|

PROSPECTUS

|

|

Filed Pursuant to Rule 424(b)(3)

Registration No. 333-273375

|

3,000,000 Ordinary Shares

3,000,000 Ordinary Warrants to purchase up to 3,000,000 Ordinary Shares

This prospectus relates to the resale, from time to time, by the selling shareholder identified in this prospectus under the section “Selling Shareholder,” (the “selling shareholder”) of NeuroSense Therapeutics Ltd. (“NeuroSense,” “we,” “us” or the “Company”) of (i) up to 3,000,000 of our ordinary shares, no par value per share (the “Ordinary Shares”), issuable upon exercise of warrants to purchase Ordinary Shares at an exercise price of $1.50 per Ordinary Share, acquired by the selling shareholder under the Purchase Agreement (defined below) (the “Ordinary Warrants”) and (ii) 3,000,000 Ordinary Warrants. The selling shareholder acquired the Ordinary Warrants from us pursuant to a securities purchase agreement (the “Purchase Agreement”), dated June 22, 2023, by and between the Company and the selling shareholder. The Ordinary Warrants and the underlying Ordinary Shares issuable upon the exercise of the Ordinary Warrants were offered and sold pursuant to the exemptions provided in Section 4(a)(2) under the Securities Act of 1933, as amended (the “Securities Act”), and Regulation D promulgated thereunder.

We are registering the resale of the Ordinary Shares issuable upon the exercise of the Ordinary Warrants and Ordinary Warrants covered by this prospectus as required by the Purchase Agreement. The selling shareholder will receive all of the proceeds from any sales of the Ordinary Shares and Ordinary Warrants offered hereby. We will not receive any of the proceeds, but we will incur expenses in connection with such offering. To the extent the Ordinary Warrants are exercised for cash, if at all, we will receive the exercise price of the Ordinary Warrants.

The selling shareholder may sell the Ordinary Shares and Ordinary Warrants covered by this prospectus through public or private transactions at market prices prevailing at the time of sale, at negotiated prices or such other prices as the selling shareholder may determine. The timing and amount of any sale are within the sole discretion of the selling shareholder. Our registration of the Ordinary Shares and Ordinary Warrants covered by this prospectus does not mean that the selling shareholder will offer or sell any of the Ordinary Shares or Ordinary Warrants. For further information regarding the possible methods by which the shares may be distributed, see “Plan of Distribution.”

We are an “emerging growth company” and a “foreign private issuer”, each as defined under federal securities laws, and, as such, have elected to comply with certain reduced public company reporting requirements for this prospectus and future filings. See “Prospectus Summary — Implications of Being an Emerging Growth Company” and “Prospectus Summary — Implications of Being a Foreign Private Issuer” for additional information.

The Company’s Ordinary Shares and warrants to purchase Ordinary Shares are listed on The Nasdaq Capital Market (“Nasdaq”) under the symbols “NRSN” and “NRSNW.” On August 28, 2023, the closing price for the Ordinary Shares was $0.90 and the closing price for the warrants to purchase Ordinary Shares was $0.135.

Investing in our securities is highly speculative and involves a high degree of risk. See “Risk Factors” beginning on page 6 to read about factors you should consider before buying the Ordinary Shares or the Ordinary Warrants.

Neither the Securities and Exchange Commission nor any other regulatory body has approved or disapproved of these securities or passed upon the accuracy or adequacy of the disclosures in this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus is September 5, 2023

Table of Contents

i

Table of Contents

ABOUT THIS PROSPECTUS

This prospectus is part of the registration statement on Form F-1 that we filed with the Securities and Exchange Commission (the “SEC”) for the offering of the Ordinary Shares and Ordinary Warrants by the selling shareholder.

You should not assume that the information contained in, or incorporated by reference into, this prospectus is accurate on any date subsequent to the date set forth on the front cover of this prospectus, even though this prospectus is delivered or Ordinary Shares and Ordinary Warrants covered by this prospectus are sold or otherwise disposed of on a later date. It is important for you to read and consider all information contained in, or incorporated by reference into, this prospectus in making your investment decision. You should also read and consider the information in the documents to which we have referred you under the caption “Where You Can Find Additional Information” in this prospectus.

Neither we nor the selling shareholder has authorized anyone to provide any information or to make any representation other than those contained in, or incorporated by reference into, this prospectus. You must not rely upon any information or representation not contained in, or incorporated by reference into, this prospectus. This prospectus does not constitute an offer to sell or the solicitation of an offer to buy any of our securities other than the securities covered hereby, nor does this prospectus constitute an offer to sell or the solicitation of an offer to buy any securities of the Company in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction.

This prospectus, including the information incorporated by reference herein, contains forward-looking statements that are subject to a number of risks and uncertainties, many of which are beyond our control. See “Risk Factors” and “Cautionary Note Regarding Forward-Looking Statements.”

TRADEMARKS, SERVICE MARKS AND TRADENAMES

The NeuroSense Therapeutics logo and other trademarks and service marks of NeuroSense Therapeutics Ltd. appearing in this prospectus or the information incorporated by reference herein are the property of the Company. Solely for convenience, some of the trademarks, service marks, logos and trade names referred to in this prospectus are presented without the ® and ™ symbols, but such references are not intended to indicate, in any way, that we will not assert, to the fullest extent under applicable law, our rights to these trademarks, service marks and trade names. This prospectus, including the information incorporated by reference herein, contains additional trademarks, service marks and trade names of others. All trademarks, service marks and trade names appearing in this prospectus or the information incorporated by reference herein are, to our knowledge, the property of their respective owners. We do not intend our use or display of other companies’ trademarks, service marks, copyrights or trade names to imply a relationship with, or endorsement or sponsorship of us by, any other companies.

MARKET AND INDUSTRY DATA

This prospectus, including the information incorporated by reference herein, contains industry, market and competitive position data that are based on industry publications and studies conducted by third parties as well as our own internal estimates and research. These industry publications and third-party studies generally state that the information that they contain has been obtained from sources believed to be reliable, although they do not guarantee the accuracy or completeness of such information. While we believe that each of these publications and third-party studies is reliable, we have not independently verified the market and industry data obtained from these third-party sources. Forecasts and other forward-looking information obtained from these sources are subject to the same qualifications and uncertainties as the other forward-looking statements included in, or incorporated by reference into, this prospectus. While we believe our internal research is reliable and the definition of our market and industry are appropriate, neither such research nor these definitions have been verified by any independent source.

ii

Table of Contents

CAUTIONARY NOTE REGARDING FORWARD-LOOKING STATEMENTS

This prospectus and certain information incorporated by reference herein contain forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the U.S. Securities Exchange Act of 1934, as amended (the “Exchange Act”), and other securities laws. Many of the forward-looking statements contained in, or incorporated by reference into, this prospectus can be identified by the use of forward-looking words such as “anticipate,” “believe,” “could,” “estimate,” “expect,” “intend,” “may,” “might,” “plan,” “potential,” “should,” “target,” “would” and other similar expressions that are predictions of or indicate future events and future trends, although not all forward-looking statements contain these identifying words.

Forward-looking statements are based on our management’s beliefs and assumptions and on information currently available to our management. Such statements are subject to substantial risks and uncertainties, and actual results may differ materially from those expressed or implied in the forward-looking statements due to a variety of factors, including, but not limited to, those identified under the section titled “Risk Factors” in this prospectus or the documents incorporated herein. These risks and uncertainties include factors relating to:

• the going concern reference in our financial statements and our need for substantial additional financing to achieve our goals;

• our limited operating history and history of incurring significant losses and negative cash flows since our inception, which we anticipate will continue for the foreseeable future;

• our dependence on the success of our lead product candidate, PrimeC, including our obtaining of regulatory approval to market PrimeC in the United States;

• our limited experience in conducting clinical trials and reliance on clinical research organizations and others to conduct them;

• our ability to advance our preclinical product candidates into clinical development and through regulatory approval;

• the results of our clinical trials, which may fail to adequately demonstrate the safety and efficacy of our product candidates;

• our ability to achieve the broad degree of physician adoption and use and market acceptance necessary for commercial success;

• our reliance on third parties in marketing, producing or distributing products and research materials for certain raw materials, compounds and components necessary to produce PrimeC for clinical trials and to support commercial scale production of PrimeC, if approved;

• our receipt of regulatory clarity and approvals for our therapeutic candidates and the timing of other regulatory filings and approvals;

• estimates of our expenses, revenues, capital requirements and our needs for additional financing;

• our efforts to obtain, protect or enforce our patents and other intellectual property rights related to our product candidates and technologies; and

• the impact of the public health, political and security situation in Israel, the U.S. and other countries in which we may obtain approvals for our products or our business.

The preceding list is not intended to be an exhaustive list of all of our risks and uncertainties. As a result of these factors, we cannot assure you that the forward-looking statements contained in, or incorporated by reference into, this prospectus will prove to be accurate. Furthermore, if our forward-looking statements prove to be inaccurate, the inaccuracy may be material. In light of the significant uncertainties in these forward-looking statements, you should not regard these statements as a representation or warranty by us or any other person that we will achieve our objectives and plans in any specified time frame, or at all.

iii

Table of Contents

In addition, statements that “we believe” and similar statements reflect our beliefs and opinions on the relevant subject. These statements are based upon information available to us as of the date of this prospectus or any document incorporated herein or therein, and while we believe such information forms a reasonable basis for such statements, such information may be limited or incomplete, and our statements should not be read to indicate that we have conducted an exhaustive inquiry into, or review of, all relevant information.

iv

Table of Contents

PROSPECTUS SUMMARY

This summary highlights selected information about us and the Ordinary Shares and the Ordinary Warrant being offered. It may not contain all of the information that may be important to you. Before investing in the Ordinary Shares and Ordinary Warrants, you should read this entire prospectus and other information incorporated by reference from our other filings with the SEC carefully for a more complete understanding of our business and this offering, including our consolidated financial statements and the section entitled “Risk Factors” included or incorporated by reference in this prospectus.

Overview

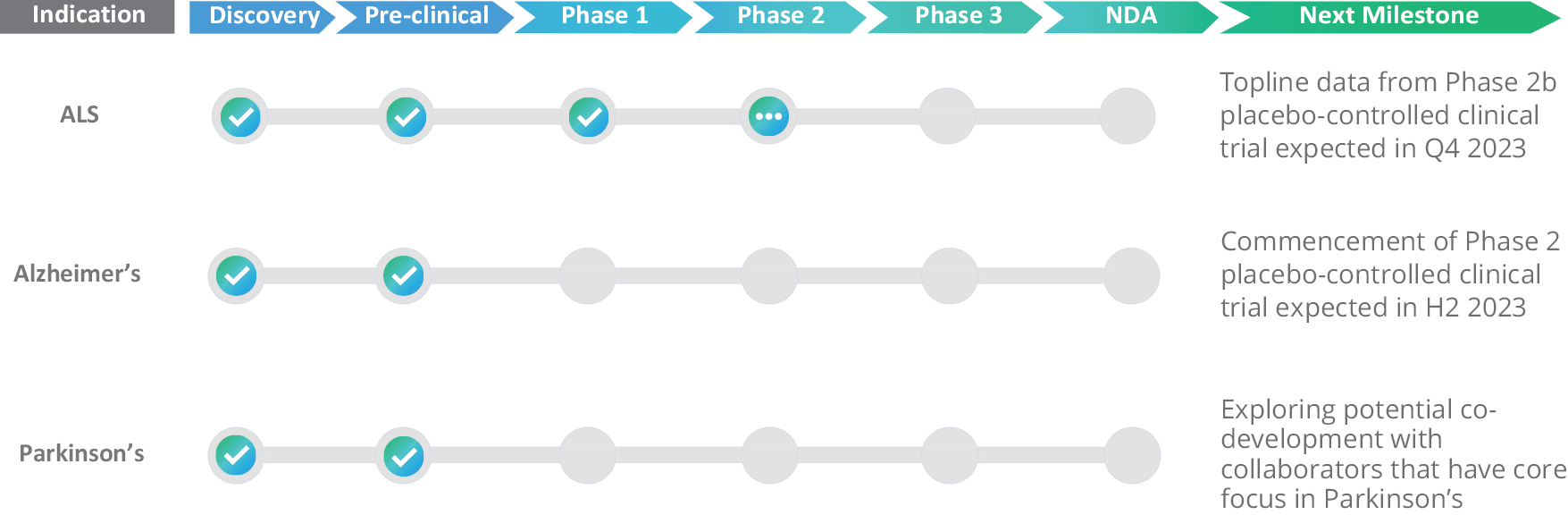

We are a clinical-stage biotechnology company focused on discovering and developing treatments for patients suffering from neurodegenerative diseases, including Amyotrophic Lateral Sclerosis (“ALS”), Alzheimer’s disease (“AD”) and Parkinson’s disease (“PD”). We believe these diseases represent some of the most significant unmet medical needs of our time, with limited effective therapeutic options available. The burden of these diseases on both patients and society is substantial. For example, the average annual cost of ALS alone is $180,000 per patient, and its estimated annual burden on the U.S. healthcare system is greater than $1 billion. Due to the complexity of neurodegenerative diseases, our strategy is utilizing a combined therapeutic approach to target multiple disease-related pathways.

Our lead therapeutic candidate, PrimeC, is a novel extended-release oral formulation, fixed-dose combination of two FDA-approved drugs, ciprofloxacin and celecoxib. PrimeC is designed to treat ALS by modulating microRNA synthesis, iron accumulation, and neuroinflammation, all of which are hallmarks of ALS pathology. The U.S. Food and Drug Administration (“FDA”) and the European Medicines Agency (“EMA”) have granted PrimeC orphan drug designation for the treatment of ALS. We believe PrimeC’s multifactorial mechanism of action has the potential to significantly prolong lifespan and improve ALS patients’ quality of life, thereby reducing the burden of this debilitating disease on both patients and healthcare systems.

PrimeC is currently being evaluated in PARADIGM (“NST003”), a Phase IIb randomized, multi-center, multinational, prospective, double-blind, placebo-controlled study, to evaluate safety, tolerability, and efficacy of PrimeC in 69 people living with ALS. Participants are being administered PrimeC or placebo at a 2:1 ratio, respectively. Study participants are allowed to continue standard of care treatment of approved products. The primary endpoints of the study are an evaluation of ALS-biomarkers as well as safety and tolerability assessment. Secondary and exploratory endpoints are the evaluation of clinical efficacy (ALS Functional Rating Scale — Revised and slow vital capacity), survival, and improvement in quality of life. All subjects who complete the six-month double-blind, placebo-controlled dosing period are transferred to the PrimeC active arm for a 12-month open label extension. The study completed enrollment in May 2023, enrolling 69 participants living with ALS in Israel, Italy, and Canada. We anticipate topline results in the fourth quarter of 2023.

Since the FDA had requested additional non-clinical data to support the overall duration of the PARADIGM trial, as PrimeC is intended for long-term administration in the treatment of ALS, we withdrew the protocol from its investigational new drug application (“IND”) in order to align our clinical strategy with the FDA, and we intend to discuss a potential trial design for an ALS pivotal trial with the FDA. Subject to agreement with FDA on trial design, the results of the PARADIGM trial and results of additional studies we intend to conduct in the interim, we believe we could be in a position to initiate a pivotal clinical trial of PrimeC for the treatment of ALS as early as 2024.

PrimeC was previously evaluated in a Phase IIa clinical trial (“NST002”) in 15 people living with ALS, conducted at the Tel Aviv Sourasky Medical Center, Israel. The primary endpoint of the NST002 trial, which was safety and tolerability, was met. In this trial, the safety profile observed was consistent with known safety profiles of ciprofloxacin and celecoxib. Side effects were mild and transient in nature. There were no new or unexpected safety signals detected during the trial.

Additionally, we observed positive clinical signals in comparison to virtual controls, and a serum biomarker analysis showed significant changes following treatment, indicating biological activity of the drug in comparison to untreated matched ALS patients. All 12 patients who completed the NST002 trial elected to continue into an extension study with PrimeC, that was conducted as an Investigator Initiated Study. To date, the Company is still supporting the drug supply for a few of the participants in this study, which is over than 40 months since NST002 was initiated.

1

Table of Contents

We completed three additional studies in 2022 as part of our drug development program to further support our future regulatory submissions. In April 2022, we initiated a pharmacokinetic (“PK”) study (“NCT05232461”) of PrimeC. The PK open-label, randomized, single-dose, three-treatment, three-period crossover study evaluated the effect of food on the bioavailability of PrimeC as compared to the bioavailability of co-administered ciprofloxacin tablets and celecoxib capsules in adult subjects in the U.S. under an FDA cleared IND protocol.

In August 2022, we completed enrollment and dosing of all subjects in a multi-dose PK study (“NCT05436678”). On September 28, 2022, we released the results of the NCT05436678 study. Based on results, we believe the PK profile of PrimeC supports the formulation’s extended-release properties, as the concentrations of the active components have been synchronized, aiming to potentially maximize the synergism between the two compounds. In June 2022, we reported the successful completion of the “in-life” phase of its 90-day GLP toxicology study. In this study, the components of PrimeC, celecoxib and ciprofloxacin, were administered to rodents at doses 4x the maximal clinical dose. All animals appeared normal, with no significant findings observed. The Company intends to present the data from these studies to the FDA as part of PrimeC’s drug development plan.

We believe we have a strong patent estate, including patents on method of use, combination, and formulation. We secured U.S. Patent 10,980,780 relating to methods for treatment of ALS using ciprofloxacin and celecoxib, the components of PrimeC, which expires in 2038. This patent also been issued in the European Patent Office, Canada and Australia. Similar patents are pending in Israel and in Japan. We also expect to take advantage of orphan drug exclusivity for PrimeC, if approved, for seven years in the United States and ten years in the European Union. In addition, U.S. patent application 16/623,467, which relates to methods of treatment of neurodegenerative disease using combinations of ciprofloxacin and celecoxib, is currently pending. This patent application is expected to expire on June 20, 2038.

Our organization is built around a management team with extensive experience in the pharmaceutical industry, with a particular focus on ALS research and clinical trials. We believe that our leadership team is well-positioned to lead us through clinical development, regulatory approval and commercialization of our product candidates.

In addition to PrimeC, we have conducted research and development efforts in AD and PD, with a similar strategy of combined products. The following chart represents our current product development pipeline:

In May 2023, we entered into a Collaborative Evaluation Agreement with Biogen MA Inc. (“Biogen”), a subsidiary of Biogen Inc., under which Biogen will evaluate the impact of PrimeC on neurofilament levels in the plasma of participants in PARADIGM. Biogen will fund the neurofilament biomarker study and conduct the analysis. Biogen also received a right of first refusal for a definitive licensing agreement to co-develop and/or commercialize PrimeC for the treatment of ALS.

Recent Developments

At-The-Market Offering

On April 14, 2023, we entered into a sales agreement with A.G.P./Alliance Global Partners (“A.G.P.”), pursuant to which we agreed to issue and sell, in an at-the-market offering, Ordinary Shares, having an aggregate offering price of up to $5,743,677 from time to time through or to A.G.P. as sales agent or principal. On June 22, 2023, we filed a prospectus supplement reflecting a reduction in the size of the at-the-market offering to $502,230. As of the date hereof, we have sold an aggregate of $7,200 of Ordinary Shares through the at-the-market offering.

2

Table of Contents

Registered Direct Offering and Concurrent Private Placement

On June 26, 2023, we issued and sold, pursuant to the Purchase Agreement, in a registered direct offering by us directly to the selling shareholder, (i) an aggregate of 1,330,000 Ordinary Shares at an offering price of $1.50 per share and (ii) an aggregate of 1,670,000 pre-funded warrants exercisable for Ordinary Shares (the “Pre-Funded Warrants”) at an offering price of $1.4999 per Pre-Funded Warrant, for gross proceeds of approximately $4.5 million before deducting the placement agent fee and related offering expenses. These securities were offered by us pursuant to an effective shelf registration statement on Form F-3 (File No. 333-269306) previously filed with the SEC on January 19, 2023 and declared effective by the SEC on January 30, 2023.

In a concurrent private placement, we issued and sold to the selling shareholder an aggregate of 3,000,000 Ordinary Warrants, each representing the right to acquire one Ordinary Share at an exercise price of $1.50 per Ordinary Share. Each Ordinary Warrant was exercisable immediately upon issuance and expires on the fifth anniversary of the original issuance date. The Ordinary Warrants and the Ordinary Shares issuable upon the exercise of the Ordinary Warrants were offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act and Regulation D promulgated thereunder.

Corporate Information

Our legal and commercial name is NeuroSense Therapeutics Ltd. We were incorporated on February 13, 2017 and were registered as a private company limited by shares under the laws of the State of Israel. We completed our initial public offering on the Nasdaq Capital Market in December 2021. The Ordinary Shares and warrants to purchase Ordinary Shares are traded on the Nasdaq Capital Market under the symbol “NRSN” and “NRSNW,” respectively.

Our principal executive offices are located at 11 HaMenofim Street, Building B, Herzliya, 4672562 Israel, and our telephone number is +972-9-7996183. Our website address is www.neurosense-tx.com. The information on our website does not constitute a part of this prospectus. Our agent for service of process in the United States is Cogency Global Inc., 122 East 42nd Street, 18th Floor, New York, NY 10168.

Implications of Being an Emerging Growth Company

As a company with less than $1.235 billion in revenue during our last fiscal year, we are an “emerging growth company” as defined in the Jumpstart Our Business Startups Act of 2012 (the “JOBS Act”). As such, we may take advantage of certain exemptions from various reporting requirements that are applicable to other publicly traded entities that are not emerging growth companies. These exemptions include:

• not being required to have our registered independent public accounting firm attest to management’s assessment of our internal control over financial reporting;

• not being required to comply with any requirement that may be adopted by the Public Company Accounting Oversight Board (“PCAOB”), regarding mandatory audit firm rotation or a supplement to the auditor’s report providing additional information about the audit and the financial statements (i.e., an auditor discussion and analysis);

• not being required to submit certain executive compensation matters to stockholder advisory votes, such as “say-on-pay,” “say-on-frequency” and “say-on-golden parachutes”; and

• not being required to disclose certain executive compensation related items such as the correlation between executive compensation and performance and comparisons of the chief executive officer’s compensation to median employee compensation.

As a result, the information contained in this prospectus and the documents incorporated by reference herein may be different from the information you receive from other public companies in which you hold shares. We may take advantage of these provisions for up until we are no longer an emerging growth company. We would cease to be an emerging growth company upon the earliest to occur of: (i) the last day of the first fiscal year in which our annual gross revenues exceed $1.235 billion; (ii) the date on which we have issued more than $1 billion in non-convertible debt securities during the previous three years; (iii) the date on which we are deemed to be a “large accelerated filer” as defined in Rule 12b-2 under the Exchange Act; or (iv) the last day of the fiscal year following the fifth anniversary of our initial public offering.

3

Table of Contents

Implications of Being a Foreign Private Issuer

We are also a non-U.S. company with foreign private issuer status. Even after we no longer qualify as an emerging growth company, as long as we continue to qualify as a foreign private issuer under the Exchange Act, we will be exempt from certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including:

• the rules under the Exchange Act requiring domestic filers to issue financial statements prepared under U.S. generally accepted accounting principles (“U.S. GAAP”);

• the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act;

• the sections of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and liability for insiders who profit from trades made in a short period of time; and

• the rules under the Exchange Act requiring the filing with the SEC of quarterly reports on Form 10-Q containing unaudited financial statements and other specified information, and current reports on Form 8-K upon the occurrence of specified significant events.

Notwithstanding these exemptions, we will file with the SEC, within four months after the end of each fiscal year, or such applicable time as required by the SEC, an Annual Report on Form 20-F containing financial statements audited by an independent registered public accounting firm.

We may take advantage of these exemptions until such time as we are no longer a foreign private issuer. We would cease to be a foreign private issuer at such time as more than 50% of our outstanding voting securities are held by U.S. residents and any of the following three circumstances applies: (i) the majority of our executive officers or directors are U.S. citizens or residents; (ii) more than 50% of our assets are located in the United States; or (iii) our business is administered principally in the United States.

Both foreign private issuers and emerging growth companies also are exempt from certain more stringent executive compensation disclosure rules. Thus, even if we no longer qualify as an emerging growth company, but remain a foreign private issuer, we will continue to be exempt from the more stringent compensation disclosures required of companies that are neither an emerging growth company nor a foreign private issuer.

4

Table of Contents

THE OFFERING

|

Ordinary Shares offered by the selling shareholder

|

|

Up to 3,000,000 Ordinary Shares following issuance upon exercise of the Ordinary Warrants.

|

|

Ordinary Warrants offered by the selling shareholder

|

|

Up to 3,000,000 Ordinary Warrants

|

|

Ordinary Shares to be outstanding immediately following this offering

|

|

16,623,042 Ordinary Shares.

|

|

Use of proceeds

|

|

All of the Ordinary Shares and Ordinary Warrants offered by the selling shareholder pursuant to this prospectus will be sold by the selling shareholder. We will not receive any proceeds from such sales. However, to the extent the Ordinary Warrants are exercised for cash, if at all, we will receive the exercise price of the Ordinary Warrants. The exercise price of the Ordinary Warrants may exceed the trading price of the Ordinary Shares. If the price of the Ordinary Shares is below $1.50, we believe that holder of the Ordinary Warrants will be unlikely to exercise their warrants, resulting in little to no cash proceeds to us. If all the Ordinary Warrants were exercised, we would receive gross proceeds of approximately $4.5 million. See the section titled “Use of Proceeds” in this prospectus for more information.

|

|

Offering price

|

|

The exercise price of the Ordinary Warrants is $1.50 per Ordinary Share. The Ordinary Shares and Ordinary Warrants offered by the selling shareholder under this prospectus may be offered and sold at prevailing market prices, negotiated prices or such other prices as the selling shareholder may determine. See the section titled “Plan of Distribution” in this prospectus for more information.

|

|

Risk factors

|

|

See the section titled “Risk Factors” beginning on page 6 and the other information included in this prospectus for a discussion of factors you should consider before deciding to invest in the Ordinary Shares and Ordinary Warrants.

|

|

Listing

|

|

The Ordinary Shares and warrants to purchase Ordinary Shares, are traded on Nasdaq under the symbols “NRSN” and “NRSNW,” respectively.

|

Unless otherwise stated, all information in this prospectus supplement, is based on 13,623,042 Ordinary Shares outstanding as of June 30, 2023, and does not include the following as of that date:

• 100,000 Ordinary Shares issuable upon the exercise of warrants outstanding as of such date, at an exercise price of $7.50 per share, which were issued to the underwriters of our initial public offering;

• 1,655,000 Ordinary Shares issuable upon the exercise of tradable warrants outstanding as of such date, at an exercise price of $6.00, which were issued as part of the units in our initial public offering;

• 1,024,128 Ordinary Shares issuable upon the exercise of options outstanding as of June 30, 2023, at a weighted average exercise price of $2.39 under our 2018 Employee Share Option Plan;

• 403,000 Ordinary Shares issuable upon the vesting of restricted stock units outstanding as of June 30, 2023; and

• 278,543 Ordinary Shares reserved for issuance and available for future grant under our 2018 Employee Share Option Plan.

Except as otherwise indicated, all information in this prospectus supplement assumes no exercise of any Pre-Funded Warrants or the Ordinary Warrants issued in the concurrent private placement.

5

Table of Contents

RISK FACTORS

Investing in our securities involves significant risks. Before making an investment decision, you should carefully consider the risks described below and under the section titled “Item 3. Key Information — D. Risk Factors” in our Annual Report on Form 20-F for the year ended December 31, 2022 which is incorporated by reference herein, as well as any other information included or incorporated by reference in this prospectus, together with all of the other information appearing in this prospectus or incorporated by reference herein, including in light of your particular investment objectives and financial circumstances. The risks so described are not the only risks we face. Additional risks not presently known to us or that we currently deem immaterial may also impair our business operations and become material. Our business, financial condition and results of operations could be materially adversely affected by any of these risks. The trading price of our securities could decline due to any of these risks, and you may lose all or part of your investment. The discussion of risks includes or refers to forward-looking statements; you should read the explanation of the qualifications and limitations on such forward-looking statements discussed elsewhere in this prospectus under the caption “Cautionary Note Regarding Forward-Looking Statements” above.

Risks Related to this Offering

As of January 1, 2024, we may no longer qualify as a foreign private issuer, which will result in significant additional costs and expenses and subject us to increased regulatory requirements.

As a foreign private issuer, we are not required to comply with certain provisions of the Exchange Act that are applicable to U.S. domestic public companies, including (1) the sections of the Exchange Act regulating the solicitation of proxies, consents or authorizations in respect of a security registered under the Exchange Act, (2) the sections of the Exchange Act requiring insiders to file public reports of their share ownership and trading activities and liability for insiders who profit from trades made in a short period of time and (3) all of the periodic disclosure and current reporting requirements of the Exchange Act applicable to domestic issuers. We have also elected to follow home country corporate governance practices rather than those of Nasdaq, including (A) following Israeli quorum requirements, (B) not soliciting proxies as required by Nasdaq Listing Rule 5620(b), (C) having our board of directors select director nominees rather than having an independent committee select nominees, and (D) opting out of shareholder approval requirements, as included in the Nasdaq Listing Rules, for the issuance of securities in connection with certain events such as the acquisition of shares or assets of another company (if, due to the potential issuance of ordinary shares, the ordinary shares would have upon issuance voting power equal to or in excess of 20% of the voting power outstanding before the issuance of stock), the establishment of or amendments to equity-based compensation plans for employees, a change of control of our company and certain private placements.

The determination of foreign private issuer status is made annually on the last business day of an issuer’s most recently completed second fiscal quarter. We are assessing whether, as of June 30, 2023, we satisfied the requirements for retaining our foreign private issuer status as of such date. Assuming we did not satisfy the requirements to remain a foreign private issuer as of June 30, 2023, we would cease to be a foreign private issuer and cease to be eligible for the foregoing exemptions and privileges effective January 1, 2024.

As a result of losing our foreign private issuer status, we would be required to file with the SEC periodic reports and registration statements on U.S. domestic issuer forms, which are more detailed and extensive than the forms available to a foreign private issuer. We would be required to begin preparing our financial statements in accordance with U.S. GAAP, which would result in financial statements that are different than our historical financial statements and may make it difficult for investors to compare our financial performance over time. We would also have to mandatorily comply with U.S. federal proxy requirements, and our officers, directors and principal shareholders would become subject to the reporting and short-swing profit disclosure and recovery provisions of Section 16 of the Exchange Act. In addition, we would lose our ability to rely upon exemptions from certain corporate governance requirements under the listing rules of Nasdaq. As a U.S. listed public company that is not a foreign private issuer, we would expect to incur significant additional legal, accounting and other expenses that we have not incurred as a foreign private issuer. We would also expect that complying with the rules and regulations applicable to United States domestic issuers will make it more difficult and expensive for us to obtain director and officer liability insurance, and we may be required to accept reduced coverage or incur substantially higher costs to obtain coverage. These rules and regulations could also make it more difficult for us to attract and retain qualified members of our management team.

6

Table of Contents

The price of the Ordinary Shares may be volatile.

The market price of the Ordinary Shares has fluctuated in the past. Consequently, the current market price of the Ordinary Shares may not be indicative of future market prices, and we may be unable to sustain or increase the value of your investment in the Ordinary Shares.

There is no guarantee that the Ordinary Warrants will be in the money, and they may expire worthless.

The exercise price of the Ordinary Warrants is $1.50 per Ordinary Share, subject to adjustment. The exercise price of the Ordinary Warrants has at times exceeded the market price of the Ordinary Shares. To the extent the price of the Ordinary Shares remains below $1.50, we believe that holders of the Ordinary Warrants will be unlikely to exercise their warrants, resulting in little to no cash proceeds to us. There is no guarantee the exercise price of the Ordinary Warrants will ever remain below the price of the Ordinary Shares and, as such, the Ordinary Warrants may expire worthless.

We do not intend to apply for any listing of the Ordinary Warrants on any exchange or nationally recognized trading system, and we do not expect a market to develop for the Ordinary Warrants.

We do not intend to apply for any listing of the Ordinary Warrants on Nasdaq or any other securities exchange or nationally recognized trading system, and we do not expect a market to develop for the Ordinary Warrants. Without an active market, the liquidity of the Ordinary Warrants will be limited. Further, the existence of the Ordinary Warrants may act to reduce both the trading volume and the trading price of the Ordinary Shares.

Holders of Ordinary Warrants purchased in this offering will have no rights as shareholders of Ordinary Shares until such holders exercise their Ordinary Warrants and acquire the Ordinary Shares.

The Ordinary Warrants offered in this offering do not confer any rights of Ordinary Share ownership on their holders, such as voting rights or the right to receive dividends, but rather merely represent the right to acquire the Ordinary Shares at a fixed price. A holder of an Ordinary Warrant may exercise the right to acquire an Ordinary Share and pay an exercise price of $1.50 at any time. Upon exercise of the Ordinary Warrants, the holders thereof will be entitled to exercise the rights of a holder of the Ordinary Shares only as to matters for which the record date occurs after the exercise date.

7

Table of Contents

THE PRIVATE PLACEMENT

On June 22, 2023, we agreed, pursuant to the Purchase Agreement, to issue to the selling shareholder Ordinary Warrants exercisable for an aggregate of 3,000,000 Ordinary Shares at an exercise price of $1.50 per share (the “Private Placement”). Each Ordinary Warrant became exercisable on the date of issuance and will remain exercisable until the fifth anniversary of the original issuance date. The Ordinary Warrants and the Ordinary Shares issuable upon the exercise of the Ordinary Warrants were offered pursuant to the exemption provided in Section 4(a)(2) under the Securities Act, and Rule 506(b) promulgated thereunder.

Pursuant to the terms of the Purchase Agreement, we agreed to use commercially reasonable efforts to cause this registration statement on Form F-1 providing for the resale by holders of the Ordinary Warrants and the Ordinary Shares issuable upon the exercise of the Ordinary Warrants, to become effective within 120 days following the date of the Purchase Agreement and to keep such registration statement effective at all times.

The foregoing descriptions of the form of Purchase Agreement and the form of Ordinary Warrant are not complete and are subject to and qualified in their entirety by reference to the form of Purchase Agreement and the form of Ordinary Warrant, respectively, copies of which are attached as Exhibits 10.1 and 4.1 respectively, to the Current Report on Form 6-K dated June 23, 2023, and are incorporated herein by reference.

8

Table of Contents

USE OF PROCEEDS

All of the Ordinary Shares and Ordinary Warrants offered by the selling shareholder pursuant to this prospectus will be sold by the selling shareholder. We will not receive any of the proceeds from such sales. The selling shareholder will receive all of the proceeds from any sales of the Ordinary Shares and Ordinary Warrants offered hereby. However, we will incur expenses in connection with the registration of the Ordinary Shares and Ordinary Warrants offered hereby.

We will receive the exercise price upon any exercise of the Ordinary Warrants, to the extent exercised on a cash basis. If all the Ordinary Warrants were exercised, we would receive gross proceeds of approximately $4.5 million. However, the holders of the Ordinary Warrants are not obligated to exercise the Ordinary Warrants, and we cannot predict whether or when, if ever, the holders of the Ordinary Warrants will choose to exercise the Ordinary Warrants, in whole or in part. The exercise price of the Ordinary Warrants may exceed the trading price of our Ordinary Shares. If the price of the Ordinary Shares is below $1.50, we believe that holder of the Ordinary Warrants will be unlikely to exercise their warrants, resulting in little to no cash proceeds to us. Accordingly, we currently intend to use the proceeds received upon such exercise, if any, for general corporate purposes and working capital.

9

Table of Contents

MARKET FOR ORDINARY SHARES AND DIVIDEND POLICY

The Ordinary Shares are traded on the Nasdaq Capital Market under the symbol “NRSN.” The last reported sale price of the Ordinary Shares on August 28, 2023 on the Nasdaq Capital Market was $0.90 per share. As of August 28, 2023, there were 1,393 shareholders of record of the Ordinary Shares. We do not plan on applying to list the Ordinary Warrants on any exchange or nationally recognized trading system.

We have never declared or paid any cash dividends on the Ordinary Shares, and we anticipate that, for the foreseeable future, we will retain any future earnings to support operations and to finance the growth and development of our business. Therefore, we do not expect to pay cash dividends for at least the next several years.

The distribution of dividends may also be limited by the Israeli Companies Law, 5759-1999 (the “Companies Law”), which permits the distribution of dividends only out of retained earnings or earnings derived over the two most recent fiscal years, whichever is higher, provided that there is no reasonable concern that payment of a dividend will prevent a company from satisfying its existing and foreseeable obligations as they become due. As of June 30, 2023, we did not have distributable earnings pursuant to the Companies Law. Dividend distributions may be determined by our board of directors, as our amended and restated articles of association do not provide that such distributions require shareholder approval.

10

Table of Contents

CAPITALIZATION

The following table sets forth our cash and cash equivalents and capitalization as of June 30, 2023 as follows:

• on an actual basis; and

• on an as adjusted basis to reflect the issuance by the Company of 3,000,000 Ordinary Shares following an assumed exercise for cash of all of the Ordinary Warrants for gross proceeds of $4.5 million.

The following table should be read in conjunction with “Use of Proceeds,” our financial statements and related notes that are incorporated by reference into this prospectus and the other financial information included or incorporated by reference into this prospectus. Our historical results do not necessarily indicate our expected results for any future periods.

|

|

|

As of June 30, 2023

|

|

(in thousands, except per share data)

|

|

Actual

|

|

As

Adjusted

|

|

Cash

|

|

$

|

7,089

|

|

|

11,589

|

|

|

Short term deposits

|

|

|

—

|

|

|

—

|

|

|

Liability in respect to warrants and pre-funded warrants

|

|

|

6,304

|

|

|

2,809

|

|

|

Shareholders’ equity:

|

|

|

|

|

|

|

|

|

Ordinary Shares, no par value per share

|

|

|

—

|

|

|

—

|

|

|

Share premium and capital reserve

|

|

|

28,355

|

|

|

36,350

|

|

|

Accumulated Deficit

|

|

|

(29,900

|

)

|

|

(29,900

|

)

|

|

Total shareholders’ equity

|

|

|

(1,545

|

)

|

|

6,450

|

|

|

Total Capitalization

|

|

$

|

4,759

|

|

|

9,259

|

|

11

Table of Contents

SELLING SHAREHOLDER

The Ordinary Shares being offered by the selling shareholder pursuant to this prospectus are those issuable to the selling shareholder upon exercise of the Ordinary Warrants. For additional information regarding the issuance of the Ordinary Warrants, see “The Private Placement” above. We are registering the Ordinary Shares and Ordinary Warrants in order to permit the selling shareholder to offer the Ordinary Shares and Ordinary Warrants for resale from time to time. To our knowledge, the selling shareholder has not had any material relationship with us or our affiliates within the past three years. Our knowledge is based on information provided by the selling shareholder in connection with the filing of this prospectus.

The table below lists the selling shareholder and other information regarding the beneficial ownership of the Ordinary Shares by the selling shareholder. The second column lists the number of Ordinary Shares beneficially owned by the selling shareholder, based on its ownership of Ordinary Shares and Ordinary Warrants, as of June 30, 2023, and assuming exercise of all of the Ordinary Warrants and Pre-Funded Warrants held by the selling shareholder on that date, without regard to any limitations on exercises. The third column lists the maximum number of Ordinary Shares that may be sold or otherwise disposed of by the selling shareholder pursuant to the registration statement of which this prospectus forms a part. The selling shareholder may sell or otherwise dispose of some, all or none of their Ordinary Shares in this offering. Pursuant to the rules of the SEC, beneficial ownership includes any of the Ordinary Shares as to which a shareholder has sole or shared voting power or investment power, as well as any Ordinary Shares that the selling shareholder has the right to acquire within 60 days of August 28, 2023. The percentage of beneficial ownership for the selling shareholder is based on 13,623,042 of the Ordinary Shares outstanding as of June 30, 2023 and the number of Ordinary Shares issuable upon exercise or conversion of convertible securities that are currently exercisable or convertible or are exercisable or convertible within 60 days of August 28, 2023 beneficially owned by the applicable selling shareholder. The fourth column assumes the sale of all of the Ordinary Shares offered by the selling shareholder pursuant to this prospectus.

Under the terms of the Ordinary Warrants, the selling shareholder may not exercise the Ordinary Warrants to the extent such exercise would cause the selling shareholder, together with its affiliates and attribution parties, to beneficially own a number of Ordinary Shares which would exceed 4.99% of our then outstanding Ordinary Shares immediately after giving effect to the issuance of Ordinary Shares upon exercise of the Ordinary Warrants held by the selling shareholder. Furthermore, under the terms of the Pre-Funded Warrants, the selling shareholder may not exercise the Pre-Funded Warrants to the extent such exercise would cause the selling shareholder, together with its affiliates and attribution parties, to beneficially own a number of Ordinary Shares which would exceed 9.99% of our then outstanding Ordinary Shares immediately after giving effect to the issuance of Ordinary Shares upon exercise of the Pre-Funded Warrants held by the selling shareholder. The number of Ordinary Shares in the second and fifth columns do not reflect these limitations. See “Plan of Distribution.”

|

Name of Selling Shareholder

|

|

Ordinary

Shares

Beneficially

Owned Prior

to the

Offering(1)

|

|

Percentage of

Outstanding

Ordinary

Shares(1)

|

|

Maximum

Number of

Ordinary

Shares

To Be Sold

Pursuant

to this

Prospectus

|

|

Number of Ordinary Shares Beneficially Owned

After the

Offering(2)

|

|

Percentage of

Outstanding

Ordinary

Shares after the

Offering(2)

|

|

Ordinary

Warrants

Beneficially

Owned

Prior to the

Offering(1)

|

|

Percentage of

Outstanding

Ordinary

Warrants(1)

|

|

Maximum

Number of

Ordinary

Warrants To Be Sold

Pursuant

to this Prospectus(2)

|

|

Percentage of

Outstanding

Ordinary

Warrants after the Offering(2)

|

|

Armistice Capital Master Fund Ltd.

|

|

6,000,000

|

(3)

|

|

32.80

|

%

|

|

3,000,000

|

|

3,000,000

|

|

16.40

|

%

|

|

3,000,000

|

|

100

|

%

|

|

3,000,000

|

|

—

|

12

Table of Contents

13

Table of Contents

TAXATION

The following description is not intended to constitute a complete analysis of all tax consequences relating to the acquisition, ownership and disposition of our securities offered hereby. You should consult your own tax advisor concerning the tax consequences of your particular situation, as well as any tax consequences that may arise under the laws of any state, local, foreign or other taxing jurisdiction.

Material United States Federal Income Tax Considerations

The following discussion describes material United States federal income tax considerations relating to the acquisition, ownership, and disposition of Ordinary Shares and Ordinary Warrants covered by this prospectus by a U.S. Holder (as defined below) that acquires the Ordinary Shares and Ordinary Warrants in this offering and holds them as a capital asset. This discussion is based on the tax laws of the United States, including the Internal Revenue Code of 1986, as amended (the “Code”), the United States Department of the Treasury (“Treasury”) regulations promulgated or proposed thereunder, and administrative and judicial interpretations thereof, all as in effect on the date hereof. These tax laws are subject to change, possibly with retroactive effect, and subject to differing interpretations that could affect the tax consequences described herein. This discussion does not address the tax consequences to a U.S. Holder under the laws of any state, local or foreign taxing jurisdiction, estate tax consequences, alternative minimum tax consequences, potential application of the Medicare contribution tax on net investment income, and tax consequences applicable to U.S. Holders subject to special rules, as discussed below.

For purposes of this discussion, a “U.S. Holder” is a beneficial owner of the Ordinary Shares and Ordinary Warrants that, for United States federal income tax purposes, is:

• an individual who is a citizen or resident of the United States;

• a domestic corporation (or other entity taxable as a corporation);

• an estate the income of which is subject to United States federal income taxation regardless of its source; or

• a trust if (1) a court within the United States is able to exercise primary supervision over the trust’s administration and one or more United States persons have the authority to control all substantial decisions of the trust or (2) a valid election under the Treasury regulations is in effect for the trust to be treated as a United States person.

This discussion does not address all aspects of United States federal income taxation that may be applicable to U.S. Holders in light of their particular circumstances or status (including, for example, banks and other financial institutions, insurance companies, broker and dealers in securities or currencies, traders in securities that have elected to mark securities to market, regulated investment companies, real estate investment trusts, partnerships or other pass-through entities and arrangements, corporations that accumulate earnings to avoid U.S. federal income tax, tax-exempt organizations, pension plans, persons that own or who are treated as constructively owning 10 percent or more of our stock by vote or by value, persons that hold the Ordinary Shares or Ordinary Warrants as part of a straddle, hedge or other integrated investment, and persons subject to alternative minimum tax or whose “functional currency” is not the U.S. dollar).

If a partnership (including any entity or arrangement treated as a partnership for United States federal income tax purposes) holds the Ordinary Shares or Ordinary Warrants the tax treatment of a person treated as a partner in the partnership for United States federal income tax purposes generally will depend on the status of the partner and the activities of the partnership. Partnerships (and other entities or arrangements so treated for United States federal income tax purposes) and their partners should consult their own tax advisors.

This discussion addresses only U.S. Holders and does not discuss any tax considerations other than United States federal income tax considerations. Prospective investors are urged to consult their own tax advisors regarding the United States federal, state, and local, and non-United States tax consequences of the purchase, ownership, and disposition of the Ordinary Shares and Ordinary Warrants.

14

Table of Contents

Exercise or Expiration of Ordinary Warrants

In general, a U.S. Holder will not recognize gain or loss for U.S. federal income tax purposes upon exercise of an Ordinary Warrant. A U.S. Holder will take a tax basis in the shares acquired on the exercise of an Ordinary Warrant equal to the exercise price of the Ordinary Warrant, increased by such U.S. holder’s adjusted tax basis in the Ordinary Warrant exercised. Subject to the passive foreign investment company (“PFIC”) rules discussed below, such U.S. Holder’s holding period in the Ordinary Shares acquired on exercise of the Ordinary Warrant will begin on the date of exercise of the warrant and will not include any period for which such U.S. Holder held the Ordinary Warrant.

The lapse or expiration of an Ordinary Warrant will be treated as if the U.S. Holder sold or exchanged the warrant and recognized a capital loss equal to the U.S. Holder’s adjusted tax basis in the warrant. The deductibility of capital losses is subject to limitations.

Dividends

We do not expect to make any distribution with respect to the Ordinary Shares. However, if we make any such distribution, under the United States federal income tax laws, and subject to the PFIC rules discussed below, the gross amount of any dividend we pay out of our current or accumulated earnings and profits (as determined for United States federal income tax purposes) will be includible in income for a U.S. Holder and subject to United States federal income taxation. Dividends paid to a noncorporate U.S. Holder that constitute qualified dividend income will be taxable at a preferential tax rate applicable to long-term capital gains of, currently, 20 percent, provided that the U.S. Holder holds the Ordinary Shares for more than 60 days during the 121-day period beginning 60 days before the ex-dividend date and meets other holding period requirements. If we are treated as a PFIC, dividends paid to a U.S. Holder will not be treated as qualified dividend income. If we are not treated as a PFIC, dividends we pay with respect to the Ordinary Shares generally will be qualified dividend income, provided that the holding period requirements are satisfied by the U.S. Holder and in the year that the U.S. Holder receives the dividend, the Ordinary Shares are readily tradable on an established securities market in the United States.

A U.S. Holder must include any Israeli tax withheld from the dividend payment in the gross amount of the dividend even though the holder does not in fact receive it. The dividend is taxable to the holder when the holder of Ordinary Shares receives the dividend, actually or constructively. Because we are not a United States corporation, the dividend will not be eligible for the dividends-received deduction generally allowed to United States corporations in respect of dividends received from other United States corporations. The amount of the dividend distribution includible in a U.S. Holder’s income will be the U.S. dollar value of the NIS payments made, determined at the spot NIS/U.S. dollar rate on the date the dividend distribution is includible in income, regardless of whether the payment is in fact converted into U.S. dollars. Generally, any gain or loss resulting from currency exchange fluctuations during the period from the date the dividend payment is included in income to the date the payment is converted into U.S. dollars will be treated as ordinary income or loss and will not be eligible for the special tax rate applicable to qualified dividend income. The gain or loss generally will be income or loss from sources within the United States for foreign tax credit limitation purposes.

Subject to certain limitations, the Israeli tax withheld in accordance with the United States Israel Tax Treaty and paid over to Israel will be creditable or deductible against a U.S. Holder’s United States federal income tax liability, if the U.S. Holder satisfies certain minimum holding period requirements. Dividends that we distribute generally should constitute “passive category income,” or, in the case of certain U.S. Holders, “general category income” for foreign tax credit limitation purposes. The rules relating to the determination of the foreign tax credit limitation are complex, and U.S. Holders should consult their tax advisor to determine whether and to what extent they will be entitled to a credit for Israeli withholding taxes imposed in respect of any dividend we distribute.

To the extent a distribution with respect to the Ordinary Shares exceeds our current or accumulated earnings and profits, as determined under United States federal income tax principles, the distribution will be treated, first, as a tax-free return of the U.S. Holder’s investment, up to the holder’s adjusted tax basis in its Ordinary Shares, and, thereafter, as capital gain, which is subject to the tax treatment described below in“— Gain on Sale, Exchange or Other Taxable Disposition of the Ordinary Shares or Ordinary Warrants.”

15

Table of Contents

Gain on Sale, Exchange or Other Taxable Disposition of the Ordinary Shares or Ordinary Warrants

Subject to the PFIC rules described below under “— Passive Foreign Investment Company Considerations,” a U.S. Holder that sells, exchanges or otherwise disposes of Ordinary Shares or Ordinary Warrants in a taxable disposition generally will recognize capital gain or loss for United States federal income tax purposes equal to the difference between the U.S. Dollar value of the amount realized and the holder’s tax basis, determined in U.S. Dollars, in the Ordinary Shares or Ordinary Warrants. Gain or loss recognized on such a sale, exchange or other disposition of Ordinary Shares or Ordinary Warrants generally will be long-term capital gain if the U.S. Holder’s holding period in the Ordinary Shares or Ordinary Warrants exceeds one year. Long-term capital gains of non-corporate U.S. Holders are generally taxed at preferential rates. The gain or loss generally will be income or loss from sources within the United States for foreign tax credit limitation purposes. A U.S. Holder’s ability to deduct capital losses is subject to limitations.

Passive Foreign Investment Company Considerations

Based on our income and assets, we believe that we were a PFIC for the preceding taxable year and expect that we will be a PFIC for the current taxable year. Because the determination of our PFIC status is made annually based on the factual tests described below, however, we cannot provide any assurances regarding our PFIC status for the current or future taxable years or that the IRS will agree with our conclusion regarding our PFIC status. If we were classified as a PFIC in any taxable year, a U.S. Holder would be subject to special rules with respect to distributions on and sales, exchanges and other dispositions of the Ordinary Shares or Ordinary Warrants. We will be treated as a PFIC for any taxable year in which at least 75 percent of our gross income is “passive income” or at least 50 percent of our gross assets during the taxable year (based on the average of the fair market values of the assets determined at the end of each quarterly period) are assets that produce or are held for the production of passive income. Passive income for this purpose generally includes, among other things, dividends, interest, rents, royalties, gains from commodities and securities transactions, and gains from assets that produce passive income. However, rents and royalties received from unrelated parties in connection with the active conduct of a trade or business are not considered passive income for purposes of the PFIC test. In determining whether we are a PFIC, a pro rata portion of the income and assets of each corporation in which we own, directly or indirectly, at least a 25% interest (by value) is taken into account.

Excess Distribution Rules

If we were a PFIC with respect to a U.S. Holder, then unless the holder makes one of the elections described below under “— QEF Election” or “— Mark-to-Market Election,” a special tax regime would apply to the U.S. Holder with respect to (a) any “excess distribution” (generally, aggregate distributions in any year that are greater than 125% of the average annual distribution received by the holder in the shorter of the three preceding years or the holder’s holding period for the Ordinary Shares) and (b) any gain realized on the sale or other disposition of the Ordinary Shares or Ordinary Warrants. Under this regime, any excess distribution and realized gain will be treated as ordinary income and will be subject to tax as if (a) the excess distribution or gain had been realized ratably over the U.S. Holder’s holding period, (b) the amount deemed realized in each year had been subject to tax in each year of that holding period at the highest marginal rate for such year (other than income allocated to the current period or any taxable period before we became a PFIC, which would be subject to tax at the U.S. Holder’s regular ordinary income rate for the current year and would not be subject to the interest charge discussed below), and (c) the interest charge generally applicable to underpayments of tax had been imposed on the taxes deemed to have been payable in those years. In addition, dividend distributions would not qualify for the lower rates of taxation applicable to long-term capital gains discussed above under “— Dividends.” For Ordinary Shares acquired pursuant to the exercise of Ordinary Warrants, a U.S. Holder’s holding period will for this purpose include the holding period of such warrants.

A U.S. Holder that holds the Ordinary Shares (or under proposed U.S. Treasury Regulations, the Ordinary Warrants) at any time during a taxable year in which we are classified as a PFIC generally will continue to treat such Ordinary Shares or Ordinary Warrants, as well as Ordinary Shares acquired pursuant to an exercise of Ordinary Warrants, as Ordinary Shares or Ordinary Warrants in a PFIC, even if we no longer satisfy the income and asset tests described above, unless the U.S. Holder elects to recognize gain, which will be taxed under the excess distribution rules as if such Ordinary Shares or warrants had been sold on the last day of the last taxable year for which we were a PFIC.

Certain elections by a U.S. Holder would alleviate some of the adverse consequences of PFIC status and would result in an alternative treatment of the Ordinary Shares, as described below. However, under U.S. Treasury Regulations applying to warrants with respect to stock in a PFIC, these elections are not available with respect to the Ordinary Warrants.

16

Table of Contents

QEF Election

If we were a PFIC, the rules above would not apply to a U.S. Holder that timely makes an election to treat the Ordinary Shares as stock of a “qualified electing fund” (“QEF”). A U.S. Holder that makes a QEF election is required to include in income its pro rata share of the ordinary earnings and net capital gain as ordinary income and long-term capital gain, respectively, subject to a separate election to defer payment of taxes, which deferral is subject to an interest charge.

The timely QEF election also allows the electing U.S. Holder to: (i) generally treat any gain recognized on the disposition of its shares of the PFIC as capital gain; (ii) treat its share of the PFIC’s net capital gain, if any, as long-term capital gain instead of ordinary income; and (iii) either avoid interest charges resulting from PFIC status altogether, or make an annual election, subject to certain limitations, to defer payment of current taxes on its share of the PFIC’s annual realized net capital gain and ordinary earnings subject, however, to an interest charge on the deferred tax computed by using the statutory rate of interest applicable to an extension of time for payment of tax. In addition, net losses (if any) of a PFIC will not pass through to an electing U.S. Holder and may not be carried back or forward in computing such PFIC’s ordinary earnings and net capital gain in other taxable years. Consequently, a U.S. Holder may over time be taxed on amounts that as an economic matter exceed our net profits.

A U.S. Holder’s tax basis in Ordinary Shares will be increased to reflect QEF income inclusions and will be decreased to reflect distributions of amounts previously included in income as QEF income inclusions. No portion of the QEF income inclusions attributable to ordinary income will be treated as qualified dividend income. Amounts included as QEF income inclusions with respect to direct and indirect investments generally will not be taxed again when distributed. U.S. Holders should consult their tax advisors as to the manner in which QEF income inclusions affect their allocable share of our income and their basis in their Ordinary Shares.

A U.S. Holder makes a QEF election generally by attaching a completed IRS Form 8621 (Information Return by a Shareholder of a Passive Foreign Investment Company or Qualified Electing Fund) (“IRS Form 8621”) to a timely filed United States federal income tax return for the year beginning with which the QEF election is to be effective (taking into account any extensions). A QEF election can be revoked only with the consent of the IRS. In order for a U.S. Holder to make a valid QEF election, we must annually provide or make available to the holder certain information. While we intend to provide to U.S. Holders the information required to make a valid QEF election, we cannot provide any assurances that we will in fact provide such information. A QEF election under the proposed U.S. Treasury Regulations is not available for the Ordinary Warrants regardless of whether we provide such information

Mark-to-Market Election

If we were a PFIC, the rules above also would not apply to a U.S. Holder that makes a “mark-to-market” election with respect to the Ordinary Shares, but this election will be available with respect to the Ordinary Shares only if they meet certain minimum trading requirements to be considered “marketable stock” for purposes of the PFIC rules. A mark-to-market election under the U.S. Treasury Regulations is not available for the Ordinary Warrants.

Ordinary Shares will be marketable stock if they are regularly traded on a national securities exchange that is registered with the SEC or on a non-U.S. exchange or market that meets certain requirements under the Treasury regulations. Ordinary Shares generally will be considered regularly traded during any calendar year during which they are traded, other than in de minimis quantities, on at least 15 days during each calendar quarter. Any trades that have as their principal purpose meeting this requirement will be disregarded.

A U.S. Holder that makes a valid mark-to-market election for the first tax year in which the holder holds (or is deemed to hold) the Ordinary Shares and for which we are a PFIC will be required to include each year an amount equal to the excess, if any, of the fair market value of such shares the U.S. Holder owns as of the close of the taxable year over their adjusted tax basis in such shares. The U.S. Holder will be entitled to a deduction for the excess, if any, of the U.S. Holder’s adjusted tax basis in the Ordinary Shares over the fair market value of such shares as of the close of the taxable year, but only to the extent of any net mark-to-market gains with respect to such shares included by the U.S. Holder under the election for prior taxable years. The U.S. Holder’s basis in such Ordinary Shares will be adjusted to reflect the amounts included or deducted pursuant to the election. Amounts included in income pursuant to a mark-to-market election, as well as gain on the sale, exchange or other taxable disposition of such Ordinary Shares, will be treated as ordinary income. The deductible portion of any mark-to-market loss, as well as loss on a sale, exchange or other disposition of the Ordinary Shares to the extent that the amount of such loss does not exceed net mark-to-market gains previously included in income, will be treated as ordinary loss.

17

Table of Contents

The mark-to-market election applies to the taxable year for which the election is made and all subsequent taxable years, unless the Ordinary Shares cease to be treated as marketable stock for purposes of the PFIC rules or the IRS consents to its revocation. The excess distribution rules described above generally will not apply to a U.S. Holder for tax years for which a mark-to-market election is in effect. However, if we were a PFIC for any year in which the U.S. Holder owns the Ordinary Shares but before a mark-to-market election is made, the interest charge rules described above would apply to any mark-to-market gain recognized in the year the election is made.

PFIC Reporting Obligations

If we were, or in the future are, a PFIC. a U.S. Holder of the Ordinary Shares or Ordinary Warrants must generally file an annual information return on IRS Form 8621 containing such information as the Treasury may require. A U.S. Holder’s failure to file the annual information return will cause the statute of limitations for such U.S. Holder’s U.S. federal income tax return to remain open with regard to the items required to be included in such report until three years after the U.S. Holder files the annual information return, and, unless such failure is due to reasonable cause and not willful neglect, the statute of limitations for the U.S. Holder’s entire U.S. federal income tax return will remain open during such period. U.S. Holders should consult their tax advisors regarding the requirements of filing such information returns under these rules.

U.S. Holders are urged to consult their tax advisors as to our status as a PFIC, and the tax consequences to them if we were a PFIC, including the reporting requirements and the desirability of making, and the availability of, a QEF election or a mark-to-market election with respect to the Ordinary Shares or Ordinary Warrants.

Medicare Tax

Non-corporate U.S. Holders that are individuals, estates or trusts and whose income exceeds certain thresholds generally are subject to a 3.8% tax on all or a portion of their net investment income, which may include their gross dividend income and net gains from the disposition of Ordinary Shares or Ordinary Warrants. A United States person that is an individual, estate or trust is encouraged to consult its tax advisors regarding the applicability of this Medicare tax to its income and gains in respect of any investment in the Ordinary Shares and Ordinary Warrants.

Information Reporting with Respect to Foreign Financial Assets

Individual U.S. Holders (and, under regulations, certain entities) may be subject to certain reporting obligations on IRS Form 8938 (Statement of Specified Foreign Financial Asset) with respect to the Ordinary Shares or Ordinary Warrants for any taxable year during which the U.S. Holder’s aggregate value of these and certain other “specified foreign financial assets” exceed a threshold amount that varies with the filing status of the individual or entity. This reporting obligation also applies to domestic entities formed or availed of to hold, directly or indirectly, specified foreign financial assets, including the Ordinary Shares and Ordinary Warrants. Significant penalties can apply if U.S. Holders are required to make this disclosure and fail to do so. Such U.S. Holders who fail to timely furnish the required information may be subject to a penalty. Additionally, if a U.S. Holder does not file the required information, the statute of limitations with respect to tax returns of the U.S. Holder to which the information relates may not close until three years after such information is filed. U.S. Holders should consult their tax advisors regarding their reporting obligations with respect to their ownership and disposition of the Ordinary Shares and Ordinary Warrants.

Information Reporting and Backup Withholding

In general, information reporting, on IRS Form 1099, will apply to dividends in respect of Ordinary Shares and the proceeds from the sale, exchange or redemption of Ordinary Shares or Ordinary Warrants that are paid to a holder of Ordinary Shares or Ordinary Warrants within the United States (and in certain cases, outside the United States), unless such holder is an exempt recipient such as a corporation. Backup withholding (currently at a 24% rate) may apply to such payments if a holder of Ordinary Shares or Ordinary Warrants fails to provide a taxpayer identification number (generally on an IRS Form W-9) or certification of other exempt status or fails to report in full dividend and interest income.

Backup withholding is not an additional tax. A U.S. Holder generally may obtain a refund or credit of any amounts withheld under the backup withholding rules that exceed the U.S. Holder’s income tax liability by timely filing a refund claim with the IRS.

18

Table of Contents

Israeli Tax Considerations

The following is a brief summary of certain material Israeli tax laws applicable to us, and certain Israeli government programs that benefit us. This section also contains a discussion of certain material Israeli tax consequences concerning the ownership and disposition of our securities offered hereby. This summary does not discuss all the aspects of Israeli tax law that may be relevant to a particular investor in light of his or her personal investment circumstances or to some types of investors subject to special treatment under Israeli law. Examples of such investors include residents of Israel or traders in securities who are subject to special tax regimes not covered in this discussion. To the extent that the discussion is based on tax legislation that has not yet been subject to judicial or administrative interpretation, we cannot assure you that the appropriate tax authorities or the courts will accept the views expressed in this discussion. The discussion below is not intended, and should not be construed, as legal or professional tax advice and is not exhaustive of all possible tax considerations. The discussion is subject to change, including due to amendments under Israeli law or changes to the applicable judicial or administrative interpretations of Israeli law, which change could affect the tax consequences described below, possibly with a retroactive effect.

THEREFORE, YOU ARE URGED TO CONSULT YOUR OWN TAX ADVISORS AS TO THE ISRAELI OR OTHER TAX CONSEQUENCES OF THE PURCHASE, OWNERSHIP AND DISPOSITION OF OUR SECURITIES OFFERED HEREBY, INCLUDING, IN PARTICULAR, THE EFFECT OF ANY FOREIGN, STATE OR LOCAL TAXES.

General Corporate Tax Structure in Israel