Immunotec Announces Record Second Quarter 2014 Results

30 May 2014 - 12:18AM

Marketwired

Immunotec Announces Record Second Quarter 2014 Results

- Revenues amounted to $19.1M, an increase of 50.9%.

- Network sales growth in Mexico of 98.2 % and in United States

of 32.4%.

- Adjusted EBITDA amounted to $1.4M, an increase of 52.4%.

- Net profit amounted to $0.8M, an increase of 16.8% over prior

year.

- Positive Outlook for Fiscal 2014.

VAUDREUIL-DORION, QUEBEC--(Marketwired - May 29, 2014) -

Immunotec Inc. (TSX-VENTURE:IMM), a Canadian company and a leader

in the wellness industry, today reported second quarter Revenues

for the three- and six-month periods ended 30 April 2014 reaching

$19.1M and $35.2M, reflecting increases of 50.9% and 42.0% as

compared to the same periods in the previous year. Net profit for

the three- and six-month periods was $0.8M and $1.5M, compared to

$0.7M and $1.2M, reflecting increases of 16.8% and 28.8%, as

compared to the same periods in the previous year.

"While these

impressive results speak for themselves, the real story is Team

Immunotec's commitment to improve people's lives," said Mr. Charles

L. Orr, Immunotec's Chief Executive Officer. "Every day we are

engaged in bringing our distinctive nutritional products and

exceptional earning opportunity to people desiring a better

life."

"Our Field leaders

were able to sponsor almost 36,000 new customers and consultants in

the first six months of the year, an increase of 80% over the prior

year," said Patrick Montpetit, Immunotec's Chief Financial Officer.

"We believe that this trend will continue for the remainder of the

fiscal year."

FINANCIAL

PERFORMANCE - KEY HIGHLIGHTS

- Network sales

are the Company's most important performance indicator and are

driven by product sales directly sold by our network of independent

consultants. During the three- and six-month periods ended 30 April

2014, Network sales were $17.5M and $32.3M as compared to $11.2M

and $22.4M for the same periods in the previous year, increases of

56.1% and 44.0%.

- Field

incentives are the Company's most significant expense and

consist of commissions from product sales, performance bonuses and

other promotional incentives provided to qualifying independent

consultants. During the three- and six-month periods ended 30 April

2014, Field incentives amounted to $9.5M or 54.2% and $17.5M or

54.1% of Network sales, compared to $5.6M or 50.0% and $11.0M or

49.0% in the same period in the previous year. This increase is a

reflection of various sponsoring activities resulting in higher

revenues and leadership rank advancements.

- Adjusted

EBITDA1 for the three- and six-month periods ended 30 April

2014 was $1.4M and $2.2M or 7.4% and 6.2% of revenues, versus $0.9M

and $1.8M or 7.4% and 7.1% for the same periods in the previous

year.

- Net profit of

$0.8M and $1.5M for the three- and six-month periods, compared to

$0.7M and $1.2M in the same periods in the previous year. Total

basic and fully diluted profit per common share for the three- and

six- month periods ended 30 April 2014 and 2013 was $0.01 and

$0.02. These period-over-period improvements are primarily the

result of revenue growth in Mexico and the United States.

1 Adjusted

EBITDA is a non-GAAP measures providing additional information on

the commercial performance of regular operations. Adjusted EBITDA

corresponds to EBITDA as defined Earnings before Interest Taxes

Depreciation and Amortization less elements that management

considers outside of the normal activities of the Company. For more

information please refer to the non-GAAP measures section of the

most recent Management Discussion and Analysis filed on

www.sedar.com

| Key Market Activities |

|

|

|

|

|

Three-month |

|

|

|

Six-month |

|

|

|

Network sales in key markets in local currency |

|

2014 |

2013 |

Growth |

|

|

2014 |

|

2013 |

Growth |

|

|

|

|

Mexico ('000s of Mexican Pesos) |

|

125,238 |

63,174 |

98.2 |

% |

|

224,111 |

|

129,698 |

72.8 |

% |

|

United States ('000s of US$) |

|

3,790 |

2,862 |

32.4 |

% |

|

7,232 |

|

5,700 |

26.9 |

% |

|

Canada ('000s of C$) |

|

2,772 |

3,036 |

-8.7 |

% |

|

5,700 |

|

6,229 |

-8.5 |

% |

|

|

|

|

|

|

|

Three-month |

|

|

|

Six-month |

|

|

|

Sponsoring of new Customers and new Consultants in key markets |

|

2014 |

2013 |

Growth |

|

|

2014 |

|

2013 |

Growth |

|

|

Mexico |

|

15,143 |

7,267 |

108.4 |

% |

|

27,282 |

|

14,820 |

84.1 |

% |

|

United States |

|

3,369 |

1,647 |

104.6 |

% |

|

6,062 |

|

3,025 |

100.4 |

% |

|

Canada |

|

1,284 |

1,103 |

16.4 |

% |

|

2,637 |

|

2,145 |

22.9 |

% |

|

Total |

|

19,796 |

10,017 |

97.6 |

% |

|

35,981 |

|

19,990 |

80.0 |

% |

Mexico is the

Company's largest geographic market, representing 54.6% of total

revenue for the six-month period ended 30 April 2014, compared to

42.9% for the same period in the previous year. Mexican Network

sales reached MXP 125.2M (C$10.5M) and MXP 224.1M (C$18.5M)

increases of 98.2% and 72.8% compared to the same periods in the

previous year. This increase is the result of continued increases

in sponsoring of new independent customers and consultants. The

number of new customers and new consultants increased by 108.4% and

84.1% compared to the same periods in the previous year. We have

been able to increase our market penetration within a number of new

districts within Mexico, where we were not present last year.

The United States is

now the Company's second largest geographic market, representing

24.1% of Network sales after six-month period ended 30 April 2014,

compared to 25.2% in the same period in the previous year. United

States Network sales reached US$3.8M (C$4.2M) and US$7.2M (C$7.8M)

increases of 32.4% and 26.9%, compared to the same periods in the

previous year. This increase is the result of increases in the

sponsoring of new independent customers and consultants by 104.6%

and 100.4% compared to the same periods in the previous year. This

increase is predominantly from the western United States and from

marketing initiatives implemented in late fiscal 2013. To support

this growth, the Company is in the process of establishing a

satellite office in California. The official opening is expected

before the end of fiscal 2014.

Canada is now the

Company's third largest geographic market, representing 17.3% of

total revenue after the six-month period ended 30 April 2014,

compared to 27.0% in the same period in the previous year. The

relative size of Canada has decreased due to the substantial growth

recorded in both Mexico and the United States. Canadian Network

sales for the three- and six-month periods ended 30 April 2014

accounted for $2.8M and $5.7M or decreases of 8.7% and 8.5% of

total revenues. Despite the decrease in Network sales, we recorded

positive growth in the number of new customers and new consultants

by 16.4% and 22.9% compared to the same periods in the previous

year. Management believes that these increases in sponsoring are a

positive indicator for this market and that it could return to

growth as additional initiatives are undertaken.

About Immunotec

Inc.

Immunotec Inc. is

dedicated to making a positive difference in people's lifestyle

every day by offering research-driven nutritional products through

its network of Independent Consultants worldwide. Immunotec's

strength comes from its culture that emphasizes teamwork and

entrepreneurial leadership by employees, consultants and research

collaborators.

Headquartered with

manufacturing facilities near Montreal, Canada, Immunotec's

independent consultants generate nearly $55.0M in annual revenues

last Fiscal 2013. Please visit us at www.immunotec.com for

additional information.

The Company files

its consolidated financial statements, its management and

discussion analysis report, its press releases and such other

required documents on the SEDAR database at www.sedar.com and on

the Company's website at www.immunotec.com. The common shares of

the Company are listed on the TSX Venture Exchange under the ticker

symbol IMM. Neither TSX Venture Exchange nor its Regulation

Services Provider (as that term is defined in policies of the TSX

Venture Exchange) accepts responsibility for the adequacy or

accuracy of this release.

CAUTION

REGARDING FORWARD-LOOKING STATEMENTS: Certain statements contained

in this news release are forward looking and are subject to

numerous risks and uncertainties, known and unknown. For

information identifying known risks and uncertainties and other

important factors that could cause actual results to differ

materially from those anticipated in the forward-looking

statements, please refer to the heading Risks and Uncertainties in

Immunotec's most recent Management's Discussion and Analysis, which

can be found at www.sedar.com. Consequently, actual results may

differ materially from the anticipated results expressed in these

forward-looking statements. The company encourages investors to

visit its website from time to time, as information is updated and

new information is posted.

Selected Financial

Information

The following tables

summarize selected financial information from the unaudited interim

Consolidated Statements of Income and the unaudited interim

Consolidated Statements of Financial Position regarding the

Company's results of operations and financial position.

| Selected financial information |

|

|

|

| For the periods ended 30 April |

|

Three-month |

|

|

Six-month |

|

| ('000s of C$, except for share and per share

data) |

|

2014 |

|

2013 |

|

|

2014 |

|

|

2013 |

|

|

|

| Revenues |

|

19,062 |

|

12,630 |

|

|

35,218 |

|

|

24,810 |

|

|

Cost of goods sold |

|

3,337 |

|

2,231 |

|

|

6,260 |

|

|

4,220 |

|

|

|

Other variable costs |

|

1,146 |

|

843 |

|

|

2,133 |

|

|

1,746 |

|

| Margin before expenses |

|

14,579 |

|

9,556 |

|

|

26,825 |

|

|

18,844 |

|

|

|

Expenses |

|

13,350 |

|

9,000 |

|

|

25,025 |

|

|

17,686 |

|

| Operating income |

|

1,229 |

|

556 |

|

|

1,800 |

|

|

1,158 |

|

|

Net finance (income) expenses |

|

121 |

|

(268 |

) |

|

(347 |

) |

|

(336 |

) |

|

|

Income taxes |

|

338 |

|

165 |

|

|

618 |

|

|

307 |

|

| Net profit |

|

770 |

|

659 |

|

|

1,529 |

|

|

1,187 |

|

|

|

| Total comprehensive income |

|

818 |

|

419 |

|

|

1,444 |

|

|

856 |

|

|

|

| Net profit per common share: |

|

|

|

|

|

|

|

|

|

|

|

| Basic and diluted |

|

0.01 |

|

0.01 |

|

|

0.02 |

|

|

0.02 |

|

| Weighted average number of common shares oustanding

during the period: |

|

|

|

|

|

|

|

|

|

|

|

| Basic |

|

69,061,780 |

|

69,681,982 |

|

|

69,094,464 |

|

|

69,767,670 |

|

| Diluted |

|

69,067,528 |

|

69,681,982 |

|

|

69,099,440 |

|

|

69,767,670 |

|

|

|

| As at |

|

|

|

|

|

|

30 April |

|

|

31 October |

|

| (000's of C$) |

|

|

|

|

|

|

2014 |

|

|

2013 |

|

|

|

| Cash |

|

|

|

|

|

|

4,596 |

|

|

4,706 |

|

| Total assets |

|

|

|

|

|

|

25,576 |

|

|

23,495 |

|

| Long-term liabilities (including current portions) |

|

|

|

|

|

|

2,688 |

|

|

2,021 |

|

| Equity |

|

|

|

|

|

|

14,461 |

|

|

13,071 |

|

|

|

|

|

|

|

| Calculation of adjusted EBITDA1 |

|

|

|

|

|

|

|

|

|

|

|

|

| For the periods ended 30 April |

|

Three-month |

|

|

|

|

Six-month |

|

|

|

|

|

|

|

|

|

Growth |

|

|

|

|

|

|

Growth |

|

| ('000s of C$) |

|

2014 |

|

2013 |

|

|

|

|

2014 |

|

2013 |

|

|

|

|

|

| Net profit |

|

770 |

|

659 |

|

|

|

|

1,529 |

|

1,187 |

|

|

|

| Add (deduct): |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Depreciation and amortization |

|

176 |

|

220 |

|

|

|

|

349 |

|

441 |

|

|

|

|

Net finance (income) expenses |

|

121 |

|

(268 |

) |

|

|

|

(347 |

) |

(336 |

) |

|

|

|

Other expenses |

|

15 |

|

16 |

|

|

|

|

32 |

|

21 |

|

|

|

|

Administrative assessments from a foreign jurisdiction |

|

- |

|

140 |

|

|

|

|

- |

|

140 |

|

|

|

|

|

Income taxes |

|

338 |

|

165 |

|

|

|

|

618 |

|

307 |

|

|

|

| Adjusted EBITDA |

|

1,420 |

|

932 |

|

52.4 |

% |

|

2,181 |

|

1,760 |

|

23.9 |

% |

|

|

| Percentage of revenues |

|

7.4 |

% |

7.4 |

% |

|

|

|

6.2 |

% |

7.1 |

% |

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

1 Adjusted

EBITDA is a non-GAAP measures providing additional information on

the commercial performance of regular operations. Adjusted EBITDA

corresponds to EBITDA as defined Earnings before Interest Taxes

Depreciation and Amortization less elements that management

considers outside of the normal activities of the Company. For more

information please refer to the non-GAAP measures section of the

most recent Management Discussion and Analysis filed on

www.sedar.com.

Immunotec Inc.Patrick Montpetit CPA, CA, CFVice-President and

Chief Financial Officer(450) 510-4527www.immunotec.com

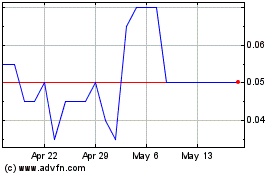

International Metals Min... (TSXV:IMM)

Historical Stock Chart

From Apr 2024 to May 2024

International Metals Min... (TSXV:IMM)

Historical Stock Chart

From May 2023 to May 2024