UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

Form 8-K

CURRENT REPORT

Pursuant

to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of Report (Date of earliest event reported): July 20, 2015

Marin Software Incorporated

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-35838 |

|

20-4647180 |

| (State or other jurisdiction

of incorporation) |

|

(Commission File Number) |

|

(IRS Employer

Identification No.) |

|

|

123 Mission Street, 25th Floor

San Francisco, California 94105 |

|

94105 |

| (Address of principal executive offices) |

|

(Zip Code) |

(415) 399-2580

(Registrant’s telephone number, including area code)

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the

following provisions:

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 5.02 |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers |

(b)

On July 20, 2015, Marin

Software Incorporated (the “Company”) announced the hiring of Catriona M. Fallon as Executive Vice President and Chief Financial Officer of the Company, effective July 27, 2015, and in such capacity, Ms. Fallon will serve as the

Company’s principal financial officer. Accordingly, effective July 27, 2015, Stephen E. Kim will cease to serve as interim Chief Financial Officer and Parveen Nandal will cease to serve as interim principal financial officer. In addition,

effective August 6, 2015, which is the day following the Company’s expected earnings call for the quarter ended June 30, 2015, Ms. Fallon shall serve as the Company’s principal accounting officer. Jugnu Bhatia, the

Company’s VP Corporate Controller and interim principal accounting officer, shall cease to serve as the interim principal accounting officer effective August 6, 2015.

(c)

On July 20, 2015, the Company

announced the hiring of Catriona M. Fallon, age 44, as Executive Vice President and Chief Financial Officer of the Company, effective July 27, 2015, reporting to the Company’s Chief Executive Officer, David A. Yovanno. In such capacity,

Ms. Fallon shall serve as the Company’s principal financial officer effective July 27, 2015, and shall serve as principal accounting officer effective August 6, 2015.

Prior to joining the Company, Ms. Fallon worked at Cognizant Technology Solutions Corporation, an information technology, consulting and

business process service provider, serving as Vice President of Finance and Chief of Staff to the Chief Financial Officer from December 2013 to July 2015. From February 2009 until September 2013, Ms. Fallon held several leadership positions at

Hewlett-Packard Company, an enterprise services and printing and personal services provider, including Vice President of Strategy and Financial Planning, Worldwide Marketing from September 2012 to September 2013, Director of Investor Relations from

July 2010 to September 2012, and Director of Strategy and Corporate Development from February 2009 to July 2010. Previously, from 2005 to 2009, Ms. Fallon was an equity analyst covering media and technology companies at Citigroup Investment

Research. Ms. Fallon’s professional experience also includes roles with Piper Jaffrey & Company, McKinsey & Company and Oracle Corporation. Ms. Fallon has an MBA from Harvard Business School and a BA in Economics

from UCLA.

On July 20, 2015, the Company issued a press release announcing Ms. Fallon’s employment as the Company’s

Executive Vice President and Chief Financial Officer. The press release is attached hereto as Exhibit 99.1.

In connection with

Ms. Fallon’s employment as the Company’s Executive Vice President and Chief Financial Officer, Ms. Fallon and the Company entered into an offer letter providing the terms of Ms. Fallon’s employment with the Company (the

“Offer Letter”). Pursuant to the Offer Letter, Ms. Fallon will be entitled to receive an annualized base salary of $325,000 and an annual target bonus of up to 50% of base salary per year based on 100% achievement of the

Company’s corporate financial metrics (the “Bonus Targets”), as established and determined by the Compensation Committee of the Board of Directors (the “Committee”) and individual goals determined by the Chief Executive

Officer. Ms. Fallon shall be eligible for such bonus compensation for fiscal year 2015, which shall be pro-rated for the portion of the fiscal year she is employed with the Company; provided, that for fiscal year 2015, Ms. Fallon is

guaranteed her pro-rated bonus based on achievement of at least 100% of the Bonus Target.

The Company will reimburse Ms. Fallon for

relocation costs she incurs in connection with her move from New Jersey to the San Francisco Bay Area, not to exceed $40,000 and based on receipts for the actual costs incurred within three (3) months of July 27, 2015.

Additionally, the Offer Letter provides that the Company will recommend to the Committee that Ms. Fallon be granted an option to purchase

275,000 shares of the Company’s common stock (the “Stock Option”), with an exercise price per share equal to the closing price per share of the Company’s common stock as of the date of the Committee’s approval of the Stock

Option. The vesting and other terms of the Stock Option will be set by the Committee. The Stock Option will be governed by the terms and conditions of the applicable Stock Option grant agreement and the Company’s 2013 Equity Incentive Plan.

Pursuant to the Offer Letter, Ms. Fallon also will enter into the Company’s standard

form of Indemnification Agreement and standard form of Severance and Change of Control Agreement (the “Severance and Change of Control Agreement”) applicable to all of the Company’s executive officers. The Severance and Change of

Control Agreement will terminate upon the earlier of June 30, 2016 or the date Ms. Fallon’s employment is terminated for a reason other than a “qualifying termination.” A “qualifying termination” is defined as a

separation occurring within three months preceding or twelve months following a Change in Control of the Company (as defined in the Severance and Change of Control Agreement) (i) for any reason other than Cause (as defined in the Severance and

Change of Control Agreement) or (ii) resulting from a voluntary resignation for Good Reason (as defined in the Severance and Change of Control Agreement). The Severance and Change of Control Agreement will renew automatically for an additional

three year term unless the Company provides notice of non-renewal at least 90 days prior to the expiration date. In the event of a qualifying termination in connection with a Change in Control, Ms. Fallon would be entitled to receive severance

benefits equal to six months of her then current annual base salary and the monthly benefits premium under COBRA for nine months. In addition, any shares of the Company’s common stock underlying all unvested equity awards held by

Ms. Fallon immediately prior to such termination will become vested and exercisable in full.

Ms. Fallon’s Offer Letter and

the form of Severance and Change in Control Agreement will be filed as exhibits to the Company’s Form 10-Q for the quarter ended June 30, 2015.

(e)

The information set

forth in Item 5.02(c) above is hereby incorporated by reference into this Item 5.02(e).

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

|

|

|

| Exhibit No. |

|

|

|

|

| 99.1 |

|

Press release of Marin Software Incorporated announcing the appointment of Catriona M. Fallon as Executive Vice President and Chief Financial Officer, dated July 20, 2015. |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

| |

|

|

|

|

|

Marin Software Incorporated |

|

|

|

|

| Date: July 20, 2015 |

|

|

|

By: |

|

/s/ Stephen Kim |

|

|

|

|

|

|

Stephen E. Kim Executive Vice President,

General Counsel and Corporate Secretary |

EXHIBIT INDEX

|

|

|

| Exhibit No. |

|

|

|

|

| 99.1 |

|

Press release of Marin Software Incorporated announcing the appointment of Catriona M. Fallon as Executive Vice President and Chief Financial Officer, dated July 20, 2015. |

Exhibit 99.1

Marin Software Appoints Catriona Fallon Executive Vice President and Chief Financial Officer

San Francisco, CA – July 20, 2015 – Marin Software (NYSE:MRIN), provider of a leading cross-channel performance advertising cloud for

advertisers and agencies, today announced that Catriona Fallon has been appointed Executive Vice President and Chief Financial Officer effective July 27. Ms. Fallon joins Marin Software from Cognizant Technology Solutions Corporation, a

global, publicly-traded company, where she served as Vice President and Chief of Staff for the CFO.

David Yovanno, CEO of Marin Software, said, “We

are thrilled to welcome Catriona to the Marin Software team. She is a well-rounded business executive who has proven financial leadership skills and strategic planning and execution capabilities. Her experience in driving performance and helping

much larger companies scale will be invaluable as we look to capitalize on Marin’s strong market position and take our company to the next level in the years ahead.”

Ms. Fallon said, “I’m excited to join the team at Marin Software and to help the company execute on its vision for cross-channel advertising.

The company is a leader and innovator in marketing and advertising technology, helping advertisers to automate and scale their global marketing campaigns to drive their revenue. I look forward to helping Marin realize its full potential, and to

improving shareholder value.”

Prior to Cognizant, Ms. Fallon spent over four years at Hewlett-Packard in key strategic financial roles, most

recently as Vice President Strategy and Financial Planning, Worldwide Marketing with responsibility for managing the financial planning and budgeting process for the global marketing group. While at HP, she also served in leadership positions in

Finance, Investor Relations and Strategy and Corporate Development. Previously, Ms. Fallon was a research analyst at Citigroup Investment Research and Piper Jaffray & Company, where she covered enterprise software, media, advertising

and publishing companies. In addition, Ms. Fallon previously served as a Consultant at McKinsey & Company and Senior Marketing Manager at Oracle Corporation. She received her bachelor’s degree from UCLA and her MBA from Harvard

Business School.

About Marin Software

Marin

Software Incorporated (NYSE:MRIN) provides a leading cross-channel performance advertising cloud for advertisers and agencies to measure, manage and optimize more than $7.2 billion as of December 31, 2014 in annualized ad spend across the web

and mobile devices. Offering an integrated SaaS platform for search, display and social advertising, Marin Software helps digital marketers improve financial performance, save time, and make better decisions. Advertisers use Marin Software to

create, target, and convert precise audiences based on recent buying signals from users’ search, social and display interactions. Headquartered in San Francisco with offices in nine countries, Marin’s technology automates advertising with

the largest publishers around the globe. For more information about Marin’s products, please visit: http://www.marinsoftware.com/solutions/overview.

Forward-Looking Statements

This press release contains forward-looking statements including, among other things, statements regarding Marin Software’s market position, benefits of

the company’s products and prospects for increasing shareholder value. These forward-looking statements are subject to the safe harbor provisions created by the Private Securities Litigation Reform Act of 1995. Actual results could differ

materially from those projected in the forward-looking statements as a result of certain risk factors, including but not limited to our ability to grow sales to new and existing customers; our ability to expand our sales and marketing capabilities;

our ability to retain and attract qualified management and technical personnel; competitive factors, including but not limited to pricing pressures, entry of new competitors and new applications; quarterly fluctuations in our operating results due

to a number of factors; delays, reductions or slower growth in the amount spent on online and mobile advertising and the development of the market for cloud-based software; adverse changes in our relationships with and access to publishers and

advertising agencies; level of usage and advertising spend managed on our platform; our ability to expand sales of our solutions in channels other than search advertising; any slow-down in the search advertising market generally; shift in customer

digital advertising budgets from search to segments in which we are not as deeply penetrated; the development of the market for digital advertising or revenue acquisition management; acceptance and continued usage of our platform and services by

customers and our ability to provide high-quality technical support to our customers; material defects in our platform, service interruptions at our single third-party data center or breaches in our security measures; our ability to develop

enhancements to our platform; our ability to protect our intellectual property; our ability to manage risks associated with international operations; the impact of fluctuations in currency exchange rates, particularly an increase in the value of the

dollar; near term changes in sales of our software services or spend under management may not be immediately reflected in our results due to our subscription business model; adverse changes in general economic or market conditions; and the ability

to acquire and integrate other businesses, including our acquisitions of Perfect Audience and SocialMoov. These forward looking statements are based on current expectations and are subject to uncertainties and changes in condition, significance,

value and effect as well as other risks detailed in documents filed with the Securities and Exchange Commission, including our most recent report on Form 10-K, recent reports on Form 10-Q and current reports on Form 8-K which we may file from time

to time, all of which are available free of charge at the SEC’s website at www.sec.gov. Any of these risks could cause actual results to differ materially from expectations set forth in the forward-looking statements.

Investor Relations Contact:

Denise Garcia

ICR for Marin Software

415-762-0327

ir@marinsoftware.com

Media Contact:

Whitney Sunseri

Corporate Communications, Marin Software

415-857-7663

press@marinsoftware.com

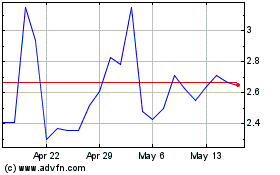

Marin Software (NASDAQ:MRIN)

Historical Stock Chart

From Jun 2024 to Jul 2024

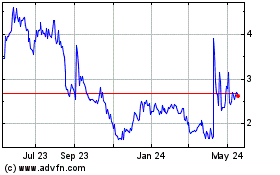

Marin Software (NASDAQ:MRIN)

Historical Stock Chart

From Jul 2023 to Jul 2024