2nd UPDATE: E.ON Sells German Power Transmission Grid To TenneT

11 November 2009 - 1:58AM

Dow Jones News

E.ON AG (EOAN.XE) Tuesday said it has agreed to sell its German

power transmission grid to Dutch electricity network operator

TenneT TSO B.V. for EUR1.1 billion, less than some analysts had

expected as regulation and the financial crisis eroded company

valuations.

E.ON and TenneT have agreed on a valuation of EUR885 million for

the power transmission grid, E.ON said. The purchase price,

however, also includes cash held by the grid business, so the exact

price tag will depend on the net financial cash position as of Dec.

31, when the deal takes effect, the company said.

The price is in line with recent press reports, but considerably

below what analysts had expected the unit to be worth when E.ON put

it up for sale in 2008.

Citigroup, in a research note published Monday, had estimated

the E.ON grid to be worth around EUR1.6 billion.

E.ON "achieved a good and fair price," Chief Executive Wulf

Bernotat said in a press conference, adding that some analysts'

valuations were "far away from reality, as it is a strongly

regulated business."

Sal. Oppenheim analyst Matthias Heck said that the limited

regulated returns on equity and increased cost of capital prompted

by the financial crisis have reduced valuations of energy grid

assets.

"The operators of the northern German grids will have to invest

massively in coming years to connect the increasing number of

offshore wind farms to the network," Heck said.

In that respect, the returns on equity allowed on that

investment are important factors that need to be considered in the

valuation of the assets.

"We have valued the E.ON grid at around EUR900 million when we

last updated our estimate in July," said Heck.

Germany's grid regulator--the Bundesnetzagentur--only allows a

pretax return on equity rate of 9.29%. Grid operators have

criticized that, after tax, the return on equity rate would fall to

below 5%, saying this is an insufficient incentive to refinance the

massive investments needed to expand the grid.

At 1412 GMT, E.ON traded EUR0.07, or 0.3%, lower at EUR26.98 in

a broadly flat market.

TenneT Chief Executive Mel Kroon Tuesday said the company

intends to invest between EUR3 billion and EUR4 billion in the

newly acquired grid over the next 10 years.

Vattenfall Europe AG, the German unit of Sweden's Vattenfall AB,

is understood to be closing in on a deal to sell its power

transmission grid to a consortium of financial investors for around

EUR500 million, which is also below analysts' expectations,

reflecting regulation and increased cost of capital.

The consortium, consisting of Allianz SE (ALV.XE), Deutsche Bank

AG's (DB) infrastructure fund RREEF and Goldman Sachs Group Inc.

(GS), also was interested in E.ON's network, people familiar with

the matter said.

The sale of E.ON's grid is part of a deal the company struck

with the European Commission in 2008. E.ON committed to sell the

grid as well as around 5 gigawatts, or around 25%, of its German

power generation capacity to settle two E.U. antitrust cases.

The divestitures are also part of E.ON's plan to sell at least

EUR10 billion worth of assets by the end of 2010 in an effort to

lower its debt pile--which it built up in an acquisitions spree

over the past two years--and refocus its business.

E.ON is on track to deliver on its divestment plans, CEO

Bernotat said, adding that the sale of the power grid raises the

value of assets already sold to around EUR6 billion.

The E.ON grid unit, called Transpower Stromuebertragungs GmbH,

employs 650 people and generated around EUR6.2 billion in revenue

in 2008. The network stretches 10,700 kilometers from the Danish

border in the far north to the border of Austria in the far south

of Germany. E.ON's grid also borders that of TenneT.

-By Jan Hromadko and Martin Rapp, Dow Jones Newswires; +49 69 29

725 503; jan.hromadko@dowjones.com

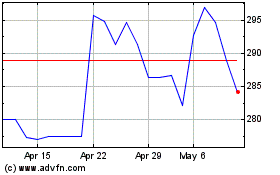

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Jun 2024 to Jul 2024

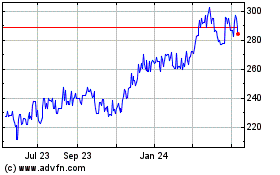

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Jul 2023 to Jul 2024