SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

Report of Foreign Issuer

pursuant to Rule 13-a-16 or 15d-16

of the Securities Exchange

Act of 1934

FOR THE MONTH

OF February 2017

FORM 6-K

COMMISSION FILE NUMBER

1-15150

The Dome Tower

Suite

3000, 333 - 7th Avenue S.W.

Calgary, Alberta

Canada T2P 2Z1

(403) 298-2200

Indicate by check mark whether

the registrant files or will file annual reports under cover Form 20-F or Form 40-F.

Indicate by check mark if

the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(1)

Indicate by check mark

if the registrant is submitting the Form 6-K in paper as permitted by Regulation S-T Rule 101(b)(7)

Indicate by check mark

whether, by furnishing the information contained in this Form, the registrant is also thereby furnishing the information to the

Commission pursuant to Rule 12g3-2(b) under the securities Exchange Act of 1934.

EXHIBIT

INDEX

| EXHIBIT 99.1 - |

|

News Release

Dated February 24, 2017 - Enerplus Announces Fourth Quarter and Year-end 2016 Financial and Operating Results and 2016 Year-end Reserves |

SIGNATURE

Pursuant

to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf

by the undersigned, thereunto duly authorized.

ENERPLUS CORPORATION

| BY: |

/s/ |

David A. McCoy |

|

| |

|

David A. McCoy |

|

| |

|

Vice President, General Counsel & Corporate Secretary |

|

| |

|

|

|

DATE: February 24, 2017

Exhibit 99.1

Enerplus Announces Fourth Quarter and Year-end 2016 Financial

and Operating Results and 2016 Year-end Reserves

All financial information contained within this news release

has been prepared in accordance with U.S. GAAP. This news release includes forward-looking statements and information within the

meaning of applicable securities laws. Readers are advised to review the "Forward-Looking Information and Statements"

at the conclusion of this news release. Readers are also referred to "Information Regarding Reserves, Resources and Operational

Information", "Notice to U.S. Readers" and "Non-GAAP Measures" at the end of this news release for information

regarding the presentation of the financial, reserves, contingent resources and operational information in this news release, as

well as the use of certain financial measures that do not have standard meaning under U.S. GAAP. A copy of Enerplus' 2016 Financial

Statements and MD&A is available on our website at www.enerplus.com, under our profile on SEDAR at www.sedar.com and

on the EDGAR website at www.sec.gov. All amounts in this news release are stated in Canadian dollars unless otherwise specified.

CALGARY, Feb. 24, 2017 /CNW/ - Enerplus Corporation ("Enerplus"

or the "Company") (TSX: ERF) (NYSE: ERF) today announced financial and operating results for the quarter and year ended

December 31, 2016, along with year-end 2016 reserves.

President and CEO Ian C. Dundas stated, "Enerplus delivered

another strong performance in 2016 underpinned by consistent operational execution, top quartile capital efficiencies, and a continued

focus on improving the financial strength of the business. Once again in 2016 the Company met or exceeded all of its financial

and operating targets, including significantly strengthening the balance sheet having reduced net debt by $841 million, or 69%,

over the course of the year. With the Company's lower cost structure and improving differentials in the Bakken and Marcellus, we

have seen a step change in the cash flow generating capability and financial sustainability of the business."

"As we increase activity at our Fort Berthold operations

in 2017, we expect to deliver meaningful production growth and strong economic returns, setting the foundation for a 20% compound

annual liquids production growth rate over the coming three-year period."

Financial and Operational Highlights

| · | Fourth quarter 2016 production averaged 88,960 BOE

per day, bringing annual average 2016 production to 93,125 BOE per day, in line with guidance of 93,000 BOE per day. Fourth quarter

2016 crude oil and natural gas liquids production averaged 41,541 barrels per day, impacted by severe weather in North Dakota during

the quarter. Annual average 2016 liquids production was 43,256 barrels per day, within the guidance range of 43,000 to 44,000 barrels

per day. |

| · | Enerplus realized strong value from its non-core divestments

in 2016, selling 13,500 BOE per day (60% natural gas) of production for aggregate proceeds of $670.4 million. |

| · | The Company reported fourth quarter 2016 net income

of $840.3 million, or $3.43 per diluted share. Net income was impacted by a gain on the sale of the Company's non-operated North

Dakota properties of $339.4 million, and a non-cash deferred tax recovery of $567.8 million primarily as a result of the reversal

of a portion of the valuation allowance on the Company's deferred tax asset. For the year ended December 31, 2016, Enerplus reported

net income of $397.4 million, or $1.72 per diluted share, compared with a net loss of $1,523.4 million, or $7.39 per share, for

the comparable 2015 period. |

| · | Enerplus generated fourth quarter 2016 adjusted funds

flow of $107.7 million, an increase of 34% from the previous quarter as a result of stronger commodity prices in the fourth quarter.

The Company generated full year 2016 adjusted funds flow of $305.6 million, down 38% from the comparable 2015 period due to lower

average commodity prices and lower hedging gains in 2016. |

| · | Enerplus delivered strong operating cost performance

in 2016 reflecting efficiency improvements and the divestment of higher cost properties. Fourth quarter operating expenses were

$7.15 per BOE, a reduction of 18% compared to the same period in 2015. Full year 2016 operating expenses were $7.27 per BOE, a

reduction of 17% compared to 2015. |

| · | Fourth quarter 2016 cash G&A expenses were $1.63

per BOE, a reduction of 7% compared to the same period in 2015. Full year 2016 cash G&A expenses were $1.75 per BOE, a reduction

of 16% compared to 2015. Enerplus' lower G&A cost structure is, in part, a result of a reduction in staffing levels related

to non-core asset divestments. |

| · | Transportation expense in the fourth quarter of 2016

was $3.44 per BOE, up slightly from the previous quarter. Full year 2016 transportation expense was $3.14 per BOE, a 6% increase

from the prior year period. |

| · | Capital spending in the fourth quarter of 2016 was

$57.5 million, with approximately 71% allocated to North Dakota. Full year 2016 capital spending totaled $209.1 million, slightly

below annual 2016 guidance of $215.0 million. |

| · | Enerplus significantly strengthened its balance sheet

during 2016 having reduced its total debt, net of cash and restricted cash, by 69%, or $840.7 million, over the twelve-month period.

Total debt, net of cash and restricted cash, at December 31, 2016 was $375.5 million, and was comprised of $23.2 million of bank

indebtedness and $745.6 million of senior notes less $393.3 million in cash, including $392.0 million in restricted cash. The restricted

cash balance reflects proceeds from the sale of the Company's non-operated North Dakota properties which were placed in escrow

in order to facilitate possible future like-kind transactions in accordance with U.S. federal tax regulations. Net debt to adjusted

funds flow at year-end was 1.2 times. |

2016 Reserves Highlights

| · | Replaced 126% of 2016 production, adding 42.6 MMBOE

(42% crude oil and natural gas liquids) of proved plus probable ("2P") reserves from development activities (including

revisions). |

| · | Material reserves growth was realized in Enerplus'

North Dakota and Marcellus assets. The Company replaced 207% of 2016 North Dakota production, excluding production from Enerplus'

non-operated North Dakota assets which were sold at the end of 2016, adding 17.5 MMBOE of 2P reserves (including revisions). The

Company also replaced 175% of 2016 Marcellus production, adding 125.0 Bcf of 2P reserves (including revisions). |

| · | Finding and development ("F&D") costs

for proved developed producing ("PDP") reserves decreased by 60% to $4.77 per BOE for 2016, generating a PDP reserves

recycle ratio of 2.0 times based on a 2016 operating netback (before hedging) of $9.66 per BOE. Enerplus' three-year average PDP

reserves F&D cost was $10.37 per BOE. |

| · | F&D costs for 2P reserves decreased by 43% to

$4.82 per BOE for 2016, including future development costs ("FDC"), generating a 2P reserves recycle ratio of 2.0 times.

Enerplus' three-year average 2P reserves F&D cost, including FDC, was $8.11 per BOE. |

| · | Enerplus sold various non-core properties in 2016

representing 37.3 MMBOE of 2P reserves at a combined value of $20.38 per BOE. Total 2P reserves, net of divestments, were 382.5

MMBOE at year-end 2016, representing a 6% decrease from year-end 2015. Excluding acquisitions and divestments, 2P reserves increased

by 2% in 2016. |

| · | 2P reserves were comprised of 51% crude oil and natural

gas liquids and 49% natural gas at year-end 2016. |

| · | Total proved reserves account for 70% of 2P reserves.

PDP reserves represent 71% of total proved reserves and 50% of 2P reserves. |

Operational Overview

| 2016 PRODUCTION & CAPITAL SPENDING |

| |

Q4 2016

Average

Production |

2016

Annual Average

Production |

2016 Capital

Spending

($million) |

| Crude Oil & NGLs (bbls/day) |

|

|

|

| Canada |

13,577 |

14,497 |

$44.4 |

| United States |

27,964 |

28,759 |

$140.4 |

| Total Crude Oil & NGLs (bbls/day) |

41,541 |

43,256 |

$184.8 |

| Natural Gas (Mcf/day) |

|

|

|

| Canada |

68,437 |

79,057 |

- |

| United States |

216,078 |

220,157 |

$24.3 |

| Total Natural Gas (Mcf/day) |

284,515 |

299,214 |

$24.3 |

| Company Total (BOE/day) |

88,960 |

93,125 |

$209.1 |

| 2016 NET DRILLING ACTIVITY(1) |

| |

Wells

Drilled |

Wells

On-stream |

| Crude Oil |

|

|

| Canada(2) |

8.0 |

6.0 |

| United States |

16.0 |

16.1 |

| Total Crude Oil |

24.0 |

22.1 |

| Natural Gas |

|

|

| Canada |

- |

- |

| United States |

1.3 |

5.2 |

| Total Natural Gas |

1.3 |

5.2 |

| Company Total |

25.3 |

27.3 |

| (1) Table may not add due to rounding. |

| (2) Includes injector wells. |

| |

|

|

|

Asset Activity

WILLISTON BASIN

Williston Basin production averaged 31,981 BOE per day in

the fourth quarter of 2016, a decrease of 3% from the prior quarter largely due to severe weather affecting operations at Fort

Berthold in North Dakota at the end of the quarter. Production from North Dakota in the fourth quarter averaged 27,391 BOE per

day, a decrease of 5% from the prior quarter. As previously announced, Enerplus completed the sale of approximately 5,000 BOE per

day of non-operated North Dakota production at the end of the fourth quarter. Full year 2016 production from the Williston Basin

averaged 32,888 BOE per day, approximately flat to 2015 average production.

Capital spending in North Dakota in the fourth quarter of

2016 was $41.1 million. At Fort Berthold, Enerplus drilled three net wells and brought 3.6 net wells on production during the fourth

quarter. Enerplus completed three operated wells in the fourth quarter, which were part of a density test comprising two Middle

Bakken wells spaced at 500 feet offset by one First Bench Three Forks well at 700 feet. The average initial 30-day production rate

from the two Middle Bakken wells was 1,667 BOE per day with continued strong production over the initial 90-day period averaging

over 1,200 BOE per day. The initial 30-day production rate of the First Bench Three Forks well was 1,530 BOE per day and the initial

90-day production rate was also over 1,200 BOE per day. These results further support Enerplus' revised development plan of approximately

ten wells per drilling spacing unit.

In 2016, Enerplus drilled 13 net operated wells (16 gross)

and brought 13 net operated wells (17 gross) on production. The average total operated well cost (drill, complete, and facilities)

in 2016 for a 10,000 foot lateral was US$8.0 million. Including non-operated wells, total net wells drilled in 2016 were 16 and

total net wells completed were 16. With the ramp-up in activity at Fort Berthold in 2017, Enerplus expects to drill approximately

26 net operated wells (34 gross) and bring 28 net operated wells (36 gross) on production under a two rig program. This is projected

to drive 50% production growth in North Dakota from the beginning of 2017 through the fourth quarter.

Enerplus estimates that it has protected approximately 75%

of its 2017 North Dakota capital program from cost escalation through service contracting. The Company is budgeting for an

US$8.0 million total well cost in 2017 for a 10,000 foot lateral under its base completion design of 1,000 pounds of proppant per

lateral foot.

Enerplus ended 2016 with approximately 11 net drilled uncompleted

wells in North Dakota.

Enerplus' Bakken crude oil price realizations continued to

improve in 2016 due to declining basin production and strong regional refinery demand. Enerplus' realized Bakken differential

below WTI improved by 21% year over year, averaging US$7.46 per barrel in 2016 compared to US$9.44 per barrel in 2015. In the fourth

quarter of 2016, Enerplus' Bakken differential averaged US$6.80 per barrel below WTI. With the expectation that the Dakota Access

Pipeline will be completed and in service around mid-year 2017, increasing regional takeaway capacity, Enerplus is improving its

forecast 2017 Bakken crude oil differential to US$4.50 per barrel below WTI, from its previous guidance of US$6.00 per barrel below

WTI.

MARCELLUS

Marcellus production averaged 192 MMcf per day in the fourth

quarter of 2016, a decrease of 6% from the prior quarter. Enerplus estimates that it had approximately 30 MMcf per day of production

curtailed during October 2016 due to low natural gas prices resulting from high regional storage inventories combined with seasonal

demand weakness. Regional Marcellus natural gas prices strengthened in November 2016 and production has been at or close to full

capacity since that time.

There was minimal drilling activity in the Marcellus during

2016, with capital activity largely focused on bringing drilled uncompleted wells on production. During the latter part of the

fourth quarter of 2016, in response to improving natural gas prices, a modest level of drilling activity recommenced with Enerplus

participating in drilling approximately one net well with one net well brought on production. Capital spending in the fourth quarter

was $4.2 million. In total, Enerplus participated in drilling one net well in 2016 and approximately five net wells that were brought

on production. Full year 2016 production from the Marcellus averaged 195 MMcf per day, approximately 4% lower than 2015 average

production.

Enerplus ended 2016 with approximately four net drilled uncompleted

wells in the Marcellus.

Enerplus' realized Marcellus differential improved in 2016

to US$0.93 per Mcf below NYMEX, compared to US$1.37 per Mcf below NYMEX in 2015. Lower capital spending in the region combined

with growing regional gas fired power demand and continued pipeline capacity additions have helped to alleviate some of the transportation

constraints in the region. In the fourth quarter of 2016, despite weak pricing in October, Enerplus' realized Marcellus differential

averaged US$0.88 per Mcf below NYMEX. The recent improvement in Marcellus natural gas prices is expected to drive a moderate return

to drilling activity in 2017. Enerplus is forecasting 2017 drilling activity of approximately eight net wells and bringing six

net wells on production, for total capital spending of $60 million. With the current strength in NYMEX natural gas prices and Enerplus'

forecast average 2017 Marcellus differential of US$0.90 per Mcf, the Marcellus is expected to generate meaningful free cash flow

in 2017.

CANADIAN WATERFLOODS

Canadian waterflood production averaged 15,748 BOE per day

in the fourth quarter of 2016, an increase of 7% from the prior quarter largely due to the acquisition of the Ante Creek property,

which closed mid-way through the fourth quarter. Full year 2016 production from the Canadian waterfloods averaged 16,137

BOE per day, a decrease of approximately 16% from 2015 reflecting the divestment of properties in the Peace River Arch area in

June 2016 and lower capital spending in 2016.

Fourth quarter 2016 capital spending in the waterfloods was

$10.2 million with full year 2016 capital spending of $44.4 million, a 60% reduction in spending year over year. 2016 capital spending

was focused on the expansion and development of existing waterfloods, sustaining polymer injection at Medicine Hat Glauc 'C' and

Giltedge, and maintenance activities. Enerplus is budgeting moderately higher spending in the waterflood portfolio in 2017 at $60

million. Capital activity in 2017 will be predominately focused on waterflood optimization and expansion at Cadogan and Southeast

Saskatchewan, ongoing polymer injection at Medicine Hat Glauc 'C' and Giltedge, and ramping up water injection at Ante Creek where

Enerplus plans to be injecting from eight wells by year-end.

Enerplus' high-margin, low decline Canadian waterflood portfolio

is expected to continue to be a strong cash flow generator in 2017. At US$55 per barrel WTI, Enerplus is forecasting approximately

$150 million in net operating income from its waterflood assets in 2017.

Risk Management

Enerplus continues to protect its capital plans through commodity

hedging. Using swaps and collar structures, Enerplus has an average of 18,000 barrels per day of crude oil protected in 2017 (approximately

63% of forecast crude oil production net of royalties), 12,500 barrels per day of crude oil protected in 2018, and 4,000 barrels

per day of crude oil protected in 2019.

| Commodity Hedging Detail (As at February 23, 2017) |

| |

WTI Crude Oil

(US$/bbl) |

NYMEX

Natural Gas

(US$/Mcf) |

| |

Jan 1, 2017 –

Jun 30, 2017 |

Jul 1, 2017 –

Dec 31, 2017 |

Jan 1, 2018 –

Dec 31, 2018 |

Jan 1, 2019 –

Mar 31, 2019 |

Apr 1, 2019 –

Dec 31, 2019 |

Jan 1, 2017 –

Dec 31, 2017 |

| |

|

|

|

|

|

|

| Swaps |

|

|

|

|

|

|

| Sold Swaps |

$53.50 |

$53.50 |

$53.73 |

$53.73 |

- |

- |

| Volume (bbls/d or Mcf/d) |

2,000 |

2,000 |

3,000 |

3,000 |

- |

- |

| |

|

|

|

|

|

|

| Three-Way Collars |

|

|

|

|

|

|

| Sold Puts |

$38.94 |

$39.62 |

$43.13 |

$45.00 |

$43.75 |

$2.06 |

| Volume (bbls/d or Mcf/d) |

14,000 |

18,000 |

9,500 |

1,000 |

4,000 |

50,000 |

| |

|

|

|

|

|

|

| Purchased Puts |

$50.29 |

$50.61 |

$54.00 |

$56.00 |

$54.69 |

$2.75 |

| Volume (bbls/d or Mcf/d) |

14,000 |

18,000 |

9,500 |

1,000 |

4,000 |

50,000 |

| |

|

|

|

|

|

|

| Sold Calls |

$61.14 |

$60.33 |

$63.09 |

$70.00 |

$66.18 |

$3.41 |

| Volume (bbls/d or Mcf/d) |

14,000 |

18,000 |

9,500 |

1,000 |

4,000 |

50,000 |

2017 Guidance

Enerplus' previously announced 2017 guidance is provided below,

including its updated Bakken crude oil differential assumption of US$4.50 per barrel below WTI (from US$6.00 per barrel below WTI

previously).

| |

|

| Capital spending |

$450 million |

| Average annual production |

86,000 – 90,000 BOE per day |

| Q4 average production |

92,000 – 97,000 BOE per day |

| Average annual crude oil and natural gas liquids production |

40,000 – 43,000 bbls per day |

| Q4 average crude oil and natural gas liquids production |

45,000 – 50,000 bbls per day |

| Average royalty and production tax rate |

23% |

| Operating expense |

$7.85 per BOE |

| Transportation expense |

$3.90 per BOE |

| Cash G&A expense |

$1.80 per BOE |

| 2017 Differential/Basis Outlook(1) |

|

| U.S. Bakken crude oil differential (compared to WTI crude oil) |

US$(4.50) per bbl |

| Marcellus basis (compared to NYMEX natural gas) |

US$(0.90) per Mcf |

| (1) Before field transportation costs. |

Selected Financial and Operating Results

| |

|

|

|

|

|

|

| |

Three months ended |

|

Twelve months ended |

| SELECTED FINANCIAL RESULTS |

December 31, |

|

December 31, |

| |

2016 |

|

2015 |

|

|

2016 |

|

2015 |

| Financial (000's) |

|

|

|

|

|

|

|

|

|

| Adjusted Funds Flow(4) |

$ |

107,730 |

$ |

102,674 |

|

$ |

305,605 |

$ |

493,101 |

| Dividends to Shareholders |

|

7,214 |

|

22,717 |

|

|

35,439 |

|

131,955 |

| Net Income/(Loss) |

|

840,325 |

|

(624,987) |

|

|

397,416 |

|

(1,523,403) |

| Debt Outstanding net of cash and restricted cash |

|

375,520 |

|

1,216,184 |

|

|

375,520 |

|

1,216,184 |

| Capital Spending |

|

57,462 |

|

89,490 |

|

|

209,135 |

|

493,403 |

| Property and Land Acquisitions |

|

118,452 |

|

8,794 |

|

|

126,126 |

|

9,552 |

| Property Divestments |

|

389,750 |

|

83,236 |

|

|

670,364 |

|

286,614 |

| Debt to Adjusted Funds Flow Ratio(4) |

|

1.2x |

|

2.5x |

|

|

1.2x |

|

2.5x |

| |

|

|

|

|

|

|

|

|

|

| Financial per Weighted Average Shares Outstanding |

|

|

|

|

|

|

|

|

|

| Net Income/(Loss) - Basic |

$ |

3.49 |

$ |

(3.03) |

|

$ |

1.75 |

$ |

(7.39) |

| Net Income/(Loss) - Diluted |

|

3.43 |

|

(3.03) |

|

|

1.72 |

|

(7.39) |

| Weighted Average Number of Shares Outstanding (000's) |

|

240,483 |

|

206,517 |

|

|

226,530 |

|

206,205 |

| |

|

|

|

|

|

|

|

|

|

| Selected Financial Results per BOE(1)(2) |

|

|

|

|

|

|

|

|

|

| Oil & Natural Gas Sales(3) |

$ |

32.81 |

$ |

23.81 |

|

$ |

25.88 |

$ |

27.07 |

| Royalties and Production Taxes |

|

(7.60) |

|

(4.75) |

|

|

(5.77) |

|

(5.63) |

| Commodity Derivative Instruments |

|

1.12 |

|

7.50 |

|

|

2.36 |

|

7.40 |

| Cash Operating Expenses |

|

(7.22) |

|

(8.68) |

|

|

(7.31) |

|

(8.75) |

| Transportation Costs |

|

(3.44) |

|

(2.98) |

|

|

(3.14) |

|

(2.95) |

| General and Administrative Expenses |

|

(1.63) |

|

(1.75) |

|

|

(1.75) |

|

(2.09) |

| Cash Share-Based Compensation |

|

(0.17) |

|

0.16 |

|

|

(0.09) |

|

(0.02) |

| Interest, Foreign Exchange and Other Expenses |

|

(0.97) |

|

(2.94) |

|

|

(1.28) |

|

(2.78) |

| Current Tax Recovery |

|

0.26 |

|

0.07 |

|

|

0.07 |

|

0.43 |

| Adjusted Funds Flow(4) |

$ |

13.16 |

$ |

10.44 |

|

$ |

8.97 |

$ |

12.68 |

| |

|

|

|

|

|

| |

Three months ended |

|

Twelve months ended |

| SELECTED OPERATING RESULTS |

December 31, |

|

December 31, |

| |

2016 |

|

2015 |

|

|

2016 |

|

2015 |

| Average Daily Production(2) |

|

|

|

|

|

|

|

|

|

| Crude Oil (bbls/day) |

|

37,128 |

|

41,135 |

|

|

38,353 |

|

41,639 |

| Natural Gas Liquids (bbls/day) |

|

4,413 |

|

5,092 |

|

|

4,903 |

|

4,763 |

| Natural Gas (Mcf/day) |

|

284,515 |

|

364,065 |

|

|

299,214 |

|

360,733 |

| Total (BOE/day) |

|

88,960 |

|

106,905 |

|

|

93,125 |

|

106,524 |

| |

|

|

|

|

|

|

|

|

|

| % Crude Oil and Natural Gas Liquids |

|

47% |

|

43% |

|

|

46% |

|

44% |

| |

|

|

|

|

|

|

|

|

|

| Average Selling Price(2)(3) |

|

|

|

|

|

|

|

|

|

| Crude Oil (per bbl) |

$ |

53.91 |

$ |

43.04 |

|

$ |

44.84 |

$ |

48.43 |

| Natural Gas Liquids (per bbl) |

|

21.31 |

|

16.61 |

|

|

15.29 |

|

18.06 |

| Natural Gas (per Mcf) |

|

2.89 |

|

1.89 |

|

|

2.06 |

|

2.15 |

| |

|

|

|

|

|

|

|

|

|

| Net Wells Drilled |

|

5 |

|

2 |

|

|

25 |

|

46 |

| |

|

|

|

|

|

|

|

|

|

| (1) Non-cash amounts have been excluded. |

| (2) Based on Company interest production volumes. See "Basis of Presentation" section in the MD&A. |

| (3) Before transportation costs, royalties, and commodity derivative instruments. |

| (4) These non-GAAP measures may not be directly comparable to similar measures presented by other entities. See "Non-GAAP Measures" section in the MD&A. |

| |

Three months ended |

|

Twelve months ended |

| |

December 31, |

|

December 31, |

| Average Benchmark Pricing |

2016 |

2015 |

|

2016 |

2015 |

| WTI crude oil (US$/bbl) |

$ |

49.29 |

$ |

42.18 |

|

$ |

43.32 |

$ |

48.80 |

| AECO natural gas – monthly index (CDN$/Mcf) |

|

2.81 |

|

2.65 |

|

|

2.09 |

|

2.77 |

| AECO natural gas – daily index (CDN$/Mcf) |

|

3.09 |

|

2.47 |

|

|

2.16 |

|

2.69 |

| NYMEX natural gas – last day (US$/Mcf) |

|

2.98 |

|

2.27 |

|

|

2.46 |

|

2.66 |

| US/CDN average exchange rate |

|

1.33 |

|

1.34 |

|

|

1.32 |

|

1.28 |

| Share Trading Summary |

|

CDN(1) – ERF |

|

U.S.(2) – ERF |

| For the twelve months ended December 31, 2016 |

|

(CDN$) |

|

(US$) |

| High |

|

$ |

13.55 |

|

$ |

10.33 |

| Low |

|

$ |

2.68 |

|

$ |

1.84 |

| Close |

|

$ |

12.74 |

|

$ |

9.48 |

| (1) TSX and other Canadian trading data combined. |

| (2) NYSE and other U.S. trading data combined. |

| |

|

|

|

|

|

|

|

| |

|

|

|

|

| 2016 Dividends per Share |

|

CDN$ |

|

US$(1) |

| First Quarter Total |

$ |

0.09 |

$ |

0.07 |

| Second Quarter Total |

$ |

0.03 |

$ |

0.02 |

| Third Quarter Total |

$ |

0.03 |

$ |

0.02 |

| Fourth Quarter Total |

$ |

0.03 |

$ |

0.02 |

| Total Year to Date |

$ |

0.18 |

$ |

0.13 |

| (1) CDN$ dividends converted at the relevant foreign exchange rate on the payment date. |

INDEPENDENT RESERVES EVALUATION

All of the Company's reserves, including its U.S. reserves,

have been evaluated in accordance with NI 51-101. Independent reserves evaluations have been conducted on properties comprising

approximately 86% of the net present value (discounted at 10%, before tax, using January 1, 2017 forecast prices and costs) of

the Company's total 2P reserves.

McDaniel, an independent petroleum consulting firm based in

Calgary, Alberta, has evaluated properties which comprise approximately 48% of the net present value (discounted at 10%, before

tax, using McDaniel's January 1, 2017 forecast prices and costs) of the Company's 2P reserves located in Canada and all of the

Company's reserves associated with the Company's properties located in North Dakota and Montana. The Company has evaluated the

remaining 52% of the net present value of its Canadian properties using similar evaluation parameters, including the same forecast

price and inflation rate assumptions utilized by McDaniel. McDaniel has reviewed the Company's internal evaluation of these properties.

NSAI, independent petroleum consultants based in Dallas, Texas, has evaluated all of the Company's reserves associated with the

Company's properties in Pennsylvania. For consistency in the Company's reserves reporting, NSAI used McDaniel's January 1, 2017

forecast prices and inflation rates to prepare its report.

The following information sets out Enerplus' gross and net

crude oil, NGLs and natural gas reserves volumes and the estimated net present values of future net revenues associated

with such reserves as at December 31, 2016 using forecast price and cost cases, together with certain information, estimates and

assumptions associated with such reserves estimates. Under different price scenarios, these reserves could vary as a change in

price can affect the economic limit associated with a property. It should be noted that tables may not add due to rounding.

Reserves Summary

| Reserves Summary |

Light &

Medium Oil

(Mbbls) |

Heavy Oil (Mbbls) |

Tight Oil

(Mbbls) |

Total Oil

(Mbbls) |

Natural

Gas

Liquids

(Mbbls) |

Conventional

Natural Gas

(MMcf) |

Shale Gas

(MMcf) |

Total

(MBOE) |

| Gross |

|

|

|

|

|

|

|

|

| |

Proved producing |

11,306 |

26,388 |

45,402 |

83,096 |

8,242 |

89,205 |

509,215 |

191,073 |

| |

Proved developed non-producing |

15 |

- |

420 |

435 |

17 |

4,839 |

989 |

1,423 |

| |

Proved undeveloped |

300 |

3,845 |

31,744 |

35,889 |

3,566 |

1,726 |

216,411 |

75,811 |

| |

Total proved |

11,621 |

30,232 |

77,566 |

119,419 |

11,825 |

95,769 |

726,614 |

268,308 |

| |

Total probable |

2,645 |

8,721 |

45,432 |

56,798 |

6,273 |

30,521 |

276,169 |

114,186 |

| Proved plus Probable |

14,265 |

38,953 |

122,998 |

176,216 |

18,098 |

126,290 |

1,002,783 |

382,493 |

| Net |

|

|

|

|

|

|

|

|

| |

Proved producing |

9,677 |

21,857 |

36,740 |

68,274 |

6,675 |

87,416 |

408,473 |

157,597 |

| |

Proved developed non-producing |

14 |

- |

351 |

365 |

12 |

3,966 |

827 |

1,177 |

| |

Proved undeveloped |

277 |

3,119 |

25,300 |

28,696 |

2,841 |

1,336 |

173,076 |

60,606 |

| |

Total proved |

9,968 |

24,976 |

62,391 |

97,335 |

9,528 |

92,717 |

582,375 |

219,379 |

| |

Total probable |

2,246 |

7,057 |

36,561 |

45,864 |

5,057 |

29,140 |

221,281 |

92,658 |

| Proved plus Probable |

12,214 |

32,033 |

98,952 |

143,199 |

14,585 |

121,857 |

803,657 |

312,036 |

Reserves Reconciliation

The following tables outline the changes in Enerplus' proved,

probable and proved plus probable reserves, on a gross basis, from December 31, 2015 to December 31, 2016.

For the fourth consecutive year, the Company realized positive

proved plus probable developed producing ("P+PDP") technical revisions at Fort Berthold and the Marcellus as a result

of continued well outperformance. At Fort Berthold, the negative 2P technical revision is a function of the SEC five-year

rule on converting proved undeveloped locations ("PUDs"). As Enerplus' program scheduling changes over time, PUDs

that were originally scheduled to be drilled and completed within a certain period may not fit the current development plan timing

and would therefore need to be removed from the Company's bookings. At year end 2016 Enerplus replaced 48 of these PUDs that

in aggregate had a lower working interest, leading to the negative 2P technical revision.

The majority of the negative technical revision in the Probable

reserves table below under the Shale Gas category, reflects the conversion of Marcellus Probable reserves into Proven reserves.

| Proved Reserves - Gross Volumes (Forecast Prices) |

| |

| |

Light &

Medium

Oil

(Mbbls) |

Heavy

Oil

(Mbbls) |

Tight Oil

(Mbbls) |

Total Oil

(Mbbls) |

Natural

Gas

Liquids

(Mbbls) |

Conventional

Natural Gas

(MMcf) |

Shale

Gas

(MMcf) |

Total

(MBOE) |

Proved Reserves at

Dec. 31, 2015 |

13,871 |

31,705 |

86,202 |

131,778 |

10,704 |

183,564 |

625,081 |

277,255 |

| Acquisitions |

1,765 |

- |

- |

1,765 |

24 |

14,162 |

- |

4,149 |

| Dispositions |

(2,885) |

- |

(6,034) |

(8,919) |

(1,522) |

(90,343) |

(7,110) |

(26,683) |

| Discoveries |

- |

- |

- |

- |

- |

- |

- |

- |

| Extensions & improved recovery |

100 |

- |

5,429 |

5,529 |

589 |

- |

36,268 |

12,163 |

| Economic factors |

(606) |

(533) |

- |

(1,139) |

(173) |

(4,731) |

(30,053) |

(7,110) |

| Technical revisions |

1,123 |

2,088 |

1,182 |

4,393 |

3,925 |

20,012 |

183,193 |

42,187 |

| Production |

(1,746) |

(3,027) |

(9,214) |

(13,987) |

(1,722) |

(26,894) |

(80,763) |

(33,653) |

Proved Reserves at

Dec. 31, 2016 |

11,621 |

30,232 |

77,566 |

119,419 |

11,825 |

95,769 |

726,614 |

268,307 |

| Probable Reserves - Gross Volumes (Forecast Prices) |

| |

| |

Light &

Medium

Oil

(Mbbls) |

Heavy

Oil

(Mbbls) |

Tight Oil

(Mbbls) |

Total Oil

(Mbbls) |

Natural

Gas

Liquids

(Mbbls) |

Conventional

Natural Gas

(MMcf) |

Shale

Gas

(MMcf) |

Total

(MBOE) |

Probable Reserves at

Dec. 31, 2015 |

3,367 |

9,804 |

45,051 |

58,222 |

4,993 |

53,802 |

338,288 |

128,563 |

| Acquisitions |

373 |

- |

- |

373 |

1 |

3,227 |

- |

911 |

| Dispositions |

(845) |

- |

(3,680) |

(4,525) |

(622) |

(29,438) |

(3,566) |

(10,648) |

| Discoveries |

- |

- |

- |

- |

- |

- |

- |

- |

| Extensions & improved recovery |

45 |

- |

13,810 |

13,855 |

1,540 |

- |

27,948 |

20,053 |

| Economic factors |

534 |

(193) |

- |

341 |

(69) |

(396) |

1,998 |

540 |

| Technical revisions |

(829) |

(890) |

(9,749) |

(11,468) |

430 |

3,325 |

(88,499) |

(25,234) |

| Production |

- |

- |

- |

- |

- |

- |

- |

- |

Probable Reserves at

Dec. 31, 2016 |

2,645 |

8,721 |

45,432 |

56,798 |

6,273 |

30,521 |

276,169 |

114,186 |

| |

|

|

|

|

|

|

|

|

| Proved Plus Probable Reserves - Gross Volumes (Forecast Prices) |

| |

| |

Light &

Medium

Oil

(Mbbls) |

Heavy

Oil

(Mbbls) |

Tight Oil

(Mbbls) |

Total Oil

(Mbbls) |

Natural

Gas

Liquids

(Mbbls) |

Conventional

Natural Gas

(MMcf) |

Shale

Gas

(MMcf) |

Total

(MBOE) |

Proved Plus Probable

Reserves at Dec. 31, 2015 |

17,238 |

41,509 |

131,253 |

190,000 |

15,697 |

237,366 |

963,368 |

405,818 |

| Acquisitions |

2,137 |

- |

- |

2,137 |

25 |

17,389 |

- |

5,060 |

| Dispositions |

(3,730) |

- |

(9,713) |

(13,443) |

(2,145) |

(119,781) |

(10,676) |

(37,331) |

| Discoveries |

- |

- |

- |

- |

- |

- |

- |

- |

| Extensions & improved recovery |

145 |

- |

19,239 |

19,384 |

2,129 |

- |

64,216 |

32,216 |

| Economic factors |

(72) |

(726) |

- |

(798) |

(242) |

(5,127) |

(28,056) |

(6,570) |

| Technical revisions |

294 |

1,198 |

(8,566) |

(7,074) |

4,356 |

23,337 |

94,694 |

16,953 |

| Production |

(1,746) |

(3,027) |

(9,214) |

(13,987) |

(1,722) |

(26,894) |

(80,763) |

(33,653) |

Proved Plus Probable

Reserves at Dec. 31, 2016 |

14,265 |

38,953 |

122,998 |

176,216 |

18,098 |

126,290 |

1,002,783 |

382,493 |

Future Development Costs

Changes in forecast FDC occur annually as a result of development

activities, acquisition and divestment activities and capital cost estimates that reflect the evaluators' best estimate of the

capital required to bring the proved and proved plus probable reserves on production. The aggregate of the exploration and development

costs incurred in the most recent year and the change during the year in estimated future development costs generally reflect the

total finding and development costs related to reserves additions for that year.

The following is a summary of the independent reserves evaluators'

estimated FDC required to bring the total proved and proved plus probable reserves on production:

| Future Development Costs |

Proved

Reserves |

Proved Plus

Probable Reserves |

| ($ millions) |

|

| 2017 |

377 |

397 |

| 2018 |

393 |

478 |

| 2019 |

97 |

401 |

| 2020 |

24 |

298 |

| 2021 |

11 |

15 |

| Remainder |

42 |

40 |

| Total FDC Undiscounted |

944 |

1,629 |

| Total FDC Discounted at 10% |

829 |

1,357 |

| F&D AND FD&A COSTS – including future development costs |

| |

|

| ($ millions except for per BOE amounts) |

2016 |

2015 |

2014 |

3 Year |

| Proved Plus Probable Reserves |

|

|

|

|

| |

|

|

|

|

| Finding & Development Costs |

|

|

|

|

| |

Capital Expenditures |

$209.1 |

$493.4 |

$811.0 |

$1,513.6 |

| |

Net change in Future Development Costs |

$(4.0) |

$(142.2) |

$(71.3) |

$(217.5) |

| |

Gross Reserves additions (MMBOE) |

42.6 |

41.6 |

75.5 |

159.7 |

| |

F&D costs ($/BOE) |

$4.82 |

$8.44 |

$9.80 |

$8.11 |

| |

|

|

|

|

| Finding, Development & Acquisition Costs |

|

|

|

|

| |

Capital expenditures and net acquisitions |

$(335.1) |

$216.2 |

$625.9 |

$507.0 |

| |

Net change in Future Development Costs |

$(94.5) |

$(212.5) |

$(59.2) |

$(366.3) |

| |

Gross Reserves additions (MMBOE) |

10.3 |

14.9 |

65.8 |

91.0 |

| |

FD&A costs ($/BOE) |

$(41.60) |

$0.25 |

$8.62 |

$1.55 |

| Proved Reserves |

|

|

|

|

| |

|

|

|

|

| Finding & Development Costs |

|

|

|

|

| |

Capital Expenditures |

$209.1 |

$493.4 |

$811.0 |

$1,513.6 |

| |

Net change in Future Development Costs |

$(124.4) |

$210.0 |

$13.8 |

$99.4 |

| |

Gross Reserves additions (MMBOE) |

47.2 |

50.7 |

69.1 |

167.0 |

| |

F&D costs ($/BOE) |

$1.79 |

$13.88 |

$11.94 |

$9.66 |

| |

|

|

|

|

| Finding, Development & Acquisition Costs |

|

|

|

|

| |

Capital expenditures and net acquisitions |

$(335.1) |

$216.2 |

$625.9 |

$507.0 |

| |

Net change in Future Development Costs |

$(202.1) |

$139.7 |

$4.9 |

$(57.5) |

| |

Gross Reserves additions (MMBOE) |

24.7 |

31.1 |

60.9 |

116.7 |

| |

FD&A costs ($/BOE) |

$(21.74) |

$11.44 |

$10.36 |

$3.85 |

| Proved Developed Producing Reserves |

|

|

|

|

| |

|

|

|

|

| Finding & Development Costs |

|

|

|

|

| |

Capital Expenditures |

$209.1 |

$493.4 |

$811.0 |

$1,513.6 |

| |

Gross Reserves additions (MMBOE) |

43.9 |

41.5 |

60.7 |

146.0 |

| |

F&D costs ($/BOE) |

$4.77 |

$11.90 |

$13.37 |

$10.37 |

| |

|

|

|

|

|

Forecast Price Assumptions

The forecast price and cost case assumes no legislative or

regulatory amendments, and includes the effects of inflation. The estimated future net revenue to be derived from the production

of the reserves is based on the following price forecasts supplied by McDaniel as of January 1, 2017, (and utilized by NSAI and

by the Company in its internal evaluations for consistency in the Corporation's reserves reporting), and the following inflation

and exchange rate assumptions.

| McDaniel January 2017 Forecast Price Assumptions |

| |

WTI

Crude Oil(1)

US$/bbl |

Light

Crude Oil(2)

Edmonton

CDN$/bbl |

Alberta

Heavy

Crude Oil(3)

CDN$/bbl |

U.S. Henry

Hub Gas

Price

US$/MMBtu |

Natural Gas

Alberta Spot

@ AECO

CDN$/MMBtu |

Exchange

Rate

US$/CDN$ |

Inflation

Rate

%/year |

| |

|

|

|

|

|

|

|

| 2017 |

55.00 |

69.80 |

46.50 |

3.40 |

3.40 |

0.750 |

0.0 |

| 2018 |

58.70 |

72.70 |

50.50 |

3.20 |

3.15 |

0.775 |

2.0 |

| 2019 |

62.40 |

75.50 |

54.00 |

3.35 |

3.30 |

0.800 |

2.0 |

| 2020 |

69.00 |

81.10 |

58.00 |

3.65 |

3.60 |

0.825 |

2.0 |

| 2021 |

75.80 |

86.60 |

61.90 |

4.00 |

3.90 |

0.850 |

2.0 |

| 2022 |

77.30 |

88.30 |

63.10 |

4.05 |

3.95 |

0.850 |

2.0 |

| 2023 |

78.80 |

90.00 |

64.40 |

4.15 |

4.10 |

0.850 |

2.0 |

| 2024 |

80.40 |

91.80 |

65.60 |

4.25 |

4.25 |

0.850 |

2.0 |

| 2025 |

82.00 |

93.70 |

67.00 |

4.30 |

4.30 |

0.850 |

2.0 |

| 2026 |

83.70 |

95.60 |

68.40 |

4.40 |

4.40 |

0.850 |

2.0 |

| 2027 |

85.30 |

97.40 |

69.60 |

4.50 |

4.50 |

0.850 |

2.0 |

| 2028 |

87.00 |

99.40 |

71.10 |

4.60 |

4.60 |

0.850 |

2.0 |

| 2029 |

88.80 |

101.40 |

72.50 |

4.65 |

4.65 |

0.850 |

2.0 |

| 2030 |

90.60 |

103.50 |

74.00 |

4.75 |

4.75 |

0.850 |

2.0 |

| 2031 |

92.40 |

105.50 |

75.40 |

4.85 |

4.85 |

0.850 |

2.0 |

| Thereafter |

(4) |

(4) |

(4) |

(4) |

(4) |

0.850 |

(4) |

| (1) |

West Texas Intermediate at Cushing, Oklahoma 40 degree API / 0.5% Sulphur. |

|

| (2) |

Edmonton Light Sweet 40 degree API, 0.3% Sulphur. |

|

| (3) |

Heavy Crude Oil 12 degree API at Hardisty, Alberta (after deducting blending costs to reach pipeline quality). |

|

| (4) |

Escalation is approximately 2% per year thereafter. |

|

| |

|

|

|

|

|

|

|

|

Net Present Value of Future Production Revenue

The following table provides an estimate of the net present

value of Enerplus' future production revenue after deduction of royalties, estimated future capital and operating expenditures,

before income taxes. It should not be assumed that the present value of estimated future cash flows shown below is representative

of the fair market value of the reserves.

| Net Present Value of Future Production Revenue – Forecast Prices and Costs (before tax) |

| Reserves at December 31, 2016, ($ Millions, discounted at) |

0% |

5% |

10% |

15% |

| Proved developed producing |

4,021 |

2,767 |

2,117 |

1,730 |

| Proved developed non-producing |

20 |

11 |

7 |

6 |

| Proved undeveloped |

1,257 |

700 |

420 |

255 |

| Total Proved |

5,297 |

3,479 |

2,544 |

1,991 |

| Probable |

3,065 |

1,432 |

820 |

524 |

| Total Proved Plus Probable Reserves (before tax) |

8,362 |

4,911 |

3,364 |

2,515 |

Contingent Resources

The following table provides a breakdown of the economic,

unrisked best estimate contingent resources associated with a portion of Enerplus' Fort Berthold, Marcellus, and Canadian waterflood

assets as at December 31, 2016. These contingent resources are economic using McDaniel's January 1, 2017 forecast commodity

prices, use established technologies and are all classified in the "development pending" maturity sub-class. There is

uncertainty that it will be commercially viable to produce any portion of the resources.

The evaluations of contingent resources associated with a

portion of Enerplus' waterflood properties and leases at Fort Berthold were conducted by Enerplus and audited by McDaniel. NSAI

evaluated 100% of Enerplus' Marcellus shale gas assets in the U.S., including the estimate of contingent resources.

Please see Enerplus' Annual Information Form ("AIF")

– Appendix A for additional disclosures related to Enerplus' contingent resources as at December 31, 2016. The AIF is available

at www.enerplus.com as well as on the Company's SEDAR profile at www.sedar.com.

| Development Pending Contingent Resources |

Unrisked "Best

Estimate" Contingent

Resources |

|

Contingent Resources

Net Drilling Locations |

| Canada |

|

|

|

| Waterfloods – IOR/EOR on a portion of waterfloods |

34.4 |

MMBOE |

54.3 |

| Total Canada |

34.4 |

MMBOE |

54.3 |

| United States Properties |

|

|

|

| Fort Berthold – Bakken/Three Forks Tight Oil wells |

119.8 |

MMBOE |

215.3 |

| Marcellus - Shale gas |

837.0 |

Bcf |

96.7 |

| Total United States |

259.3 |

MMBOE |

312.0 |

| Total Company |

293.7 |

MMBOE |

366.3 |

LIVE CONFERENCE CALL

Enerplus plans to hold a conference call hosted by Ian C.

Dundas, President and CEO, today, February 24, 2017 at 9:00 a.m. MT (11:00 a.m. ET) to discuss these results. Details of the conference

call are as follows:

| Date: |

Friday, February 24, 2017 |

| Time: |

9:00 am MT/11:00 am ET |

| Dial-In: |

647-427-7450 |

| |

1-888-231-8191 (toll free) |

| Audiocast: |

http://event.on24.com/r.htm?e=1347471&s=1&k=96151D7131406EA88FD59E83EC73A3A5 |

To ensure timely participation in the conference call, callers

are encouraged to dial in 15 minutes prior to the start time to register for the event. A telephone replay will be available for

30 days following the conference call and can be accessed at the following numbers:

| Dial-In: |

416-849-0833 |

| |

1-855-859-2056 (toll free) |

| Passcode: |

51750852 |

Electronic copies of our 2016 year-end MD&A and Financial

Statements, along with other public information including investor presentations, are available on our website at www.enerplus.com.

For further information, please contact Investor Relations at 1-800-319-6462 or email investorrelations@enerplus.com.

Follow @EnerplusCorp on Twitter at https://twitter.com/EnerplusCorp.

INFORMATION REGARDING RESERVES, RESOURCES AND OPERATIONAL

INFORMATION

Currency and Accounting Principles

All amounts in this news release are stated in Canadian

dollars unless otherwise specified. All financial information in this news release has been prepared and presented in accordance

with U.S. GAAP, except as noted below under "Non-GAAP Measures".

Barrels of Oil Equivalent

This news release also contains references to "BOE"

(barrels of oil equivalent), "MBOE" (one thousand barrels of oil equivalent), and "MMBOE" (one million barrels

of oil equivalent). Enerplus has adopted the standard of six thousand cubic feet of gas to one barrel of oil (6 Mcf: 1 bbl) when

converting natural gas to BOEs. BOE, MBOE and MMBOE may be misleading, particularly if used in isolation. The foregoing

conversion ratios are based on an energy equivalency conversion method primarily applicable at the burner tip and do not represent

a value equivalency at the wellhead. Given that the value ratio based on the current price of oil as compared to natural gas is

significantly different from the energy equivalent of 6:1, utilizing a conversion on a 6:1 basis may be misleading.

Presentation of Production and Reserves Information

Under U.S. GAAP oil and gas sales are generally presented

net of royalties and U.S. industry protocol is to present production volumes net of royalties. Under IFRS and Canadian industry

protocol oil and gas sales and production volumes are presented on a gross basis before deduction of royalties. In

order to continue to be comparable with Enerplus' Canadian peer companies, the summary results contained within this news release

presents Enerplus' production and BOE measures on a before royalty company interest basis.

All production volumes and revenues presented herein are

reported on a "company interest" basis, before deduction of Crown and other royalties, plus Enerplus' royalty interest.

Unless otherwise specified, all reserves volumes in this news release (and all information derived therefrom) are

based on "gross reserves" using forecast prices and costs. "Gross reserves" (as defined in NI 51-101), being

Enerplus' working interest before deduction of any royalties. Enerplus' oil and gas reserves statement for the year ended December

31, 2016, which will include complete disclosure of our oil and gas reserves and other oil and gas information in accordance with

NI 51-101, is contained within our Annual Information Form for the year ended December 31, 2016 ("our AIF") which

is available on our website at www.enerplus.com and under our SEDAR profile at www.sedar.com. Additionally, our AIF forms

part of our Form 40-F that is filed with the U.S. Securities and Exchange Commission and is available on EDGAR at www.sec.gov.

Readers are also urged to review the Management's Discussion & Analysis and financial statements filed on SEDAR and as part

of our Form 40-F on EDGAR concurrently with this news release for more complete disclosure on our operations.

Contingent Resources Estimates

This news release contains estimates of "contingent

resources". "Contingent resources" are not, and should not be confused with, oil and gas reserves. "Contingent

resources" are defined in the Canadian Oil and Gas Evaluation Handbook (the "COGE Handbook") as "those

quantities of petroleum estimated, as of a given date, to be potentially recoverable from known accumulations using established

technology or technology under development, but which are not currently considered to be commercially recoverable due to one or

more contingencies. Contingencies may include factors such as ultimate recovery rates, legal, environmental, political and regulatory

matters or a lack of markets. It is also appropriate to classify as "contingent resources" the estimated discovered recoverable

quantities associated with a project in the early evaluation stage. All of our contingent resources estimates are economic using

established technologies and based on McDaniel's January 1, 2017 forecast prices. Enerplus expects to develop these contingent

resources in the coming years however it is too early in their development for these resources to be classified as reserves at

this time. There is uncertainty that Enerplus will produce any portion of the volumes currently classified as "contingent

resources". "Development pending contingent resources" refer to a "contingent resources" project maturity

sub-class for a particular project where resolution of the final conditions for development are being actively pursued (there is

a high chance of development) and the project is expected to be developed in a reasonable timeframe. The "contingent resources"

estimates contained herein are presented as the "best estimate" of the quantity that will actually be recovered, effective

as of December 31, 2016. A "best estimate" of contingent resources means that it is equally likely that the actual

remaining quantities recovered will be greater or less than the best estimate, and if probabilistic methods are used, there should

be at least a 50% probability that the quantities actually recovered will equal or exceed the best estimate.

For additional information regarding the primary contingencies

which currently prevent the classification of Enerplus' disclosed "contingent resources" associated with Enerplus' Marcellus

shale gas properties, Enerplus' Fort Berthold properties, Enerplus' Wilrich natural gas properties and a portion of Enerplus' Canadian

crude oil properties as reserves and the positive and negative factors relevant to the "contingent resources" estimates,

see Appendix A to Enerplus' AIF, a copy of which is available under Enerplus' SEDAR profile at www.sedar.com, and Enerplus' Form

40-F, a copy of which is available under Enerplus' EDGAR profile at www.sec.gov.

F&D and FD&A Costs

F&D costs presented in this news release are calculated

(i) in the case of F&D costs for proved developed producing reserves, by dividing the sum of the exploration and development

costs incurred in the year, by the additions to proved developed producing reserves in the year, (ii) in the case of F&D costs

for proved reserves, by dividing the sum of exploration and development costs incurred in the year plus the change in estimated

future development costs in the year, by the additions to proved reserves in the year, and (iii) in the case of F&D costs for

proved plus probable reserves, by dividing the sum of exploration and development costs incurred in the year plus the change in

estimated future development costs in the year, by the additions to proved plus probable reserves in the year. The aggregate of

the exploration and development costs incurred in the most recent financial year and the change during that year in estimated future

development costs generally reflect total finding and development costs related to its reserves additions for that year.

FD&A costs presented in this news release are calculated

(i) in the case of FD&A costs for proved reserves, by dividing the sum of exploration and development costs and the cost of

net acquisitions incurred in the year plus the change in estimated future development costs in the year, by the additions to proved

reserves including net acquisitions in the year, and (ii) in the case of FD&A costs for proved plus probable reserves, by dividing

the sum of exploration and development costs and the cost of net acquisitions incurred in the year plus the change in estimated

future development costs in the year, by the additions to proved plus probable reserves including net acquisitions in the year.

The aggregate of the exploration and development costs incurred in the most recent financial year and the change during that year

in estimated future development costs generally reflect total finding, development and acquisition costs related to its reserves

additions for that year.

NOTICE TO U.S. READERS

The oil and natural gas reserves information contained

in this news release has generally been prepared in accordance with Canadian disclosure standards, which are not comparable in

all respects to United States or other foreign disclosure standards. Reserves categories such as "proved reserves" and

"probable reserves" may be defined differently under Canadian requirements than the definitions contained in the United

States Securities and Exchange Commission (the "SEC") rules. In addition, under Canadian disclosure requirements

and industry practice, reserves and production are reported using gross (or, as noted above with respect to production information,

"company interest") volumes, which are volumes prior to deduction of royalty and similar payments. The practice in the

United States is to report reserves and production using net volumes, after deduction of applicable royalties and similar payments.

Canadian disclosure requirements require that forecasted commodity prices be used for reserves evaluations, while the SEC mandates

the use of an average of first day of the month price for the 12 months prior to the end of the reporting period. Additionally,

the SEC prohibits disclosure of oil and gas resources in SEC filings, whereas Canadian issuers may disclose oil and gas resources.

Resources are different than, and should not be construed as reserves. For a description of the definition of, and the risks and

uncertainties surrounding the disclosure of, contingent resources, see "Contingent Resources Estimates" above.

FORWARD-LOOKING INFORMATION AND STATEMENTS

This news release certain forward-looking information and

forward-looking statements within the meaning of applicable securities laws ("forward-looking information"). The use

of any of the words "expect", "anticipate", "continue", "estimate", "guidance",

"objective", "ongoing", "may", "will", "project", "should", "believe",

"plans", "intends", "budget", "strategy" and similar expressions are intended to identify

forward-looking information. In particular, but without limiting the foregoing, this news release contains forward-looking information

pertaining to the following: expected 2017 average production volumes and the anticipated production mix; the proportion of our

anticipated oil and gas production that is hedged and the effectiveness of such hedges in protecting our adjusted funds flow; the

results from our drilling program, timing of related production, and ultimate well recoveries; oil and natural gas prices and differentials

and our commodity risk management programs in 2017 and in the future; expectations regarding our realized oil and natural gas prices;

future royalty rates on our production and future production taxes; anticipated cash and non-cash G&A, share-based compensation

and financing expenses; operating and transportation costs; capital spending levels in 2017, net debt to adjusted funds-flow ratio

and adjusted payout ratio, financial capacity, liquidity and capital resources to fund capital spending and working capital requirements;

and expectations regarding our ability to comply with debt covenants under our bank credit facility and outstanding senior notes.

The forward-looking information contained in this news

release reflects several material factors, expectations and assumptions including, without limitation: that we will conduct our

operations and achieve results of operations as anticipated; that our development plans will achieve the expected results; that

lack of adequate infrastructure will not result in curtailment of production and/or reduced realized prices; current commodity

price, differentials and cost assumptions; the general continuance of current or, where applicable, assumed industry conditions;

the continuation of assumed tax, royalty and regulatory regimes; the accuracy of the estimates of our reserve and contingent resource

volumes; the continued availability of adequate debt and/or equity financing and adjusted funds flow to fund our capital, operating

and working capital requirements, and dividend payments as needed; the continued availability and sufficiency of our adjusted funds

flow and availability under our bank credit facility to fund our working capital deficiency; our ability to negotiate debt covenant

relief under our bank credit facility and outstanding senior notes if required; the availability of third party services; and the

extent of our liabilities. In addition, our 2017 guidance contained in this news release is based on the following: a WTI price

of US$55.00/bbl, a NYMEX price of US$3.00/Mcf, an AECO price of $2.75/GJ and a USD/CDN exchange rate of 1.35. We believe the material

factors, expectations and assumptions reflected in the forward-looking information are reasonable but no assurance can be given

that these factors, expectations and assumptions will prove to be correct.

The forward-looking information included in this news release

is not a guarantee of future performance and should not be unduly relied upon. Such information involves known and unknown risks,

uncertainties and other factors that may cause actual results or events to differ materially from those anticipated in such forward-looking

information including, without limitation: continued low commodity prices environment or further decline of commodity prices; changes

in realized prices of Enerplus' products; changes in the demand for or supply of our products; unanticipated operating results,

results from our capital spending activities or production declines; curtailment of our production due to low realized prices or

lack of adequate infrastructure; changes in tax or environmental laws, royalty rates or other regulatory matters; changes in our

capital plans or by third party operators of our properties; increased debt levels or debt service requirements; inability to comply

with debt covenants under our bank credit facility and outstanding senior notes; inaccurate estimation of our oil and gas reserve

and contingent resource volumes; limited, unfavourable or a lack of access to capital markets; increased costs; a lack of adequate

insurance coverage; the impact of competitors; reliance on industry partners and third party service providers; and certain other

risks detailed from time to time in our public disclosure documents (including, without limitation, those risks and contingencies

described under "Risk Factors and Risk Management" in Enerplus' MD&A and in our other public filings).

The purpose of disclosure of net operating income from

our Canadian waterflood assets is to assist readers in understanding our expected and targeted financial results, and this information

may not be appropriate for other purposes. The forward-looking information contained in this press release speaks only as of the

date of this press release, and we do not assume any obligation to publicly update or revise such forward-looking information to

reflect new events or circumstances, except as may be required pursuant to applicable laws

NON-GAAP MEASURES

In this news release, Enerplus uses the terms "adjusted

funds flow", "net debt to adjusted funds flow", and "netback" as measures to analyze operating performance,

leverage and liquidity. "Adjusted funds flow" is calculated as net cash generated from operating activities but

before changes in non-cash operating working capital and asset retirement obligation expenditures. "Net debt to adjusted funds

flow" is calculated as total debt net of cash, including restricted cash, divided by adjusted funds flow.

Enerplus believes that, in addition to net earnings and

other measures prescribed by U.S. GAAP, the terms "adjusted funds flow", "net debt to adjusted funds flow",

and "netback" are useful supplemental measures as they provide an indication of the results generated by Enerplus' principal

business activities. However, these measures are not measures recognized by U.S. GAAP and do not have a standardized meaning prescribed

by U.S.GAAP. Therefore, these measures, as defined by Enerplus, may not be comparable to similar measures presented by other issuers.

For reconciliation of these measures to the most directly comparable measure calculated in accordance with U.S. GAAP, and further

information about these measures, see disclosure under "Non-GAAP Measures" in Enerplus' 2016 MD&A.

Ian C. Dundas

President & Chief Executive Officer

Enerplus Corporation

SOURCE Enerplus Corporation

To view this news release in HTML formatting, please use the

following URL: http://www.newswire.ca/en/releases/archive/February2017/24/c3793.html

%CIK: 0001126874

For further information: ENERPLUS CORPORATION, The Dome Tower,

Suite 3000, 333 - 7th Avenue SW, Calgary, Alberta, T2P 2Z1, T. 403-298-2200, F. 403-298-2211, www.enerplus.com

CO: Enerplus Corporation

CNW 06:00e 24-FEB-17

This regulatory filing also includes additional resources:

ex991.pdf

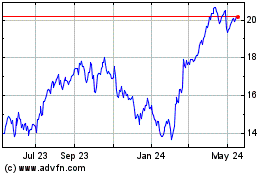

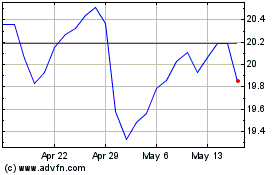

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Enerplus (NYSE:ERF)

Historical Stock Chart

From Jul 2023 to Jul 2024