UPDATE: Allianz 3Q Net Profit More Than Doubles; No Guidance

09 November 2009 - 8:02PM

Dow Jones News

Allianz SE (ALV.XE), Europe's largest primary insurer by market

capitalization, Monday said third-quarter net profit more than

doubled on lower asset write-downs, and as improvements in

life/health insurance and financial services more than offset lower

contributions from property/casualty insurance.

The figures reflect Allianz's improved earnings power in its

core operations following the sale of loss-making Dresdner

Bank.

The company gave no concrete earnings target for 2009 or beyond.

But it is well capitalized and prepared for delivering solid

earnings even in the "challenging market environment with

structurally lower returns" ahead, due to its high-quality

investment portfolio and conservative risk management approach,

said Chief Financial Officer Oliver Baete, who took the position

Sept. 1.

It also said it accrued a dividend equivalent of EUR1.4 billion

for the first nine months.

Third-quarter net profit rose to EUR1.32 billion from EUR545

million in the year-earlier quarter, roughly in line with the

EUR1.33 billion average forecast in a Dow Jones Newswires poll of

15 analysts.

The year-earlier figure was restated to reflect continuing

operations only, after Allianz sold Dresdner Bank to Commerzbank AG

(CBK.XE) for around EUR5.1 billion in the first quarter. A year

ago, Allianz made a EUR2.02 billion loss when it still owned

Dresdner Bank.

Operating profit rose 23% to EUR1.93 billion from EUR1.56

billion, beating a forecast of EUR1.84 billion. It had a strong

contribution from life/health insurance and financial services,

which benefited from improvements in capital markets, the gradual

economic recovery and the narrowing of credit spreads - which

supported good-margin revenue growth from investment products with

underlying guarantees.

Meanwhile, property/casualty contributed 18% less to operating

profit than in the year-ago quarter, which the company attributed

to negative effects from the recession on business in Germany,

France, Italy and credit insurance, and to an unusually high number

of weather-related claims in those countries.

Allianz called the operating result in property/casualty

business "not yet satisfactory." It said the segment needs to

improve productivity and that business volumes remain challenged

due to weaker demand and portfolio cleaning measures, though rates

are rising. Efforts to improve productivity will be seen in 2010,

but the full impact will only be noticeable over the next three

years, Allianz said.

The investment result, and notably lower net write-downs on

investments, made a substantially better contribution to earnings

than a year ago. In the quarter, net write-downs on investments

were EUR46 million compared with EUR921 million in the third

quarter of 2008.

Allianz had net realized disposal gains of EUR322 million

compared with EUR517 million a year ago.

At 0804 GMT, Allianz shares were up EUR3.02, or 3.6%, at

EUR82.10. UniCredit analyst Andreas Weese said net profit and

operating profit were ahead of consensus, reflecting a

better-than-forecast contribution from life/health insurance and

financial services, while the contribution from property/casualty

insurance was in line. Weese, who rates the share at buy, called

the capital position good. Merck Finck analyst Konrad Becker also

said the figures topped his forecast, though he would have liked to

see some full-year guidance.

-By Ulrike Dauer, Dow Jones Newswires; +49 69 29725 500;

ulrike.dauer@dowjones.com

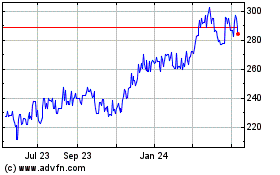

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Jun 2024 to Jul 2024

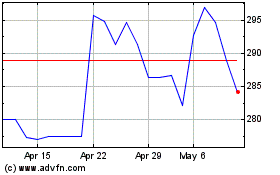

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Jul 2023 to Jul 2024