As filed with the Securities and Exchange

Commission on January 8, 2021

Registration No. 333-

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM S-3

REGISTRATION STATEMENT

UNDER

THE SECURITIES ACT OF 1933

SUMMIT THERAPEUTICS INC.

(Exact name of registrant as specified in

its charter)

|

Delaware

|

37-1979717

|

|

(State or other jurisdiction of

incorporation or organization)

|

(I.R.S. Employer

Identification Number)

|

One Broadway, 14th Floor

Cambridge, Massachusetts 02142

(617) 514-7149

(Address, Including Zip Code, and Telephone

Number, Including Area Code, of Registrant’s Principal Executive Offices)

Robert Duggan

Chief Executive Officer

Summit Therapeutics Inc.

One Broadway, 14th Floor

Cambridge, MA 02142

(617) 514-7149

(Name, Address, Including Zip

Code, and Telephone Number, Including Area Code, of Agent for Service)

Copy to:

Adam W. Finerman

Olshan Frome Wolosky LLP

1325 Avenue of the Americas

New York, New York 10019

Telephone: (212) 451-2300

Approximate date of commencement of

proposed sale to the public: From time to time after this registration statement becomes effective.

If the only securities being registered

on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following box. ☐

If any of the securities being registered

on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415 under the Securities Act of 1933,

other than securities offered only in connection with dividend or interest reinvestment plans, check the following box. ☒

If this Form is filed to register

additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following box

and list the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a post-effective

amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act

registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form is a registration statement

pursuant to General Instruction I.D. or a post-effective amendment thereto that shall become effective upon filing with the Commission

pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If this Form is a post-effective

amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional

classes of securities pursuant to Rule 413(b) under the Securities Act, check the following box. ☐

Indicate by check mark whether the registrant

is a large accelerated filer, an accelerated filer, a non-accelerated filer, a smaller reporting company, or an emerging growth

company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting

company” and "emerging growth company" in Rule 12b-2 of the Exchange Act.

Large accelerated filer ☐ Accelerated

filer ☐

Non-accelerated filer ☒ Smaller

reporting company ☐

(Do not check if a smaller reporting company) Emerging

growth company ☐

If an emerging growth company, indicate

by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial

accounting standards provided pursuant to Section 7(a)(2)(B) of the Securities Act. ☐

CALCULATION OF REGISTRATION FEE

|

|

|

Title of Each Class of

Securities to be Registered(1)

|

Amount

to be

Registered(1)

|

Proposed

Maximum

Offering Price

Per Unit(1)

|

Maximum

Aggregate

Offering Price(1)

|

Amount of

Registration Fee

|

|

Common Stock, par value $0.01 per share(2)

|

69,333,633

|

$4.99

|

$345,974,829

|

$37,745.85

|

|

|

|

|

|

|

(1)

|

Pursuant to Rule 416 under the Securities Act of 1933, as amended (the “Securities Act”), this registration statement

also covers any additional securities that may be offered or issued in connection with any stock split, stock dividend or pursuant

to anti-dilution provisions of any of the shares of Common Stock registered hereunder. Separate consideration may or may not be

received for securities that are issuable upon conversion, exercise or exchange of other securities. In addition, the total amount

to be registered and the proposed maximum aggregate offering price are estimated solely for the purpose of calculating the registration

fee pursuant to Rule 457(o) under the Securities Act. In accordance with Rule 457(c) under the Securities Act, the aggregate offering

price of the Common Stock is based on the average of the high and low sales prices of our stock reported by the Nasdaq Global Market

on January 4, 2021.

|

|

|

(2)

|

Represents the resale of (i) 63,859,111 shares of Common Stock issued and outstanding and (ii) 5,474,522 shares of Common Stock

in the aggregate issuable upon the exercise of warrants to purchase to Common Stock issued to certain of the selling stockholders

on September 18, 2020 in connection with the domestication of the Company as a Delaware corporation in exchange for warrants to

purchase securities in Old Summit (as defined below) held by such selling stockholders.

|

The Registrant hereby amends this Registration Statement

on such date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which

specifically states that this Registration Statement shall thereafter become effective in accordance with Section 8(a) of

the Securities Act of 1933 or until the Registration Statement shall become effective on such date as the Commission acting pursuant

to said Section 8(a), may determine.

The information in this prospectus is not

complete and may be changed. The selling stockholders may not sell these securities until the registration statement filed with

the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and the selling stockholders

are not soliciting offers to buy these securities in any jurisdiction where the offer or sale is not permitted.

Subject to completion, dated

January 8, 2021

PROSPECTUS

SUMMIT THERAPEUTICS INC.

63,859,111 Shares of Common Stock

5,474,522 Shares of Common Stock Issuable

Upon Exercise of Certain Existing Warrants

The selling stockholders of Summit Therapeutics

Inc. (“Summit, “we”, “us”, “our,” “ours,” “our company,” “our

group” or similar terms refer to Summit Therapeutics Inc., a Delaware corporation, and its consolidated subsidiaries) identified

in this prospectus, including their pledgees, donees, transferees, assigns or other successors in interest (“selling stockholders”),

may, from time to time, offer and resell under this prospectus up to 69,333,633 shares in the aggregate (the “Shares”)

of our common stock, par value $0.01 per share (the “Common Stock”) comprised of (i) 63,859,111 shares of Common Stock

issued and outstanding and (ii) 5,474,522 shares of Common Stock issuable upon the exercise of warrants to purchase to Common Stock

issued to certain of the selling stockholders on September 18, 2020 in connection with the domestication of the Company as a Delaware

corporation in exchange for warrants to purchase securities in Old Summit (as defined below) held by such selling stockholders.

The selling stockholders will receive all of the proceeds from any sales of the Shares offered hereby and we will not receive any

proceeds from any such sales. This prospectus describes the general terms of the Shares and the general manner in which the Shares

will be offered. You should read this prospectus and any applicable prospectus supplement carefully before you invest in the Shares.

Our registration of the Shares covered

by this prospectus does not mean that the selling stockholders will offer or sell any of the Shares. The selling stockholders may

sell any, all or none of the securities offered by this prospectus and we do not know when or in what amount the selling stockholders

may sell their shares of Common Stock hereunder following the effective date of this registration statement. The timing and amount

of any sale are within the sole discretion of the selling stockholders.

The selling stockholders may sell the

Shares through public or private transactions at market prices prevailing at the time of sale or at negotiated prices. For further

information regarding the possible methods by which the Shares may be distributed, see “Plan of Distribution” beginning

on page 15 in this prospectus.

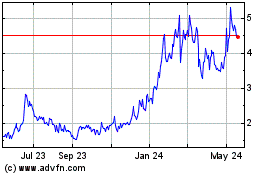

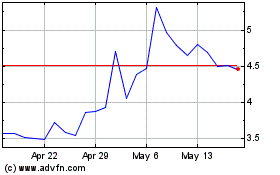

Our common stock is listed on the Nasdaq

Global Market under the symbol “SMMT.” On January 7, 2021, the last reported sale price for our Common Stock was $5.28

per share.

Investing in our Common Stock involves

significant risks. See “Risk Factors” beginning on page 6 of this prospectus and in the documents incorporated by reference

in this prospectus for a discussion of the factors you should carefully consider before deciding to purchase any of the Shares.

Neither the Securities and Exchange Commission

nor any state securities commission has approved or disapproved of these securities or passed upon the adequacy or accuracy of

this prospectus. Any representation to the contrary is a criminal offense.

The date of this prospectus

is , 2021.

TABLE OF CONTENTS

ABOUT THIS PROSPECTUS

This prospectus is part of a registration

statement that we filed with the Securities and Exchange Commission (the “SEC”) pursuant to which the selling stockholders

named herein may, from time to time, offer and sell or otherwise dispose of the Shares covered by this prospectus.

This prospectus provides you with a

general description of the securities which may be offered. We may provide one or more prospectus supplements that will add, update

or change information contained in this prospectus. You should read both this prospectus and any accompanying prospectus supplement

together with the additional information described under the heading “Where You Can Find More Information” beginning

on page 2 of this prospectus.

You should rely only on the information

contained in or incorporated by reference in this prospectus, any accompanying prospectus supplement or in any related free writing

prospectus filed by us with the SEC. We have not authorized anyone to provide you with different information. This prospectus and

any accompanying prospectus supplement do not constitute an offer to sell or the solicitation of an offer to buy any securities

other than the securities described in this prospectus or such accompanying prospectus supplement or an offer to sell or the solicitation

of an offer to buy such securities in any circumstances in which such offer or solicitation is unlawful. You should assume that

the information appearing in this prospectus, any prospectus supplement, the documents incorporated by reference and any related

free writing prospectus is accurate only as of their respective dates. Our business, financial condition, results of operations

and prospects may have changed materially since those dates.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and current

reports, proxy statements and other information with the SEC. Our SEC filings are available to the public over the Internet at

the SEC’s website at http://www.sec.gov. Copies of certain information filed by us with the SEC are also available on

our website at http://www.summittxinc.com. Our website is not a part of this prospectus and is not incorporated by reference in

this prospectus.

This prospectus is part of a registration

statement we filed with the SEC. This prospectus omits some information contained in the registration statement in accordance with

SEC rules and regulations. You should review the information and exhibits in the registration statement for further information

about us and our consolidated subsidiaries and the securities offered hereunder. Statements in this prospectus concerning any document

we filed as an exhibit to the registration statement or that we otherwise filed with the SEC are not intended to be comprehensive

and are qualified by reference to these filings. You should review the complete document to evaluate these statements. You can

obtain a copy of the registration statement from the SEC’s website.

INCORPORATION

BY REFERENCE

The SEC allows us to

incorporate by reference in this prospectus much of the information we file with the SEC, which means that we can disclose important

information to you by referring you to those publicly available documents. The information that we incorporate by reference in

this prospectus is considered to be part of this prospectus. Because we are incorporating by reference future filings with the

SEC, this prospectus is continually updated and those future filings may modify or supersede some of the information included or

incorporated in this prospectus. This means that you must look at all of the SEC filings that we incorporate by reference to determine

if any of the statements in this prospectus or in any document previously incorporated by reference have been modified or superseded.

This prospectus incorporates by reference the documents listed below and any future filings we make with the SEC under Sections

13(a), 13(c), 14 or 15(d) of the Exchange Act (in each case, other than those documents or the portions of those documents not

deemed to be filed) between the date of the initial registration statement and the effectiveness of the registration statement

and following the effectiveness of the registration statement until the offering of the securities under the registration statement

is terminated or completed:

|

|

·

|

Our Quarterly Report on Form 10-Q filed on November 16, 2020;

|

|

|

·

|

Our Current Reports on Form 8-K filed on September 18, 2020, September 29, 2020 (Item 8.01 only, which filing includes certain

financial statements relating to our predecessor, Old Summit (as defined below)), October 5, 2020, November 6, 2020, November 13, 2020 and November 23, 2020 (as amended on November 24, 2020); and

|

|

|

·

|

The description of the securities contained in our Current Report on Form 8-K dated September 18, 2020, including any amendment

or report filed for the purpose of updating such description.

|

You may request a copy of these filings, at

no cost, by writing or telephoning us at the following address or telephone number:

Summit Therapeutics Inc.

Attention: Investor Relations

One Broadway, 14th Floor

Cambridge, Massachusetts 02142

(617) 514-7149

FORWARD-LOOKING STATEMENTS

This prospectus and the information

incorporated by reference in this prospectus include “forward-looking statements” within the meaning of Section 27A

of the Securities Act, and Section 21E of the Exchange Act. All statements contained or incorporated by reference herein,

including statements regarding our strategy, future operations, future financial position, future revenue, projected costs, prospects,

plans, objectives of management and expected market growth, other than statements of historical facts, are forward-looking statements.

The words “anticipate,” “believe,” “estimate,” “expect,” “intend,”

“may,” “plan,” “predict,” “project,” “potential,” “will,”

“would,” “could,” “should,” “continue,” and similar expressions are intended to

identify forward-looking statements, although not all forward-looking statements contain these identifying words.

We may not actually achieve the plans,

intentions or expectations disclosed in our forward-looking statements, and you should not place undue reliance on our forward-looking

statements. Actual results or events could differ materially from the plans, intentions and expectations disclosed in the forward-looking

statements we make. You are cautioned that these forward-looking statements are only predictions and are subject to risks, uncertainties

and assumptions that are referenced in the section of any accompanying prospectus supplement entitled “Risk Factors.”

You should also carefully review the risk factors and cautionary statements described in the other documents we file from time

to time with the SEC, specifically our most recent Annual Report on Form 10-K, our Quarterly Reports on Form 10-Q and our

Current Reports on Form 8-K. We undertake no obligation to revise or update any forward-looking statements, except to the extent

required by law.

PROSPECTUS SUMMARY

The following summary highlights information

contained elsewhere or incorporated by reference into this prospectus. It may not contain all the information that may be important

to you. You should read this entire prospectus, including all documents incorporated by reference, carefully, especially the “Risk

Factors” contained in any applicable prospectus supplement and under similar headings in the other documents that are incorporated

by reference into this prospectus, and our financial statements and related notes incorporated by reference in this prospectus

before making an investment decision with respect to our securities. Please see the sections titled “Incorporation of Certain

Information by Reference” and “Where You Can Find More Information” in this prospectus.

Company Overview

We are a biopharmaceutical company focused on

the discovery, development and commercialization of novel antibiotics for serious infectious diseases. We are conducting a Phase

3 clinical program focused on the infectious disease C. difficile infection. We are also seeking to expand our

product candidate portfolio through the development of new mechanism, precision antibiotics using our proprietary Discuva Platform.

Our principal executive offices are located

at One Broadway, 14th Floor, Cambridge, Massachusetts 02142, and our telephone number is (617) 514-7149.

Recent Developments

On September 18,

2020, Summit Therapeutics Inc., a Delaware corporation, became the successor issuer to Summit Therapeutics plc, a public limited

company incorporated in England and Wales (“Old Summit”) for certain purposes under both the Securities Act of 1933,

as amended (the “Securities Act”), and the Securities Exchange Act of 1934, as amended (the “Exchange Act”).

Such succession occurred following the effectiveness of a United Kingdom court-approved scheme of arrangement in which every five

ordinary shares, £0.01 par value per share, of Old Summit were exchanged for one share of Common Stock, of Summit, which

resulted in Summit becoming the holding company of Old Summit and its subsidiaries.

On November 6, 2020, we closed a private placement

for a fundraising of $50 million through the issuance and sale of shares of Common Stock to our Chief Executive Officer and Executive

Chairman, Robert W. Duggan and to the Investors (as defined below). We consummated the transactions contemplated by that certain

Securities Purchase Agreement dated as of October 2, 2020 (the “Duggan SPA”), by and between the Company and Robert

W. Duggan, and entered into and consummated Securities Purchase Agreements (the “Investor Purchase Agreements”) with

each of Polar Capital Funds plc – Biotechnology Fund and the Mahkam Zanganeh Revocable Trust (together, the “Investors”).

Pursuant to the Duggan SPA and the Investor Purchase Agreements, the Company issued and sold to Mr. Duggan and the Investors 14,970,060

shares in the aggregate of Common Stock in a private placement at price per share of $3.34. The purchase price per share of Common

Stock represented the Nasdaq closing price per share of Common Stock immediately preceding the entry into the Duggan SPA. The Investor

Purchase Agreements provided for substantially similar terms as the Duggan SPA for the issuance and sale of Common Stock, excepting

the existence in the Duggan SPA of an executory period and the ability for the Company to reduce the number of shares to place

with Mr. Duggan and to instead place with additional investors for purchase in the Company’s sole discretion (subject to

certain terms and conditions). The Company exercised this right by placing certain additional shares with the Investors as described

above.

In connection with the entry into and closing

of the Investor Purchase Agreements, on November 6, 2020, the Company entered into a Registration Rights Agreement with the Investors,

whereby the Company has agreed to file a registration statement registering for resale the shares issued pursuant to the Investor

Purchase Agreements within 60 days of the closing, subject to certain customary terms and conditions (the “Registration Rights

Agreement”).

The Offering

|

Issuer:

|

Summit Therapeutics Inc.

|

|

Shares of Common Stock Offered for Resale by the Selling Stockholders:

|

Up to an aggregate of 69,333,633 shares, comprised of (i) 63,859,111 shares of Common Stock issued and outstanding and (ii) 5,474,522 shares of Common Stock issuable upon the exercise of warrants to purchase to Common Stock.

|

|

|

|

|

Use of Proceeds:

|

The selling stockholders will receive all of the net proceeds from the sale of the Shares. We will not receive any proceeds from the sale of the Shares.

|

|

Offering Price:

|

The selling stockholders may sell all or a portion of

their Shares through public or private transactions at prevailing market prices or at privately negotiated prices.

|

|

Market for our Common Stock:

|

Our Common Stock is listed on the Nasdaq Global Market.

|

|

Nasdaq Ticker Symbol:

|

SMMT

|

RISK FACTORS

An investment in our securities involves risks.

Before you invest in our securities, you should carefully consider the risk factors set forth in Exhibit 99.1 to our current report

on Form 8-K, filed with the Securities and Exchange Commission on September 29, 2020. In addition, the Company is providing an

updated risk factor set forth below to supplement the risk factors contained in Exhibit 99.1 to our current report on Form 8-K,

filed with the Securities and Exchange Commission on September 29, 2020. The risks referenced herein are not the only risks facing

our Company. Additional risk and uncertainties not currently known to us or that we currently deem to be immaterial also may materially

adversely affect our business, financial condition and/or operating results.

We will need substantial additional funding. If we are unable

to raise capital when needed, we could be forced to delay, reduce or eliminate our product development programs or commercialization

efforts.

While we received approximately $50 million

from the sale of our Common Stock in November 2020, we expect our research and development expenses to increase substantially in

connection with our ongoing activities, particularly as we initiate and continue clinical trials of ridinilazole for the treatment

of CDI, continue our research activities and initiate preclinical programs for other product candidates. In addition, if we obtain

marketing approval for ridinilazole where we retain commercial rights or any other product candidates we develop, we expect to

incur significant commercialization expenses related to product sales, marketing, distribution and manufacturing. Furthermore,

we expect to incur additional costs associated with operating as a domestic issuer in the United States following the domestication.

Accordingly, we will need to obtain substantial additional funding in connection with our continuing operations. If we are unable

to raise capital when needed or on attractive terms, we could be forced to delay, reduce or eliminate our research and development

programs or any future commercialization efforts.

We believe that our existing cash and cash equivalents,

as well as the remaining committed amounts receivable that we have been awarded under our contract with the Biomedical Advanced

Research and Development Authority, or BARDA, for the development of ridinilazole, will be sufficient to enable us to fund our

operating expenses and capital expenditure requirements until the fourth quarter of 2021. While these capital resources have allowed

us to initiate our two Phase 3 clinical trials of ridinilazole, we do not expect to be able to complete these trials without additional

capital. These circumstances led management to conclude that substantial doubt on our ability to continue as a going concern for

a period of one year from the issuance of our consolidated financial statements exists. Our failure to obtain sufficient funds

on acceptable terms when needed could have a material adverse effect on our business, results of operations and financial condition.

We have based the foregoing estimate on assumptions

that may prove to be wrong, and we could use our capital resources sooner than we currently expect. This estimate assumes, among

other things, that we do not obtain any additional funding through grants and clinical trial support or through new collaboration

arrangements. Our future capital requirements will depend on many factors, including:

|

|

·

|

the progress, costs and results of clinical trials of ridinilazole for CDI;

|

|

|

·

|

the number and development requirements of other product candidates that we pursue;

|

|

|

·

|

the costs, timing and outcome of regulatory review of ridinilazole and other product candidates we develop;

|

|

|

·

|

the costs and timing of commercialization activities, including product sales, marketing, distribution and manufacturing, for

any of our product candidates that receive marketing approval;

|

|

|

·

|

subject to receipt of marketing approval, revenue received from commercial sales of ridinilazole or any other product candidates;

|

|

|

·

|

the costs and timing of preparing, filing and prosecuting patent applications, maintaining and protecting our intellectual

property rights and defending against any intellectual property-related claims;

|

|

|

·

|

our contract with BARDA and whether BARDA elects to pursue its final designated option;

|

|

|

·

|

the amounts we receive from Eurofarma under our license and commercialization agreement, including for the achievement of development,

commercialization and sales milestones and for product supply transfers;

|

|

|

·

|

our ability to establish and maintain collaborations, licensing or other arrangements and the financial terms of such arrangements;

|

|

|

·

|

the extent to which we acquire or invest in other businesses, products and technologies;

|

|

|

·

|

the rate of the expansion of our physical presence;

|

|

|

·

|

the extent to which we change our physical presence; and

|

|

|

·

|

the costs of operating as a domestic issuer in the United States following the domestication.

|

Conducting preclinical testing and clinical

trials is a time-consuming, expensive and uncertain process that takes years to complete, and we may never generate the necessary

data or results required to obtain marketing approval and achieve product sales. In addition, our product candidates, if approved,

may not achieve commercial success. Our commercial revenues, if any, will be derived from sales of products that we are not planning

to have commercially available for several years, if at all. Accordingly, we will need to continue to rely on additional financing

to achieve our business objectives. In addition, we may seek additional capital due to favorable market conditions or strategic

considerations, even if we believe that we have sufficient funds for our current or future operating plans. Additional financing

may not be available to us on acceptable terms, or at all.

USE OF PROCEEDS

All of the Shares offered and sold

by the selling stockholders pursuant to this prospectus will be sold by the selling stockholders for their respective accounts.

We will not receive any of the proceeds from these sales.

SELLING STOCKHOLDERS

This prospectus covers the resale from

time to time of up to an aggregate of 69,333,633 shares of our Common Stock by the selling stockholders.

The selling stockholders identified

in the table below may from time to time offer and sell under this prospectus any or all of the Shares described under the column

“Number of Shares of Common Stock Being Offered” in the table below. The table

below has been prepared based upon information furnished to us by the selling stockholders as of the dates represented in the footnotes

accompanying the table. The selling stockholders identified below may have sold, transferred or otherwise disposed of some or all

of their shares since the date on which the information in the following table is presented in transactions exempt from or not

subject to the registration requirements of the Securities Act. Information concerning the selling stockholders may change from

time to time and, if necessary, we will amend or supplement this prospectus accordingly and as required.

The

following table and footnote disclosure following the table sets forth the name of each selling stockholder, the nature of any

position, office or other material relationship, if any, that the selling stockholders have had within the past three years with

us or with any of our predecessors or affiliates, and the number of shares of our Common Stock beneficially owned by the selling

stockholders before this offering. The number of shares reflected are those beneficially owned, as determined under applicable

rules of the SEC, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under applicable

SEC rules, beneficial ownership includes any shares of Common Stock as to which a person has sole or shared voting power or investment

power and any shares of Common Stock which the person has the right to acquire within 60 days after December 30, 2020 through the

exercise of any option, warrant or right or through the conversion of any convertible security. Unless otherwise indicated in the

footnotes to the table below and subject to community property laws where applicable, we believe, based on information furnished

to us that each of the selling stockholders named in this table has sole voting and investment power with respect to the shares

indicated as beneficially owned.

We

have assumed that all shares of Common Stock reflected in the table as being offered in the offering covered by this prospectus

will be sold from time to time in this offering. We cannot provide an estimate as to the number of shares of Common Stock that

will be held by the selling stockholders upon termination of the offering covered by this prospectus because the selling stockholders

may offer some, all or none of their shares of Common Stock being offered in the offering. Information about the selling stockholders

may change over time. Any changed information will be set forth in an amendment to the resale registration statement or supplement

to this prospectus, to the extent required by law.

|

|

Shares of Common Stock Beneficially Owned Prior to this Offering

|

Number of Shares of Common Stock Being Offered

|

Shares of Common Stock to be Beneficially Owned Upon Completion of this Offering

|

|

Selling Stockholder

|

Number

|

Percentage(2)

|

Number

|

Percentage(2)(9)

|

|

Robert W. Duggan(3)

|

60,281,588

|

69.64%

|

60,281,588

|

0

|

0%

|

|

Daniel Douglas Duggan Trust(4)

|

403,369

|

*

|

403,369

|

0

|

0%

|

|

Dante Eon Duggan Trust(4)

|

403,369

|

*

|

403,369

|

0

|

0%

|

|

David Michael Duggan Trust(4)

|

403,369

|

*

|

403,369

|

0

|

0%

|

|

Diamond Augustus Duggan Trust(4)

|

403,369

|

*

|

403,369

|

0

|

0%

|

|

Diana Star Duggan Trust(4)

|

403,369

|

*

|

403,369

|

0

|

0%

|

|

Dsara Ann Duggan Trust(4)

|

403,369

|

*

|

403,369

|

0

|

0%

|

|

Dylan Duke Duggan Trust(4)

|

403,369

|

*

|

403,369

|

0

|

0%

|

|

The Mahkam Zanganeh Revocable Trust(5)

|

2,569,923

|

3.10%

|

2,569,923

|

0

|

0%

|

|

The Shaun Zanganeh Irrevocable Trust(6)

|

2,420,222

|

2.92%

|

2,420,222

|

0

|

0%

|

|

Mahkam Zanganeh(7)

|

5,483,282

|

6.55%

|

5,479,959

|

3,323

|

*

|

|

Polar Capital Funds plc – Biotechnology Fund(8)

|

5,936,147

|

7.17%

|

748,503

|

5,187,644

|

6.27%

|

(1) All information

regarding selling stockholders is based on information provided to the Company as of December 30, 2020.

(2) Percentage ownership

is based on a denominator equal to the sum of (i) 82,575,064 shares of our Common Stock outstanding as of December 30, 2020 and

(ii) the number of shares of Common Stock issuable upon exercise or conversion of convertible securities beneficially owned by

the applicable selling stockholder.

(3) The securities

held by Robert Duggan, our Chief Executive Officer and Executive Chairman, consist of 56,296,533 shares of Common Stock and include

the exercise of warrants to purchase 3,985,055 shares of Common Stock. Mr. Duggan first acquired a material ownership stake in

Old Summit on January 9, 2019 pursuant to a Securities Purchase Agreement with Old Summit dated December 14, 2018. On December

24, 2019, Mr. Duggan acquired additional securities in Old Summit pursuant to a Securities Purchase Agreement dated December 6,

2019. All of Mr. Duggan’s securities in Old Summit were converted into shares of Common Stock and warrants to purchase Common

Stock in connection with the domestication on September 18, 2020 of the Company as a Delaware corporation. On November 6, 2020,

he acquired additional shares of Common Stock pursuant to the Duggan SPA. Mr. Duggan was first elected to our board of directors

in December 2019, and became Executive Chairman of the board of directors in February 2020. He has served as our Chief Executive

Officer since April 14, 2020.

(4) The securities

held by the Daniel Douglas Duggan Trust, Dante Eon Duggan Trust, David Michael Duggan Trust, Diamond Augustus Duggan Trust, Diana

Star Duggan Trust, Dsara Ann Duggan Trust and Dylan Duke Duggan Trust (collectively, the “Duggan Trusts”) were acquired

pursuant to a Securities Purchase Agreement dated December 24, 2019, pursuant to which the Duggan Trusts purchased certain securities

in Old Summit (the predecessor of the Company) from Robert Duggan, our Chief Executive Officer and Executive Chairman, which securities

were converted into shares of Common Stock and warrants to purchase Common Stock in connection with the domestication on September

18, 2020 of the Company as a Delaware corporation. The securities held by each Duggan Trust consist of 350,756 shares of Common

Stock and include the exercise of warrants to purchase 52,613 shares of Common Stock. Mr. Duggan’s children are the sole

beneficiaries of each Duggan Trust established in their respective names. Mr. Duggan does not act as trustee of any Duggan Trust,

or serve in any other capacity which would afford him voting or investment power over the assets of any such trust. Mr. Duggan

disclaims any beneficial ownership in any of the securities of the Company held by the Duggan Trusts.

(5) The securities

held by the Mahkam Zanganeh Revocable Trust (the “MZ Trust”) consist of 2,254,242 shares of Common Stock and include

the exercise of warrants to purchase 315,681 shares of Common Stock. The securities held by the MZ Trust were acquired pursuant

to (i) a Securities Purchase Agreement dated December 24, 2019, pursuant to which the MZ Trust purchased certain securities in

Old Summit (the predecessor of the Company) from our Chief Executive Officer and Executive Chairman, Robert Duggan, which securities

were converted into shares of Common Stock and warrants to purchase Common Stock in connection with the domestication on September

18, 2020 of the Company as a Delaware corporation and (ii) a Securities Purchase Agreement dated November 6, 2020 by and between

the MZ Trust and the Company. As trustee of the MZ Trust, Dr. Mahkam Zanganeh, our Chief Operating Officer and a member of our

board of directors, may be deemed to beneficially own the securities of the Company owned by the MZ Trust.

(6) The securities

held by the Shaun Zanganeh Irrevocable Trust (the “SZ Trust”) consist of 2,104,541 shares of Common Stock and includes

the exercise of warrants to purchase 315,681 shares of Common Stock. The securities held by the SZ Trust were acquired pursuant

to a Securities Purchase Agreement dated December 24, 2019, pursuant to which the SZ Trust purchased certain securities in Old

Summit (the predecessor of the Company) from our Chief Executive Officer and Executive Chairman, Robert Duggan, which securities

were converted into shares of Common Stock and warrants to purchase Common Stock in connection with the domestication on September

18, 2020 of the Company as a Delaware corporation. As trustee of the SZ Trust, Dr. Mahkam Zanganeh, our Chief Operating Officer

and a member of our board of directors, may be deemed to beneficially own the securities of the Company owned by the SZ Trust.

(7) The securities

held by Mahkam Zanganeh include (i) those securities listed herein by both the MZ Trust and SZ Trust, over which Dr. Zanganeh,

as the sole trustee of each trust, may be deemed to have shared dispositive power, (ii) the exercise of warrants to purchase 489,814

shares of Common Stock and (iii) options to purchase 3,323 shares of Common Stock which were granted to Dr. Zanganeh pursuant to

the Company’s 2020 Stock Incentive Plan and which are scheduled to vest and become exercisable on December 31, 2020. The

warrants held by Dr. Zanganeh were acquired in connection with a consulting relationship by and between Old Summit and Maky Zanganeh

& Associates Inc. (“MZA”) pursuant to a Consulting Agreement, which was terminated on June 29, 2020 by mutual agreement

in accordance with its terms. Pursuant to the Consulting Agreement, MZA had received an allotment of warrants to purchase ordinary

shares in Old Summit. The warrants granted to MZA were transferred to Dr. Zanganeh (other than a small number of warrants which

were transferred to an employee of MZA) and such warrants were converted into warrants to purchase Common Stock in connection with

the domestication on September 18, 2020 of the Company as a Delaware corporation. Dr. Zanganeh is the sole stockholder of MZA.

(8) The securities

held by Polar Capital Funds plc – Biotechnology Fund (“Polar”) consist of 5,936,147 shares of Common Stock in

the aggregate and include the exercise of warrants to purchase 186,147 shares of Common Stock. The securities held by Polar were

acquired pursuant to (i) a Securities Purchase Agreement dated November 6, 2020 by and between Polar and the Company and (ii) acquired

through transactions in the open market. The shares of common stock are beneficially owned by Polar Capital Funds plc – Biotechnology

Fund, a sub fund of the Polar Capital Funds plc umbrella. This entity is wholly controlled by Polar Capital LLP, an FCA and SEC

regulated fund manager/investment advisor. Polar Capital LLP is 100% owned by Polar Capital Partners Ltd, which is in turn 100%

owned by Polar Capital Holdings plc our London AIM listed holding company. Certain directors/employees are beneficial owners of

Polar Capital Holdings plc but each such individual disclaims any beneficial ownership of the reported shares, other than to the

extent they may or may not hold shares directly of Polar Capital Funds plc – Biotechnology Fund.

(9) Assumes that

all shares of Common Stock being registered for resale under the registration statement of which this prospectus forms a part

are sold in this offering, and that none of the selling stockholders dispose of any additional shares of our Common Stock after

the date of this prospectus and prior to completion of this offering.

DESCRIPTION OF CAPITAL STOCK

The following description of our capital

stock is intended as a summary only and therefore is not a complete description of our capital stock. This description is based

upon, and is qualified by reference to, our restated certificate of incorporation, our amended and restated bylaws and applicable

provisions of Delaware corporate law. You should read our restated certificate of incorporation and amended and restated bylaws,

which are filed as exhibits to the registration statement of which this prospectus forms a part, for the provisions that are important

to you.

Our authorized capital stock consists of 250,000,000

shares of common stock, $0.01 par value per share and 20,000,000 shares of preferred stock, $0.01 par value per share. As of December

30, 2020, 82,575,064 shares of common stock were outstanding, and no shares of preferred stock were outstanding.

Common Stock

Annual Meeting. Annual meetings of our

stockholders are held on the date designated in accordance with our by-laws. Written notice must be mailed to each stockholder

entitled to vote not less than ten nor more than 60 days before the date of the meeting. The presence in person or by proxy of

the holders of record of a majority of our issued and outstanding shares entitled to vote at such meeting constitutes a quorum

for the transaction of business at meetings of the stockholders. Special meetings of the stockholders may be called for any purpose

by the board of directors and shall be called by the secretary upon the written request, stating the purpose of such meeting, of

the holders of at least twenty-five percent (25%) of the shares of capital stock entitled to vote in an election of directors.

Except as may be otherwise provided by applicable law, our certificate of incorporation or our by-laws, all elections shall be

decided by a plurality, and all other questions shall be decided by a majority, of the votes cast by stockholders entitled to vote

thereon at a duly held meeting of stockholders at which a quorum is present.

Voting Rights. Each holder of common

stock is entitled to one vote for each share held of record on all matters to be voted upon by stockholders.

Dividends. Subject to the rights, powers

and preferences of any outstanding preferred stock, and except as provided by law or in our certificate of incorporation, dividends

may be declared and paid or set aside for payment on the common stock out of legally available assets or funds when and as declared

by the board of directors.

Liquidation, Dissolution and Winding Up.

Subject to the rights, powers and preferences of any outstanding preferred stock, in the event of our liquidation, dissolution

or winding up, our net assets will be distributed pro rata to the holders of our common stock.

Other Rights. Holders of the common

stock have no right to:

|

|

·

|

convert the stock into any other security;

|

|

|

·

|

have the stock redeemed;

|

|

|

·

|

purchase additional stock; or

|

|

|

·

|

maintain their proportionate ownership interest.

|

The common stock does not have cumulative voting

rights. Holders of shares of the common stock are not required to make additional capital contributions.

Transfer Agent and Registrar. Computershare

Trust Company, N.A. is transfer agent and registrar for the common stock.

Preferred Stock

We are authorized to issue “blank

check” preferred stock, which may be issued in one or more series upon authorization of our board of directors. Our board

of directors is authorized to fix the designations, powers, preferences and the relative, participating, optional or other special

rights and any qualifications, limitations and restrictions of the shares of each series of preferred stock. The authorized shares

of our preferred stock are available for issuance without further action by our stockholders, unless such action is required by

applicable law or the rules of any stock exchange on which our securities may be listed. If the approval of our stockholders is

not required for the issuance of shares of our preferred stock, our board may determine not to seek stockholder approval.

A series of our preferred stock could,

depending on the terms of such series, impede the completion of a merger, tender offer or other takeover attempt. Our board of

directors will make any determination to issue preferred shares based upon its judgment as to the best interests of our stockholders.

Our directors, in so acting, could issue preferred stock having terms that could discourage an acquisition attempt through which

an acquirer may be able to change the composition of our board of directors, including a tender offer or other transaction that

some, or a majority, of our stockholders might believe to be in their best interests or in which stockholders might receive a premium

for their stock over the then-current market price of the stock.

The preferred stock has the terms described

below unless otherwise provided relating to a particular series of preferred stock. You should read any applicable offering documents

relating to any particular series of preferred stock being offered for specific terms, including:

|

|

·

|

the designation and stated value per share of the preferred stock and the number of shares offered;

|

|

|

·

|

the amount of liquidation preference per share;

|

|

|

·

|

the price at which the preferred stock will be issued;

|

|

|

·

|

the dividend rate, or method of calculation of dividends, the dates on which dividends will be payable, whether dividends will

be cumulative or noncumulative and, if cumulative, the dates from which dividends will commence to accumulate;

|

|

|

·

|

any redemption or sinking fund provisions;

|

|

|

·

|

if other than the currency of the United States, the currency or currencies including composite currencies in which the preferred

stock is denominated and/or in which payments will or may be payable;

|

|

|

·

|

any conversion provisions; and

|

|

|

·

|

any other rights, preferences, privileges, limitations and restrictions on the preferred stock.

|

The preferred stock will, when issued,

be fully paid and non-assessable. Unless otherwise specified, each series of preferred stock will rank equally as to dividends

and liquidation rights in all respects with each other series of preferred stock. The rights of holders of shares of each series

of preferred stock will be subordinate to those of our general creditors.

Rank. Unless otherwise specified,

the preferred stock will, with respect to dividend rights and rights upon our liquidation, dissolution or winding up of our affairs,

rank:

|

|

·

|

senior to our common stock and to all equity securities ranking junior to such preferred stock with respect to dividend rights

or rights upon our liquidation, dissolution or winding up of our affairs;

|

|

|

·

|

on a parity with all equity securities issued by us, the terms of which specifically provide that such equity securities rank

on a parity with the preferred stock with respect to dividend rights or rights upon our liquidation, dissolution or winding up

of our affairs; and

|

|

|

·

|

junior to all equity securities issued by us, the terms of which specifically provide that such equity securities rank senior

to the preferred stock with respect to dividend rights or rights upon our liquidation, dissolution or winding up of our affairs.

|

The term “equity securities”

does not include convertible debt securities.

Dividends. Holders of the preferred

stock of each series will be entitled to receive, when, as and if declared by our board of directors, cash dividends at such rates

and on such dates as may be determined by our board of directors. Different series of preferred stock may be entitled to dividends

at different rates or based on different methods of calculation. The dividend rate may be fixed or variable or both. Dividends

will be payable to the holders of record as they appear on our stock books on record dates fixed by our board of directors.

Dividends on any series of preferred

stock may be cumulative or noncumulative. If our board of directors does not declare a dividend payable on a dividend payment date

on any series of noncumulative preferred stock, then the holders of that noncumulative preferred stock will have no right to receive

a dividend for that dividend payment date, and we will have no obligation to pay the dividend accrued for that period, whether

or not dividends on that series are declared payable on any future dividend payment dates. Dividends on any series of cumulative

preferred stock will accrue from the date we initially issue shares of such series or such other date specified.

No dividends may be declared or paid

or funds set apart for the payment of any dividends on any parity securities unless full dividends have been paid or set apart

for payment on the preferred stock. If full dividends are not paid, the preferred stock will share dividends pro rata with the

parity securities.

No dividends may be declared or paid

or funds set apart for the payment of dividends on any junior securities unless full dividends for all dividend periods terminating

on or prior to the date of the declaration or payment will have been paid or declared and a sum sufficient for the payment set

apart for payment on the preferred stock.

Liquidation Preference. Upon any

voluntary or involuntary liquidation, dissolution or winding up of our affairs, then, before we make any distribution or payment

to the holders of any common stock or any other class or series of our capital stock ranking junior to the preferred stock in the

distribution of assets upon any liquidation, dissolution or winding up of our affairs, the holders of each series of preferred

stock shall be entitled to receive out of assets legally available for distribution to stockholders, liquidating distributions

in the amount of the liquidation preference per share applicable for each such series of preferred stock, plus any accrued and

unpaid dividends thereon. Such dividends will not include any accumulation in respect of unpaid noncumulative dividends for prior

dividend periods. Unless otherwise specified, after payment of the full amount of their liquidating distributions, the holders

of preferred stock will have no right or claim to any of our remaining assets. Upon any such voluntary or involuntary liquidation,

dissolution or winding up, if our available assets are insufficient to pay the amount of the liquidating distributions on all outstanding

preferred stock and the corresponding amounts payable on all other classes or series of our capital stock ranking on parity with

the preferred stock and all other such classes or series of shares of capital stock ranking on parity with the preferred stock

in the distribution of assets, then the holders of the preferred stock and all other such classes or series of capital stock will

share ratably in any such distribution of assets in proportion to the full liquidating distributions to which they would otherwise

be entitled.

Upon any such liquidation, dissolution

or winding up and if we have made liquidating distributions in full to all holders of preferred stock, we will distribute our remaining

assets among the holders of any other classes or series of capital stock ranking junior to the preferred stock according to their

respective rights and preferences and, in each case, according to their respective number of shares. For such purposes, our consolidation

or merger with or into any other corporation, trust or entity, or the sale, lease or conveyance of all or substantially all of

our property or assets will not be deemed to constitute a liquidation, dissolution or winding up of our affairs.

Redemption. The preferred stock

may be subject to mandatory redemption or redemption at our option, as a whole or in part, in each case upon the terms, at the

times and at the redemption prices as may be determined by our board of directors.

A series of preferred stock that is subject

to mandatory redemption will specify the number of shares of preferred stock that shall be redeemed by us in each year commencing

after a date to be specified, at a redemption price per share to be specified, together with an amount equal to all accrued and

unpaid dividends thereon to the date of redemption. Unless the shares have a cumulative dividend, such accrued dividends will not

include any accumulation in respect of unpaid dividends for prior dividend periods. We may pay the redemption price in cash or

other property. If the redemption price for preferred stock of any series is payable only from the net proceeds of the issuance

of shares of our capital stock, the terms of such preferred stock may provide that, if no such shares of our capital stock shall

have been issued or to the extent the net proceeds from any issuance are insufficient to pay in full the aggregate redemption price

then due, such preferred stock shall automatically and mandatorily be converted into the applicable shares of our capital stock

pursuant to conversion provisions applicable to such preferred stock. Notwithstanding the foregoing, we will not redeem any preferred

stock of a series unless:

|

|

·

|

if that series of preferred stock has a cumulative dividend, we have declared and paid or contemporaneously declare and pay

or set aside funds to pay full cumulative dividends on the preferred stock for all past dividend periods and the then current dividend

period; or

|

|

|

·

|

if such series of preferred stock does not have a cumulative dividend, we have declared and paid or contemporaneously declare

and pay or set aside funds to pay full dividends for the then current dividend period.

|

In addition, we will not acquire any

preferred stock of a series unless:

|

|

·

|

if that series of preferred stock has a cumulative dividend, we have declared and paid or contemporaneously declare and pay

or set aside funds to pay full cumulative dividends on all outstanding shares of such series of preferred stock for all past dividend

periods and the then current dividend period; or

|

|

|

·

|

if that series of preferred stock does not have a cumulative dividend, we have declared and paid or contemporaneously declare

and pay or set aside funds to pay full dividends on the preferred stock of such series for the then current dividend period.

|

However, at any time we may purchase

or acquire preferred stock of that series (1) pursuant to a purchase or exchange offer made on the same terms to holders of all

outstanding preferred stock of such series or (2) by conversion into or exchange for shares of our capital stock ranking junior

to the preferred stock of such series as to dividends and upon liquidation.

If fewer than all of the outstanding

shares of preferred stock of any series are to be redeemed, we will determine the number of shares that may be redeemed pro rata

from the holders of record of such shares in proportion to the number of such shares held or for which redemption is requested

by such holder or by any other equitable manner that we determine. Such determination will reflect adjustments to avoid redemption

of fractional shares.

Unless otherwise specified, we will mail

notice of redemption at least 30 days but not more than 60 days before the redemption date to each holder of record of preferred

stock to be redeemed at the address shown on our stock transfer books. Each notice shall state:

|

|

·

|

the number of shares and series of preferred stock to be redeemed;

|

|

|

·

|

the place or places where certificates for such preferred stock are to be surrendered for payment of the redemption price;

|

|

|

·

|

that dividends on the shares to be redeemed will cease to accrue on such redemption date;

|

|

|

·

|

the date on which the holder’s conversion rights, if any, as to such shares shall terminate; and

|

|

|

·

|

the specific number of shares to be redeemed from each such holder if fewer than all the shares of any series are to be redeemed.

|

If notice of redemption has been given

and we have set aside the funds necessary for such redemption in trust for the benefit of the holders of any shares called for

redemption, then from and after the redemption date, dividends will cease to accrue on such shares, and all rights of the holders

of such shares will terminate, except the right to receive the redemption price.

Voting Rights. Holders of preferred

stock will not have any voting rights, except as required by law or as otherwise determined by our board of directors.

Unless otherwise provided for under the

terms of any series of preferred stock, no consent or vote of the holders of shares of preferred stock or any series thereof shall

be required for any amendment to our restated certificate of incorporation that would increase the number of authorized shares

of preferred stock or the number of authorized shares of any series thereof or decrease the number of authorized shares of preferred

stock or the number of authorized shares of any series thereof (but not below the number of authorized shares of preferred stock

or such series, as the case may be, then outstanding).

Conversion Rights. The terms and

conditions, if any, upon which any series of preferred stock is convertible into our common stock will be determined by our board

of directors. Such terms will include the number of shares of common stock into which the shares of preferred stock are convertible,

the conversion price, rate or manner of calculation thereof, the conversion period, provisions as to whether conversion will be

at our option or at the option of the holders of the preferred stock, the events requiring an adjustment of the conversion price

and provisions affecting conversion in the event of the redemption.

Transfer Agent and Registrar.

The transfer agent and registrar for the preferred stock will be determined by our board of directors.

Certain Provisions of Our Certificate of Incorporation

and By-laws and Delaware Law

Board of Directors. All of our

directors are elected annually. The number of directors comprising our board of directors is fixed from time to time by the board

of directors.

Stockholder Nomination of Directors.

Our by-laws provide that a stockholder must notify us in writing of any stockholder nomination of a director not earlier than the

120th day and not later than the 90th day prior to the first anniversary of the preceding year’s annual

meeting; provided, that if the date of the annual meeting is advanced or delayed by more than 30 days from such anniversary date,

notice by the stockholder to be timely must be so delivered not earlier than the 120th day prior to the date of such

annual meeting and not later than the 90th day prior to the date of such meeting and (y) the 10th day following

the day on which public announcement of the date of such annual meeting is first made by us.

Exclusive forum provision. Our

restated certificate of incorporation provides that, unless we consent in writing to the selection of an alternative forum, the

Court of Chancery of the State of Delaware (or, if the Court of Chancery of the State of Delaware does not have jurisdiction, the

federal district court for the District of Delaware) shall be the sole and exclusive forum for the following types of proceedings:

(1) any derivative action or proceeding brought on behalf of our company, (2) any action asserting a claim of breach of a fiduciary

duty owed by any of our directors, officers, employees or stockholders to our company or our stockholders, (3) any action asserting

a claim arising pursuant to any provision of the General Corporation Law of the State of Delaware or as to which the General Corporation

Law of the State of Delaware confers jurisdiction on the Court of Chancery of the State of Delaware, or (4) any action asserting

a claim arising pursuant to any provision of our restated certificate of incorporation or amended and restated bylaws (in each

case, as they may be amended from time to time) or governed by the internal affairs doctrine. These choice of forum provisions

will not apply to suits brought to enforce a duty or liability created by the Exchange Act. Furthermore, Section 22 of the Securities

Act creates concurrent jurisdiction for federal and state courts over all such Securities Act actions. Accordingly, both state

and federal courts have jurisdiction to entertain such claims. To prevent having to litigate claims in multiple jurisdictions and

the threat of inconsistent or contrary rulings by different courts, among other considerations, our certificate of incorporation

provides that, unless we consent in writing to the selection of an alternative forum, the federal district courts of the United

States of America shall, to the fullest extent permitted by law, be the sole and exclusive forum for the resolution of any claims

arising under the Securities Act. While the Delaware courts have determined that such choice of forum provisions are facially valid,

a stockholder may nevertheless seek to bring a claim in a venue other than those designated in the exclusive forum provisions.

In such instance, we would expect to vigorously assert the validity and enforceability of the exclusive forum provisions of our

restated certificate of incorporation. This may require significant additional costs associated with resolving such action in other

jurisdictions and there can be no assurance that the provisions will be enforced by a court in those other jurisdictions.

PLAN OF DISTRIBUTION

We are registering

the Shares to permit the resale of the Shares by the selling stockholders from time to time after the date of this prospectus.

We will not receive any of the proceeds from the sale by the selling stockholders of the Shares. We will bear all fees and expenses

incident to the registration of the Shares including, without limitation, SEC filing fees and expenses of compliance with state

securities or “blue sky” laws; provided, however, that each selling stockholder will pay all

underwriting discounts and selling commissions or fees incident to sales of the Shares, if any, and any related legal expenses

incurred by such selling stockholder.

The selling stockholders, which as used

herein includes donees, pledgees, transferees or other successors-in-interest selling Common Stock or interests in Common Stock

received after the date of this prospectus from a selling stockholder as a gift, pledge, partnership distribution or other transfer,

may, from time to time, sell, transfer or otherwise dispose of any or all of their Shares or interests in Shares on any stock exchange,

market or trading facility on which the Common Stock is traded or in private transactions. These dispositions may be at fixed prices,

at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined

at the time of sale, or at negotiated prices.

The selling stockholders may use any

one or more of the following methods when disposing of Shares or interests therein:

|

|

·

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

·

|

block trades in which the broker-dealer will attempt to sell shares as agent, but may position and resell a portion of the

block as principal to facilitate the transaction;

|

|

|

·

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

·

|

an exchange distribution in accordance with the rules of the applicable exchange; – privately negotiated transactions;

|

|

|

·

|

short sales effected after the date the registration statement of which this prospectus is a part is declared effective by

the SEC;

|

|

|

·

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

·

|

broker-dealers may agree with the selling holders to sell a specified number of such Shares at a stipulated price per share;

|

|

|

·

|

a combination of any such methods of sale;

|

|

|

·

|

privately negotiated transactions; and

|

|

|

·

|

any other method permitted by applicable law.

|

The selling stockholders may, from time

to time, pledge or grant a security interest in some or all of the Shares owned by them and, if they default in the performance

of their secured obligations, the pledgees or secured parties may offer and sell the Shares, from time to time, under this prospectus,

or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act amending the

list of selling stockholders to include the pledgee, transferee or other successors in interest as selling stockholders under this

prospectus. The selling stockholders also may transfer the shares of Common Stock in other circumstances, in which case the transferees,

pledgees or other successors in interest will be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of Shares

or interests therein, the selling stockholders may enter into hedging transactions with broker-dealers or other financial institutions,

which may in turn engage in short sales of shares of Common Stock in the course of hedging the positions they assume. The selling

stockholders may also sell shares of Common Stock short and deliver Shares to close out their short positions, or loan or pledge

Shares to broker-dealers that in turn may sell such Shares. The selling stockholders may also enter into option or other transactions

with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery

to such broker-dealer or other financial institution of shares of Common Stock offered by this prospectus, which shares such broker-dealer

or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The aggregate proceeds to the selling

stockholders from the sale of the Shares offered by them will be the purchase price of the shares less discounts or commissions,

if any. Each of the selling stockholders reserves the right to accept and, together with their agents from time to time, to reject,

in whole or in part, any proposed purchase of Shares to be made directly or through agents. We will not receive any of the proceeds

from this offering.

The selling stockholders also may resell

all or a portion of the shares of Common Stock in open market transactions in reliance upon Rule 144 under the Securities Act of

1933, provided that they meet the criteria and conform to the requirements of that rule.

The selling stockholders and any underwriters,

broker-dealers or agents that participate in the sale of the shares of Common Stock or interests therein may be “underwriters”

within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit they earn on any resale

of the shares of Common Stock may be underwriting discounts and commissions under the Securities Act. Selling stockholders who

are “underwriters” within the meaning of Section 2(11) of the Securities Act will be subject to the prospectus delivery

requirements of the Securities Act.

To the extent required, the Shares to

be sold, the names of the selling stockholders, the respective purchase prices and public offering prices, the names of any agents,

dealer or underwriter, any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying

prospectus supplement or, if appropriate, a post-effective amendment to the registration statement that includes this prospectus.

In order to comply with the securities

laws of some states, if applicable, the Shares may be sold in these jurisdictions only through registered or licensed brokers or

dealers. In addition, in some states the Shares may not be sold unless they have been registered or qualified for sale or an exemption

from registration or qualification requirements is available and is complied with.

We have advised the selling stockholders

that the anti-manipulation rules of Regulation M under the Exchange Act may apply to sales of shares of Common Stock in the market

and to the activities of the selling stockholders and their affiliates. In addition, to the extent applicable we will make copies

of this prospectus (as it may be supplemented or amended from time to time) available to the selling stockholders for the purpose

of satisfying the prospectus delivery requirements of the Securities Act. The selling stockholders may indemnify any broker-dealer

that participates in transactions involving the sale of the shares of Common Stock against certain liabilities, including liabilities

arising under the Securities Act.

We have agreed to indemnify the selling

stockholders against liabilities, including liabilities under the Securities Act and state securities laws, relating to the registration

of the shares of Common Stock offered by this prospectus.

Pursuant to the Registration Rights Agreement,

we have agreed with the Investors to keep the registration statement of which this prospectus constitutes a part effective until

the earliest of (1) such time as all of their Shares covered by this prospectus have been disposed of pursuant to and in accordance

with such registration statement, (2) the date on which all of their Shares may be sold without restriction pursuant to Rule 144

of the Securities Act or (3) the date that is five years after the date on which the Investors acquired their Shares.

LEGAL MATTERS

Unless an applicable prospectus supplement

indicates otherwise, the validity of the securities in respect of which this prospectus is being delivered will be passed upon

by Olshan Frome Wolosky LLP.

EXPERTS

The financial statements incorporated

in this prospectus by reference to the Company’s Current Report on Form 8-K filed dated September 29, 2020 have been

so incorporated in reliance on the report (which contains an explanatory paragraph relating to the Company’s ability to continue

as a going concern as described in Note 2 to the financial statements) of PricewaterhouseCoopers LLP, an independent registered

public accounting firm, given on the authority of said firm as experts in auditing and accounting.

SUMMIT THERAPEUTICS INC.

63,859,111 Shares of Common Stock

5,474,522 Shares of Common Stock Issuable

Upon Exercise of Certain Existing Warrants

PROSPECTUS

,

2021

PART II.

INFORMATION NOT REQUIRED IN PROSPECTUS

Item 14. Other Expenses of Issuance and Distribution.

Set forth below are estimates (except

in the case of the SEC registration fee) of the amount of fees and expenses to be incurred by us in connection with the issuance

and distribution of the offered securities.

|

SEC registration fee

|

|

$

|

37,745.85

|

|

|

Printing and engraving

|

|

|

—

|

|

|

Accounting services

|

|

|

5,000.00

|

|

|

Legal fees of registrant’s counsel

|

|

|

10,000.00

|

|

|

Miscellaneous

|

|

|

5,000.00

|

|

|

Total

|

|

$

|

57,745.85

|

|

|

|

Item 15.

|

Indemnification of Directors and Officers.

|

Section 102 of the Delaware General

Corporation Law permits a corporation to eliminate the personal liability of directors of a corporation to the corporation or its

stockholders for monetary damages for a breach of fiduciary duty as a director, except where the director breached his duty of

loyalty, failed to act in good faith, engaged in intentional misconduct or knowingly violated a law, authorized the payment of

a dividend or approved a stock repurchase in violation of Delaware corporate law or obtained an improper personal benefit. The

registrant’s certificate of incorporation provides that none of its directors shall be personally liable to the registrant

or its stockholders for monetary damages for any breach of fiduciary duty as director, notwithstanding any provision of law imposing

such liability, except to the extent that the Delaware General Corporation Law prohibits the elimination or limitation of liability

of directors for breaches of fiduciary duty.

Section 145 of the Delaware General

Corporation Law provides that a corporation has the power to indemnify a director, officer, employee or agent of the corporation

and certain other persons serving at the request of the corporation in related capacities against expenses (including attorneys’

fees), judgments, fines and amounts paid in settlements actually and reasonably incurred by the person in connection with an action,