Allianz Aims To Up Global Lines Share In Group Earnings Mid-Term

01 July 2010 - 7:49PM

Dow Jones News

Allianz SE (ALV.XE), Europe's largest insurer by gross premiums,

aims for a higher contribution from global business lines in the

mid-term, management board member Clement Booth told investors,

according to an investor presentation on Allianz's website.

Allianz's global business lines include industrial insurance,

asset management, credit insurance, life and health insurance,

insurance-bound assistance, automotive insurance, reinsurance and

others. In 2009, these business lines combined contributed about

15%, or EUR14.5 billion, to Allianz's group revenue of EUR97.4

billion; and 34%, or EUR2.5 billion, to operating profit of EUR7.2

billion.

In its industrial insurance business, called Allianz Global

Corporate & Specialty, which is vulnerable to losses from

natural or man-made disasters such as earthquakes, hurricanes and

oil spills, the "diversified portfolio helps to keep large and CAT

[catastrophic] losses within expectations," according to the

presentation.

In its industrial business, Allianz expects "challenging market

conditions" for 2010 and 2011, saying rates across all business

lines will drop by 1% this year and remain flat next year. However,

the mid-term outlook is positive, the insurer said, adding that it

expects a 1% rate rise in industrial business in 2012 and an

improved 2% in 2013.

In its asset management business, Allianz Global Investors,

Allianz is targeting a cost-income ratio of below 65% mid-term.

-By Ulrike Dauer, Dow Jones Newswires; +49 69 29725 500;

ulrike.dauer@dowjones.com

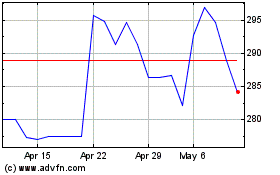

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Jun 2024 to Jul 2024

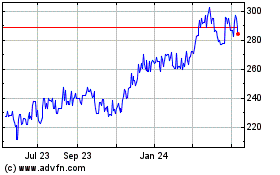

Allianz Ag Muenchen Namen (PK) (USOTC:ALIZF)

Historical Stock Chart

From Jul 2023 to Jul 2024