1st Colonial Bancorp, Inc. (OTCBB:FCOB), holding company of 1st

Colonial National Bank, today reported that its net income for the

year ended December 31, 2010 was $240,000 ($0.08 per share),

compared to $405,000 ($0.14 per share) for the year ended December

31, 2009.

Gerry Banmiller, President and Chief Executive Officer,

commented, “The commercial loan portfolio sustained a significant

charge-off in the 4th Quarter of 2010 due to one particular loan of

size being written off. This event obviously had a negative impact

on our net earnings. The increase in our core earnings, however,

allowed this negative event to be absorbed and we were still able

to show positive earnings of $240,000 for the year.”

He continued, “As we entered 2010, our intent was to shrink

certain elements of our deposit base such as certificates of

deposit, given the inability to arbitrage these liabilities into

reasonable earnings. As you know, highly profitable investment

opportunities in government securities do not exist. This downward

re-pricing allowed us to reduce our higher cost time deposits by

$11 million, replacing them with a similar amount of no cost demand

deposit accounts or low cost transaction accounts. For this reason,

you will note that our deposits were relatively unchanged from

December 31, 2009.”

At December 31, 2010, 1st Colonial also reported $272.6 million

in total assets and $232.6 million in deposits. These amounts

reflect a decrease of $4.0 million in assets from December 31,

2009. Deposits were relatively unchanged. Total loans were $177.3

million, an increase of $6.8 million or 4.0% from December 31,

2009.

1st Colonial’s provision for loan losses increased by $1.5

million to $3.1 million for the year ended December 31, 2010,

compared to the $1.6 million provision for the year ended December

31, 2009.

Net interest income of $8,482,000 for the year ended December

31, 2010 was $1.3 million, or 18.4%, higher than the net interest

income of $7,165,000 for the year ended December 31, 2009. This was

due primarily to an increase in net interest spread of 0.31% to

3.15% for the year ended December 31, 2010 compared to 2.84% for

the year ended December 31, 2009.

Non-interest income increased $579,000 or 46.3% from the prior

year. Fees generated by origination and sale of residential

mortgage loans increased by $248,000, gains on the sale of

investment securities increased by $209,000, fees generated by

origination and sale of SBA loans accounted for $40,000 of the

increase and income from bank owned life insurance increased by

$38,000.

Non-interest expense increased $569,000 or 8.6% from the

comparable period in 2009. Salaries and benefits accounted for

$384,000 of the increase due to increased expenses related to loan

volume in our residential lending department and general salary and

benefit increases. Expenses related to loans in foreclosure

increased by $120,000 and advertising expense increased by $73,000,

as increased marketing is typically needed in a down economy.

For the year ended December 31, 2010, 1st Colonial had a net

loss before income tax expense of $3,000. Its $243,000 income tax

benefit for the year ended December 31, 2010 represented an

increase of $67,000 compared to the prior year income tax benefit

of $176,000.

Highlights as of December 31, 2010 and December 31, 2009, and

comparing the year ended December 31, 2010 and the year ended

December 31, 2009, respectively, include the following (dollars in

thousands, except per share data):

At At $ increase/ % increase/

December 31, 2010 December 31, 2009

(decrease) (decrease) (Unaudited) Total

assets $ 272,620 $ 276,578 $ (3,958 ) -1.4 % Total loans

177,310 170,509 6,801 4.0 % Investments 83,529 91,889 (8,360

) -9.1 % Total deposits 232,631 232,749 (118 ) -0.1 %

Shareholders' equity

23,208 22,746 462 2.0 %

For the year ended $ increase/ % increase/

December 31,

2010 December 31, 2009 (decrease)

(decrease) (Unaudited) Net interest income $ 8,482 $

7,165 $ 1,317 18.4 % Provision for loan losses 3,110 1,551

1,559 100.5 % Other income 1,829 1,250 579 46.3 %

Non-interest expense 7,204 6,635 569 8.6 % Tax benefit 243

176 67 38.1 % Net income 240 405 (165 ) -40.7 %

Earnings per share, diluted $ 0.08 $ 0.14 $ (0.06 ) -42.9 %

1st Colonial National Bank, the subsidiary of 1st Colonial

Bancorp, provides a range of business and consumer financial

services, placing emphasis on customer service and access to

decision makers. Headquartered in Collingswood, New Jersey, the

Bank also has branches in the New Jersey communities of Westville

and Cinnaminson. To learn more, call (856) 858-8402 or visit

www.1stcolonial.com.

This Release contains forward-looking statements that are not

historical facts and include statements about management’s

strategies and expectations about our business. There are risks and

uncertainties that may cause our actual results and performance to

be materially different from results indicated by these

forward-looking statements. Factors that might cause a difference

include economic conditions; unanticipated loan losses, lack of

liquidity; changes in interest rates, changes in FDIC assessments,

deposit flows, loan demand, and real estate values; competition;

changes in accounting principles, policies or guidelines; changes

in laws or regulation; new technology and other factors affecting

our operations, pricing, products and services.

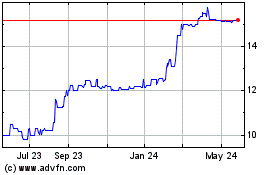

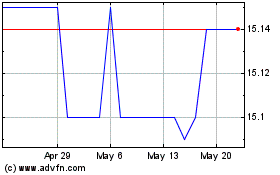

1st Colonial Bancorp (PK) (USOTC:FCOB)

Historical Stock Chart

From Jun 2024 to Jul 2024

1st Colonial Bancorp (PK) (USOTC:FCOB)

Historical Stock Chart

From Jul 2023 to Jul 2024