FALSE000070738800007073882023-11-082023-11-080000707388us-gaap:CommonStockMember2023-11-082023-11-080000707388us-gaap:SeriesAMember2023-11-082023-11-08

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of

The Securities Exchange Act of 1934

Date of Report:

November 8, 2023

(Date of earliest event reported)

Star Equity Holdings, Inc.

(Exact name of registrant as specified in its charter)

| | | | | | | | | | | | | | |

| Delaware | | 001-35947 | | 33-0145723 |

| (State or other jurisdiction of incorporation) | | (Commission File Number) | | (IRS Employer

Identification No.) |

53 Forest Ave, Suite 101

Old Greenwich, CT 06870

(Address of principal executive offices, including zip code)

(203) 489-9500

(Registrant’s telephone number, including area code)

Not Applicable

(Former name or former address, if changed since last report)

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

☐ Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425)

☐ Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

☐ Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

☐ Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

Securities registered pursuant to Section 12(b) of the Act: | | | | | | | | |

| Title of each class | Trading Symbol(s) | Name of each exchange

on which registered |

| Common Stock, par value $0.0001 per share | STRR | NASDAQ Global Market |

Series A Cumulative Perpetual Preferred Stock, par value $0.0001 per share

| STRRP | NASDAQ Global Market |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§232.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 2.02. Results of Operations and Financial Condition

On November 8, 2023, Star Equity Holdings, Inc. (the “Registrant”) issued a press release announcing financial results for the three and nine months ended September 30, 2023. A copy of the press release is furnished as Exhibit 99.1 to this Current Report on Form 8-K.

The information contained herein and in the accompanying exhibit shall not be incorporated by reference into any filing of the Registrant, whether made before or after the date hereof, regardless of any general incorporation language in such filing, unless expressly incorporated by specific reference to such filing. The information in this report, including the exhibit hereto, shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section or Sections 11 and 12(a)(2) of the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits

(d) Exhibits:

| | | | | | | | |

| Exhibit No. | | Description |

| | |

| | Press Release of Star Equity Holdings, Inc. dated November 8, 2023 |

| | Information Related to the Use of Non-GAAP Financial Measures |

| 104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURES

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

| | | | | | | | | | | |

| | Star Equity Holdings, Inc. |

| | |

| By: | /s/ Richard K. Coleman, Jr. | |

| | Richard K. Coleman, Jr. Chief Executive Officer

|

Date: November 8, 2023

Exhibit 99.1

| | | | | | | | |

| For immediate release | | |

November 8, 2023 | | |

Star Equity Holdings, Inc. Announces 2023 Third Quarter Financial Results

Ended the third quarter with cash and cash equivalents of $20.7 million; well positioned to expand existing businesses organically or grow through acquisitions of bolt-ons or new verticals

Old Greenwich, CT. - Star Equity Holdings, Inc. (Nasdaq: STRR; STRRP) (“Star Equity” or the “Company”), a diversified holding company, reported today its financial results for the third quarter (Q3) ended September 30, 2023. All 2023 and 2022 amounts in this release are unaudited.

Following the sale of our Digirad Health business on May 4, 2023, all financial results for the 2023 and 2022 reporting periods, unless stated otherwise, relate to continuing operations, which currently include two divisions: Construction and Investments.

Q3 2023 Financial Highlights vs. Q3 2022 (unaudited)

•Revenues decreased by 6.1% to $10.4 million from $11.1 million.

•Gross profit decreased by 28.3% to $2.2 million from $3.1 million.

•Net loss from continuing operations was $2.4 million (or $0.15 per basic and diluted share) compared to a net loss from continuing operations of $1.0 million (or $0.06 per basic and diluted share).

•Non-GAAP adjusted net income was $0.2 million (or $0.01 per diluted share) compared to a net income of $0.3 million (or $0.02 per diluted share).

•Non-GAAP adjusted EBITDA was a loss of $14 thousand versus income of $0.6 million.

Year-to-Date 2023 Financial Highlights vs. Year-to-Date 2022 (unaudited)

•Revenues decreased by 19.9% to $31.7 million from $39.5 million.

•Gross profit increased by 29.9% to $9.1 million from $7.0 million.

•Net loss from continuing operations was $3.7 million (or $0.24 per basic and diluted share) compared to a net loss from continuing operations of $6.7 million (or $0.46 per basic and diluted share).

•Non-GAAP adjusted net loss from continuing operations was $0.2 million (or $0.01 per diluted share) compared to a net loss of $2.1 million (or $0.14 per diluted share).

•Non-GAAP adjusted EBITDA from continuing operations improved to a net loss of $50 thousand versus a loss of $1.0 million.

•As of September 30, 2023, cash and cash equivalents increased to $20.7 million compared to cash and cash equivalents of $14.1 million at September 30, 2022

•Debt decreased to $0.5 million at September 30, 2023 from $3.5 million at September 30, 2022.

Rick Coleman, Chief Executive Officer, noted, “In the third quarter of 2023, Construction revenue and gross profit declined versus the third quarter of 2022. Year-to-date, however, gross profit increased 28% versus the prior year despite lower revenues. Continued credit tightening in the quarter caused some delays in commercial projects, but single-family residential activity and our overall backlog and sales pipeline remained robust due to our focus on select niche markets where we’ve built significant expertise and a strong reputation.”

Mr. Coleman continued, “In addition, we were excited to announce our acquisition of Big Lake Lumber on October 31st. This accretive bolt-on acquisition for our Glenbrook business represents an important step in the execution of our growth strategy, which includes organic Construction division expansion, bolt-on acquisitions, acquisitions in new industries, and thoughtfully exploring new opportunities at our Investments division.”

Revenues

The Company’s Q3 2023 revenues decreased 6.1% to $10.4 million from $11.1 million in Q2 2022.

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Revenues in $ thousands | | Q3 2023 | | Q3 2022 | | % change | | 9M 2023 | | 9M 2022 | | % change |

| Construction | | $ | 10,435 | | | $ | 11,107 | | | (6.1) | % | | $ | 31,674 | | | $ | 39,544 | | | (19.9) | % |

| Investments | | 89 | | | 159 | | | (44.0) | % | | 405 | | | 475 | | | (14.7) | % |

| Intersegment elimination | | (89) | | | (159) | | | (44.0) | % | | (405) | | | (475) | | | (14.7) | % |

| Total Revenues | | $ | 10,435 | | | $ | 11,107 | | | (6.1) | % | | $ | 31,674 | | | $ | 39,544 | | | (19.9) | % |

Q3 2023 Construction revenue decreased by 6.1% from the prior year and year-to-date 2023 revenue decreased 19.9% from year-to-date 2022. While our sales pipeline and construction backlog remain strong, credit tightening has slowed overall construction activity and delayed some commercial project starts.

Gross Profit

| | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | | |

| Gross profit (loss) in $ thousands | | Q3 2023 | | Q3 2022 | | % change | | 9M 2023 | | 9M 2022 | | % change |

| Construction | | $ | 2,248 | | | $ | 3,132 | | | (28.2) | % | | $ | 9,241 | | | $ | 7,203 | | | 28.3 | % |

| Construction gross margin | | 21.5 | % | | 28.2 | % | | (6.7) | % | | 29.2 | % | | 18.2 | % | | 11.0 | % |

| Investments | | 44 | | | 100 | | | (56.0) | % | | 236 | | | 253 | | | (6.7) | % |

| | | | | | | | | | | | |

| Intersegment elimination | | (89) | | | (158) | | | (43.7) | % | | (405) | | | (474) | | | (14.6) | % |

| Total gross profit | | $ | 2,203 | | | $ | 3,074 | | | (28.3) | % | | $ | 9,072 | | | $ | 6,982 | | | 29.9 | % |

| Total gross margin | | 21.1 | % | | 27.7 | % | | (6.6) | % | | 28.6 | % | | 17.7 | % | | 10.9 | % |

Q3 2023 Construction gross profit decreased 28.2% due primarily to lower revenues, while year-to-date 2023 gross profit increased 28.3% from the prior year periods despite lower revenues. The year-to-date increase is due to higher pricing levels and lower input costs.

Operating Expenses

On a consolidated basis, Q3 2023 sales, general and administrative (“SG&A”) expenses increased by $0.3 million, or 10.9%, versus the prior year period. The major drivers of the increase in SG&A were increases in legal and outside services expense related to our Investments activities and the sale of our Healthcare business. SG&A as a percentage of revenue increased in Q3 2023 to 32.9% versus 27.9% in Q3 2022.

Net Income

Q3 2023 net loss from continuing operations was $2.4 million, or $0.15 per basic and diluted share, compared to net loss of $1.0 million, or $0.06 per basic and diluted share in the same period in the prior year. Q3 2023 non-GAAP adjusted net income from continuing operations was $0.2 million, or $0.01 per basic and diluted share, compared to non-GAAP adjusted net income from continuing operations of $0.3 million, or $0.02 per basic and diluted share, in the prior year period.

Year-to-date 2023 net loss from continuing operations was $3.7 million, or $0.24 per basic and diluted share, compared to net loss of $6.7 million, or $0.46 per basic and diluted share, in the same period in the prior year. Year to date 2023 non-GAAP adjusted net loss from continuing operations was $0.2 million, or $0.01 per basic and diluted share, compared to adjusted net loss from continuing operations of $2.1 million, or $0.14 per basic and diluted share, in the prior year period.

Non-GAAP Adjusted EBITDA

Q3 2023 non-GAAP adjusted EBITDA was a loss of $14 thousand versus income of $0.6 million in the same quarter of the prior year, primarily due to decreased revenues and increased corporate expenses. Year-to-date 2023 non-GAAP adjusted EBITDA was a loss of $50 thousand, compared to a loss of $1.0 million in year-to-date 2022, primarily due to improved margins at our Construction division.

Operating Cash Flow

Q3 2023 cash flow from operations was an inflow of $0.8 million, compared to an outflow of $3.2 million for the same period in the prior year. The increase in cash flow was due in part to decreased use of cash for working capital in 2023. Year-to-date 2023 cash flow from operations was an inflow of $2.7 million, compared to an outflow of $0.2 million for year-to-date 2022. This was also due in part to decreased use of cash for working capital in 2023.

Preferred Stock Dividends

In Q3 2023, the Company’s board of directors declared a cash dividend to holders of our Series A Preferred Stock of $0.25 per share, for an aggregate amount of approximately $0.5 million. The record date for this dividend was September 1, 2023, and the payment date was September 12, 2023.

Conference Call Information

A conference call is scheduled for 10:00 a.m. ET (7:00 a.m. PT) on November 8, 2023 to discuss the results and management’s outlook. The call may be accessed by dialing (833) 630-1956 (toll free) or (412) 317-1837 (international), five minutes prior to the scheduled start time and referencing Star Equity. A simultaneous webcast of the call may be accessed online from the Events & Presentations link on the Investor Relations page at www.starequity.com/events-and-presentations/presentations; an archived replay of the webcast will be available within 15 minutes of the end of the conference call.

If you have any questions, either prior to or after our scheduled Earnings Conference call, please e-mail admin@starequity.com or lcati@equityny.com.

Use of Non-GAAP Financial Measures by Star Equity Holdings, Inc.

This release presents the non-GAAP financial measures “adjusted net income (loss),” “adjusted net income (loss) per basic and diluted share,” and “adjusted EBITDA from continuing operations.” The most directly comparable measures for these non-GAAP financial measures are “net income (loss),” “net income (loss) per basic and diluted share,” and “cash flows from operating activities.” The Company has included below unaudited adjusted financial information, which presents the Company’s results of operations after excluding acquired intangible asset amortization, unrealized gain (loss) on equity securities and lumber derivatives, litigation costs, transaction costs, financing costs, and income tax adjustments. Further excluded in the measure of adjusted EBITDA are stock-based compensation, interest, depreciation, and amortization.

A discussion of the reasons why management believes that the presentation of non-GAAP financial measures provides useful information to investors regarding the Company’s financial condition and results of operations is included as Exhibit 99.2 to the Company’s report on Form 8-K filed with the Securities and Exchange Commission on November 8, 2023.

About Star Equity Holdings, Inc.

Star Equity Holdings, Inc. is a diversified holding company with two divisions: Construction and Investments. Prior to the May 4, 2023 sale of Digirad Health, Star Equity Holdings had three divisions: Healthcare, Construction, and Investments.

Construction

Our Construction division manufactures modular housing units for commercial and residential real estate projects and operates in two businesses: (i) modular building manufacturing and (ii) structural wall panel and wood foundation manufacturing, including building supply distribution operations for professional builders.

Investments

Our Investments division manages and finances the Company’s real estate assets as well as its investment positions in private and public companies.

Healthcare

Our Healthcare division, which operated as Digirad Health until the sale of Digirad Health on May 4, 2023, provided products and services in the area of nuclear medical imaging with a focus on cardiac health.

Forward-Looking Statements

“Safe Harbor” Statement under the Private Securities Litigation Reform Act of 1995: This release contains forward-looking statements within the meaning of the Private Securities Litigation Reform Act of 1995. All statements in this release that are not statements of historical fact are hereby identified as “forward-looking statements” for the purpose of the safe harbor provided by Section 27A of the Securities Act of 1933, as amended, and Section 21E of the Securities Exchange Act of 1934, as amended. Forward-looking Statements include, without limitation, statements regarding (i) the plans and objectives of management for future operations, including plans or objectives relating to acquisitions and related integration, development of commercially viable products, novel technologies, and modern applicable services, (ii) projections of income (including income/loss), EBITDA, earnings (including earnings/loss) per share, capital expenditures, cost reductions, capital structure or other financial items, (iii) the future financial performance of the Company or acquisition targets and (iv) the assumptions underlying or relating to any statement described above. Moreover, forward-looking statements necessarily involve assumptions on the Company’s part. These forward-looking statements generally are identified by the words “believe”, “expect”, “anticipate”, “estimate”, “project”, “intend”, “plan”, “should”, “may”, “will”, “would”, “will be”, “will continue” or similar expressions. Such forward-looking statements are not meant to predict or guarantee actual results, performance, events or circumstances and may not be realized because they are based upon the Company's current projections, plans, objectives, beliefs, expectations, estimates and assumptions and are subject to a number of risks and uncertainties and other influences, many of which the Company has no control over. Actual results and the timing of certain events and circumstances may differ materially from those described above as a result of these risks and uncertainties. Factors that may influence or contribute to the inaccuracy of forward-looking statements or cause actual results to differ materially from expected or desired results may include, without limitation, the substantial amount of debt of the Company and the Company’s ability to repay or refinance it or incur additional debt in the future; the Company’s need for a significant amount of cash to service and repay the debt and to pay dividends on the Company’s preferred stock; the restrictions contained in the debt agreements that limit the discretion of management in operating the business; legal, regulatory, political and economic risks in markets and public health crises that reduce economic activity and cause restrictions on operations (including the recent coronavirus COVID-19 outbreak); the length of time associated with servicing customers; losses of significant contracts or failure to get potential contracts being discussed; disruptions in the relationship with third party vendors; accounts receivable turnover; insufficient cash flows and resulting lack of liquidity; the Company's inability to expand the Company's business; unfavorable changes in the extensive governmental legislation and regulations governing healthcare providers and the provision of healthcare services and the competitive impact of such changes (including unfavorable changes to reimbursement policies); high costs of regulatory compliance; the liability and compliance costs regarding environmental regulations; the underlying condition of the technology support industry; the lack of product diversification; development and introduction of new technologies and intense competition in the healthcare industry; existing or increased competition; risks to the price and volatility of the Company’s common stock and preferred stock; stock volatility and in liquidity; risks to preferred stockholders of not receiving dividends and risks to the Company’s ability to pursue growth opportunities if the Company continues to pay dividends according to the terms of the Company’s preferred stock; the Company’s ability to execute on its business strategy (including any cost reduction plans); the Company’s failure to realize expected benefits of restructuring and cost-cutting actions; the Company’s ability to preserve and monetize its net operating losses; risks associated with the Company’s possible pursuit of acquisitions; the Company’s ability to consummate successful acquisitions and execute related integration, as well as factors related to the Company’s business including economic and financial market conditions generally and economic conditions in the Company’s markets; failure to keep pace with evolving technologies and difficulties integrating technologies; system failures; losses of key management personnel and the inability to attract and retain highly qualified management and personnel in the future; and the continued demand for and market acceptance of the Company’s services. For a detailed discussion of cautionary statements and risks that may affect the Company’s future results of operations and financial results, please refer to the Company’s filings with the Securities and Exchange Commission, including, but not limited to, the risk factors in the Company’s most recent Annual Report on Form 10-K and Quarterly Reports on Form 10-Q. This release reflects management’s views as of the date presented.

All forward-looking statements are necessarily only estimates of future results, and there can be no assurance that actual results will not differ materially from expectations, and, therefore, you are cautioned not to place undue reliance on such statements. Further, any forward-looking statement speaks only as of the date on which it is made, and we undertake no obligation to update any forward-looking statement to reflect events or circumstances after the date on which the statement is made or to reflect the occurrence of unanticipated events.

| | | | | | | | |

| For more information contact: | | |

| Star Equity Holdings, Inc. | The Equity Group | |

| Rick Coleman | Lena Cati | |

| Chief Executive Officer | Senior Vice President | |

| 203-489-9508 | 212-836-9611 | |

| rick.coleman@starequity.com | lcati@equityny.com | |

(Financial tables follow)

Star Equity Holdings, Inc.

Condensed Consolidated Statements of Operations

(Unaudited) (In thousands, except for per share amounts) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenues: | | | | | | | | |

| | | | | | | | |

| Construction | | $ | 10,435 | | | $ | 11,107 | | | $ | 31,674 | | | $ | 39,544 | |

| | | | | | | | |

| Total revenues | | 10,435 | | | 11,107 | | | 31,674 | | | 39,544 | |

| | | | | | | | |

| Cost of revenues: | | | | | | | | |

| | | | | | | | |

| Construction | | 8,187 | | | 7,975 | | | 22,433 | | | 32,341 | |

| Investments | | 45 | | | 58 | | | 169 | | | 221 | |

| Total cost of revenues | | 8,232 | | | 8,033 | | | 22,602 | | | 32,562 | |

| | | | | | | | |

| Gross profit | | 2,203 | | | 3,074 | | | 9,072 | | | 6,982 | |

| | | | | | | | |

| Operating expenses: | | | | | | | | |

| Selling, general and administrative | | 3,434 | | | 3,096 | | | 11,327 | | | 9,981 | |

| Amortization of intangible assets | | 430 | | | 430 | | | 1,290 | | | 1,290 | |

| | | | | | | | |

| | | | | | | | |

| Total operating expenses | | 3,864 | | | 3,526 | | | 12,617 | | | 11,271 | |

| | | | | | | | |

| Income (loss) from continuing operations | | (1,661) | | | (452) | | | (3,545) | | | (4,289) | |

| | | | | | | | |

| Other income (expense): | | | | | | | | |

| Other income (expense), net | | (965) | | | (713) | | | (506) | | | (1,157) | |

| Interest income (expense), net | | 433 | | | (120) | | | 569 | | | (400) | |

| | | | | | | | |

| Total other income (expense), net | | (532) | | | (833) | | | 63 | | | (1,557) | |

| | | | | | | | |

| Income (loss) before income taxes from continuing operations | | (2,193) | | | (1,285) | | | (3,482) | | | (5,846) | |

| Income tax benefit (provision) from continuing operations | | (172) | | | 299 | | | (233) | | | (861) | |

| Income (loss) from continuing operations, net of tax | | (2,365) | | | (986) | | | (3,715) | | | (6,707) | |

Income (loss) from discontinued operations, net of tax | | (257) | | | (898) | | | 27,119 | | | (454) | |

| Net income (loss) | | (2,622) | | | (1,884) | | | 23,404 | | | (7,161) | |

| Deemed dividend on Series A perpetual preferred stock | | (479) | | | (479) | | | (1,437) | | | (1,437) | |

| Net income (loss) attributable to common shareholders | | $ | (3,101) | | | $ | (2,363) | | | $ | 21,967 | | | $ | (8,598) | |

| | | | | | | | |

| Net income (loss) per share | | | | | | | | |

| Net income (loss) per share, continuing operations | | | | | | | | |

| Basic* | | $ | (0.15) | | | $ | (0.06) | | | $ | (0.24) | | | $ | (0.46) | |

| Diluted | | $ | (0.15) | | | $ | (0.06) | | | $ | (0.24) | | | $ | (0.46) | |

| Net income (loss) per share, discontinued operations | | | | | | | | |

| Basic* | | $ | (0.02) | | | $ | (0.06) | | | $ | 1.74 | | | $ | (0.03) | |

| Diluted | | $ | (0.02) | | | $ | (0.06) | | | $ | 1.72 | | | $ | (0.03) | |

| Net income (loss) per share | | | | | | | | |

| Basic* | | $ | (0.17) | | | $ | (0.12) | | | $ | 1.50 | | | $ | (0.49) | |

| Diluted* | | $ | (0.17) | | | $ | (0.12) | | | $ | 1.49 | | | $ | (0.49) | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Net income (loss) per share, attributable to common shareholders | | | | | | | | |

| Basic* | | $ | (0.20) | | | $ | (0.15) | | | $ | 1.41 | | | $ | (0.59) | |

| Diluted* | | $ | (0.20) | | | $ | (0.15) | | | $ | 1.40 | | | $ | (0.59) | |

| Weighted-average common shares outstanding | | | | | | | | |

| Basic* | | 15,681 | | | 15,434 | | | 15,573 | | | 14,503 | |

| Diluted* | | 15,819 | | | 15,434 | | | 15,743 | | | 14,503 | |

| | | | | | | | |

| Dividends declared per share of Series A perpetual preferred stock | | $ | 0.25 | | | $ | 0.25 | | | $ | 0.75 | | | $ | 0.75 | |

*Earnings per share may not add due to rounding

Star Equity Holdings, Inc.

Condensed Consolidated Balance Sheets

(Unaudited) (In thousands, except share amounts)

| | | | | | | | | | | |

| September 30, 2023 (unaudited) | | December 31,

2022 |

| Assets: | | | |

| Current assets: | | | |

| Cash and cash equivalents | $ | 20,691 | | | $ | 4,377 | |

| Restricted cash | 561 | | | 142 | |

| Investments in equity securities | 4,309 | | | 3,490 | |

| | | |

| Accounts receivable, net of allowances of $116 and $270, respectively | 3,727 | | | 7,975 | |

| Note receivable, current portion | 223 | | | 73 | |

| Inventories, net | 4,243 | | | 4,678 | |

| Other current assets | 859 | | | 682 | |

| | | |

| Current assets – discontinued operations | — | | | 17,851 | |

| Total current assets | 34,613 | | | 39,268 | |

| Property and equipment, net | 5,217 | | | 5,665 | |

| Operating lease right-of-use assets, net | 1,569 | | | 1,856 | |

| Intangible assets, net | 12,062 | | | 13,352 | |

| Goodwill | 4,438 | | | 4,438 | |

| | | |

| | | |

Cost method investment | 6,000 | | | — | |

Notes receivable | 8,327 | | | 1,285 | |

| Other assets | 36 | | | — | |

| Non-current assets – discontinued operations | — | | | 7,438 | |

| Total assets | $ | 72,262 | | | $ | 73,302 | |

| | | |

| Liabilities and Stockholders’ Equity: | | | |

| Current liabilities: | | | |

| Accounts payable | $ | 1,141 | | | $ | 1,447 | |

| Accrued liabilities | 1,386 | | | 462 | |

| Accrued compensation | 1,633 | | | 1,838 | |

| Accrued warranty | 42 | | | 38 | |

| Lumber derivative contracts | 94 | | | 104 | |

| | | |

| Deferred revenue | 1,479 | | | 1,673 | |

| Short-term debt | 537 | | | 3,383 | |

| | | |

| Operating lease liabilities | 395 | | | 372 | |

| Finance lease liabilities | 54 | | | 82 | |

| | | |

| | | |

| Current liabilities - discontinued operations | — | | | 18,146 | |

| Total current liabilities | 6,761 | | | 27,545 | |

| | | |

| Deferred tax liabilities | 254 | | | — | |

| Operating lease liabilities, net of current portion | 1,208 | | | 1,510 | |

| Finance lease liabilities, net of current portion | 45 | | | 96 | |

| | | |

| Non-current liabilities - discontinued operations | — | | | 2,396 | |

| Total liabilities | 8,268 | | | 31,547 | |

| | | |

| | | |

| | | |

| Stockholders’ Equity: | | | |

| Preferred stock, $0.0001 par value: 10,000,000 shares authorized: Series A Preferred Stock, 8,000,000 shares authorized, liquidation preference ($10.00 per share), 1,915,637 shares issued and outstanding at September 30, 2023. (Liquidation preference: $18,988,390 as of September 30, 2023.) | 18,988 | | | 18,988 | |

| Series C Preferred stock, $0.0001 par value: 25,000 shares authorized; no shares issued or outstanding | — | | | — | |

| Common stock, $0.0001 par value: 50,000,000 shares authorized; 15,826,217 and 15,177,919 shares issued and outstanding (net of treasury shares) at September 30, 2023 and December 31, 2022, respectively | 2 | | | 1 | |

| Treasury stock, at cost; 258,849 shares at September 30, 2023 and December 31, 2022, respectively | (5,728) | | | (5,728) | |

| Additional paid-in capital | 160,549 | | | 161,715 | |

| | | |

| Accumulated deficit | (109,817) | | | (133,221) | |

| Total stockholders’ equity | 63,994 | | | 41,755 | |

| Total liabilities and stockholders’ equity | $ | 72,262 | | | $ | 73,302 | |

Star Equity Holdings, Inc.

Reconciliation of Non-GAAP Financial Measures

(Unaudited) (In thousands, except per share amounts)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Net income (loss) from continuing operations | | $ | (2,365) | | | $ | (986) | | | $ | (3,715) | | | $ | (6,707) | |

| Acquired intangible amortization | | 430 | | | 430 | | | 1,290 | | | 1,290 | |

Unrealized loss (gain) on equity securities (1) | | 971 | | | 834 | | | 24 | | | 834 | |

Unrealized loss (gain) on lumber derivatives (2) | | 137 | | | 153 | | | (10) | | | 1,298 | |

| Interest income | | 440 | | | — | | | 686 | | | — | |

| | | | | | | | |

| | | | | | | | |

Transaction costs related to sale (3) | | 123 | | | — | | | 1,281 | | | — | |

Transaction costs related to mergers and acquisitions (4) | | 17 | | | — | | | 17 | | | — | |

Loss (Gain) on sale of assets | | 38 | | | — | | | (386) | | | — | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Write off of lease liabilities | | 240 | | | — | | | 240 | | | — | |

Financing costs (5) | | 2 | | | 115 | | | 151 | | | 324 | |

| Income tax (benefit) provision | | 171 | | | (299) | | | 232 | | | 861 | |

| Non-GAAP adjusted net income (loss) from continuing operations | | $ | 204 | | | $ | 250 | | | $ | (190) | | | $ | (2,097) | |

| | | | | | | | |

| Net income (loss) from continuing operations per diluted share | | $ | (0.15) | | | $ | (0.06) | | | $ | (0.24) | | | $ | (0.46) | |

| Acquired intangible amortization | | 0.03 | | | 0.03 | | | 0.08 | | | 0.09 | |

Unrealized loss (gain) on equity securities (1) | | 0.06 | | | 0.05 | | | — | | | 0.06 | |

Unrealized loss (gain) on lumber derivatives (2) | | 0.01 | | | 0.01 | | | — | | | 0.09 | |

| Interest income | | 0.03 | | | — | | | 0.04 | | | — | |

| | | | | | | | |

| | | | | | | | |

Transaction costs related to sale (3) | | 0.01 | | | — | | | 0.08 | | | — | |

Transaction costs related to mergers and acquisitions (4) | | — | | | — | | | — | | | — | |

Loss (Gain) on sale of assets | | — | | | — | | | (0.02) | | | — | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| Write off of lease liabilities | | 0.02 | | | — | | | 0.02 | | | — | |

Financing costs (5) | | — | | | 0.01 | | | 0.01 | | | 0.02 | |

| Income tax (benefit) provision | | 0.01 | | | (0.02) | | | 0.01 | | | 0.06 | |

Non-GAAP adjusted net income (loss) from continuing operations per basic share (6) | | $ | 0.01 | | | $ | 0.02 | | | $ | (0.01) | | | $ | (0.14) | |

Non-GAAP adjusted net income (loss) from continuing operations per diluted share (6) | | $ | 0.01 | | | $ | 0.02 | | | $ | (0.01) | | | $ | (0.14) | |

(1)Reflects adjustments for any unrealized gains or losses in equity securities.

(2)Reflects adjustments for any unrealized gains or losses in lumber derivatives value..

(3)Reflects one time transaction costs related to the sale of the Healthcare Division.

(4)Reflects one time transaction costs related to potential mergers and acquisitions.

(5)Reflects financing costs from our credit facilities.

(6)Per share amounts are computed independently for each discrete item presented. Therefore, the sum of the quarterly per share amounts will not necessarily equal to the total for the year, and the sum of individual items may not equal the total.

Star Equity Holdings, Inc.

Reconciliation of Non-GAAP Financial Measures

(Unaudited) (In thousands) | | | | | | | | | | | | | | | | | | | | | | | | | | |

| For The Three Months Ended September 30, 2023 | | Construction | | Investments | | Star Equity Corporate | | Total |

| | | | | | | | |

| Net income (loss) from continuing operations | | $ | (108) | | | $ | (763) | | | $ | (1,494) | | | $ | (2,365) | |

| Depreciation and amortization | | 515 | | | 45 | | | 9 | | | 569 | |

| Interest (income) expense | | 7 | | | (193) | | | (247) | | | (433) | |

| Income tax (benefit) provision | | 1 | | | — | | | 170 | | | 171 | |

| EBITDA from continuing operations | | 415 | | | (911) | | | (1,562) | | | (2,058) | |

| | | | | | | | |

Unrealized loss (gain) on equity securities (1) | | — | | | 971 | | | — | | | 971 | |

Unrealized loss (gain) on lumber derivatives (2) | | 137 | | | — | | | — | | | 137 | |

Interest income | | — | | | 440 | | | — | | | 440 | |

| | | | | | | | |

| | | | | | | | |

| Stock-based compensation | | 9 | | | — | | | 67 | | | 76 | |

| | | | | | | | |

Transaction costs related to sale (4) | | — | | | — | | | 123 | | | 123 | |

Transaction costs related to mergers and acquisitions (5) | | — | | | — | | | 17 | | | 17 | |

| | | | | | | | |

Loss (Gain) on sale of assets | | — | | | 38 | | | — | | | 38 | |

| | | | | | | | |

| | | | | | | | |

Write off of lease liabilities | | 240 | | | — | | | — | | | 240 | |

Financing costs (6) | | 2 | | | — | | | — | | | 2 | |

| Non-GAAP adjusted EBITDA from continuing operations | | $ | 803 | | | $ | 538 | | | $ | (1,355) | | | $ | (14) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| For The Three Months Ended September 30, 2022 | | Construction | | Investments | | Star Equity Corporate | | Total |

| | | | | | | | |

| Net income (loss) from continuing operations | | $ | 975 | | | $ | (561) | | | $ | (1,400) | | | $ | (986) | |

| Depreciation and amortization | | 489 | | | 58 | | | — | | | 547 | |

| Interest expense | | 78 | | | 42 | | | — | | | 120 | |

| Income tax (benefit) provision | | — | | | — | | | (299) | | | (299) | |

| EBITDA from continuing operations | | 1,542 | | | (461) | | | (1,699) | | | (618) | |

| | | | | | | | |

Unrealized loss (gain) on equity securities (1) | | — | | | 834 | | | — | | | 834 | |

Unrealized loss (gain) on lumber derivatives (2) | | 153 | | | — | | | — | | | 153 | |

| | | | | | | | |

| Stock-based compensation | | 6 | | | — | | | 99 | | | 105 | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Severance and retention (9) | | — | | | — | | | 3 | | | 3 | |

| | | | | | | | |

Financing costs (6) | | 98 | | | 17 | | | — | | | 115 | |

| Non-GAAP adjusted EBITDA from continuing operations | | $ | 1,799 | | | $ | 390 | | | $ | (1,597) | | | $ | 592 | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| For The Nine Months Ended September 30, 2023 | | Construction | | Investments | | Star Equity Corporate | | Total |

| | | | | | | | |

| Net income (loss) from continuing operations | | $ | 1,746 | | | $ | 178 | | | $ | (5,639) | | | $ | (3,715) | |

| Depreciation and amortization | | 1,530 | | | 169 | | | 21 | | | 1,720 | |

| Interest (income) expense | | 52 | | | (276) | | | (345) | | | (569) | |

| Income tax (benefit) provision | | 1 | | | — | | | 231 | | | 232 | |

| EBITDA | | 3,329 | | | 71 | | | (5,732) | | | (2,332) | |

| | | | | | | | |

Unrealized loss (gain) on equity securities (1) | | — | | | 24 | | | — | | | 24 | |

Unrealized loss (gain) on lumber derivatives (2) | | (10) | | | — | | | — | | | (10) | |

Interest income (3) | | — | | | 686 | | | — | | | 686 | |

| | | | | | | | |

| | | | | | | | |

| Stock-based compensation | | 18 | | | — | | | 261 | | | 279 | |

| | | | | | | | |

Transaction costs related to sale (4) | | — | | | — | | | 1,281 | | | 1,281 | |

Transaction costs related to mergers and acquisitions (5) | | — | | | — | | | 17 | | | 17 | |

| | | | | | | | |

Loss (Gain) on sale of assets | | — | | | (386) | | | — | | | (386) | |

| | | | | | | | |

| | | | | | | | |

Write off of lease liabilities | | 240 | | | — | | | — | | | 240 | |

Financing costs (6) | | 134 | | | 17 | | | — | | | 151 | |

| Non-GAAP adjusted EBITDA | | $ | 3,711 | | | $ | 412 | | | $ | (4,173) | | | $ | (50) | |

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| For The Nine Months Ended September 30, 2022 | | Construction | | Investments | | Star Equity Corporate | | Total |

| | | | | | | | |

| Net income (loss) from continuing operations | | $ | 153 | | | $ | (794) | | | $ | (6,066) | | | $ | (6,707) | |

| Depreciation and amortization | | 1,471 | | | 221 | | | — | | | 1,692 | |

| Interest expense | | 269 | | | 131 | | | — | | | 400 | |

| Income tax (benefit) provision | | — | | | — | | | 861 | | | 861 | |

| EBITDA | | 1,893 | | | (442) | | | (5,205) | | | (3,754) | |

| | | | | | | | |

Unrealized loss (gain) on equity securities (1) | | — | | | 834 | | | — | | | 834 | |

Unrealized loss (gain) on lumber derivatives (2) | | 1,298 | | | — | | | — | | | 1,298 | |

| | | | | | | | |

| | | | | | | | |

| Stock-based compensation | | 17 | | | — | | | 300 | | | 317 | |

| | | | | | | | |

| | | | | | | | |

Severance and retention (9) | | — | | | — | | | 3 | | | 3 | |

| | | | | | | | |

Financing costs (6) | | 259 | | | 65 | | | — | | | 324 | |

| Non-GAAP adjusted EBITDA | | $ | 3,467 | | | $ | 457 | | | $ | (4,902) | | | $ | (978) | |

(1)Reflects adjustments for any unrealized gains or losses on equity securities.

(2)Reflects adjustments for any unrealized gains or losses in lumber derivatives value.

(3)We allocate all corporate interest income to the Investments Division.

(4)Reflects one time transaction costs related to the sale of the Healthcare Division.

(5)Reflects one time transaction costs related to potential mergers and acquisitions.

(6)Reflects financing costs from our credit facilities.

Star Equity Holdings, Inc.

Supplemental Debt Information

(Unaudited) (In thousands)

A summary of the Company’s credit facilities are as follows:

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | September 30, 2023 | | December 31, 2022 |

| | Amount | | Weighted-Average Interest Rate | | Amount | | Weighted-Average Interest Rate |

| | | | | | | | |

| Revolving Credit Facility - Premier | | $ | 537 | | | 9.25% | | $ | — | | | —% |

| Revolving Credit Facility - eCapital EBGL | | — | | | —% | | 2,592 | | | 10.25% |

| Revolving Credit Facility - Webster | | — | | | —% | | — | | | —% |

| Total Short-term Revolving Credit Facilities | | $ | 537 | | | 9.25% | | $ | 2,592 | | | 10.25% |

| eCapital - Star Loan Principal, net | | $ | — | | | —% | | $ | 791 | | | 10.50% |

| | | | | | | | |

| Short Term Loan | | $ | — | | | —% | | $ | 791 | | | 10.50% |

| | | | | | | | |

| Total Short-term debt | | $ | 537 | | | 9.25% | | $ | 3,383 | | | 10.31% |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

| | | | | | | | |

Star Equity Holdings, Inc.

Supplemental Segment Information

(Unaudited) (In thousands)

| | | | | | | | | | | | | | | | | | | | | | | | | | |

| | Three Months Ended September 30, | | Nine Months Ended September 30, |

| | 2023 | | 2022 | | 2023 | | 2022 |

| Revenue by segment: | | | | | | | | |

| Construction | | $ | 10,435 | | | $ | 11,107 | | | $ | 31,674 | | | $ | 39,544 | |

| Investments | | 89 | | | 159 | | | 405 | | | 475 | |

| Intersegment elimination | | (89) | | | (159) | | | (405) | | | (475) | |

| Consolidated revenue | | $ | 10,435 | | | $ | 11,107 | | | $ | 31,674 | | | $ | 39,544 | |

| | | | | | | | |

| Gross profit (loss) by segment: | | | | | | | | |

| Construction | | $ | 2,248 | | | $ | 3,132 | | | $ | 9,241 | | | $ | 7,203 | |

| Investments | | 44 | | | 100 | | | 236 | | | 253 | |

| Intersegment elimination | | (89) | | | (158) | | | (405) | | | (474) | |

| Consolidated gross profit | | $ | 2,203 | | | $ | 3,074 | | | $ | 9,072 | | | $ | 6,982 | |

| | | | | | | | |

| Income (loss) from continuing operations by segment: | | | | | | | | |

| Construction | | $ | (21) | | | $ | 1,150 | | | $ | 1,960 | | | $ | 681 | |

| Investments | | (71) | | | 97 | | | (527) | | | 236 | |

| Corporate, eliminations and other | | (1,569) | | | (1,699) | | | (4,978) | | | (5,206) | |

| Segment income (loss) from operations | | $ | (1,661) | | | $ | (452) | | | $ | (3,545) | | | $ | (4,289) | |

| | | | | | | | |

| Depreciation and amortization by segment: | | | | | | | | |

| Construction | | $ | 515 | | | $ | 489 | | | $ | 1,530 | | | $ | 1,471 | |

| Investments | | 45 | | | 58 | | | 169 | | | 221 | |

| Star Equity corporate | | 9 | | | — | | | 21 | | | — | |

| Total depreciation and amortization | | $ | 569 | | | $ | 547 | | | $ | 1,720 | | | $ | 1,692 | |

Exhibit 99.2

Use of Non-GAAP Financial Measures

In addition to financial results calculated in accordance with U.S. generally accepted accounting principles (“GAAP”), information containing non-GAAP financial measures for Star Equity Holdings, Inc. (the “Company”) was disclosed in the Company's press release (the “Press Release”) dated November 8, 2023 announcing results for the three and nine months ended September 30, 2023 that accompanied a conference call held by the Company on November 8, 2023. The non-GAAP financial measures disclosed by the Company should not be considered a substitute for, or superior to, financial measures calculated in accordance with GAAP, and the financial results calculated in accordance with GAAP and reconciliations to those financial statements should be carefully evaluated. The non-GAAP financial measures used by the Company may be calculated differently from, and therefore may not be comparable to, similarly titled measures used by other companies. The Company has provided reconciliations of the non-GAAP financial measures to the most directly comparable GAAP financial measures. Management encourages readers to rely upon the GAAP numbers, but includes the non-GAAP financial measures as supplemental metrics to assist readers. Definitions of the non-GAAP financial measures are included in the Press Release.

In the Press Release, the Company presented the non-GAAP financial measures “adjusted net income (loss),” “adjusted net income (loss) per basic and diluted share,” “adjusted EBITDA” Company management uses these non-GAAP financial measures to evaluate the Company's performance. Company management finds it useful to use financial measures that do not include acquired intangible asset amortization, unrealized gain (loss) on lumber derivatives and available-for-sale securities, gain (loss) on sale of assets, lease write offs, litigation costs, financing costs, transaction costs, financing fees, and income tax adjustments. While we may have these types of items and charges in the future, Company management believes that they are not reflective of the day-to-day offering of its products and services and relate more to strategic, multi-year corporate actions, without predictable trends, and that may obscure the trends and financial performance of the Company's core business. In the case of “adjusted EBITDA,” Company management believes the exclusion of interest, taxes, depreciation and amortization, and stock-based compensation is a very common measure utilized in the investment community and it helps Company management benchmark its operations and results with the industry.

The limitation associated with using these non-GAAP financial measures is that these measures exclude items that impact the Company's current period operating results. This limitation is best addressed by using these non-GAAP financial measures in combination with “net income (loss),” “net income (loss) per basic and diluted share,” and "operating cash flow" (the most comparable GAAP measures) because these non-GAAP financial measures do not reflect items that impact current period operating results and may be higher or lower than the most comparable GAAP measure.

v3.23.3

Cover

|

Nov. 08, 2023 |

| Cover [Abstract] |

|

| Amendment Flag |

false

|

| Entity Central Index Key |

0000707388

|

| Document Information [Line Items] |

|

| Written Communications |

false

|

| Soliciting Material |

false

|

| Pre-commencement Tender Offer |

false

|

| Pre-commencement Issuer Tender Offer |

false

|

| Entity Emerging Growth Company |

false

|

| Entity Address, Postal Zip Code |

06870

|

| Entity Address, Address Line One |

53 Forest Ave

|

| Entity Address, City or Town |

Old Greenwich

|

| Entity Address, State or Province |

CT

|

| City Area Code |

203

|

| Local Phone Number |

489-9500

|

| Entity Registrant Name |

Star Equity Holdings, Inc.

|

| Entity Incorporation, State or Country Code |

DE

|

| Entity File Number |

001-35947

|

| Entity Tax Identification Number |

33-0145723

|

| Document Period End Date |

Nov. 08, 2023

|

| Document Type |

8-K

|

| Entity Address, Address Line Two |

Suite 101

|

| Common Stock |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Common Stock, par value $0.0001 per share

|

| Trading Symbol |

STRR

|

| Security Exchange Name |

NASDAQ

|

| Series A |

|

| Document Information [Line Items] |

|

| Title of 12(b) Security |

Series A Cumulative Perpetual Preferred Stock, par value $0.0001 per share

|

| Trading Symbol |

STRRP

|

| Security Exchange Name |

NASDAQ

|

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 2 such as Street or Suite number

| Name: |

dei_EntityAddressAddressLine2 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the state or province.

| Name: |

dei_EntityAddressStateOrProvince |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:stateOrProvinceItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCommission file number. The field allows up to 17 characters. The prefix may contain 1-3 digits, the sequence number may contain 1-8 digits, the optional suffix may contain 1-4 characters, and the fields are separated with a hyphen.

| Name: |

dei_EntityFileNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:fileNumberItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTwo-character EDGAR code representing the state or country of incorporation.

| Name: |

dei_EntityIncorporationStateCountryCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarStateCountryItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe exact name of the entity filing the report as specified in its charter, which is required by forms filed with the SEC. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityRegistrantName |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe Tax Identification Number (TIN), also known as an Employer Identification Number (EIN), is a unique 9-digit value assigned by the IRS. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityTaxIdentificationNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:employerIdItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionLocal phone number for entity.

| Name: |

dei_LocalPhoneNumber |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 13e

-Subsection 4c

| Name: |

dei_PreCommencementIssuerTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 14d

-Subsection 2b

| Name: |

dei_PreCommencementTenderOffer |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTitle of a 12(b) registered security. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b

| Name: |

dei_Security12bTitle |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:securityTitleItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionName of the Exchange on which a security is registered. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection d1-1

| Name: |

dei_SecurityExchangeName |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:edgarExchangeCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as soliciting material pursuant to Rule 14a-12 under the Exchange Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Section 14a

-Number 240

-Subsection 12

| Name: |

dei_SolicitingMaterial |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionTrading symbol of an instrument as listed on an exchange.

| Name: |

dei_TradingSymbol |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:tradingSymbolItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionBoolean flag that is true when the Form 8-K filing is intended to satisfy the filing obligation of the registrant as written communications pursuant to Rule 425 under the Securities Act. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Securities Act

-Number 230

-Section 425

| Name: |

dei_WrittenCommunications |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_CommonStockMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

| X |

- Details

| Name: |

us-gaap_StatementClassOfStockAxis=us-gaap_SeriesAMember |

| Namespace Prefix: |

|

| Data Type: |

na |

| Balance Type: |

|

| Period Type: |

|

|

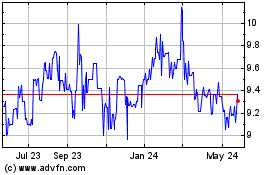

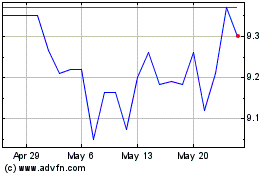

Star Equity (NASDAQ:STRRP)

Historical Stock Chart

From Apr 2024 to May 2024

Star Equity (NASDAQ:STRRP)

Historical Stock Chart

From May 2023 to May 2024