Oceanic Engages CapitalAsia Investment Holdings Group as A Strategic Advisor and Announces Financing

22 May 2013 - 3:01AM

Marketwired Canada

NOT FOR DISSEMINATION INTO THE UNITED STATES OF AMERICA OR DISTRIBUTION TO U.S.

NEWSWIRE SERVICES

Oceanic Iron Ore Corp. ("Oceanic", or the "Company") (TSX

VENTURE:FEO)(OTCQX:FEOVF) announces that it has engaged CapitalAsia Investment

Holdings Group ("CapitalAsia") as a strategic advisor in respect of select

strategic partnering initiatives focused in China.

The Company also announces a non-brokered financing of $3 million ("Financing")

subscribed for by Sino-Canada Natural Resources Fund ("Sino-Canada Fund").

Sino-Canada Fund will be issued convertible debentures (the "Debentures") which

will earn interest at a rate of 6% over the 30 month term (the "Term") of the

Debentures.

The principal amount of the Debentures will be convertible to common shares of

the Company ("Common Shares") at a price of $0.16 per share at the election of

the subscriber. In addition, the Company has the right at any time to pay all or

any part of the unpaid principal in respect of the Debentures in Common Shares,

where the issue price of each Common Share will be equal to the volume weighted

average trading price for the 20 days prior to the date of notice of the

conversion.

In the event that the volume weighted average trading price of Common Shares is

equal to or greater than $0.16 per share for any 20 consecutive trading day

period during the term of the Debentures, the principal and interest owing under

the Debentures will be automatically converted into Common Shares of the

Company.

Following the closing of the Financing Sino-Canada Fund will have the right to

nominate one individual for appointment to the Company's Strategic Advisory

Committee. Should the advisory services of CapitalAsia lead to the completion of

a transaction between the Company and a strategic partner, Sino-Canada Fund will

have the right to nominate one individual for appointment as a director of the

Company.

Sino-Canada Fund has secured the necessary Chinese regulatory approvals for its

investment in Oceanic. The Financing is subject to the approval of the TSX

Venture Exchange. The Company will pay finder's fees in association with the

private placement.

The Company intends to use the proceeds of the Financing to fund its ongoing

negotiations with potential strategic partners, studies in connection with the

feasibility study and environmental assessment in respect of the Company's Hopes

Advance project as well as for general claims maintenance, and corporate and

working capital purposes.

Thomas Lau, Managing Partner of Sino-Canada Natural Resources Fund indicated:

"Our investment in Oceanic provides us with excellent exposure to iron ore,

which we believe will continue to have strong demand dynamics in Asia and other

emerging economies developing infrastructure and focused on urbanization. Run by

an experienced executive team led by Steven Dean, the Hopes Advance project has

unique advantages, including an expected life of mine operating cost per tonne

of approximately $30, which makes it one of the best projects in the world. We

are looking forward to offering our insights in respect of the Chinese market to

Oceanic in order to create mutual benefit for both Canada's and China's

economies."

Steven Dean, Chairman added: "We are pleased to have established an advisory

relationship with CapitalAsia in respect of our strategic partnering initiatives

focused in China and also look forward to welcoming Sino-Canada Natural

Resources Fund as a new investor in Oceanic upon the closing of this

transaction. We value Sino-Canada's endorsement and look forward to their

participation on our Strategic Advisory Committee as we focus on both securing a

strategic partner for the Hopes Advance project and advancing certain critical

components of the feasibility and environmental assessment work."

About Sino-Canada Natural Resources Fund:

Sino-Canada Natural Resources Fund is a Cayman Islands registered private equity

fund focused on investments in Canadian listed and private companies that

develop and operate natural resource projects (mining, oil & gas, forestry)

worldwide. Sino-Canada Fund is managed in Hong Kong on behalf of private and

institutional investors from China.

About Oceanic:

Oceanic is a feasibility stage company focused on the development of its 100%

owned Hopes Advance, Morgan Lake and Roberts Lake iron ore development projects

located on the coast in the Labrador Trough in Quebec, Canada. The Company is

led by a highly experienced management team that has managed, operated developed

and/or sold over $20 bn in assets. In November 2012, the Company published the

results of the pre-feasibility study completed in respect of the flagship Hopes

Advance project outlining a base case pre-tax NPV of $5.6bn over a 30 year mine

life, supported by a NI 43-101 proven and probable reserve of approximately 1.36

bn tonnes and a life of mine operating cost of approximately $30/tonne, making

it one of the lowest cost development projects globally. The pre-feasibility

study is available for review on the Company's website (www.oceanicironore.com)

and SEDAR (www.sedar.com). Further information in respect of the Morgan Lake and

Roberts Lake projects, both of which have been explored historically and which

have defined historical resources, is also available on the Company's website.

OCEANIC IRON ORE CORP. (www.oceanicironore.com)

On behalf of the Board of Directors

Steven Dean, Chairman and Chief Executive Officer

This news release includes certain "Forward-Looking Statements" as that term is

used in applicable securities law. All statements included herein, other than

statements of historical fact, including, without limitation, statements

regarding potential mineralization and resources, exploration results, and

future plans and objectives of Oceanic Iron Ore Corp. ("Oceanic", or the

"Company"), are forward-looking statements that involve various risks and

uncertainties. In certain cases, forward-looking statements can be identified by

the use of words such as "plans", "expects" or "does not expect", "scheduled",

"believes", or variations of such words and phrases or statements that certain

actions, events or results "potentially", "may", "could", "would", "might" or

"will" be taken, occur or be achieved. There can be no assurance that such

statements will prove to be accurate, and actual results could differ materially

from those expressed or implied by such statements. Forward-looking statements

are based on certain assumptions that management believes are reasonable at the

time they are made. In making the forward-looking statements in this

presentation, the Company has applied several material assumptions, including,

but not limited to, the assumption that: (1) there being no significant

disruptions affecting operations, whether due to labour/supply disruptions,

damage to equipment or otherwise; (2) permitting, development, expansion and

power supply proceeding on a basis consistent with the Company's current

expectations; (3) certain price assumptions for iron ore; (4) prices for

availability of natural gas, fuel oil, electricity, parts and equipment and

other key supplies remaining consistent with current levels; (5) the accuracy of

current mineral resource estimates on the Company's property; and (6) labour and

material costs increasing on a basis consistent with the Company's current

expectations.

Important factors that could cause actual results to differ materially from the

Company's expectations are disclosed under the heading "Risks and Uncertainties

" in the Company's MD&A filed February 27, 2013 (a copy of which is publicly

available on SEDAR at www.sedar.com under the Company's profile) and elsewhere

in documents filed from time to time, including MD&A, with the TSX Venture

Exchange and other regulatory authorities. Such factors include, among others,

risks related to the ability of the Company to obtain necessary financing and

adequate insurance; the economy generally; fluctuations in the currency markets;

fluctuations in the spot and forward price of iron ore or certain other

commodities (e.g., diesel fuel and electricity); changes in interest rates;

disruption to the credit markets and delays in obtaining financing; the

possibility of cost overruns or unanticipated expenses; employee relations.

Accordingly, readers are advised not to place undue reliance on Forward-Looking

Statements. Except as required under applicable securities legislation, the

Company undertakes no obligation to publicly update or revise Forward-Looking

Statements, whether as a result of new information, future events or otherwise.

FOR FURTHER INFORMATION PLEASE CONTACT:

Oceanic Iron Ore Corp.

Steven Dean

Chairman and Chief Executive Officer

+1 604 566 9080

Oceanic Iron Ore Corp.

Alan Gorman

President and Chief Operating Officer

+1 514 289 1183

agorman@oceanicironore.com

Oceanic Iron Ore Corp.

Irfan Shariff

CFO

+1 604 566 9080

is@oceanicironore.com

www.oceanicironore.com

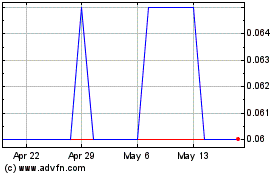

Oceanic Iron Ore (TSXV:FEO)

Historical Stock Chart

From Jun 2024 to Jul 2024

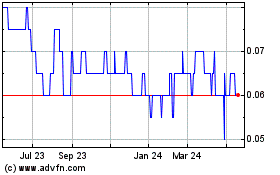

Oceanic Iron Ore (TSXV:FEO)

Historical Stock Chart

From Jul 2023 to Jul 2024