Miromatrix Medical Inc. (Nasdaq: MIRO) (the “Company”), a life

sciences company pioneering a novel technology for bioengineering

fully transplantable organs to help save and improve patients'

lives, today reported third quarter 2023 financial results.

Due to the Company’s pending proposed

transaction with United Therapeutics Corporation (Nasdaq: UTHR)

(“United Therapeutics”), the Company’s management has suspended

guidance for 2023 and will not hold a conference call to discuss

third quarter 2023 results.

Third Quarter 2023 Financial

Results

Unrestricted cash and investments totaled $16.1

million as of September 30, 2023, compared to $20.4 million as of

June 30, 2023.

Operating loss was $6.6 million and $21.4

million for the three- and nine-month periods ended September 30,

2023, respectively, as compared to $7.8 million and $23.2 million

for the three- and nine- month periods ended September 30, 2022,

respectively. The decrease in operating loss for comparable periods

was primarily attributable to reduced research and development

spending.

Net loss was $6.5 million and $20.5 million for

the three- and nine-month periods ended September 30, 2023,

respectively, as compared to $7.6 million and $23.0 million for the

three- and nine- month periods ended September 30, 2022,

respectively. The decrease in net loss for comparable periods was

primarily attributable to reduced research and development

spending, in addition to a one-time employee retention credit

totaling $0.5 million that was recorded as other income in the

first quarter of 2023.

Miromatrix Agrees to be Acquired by

United Therapeutics Corporation

On October 30, 2023, the Company announced that

it had entered into a definitive merger agreement with United

Therapeutics pursuant to which United Therapeutics would acquire

the Company. United Therapeutics has commenced a tender offer to

acquire all outstanding shares of the Company for a purchase price

of $3.25 per share in cash at closing (an aggregate of

approximately $91 million) and an additional $1.75 per share in

cash upon the achievement of a clinical development milestone

related to the Company’s development-stage, fully-implantable

manufactured kidney product known as mirokidney™ by December 31,

2025. The offer will expire one minute after 11:59 p.m., New York

City time, on December 11, 2023, unless the offer is otherwise

extended or earlier terminated. The Company’s board of directors

has unanimously recommended that the stockholders of the Company

accept the offer and tender their shares.

This transaction is expected to close in the

fourth quarter of 2023, subject to customary closing conditions,

including the tender of a majority of the outstanding shares of the

Company’s common stock.

About Miromatrix

Miromatrix Medical Inc. is a life sciences

company pioneering a novel technology for bioengineering fully

transplantable human organs to help save and improve patients'

lives. The Company has developed a proprietary perfusion technology

platform for bioengineering organs that it believes will

efficiently scale to address the shortage of available human

organs. The Company's initial development focus is on human livers

and kidneys. For more information, visit miromatrix.com.

ADDITIONAL INFORMATION REGARDING THE

PROPOSED TRANSACTION

This communication is neither an offer to

purchase nor a solicitation of an offer to sell any shares of the

common stock of the Company or any other securities. On November

13, 2023, a tender offer statement on Schedule TO, including an

offer to purchase, a letter of transmittal and related documents,

was filed with the Securities and Exchange Commission (the “SEC”),

by United Therapeutics Corporation (“United Therapeutics”) and

Morpheus Subsidiary Inc., and on November 13, 2023, a

Solicitation/Recommendation Statement on Schedule 14D-9 was filed

with the SEC by the Company. The offer to purchase shares of the

Company’s common stock (the “Offer”) is only made pursuant to the

offer to purchase, the letter of transmittal and related documents

filed as a part of the Schedule TO.

INVESTORS AND SECURITY HOLDERS ARE URGED

TO READ CAREFULLY BOTH THE TENDER OFFER MATERIALS (INCLUDING THE

OFFER TO PURCHASE, A RELATED LETTER OF TRANSMITTAL AND CERTAIN

OTHER TENDER OFFER DOCUMENTS) AND THE SOLICITATION/RECOMMENDATION

STATEMENT ON SCHEDULE 14D-9 REGARDING THE OFFER, AS THEY MAY BE

AMENDED FROM TIME TO TIME, BECAUSE THEY CONTAIN IMPORTANT

INFORMATION THAT INVESTORS AND SECURITY HOLDERS SHOULD CONSIDER

BEFORE MAKING ANY DECISION REGARDING TENDERING THEIR

SECURITIES.

Investors and security holders may obtain a free

copy of the Offer to Purchase, the related Letter of Transmittal,

certain other tender offer documents and the

Solicitation/Recommendation Statement and other documents filed

with the SEC at the website maintained by the SEC at www.sec.gov or

by directing such requests to Innisfree M&A Incorporated, the

Information Agent for the tender offer, at (877) 456-3463 (toll

free) or by email at info@innisfreema.com. In addition, United

Therapeutics and the Company file annual, quarterly and current

reports and other information with the SEC, which are available to

the public from commercial document-retrieval services and at the

SEC’s website at www.sec.gov. Copies of the documents filed with

the SEC by United Therapeutics may be obtained at no charge on

United Therapeutics’ internet website at ir.unither.com or by

contacting United Therapeutics at 1000 Spring Street, Silver

Spring, MD 20910 or (301) 608-9292. Copies of the documents filed

with the SEC by the Company may be obtained at no charge on the

Company’s internet website at miromatrix.com or by contacting the

Company at 6455 Flying Cloud Drive, Suite 107, Eden Prairie, MN

55344 or (952) 942-6000.

Cautionary Statement Regarding

Forward-Looking Statements

This press release contains forward-looking

statements. All statements other than statements of historical

facts are forward looking statements, including statements

regarding the expected closing of United Therapeutics’ acquisition

of the Company and the Company’s technology and its potential

benefits. In some cases, you can identify forward-looking

statements by terms such as "may," "will," "should," "expect,"

"plan," "anticipate," "could," "outlook," "guidance," "intend,"

"target," "project," "contemplate," "believe," "estimate,"

"predict," "potential," "continue," "remain,” or "on pace" or the

negative of these terms or other similar expressions, although not

all forward-looking statements contain these words. The

forward-looking statements in this press release are only

predictions and are based largely on our current business plans,

expectations, and projections about future events and financial

trends that we believe may affect our business, financial

condition, and results of operations. These forward-looking

statements speak only as of the date of this press release and are

subject to a number of known and unknown risks, uncertainties and

assumptions, including, but not limited to, our history of

significant losses, which we expect to continue; our limited

history operating as a commercial company; our expectations with

respect to the regulatory pathway of our product candidates, our

ability to obtain regulatory approvals for such product candidates,

and the anticipated effect of delays in obtaining any such

regulatory approvals; our expectations with respect to preclinical

and clinical trial plans for our product candidates, the results of

such activities and the safety and efficacy of our product

candidates; our ability to commercialize our product candidates;

our ability to compete successfully with larger competitors in our

highly competitive industry; our ability to achieve and maintain

adequate levels of coverage or reimbursement for any future

products we may seek to commercialize; our expectations regarding

our manufacturing capabilities; a pandemic, epidemic or outbreak of

an infectious disease in the U.S. or worldwide, including the

outbreak of the novel strain of coronavirus, COVID-19; product

liability claims; our ability to establish and maintain

intellectual property protection for our products, as well as our

ability to operate our business without infringing the intellectual

property rights of others; our ability to attract and retain senior

management and key scientific personnel; and other important

factors that could cause actual results, performance or

achievements to differ materially from those expected or projected.

For information identifying important factors that could cause

actual results to differ materially from those anticipated in the

forward-looking statements, please refer to the Risk Factors

section of the Company's Form 10-K filed with the U.S. Securities

and Exchange Commission and any additional risks presented in our

Quarterly Reports on Form 10-Q and our Current Reports on Form 8-K.

Except as expressly required by applicable securities law, the

Company disclaims any intention or obligation to update or revise

any forward-looking statements whether as a result of new

information, future events or otherwise.

MIROMATRIX

MEDICAL INC.Condensed Balance

Sheets

| |

|

|

|

|

|

|

| |

|

September 30, |

|

December 31, |

| |

|

2023 |

|

|

2022 |

|

| |

|

(unaudited) |

|

|

|

| Assets |

|

|

|

|

|

|

| Current assets: |

|

|

|

|

|

|

|

Cash and cash equivalents |

|

$ |

6,116,084 |

|

|

$ |

5,208,005 |

|

|

Restricted cash |

|

|

800,100 |

|

|

|

800,100 |

|

|

Short-term investments |

|

|

9,945,715 |

|

|

|

19,989,489 |

|

|

Employee retention credit receivable |

|

|

70,000 |

|

|

|

— |

|

|

Receivable from Reprise Biomedical, Inc. |

|

|

11,176 |

|

|

|

930,355 |

|

|

Interest receivable |

|

|

9,433 |

|

|

|

107,861 |

|

|

Prepaid expenses and other current assets |

|

|

239,922 |

|

|

|

274,952 |

|

|

Total current assets |

|

|

17,192,430 |

|

|

|

27,310,762 |

|

|

Deferred offering costs |

|

|

— |

|

|

|

232,899 |

|

|

Right of use asset |

|

|

1,517,956 |

|

|

|

1,673,575 |

|

|

Property and equipment, net |

|

|

4,710,763 |

|

|

|

5,545,694 |

|

|

Total assets |

|

$ |

23,421,149 |

|

|

$ |

34,762,930 |

|

|

|

|

|

|

|

|

|

| Liabilities and

Shareholders' Equity |

|

|

|

|

|

|

| Current liabilities: |

|

|

|

|

|

|

|

Current portion of deferred royalties |

|

$ |

862,609 |

|

|

$ |

979,167 |

|

|

Accounts payable |

|

|

1,048,364 |

|

|

|

1,584,929 |

|

|

Current portion of financing lease obligations |

|

|

17,281 |

|

|

|

44,157 |

|

|

Current portion of lease liability |

|

|

413,650 |

|

|

|

389,649 |

|

|

Accrued expenses |

|

|

2,624,031 |

|

|

|

1,948,376 |

|

|

Total current liabilities |

|

|

4,965,935 |

|

|

|

4,946,278 |

|

|

Deferred royalties, net |

|

|

— |

|

|

|

491,733 |

|

|

Long-term debt |

|

|

385,997 |

|

|

|

385,997 |

|

|

Financing lease obligations, net |

|

|

— |

|

|

|

11,689 |

|

|

Lease liability, net |

|

|

2,406,066 |

|

|

|

2,720,781 |

|

|

Accrued interest |

|

|

120,780 |

|

|

|

99,048 |

|

|

Total liabilities |

|

|

7,878,778 |

|

|

|

8,655,526 |

|

| Commitments and

contingencies |

|

|

|

|

|

|

| Shareholders’ equity: |

|

|

|

|

|

|

|

Common stock, par value $0.00001; 190,000,000 shares authorized;

27,419,228 issued and outstanding as of

September 30, 2023 and 20,944,109 issued and outstanding

as of December 31, 2022 |

|

|

274 |

|

|

|

209 |

|

|

Additional paid-in capital |

|

|

140,018,271 |

|

|

|

130,119,106 |

|

|

Accumulated deficit |

|

|

(124,476,174) |

|

|

|

(104,011,911) |

|

|

Total shareholders’ equity |

|

|

15,542,371 |

|

|

|

26,107,404 |

|

|

Total liabilities and shareholders’ equity |

|

$ |

23,421,149 |

|

|

$ |

34,762,930 |

|

MIROMATRIX

MEDICAL INC.Condensed Statements of

Operations(Unaudited)

| |

|

|

|

|

|

|

|

|

|

|

|

|

| |

|

Three Months Ended |

|

Nine Months Ended |

| |

|

September 30, |

|

September 30, |

| |

|

2023 |

|

|

2022 |

|

|

2023 |

|

|

2022 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

Licensing revenue |

|

$ |

11,176 |

|

|

$ |

12,395 |

|

|

$ |

27,674 |

|

|

$ |

23,115 |

|

| Cost of goods sold |

|

|

125,000 |

|

|

|

125,000 |

|

|

|

375,000 |

|

|

|

375,000 |

|

|

Gross loss |

|

|

(113,824) |

|

|

|

(112,605) |

|

|

|

(347,326) |

|

|

|

(351,885) |

|

| Operating expenses: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Research and development |

|

|

3,506,054 |

|

|

|

4,574,534 |

|

|

|

11,519,395 |

|

|

|

13,569,434 |

|

|

Regulatory and clinical |

|

|

455,313 |

|

|

|

381,903 |

|

|

|

1,259,077 |

|

|

|

1,156,535 |

|

|

Quality |

|

|

416,476 |

|

|

|

634,511 |

|

|

|

1,515,394 |

|

|

|

1,592,778 |

|

|

General and administration |

|

|

2,143,421 |

|

|

|

2,052,731 |

|

|

|

6,781,337 |

|

|

|

6,513,748 |

|

|

Total operating expenses |

|

|

6,521,264 |

|

|

|

7,643,679 |

|

|

|

21,075,203 |

|

|

|

22,832,495 |

|

|

Operating loss |

|

|

(6,635,088) |

|

|

|

(7,756,284) |

|

|

|

(21,422,529) |

|

|

|

(23,184,380) |

|

| Other income (expense) |

|

|

|

|

|

|

|

|

|

|

|

|

|

Interest income |

|

|

196,681 |

|

|

|

143,555 |

|

|

|

464,820 |

|

|

|

205,403 |

|

|

Interest expense |

|

|

(15,284) |

|

|

|

(15,325) |

|

|

|

(33,697) |

|

|

|

(35,015) |

|

|

Employee retention credit |

|

|

— |

|

|

|

— |

|

|

|

527,143 |

|

|

|

— |

|

|

Total other income |

|

|

181,397 |

|

|

|

128,230 |

|

|

|

958,266 |

|

|

|

170,388 |

|

|

Net loss |

|

$ |

(6,453,691) |

|

|

$ |

(7,628,054) |

|

|

$ |

(20,464,263) |

|

|

$ |

(23,013,992) |

|

|

Net loss per share, basic and diluted |

|

$ |

(0.24) |

|

|

$ |

(0.37) |

|

|

$ |

(0.80) |

|

|

$ |

(1.11) |

|

|

Weighted average shares used in computing net loss per share, basic

and diluted |

|

|

27,313,881 |

|

|

|

20,895,513 |

|

|

|

25,714,215 |

|

|

|

20,664,494 |

|

Investor Contact

Greg Chodaczek

347-620-7010

ir@miromatrix.com

Media Contact:

Christina Campbell

612-924-3793

press@miromatrix.com

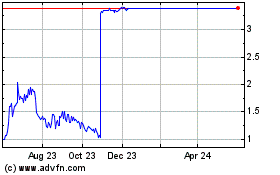

MiroMatrix Medical (NASDAQ:MIRO)

Historical Stock Chart

From Oct 2024 to Nov 2024

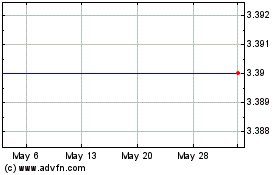

MiroMatrix Medical (NASDAQ:MIRO)

Historical Stock Chart

From Nov 2023 to Nov 2024