Mutual Fund Summary Prospectus (497k)

01 March 2014 - 7:26AM

Edgar (US Regulatory)

|

|

|

|

|

Summary Prospectus February 28, 2014

|

|

|

JPMorgan International Opportunities Fund

Class/Ticker: Institutional/JPIOX

Before you invest, you may want to review the Fund’s Prospectus, which contains more information about the Fund and its risks. You can find the Fund’s Prospectus and other information about the

Fund, including the Statement of Additional Information, online at www.jpmorganfunds.com/funddocuments. You can also get this information at no cost by calling 1-800-480-4111 or by sending an e-mail request to Funds.Website.Support@jpmorganfunds.com

or by asking any financial intermediary that offers shares of the Fund. The Fund’s Prospectus and Statement of Additional Information, both dated February 28, 2014, are incorporated by reference into this Summary Prospectus.

What is the goal of the Fund?

The Fund seeks to provide high total return from a portfolio of equity securities of foreign companies in developed and, to a lesser extent, emerging markets.

Fees and Expenses of the Fund

The following table describes the fees and expenses that you may pay if you buy and hold shares of the Fund. “Acquired Fund Fees and Expenses” are expenses incurred indirectly by the Fund through

its ownership of shares in other investment companies, including affiliated money market funds, other mutual funds, exchange-traded funds and business development companies. The impact of Acquired Fund Fees and Expenses is included in the total

returns of the Fund. Acquired Fund Fees and Expenses are not direct costs of the Fund, are not used to calculate the Fund’s net asset value per share and are not included in the calculation of the ratio of expenses to average net assets shown

in the Financial Highlights section of the Fund’s prospectus.

|

|

|

|

|

|

|

ANNUAL FUND OPERATING EXPENSES

(Expenses that you pay each year as a percentage of the value

of your investment)

|

|

|

|

|

Institutional

Class

|

|

|

Management Fees

|

|

|

0.60

|

%

|

|

Distribution (Rule 12b-1) Fees

|

|

|

NONE

|

|

|

Other Expenses

|

|

|

0.26

|

|

|

Shareholder Service Fees

|

|

|

0.10

|

|

|

Remainder of Other Expenses

|

|

|

0.16

|

|

|

Acquired Fund Fees and Expenses

|

|

|

0.01

|

|

|

|

|

|

|

|

|

Total Annual Fund Operating Expenses

|

|

|

0.87

|

|

Example

This Example is intended to help you compare the cost of investing in the Fund with the cost of investing in other mutual funds. The Example assumes that you invest $10,000 in the Fund for the time periods

indicated. The Example also assumes that your investment has a 5% return each year and that the Fund’s operating expenses are equal to the total annual fund operating expenses shown in the fee table. Your actual costs may be higher or lower.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

WHETHER OR NOT YOU SELL YOUR SHARES, YOUR

COST WOULD BE:

|

|

|

|

|

1 Year

|

|

|

3 Years

|

|

|

5 Years

|

|

|

10 Years

|

|

|

INSTITUTIONAL CLASS SHARES ($)

|

|

|

89

|

|

|

|

278

|

|

|

|

482

|

|

|

|

1,073

|

|

Portfolio Turnover

The Fund pays transaction costs, such as commissions, when it buys and sells securities (or “turns over” its portfolio). A higher portfolio turnover rate may indicate higher transaction costs and

may result in higher taxes when Fund shares are held in a taxable account. These costs, which are not reflected in annual fund operating expenses or in the Example, affect the Fund’s performance. During the Fund’s most recent fiscal year,

the Fund’s portfolio turnover rate was 36% of the average value of its portfolio.

1

What are the Fund’s main investment strategies?

The Fund’s assets are invested primarily in equity securities of companies from developed countries other than the United States. The Fund’s assets

may also be invested to a limited extent in emerging markets issuers. Developed countries include Australia, Canada, Japan, New Zealand, Hong Kong, Singapore, the United Kingdom, and most of the countries of Western Europe; emerging markets include

most other countries in the world.

The equity securities in which the Fund may invest include, but are not limited to, common stock, preferred

stock, convertible securities, trust or partnership interests, depositary receipts, privately placed securities and warrants and rights.

The Fund

may invest in securities denominated in U.S. dollars, major reserve currencies and currencies of other countries in which it can invest.

The Fund

will invest substantially in securities denominated in foreign currencies and may seek to enhance returns and manage currency risk where appropriate through managing currency exposure.

The Fund may utilize currency forwards to reduce currency deviations, where practical, for the purpose of risk management. The Fund may also use exchange-traded futures for the efficient management of cash

flows.

Investment Process: In managing the Fund, the adviser employs a three-step process that combines research, valuation and securities

selection.

The adviser selects securities for the Fund’s portfolio using its own investment process to determine which companies it believes

are most likely to provide high total return to shareholders. The adviser chooses what it believes to be the most attractive securities in each sector and builds the portfolio bottom up. Securities in each industry are ranked with the help of

fundamental valuations, then selected for investment. The adviser may adjust currency exposure to manage risks and enhance returns.

Through its

extensive global equity research and analytical systems, the adviser seeks to generate an information advantage. Using fundamental analysis, the adviser develops proprietary research, primarily on companies but also on countries and currencies.

In these processes, the analysts focus on a relatively long period rather than on near-term expectations alone.

Fundamental security research is used to produce a ranking of companies in each industry group according to their relative value. The Fund’s adviser

then buys and sells securities, using the research and valuation rankings as well as its assessment of other factors, including:

|

Ÿ

|

|

catalysts that could trigger a change in a security’s price;

|

|

Ÿ

|

|

potential reward compared to potential risk; and

|

|

Ÿ

|

|

temporary mispricings caused by market overreactions.

|

The Fund may invest a substantial part of its assets in just one region or country.

The Fund’s

Main Investment Risks

The Fund is subject to management risk and may not achieve its objective if the adviser’s expectations regarding

particular securities or markets are not met.

An investment in this Fund or any other fund may not provide a complete investment program. The suitability

of an investment in the Fund should be considered based on the investment objective, strategies and risks described in this prospectus, considered in light of all of the other investments in your portfolio, as well as your risk tolerance, financial

goals and time horizons. You may want to consult with a financial advisor to determine if this Fund is suitable for you.

Equity Market

Risk.

The price of equity securities may rise or fall because of changes in the broad market or changes in a company’s financial condition, sometimes rapidly or unpredictably. These price movements may result from factors affecting

individual companies, sectors or industries selected for the Fund’s portfolio or the securities market as a whole, such as changes in economic or political conditions. When the value of the Fund’s securities goes down, your investment in

the Fund decreases in value.

General Market Risk.

Economies and financial markets throughout the world are becoming increasingly

interconnected, which increases the likelihood that events or conditions in one country or region will adversely impact markets or issuers in other countries or regions.

Foreign Securities and Emerging Market Risk.

Investments in foreign issuers and foreign securities (including depositary receipts) are subject to additional risks, including political and economic

risks, civil conflicts and war, greater volatility, expropriation and nationalization risks, currency fluctuations, higher transaction costs, delayed settlement, possible foreign controls on investment, and less stringent investor protection and

disclosure standards of foreign markets. In certain markets where securities and other instruments are not traded “delivery versus payment,” the Fund may not receive timely payment for securities or other instruments it has delivered and

may be subject to increased risk that the counterparty will fail to make payments when due or default completely

.

Events and evolving conditions in certain economies or markets may alter the risks associated with investments tied to countries

or regions that historically were perceived as comparatively stable becoming riskier and more volatile. These risks are magnified in “emerging markets.”

2

Smaller Cap Company Risk.

Investments in securities of smaller companies may be riskier and more

volatile and vulnerable to economic, market and industry changes than securities of larger, more established companies. As a result, share price changes may be more sudden or erratic than the prices of other equity securities, especially over the

short term.

Derivatives Risk.

Derivatives, including forward currency contracts and futures, may be riskier than other types of

investments because they may be more sensitive to changes in economic or market conditions than other types of investments and could result in losses that significantly exceed the Fund’s original investment. Many derivatives create leverage

thereby causing the Fund to be more volatile than it would be if it had not used derivatives. Derivatives also expose the Fund to counterparty risk (the risk that the derivative counterparty will not fulfill its contractual obligations), including

credit risk of the derivative counterparty. Certain derivatives are synthetic instruments that attempt to replicate the performance of certain reference assets. With regard to such derivatives, the Fund does not have a claim on the reference assets

and is subject to enhanced counterparty risk.

Currency Risk.

Changes in foreign currency exchange rates will affect the value of the

Fund’s securities and the price of the Fund’s shares. Generally, when the value of the U.S. dollar rises in value relative to a foreign currency, an investment in that country loses value because that currency is worth fewer U.S. dollars.

Devaluation of a currency by a country’s government or banking authority also will have a significant impact on the value of any investments denominated in that currency. Currency markets generally are not as regulated as securities markets.

Redemption Risk.

The Fund could experience a loss when selling securities to meet redemption requests by shareholders. The risk of loss

increases if the redemption requests are unusually large or frequent or occur in times of overall market turmoil or declining prices.

Investments in the Fund are not deposits or obligations of, or guaranteed or endorsed by, any bank and are

not insured or guaranteed by the FDIC, the Federal Reserve Board or any other government agency.

You could lose money investing in the Fund.

The Fund’s Past Performance

This section

provides some indication of the risks of investing in the Fund. The bar chart shows how the performance of the Fund’s Institutional Class Shares has varied from year to year for the past ten calendar years. The table shows the average annual

total returns over the past one year, five years and ten years.

The table compares that performance to the Morgan Stanley Capital International (MSCI), Europe, Australasia and Far East (EAFE) Index (net of foreign withholding taxes) and the Lipper

International

Large-Cap

Core Funds Index, an index based on the total returns of certain mutual funds within the Fund’s designated category as determined by Lipper. Unlike the other index, the Lipper

index includes the expenses of the mutual funds included in the index. Past performance (before and after taxes) is not necessarily an indication of how the Fund will perform in the future.

Updated performance information is available by visiting

www.jpmorganfunds.com or by calling

1-800-480-4111.

|

|

|

|

|

|

|

|

|

Best Quarter

|

|

2nd quarter, 2009

|

|

|

23.61%

|

|

|

Worst Quarter

|

|

3rd quarter, 2011

|

|

|

–21.67%

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

AVERAGE ANNUAL TOTAL RETURNS

(For the period ended December 31, 2013)

|

|

|

|

|

Past

1 Year

|

|

|

Past

5 Years

|

|

|

Past

10 Years

|

|

|

INSTITUTIONAL CLASS SHARES

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Return Before Taxes

|

|

|

19.87

|

%

|

|

|

12.39

|

%

|

|

|

7.21

|

%

|

|

Return After Taxes on Distributions

|

|

|

19.69

|

|

|

|

11.95

|

|

|

|

6.80

|

|

|

Return After Taxes on Distributions and Sale of Fund Shares

|

|

|

11.61

|

|

|

|

9.99

|

|

|

|

5.89

|

|

|

MSCI EAFE INDEX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Net of Foreign Withholding Taxes)

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Reflects No Deduction for Fees, Expenses or Taxes, Except Foreign Withholding Taxes)

|

|

|

22.78

|

|

|

|

12.44

|

|

|

|

6.91

|

|

|

LIPPER INTERNATIONAL

LARGE-

CAP CORE FUNDS INDEX

|

|

|

|

|

|

|

|

|

|

|

|

|

|

(Reflects No Deduction for Taxes)

|

|

|

20.67

|

|

|

|

11.74

|

|

|

|

6.37

|

|

3

After-tax

returns are calculated using the historical highest

individual federal marginal income tax rates and do not reflect the impact of state and local taxes. Actual

after-tax

returns depend on the investor’s tax situation and may differ from those shown, and

the

after-tax

returns shown are not relevant to investors who hold their shares through

tax-deferred

arrangements such as 401(k) plans or individual retirement accounts.

Management

J.P. Morgan Investment Management Inc.

|

|

|

|

|

|

|

Portfolio

Manager

|

|

Managed the

Fund

Since

|

|

Primary Title with

Investment Adviser

|

|

Jeroen Huysinga

|

|

2000

|

|

Managing Director

|

Purchase and Sale of Fund Shares

Purchase minimums

|

|

|

|

|

|

|

For Institutional Class Shares

|

|

|

|

|

|

To establish an account

|

|

|

$3,000,000

|

|

|

To add to an account

|

|

|

No minimum levels

|

|

In general, you may purchase or redeem shares on any business day:

|

Ÿ

|

|

Through your Financial Intermediary

|

|

Ÿ

|

|

By writing to J.P. Morgan Funds Services, P.O. Box 8528, Boston, MA 02266-8528

|

|

Ÿ

|

|

After you open an account, by calling J.P. Morgan Funds Services at

1-800-480-4111

|

Tax Information

The Fund intends to make distributions that may be taxed as ordinary income or capital gains, except when your investment is in an IRA, 401(k) plan or other

tax-advantaged

investment plan, in which case you may be subject to federal income tax upon withdrawal from the tax-advantaged investment plan.

Payments to Broker-Dealers and Other Financial Intermediaries

If you purchase shares of the Fund

through a broker-dealer or other financial intermediary (such as a bank), the Fund and its related companies may pay the financial intermediary for the sale of Fund shares and related services. These payments may create a conflict of interest by

influencing the broker dealer or financial intermediary and your salesperson to recommend the Fund over another investment. Ask your salesperson or visit your financial intermediary’s website for more information.

SPRO-IO-I-214

4

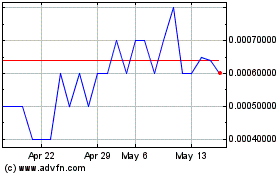

APT Systems (PK) (USOTC:APTY)

Historical Stock Chart

From Jun 2024 to Jul 2024

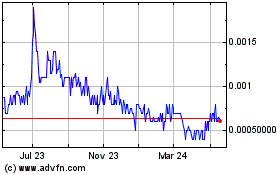

APT Systems (PK) (USOTC:APTY)

Historical Stock Chart

From Jul 2023 to Jul 2024