Orestone Completes Two Million Dollar Private Placement

25 October 2012 - 8:13AM

Marketwired Canada

Orestone Mining Corp. (TSX VENTURE:ORS) (the "Company") is pleased to announce

that the non-brokered private placement announced on September 25th and amended

September 27th and October 10th, 2012 has closed. The Company has issued

15,875,000 units ("Units") at a price of $0.10 per Unit and 3,300,000 units

("Flow-Through Units") at a price of $0.125 per Flow-Through Unit for aggregate

gross proceeds of $2,000,000 (the "Private Placement"). Each Unit consisted of

one common share of the Company and one-half of one common share purchase

warrant (each whole common share purchase warrant, an "A Warrant"). Each A

Warrant is exercisable for one common share of the Company at a price of $0.15

until October 23, 2013. Each Flow-Through Unit consisted of one common share of

the Company issued on a "flow-through" basis pursuant to the Income Tax Act

(Canada) and one-half of one common share purchase warrant (each whole common

share purchase warrant, a "B Warrant"). Each B Warrant is exercisable for one

common share of the Company at a price of $0.17 until October 23, 2013.

The Company has paid to certain arm's length finders a fee of 7 per cent of the

aggregate gross proceeds of the Private Placement consisting of $73,325 in cash

and 220,500 units of the Company, each finder's unit consisting of one common

share of the Company and one half of one non-transferable common share purchase

warrant (each whole warrant, a "Finder's Unit Warrant"). The Finder's Unit

Warrants entitle the holders thereof to purchase one common share of the Company

at an exercise price of $0.15 or $0.17 as the case may be, until October 23,

2013. In addition, the Company has issued 931,000 non-transferable finder's

warrants ("Finder's Warrants") representing an amount equal to 7 per cent of the

aggregate number of Units and/or Flow-Through Units sold to subscribers

introduced to the Company by such finder, each Finder's Warrant entitling the

holder thereof to acquire one common share of the Company at an exercise price

of $0.10 or $0.125, respectively, until October 23, 2013.

All securities issued under the Private Placement, including the common shares

issuable pursuant to the exercise of the A Warrants, B Warrants, Finder's Unit

Warrants and Finder's Warrants, will be subject to a four-month hold period

which will expire on February 24, 2013.

The net proceeds of the Private Placement will be used for exploration and

development of the Company's mineral property portfolio and for general

corporate purposes.

Within British Columbia, Canada, Orestone has recently discovered a large

copper/gold porphyry system on the 100% owned Captain Project and is seeing

increased interest in the Stewart Mining Camp where the Company's 50 square

kilometer Todd Creek (51%) asset is located. In addition, the Company has

initiated a global project search focused on the acquisition of high potential

assets to compliment the Company's current portfolio. For additional information

please visit www.orestone.ca.

ON BEHALF OF ORESTONE MINING CORP.

David Hottman, President and CEO

This news release has been prepared by management and no regulatory authority

has approved or disapproved the information contained herein.

FOR FURTHER INFORMATION PLEASE CONTACT:

Orestone Mining Corp.

David Hottman

President & CEO

604-629-1929

info@orestone.ca

www.orestone.ca

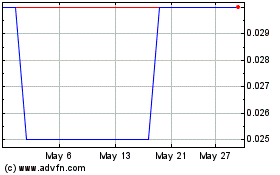

Orestone Mining (TSXV:ORS)

Historical Stock Chart

From May 2024 to Jun 2024

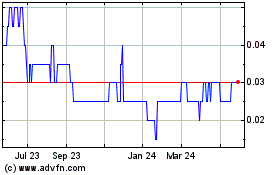

Orestone Mining (TSXV:ORS)

Historical Stock Chart

From Jun 2023 to Jun 2024

Real-Time news about Orestone Mining Corp (TSX Venture Exchange): 0 recent articles

More Orestone Mining Corp. News Articles