Allianz: Sees Full-Year Combined Ratio 97%-98% For 2009

09 November 2009 - 9:14PM

Dow Jones News

Allianz SE (ALV.XE) expects a combined ratio in its

property/casualty insurance business in a 97% to 98% range for

2009, Chief Financial Officer Oliver Baete said Monday.

Baete, who took up the position Sept. 1, told journalists in a

conference call that the insurer's third-quarter combined ratio of

96.9% was just below the 97% Allianz targets for the full year, or

the broader 97%-98% range that it expects to post annually.

"We target 97%, market expectation is for 98%, we are working

very hard to reach the 97%, but in the end it may be 98%," Baete

said.

The combined ratio measures an insurer's underwriting

performance by comparing costs and revenue; a figure below 100%

means the underwriting result, when stripping out the investment

result, was profitable. A figure of 90% is good, 70% is

excellent.

For instance, insurers had to pay claims caused by hailstorms in

Germany and Central Europe and Canada, an industrial fire claim in

Russia and a flood in the Philippines in the third quarter. Baete

said other factors, such as additional reserving for previous

claims that turned out to be more expensive than initially thought

also drove the combined ratio higher in the quarter

Allianz had a combined ratio of 98.9% in the second quarter and

of 98.7% in the first quarter.

-By Ulrike Dauer, Dow Jones Newswires; +49 69 29725 500;

ulrike.dauer@dowjones.com

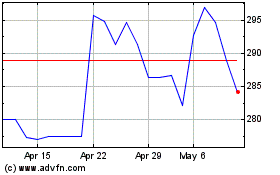

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Jun 2024 to Jul 2024

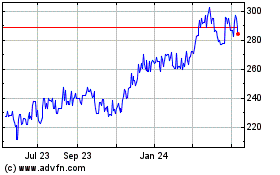

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Jul 2023 to Jul 2024

Real-Time news about Allianz Ag Muenchen Namen (PK) (OTCMarkets): 0 recent articles

More Allianz SE News Articles