Enerplus Announces Closing of Senior Unsecured Notes

16 May 2012 - 8:40AM

PR Newswire (US)

CALGARY, May 15, 2012 /CNW/ - Enerplus Corporation

("Enerplus") (TSX: ERF) (NYSE: ERF) is pleased to announce the

closing of our previously announced offering of senior unsecured

notes which were issued on a private placement basis in

the United States and Canada (the "Private Placement") in an

aggregate principal amount of approximately US$405 million.

The notes were issued in three separate tranches as follows:

- US$355 million at 4.40% with a 12

year amortizing term with principal payments required in five equal

annual instalments beginning in 2020;

- US$20 million at 4.40% with a 10

year bullet term; and

- CDN$30 million at 4.34% with a 7

year bullet term.

The notes are unsecured and rank equally with our bank credit

facility and other outstanding senior notes. The proceeds were used

to repay advances on our bank credit facility.

Citigroup Global Markets Inc. acted as the exclusive placement

agent in connection with the Private Placement. The notes

issued pursuant to the Private Placement have not been and will not

be registered under the United States Securities Act of 1933, as

amended (the "Securities Act"), and may not be offered or sold in

the United States absent

registration or an applicable exemption from the registration

requirements of the Securities Act.

Gordon J. Kerr

President & Chief Executive Officer

Enerplus Corporation

SOURCE Enerplus Corporation

Copyright 2012 Canada NewsWire

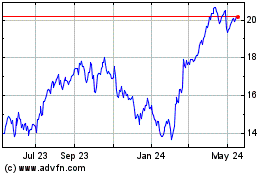

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jun 2024 to Jul 2024

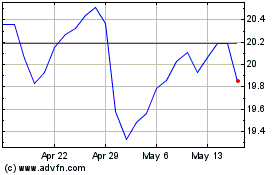

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jul 2023 to Jul 2024