As filed with the Securities and Exchange Commission

on December 22, 2023

Registration No. 333-258887

Registration No. 333-263508

Registration No. 333-270243

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

POST-EFFECTIVE AMENDMENT NO. 1 TO

Form S-8 Registration No. 333-258887

Form S-8 Registration No. 333-263508

Form S-8 Registration No. 333-270243

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

LIVEVOX HOLDINGS, INC.

(Exact name of registrant as specified in its

charter)

| Delaware |

|

82-3447941 |

|

(State or other jurisdiction of

incorporation or organization) |

|

(I.R.S. Employer

Identification No.) |

655 Montgomery Street

Suite 1000

San Francisco, CA 94111

(Address, including zip code, of principal executive

offices)

LiveVox

Holdings, Inc. 2021 Equity Incentive Plan

LiveVox Value Creation Incentive Plan

LiveVox Option-Based Incentive Plan

(Full title of the plan)

John DiLullo

Chief Executive Officer

655 Montgomery Street

Suite 1000

San Francisco, CA 94111

Telephone: (415) 671-6000

(Name, address and telephone number, including

area code, of agent for service)

Indicate by check mark whether

the registrant is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging

growth company. See definition of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule 12b-2 of the Exchange Act.

| Large accelerated filer |

|

¨ |

|

Accelerated filer |

|

¨ |

| |

|

|

|

| Non-accelerated filer |

|

x |

|

Smaller reporting company |

|

x |

| |

|

|

|

| |

|

|

|

Emerging growth company |

|

x |

If an emerging growth company, indicate by check

mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting

standards provided pursuant to Section 13(a) of the Exchange Act. ☐

DEREGISTRATION OF UNSOLD SECURITIES

This Post-Effective Amendment

No. 1 (this “Post-Effective Amendment”) relates to the following Registration Statements (each a “Registration

Statement” and, collectively, the “Registration Statements”) of LiveVox Holdings, Inc., a Delaware corporation

(the “Company”):

· Registration Statement

No. 333-258887, registering an aggregate of 14,338,644 shares of the Company’s Class A Common Stock, par value $0.0001 per share

(the “Common Stock”), which included (i) 10,747,000 shares of Common Stock issuable pursuant to the LiveVox Holdings,

Inc. 2021 Equity Incentive Plan (the “2021 Plan”) and (ii) 3,591,644 shares of Common Stock issuable pursuant to the

LiveVox Value Creation Incentive Plan and the LiveVox Option-Based Incentive Plan, filed with the Securities and Exchange Commission (the

“SEC”) on August 18, 2021;

· Registration Statement No. 333-263508,

registering 4,912,036 additional shares of Common Stock, issuable pursuant to the 2021 Plan, filed with the SEC on March 11, 2022; and

· Registration Statement No. 333-270243,

registering 5,013,643 additional shares of Common Stock, issuable pursuant to the 2021 Plan, filed with the SEC on March 2, 2023.

On October 3, 2023, the Company, entered into

an Agreement and Plan of Merger (the “Merger Agreement”) with inContact, Inc., a Delaware corporation (“Parent”),

Laser Bridge Merger Sub Inc., a Delaware corporation and a wholly owned subsidiary of Parent (“Merger Subsidiary”),

and NICE Ltd., a company organized under the laws of the State of Israel (“NICE”), providing that, among other things,

Merger Subsidiary will be merged with and into the Company, with the Company surviving as a wholly owned subsidiary of Parent (the “Merger”).

On December 22, 2023, the

Merger became effective as a result of the filing of a Certificate of Merger with the Secretary of State of the State of Delaware (the

“Effective Time”). As a result of the Merger and except as otherwise provided in the Merger Agreement:

| i. | each share of Common Stock that was issued and outstanding as of immediately prior to the Effective Time

(other than any shares of Common Stock held by the Company as treasury stock or owned by NICE, Parent, Merger Subsidiary or any other

subsidiaries thereof, the Earnout Shares and the Lock-Up Shares (each as defined below), or any shares of Common Stock as to which appraisal

rights had been properly exercised in accordance with Delaware law), was automatically cancelled, extinguished and converted into the

right to receive $3.74 (the “Merger Consideration”), without interest thereon and less any withholding taxes; |

| ii. | each award of time-based restricted stock units of the Company (each, a “Company RSU”)

that was (a) outstanding and vested as of immediately prior to, or the vesting of which accelerated at, the Effective Time or (b) outstanding

as of immediately prior to the Effective Time and held by a non-employee director of the Company or held by a former service provider

to the Company (whether vested or unvested) (each, a “Terminating Company RSU”), was, at the Effective Time, cancelled

and converted into the right to receive an amount in cash (without interest and subject to applicable withholding taxes) equal to the

product of (x) the aggregate number of shares of Common Stock subject to such Terminating Company RSU as of immediately prior to the Effective

Time and (y) the Merger Consideration; |

| iii. | each Company RSU that was outstanding as of immediately prior to the Effective Time that was not a Terminating

Company RSU (an “Unvested Company RSU”) was, at the Effective Time, cancelled and converted into an award under the

NICE share incentive plan of time-vesting restricted stock units with respect to a number of American Depositary Shares of NICE, each

representing one share of NICE (the “NICE ADSs”), equal to the product of (a) the number of shares of Common Stock

subject to such Unvested Company RSU and (b) the quotient obtained by dividing (x) the Merger Consideration by (y) the volume-weighted

average closing price of NICE ADSs reported on the Nasdaq for the ten full trading days ending on (and including) the trading day immediately

preceding the date on which the Effective Time occurs, rounded to the nearest whole share (each, a “Converted NICE RSU”).

Each Converted NICE RSU will remain subject to the same terms and conditions (including vesting, acceleration and payment schedule) as

applied to the corresponding Company RSU immediately prior to the Effective Time; and |

| iv. | each award of performance-based Company RSUs issued pursuant to the 2021 Plan that was outstanding as

of immediately prior to the Effective Time, was, at the Effective Time, cancelled in its entirety without the payment of any consideration

with respect thereto. |

“Earnout Shares”

means an aggregate of 5,000,000 shares of Common Stock and “Lock-Up Shares” means an aggregate of 2,543,750 shares

of Common Stock, in each case, held in escrow for the benefit of certain stockholders as disclosed on the Company’s Annual Report

on Form 10-K, filed with the SEC on March 2, 2023. All Earnout Shares and Lock-Up Shares were cancelled at the Effective Time, and no

payment was made with respect thereto.

As a result of the consummation

of the transactions in connection with the Merger, the Company has terminated all offerings of its securities pursuant to its existing

registration statements, including the Registration Statements. Effective upon filing hereof, the Company hereby removes from registration

all shares of Common Stock registered under the Registration Statements that remain unsold as of the Effective Time.

SIGNATURES

Pursuant to the requirements of the Securities

Act of 1933, as amended (the “Securities Act”), the registrant certifies that it has reasonable grounds to believe

that it meets all of the requirements for filing on Form S-8 and has duly caused this Post-Effective Amendment to the Registration Statements

described above to be signed on its behalf by the undersigned, thereunto duly authorized, in the City of San Francisco, State of California,

on December 22, 2023.

| |

LIVEVOX HOLDINGS, INC. |

| |

|

|

| |

By: |

/s/ Aaron Ross |

| |

Name: |

Aaron Ross |

| |

Title: |

Chief Legal Officer |

No other person is required to sign this Post-Effective Amendment in

reliance upon Rule 478 under the Securities Act.

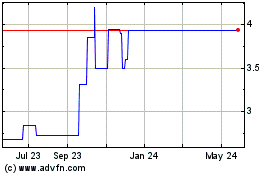

LiveVox (NASDAQ:LVOXU)

Historical Stock Chart

From Apr 2024 to May 2024

LiveVox (NASDAQ:LVOXU)

Historical Stock Chart

From May 2023 to May 2024