Current Report Filing (8-k)

14 April 2023 - 6:06AM

Edgar (US Regulatory)

c/o Magnachip Semiconductor, Ltd. false 0001325702 0001325702 2023-04-11 2023-04-11

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, DC 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d)

of the Securities Exchange Act of 1934

Date of report (Date of earliest event reported): April 11, 2023

Magnachip Semiconductor Corporation

(Exact name of Registrant as specified in its charter)

|

|

|

|

|

| Delaware |

|

001-34791 |

|

83-0406195 |

(State or Other Jurisdiction of Incorporation) |

|

(Commission File Number) |

|

(IRS Employer Identification No.) |

|

|

|

c/o Magnachip Semiconductor, Ltd. 15F, 76 Jikji-daero 436beon-gil, Heungdeok-gu Cheongju-si, Chungcheongbuk-do, 28581, Republic of Korea |

|

Not Applicable |

| (Address of Principal Executive Offices) |

|

(Zip Code) |

Registrant’s telephone number, including area code: +82 (2) 6903-3054

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| ☐ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ☐ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ☐ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ☐ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Securities registered pursuant to Section 12(b) of the Act:

|

|

|

|

|

Title of each class |

|

Trading Symbol |

|

Name of each exchange on which registered |

| Common Stock, par value $0.01 per share |

|

MX |

|

New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§ 230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§ 240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

| Item 1.01. |

Entry into a Material Definitive Agreement. |

On April 11, 2023, Magnachip Semiconductor Corporation (the “Company”) entered into an Agreement (the “Agreement”) with Jackson Square Advisors LLC (“Jackson”), GT Investments II Corp (“GTI”) and Gilbert Nathan (in his capacity as a stockholder of the Company and together with Jackson and GTI, collectively, the “Stockholders”), who, collectively with certain of Mr. Nathan’s immediate family members, beneficially own 161,515 shares of the Company’s common stock, par value $0.01 (“Common Stock”). Pursuant to the Agreement, the Company’s board of directors (the “Board”) agreed that, reasonably promptly following the 2023 annual meeting of the stockholders of the Company (the “2023 Annual Meeting”), it will increase the size of the Board to seven directors and take all necessary action to appoint Mr. Nathan as a director of the Company with a term expiring at the 2024 annual meeting of stockholders of the Company (the “2024 Annual Meeting”), and as a member of any ad hoc Strategic Review Committee of the Board. Until the time of such appointment, the Board has agreed that Mr. Nathan may attend meetings of the Board and any ad hoc Strategic Review Committee of the Board in a “board observer” capacity, subject to certain limitations.

Pursuant to the Agreement, the Stockholders have agreed, among other things, to not nominate or recommend for nomination any person for election at the 2023 Annual Meeting, submit any proposal for consideration at the 2023 Annual Meeting or initiate, encourage or participate in any “withhold” or similar campaign with respect to the 2023 Annual Meeting. The Stockholders have also agreed to vote all of their shares in favor of the Company’s nominees at the 2023 Annual Meeting and to vote in favor of the Board’s recommendation with respect to any stockholder proposals or other business presented at the 2023 Annual Meeting. Further, the Stockholders have agreed that if at any time after the date of the Agreement, the Stockholders (and Mr. Nathan’s immediate family members) cease to beneficially own in the aggregate 125,000 shares of Common Stock, then the Stockholders shall cause Mr. Nathan to promptly offer to tender his resignation from the Board and any committee of the Board on which he may be a member, and the Company shall have no further obligations under the Agreement (other than with respect to non-disparagement). The Stockholders have also agreed to a customary standstill provision.

The foregoing summary of the Agreement does not purport to be complete and is subject to and qualified in its entirety by reference to the Agreement attached hereto as Exhibit 10.1.

On April 13, 2023, the Company issued a press release which announced the Agreement referred to under Item 1.01 above. A copy of the press release is included herein as Exhibit 99.1, which is incorporated herein by reference.

| Item 9.01 |

Financial Statements and Exhibits. |

(d) Exhibits.

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

|

|

|

|

|

|

|

|

|

|

|

MAGNACHIP SEMICONDUCTOR CORPORATION |

|

|

|

|

| Dated: April 13, 2023 |

|

|

|

By: |

|

/s/ Theodore Kim |

|

|

|

|

|

|

Theodore Kim |

|

|

|

|

|

|

Chief Compliance Officer, General Counsel and Secretary |

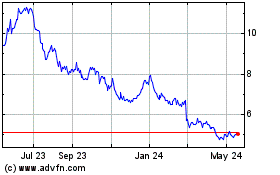

Magnachip Semiconductor (NYSE:MX)

Historical Stock Chart

From Jun 2024 to Jul 2024

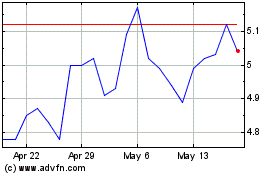

Magnachip Semiconductor (NYSE:MX)

Historical Stock Chart

From Jul 2023 to Jul 2024