copy of such documents, without charge and once available, by directing a request to: Jupiter Acquisition Corporation, 11450 SE Dixie Hwy, Suite 105, Hobe Sound, FL 33455. These documents can also be obtained, without charge, at the SEC’s web site (http://www.sec.gov). INVESTMENT IN ANY SECURITIES DESCRIBED HEREIN HAS NOT BEEN APPROVED OR DISAPPROVED BY THE SEC OR ANY OTHER REGULATORY AUTHORITY NOR HAS ANY AUTHORITY PASSED UPON OR ENDORSED THE MERITS OF THE OFFERING OR THE ACCURACY OR ADEQUACY OF THE INFORMATION CONTAINED HEREIN. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL OFFENSE. Participants in the Solicitation Jupiter, Filament, TopCo and their respective directors, executive officers and other members of their management and employees, under SEC rules, may be deemed to be participants in the solicitation of proxies from Jupiter’s stockholders in connection with the Proposed Transactions. Investors and security holders may obtain more detailed information regarding the names, affiliations and interests of Jupiter’s directors in the Jupiter Annual Report. Information regarding the persons who may, under SEC rules, be deemed participants in the solicitation of proxies from Jupiter’s stockholders in connection with the Proposed Transactions is set forth in the Form F - 4, the proxy statement/prospectus included therein, and any amendments or supplements thereto. Information concerning the interests of Jupiter’s, Filament’s and TopCo’s participants in the solicitation, which may, in some cases, be different than those of Jupiter’s, Filament’s and TopCo’s equity holders generally, is set forth in the Form F - 4, the proxy statement/prospectus included therein, and any amendments or supplements thereto. Jupiter’s stockholders, potential investors and other interested persons should read the Form F - 4, and the proxy statement/prospectus included therein, and any amendments or supplements thereto, and related documents filed with the SEC carefully before making any voting or investment decisions. These documents can be obtained free of charge from the sources indicated above. No Offer or Solicitation This Presentation and any oral statements made in connection with this Presentation do not constitute an offer to sell, or a solicitation of an offer to buy, or a recommendation to purchase, any securities in any jurisdiction, or the solicitation of any proxy, vote, consent or approval in any jurisdiction in connection with the Proposed Transactions or any related transactions, nor shall there be any sale, issuance or transfer of any securities in any jurisdiction where, or to any person to whom, such offer, solicitation or sale may be unlawful under the laws of such jurisdiction. This Presentation does not constitute either advice or a recommendation regarding any securities. Any offer to sell securities will be made only pursuant to a definitive subscription agreement and will be made in reliance on an exemption from registration under the Securities Act of 1933, as amended, for offers and sales of securities that do not involve a public offering, or by means of a prospectus meeting the requirements of Section 10 of the Securities Act of 1933, as amended. Jupiter, Filament and TopCo reserve the right to withdraw or amend for any reason any offering and to reject any subscription agreement for any reason. The communication of this Presentation is restricted by law; it is not intended for distribution to, or use by any person in, any jurisdiction where such distribution or use would be contrary to local law or regulation. In Canada, no offering of securities shall be made except by means of a prospectus in accordance with the requirements of applicable Canadian securities laws or an exemption therefrom. This communication is not, and under no circumstances is it to be construed as, a prospectus, offering memorandum, an advertisement or a public offering in any province or territory of Canada. In Canada, no prospectus has been filed with any securities commission or similar regulatory authority in respect of any of the securities referred to herein. Trademarks This Presentation contains trademarks, service marks, trade names and copyrights of Jupiter, Filament, TopCo and other companies, which are the property of their respective owners. The use or display of third parties’ trademarks, service marks, trade names or products in this presentation is not intended to, and does not imply, a relationship with Jupiter, Filament or TopCo, or an endorsement or sponsorship by or of Jupiter, Filament or TopCo. Solely for convenience, the trademarks, service marks, trade names and copyrights referred to in this presentation may appear without the TM, SM, ® or © symbols, but such references are not intended to indicate, in any way, that Jupiter, Filament or TopCo will not assert, to the fullest extent under applicable law, their rights or the right of the applicable licensor to these trademarks, service marks, trade names and copyrights. Forward - Looking Statements This Presentation includes certain statements that are not historical facts but are forward - looking statements for purposes of the safe harbor provisions under the United States Private Securities Litigation Reform Act of 1995. Forward - looking statements generally are accompanied by words such as “believe,” “may,” “will,” “estimate,” “continue,” “anticipate,” “intend,” “expect,” “should,” “would,” “plan,” “predict,” “potential,” “seem,” “seek,” “future,” “outlook,” and similar expressions that predict or indicate future events or trends or that are not statements of historical matters, but the absence of these words does not mean that a statement is not forward - looking. These forward - looking statements include, but are not limited to, statements regarding the completion of the Proposed Transactions and expansion and market opportunities of the combined company. These statements are based on various assumptions, whether or not identified in this Presentation, and on the current expectations of Filament, TopCo and/or Jupiter’s management and are not predictions of actual performance. These forward - looking statements are provided for illustrative purposes only and are not intended to serve as, and must not be relied on by any investor as, a guarantee, an assurance, a prediction or a definitive statement of fact or probability. Actual events and circumstances are difficult or impossible to predict and will differ from assumptions. Many actual events and circumstances are beyond the control of Jupiter, Filament and TopCo. These forward - looking statements are subject to a number of risks and uncertainties, which include, without limitation, Jupiter’s, Filament’s and TopCo’s inability to recognize the anticipated benefits of the Proposed Transactions, which may be affected by, among other things, the amount of cash available following any redemptions by Jupiter’s public stockholders; the ability to meet Nasdaq’s listing standards following the consummation of the Proposed Transactions; costs related to the Proposed Transactions; expectations with respect to future performance and growth; the timing of the completion of the Proposed Transactions; Filament’s or TopCo’s ability to execute its business plans and strategy and to receive regulatory approvals; potential litigation involving the parties; changes in domestic and foreign business, market, financial, political and legal conditions; geopolitical events, including the invasion of Ukraine by Russia; the ability of the parties to complete the Proposed Transactions or the performance of the combined company following consummation of the Proposed Transactions; regulatory changes, including the proposed rules issued by the SEC with respect to business combination transactions involving special purpose acquisition companies; access to additional financing; and other risks and uncertainties indicated from time to time in filings with the SEC by Jupiter, Filament or TopCo. Other factors include the possibility that the Proposed Transactions do not close, including due to the failure to receive required security holder approvals, or the failure of other closing conditions. The foregoing list of factors is not exclusive. Additional information concerning certain of these and other risk factors is contained in Jupiter’s most recent filings with the SEC and will be contained in the Form F - 4 filed in connection with the Proposed Transactions described above. All subsequent written and oral forward - looking statements concerning Jupiter, Filament or TopCo, the Proposed Transactions or other matters and attributable to Jupiter, Filament, TopCo or any person acting on their behalf are expressly qualified in their entirety by the cautionary statements above. Recipients of this Presentation are cautioned not to place undue reliance upon any forward - looking statements, which speak only as of the date made. Jupiter, Filament and TopCo expressly disclaim any obligations or undertaking to release publicly any updates or revisions to any forward - looking statements contained herein to reflect any change in Jupiter’s, Filament’s or TopCo’s expectations with respect thereto or any change in events, conditions or circumstances on which any statement is based. Financial Information Filament’s historical financial information and data included in this Presentation is unaudited and has been prepared in accordance with International Financial Reporting Standards as issued by the International Accounting Standards Board (“IFRS”) or is based on information prepared by Filament in accordance with IFRS. There are important differences between IFRS and generally accepted accounting principles in the United States of America, or GAAP. Additionally, certain financial information and data included in this Presentation is unaudited and does not conform to Regulation S - X promulgated by the SEC and may not be included in, may be adjusted in or may be presented differently in, any proxy statement, registration statement, or prospectus, including the Form F - 4, the proxy statement/prospectus included therein and any amendments or supplements thereto, for the Proposed Transactions. There is no assurance that any such adjustments will not be material. This Presentation may contain financial forecasts and projections (collectively, “prospective financial information”) of Filament or the combined company. The independent registered public accounting firm of Filament did not audit, review, compile or perform any procedures with respect to the prospective financial information for the purpose of their inclusion in this Presentation, and accordingly, such firm has not expressed an opinion or provided any other form of assurance with respect thereto for the purpose of this Presentation. This prospective financial information constitutes forward - looking statements and should not be relied upon as being guarantees or necessarily indicative of future results. The assumptions and estimates underlying such prospective financial information are inherently uncertain and are subject to a wide variety of significant business, economic, competitive and other risks and uncertainties that could cause actual results to differ materially from those contained in the prospective financial information. See “Forward - Looking Statements.” Accordingly, there can be no assurance that the prospective financial information is indicative of future performance of Filament or the combined company, or that actual results will not differ materially from the results presented in the prospective financial information included in this Presentation. Actual results may differ materially from the results contemplated by the prospective financial information included in this Presentation. The inclusion of such prospective financial information herein should not be regarded as a representation by any person that the results reflected in such projections will be achieved. The purpose of the prospective financial information is to assist investors, shareholders and others in evaluating the performance of Filament's or the combined company's business. The prospective financial information may not be appropriate for other purposes. Information about Filament's guidance, including the various assumptions underlying it, is forward - looking and should be read in conjunction with “Forward - Looking Statements” in this Presentation, and the related disclosure and information about various economic, competitive, and regulatory assumptions, factors, and risks that may cause Filament's or the combined company's actual future financial and operating results to differ from what Filament currently expects. All amounts in this Presentation are expressed in U.S. dollars unless otherwise indicated. Disclaimers 2

Investor Presentation - October 2023 FILAMENT HEALTH 3 Filament Health Value Pillars ● Botanical drug development platform to create clinical - stage drug candidates ● Exceptional IP benefits from complex botanical API with faster path to clinic and ongoing distribution via early access programs ● Multi - billion dollar market opportunities 1 to address the global mental health crisis ● Focus on substance use disorders; Phase I trial underway and Phase II trials approved ● Positioned for revenue from early access and out - licensing programs with future commercial royalties in non - core indications ● 20 issued patents in the US and Canada, at least 45 patent applications worldwide ● Partner trial program generating clinical data in new potential indications at minimal cost ● Vertically integrated GMP manufacturing enabling in - house research, development and intellectual property generation ● Experienced management team and board of directors 1) API = Active Pharmaceutical Ingredient IP = Intellectual Property GMP = Good Manufacturing Practice Based on Filament - commissioned 3rd Party Research Estimates by Pinney and Associates and Old Street Strategy

Investor Presentation - October 2023 FILAMENT HEALTH 4 Summary Transaction Overview • Filament Health Corp. (“Filament”) signed a Business Combination Agreement on July 18, 2023, to combine with Jupiter Acquisition Corporation (Nasdaq:JAQC) (“Jupiter”) • Combined company will operate under the same management team as Filament Health Corp. • Anticipate closing in Q4 2023; begin trading on Nasdaq subject to approval and continue trading on NEO Exchange Overview Ownership • The transaction contemplates a pre - money enterprise value of approximately US $175 million for Filament • Filament shareholders are expected to retain a pro forma ownership of approximately 79.7% of the combined company (Including bridge shares, excluding shares underlying Jupiter warrants, and assuming a $5 million PIPE and no redemptions by Jupiter’s public stockholders) Financing • There is expected to be a minimum of US$5 million in cash on the balance sheet at closing that may be sourced from a combination of the cash held in trust (net of redemptions), cash on the balance sheet, and through additional financing sources Transaction Rationale • Provides Filament with access to the U.S. capital markets, to accelerate the development and advancement of its clinical pipeline • Public company - ready management and board, as Filament is currently listed on the NEO exchange • Gain access to a more sophisticated investor base for enhanced value Use of Proceeds • To initiate Phase II clinical trials for its lead asset, PEX010, for Methamphetamine Use Disorder and Opioid Use Disorder • Working capital and general corporate purposes

Investor Presentation - October 2023 FILAMENT HEALTH 5 Detailed Transaction Overview Illustrative Sources & Uses Sources (In USD millions) 15.3 $ Jupiter Cash in Trust 5 176.0 $ Stock Issuance to Filament 8 1.9 $ Cash from Bridge Financing 10 5.0 $ Cash from PIPE 6 198.2 $ Total Sources Uses (In USD millions) 176.0 $ Filament Equity Rollover 8 14.8 $ Cash to Balance Sheet 5 7.4 $ Estimated Transaction Fees & Expenses 198.2 $ Total Uses Pro Forma Valuation 5,7 (In USD millions, except per share data) 25,028,213 Pro - forma Shares Outstanding 10.00 $ (x) Illustrative Share Price 250.3 $ Pro Forma Equity Value 7 14.8 $ ( - ) Pro Forma Net Cash 235.5 $ Total Enterprise Value 7 1) 2) 3) 4) 5) 6) 7) Excludes 1,500,000 TopCo Class B Earnout Shares and 1,500,000 TopCo Class C Earnout Shares, but includes 2,791,710 Filament Common Shares to be issued in connection with the conversion of an outstanding Filament convertible debenture Excludes Founder Shares separately included under “Sponsor Shares” and “Other Shares” Includes 833,652 Founder Shares (2,778,841 Founder Shares minus 1,945,189 Sponsor Earnout Shares) and 432,575 Private Shares Includes (i) 59,572 Founder Shares (198,573 Founder Shares minus 139,001 Underwriter Earnout Shares), 162,662 Private Shares and 300,000 Deferred Fee Shares, in each case to be held by Jupiter's IPO underwriters, (ii) 350,000 Advisor Shares to be issued to Maxim, and (iii) 2,351,211 Bridge Shares issued in the Bridge Financing Assumes no redemptions by Jupiter public stockholders Estimated $5 million in net proceeds to close concurrently with the business combination Pro forma diluted basis at $10.00 per share, assumes no redemptions and excludes impact of unvested stock - based compensation and unvested shares pursuant to the new, to - be - established equity incentive plan and warrants 8) Assumes $1 million of existing cash on Filament’s balance sheet 9) Defined terms used but undefined in this table have the meanings set forth in the Form F - 4 10) References to "bridge financing" refer to the non - brokered private placement by Filament of 27,777,773 units, each consisting of one Filament common share and one warrant, for gross proceeds of approximately C$2,500,000, which was completed on July 24, 2023, and assume for purposes of this presentation no further private placements by Filament prior to the consummation of the proposed business combination

Investor Presentation - October 2023 FILAMENT HEALTH ● Defined by the FDA Botanical Drug Guidance (2016) 1 , botanical drugs: ○ Are derived from plant materials, algae, macroscopic fungi, and combinations thereof ○ Have a complex combination of multiple active compounds, rather than one single compound ○ Typically have documented historical use by humans ● Active metabolite, mechanism of action, full characterization may not be known or be impossible to determine ● Secondary compounds are not impurities, they are part of the API and may improve efficacy ● Manufacturing, characterization, complex/multiple methods of action more akin to biologics than new chemical entities ● Significant contrast to conventional approach of single - compound API 6 Exceptional IP advantages due to the difficulty in genericizing complex mixtures protected by process patents and trade secrets Fast track to clinical development leveraging documented historical human consumption instead of preclinical studies Potential efficacy benefits through entourage effect and consumer preference over synthetics 1 2 3 BOTANICAL DRUG ADVANTAGES Advantages: Botanical Drugs Differentiated FDA development pathway with significant untapped potential 1. Further reading: FDA Botanical Drug Guidance FDA = U.S. Food and Drug Administration

Investor Presentation - October 2023 FILAMENT HEALTH 7 Botanical Drug Advantages 1. Intellectual Property ● Process patents for manufacturing methods (extraction, purification, standardization) ● Small changes in the source material, manufacturing methods, or formulation can cause large changes in the final composition but are patented or kept as trade secret ● Small molecule methods are irrelevant if target compound purity achieved ● Genericization straightforward with small molecule, extremely difficult or impossible with complex botanicals ● Botanicals much more similar to biologics than small molecules Botanical Drug Chromatogram 4 Synthetic Drug Chromatogram 4 1. FDA Says It Won't Approve Generic Forms of Premarin 2. The Botanical Drug Substance Crofelemer as a Model System for Comparative Characterization of Complex Mixture Drugs 3. Filing for a Patent Versus Keeping Your Invention a Trade Secret 4. Filament, illustrative chromatogram (a laboratory technique to separate, identify and quantify various compositional elements making up one substance; y - axis depicts detector response and x - axis represents time) Trade - secret process IP for extracts can outlast traditional NCE patent protection. Examples include: ● Premarin: naturally - derived menopause drug developed by Wyeth/Pfizer 1 ○ Patents expired 1971 and yet sales reached $1.5B in 1999 ○ Synthetic generics repeatedly denied by FDA for failure to precisely replicate composition and activity ● Crofelemer: Approved botanical drug so complex that the product can’t be characterized and is released based on a trade - secret bioassay 2 ● Coca - Cola: trade - secret extraction process has protected the product since 1886 3 BOTANICAL DRUG ADVANTAGES NCE = New Chemical Entity

Investor Presentation - October 2023 FILAMENT HEALTH 8 3. Efficacy Benefits and Consumer Preference ● Positive efficacy benefit from several compounds working together (entourage effect) is not possible in synthetics or natural isolates ● Natural drugs have a completely different impurity profile which can increase tolerability ● Consumer preference for natural products across many industries 1 ● Lower cost to manufacture Consumer preference Limited residues and no byproducts Lower cost to manufacture Entourage Effect BOTANICAL DRUG ADVANTAGES FILAMENT HEALTH Botanical Drug Advantages 2. Fast Track to Clinical Development ● Documented historical use can replace preclinical studies ● NCEs have unknown safety and efficacy which must be demonstrated through costly IND - enabling and phase 1 studies Filament Filament has received authorizations through its sponsors/partners to enter directly into Phase II clinical trials from FDA, Health Canada, and EMA* Example: Examples: Acthar Attempts at recreating Acthar gel, a complex natural mixture, by combining isolated synthetic constituents failed to provide similar safety. Although long off patent, Questcor (then - maker of Acthar) was sold to Mallinckrodt for approximately $5.8B in 2014 Dronabinol Dronabinol is a lab - made synthetic cannabinoid, genericized and distributed under the brand names Marinol, Syndros, Reduvo and Adversa whereas cannabis is a natural plant containing multiple active ingredients NCE = New Chemical Entity EMA = European Medicines Agency IND = Investigational New Drug Application *MHRA (Medicines and Healthcare Products Regulatory Agency is for UK license ) 1. “Consumers prefer natural versions of many things, including foods, medicines, personal care products and home products.” Scott, Rozin, and Small, Consumers Prefer “Natural” More for Preventatives than for Curatives, Journal of Consumer Research (Oct. 2020).

Investor Presentation - October 2023 FILAMENT HEALTH Second Generation Psychedelic Compounds: ● While patentable, have unknown safety and efficacy requiring costly and risky preclinical work ● Seek to shorten treatment time; whether this can be accomplished remains to be seen. For now the only real advantage is patentability ● Ineligible for any early legalisation efforts (OR, CO, AUS, CAN) 9 ● Almost all known psychedelics are natural; some have documented use ● Many are almost or completely unexplored clinically (mescaline, salvia, bufotenine) ● Isolated compounds show efficacy for many important indications, but development suffers due to lack of IP on non - patentable generic synthetics Echinopsis pachanoi ↓ MESCALINE Anadenanthera peregrina ↓ BUFOTENIN Acacia simplex ↓ N,N - DMT Botanical Drug Advantages Best Leveraged in Psychedelics BOTANICAL DRUG ADVANTAGES Botanical psychedelic drugs can provide the best of both worlds: Foundational IP, significant modern and historical evidence, entourage effect, consumer preference. Can be distributed today via early access programs, as described on Slide 14 OR = Oregon CO = Colorado AUS = Australia CAN = Canada

Investor Presentation - October 2023 FILAMENT HEALTH 10 Currently in FDA Trials: Psychedelic Botanical Drugs Technology enables rapid creation of unique, protected drug candidates with fast - track to clinical development Code Primary Compound Route Standardized Dosages R&D Phase I Phase II Target Indications PEX010 Psilocybin Oral 1mg, 5mg, 25mg Methamphetamine Use Disorder, Opioid Use Disorder, others via licensing and academic trials PEX020 Psilocin Oral Withheld Anywhere psilocybin has shown efficacy PEX030 Psilocin Sublingual Withheld Anywhere psilocybin has shown efficacy AEX010 DMT/ β - Carbolines Oral Withheld PTSD, Substance use disorders MEX010 Mescaline Oral Withheld Substance use disorders IEX010 Ibogaine Oral Withheld Substance use disorders BOTANICAL DRUG ADVANTAGES

Investor Presentation - October 2023 FILAMENT HEALTH 11 Drug Development Focus - Substance Use Disorders Clear endpoints and significant unmet needs ● Among Americans aged 12 or older in 2021, 8.6% (or 24 million people) had at least one drug use disorder in the past year 1 ● Psychedelics have long provided anecdotal evidence for substance use disorders and are beginning to show positive clinical evidence: ○ Bogenschutz 2022 (NYU): 83% reduction in heavy drinking n=93 2 ○ Johnson 2016 (Hopkins): 67% 1yr smoking abstinence n=15 3 ● Filament drug development is currently focused on Stimulant Use Disorder and Opioid Use Disorder ● Filament has partnered with the University of California San Francisco to conduct Phase I and Phase II trials led by Principal Investigator, Dr. Joshua Woolley, MD/Ph.D. ● IITs cost - effective way to get proof - of - concept data which derisks larger phase 2b studies DRUG DEVELOPMENT Lead Indications: - Synthetic Opioids - Psychostimulants - Cocaine 1. Key Substance Use and Mental Health Indicators in the United States: Results from the 2021 National Survey on Drug Use and Health 2. Percentage of Heavy Drinking Days Following Psilocybin - Assisted Psychotherapy vs Placebo in the Treatment of Adult Patients With Alcohol Use Disorder 3. Long - term Follow - up of Psilocybin - facilitated Smoking Cessation IIT = Investigator Initiated Trial

Investor Presentation - October 2023 FILAMENT HEALTH 1. Key Substance Use and Mental Health Indicators in the United States: Results from the 2021 National Survey on Drug Use and Health 2. NCHS Data Brief: Drug Overdose Deaths in the United States, 1999 – 2019 3. Filament - commissioned 3rd Party Research Estimates by Pinney and Associates and Old Street Strategy ● In the latest (2021) national survey, 11 million Americans reported stimulant misuse and 4.5 million reported a stimulant use disorder (StUD) 1 ● From 2012 through 2019, the fatal overdose rate increased on average by 29% per year to 5.0 deaths per 100,000 standard population 2 ○ Side effects include violent outbursts and aggressive behaviour ○ Three subcategories share similar or identical mechanisms of action: ■ Methamphetamine use disorder, cocaine use disorder and prescription stimulant use disorder ● There are no approved treatments for StUD ● Filament estimates addressable StUD patient population of 835,000 with peak annual revenues of US$1.2 billion 3 12 Stimulant Use Disorder Development Plan DRUG DEVELOPMENT *Anticipated start date Purpose Product n Start Phase 3 Phase 2 Phase 1 Indication Sponsor Assess the benefits of directly administering psilocin orally (PEX020) and sublingually (PEX030) PEX010, 020, 030 20 Dosing Healthy Volunteers UCSF Pilot open label study - Psilocybin for Methamphetamine Use Disorder. Planned 50 person multicentre study, Q1 2024* PEX010 (25mg) 10 Q4 2023* Methamphetamine Use Disorder Filament

Investor Presentation - October 2023 FILAMENT HEALTH ● In the latest (2021) national survey, 9.2 million Americans reported opioid misuse of which 5.6 million reported an opioid use disorder (OUD) 1 ● Overdose deaths nearly doubled from 7.4 to 15.5 deaths per 100,000 standard population from 2012 to 2019 2 ● The global opioid use disorder pharmaceutical market is projected to grow from $3.35 billion in 2023 to $6.14 billion by 2030, at a CAGR of 9.1% 3 ● Existing therapies are poor: ○ Substitution therapy replaces misused opioid with prescription opioid agonist (58% retention at 6 months 4 ) ○ Antagonist therapy requires complete detox and abstinence and monthly injections, and can lead to more deadly relapses (50% 6 - month retention 5 ) ● Filament forecasts addressable OUD patient population of 295,000 with peak annual revenues of ~$387 million 6 1. Key Substance Use and Mental Health Indicators in the United States: Results from the 2021 National Survey on Drug Use and Health 2. NCHS Data Brief: Drug Overdose Deaths in the United States, 1999 – 2019 3. Fortune Business Insights: Opioid Use Disorder (OUD) Market Size 4. Retention of Patients in Opioid Substitution Treatment: A Systematic Review 5. A Randomized Trial Comparing Extended - Release Injectable Suspension and Oral Naltrexone, Both Combined With Behavioral Therapy, for the Treatment of Opioid Use Disorder 6. Filament - commissioned 3rd Party Research Estimates by Pinney and Associates and Old Street Strategy 13 *Anticipated start date Opioid Use Disorder Development Plan DRUG DEVELOPMENT Purpose Product n Start Phase 3 Phase 2 Phase 1 Indication Sponsor Assess the benefits of directly administering psilocin orally (PEX020) and sublingually (PEX030) PEX010, 020, 030 20 Dosing Healthy Volunteers UCSF Pilot open label study - Psilocybin for Opioid Use Disorder. Planned 50 person multicentre study, Q1 2024* PEX010 (25mg) 10 Q4 2023* Opioid Use Disorder Filament

Investor Presentation - October 2023 FILAMENT HEALTH 14 Pre - Marketing Authorization Sales Significant revenue opportunities and potential first - mover advantage in both pharma and non - pharma emerging markets Prescription: Several jurisdictions have enabled pre - marketing authorization distribution of psychedelic drugs on a limited basis ● Health Canada Special Access Program (SAP): Filament is the supplier for 84 of 93 patients approved for MDD and End of Life Distress 1 ● Australian TGA Authorized Prescriber Scheme: Filament is well - positioned to supply ● FDA Expanded Access: Filament is actively monitoring this program Opportunities: Establish prescriber and patient networks, build relationships with health authorities, gain feedback on real - world application of drugs, treat patients Non - Prescription: Some states (i.e. Oregon) are in the process of developing guidelines and issuing licenses for the supervised use of psilocybin 2 Opportunities: Gain exposure to regulatory changes permitting legal sales; Filament’s focus on natural products allows participation in both markets, which is not possible with synthetics EMERGING MARKETS Dr. Valorie Masuda is a palliative care physician and Associate Professor of Clinical Medicine at the University of British Columbia. She has administered 11 doses of PEX010 to patients via the SAP. MDD = Major Depressive Disorder TGA = Therapeutic Goods Administration 1. As of March 24, 2023 2. Due to regulatory limitations, Filament cannot import, sell, or manufacture directly in Oregon and may not be able to in other potential jurisdictions, but Filament can license technology to parties operating within Oregon (or other potential jurisdictions) that hold the appropriate manufacturing and extraction licenses.

Investor Presentation - October 2023 FILAMENT HEALTH Strategic Out - Licensing Program ● Filament Milestone payments are generated with respect to each Phase II and/or III clinical trial conducted 2 ● Marketing authorization milestones are separately triggered in each major jurisdiction 15 Illustrative Contract Structure (in $000’s) 1 LICENSING Low - double digit royalties to to Phase II Milestone Payments 2 Phase III Milestone Payments 2 Marketing Authorization Commercial Royalties $300 $250 $1,000 $1,000+ $100 to to Generating current, near - term and long - term benefits ● Benefits to Filament: ○ Exposure to non - core indications and upside from licensees’ drug development programs ○ Milestone - based revenues generate cash for core operations and other drug development ○ Blue sky upside from royalties upon third - party commercialization ○ Safety data for internal development program ● Six revenue - generating licensing agreements executed to date ○ Out - licensing products at ever more advanced stages of development ● Strong pipeline and active business development program within a supply - constrained market ○ Filament has generated revenues of C$364,500 in 2022 1. These represent illustrative contract terms and are not specifically related to an executed contract. 2. Phase II and III milestone payments may be comprised of payments upon execution of the agreement, approval of trial, provision of materials and/or completion of the clinical trial.

Investor Presentation - October 2023 FILAMENT HEALTH 16 LICENSING Select Customer Contracts Demonstrated history of generating revenue through strategic out - licensing arrangements Commercial Rights? 1 Arrangement Drug Trial Jurisdiction Phase 3 Phase 2 Phase 1 Indication Customer Yes Licensing PEX010 (25mg) UK Palliative Care Psyence Group Yes Licensing PEX010 (25mg) Canada Eating Disorders NeoLumina Bioscience No Licensing PEX010 (25mg) Canada Depression Cybin Therapeutics No Licensing PEX010 (25mg) Canada Opioid Tapering EntheoTech Bioscience No Licensing PEX010 (25mg) Canada Chronic Pain/ Depression EntheoTech Bioscience No Licensing PEX010 (25mg) Canada COVID Mental Health Concerns – Frontline HCWs ATMA Journey Centers No Licensing PEX010 (25mg) Canada Therapist Training ATMA Journey Centers No Licensing PEX010 (25mg) US Demoralization Syndrome Reset Pharmaceuticals No Contract Development and Manufacturing MDMA N/A MDMA Encapsulation PharmAla Biotech 1. Licensing agreements with no commercial rights grant the licensee the rights to use the product for specific clinical development purposes, whereas licensing agreements with commercial rights grant the licensee the rights to use the product for clinical development, marketing authorization, and commercialization purposes.

Investor Presentation - October 2023 FILAMENT HEALTH Significant Intellectual Property Portfolio As of September 22 nd , 2023, 20 issued patents and at least 45 additional patent applications believed to create significant barriers to entry ● There are a finite number of ways to extract, purify, and standardize naturally - occurring psychedelic compounds ○ In contrast to the nearly unlimited number of synthetic forms and methods ● Prohibition has led to a dearth of expertise in botanical extraction with few people having the experience and knowledge required ● Filament’s IP portfolio is focused on: ○ The limited number of viable extraction and purification methods ○ Specific standardization processes ○ Compositions of matter Psychedelic Botanical Drug Processing Steps: STEP 1: PROPAGATION Grow botanical psychedelics Trade Secrets 17 STEP 2: EXTRACTION Remove target compounds from biomass 11 Granted & 15 Pending Patent Families 1 & 7 STEP 4: STANDARDIZATION & STABILIZATION Precise and stable formulation 2 Granted & 17 Pending Patent Families 3 & 4 STEP 3: PURIFICATION Remove non - primary/secondary metabolites (i.e. protein) 1 Granted & 9 Pending Patent Families 2 & 6 STEP 5: HUMAN DELIVERY Compositions of matter for different deliverable forms 6 Granted & 5 Pending Patent Family 5

Investor Presentation - October 2023 FILAMENT HEALTH Enabling a Thriving Research Ecosystem Indication Dosage Drug Phase 3 Phase 2 Phase 1 Sponsor Depression 1mg PEX010 University of Toronto Alcohol Use Disorder 25mg PEX010 Brugmann University Hospital Alcohol Use Disorder 25mg PEX010 Copenhagen U. Hospital Treatment Resistant Depression 25mg PEX010 Centre for Addiction and Mental Health Mild Cognitive Impairment 25mg PEX010 Centre for Addiction and Mental Health Existential Crisis 1mg PEX010 Ottawa Research Hospital Depression 25mg PEX010 UCLA Cancer - related Anxiety Group Model 25mg PEX010 University of Washington Coma 25mg PEX010 University of Liège Bi - Polar Depression 25mg PEX010 University Health Network Chronic Pain 25mg PEX010 UCSF 18 LICENSING Filament has partnered with academic trials to obtain efficacy and safety data This provides data preview to clinical data in new indications which Filament may choose to develop further, offering pipeline expansion at minimal cost

Investor Presentation - October 2023 FILAMENT HEALTH Magdalena Biosciences Joint Venture 19 (20% ownership) ● Provide funding of US $1.0M on the achievement of defined milestones Value - creating joint venture leveraging Filament’s R&D expertise ● Formed US - based joint venture, Magdalena Biosciences, in January 2023 to develop novel, natural prescription medicines derived from plants for mental health conditions including attention - deficit/hyperactivity disorder (ADHD) in partnership with: ○ Jaguar Health (Nasdaq:JAGX) , a commercial stage pharmaceutical company and marketer of crofelemer (oral botanical drug); and ○ One Small Planet , a Colorado - based vital capital group founded by Will Peterffy ● Initial focus on three new non - psychedelic botanical drug candidates has begun, with raw material samples in processing at Filament Ownership and Responsibilities: (40% ownership) ● Import and process controlled substances ● Develop manufacturing processes and IP to produce standardized, pharmaceutical - grade drug candidates (40% ownership) ● Provide access to plants in Jaguar’s library of 2 , 300 highly characterized medicinal plants ● Lead drug development and financing initiatives JOINT VENTURE

Investor Presentation - October 2023 FILAMENT HEALTH Vertically - Integrated Supply Chain ~3,500 ft 2 GMP - compliant manufacturing, research, and development facility on British Columbia Institute of Technology campus Propagation, extraction, production, distribution, and sale of all natural psychedelic compounds Ongoing propagation and cultivation research program to identify best strains and genetics. 20+ varieties analyzed Multiple supply and licensing agreements for drug candidates and IP In - house manufacturing allows for rapid product and IP development and enables timely fulfillment of partner requests. Current production capacity is 2,500 doses of psilocybin per month 1 20 1. Management estimates

Investor Presentation - October 2023 FILAMENT HEALTH Filament Management Team Deep experience in botanical extraction, intellectual property, biotech, pharma, commercialization, and capital markets Benjamin Lightburn CEO, Director Co - Founder B.Sc (Physics), MBA Proven entrepreneur and leader specializing in the research, development and commercialization of novel extraction technologies Ryan Moss Chief Science Officer M. Analytical Chemistry Expert in the field of botanical extraction, purification, standardization Lisa Ranken Chief Operating Officer P.Eng, M.Eng Operational and leadership expertise in rapidly growing industries Beatriz Ramos Quality Director B.Sc. Quality management, regulatory compliance, and attaining third - party certification 21 Warren Duncan CFO CPA, B.Comm Experienced in audit, accounting, capital markets, M&A and equity financing Jeff Fellows Head of Regulatory B.Sc. 30 years of drug development experience leading regulatory development efforts from pre - IND to post - approval Taran Grey Director of IP BA Extensive patent and trademark portfolio experience in healthcare, technology and other diversified industries Anna Cordon Director of Communications BA experience leading 12+ years of marketing and communications for global organizations Andry Tjahyana VP Business Dev BBA +25 years in B2B business development. Former senior executive of several pharmaceutical and natural product organizations Global Experts in Botanical Extraction and Commercialization • Scaled Mazza Innovation from pre - seed to $26M sale to Sensient Technologies (NYSE:SXT) in 2018 • Developed and commercialized patent - protected, botanical extraction technology at commercial - scale ~3,500 sq. ft. GMP facility Josh Woolley Advisor B.Sc., Ph.D, M.D. Associate Professor at UCSF; PI and Director of UCSF’s BAND Lab; Director of the TrPR Program at UCSF Jeff Chilton Advisor B.Sc. Founder of Nammex, specialized in development and manufacture of functional mushroom extracts. Co - author of the acclaimed book, The Mushroom Cultivator TEAM

Investor Presentation - October 2023 FILAMENT HEALTH Filament Board of Directors Jon Conlin Director Partner at Fasken Corporate and commercial lawyer specializing in companies in the technology and health sciences sectors including venture capitalists and start - ups Maureen O’Connell Director, Audit Committee Chair Certified Public Accountant Previously Audit Committee Chair of Sucampo Pharma (Nasdaq: SCMP) until its sale in 2018 Former CFO of Scholastic Board Member of Harte Hanks, Beazer Homes Chris Wagner Director Over 25 years of experience in the life sciences industry, most recently as CEO and Director of both private and public companies Led Prozac and Zyprexa teams at Eli Lilly Founder and VP at Aspreva Pharmaceuticals 22 Benjamin Lightburn Chairman, CEO, Co - Founder Proven entrepreneur and leader specializing in the research, development and commercialization of novel extraction technologies Kostia Adamsky Director COO at Negev Capital. Career - long track record in pharmaceutical R&D Co - Founder and Director of Celleska Pty, Australian Cell & Gene Therapy Incubator Former CEO and VP Operations at Regenera Pharma LTD and Director and Co - CEO at Targia Pharmaceuticals. Dr. Adamsky holds a Ph.D from Weizmann Institute of Science, Israel BOARD

Investor Presentation - October 2023 FILAMENT HEALTH 23 Overview of the Jupiter Acquisition Corporation Team Jupiter Overview Jupiter is a special purpose acquisition company (“SPAC”) created to enter into a business combination with a company where the management team can make a transformative impact utilizing their extensive operational, financial, and M&A experience. Jupiter raised approximately $150 million in its IPO in August 2021 James N. Hauslein Chairman, CEO, and CFO B.S., MBA Over 35 years of private equity investing and public and private company operating experience Experience: President of Hauslein & Company, Inc., Chairman & CEO of Big Time, Chairman & CEO of Sunglass Hut, Partner at Kidd, Kamm & Company, CEO of Atlas Acquisition Holdings Corp., Director of GLG Partners James N. Clarke Vice Chairman M.S. Over 25 years of entrepreneurship, operating and investing experience and is the CEO of Clarke Capital Partners Experience: Founder & CEO of Clarke Capital, Founder, Chairman & CEO of CLEARLINK, Chairman of Brandless, Chairman of PetIQ Gaurav Burman President, Director B.A. Over 25 years of private equity and operational experience and currently manages Burman Family Holdings Experience: Director at Dabur International Ltd., Manager at Burman Family Holdings, President of Atlas Acquisition Holdings Corp., Director of: DMI Finance Pvt. Ltd., Experian India, Healthcare at Home India, Burman Hospitality and M3 India Jonathan Leong Executive Vice President B.A. Over 20 years of Investment Banking, financial, M&A, and capital markets experience Experience: Managing Director at Nomura, Managing Director at Jefferies, Principal at Bank of America Merrill Lynch

Investor Presentation - October 2023 FILAMENT HEALTH $27 $68 $117 $216 $343 $547 Source: Filament Management, S&P CapitalIQ, Company Filings; Market data as of 9/28/2023 1. Represents the market capitalizations and enterprise values as of 9/28/2023 2. The valuations listed on this slide reflect valuations of certain companies operating in a similar field as Filament. Please note that such valuations are for informational purposes only and do not purport to reflect the real, assumed or potential valuation of Filament or the combined company following the proposed business combination. The valuations should not be relied upon in making an investment decision with respect to the potential purchase of Filament’s or the combined company’s securities and all individuals should refer to the disclaimers and the summary of risk factors related to these valuations on slides 2 and 26 and contained in the F - 4 filing ● Botanically - derived psilocybin, imparting compelling competitive advantages, and approved for Phase 2 trial by US FDA, Health Canada, EMA and MHRA* ● Proprietary extraction and drug development platform for naturally - derived medicines imparting near - term revenue generating opportunities and growth through internal drug development and out - licensing ● Further catalysts to enable potential for significant share price appreciation Current Market Capitalizations of Publicly Traded Psychedelic Companies (USD $M) 1,2 24 Selected Clinical Stage Psychedelic Companies (1)(2) * EMA: European Medicines Agency; MHRA: Medicines and Healthcare Products Regulatory Agency

Investor Presentation - October 2023 FILAMENT HEALTH 25 Selected Clinical Stage Psychedelic Companies (1)(2)(3) NCE = New Chemical Entity Source: Filament Management, S&P CapitalIQ, Company Filings; Market data as of 9/28/2023 1. Represents the market capitalizations and enterprise values as of 9/28/2023 2. The valuations listed on this slide reflect valuations of certain companies operating in a similar field as Filament. Please note that such valuations are for informational purposes only and do not purport to reflect the real, assumed or potential valuation of Filament or the combined company following the proposed business combination. The valuations should not be relied upon in making an investment decision with respect to the potential purchase of Filament’s or the combined company’s securities and all individuals should refer to the disclaimers and the summary of risk factors related to these valuations on slides 2 and 26 and contained in the F - 4 filing 3. Excludes the impact of the bridge financing to Filament’s enterprise value. References to "bridge financing" refer to the non - brokered private placement by Filament of 27,777,773 units, each consisting of one Filament common share and one warrant, for gross proceeds of approximately C$2,500,000, which was completed on July 24, 2023, and assume for purposes of this presentation no further private placements by Filament prior to the consummation of the proposed business combination

Investor Presentation - October 2023 FILAMENT HEALTH The risks listed below are certain of the general risks related to the business of Filament Corp. ("Filament"). This list is not exhaustive and has been prepared solely for the purpose of inclusion in this presentation and not for any other purpose. These risks are based on certain assumptions made by Filament which may later prove to be incorrect or incomplete; see the disclaimers included on slide 2 of this presentation, particularly "Forward - Looking Statements." Risks relating to the business of Filament and the potential business combination described in this presentation, and the other parties thereto, will be disclosed in future documents filed or furnished with the U.S. Securities and Exchange Commission (the "SEC"). The risks presented in such filings will be consistent with those that would be required for a public company in its SEC filings and may differ significantly from, and be more extensive than, those presented below. • Filament is a relatively new company with a history of losses, and it expects to incur significant expenses for the foreseeable future as a result of long - term research and development and operations. As a result, there is no assurance that Filament will ever be able to achieve or sustain profitability. • Filament’s business model has yet to be tested, and any failure to realize its strategic plans would have an adverse effect on its business. Any investment in Filament is therefore highly speculative and could result in the loss of the entire amount of that investment. • Filament’s product candidates are at early stages of development, and Filament may not generate revenue for several years, if at all, from these products. • Filament currently has limited licensing revenue and will require additional financing in the future to fund its future operations. The failure to obtain necessary funding when needed on acceptable terms, or at all, could force Filament to delay, limit, reduce, or terminate its manufacturing and commercialization efforts or other operations. • Raising necessary additional capital may decrease the value of Filament’s common shares, dilute shareholders’ voting power, restrict its operations, require Filament to relinquish certain rights, and/or reduce Filament’s earnings per share. • Filament may not be successful in developing or commercializing its products, or may not be able to do so at acceptable costs. • Psychedelic - inspired drugs are new in North America, and the psychedelic - inspired medicines industry and markets may not continue to exist or to develop as anticipated. Filament ultimately may be unable to succeed as anticipated in this industry. • Filament’s success will be dependent on demand for of psychedelic - inspired medicines in general and Filament’s brand in particular, which may not materialize. • There is a lack of information available concerning the potential market size for psychedelics in North America as well as about comparable companies and their business models. • Filament faces competition from other biotechnology and pharmaceutical companies, some of which may have longer operating histories and more financial resources and manufacturing and marketing expertise than Filament, and Filament’s business may fail if it cannot compete effectively or if competitors commercialize psychedelic - based products before Filament does. • Psychedelic - inspired drugs are highly regulated at the federal and provincial level in Canada and at the federal and state level in the United States and require regulatory approval before they can be commercialized. Regulatory approval processes are lengthy, expensive and inherently unpredictable, and Filament’s product candidates may never receive the necessary regulatory approval. • Filament’s business plan depends on the occurrence of regulatory changes that may benefit psychedelic - inspired medicines and on determinations by Canadian and U.S. regulators that are favorable to psychedelic - inspired medicines, and there can be no assurance that such changes or determinations will occur. • Operating in a highly regulated business requires significant resources, and Filament may not have the necessary resources or be able to obtain them. • Clinical trials of Filament’s product candidates may fail to demonstrate substantial evidence of safety and efficacy to the satisfaction of regulatory authorities. If that were to happen, Filament would incur additional costs or experience delays in completing, or ultimately may be unable to complete, the development and commercialization of its product candidates. • If Filament fails to meet its milestones or experiences delays in clinical testing, including as a result difficulties in enrolling patients, it will be delayed in commercializing its product candidates, and its business may be substantially harmed. • Filament relies on, and will continue to rely on, third parties to plan, conduct and monitor its preclinical studies and clinical trials. Any failure of such third parties to fulfill their obligations with respect to preclinical studies and clinical trials could cause substantial harm to Filament’s business. • Filament’s product candidates may be subject to controlled substance laws and regulations in the jurisdictions in which the product will be marketed, and Filament’s business will be subject to extensive and complex governmental regulation. Failure to comply with these laws and regulations or the cost of compliance with these laws and regulations may harm Filament’s business. • Psilocybin and psilocin are listed as Schedule I controlled substances under the Controlled Substances Act in the United States, they are currently listed as Schedule III drugs under the Controlled Drugs and Substances Act (Canada) and they are subject to similar controlled substance legislation in other countries. Filament must comply with applicable laws and regulations at the federal, state, and provincial levels, and compliance may be expensive. • Any compliance failure could lead to federal, state or provincial government enforcement actions, including civil or criminal penalties, private litigation, and adverse publicity. • The laws and regulations that are generally applicable to psychedelic - inspired medicines, or to research involving psilocybin or psilocin, in Canada or the United States may change in ways that have a negative impact on Filament’s product candidates and business. • Filament may not be successful in achieving market acceptance of its products by healthcare professionals, patients and/or third - party payors. • Adverse publicity or a negative public perception about psychedelic - inspired medicines, including as a result of adverse results of future clinical research, may harm Filament’s business. • Filament manufactures psychedelic - inspired products in - house. If Filament’s products are subject to contamination, quality control, cost or delivery issues, its business operations and reputation could suffer significant harm. • Filament faces the risk of product liability claims, whether or not meritorious, and product recalls, either of which could result in expensive and time - consuming litigation, payment of substantial damages and/or an increase in Filament’s insurance rates. • Filament may be unable adequately to protect its brand, its patents, and its other intellectual property rights. • If Filament is unable to adequately protect and enforce its intellectual property, Filament’s competitors may take advantage of its development efforts or acquired technology and compromise its prospects of marketing and selling its key product candidates. • Filament’s reliance on third parties to conduct preclinical studies and clinical trials requires Filament to share its trade secrets, which increases the possibility that a competitor will discover them and use them to Filament’s detriment. • Litigation regarding patents, patent applications, and other intellectual property rights may be expensive and time - consuming and may cause delays in the development and manufacturing of Filament’s key product candidates. • Filament is exposed to the financial risk related to the fluctuation of foreign exchange rates and the degrees of volatility of those rates. • There is no assurance an active or liquid market for Filament’s common shares will be developed or sustained. As a result of these and other risks, a shareholder may be unable to resell their common shares of Filament at or above the price paid for such common shares, or at all. Risk Factors 26