Current Report Filing (8-k)

25 June 2020 - 7:02AM

Edgar (US Regulatory)

0001497645

false

0001497645

2020-06-17

2020-06-18

0001497645

us-gaap:CommonStockMember

2020-06-17

2020-06-18

0001497645

inn:SeriesDCumulativeRedeemablePreferredStock0.01ParValueMember

2020-06-17

2020-06-18

0001497645

inn:SeriesECumulativeRedeemablePreferredStock0.01ParValueMember

2020-06-17

2020-06-18

iso4217:USD

xbrli:shares

iso4217:USD

xbrli:shares

UNITED

STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities

Exchange Act of 1934

Date

of Report (Date of earliest event reported): June

18, 2020

SUMMIT HOTEL PROPERTIES, INC.

(Exact Name of Registrant as Specified in its Charter)

|

Maryland

|

001-35074

|

27-2962512

|

|

(State or Other Jurisdiction

of Incorporation or Organization)

|

(Commission File Number)

|

(I.R.S. Employer Identification No.)

|

13215 Bee Cave Parkway, Suite B-300

Austin, Texas 78738

(Address of Principal Executive Offices) (Zip Code)

(512) 538-2300

(Registrants’ telephone number, including area code)

Not applicable

(Former name or former address, if changed since last report.)

Check the appropriate box below if the Form 8-K filing is intended

to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

|

|

¨

|

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 240.425)

|

|

|

¨

|

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12)

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b))

|

|

|

¨

|

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c))

|

|

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

|

|

|

Title of each class

|

Trading Symbol(s)

|

Name of each exchange on which registered

|

|

Common Stock, $0.01 par value

|

INN

|

New York Stock Exchange

|

|

Series D Cumulative Redeemable Preferred Stock, $0.01 par value

|

INN-PD

|

New York Stock Exchange

|

|

Series E Cumulative Redeemable Preferred Stock, $0.01 par value

|

INN-PE

|

New York Stock Exchange

|

Indicate by check mark whether the registrant is an emerging

growth company as defined in as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter or Rule 12b-2 of the Securities

Exchange Act of 1934 (§240.12b-2 of this chapter).

|

Emerging growth company

|

¨

|

|

If

an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for

complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act.

¨

|

Item 1.01.

|

Entry into a Material Definitive Agreement.

|

Second Amendment to $200.0 Million Senior Credit Facility

On June 18, 2020, Summit

JV MR 1, LLC (the “Borrower” or “we”), as borrower, Summit Hospitality JV, LP, as parent, and each party

executing the credit facility documentation as a subsidiary guarantor, entered into the Second Amendment to Credit Agreement (the

“Second Amendment”) of the Borrower’s $200 Million senior credit facility (the “Credit Facility”)

with Bank of America, N.A., as administrative agent, BofA Securities, Inc., as sole lead arranger and sole bookrunner, and a syndicate

of lenders including Bank of America, N.A., KeyBank National Association, and Bank of Montreal, Chicago Branch.

The following summary

of the Second Amendment is qualified in its entirety by reference to the Second Amendment to Credit Agreement, dated June 18, 2020,

a copy of which is attached hereto as Exhibit 10.1 and incorporated by reference herein. The following is a summary of the material

amendments to the Credit Facility:

Certain financial and

other covenants under the Credit Facility were waived or adjusted, for the periods described below:

|

|

·

|

Temporary waivers of the Consolidated Fixed Charge Coverage Ratio covenant and certain other covenants in the Credit Facility for the period June 18, 2020 through the date the Borrower is required to deliver to the lenders a compliance certificate for the period ending June 30, 2021 (“Covenant Waiver Period”); and

|

|

|

·

|

Adjustments to the Borrowing Base Coverage Ratio beginning on June 18, 2020, and adjusting up through June 30, 2022.

|

The Second Amendment

confirmed that the Borrower may make additional advances on the existing revolving facility. Prior to the expiration of the Covenant

Waiver Period, advances are limited to the lesser of the aggregate facility amount and the aggregate Borrowing Base Asset Value

multiplied by 55%, less all outstanding advances. Upon the expiration of the Covenant Waiver Period, advances are limited to the

lesser of the aggregate facility amount, the aggregate Borrowing Base Asset Value multiplied by 55%, and the amount that would

permit the Borrower to achieve the Borrowing Base Coverage Ratio then applicable, less all outstanding advances.

Certain other typical

limitations and conditions for credit facilities of this nature were included among the provisions in the Second Amendment including,

among other provisions, limitations on the use of revolving facility advances, certain restrictions on payments of dividends and

limitations on investments and dispositions.

We retain the right

to opt out of certain additional restrictive covenants upon demonstration of compliance with the required financial covenants.

|

Item 2.03.

|

Creation of a Direct Financial Obligation or an Obligation under an Off-Balance Sheet Arrangement of a Registrant.

|

The information contained

in Item 1.01 concerning the Company’s direct financial obligations is incorporated herein by reference.

|

Item 9.01.

|

Financial Statements and Exhibits.

|

(d) Exhibits

|

Exhibit No.

|

Description

|

|

|

|

|

10.1

|

Second Amendment to Credit Agreement dated June 18, 2020 among Summit JV MR 1, LLC, as borrower, Summit Hospitality JV, LP, as parent guarantor, each party executing the credit facility documentation as a subsidiary guarantor, Bank of America, N.A., as administrative agent, and the lenders party to the Credit Agreement.

|

|

|

|

|

101

|

Cover Page Interactive Data – the cover page XBRL tags are

embedded within the Inline XBRL document

|

|

|

|

|

104

|

Cover Page Interactive Data File – the cover page XBRL tags are embedded within the Inline XBRL document

|

SIGNATURE

Pursuant to the requirements

of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

|

|

SUMMIT HOTEL PROPERTIES, INC.

|

|

|

|

|

|

By:

|

/s/ Christopher R. Eng

|

|

|

|

Christopher R. Eng

|

|

|

|

Executive Vice President, General Counsel

|

|

Date: June 24, 2020

|

|

Chief Risk Officer and Secretary

|

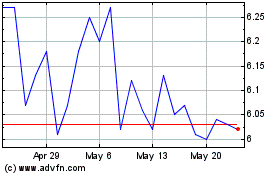

Summit Hotel Properties (NYSE:INN)

Historical Stock Chart

From Jun 2024 to Jul 2024

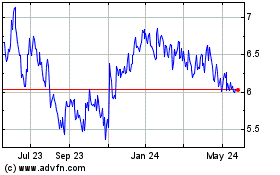

Summit Hotel Properties (NYSE:INN)

Historical Stock Chart

From Jul 2023 to Jul 2024