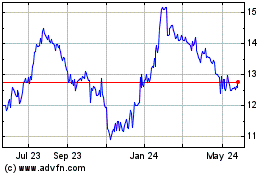

Provident Financial Holdings, Inc. (“Company”), NASDAQ GS: PROV,

the holding company for Provident Savings Bank, F.S.B. (“Bank”),

today announced earnings for the fourth quarter and the fiscal year

ended June 30, 2023.

For the quarter ended June 30, 2023, the Company

reported net income of $1.81 million, or $0.26 per diluted share

(on 7.07 million average diluted shares outstanding), down 27

percent from net income of $2.46 million, or $0.34 per diluted

share (on 7.32 million average diluted shares outstanding), in the

comparable period a year ago. The decrease in earnings was

primarily attributable to a $1.16 million increase in non-interest

expenses and a $355,000 decrease in the recovery from the allowance

for loan losses, partly offset by a $728,000 increase in net

interest income.

“We are pleased that the banking industry

turmoil from earlier this year seems to have subsided but note that

the spotlight is shining on the near-term performance of the

industry against the backdrop of tighter monetary policy, tighter

liquidity conditions, concerns regarding future credit quality, and

an uncertain economic environment,” said Craig G. Blunden, Chairman

and Chief Executive Officer of the Company. “We, like others, have

adjusted our short-term strategies to respond to current market

conditions such as reducing the growth of our loan portfolios and

augmenting our already robust contingency funding plans,” concluded

Blunden.

Return on average assets for the fourth quarter

of fiscal 2023 was 0.55 percent, down from 0.83 percent for the

same period of fiscal 2022; and return on average stockholders’

equity for the fourth quarter of fiscal 2023 was 5.52 percent, down

from 7.72 percent for the comparable period of fiscal 2022.

On a sequential quarter basis, the $1.81 million

net income for the fourth quarter of fiscal 2023 reflects a 22

percent decrease from $2.32 million in the third quarter of fiscal

2023. The decrease was primarily attributable to a $683,000

increase in non-interest expenses and a $167,000 decrease in net

interest income, partly offset by a $225,000 change to the

provision for loan losses to a $56,000 recovery from the allowance

for loan losses this quarter in contrast to a $169,000 provision

for loan losses in the prior sequential quarter and a $154,000

increase in non-interest income. The increase in non-interest

expenses was primarily due to a $496,000 increase in salaries and

employee benefits, attributable primarily to higher equity

compensation expenses. Diluted earnings per share for the fourth

quarter of fiscal 2023 were $0.26 per share, down 21 percent from

$0.33 per share in the third quarter of fiscal 2023. Return on

average assets was 0.55 percent for the fourth quarter of fiscal

2023, compared to 0.72 percent in the third quarter of fiscal 2023;

and return on average stockholders’ equity for the fourth quarter

of fiscal 2023 was 5.52 percent, compared to 7.12 percent for the

third quarter of fiscal 2023.

For the fiscal year ended June 30, 2023, net

income decreased $501,000, or six percent, to $8.59 million from

$9.09 million in the prior fiscal year. Diluted earnings per share

for the fiscal year ended June 30, 2023 decreased two percent to

$1.19 per share (on 7.19 million average diluted shares

outstanding) from $1.22 per share (on 7.45 million average diluted

shares outstanding) for the fiscal year ended June 30, 2022. The

decrease in earnings was primarily attributable to a $2.84 million

change in the provision for loan losses to a $374,000 provision for

loan losses in the fiscal year ended June 30, 2023 from a $2.46

million recovery from the allowance for loan losses in the prior

fiscal year, a $2.36 million increase in non-interest expense and a

$641,000 decrease in non-interest income (mainly in loan prepayment

fees), partly offset by a $5.39 million increase in net interest

income. The increase in non-interest expenses was primarily due to

a $1.90 million increase in salaries and employee benefits,

attributable primarily to a $1.20 million employee retention tax

credit recorded in the first quarter of fiscal 2022 and not

replicated in the current fiscal year and higher equity and

incentive compensation, partly offset by a recovery from the Bank’s

obligations for the supplemental executive retirement plans. The

increase in net interest income was due primarily to a higher net

interest margin (2.99% vs. 2.72%) and higher balance of

interest-earning assets ($1.24 billion vs. $1.16 billion).

In the fourth quarter of fiscal 2023, net

interest income increased $728,000, or nine percent, to $9.23

million from $8.51 million for the same quarter last year. The

increase in net interest income was primarily due to a higher

balance of interest-earning assets, partly offset by a lower net

interest margin. The average balance of interest-earning assets

increased by 11 percent to $1.28 billion in the fourth quarter of

fiscal 2023 from $1.16 billion in the same quarter last year. This

increase was attributable to the increase in the average balance of

loans receivable, partly offset by decreases in the average balance

of investment securities and interest-earning deposits. The net

interest margin during the fourth quarter of fiscal 2023 decreased

five basis points to 2.88 percent from 2.93 percent in the same

quarter last year. The average yield on interest-earning assets

increased 85 basis points to 4.03 percent in the fourth quarter of

fiscal 2023 from 3.18 percent in the same quarter last year while

the average cost of interest-bearing liabilities increased by 100

basis points to 1.27 percent in the fourth quarter of fiscal 2023

from 0.27 percent in the same quarter last year.

Interest income on loans receivable increased by

$3.34 million, or 39 percent, to $11.83 million in the fourth

quarter of fiscal 2023 from $8.49 million in the same quarter of

fiscal 2022. The increase was due to a higher average loan yield

and a higher average loan balance. The average yield on loans

receivable increased by 68 basis points to 4.38 percent in the

fourth quarter of fiscal 2023 from 3.70 percent in the same quarter

last year. Net deferred loan cost amortization in the fourth

quarter of fiscal 2023 increased 21 percent to $232,000 from

$191,000 in the same quarter last year. Adjustable-rate loans of

approximately $86.9 million were repriced upward in the fourth

quarter of fiscal 2023 by approximately 121 basis points from a

weighted average rate of 5.23 percent to 6.44 percent. The average

balance of loans receivable increased by $164.2 million, or 18

percent, to $1.08 billion in the fourth quarter of fiscal 2023 from

$916.2 million in the same quarter last year. Total loans

originated and purchased for investment in the fourth quarter of

fiscal 2023 were $24.3 million, down 72 percent from $85.9 million

in the same quarter last year. Loan principal payments received in

the fourth quarter of fiscal 2023 were $25.1 million, down 39

percent from $41.3 million in the same quarter last year.

Interest income from investment securities

decreased slightly to $537,000 in the fourth quarter of fiscal 2023

from $540,000 for the same quarter of fiscal 2022. This decrease

was attributable to a lower average balance, partly offset by a

higher average yield. The average balance of investment securities

decreased by $33.9 million, or 17 percent, to $160.6 million in the

fourth quarter of fiscal 2023 from $194.5 million in the same

quarter last year. The decrease in the average balance was due to

scheduled principal payments and prepayments of the investment

securities. The average yield on investment securities increased 23

basis points to 1.34 percent in the fourth quarter of fiscal 2023

from 1.11 percent for the same quarter last year. The increase in

the average investment securities yield was primarily attributable

to a lower premium amortization during the current quarter in

comparison to the same quarter last year ($168,000 vs. $270,000)

attributable to a lower total principal repayment ($6.9 million vs.

$10.5 million) and, to a lesser extent, the upward repricing of

adjustable-rate mortgage-backed securities.

In the fourth quarter of fiscal 2023, the

Federal Home Loan Bank – San Francisco (“FHLB”) distributed a

$142,000 cash dividend to the Bank on its FHLB stock, up 17 percent

from $121,000 in the same quarter last year, resulting in an

average yield on FHLB stock of 6.15 percent in the fourth quarter

of fiscal 2023 compared to 5.89 percent in the same quarter last

year. The average balance of FHLB – San Francisco stock in the

fourth quarter of fiscal 2023 was $9.2 million, up from $8.2

million in the same quarter of fiscal 2022.

Interest income from interest-earning deposits,

primarily cash deposited at the Federal Reserve Bank of San

Francisco, was $410,000 in the fourth quarter of fiscal 2023, up

494 percent from $69,000 in the same quarter of fiscal 2022. The

increase was due to a higher average yield, partly offset by a

lower average balance. The average yield earned on interest-earning

deposits in the fourth quarter of fiscal 2023 was 5.01 percent, up

433 basis points from 0.68 percent in the same quarter last year.

The increase in the average yield was due to a higher average

interest rate on the Federal Reserve Bank’s reserve balances

resulting from recent increases in the targeted federal funds rate.

The average balance of the Company’s interest-earning deposits

decreased $8.0 million, or 20 percent, to $32.4 million in the

fourth quarter of fiscal 2023 from $40.4 million in the same

quarter last year.

Interest expense on deposits for the fourth

quarter of fiscal 2023 was $1.48 million, a 478 percent increase

from $255,000 for the same period last year. The increase in

interest expense on deposits was attributable primarily to a higher

weighted average cost. The average cost of deposits was 0.62

percent in the fourth quarter of fiscal 2023, up 51 basis points

from 0.11 percent in the same quarter last year. The increase in

the average cost of deposits was primarily attributable to the

increase in time deposit costs, particularly brokered certificates

of deposit. The average balance of deposits decreased $11.9

million, or one percent, to $956.7 million in the fourth quarter of

fiscal 2023 from $968.6 million in the same quarter last year.

Transaction account balances or “core deposits”

decreased $104.8 million, or 13 percent, to $729.6 million at June

30, 2023 from $834.4 million at June 30, 2022, while time deposits

increased $99.8 million, or 82 percent, to $220.9 million at June

30, 2023 from $121.1 million at June 30, 2022. The increase in time

deposits was due to a $106.4 million increase in brokered

certificates of deposit. As of June 30, 2023, brokered certificates

of deposit totaled $106.4 million with a weighted average cost of

4.78 percent (including broker fees).

Interest expense on borrowings, consisting of

FHLB – San Francisco advances, for the fourth quarter of fiscal

2023 increased $1.75 million, or 386 percent, to $2.21 million from

$454,000 for the same period last year. The increase in interest

expense on borrowings was primarily the result of a higher average

balance and a higher average cost. The average balance of

borrowings increased by $126.9 million, or 158 percent, to $207.5

million in the fourth quarter of fiscal 2023 from $80.5 million in

the same quarter last year and the average cost of borrowings

increased by 200 basis points to 4.26 percent in the fourth quarter

of fiscal 2023 from 2.26 percent in the same quarter last year.

At June 30, 2023, the Bank had approximately

$287.9 million of remaining borrowing capacity at the FHLB – San

Francisco. Additionally, the Bank has an unused secured borrowing

facility of approximately $139.0 million with the Federal Reserve

Bank of San Francisco and an unused unsecured federal funds

borrowing facility of $50.0 million with its correspondent bank.

The total available borrowing capacity across all sources totals

approximately $476.9 million at June 30, 2023.

The Bank continues to work with both the FHLB -

San Francisco and Federal Reserve Bank of San Francisco to ensure

that borrowing capacity is continuously reviewed and updated in

order to be accessed seamlessly should the need arise. In May 2023,

the FHLB – San Francisco increased the Bank’s borrowing capacity

from 35% to 40% of total assets, an increase of approximately $66.8

million of borrowing capacity. In addition, the Bank is in the

process of moving its excess pledged collateral from the FHLB – San

Francisco to the Federal Reserve Bank of San Francisco to increase

the Bank’s Discount Window facility which is anticipated to occur

in the first quarter of fiscal 2024.

During the fourth quarter of fiscal 2023, the

Company recorded a recovery from the allowance for loan losses of

$56,000, as compared to a $411,000 recovery from the allowance for

loan losses recorded during the same period last year and the

$169,000 provision for loan losses recorded in the third quarter of

fiscal 2023 (sequential quarter). The recovery from the allowance

for loan losses primarily reflects the mix of loans held for

investment and a few loan upgrades during the quarter, while the

outstanding balance of loans held for investment in the fourth

quarter of fiscal 2023 remained virtually unchanged from the

sequential quarter and the overall loan credit quality remains very

strong.

Non-performing assets, comprised solely of

non-performing loans with underlying collateral located in

California, decreased $123,000 or nine percent to $1.3 million, or

0.10 percent of total assets, at June 30, 2023, compared to $1.4

million, or 0.12 percent of total assets, at June 30, 2022. The

non-performing loans at June 30, 2023 were comprised of six

single-family loans, while the non-performing loans at June 30,

2022 were comprised of seven single-family loans. At both June 30,

2023 and June 30, 2022, there was no real estate owned. Net loan

recoveries for the quarter ended June 30, 2023 were $1,000, as

compared to $6,000 for the quarter ended June 30, 2022 and $2,000

for the quarter ended March 31, 2023 (sequential quarter).

Classified assets were $2.3 million at June 30,

2023 which consists of $509,000 of loans in the special mention

category and $1.8 million of loans in the substandard category.

Classified assets at June 30, 2022 were $1.6 million, consisting of

$224,000 of loans in the special mention category and $1.4 million

of loans in the substandard category.

The allowance for loan losses was $5.9 million,

or 0.55 percent of gross loans held for investment, at June 30,

2023, up from the $5.6 million, or 0.59 percent of gross loans held

for investment, at June 30, 2022. Management believes that, based

on currently available information, the allowance for loan losses

is sufficient to absorb potential losses inherent in loans held for

investment at June 30, 2023 under the incurred loss

methodology.

Non-interest income decreased by $30,000, or

three percent, to $1.14 million in the fourth quarter of fiscal

2023 from $1.17 million in the same period last year, due to

decreases in loan servicing and other fees, attributable primarily

to lower loan prepayment fees and, to a lesser extent, deposit

account fees and card and processing fees, partly offset by a

recovery from the recourse reserve for sold loans. On a sequential

quarter basis, non-interest income increased $154,000 or 16

percent, primarily due to the recovery from the recourse reserve

for sold loans and an increase in card and processing fees, partly

offset by decreases in deposit account fees and loan servicing and

other fees.

Non-interest expenses increased $1.16 million,

or 18 percent, to $7.61 million in the fourth quarter of fiscal

2023 from $6.45 million for the same quarter last year. The

increase in the non-interest expenses in the fourth quarter of

fiscal 2023 was primarily due to higher salaries and employee

benefits and premises and occupancy expenses. The increase in

salaries and employee benefits expenses was due mainly to higher

equity and incentive compensation primarily resulting from the

true-up adjustments associated with the May 30, 2023 vesting of

stock options and distribution of restricted stock ($334,000), a

lower recovery of loan origination costs (ASC 310) resulting

primarily from lower loan originations ($280,000) and higher bonus

expenses ($143,000), while the increase in premises and occupancy

expenses was due primarily to a $136,000 expense recovery from

on-line charges in the fourth quarter of last year and not

replicated this quarter. On a sequential quarter basis,

non-interest expenses increased by $683,000 or 10 percent to $7.61

million in the fourth quarter of fiscal 2023 from $6.92 million in

the third quarter of fiscal 2023, primarily due to an increase in

salaries and employee benefits expenses, attributable mainly to

higher equity compensation primarily resulting from the true-up

adjustments associated with the May 30, 2023 vesting of stock

options and distribution of restricted stock ($303,000) and a lower

recovery from the Bank’s obligations for the supplemental executive

retirement plans ($149,000).

The Company’s efficiency ratio, defined as

non-interest expense divided by the sum of net interest income and

non-interest income, in the fourth quarter of fiscal 2023 was 73.36

percent, an increase from 66.68 percent in the same quarter last

year and 66.69 percent in the third quarter of fiscal 2023

(sequential quarter). The increase in the efficiency ratio was

primarily due to higher total expenses relative to revenue during

the current quarter, compared to the comparable quarter last

year.

The Company’s provision for income taxes was

$1.01 million for the fourth quarter of fiscal 2023, down 14

percent from $1.17 million in the same quarter last year and up

five percent from $966,000 during third quarter of fiscal 2023. The

decrease during the current quarter compared to the same quarter

last year was primarily due to a decrease in income before income

taxes, partly offset by a decrease in the tax benefit from the

vesting of equity compensation awards. The effective tax rate in

the fourth quarter of fiscal 2023 was 35.8 percent as compared to

32.2 percent in the same quarter last year and 29.4 percent for the

third quarter of fiscal 2023 (sequential quarter).

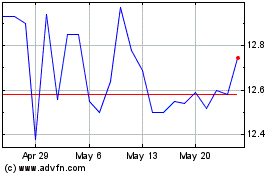

The Company repurchased 51,498 shares of its

common stock with an average cost of $12.64 per share during the

quarter ended June 30, 2023 pursuant to its April 2022 stock

repurchase plan. As of June 30, 2023, a total of 61,540 shares or

17 percent of the shares authorized for repurchase under the plan

remain available to purchase until the plan expires on April 28,

2024.

The Bank currently operates 13 retail/business

banking offices in Riverside County and San Bernardino County

(Inland Empire).

The Company will host a conference call for

institutional investors and bank analysts on Thursday, July 27,

2023 at 9:00 a.m. (Pacific) to discuss its financial results. The

conference call can be accessed by dialing 1-877-692-8959 and

referencing access code number 8701784. An audio replay of the

conference call will be available through Thursday, August 3, 2023

by dialing 1-866-207-1041 and referencing access code number

8265228.

For more financial information about the Company

please visit the website at www.myprovident.com and click on the

“Investor Relations” section.

Safe-Harbor Statement

This press release contains statements that the

Company believes are “forward-looking statements” within the

meaning of the Private Securities Litigation Reform Act of 1995.

These statements relate to the Company’s financial condition,

liquidity, results of operations, plans, objectives, future

performance or business. You should not place undue reliance on

these statements, as they are subject to risks and uncertainties.

When considering these forward-looking statements, you should keep

in mind these risks and uncertainties, as well as any cautionary

statements the Company may make. Moreover, you should treat these

statements as speaking only as of the date they are made and based

only on information then actually known to the Company. There are a

number of important factors that could cause future results to

differ materially from historical performance and these

forward-looking statements. Factors which could cause actual

results to differ materially from the results anticipated or

implied by our forward-looking statements include, but are not

limited to potential adverse impacts to economic conditions in our

local market areas, other markets where the Company has lending

relationships, or other aspects of the Company's business

operations or financial markets, including, without limitation, as

a result of employment levels, labor shortages and the effects of

inflation, a potential recession or slowed economic growth caused

by increasing political instability from acts of war including

Russia’s invasion of Ukraine, as well as supply chain disruptions;

increased competitive pressures; changes in the interest rate

environment; changes in general economic conditions, including the

effects of inflation, and conditions within the securities markets;

fluctuations in deposits; liquidity issues, including our ability

to borrow funds or raise additional capital, if necessary; the

impact of bank failures or adverse developments at other banks and

related negative press about the banking industry in general on

investor and depositor sentiment; legislative and regulatory

changes, including changes in banking, securities and tax law, in

regulatory policies and principles, or the interpretation of

regulatory capital or other rules; and other factors described in

the Company’s latest Annual Report on Form 10-K and Quarterly

Reports on Form 10-Q and other reports filed with and furnished to

the Securities and Exchange Commission (“SEC”) - which are

available on our website at www.myprovident.com and on the SEC’s

website at www.sec.gov. We do not undertake and specifically

disclaim any obligation to revise any forward-looking statements to

reflect the occurrence of anticipated or unanticipated events or

circumstances after the date of such statements whether as a result

of new information, future events or otherwise. These risks could

cause our actual results for fiscal 2024 and beyond to differ

materially from those expressed in any forward-looking statements

by, or on behalf of us and could negatively affect our operating

and stock price performance.

Contacts:

Craig G. BlundenChairman andChief Executive

Officer

Donavon P. TernesPresident, Chief Operating

Officerand Chief Financial Officer(951) 686-6060

|

PROVIDENT FINANCIAL HOLDINGS,

INC.Condensed Consolidated Statements of Financial

Condition(Unaudited –In Thousands, Except Share and Per

Share Information) |

| |

June 30, |

|

March 31, |

|

December 31, |

|

September 30, |

|

June 30, |

| |

2023 |

|

|

2023 |

|

|

2022 |

|

|

2022 |

|

|

2022 |

|

| Assets |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Cash and cash equivalents |

$ |

65,849 |

|

|

$ |

60,771 |

|

|

$ |

24,840 |

|

|

$ |

38,701 |

|

|

$ |

23,414 |

|

|

Investment securities – held to maturity, at cost |

|

154,337 |

|

|

|

161,336 |

|

|

|

168,232 |

|

|

|

176,162 |

|

|

|

185,745 |

|

|

Investment securities - available for sale, at fair value |

|

2,155 |

|

|

|

2,251 |

|

|

|

2,377 |

|

|

|

2,517 |

|

|

|

2,676 |

|

|

Loans held for investment, net of allowance for loan losses of

$5,946; $6,001; $5,830; $5,638 and $5,564, respectively; includes

$1,312; $1,352; $1,345; $1,350 and $1,396 of loans held at fair

value, respectively |

|

1,077,629 |

|

|

|

1,077,704 |

|

|

|

1,040,337 |

|

|

|

993,942 |

|

|

|

939,992 |

|

|

Accrued interest receivable |

|

3,711 |

|

|

|

3,610 |

|

|

|

3,343 |

|

|

|

3,054 |

|

|

|

2,966 |

|

|

FHLB – San Francisco stock |

|

9,505 |

|

|

|

8,239 |

|

|

|

8,239 |

|

|

|

8,239 |

|

|

|

8,239 |

|

|

Premises and equipment, net |

|

9,231 |

|

|

|

9,193 |

|

|

|

8,911 |

|

|

|

8,707 |

|

|

|

8,826 |

|

|

Prepaid expenses and other assets |

|

10,531 |

|

|

|

12,176 |

|

|

|

14,763 |

|

|

|

14,593 |

|

|

|

15,180 |

|

|

Total assets |

$ |

1,332,948 |

|

|

$ |

1,335,280 |

|

|

$ |

1,271,042 |

|

|

$ |

1,245,915 |

|

|

$ |

1,187,038 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities and

Stockholders’ Equity |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Liabilities: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Non-interest-bearing deposits |

$ |

103,006 |

|

|

$ |

108,479 |

|

|

$ |

108,891 |

|

|

$ |

123,314 |

|

|

$ |

125,089 |

|

|

Interest-bearing deposits |

|

847,565 |

|

|

|

874,567 |

|

|

|

836,411 |

|

|

|

862,010 |

|

|

|

830,415 |

|

|

Total deposits |

|

950,571 |

|

|

|

983,046 |

|

|

|

945,302 |

|

|

|

985,324 |

|

|

|

955,504 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Borrowings |

|

235,009 |

|

|

|

205,010 |

|

|

|

180,000 |

|

|

|

115,000 |

|

|

|

85,000 |

|

|

Accounts payable, accrued interest and other liabilities |

|

17,681 |

|

|

|

17,818 |

|

|

|

16,499 |

|

|

|

16,402 |

|

|

|

17,884 |

|

|

Total liabilities |

|

1,203,261 |

|

|

|

1,205,874 |

|

|

|

1,141,801 |

|

|

|

1,116,726 |

|

|

|

1,058,388 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Stockholders’ equity: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Preferred stock, $.01 par value (2,000,000 shares authorized; none

issued and outstanding) |

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

|

— |

|

|

Common stock, $.01 par value; (40,000,000 shares authorized;

18,229,615; 18,229,615; 18,229,615; 18,229,615 and 18,229,615

shares issued respectively; 7,043,170; 7,033,963; 7,132,270;

7,235,560 and 7,285,184 shares outstanding, respectively) |

|

183 |

|

|

|

183 |

|

|

|

183 |

|

|

|

183 |

|

|

|

183 |

|

|

Additional paid-in capital |

|

99,505 |

|

|

|

98,962 |

|

|

|

98,732 |

|

|

|

98,559 |

|

|

|

98,826 |

|

|

Retained earnings |

|

207,274 |

|

|

|

206,449 |

|

|

|

205,117 |

|

|

|

203,750 |

|

|

|

202,680 |

|

|

Treasury stock at cost (11,186,445; 11,195,652; 11,097,345;

10,994,055 and 10,944,431 shares, respectively) |

|

(177,237 |

) |

|

|

(176,163 |

) |

|

|

(174,758 |

) |

|

|

(173,286 |

) |

|

|

(173,041 |

) |

|

Accumulated other comprehensive (loss) income, net of tax |

|

(38 |

) |

|

|

(25 |

) |

|

|

(33 |

) |

|

|

(17 |

) |

|

|

2 |

|

|

Total stockholders’ equity |

|

129,687 |

|

|

|

129,406 |

|

|

|

129,241 |

|

|

|

129,189 |

|

|

|

128,650 |

|

|

Total liabilities and stockholders’ equity |

$ |

1,332,948 |

|

|

$ |

1,335,280 |

|

|

$ |

1,271,042 |

|

|

$ |

1,245,915 |

|

|

$ |

1,187,038 |

|

|

PROVIDENT FINANCIAL HOLDINGS,

INC.Condensed Consolidated Statements of

Operations(Unaudited - In Thousands, Except Per Share

Information) |

| |

Quarter Ended |

|

Fiscal Year Ended |

| |

June 30, |

|

June 30, |

| |

2023 |

|

|

2022 |

|

|

2023 |

|

2022 |

|

| Interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

Loans receivable, net |

$ |

11,826 |

|

|

$ |

8,485 |

|

|

$ |

42,191 |

|

$ |

32,161 |

|

|

Investment securities |

|

537 |

|

|

|

540 |

|

|

|

2,169 |

|

|

1,906 |

|

|

FHLB – San Francisco stock |

|

142 |

|

|

|

121 |

|

|

|

556 |

|

|

489 |

|

|

Interest-earning deposits |

|

410 |

|

|

|

69 |

|

|

|

1,076 |

|

|

174 |

|

|

Total interest income |

|

12,915 |

|

|

|

9,215 |

|

|

|

45,992 |

|

|

34,730 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

Checking and money market deposits |

|

50 |

|

|

|

51 |

|

|

|

227 |

|

|

220 |

|

|

Savings deposits |

|

38 |

|

|

|

44 |

|

|

|

168 |

|

|

172 |

|

|

Time deposits |

|

1,387 |

|

|

|

160 |

|

|

|

2,751 |

|

|

752 |

|

|

Borrowings |

|

2,206 |

|

|

|

454 |

|

|

|

5,861 |

|

|

1,991 |

|

|

Total interest expense |

|

3,681 |

|

|

|

709 |

|

|

|

9,007 |

|

|

3,135 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

9,234 |

|

|

|

8,506 |

|

|

|

36,985 |

|

|

31,595 |

|

| (Recovery) provision for loan

losses |

|

(56 |

) |

|

|

(411 |

) |

|

|

374 |

|

|

(2,462 |

) |

| Net interest income, after

(recovery) provision for loan losses |

|

9,290 |

|

|

|

8,917 |

|

|

|

36,611 |

|

|

34,057 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

| Non-interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

Loan servicing and other fees |

|

87 |

|

|

|

189 |

|

|

|

414 |

|

|

1,056 |

|

|

Deposit account fees |

|

298 |

|

|

|

336 |

|

|

|

1,296 |

|

|

1,302 |

|

|

Card and processing fees |

|

416 |

|

|

|

457 |

|

|

|

1,525 |

|

|

1,639 |

|

|

Other |

|

334 |

|

|

|

183 |

|

|

|

840 |

|

|

719 |

|

|

Total non-interest income |

|

1,135 |

|

|

|

1,165 |

|

|

|

4,075 |

|

|

4,716 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

4,855 |

|

|

|

4,055 |

|

|

|

17,737 |

|

|

15,833 |

|

|

Premises and occupancy |

|

947 |

|

|

|

690 |

|

|

|

3,447 |

|

|

3,189 |

|

|

Equipment |

|

304 |

|

|

|

350 |

|

|

|

1,152 |

|

|

1,282 |

|

|

Professional expenses |

|

355 |

|

|

|

311 |

|

|

|

1,517 |

|

|

1,419 |

|

|

Sales and marketing expenses |

|

118 |

|

|

|

165 |

|

|

|

622 |

|

|

642 |

|

|

Deposit insurance premiums and regulatory assessments |

|

192 |

|

|

|

134 |

|

|

|

657 |

|

|

543 |

|

|

Other |

|

836 |

|

|

|

744 |

|

|

|

3,138 |

|

|

3,007 |

|

|

Total non-interest expense |

|

7,607 |

|

|

|

6,449 |

|

|

|

28,270 |

|

|

25,915 |

|

| Income before income

taxes |

|

2,818 |

|

|

|

3,633 |

|

|

|

12,416 |

|

|

12,858 |

|

| Provision for income

taxes |

|

1,010 |

|

|

|

1,170 |

|

|

|

3,824 |

|

|

3,765 |

|

|

Net income |

$ |

1,808 |

|

|

$ |

2,463 |

|

|

$ |

8,592 |

|

$ |

9,093 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per

share |

$ |

0.26 |

|

|

$ |

0.34 |

|

|

$ |

1.20 |

|

$ |

1.23 |

|

| Diluted earnings per

share |

$ |

0.26 |

|

|

$ |

0.34 |

|

|

$ |

1.19 |

|

$ |

1.22 |

|

| Cash dividends per

share |

$ |

0.14 |

|

|

$ |

0.14 |

|

|

$ |

0.56 |

|

$ |

0.56 |

|

|

PROVIDENT FINANCIAL HOLDINGS,

INC.Condensed Consolidated Statements of

Operations – Sequential Quarters(Unaudited – In Thousands,

Except Per Share Information) |

| |

Quarter Ended |

| |

June 30, |

|

March 31, |

|

December 31, |

|

September 30, |

|

June 30, |

| |

2023 |

|

|

2023 |

|

2022 |

|

2022 |

|

2022 |

|

| Interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loans receivable, net |

$ |

11,826 |

|

|

$ |

11,028 |

|

$ |

10,237 |

|

$ |

9,100 |

|

$ |

8,485 |

|

|

Investment securities |

|

537 |

|

|

|

548 |

|

|

548 |

|

|

536 |

|

|

540 |

|

|

FHLB – San Francisco stock |

|

142 |

|

|

|

146 |

|

|

145 |

|

|

123 |

|

|

121 |

|

|

Interest-earning deposits |

|

410 |

|

|

|

286 |

|

|

241 |

|

|

139 |

|

|

69 |

|

|

Total interest income |

|

12,915 |

|

|

|

12,008 |

|

|

11,171 |

|

|

9,898 |

|

|

9,215 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Checking and money market deposits |

|

50 |

|

|

|

56 |

|

|

61 |

|

|

60 |

|

|

51 |

|

|

Savings deposits |

|

38 |

|

|

|

42 |

|

|

44 |

|

|

44 |

|

|

44 |

|

|

Time deposits |

|

1,387 |

|

|

|

781 |

|

|

370 |

|

|

213 |

|

|

160 |

|

|

Borrowings |

|

2,206 |

|

|

|

1,728 |

|

|

1,311 |

|

|

616 |

|

|

454 |

|

|

Total interest expense |

|

3,681 |

|

|

|

2,607 |

|

|

1,786 |

|

|

933 |

|

|

709 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Net interest income |

|

9,234 |

|

|

|

9,401 |

|

|

9,385 |

|

|

8,965 |

|

|

8,506 |

|

| (Recovery) provision for loan

losses |

|

(56 |

) |

|

|

169 |

|

|

191 |

|

|

70 |

|

|

(411 |

) |

| Net interest income, after

(recovery) provision for loan losses |

|

9,290 |

|

|

|

9,232 |

|

|

9,194 |

|

|

8,895 |

|

|

8,917 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-interest income: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Loan servicing and other fees |

|

87 |

|

|

|

104 |

|

|

115 |

|

|

108 |

|

|

189 |

|

|

Deposit account fees |

|

298 |

|

|

|

328 |

|

|

327 |

|

|

343 |

|

|

336 |

|

|

Card and processing fees |

|

416 |

|

|

|

361 |

|

|

367 |

|

|

381 |

|

|

457 |

|

|

Other |

|

334 |

|

|

|

188 |

|

|

147 |

|

|

171 |

|

|

183 |

|

|

Total non-interest income |

|

1,135 |

|

|

|

981 |

|

|

956 |

|

|

1,003 |

|

|

1,165 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Non-interest expense: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Salaries and employee benefits |

|

4,855 |

|

|

|

4,359 |

|

|

4,384 |

|

|

4,139 |

|

|

4,055 |

|

|

Premises and occupancy |

|

947 |

|

|

|

843 |

|

|

796 |

|

|

861 |

|

|

690 |

|

|

Equipment |

|

304 |

|

|

|

279 |

|

|

258 |

|

|

311 |

|

|

350 |

|

|

Professional expenses |

|

355 |

|

|

|

260 |

|

|

310 |

|

|

592 |

|

|

311 |

|

|

Sales and marketing expenses |

|

118 |

|

|

|

182 |

|

|

175 |

|

|

147 |

|

|

165 |

|

|

Deposit insurance premiums and regulatory assessments |

|

192 |

|

|

|

191 |

|

|

139 |

|

|

135 |

|

|

134 |

|

|

Other |

|

836 |

|

|

|

810 |

|

|

736 |

|

|

756 |

|

|

744 |

|

|

Total non-interest expense |

|

7,607 |

|

|

|

6,924 |

|

|

6,798 |

|

|

6,941 |

|

|

6,449 |

|

| Income before income

taxes |

|

2,818 |

|

|

|

3,289 |

|

|

3,352 |

|

|

2,957 |

|

|

3,633 |

|

| Provision for income

taxes |

|

1,010 |

|

|

|

966 |

|

|

981 |

|

|

867 |

|

|

1,170 |

|

| Net income |

$ |

1,808 |

|

|

$ |

2,323 |

|

$ |

2,371 |

|

$ |

2,090 |

|

$ |

2,463 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per

share |

$ |

0.26 |

|

|

$ |

0.33 |

|

$ |

0.33 |

|

$ |

0.29 |

|

$ |

0.34 |

|

| Diluted earnings per

share |

$ |

0.26 |

|

|

$ |

0.33 |

|

$ |

0.33 |

|

$ |

0.29 |

|

$ |

0.34 |

|

| Cash dividends per

share |

$ |

0.14 |

|

|

$ |

0.14 |

|

$ |

0.14 |

|

$ |

0.14 |

|

$ |

0.14 |

|

|

PROVIDENT FINANCIAL HOLDINGS,

INC.Financial Highlights(Unaudited -

Dollars in Thousands, Except Share and Per Share Information) |

| |

As of and For the |

|

| |

Quarter Ended |

|

Fiscal Year Ended |

|

| |

June 30, |

|

June 30, |

|

| |

2023 |

|

2022 |

|

2023 |

|

2022 |

|

|

SELECTED FINANCIAL RATIOS: |

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

|

0.55 |

% |

|

0.83 |

% |

|

0.68 |

% |

|

0.76 |

% |

| Return on average

stockholders' equity |

|

5.52 |

% |

|

7.72 |

% |

|

6.58 |

% |

|

7.14 |

% |

| Stockholders’ equity to total

assets |

|

9.73 |

% |

|

10.84 |

% |

|

9.73 |

% |

|

10.84 |

% |

| Net interest spread |

|

2.76 |

% |

|

2.91 |

% |

|

2.92 |

% |

|

2.69 |

% |

| Net interest margin |

|

2.88 |

% |

|

2.93 |

% |

|

2.99 |

% |

|

2.72 |

% |

| Efficiency ratio |

|

73.36 |

% |

|

66.68 |

% |

|

68.85 |

% |

|

71.37 |

% |

| Average interest-earning

assets to average interest-bearing liabilities |

|

110.18 |

% |

|

110.51 |

% |

|

110.27 |

% |

|

110.67 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

| SELECTED FINANCIAL

DATA: |

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share |

$ |

0.26 |

|

$ |

0.34 |

|

$ |

1.20 |

|

$ |

1.23 |

|

| Diluted earnings per

share |

$ |

0.26 |

|

$ |

0.34 |

|

$ |

1.19 |

|

$ |

1.22 |

|

| Book value per share |

$ |

18.41 |

|

$ |

17.66 |

|

$ |

18.41 |

|

$ |

17.66 |

|

| Shares used for basic EPS

computation |

|

7,031,674 |

|

|

7,291,046 |

|

|

7,143,273 |

|

|

7,404,089 |

|

| Shares used for diluted EPS

computation |

|

7,071,644 |

|

|

7,323,138 |

|

|

7,191,685 |

|

|

7,449,004 |

|

| Total shares issued and

outstanding |

|

7,043,170 |

|

|

7,285,184 |

|

|

7,043,170 |

|

|

7,285,184 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

| LOANS ORIGINATED AND

PURCHASED FOR INVESTMENT: |

|

|

|

|

|

|

|

|

|

|

|

|

| Mortgage Loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

Single-family |

$ |

12,271 |

|

$ |

62,908 |

|

$ |

165,942 |

|

$ |

198,026 |

|

|

Multi-family |

|

6,804 |

|

|

16,013 |

|

|

50,323 |

|

|

87,738 |

|

|

Commercial real estate |

|

5,207 |

|

|

6,971 |

|

|

18,979 |

|

|

18,187 |

|

|

Construction |

|

— |

|

|

— |

|

|

1,648 |

|

|

2,228 |

|

| Commercial business loans |

|

— |

|

|

— |

|

|

190 |

|

|

— |

|

|

Total loans originated and purchased for investment |

$ |

24,282 |

|

$ |

85,892 |

|

$ |

237,082 |

|

$ |

306,179 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

PROVIDENT FINANCIAL HOLDINGS,

INC.Financial Highlights(Unaudited -

Dollars in Thousands, Except Share and Per Share Information) |

| |

As of and For the |

|

| |

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

|

| |

Ended |

|

Ended |

|

Ended |

|

Ended |

|

Ended |

|

| |

06/30/23 |

|

03/31/23 |

|

12/31/22 |

|

09/30/22 |

|

06/30/22 |

|

|

SELECTED FINANCIAL RATIOS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Return on average assets |

|

0.55 |

% |

|

0.72 |

% |

|

0.75 |

% |

|

0.69 |

% |

|

0.83 |

% |

| Return on average

stockholders' equity |

|

5.52 |

% |

|

7.12 |

% |

|

7.27 |

% |

|

6.42 |

% |

|

7.72 |

% |

| Stockholders’ equity to total

assets |

|

9.73 |

% |

|

9.69 |

% |

|

10.17 |

% |

|

10.37 |

% |

|

10.84 |

% |

| Net interest spread |

|

2.76 |

% |

|

2.90 |

% |

|

3.00 |

% |

|

3.01 |

% |

|

2.91 |

% |

| Net interest margin |

|

2.88 |

% |

|

3.00 |

% |

|

3.05 |

% |

|

3.05 |

% |

|

2.93 |

% |

| Efficiency ratio |

|

73.36 |

% |

|

66.69 |

% |

|

65.74 |

% |

|

69.63 |

% |

|

66.68 |

% |

| Average interest-earning

assets to average interest-bearing liabilities |

|

110.18 |

% |

|

110.23 |

% |

|

110.14 |

% |

|

110.56 |

% |

|

110.51 |

% |

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| SELECTED FINANCIAL

DATA: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Basic earnings per share |

$ |

0.26 |

|

$ |

0.33 |

|

$ |

0.33 |

|

$ |

0.29 |

|

$ |

0.34 |

|

| Diluted earnings per

share |

$ |

0.26 |

|

$ |

0.33 |

|

$ |

0.33 |

|

$ |

0.29 |

|

$ |

0.34 |

|

| Book value per share |

$ |

18.41 |

|

$ |

18.40 |

|

$ |

18.12 |

|

$ |

17.85 |

|

$ |

17.66 |

|

| Average shares used for basic

EPS |

|

7,031,674 |

|

|

7,080,817 |

|

|

7,184,652 |

|

|

7,273,377 |

|

|

7,291,046 |

|

| Average shares used for

diluted EPS |

|

7,071,644 |

|

|

7,145,583 |

|

|

7,236,451 |

|

|

7,310,490 |

|

|

7,323,138 |

|

| Total shares issued and

outstanding |

|

7,043,170 |

|

|

7,033,963 |

|

|

7,132,270 |

|

|

7,235,560 |

|

|

7,285,184 |

|

| |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| LOANS ORIGINATED AND

PURCHASED FOR INVESTMENT: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Mortgage loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Single-family |

$ |

12,271 |

|

$ |

39,543 |

|

$ |

57,079 |

|

$ |

57,049 |

|

$ |

62,908 |

|

|

Multi-family |

|

6,804 |

|

|

10,660 |

|

|

8,663 |

|

|

24,196 |

|

|

16,013 |

|

|

Commercial real estate |

|

5,207 |

|

|

3,422 |

|

|

7,025 |

|

|

3,325 |

|

|

6,971 |

|

|

Construction |

|

— |

|

|

260 |

|

|

1,388 |

|

|

— |

|

|

— |

|

| Commercial business loans |

|

— |

|

|

— |

|

|

190 |

|

|

— |

|

|

— |

|

|

Total loans originated and purchased for investment |

$ |

24,282 |

|

$ |

53,885 |

|

$ |

74,345 |

|

$ |

84,570 |

|

$ |

85,892 |

|

|

PROVIDENT FINANCIAL HOLDINGS,

INC.Financial Highlights(Unaudited -

Dollars in Thousands) |

| |

As of |

|

As of |

|

As of |

|

As of |

|

As of |

|

| |

06/30/23 |

|

03/31/23 |

|

12/31/22 |

|

09/30/22 |

|

06/30/22 |

|

|

ASSET QUALITY RATIOS AND DELINQUENT

LOANS: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Recourse reserve for loans

sold |

$ |

33 |

|

$ |

160 |

|

$ |

160 |

|

$ |

160 |

|

$ |

160 |

|

| Allowance for loan losses |

$ |

5,946 |

|

$ |

6,001 |

|

$ |

5,830 |

|

$ |

5,638 |

|

$ |

5,564 |

|

| Non-performing loans to loans

held for investment, net |

|

0.12 |

% |

|

0.09 |

% |

|

0.09 |

% |

|

0.10 |

% |

|

0.15 |

% |

| Non-performing assets to total

assets |

|

0.10 |

% |

|

0.07 |

% |

|

0.08 |

% |

|

0.08 |

% |

|

0.12 |

% |

| Allowance for loan losses to

gross loans held for investment |

|

0.55 |

% |

|

0.56 |

% |

|

0.56 |

% |

|

0.57 |

% |

|

0.59 |

% |

| Net loan charge-offs

(recoveries) to average loans receivable (annualized) |

|

— |

% |

|

— |

% |

|

— |

% |

|

— |

% |

|

— |

% |

| Non-performing loans |

$ |

1,300 |

|

$ |

945 |

|

$ |

956 |

|

$ |

964 |

|

$ |

1,423 |

|

| Loans 30 to 89 days

delinquent |

$ |

1 |

|

$ |

963 |

|

$ |

4 |

|

$ |

1 |

|

$ |

3 |

|

| |

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

|

Quarter |

| |

Ended |

|

Ended |

|

Ended |

|

Ended |

|

Ended |

| |

06/30/23 |

|

03/31/23 |

|

12/31/22 |

|

09/30/22 |

|

06/30/22 |

|

Recourse (recovery) provision for loans sold |

$ |

(127 |

) |

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

|

$ |

— |

|

| (Recovery) provision for loan

losses |

$ |

(56 |

) |

|

$ |

169 |

|

|

$ |

191 |

|

|

$ |

70 |

|

|

$ |

(411 |

) |

| Net loan charge-offs

(recoveries) |

$ |

(1 |

) |

|

$ |

(2 |

) |

|

$ |

(1 |

) |

|

$ |

(4 |

) |

|

$ |

(6 |

) |

|

|

As of |

|

As of |

|

As of |

|

As of |

|

As of |

|

| |

06/30/2023 |

|

03/31/2023 |

|

12/31/2022 |

|

09/30/2022 |

|

06/30/2022 |

|

| REGULATORY CAPITAL

RATIOS (BANK): |

|

|

|

|

|

|

|

|

|

|

| Tier 1 leverage ratio |

9.59 |

% |

9.59 |

% |

9.55 |

% |

9.74 |

% |

10.47 |

% |

| Common equity tier 1 capital

ratio |

18.50 |

% |

17.90 |

% |

17.87 |

% |

17.67 |

% |

19.58 |

% |

| Tier 1 risk-based capital

ratio |

18.50 |

% |

17.90 |

% |

17.87 |

% |

17.67 |

% |

19.58 |

% |

| Total risk-based capital

ratio |

19.38 |

% |

18.78 |

% |

18.74 |

% |

18.54 |

% |

20.47 |

% |

| |

As of June 30, |

|

| |

2023 |

|

2022 |

|

| |

Balance |

|

Rate(1) |

|

Balance |

|

Rate(1) |

|

|

INVESTMENT SECURITIES: |

|

|

|

|

|

|

|

|

|

|

| Held to maturity (at

cost): |

|

|

|

|

|

|

|

|

|

|

| Certificates of deposit |

$ |

— |

|

— |

% |

$ |

400 |

|

0.73 |

% |

| U.S. SBA securities |

|

651 |

|

5.35 |

|

|

940 |

|

0.85 |

|

| U.S. government sponsored

enterprise MBS |

|

149,803 |

|

1.46 |

|

|

180,492 |

|

1.36 |

|

| U.S. government sponsored

enterprise CMO |

|

3,883 |

|

2.19 |

|

|

3,913 |

|

2.23 |

|

|

Total investment securities held to maturity |

$ |

154,337 |

|

1.49 |

% |

$ |

185,745 |

|

1.37 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Available for sale (at

fair value): |

|

|

|

|

|

|

|

|

|

|

| U.S. government agency

MBS |

$ |

1,370 |

|

2.90 |

% |

$ |

1,698 |

|

1.90 |

% |

| U.S. government sponsored

enterprise MBS |

|

683 |

|

4.64 |

|

|

865 |

|

2.67 |

|

| Private issue CMO |

|

102 |

|

4.67 |

|

|

113 |

|

3.02 |

|

|

Total investment securities available for sale |

$ |

2,155 |

|

3.54 |

% |

$ |

2,676 |

|

2.20 |

% |

|

Total investment securities |

$ |

156,492 |

|

1.52 |

% |

$ |

188,421 |

|

1.39 |

% |

(1) The interest rate described in the rate

column is the weighted-average interest rate or yield of all

instruments, which are included in the balance of the respective

line item.

|

PROVIDENT FINANCIAL HOLDINGS,

INC.Financial Highlights(Unaudited -

Dollars in Thousands) |

| |

As of June 30, |

|

| |

2023 |

|

2022 |

|

| |

Balance |

|

Rate(1) |

|

Balance |

|

Rate(1) |

|

| LOANS HELD FOR

INVESTMENT: |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

|

Single-family (1 to 4 units) |

$ |

518,821 |

|

|

4.12 |

% |

$ |

378,234 |

|

|

3.34 |

% |

| Multi-family (5 or more

units) |

|

461,113 |

|

|

4.70 |

|

|

464,676 |

|

|

4.05 |

|

| Commercial real estate |

|

90,558 |

|

|

5.73 |

|

|

90,429 |

|

|

4.61 |

|

| Construction |

|

1,936 |

|

|

7.76 |

|

|

3,216 |

|

|

3.62 |

|

| Other mortgage |

|

106 |

|

|

5.25 |

|

|

123 |

|

|

5.25 |

|

| Commercial business |

|

1,565 |

|

|

10.24 |

|

|

1,206 |

|

|

6.66 |

|

| Consumer |

|

65 |

|

|

18.25 |

|

|

86 |

|

|

15.00 |

|

|

Total loans held for investment |

|

1,074,164 |

|

|

4.52 |

% |

|

937,970 |

|

|

3.82 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

| Advance payments of

escrows |

|

148 |

|

|

|

|

|

47 |

|

|

|

|

| Deferred loan costs, net |

|

9,263 |

|

|

|

|

|

7,539 |

|

|

|

|

| Allowance for loan losses |

|

(5,946 |

) |

|

|

|

|

(5,564 |

) |

|

|

|

|

Total loans held for investment, net |

$ |

1,077,629 |

|

|

|

|

$ |

939,992 |

|

|

|

|

| Purchased loans serviced by

others included above |

$ |

10,561 |

|

|

4.67 |

% |

$ |

11,394 |

|

|

3.50 |

% |

(1) The interest rate described in the rate

column is the weighted-average interest rate or yield of all

instruments, which are included in the balance of the respective

line item.

| |

As of June 30, |

|

| |

2023 |

|

2022 |

|

| |

Balance |

|

Rate(1) |

|

Balance |

|

Rate(1) |

|

|

DEPOSITS: |

|

|

|

|

|

|

|

|

|

|

| Checking accounts – non

interest-bearing |

$ |

103,006 |

|

— |

% |

$ |

125,089 |

|

— |

% |

| Checking accounts –

interest-bearing |

|

302,872 |

|

0.04 |

|

|

335,788 |

|

0.04 |

|

| Savings accounts |

|

290,204 |

|

0.05 |

|

|

333,581 |

|

0.05 |

|

| Money market accounts |

|

33,551 |

|

0.23 |

|

|

39,897 |

|

0.17 |

|

| Time deposits |

|

220,938 |

|

2.98 |

|

|

121,149 |

|

0.52 |

|

|

Total deposits(2)(3) |

$ |

950,571 |

|

0.73 |

% |

$ |

955,504 |

|

0.11 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

BORROWINGS: |

|

|

|

|

|

|

|

|

|

|

| Overnight |

$ |

— |

|

— |

% |

$ |

5,000 |

|

1.66 |

% |

| Three months or less |

|

45,009 |

|

4.44 |

|

|

20,000 |

|

1.75 |

|

| Over three to six months |

|

25,000 |

|

5.30 |

|

|

— |

|

— |

|

| Over six months to one

year |

|

80,000 |

|

4.29 |

|

|

10,000 |

|

2.25 |

|

| Over one year to two

years |

|

70,000 |

|

3.99 |

|

|

30,000 |

|

2.25 |

|

| Over two years to three

years |

|

10,000 |

|

4.42 |

|

|

20,000 |

|

2.70 |

|

| Over three years to four

years |

|

— |

|

— |

|

|

— |

|

— |

|

| Over four years to five

years |

|

5,000 |

|

4.22 |

|

|

— |

|

— |

|

|

Total borrowings(4) |

$ |

235,009 |

|

4.34 |

% |

$ |

85,000 |

|

2.20 |

% |

(1) The interest rate described in the rate

column is the weighted-average interest rate or cost of all

instruments, which are included in the balance of the respective

line item.(2) Includes uninsured deposits of approximately

$140.1 million and $173.7 million at June 30, 2023 and 2022,

respectively.(3) The average balance of deposit accounts was

approximately $34 thousand and $32 thousand at June 30, 2023 and

2022, respectively.(4) The Bank had approximately $287.9

million and $310.3 million of remaining borrowing capacity at the

FHLB – San Francisco, approximately $139.0 million and $153.9

million of borrowing capacity at the Federal Reserve Bank of San

Francisco and $50.0 million and $50.0 million of borrowing capacity

with its correspondent bank at June 30, 2023 and 2022,

respectively.

|

PROVIDENT FINANCIAL HOLDINGS,

INC.Financial Highlights(Unaudited -

Dollars in Thousands) |

| |

Quarter Ended |

|

Quarter Ended |

|

| |

June 30, 2023 |

|

June 30, 2022 |

|

| |

Balance |

|

Rate(1) |

|

Balance |

|

Rate(1) |

|

|

SELECTED AVERAGE BALANCE SHEETS: |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Loans receivable, net |

$ |

1,080,440 |

|

4.38 |

% |

$ |

916,241 |

|

3.70 |

% |

| Investment securities |

|

160,572 |

|

1.34 |

|

|

194,524 |

|

1.11 |

|

| FHLB – San Francisco

stock |

|

9,240 |

|

6.15 |

|

|

8,222 |

|

5.89 |

|

| Interest-earning deposits |

|

32,395 |

|

5.01 |

|

|

40,385 |

|

0.68 |

|

| Total interest-earning

assets |

$ |

1,282,647 |

|

4.03 |

% |

$ |

1,159,372 |

|

3.18 |

% |

| Total assets |

$ |

1,313,057 |

|

|

|

$ |

1,192,583 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Deposits |

$ |

956,701 |

|

0.62 |

% |

$ |

968,554 |

|

0.11 |

% |

| Borrowings |

|

207,483 |

|

4.26 |

|

|

80,549 |

|

2.26 |

|

| Total interest-bearing

liabilities |

$ |

1,164,184 |

|

1.27 |

% |

$ |

1,049,103 |

|

0.27 |

% |

| Total stockholders’

equity |

$ |

131,085 |

|

|

|

$ |

127,561 |

|

|

|

(1) The interest rate described in the rate

column is the weighted-average interest rate or yield/cost of all

instruments, which are included in the balance of the respective

line item.

| |

Fiscal Year Ended |

|

Fiscal Year Ended |

|

| |

June 30, 2023 |

|

June 30, 2022 |

|

| |

Balance |

|

Rate(1) |

|

Balance |

|

Rate(1) |

|

|

SELECTED AVERAGE BALANCE SHEETS: |

|

|

|

|

|

|

|

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Loans receivable, net |

$ |

1,029,000 |

|

4.10 |

% |

$ |

870,328 |

|

3.70 |

% |

| Investment securities |

|

172,005 |

|

1.26 |

|

|

206,876 |

|

0.92 |

|

| FHLB – San Francisco

stock |

|

8,488 |

|

6.55 |

|

|

8,172 |

|

5.98 |

|

| Interest-earning deposits |

|

26,214 |

|

4.05 |

|

|

74,897 |

|

0.23 |

|

| Total interest-earning

assets |

$ |

1,235,707 |

|

3.72 |

% |

$ |

1,160,273 |

|

2.99 |

% |

| Total assets |

$ |

1,268,470 |

|

|

|

$ |

1,193,060 |

|

|

|

| |

|

|

|

|

|

|

|

|

|

|

| Deposits |

$ |

960,860 |

|

0.33 |

% |

$ |

961,497 |

|

0.12 |

% |

| Borrowings |

|

159,742 |

|

3.67 |

|

|

86,883 |

|

2.29 |

|

| Total interest-bearing

liabilities |

$ |

1,120,602 |

|

0.80 |

% |

$ |

1,048,380 |

|

0.30 |

% |

| Total stockholders’

equity |

$ |

130,561 |

|

|

|

$ |

127,408 |

|

|

|

(1) The interest rate described in the rate

column is the weighted-average interest rate or yield/cost of all

instruments, which are included in the balance of the respective

line item.

PROVIDENT FINANCIAL HOLDINGS,

INC.Financial Highlights(Unaudited -

Dollars in Thousands)

ASSET QUALITY:

| |

As of |

|

As of |

|

As of |

|

As of |

|

As of |

| |

06/30/23 |

|

03/31/23 |

|

12/31/22 |

|

09/30/22 |

|

06/30/22 |

|

Loans on non-accrual status (excluding restructured loans): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Mortgage loans: |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Single-family |

$ |

592 |

|

$ |

235 |

|

$ |

242 |

|

$ |

243 |

|

$ |

701 |

|

Total |

|

592 |

|

|

235 |

|

|

242 |

|

|

243 |

|

|

701 |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

| Accruing loans past due 90

days or more: |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

Total |

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

— |

|

|

|

|

|

|

|