Information Statement - All Other (definitive) (def 14c)

11 April 2018 - 3:11AM

Edgar (US Regulatory)

UNITED

STATES

SECURITIES

AND EXCHANGE COMMISSION

WASHINGTON,

D.C. 20549

SCHEDULE

14C INFORMATION

Information

Statement Pursuant to Section 14(c)

of

the Securities Exchange Act of 1934

Check

the appropriate box:

|

☐

|

Preliminary

Information Statement

|

|

☐

|

Confidential,

For Use of the Commission Only (as permitted by Rule 14c-5(d)(2))

|

|

☒

|

Definitive

Information Statement

|

AVALON

OIL & GAS, INC.

(Name

of Registrant as Specified In Its Charter)

Payment

of Filing Fee (Check the appropriate box):

|

☒

|

No fee required.

|

|

☐

|

Fee computed on table below per Exchange Act

Rules 14c-f5(g) and 0-11.

|

|

|

1)

|

Title

of each class of securities to which transaction applies:

|

|

|

|

|

|

|

2)

|

Aggregate number

of securities to which transaction applies:

|

|

|

|

|

|

|

3)

|

Per unit price or

other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing

fee is calculated and state how it was determined):

|

|

|

|

|

|

|

4)

|

Proposed maximum

aggregate value of transaction:

|

|

|

|

|

|

|

5)

|

Total fee paid:

|

|

|

|

|

|

|

|

|

|

☐

|

Fee

paid previously with preliminary materials:

|

|

☐

|

Check box if any part of the fee

is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously.

Identify the previous filing by registration statement number, or the Form or Schedule and the date of its filing.

|

|

|

|

|

|

|

1)

|

Amount previously

paid:

|

|

|

|

|

|

|

2)

|

Form, Schedule or

Registration Statement No.:

|

|

|

|

|

|

|

3)

|

Filing Party:

|

|

|

|

|

|

|

4)

|

Date Filed:

|

|

|

|

|

AVALON

OIL & GAS, INC.

310

FOURTH AVENUE SOUTH, SUITE 7000

MINNEAPOLIS,

MN 55415

INFORMATION

STATEMENT

NO

VOTE OR OTHER ACTION OF THE COMPANY’S SHAREHOLDERS

IS

REQUIRED IN CONNECTION WITH THIS INFORMATION STATEMENT

WE

ARE NOT ASKING YOU FOR A PROXY.

YOU

ARE REQUESTED NOT TO SEND US A PROXY.

Dear

Shareholders:

This

Information Statement is furnished by the Board of Directors (the “Board”) of Avalon Oil & Gas, Inc. (the “Company”)

to inform shareholders of the Company of certain action adopted by the Board and approved by shareholders holding a majority in

interest of the voting power of the Company. This Information Statement will be mailed on approximately April 23, 2018 to shareholders

of record of the Company’s Common Stock as of April 3, 2018 (“Record Date”). Specifically, this Information

Statement relates to the following:

|

|

1.

|

On

March 21, 2018, the Board adopted a resolution to change the name of the Company.

|

|

|

2.

|

Also

on March 21, 2018, the Board referred the proposed name change amendment of the Articles

of Incorporation to shareholders for approval (with its recommendation for the approval

of such amendment).

|

|

|

3.

|

On

March 21, 2018, shareholders holding a majority in interest of the voting power of the

Company (51%) approved the amendment and as a result no further votes will be needed.

|

The

filing of a Certificate of Amendment with the Nevada Secretary of State which will effect the foregoing amendment will not be

done until a date which is at least twenty (20) days after the mailing of this definitive Information Statement. This Information

Statement will be sent on or about April 23, 2018 to the Company’s shareholders of record on the Record Date who have not

been solicited for their consent to this corporate action.

Pursuant

to Nevada law, there are no dissenter’s or appraisal rights relating to the action taken.

No

action is required by you. The enclosed Information Statement is being furnished to you to inform you that the foregoing action

has been approved by the holder of at least a majority of the outstanding shares of all voting stock of the Company. Because a

shareholder holding a majority of the voting rights of our outstanding capital stock has voted in favor of the foregoing action,

and such shareholder has sufficient voting power to approve such action through his ownership of Preferred Stock, no other shareholder

consents will be solicited in connection with the transaction described in this Information Statement. The Board is not soliciting

your proxy in connection with the adoption of these resolutions, and proxies are not requested from shareholders.

|

|

|

Sincerely,

|

|

|

|

|

|

|

By:

|

/s/

Kent Rodriguez

|

|

|

|

Kent Rodriguez

|

|

|

|

President and Chief Executive Officer

|

AMENDMENT

OF ARTICLES OF INCORPORATION

The

Board and shareholders holding the necessary number of votes have approved an amendment to the Company’s Articles of Incorporation

to amend Article First to change the name of the Company from Avalon Oil & Gas, Inc. to “Groove Botanicals, Inc.”

As amended, Article First will read as follows:

ARTICLE

FIRST. The name of the Company is Groove Botanicals, Inc.

Article

First is set forth in its entirety on Exhibit A attached to this Information Statement.

PURPOSE

OF AMENDMENT OF ARTICLES OF INCORPORATION

The

purpose of the amendment to our Articles of Incorporation is to change the name of the Company to “Groove Botanicals, Inc.”

REASON

FOR AMENDMENT OF ARTICLES OF INCORPORATION

In

early 2017, the Company began studying a change in the Company’s business and focused on the production, marketing, distribution

and sale of products, such as personal grooming products and cosmetics containing CBD (cannabidiol) extracted from hemp. We have

decided to enter that field, to transfer our oil and gas assets and liabilities to our subsidiary, AFS Holdings, Inc., and change

our Corporate Name to reflect our new business focus.

INTEREST

OF CERTAIN PERSONS IN MATTER BEING ACTED UPON

No

director, executive officer, associate of any director or executive officer, or any other person has any substantial interest,

direct or indirect, by security holdings or otherwise, resulting from the amendment to the Articles of Incorporation described

herein which is not shared by all other shareholders

pro rata

and in accordance with their respective interests.

SECURITY

OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Common

Stock

The

following table lists, as of April 3, 2018, the number of shares of common stock beneficially owned by (i) each person or entity

known to the Company to be the beneficial owner of more than 5% of the outstanding common stock; (ii) each officer and director

of our Company; and (iii) all officers and directors as a group. Except as noted below, each person has sole voting and investment

power.

The

percentages below are calculated based on 23,992,062 shares of common stock outstanding as of April 3, 2018. The business address

of the persons listed below is c/o Avalon Oil & Gas, Inc., 310 Fourth Avenue South, Suite 7000, Minneapolis, MN 55415.

|

Name and Address

of Beneficial Owner

|

|

Amount/

Nature of Beneficial Ownership

|

|

Percent

of Class

|

|

Kent Rodriguez

|

|

|

25,955,970

|

*

|

|

|

51.02

|

%

|

|

Douglas Barton

|

|

|

260,667

|

|

|

|

1.09

|

%

|

|

Jill Allison

|

|

|

260,000

|

|

|

|

1.08

|

%

|

|

Rene Haeusler

|

|

|

458,565,

|

|

|

|

1.91

|

%

|

|

All directors and executive officers as a group (4 persons)

|

|

|

25,891,070

|

|

|

|

55.10

|

%

|

*Includes 24,972,371

shares of common stock upon conversion of shares of the Series A Preferred Stock.

Preferred Stock

The

Company has designated two series of Preferred Stock: (1) 100 shares of Series A Convertible Preferred Stock and 2,000 shares

of Series B Convertible Preferred Stock. The Series A shares having voting power equal to 51% of the Common Stock on an

as converted basis. The Series B shares have no voting rights. All 100 shares of the Series A were issued to Kent

Rodriguez, the Company’s President and CEO.

The

100 shares of Series A Convertible Preferred Stock were issued on June 3, 2002 as payment for

$500,000 in promissory notes and are convertible into the number of shares of Common Stock sufficient to represent forty

percent (40%) of the fully-diluted shares outstanding after their issuance.

On

January 9, 2018, the Company Amended the Certificate of Designation for the Series A Convertible Preferred stock by changing the

ratio for conversion, in Article IV, subparagraph (a), from 0.4% to 0.51% so that upon conversion the number of shares of common

stock to be exchanged shall equal fifty one percent (51%) of then issued and outstanding common stock.

The Series A

Convertible Preferred Stock pays an eight percent (8%) dividend. The dividends are cumulative and payable quarterly.

The Series A Convertible Preferred Stock carries liquidating preference, over all other classes of stock,

equal to the amount paid for the Stock plus any unpaid dividends.

ADDITIONAL

INFORMATION

We

file annual, quarterly and current reports, proxy statements and other information with the Securities and Exchange Commission

(“SEC”), although at present we are not current with our filings. You may read and copy any reports, statements or

other information that we file at the SEC's public reference rooms, including its public reference room located at Room 1024,

450 Fifth Street N.W., Washington, D.C. 20549. You may also obtain these materials upon written request addressed to the Securities

and Exchange Commission, Public Reference Section, 450 Fifth Street, N.W., Washington, D.C. 20549, at prescribed rates. Please

call the SEC at 1-800-SEC-0330 for further information on its public reference rooms. Our public filings are also available at

the Internet web site maintained by the SEC for issuers that file electronically with the SEC through the Electronic Data Gathering,

Analysis and Retrieval System (EDGAR).

MISCELLANEOUS

We

request brokers, custodians, nominees and fiduciaries to forward this Information Statement to the beneficial owners of our Common

Stock and we will reimburse such persons for their reasonable expenses in connection therewith. Additional copies of this Information

Statement may be obtained at no charge by writing to us at our administrative office, 310 Fourth Avenue South, Suite 7000, Minneapolis,

MN 55415.

|

|

|

BY ORDER OF THE BOARD OF

DIRECTORS

|

|

|

|

April 10, 2018

|

|

|

|

|

|

|

|

|

|

|

By:

|

/s/

Kent Rodriguez

|

|

|

|

Kent Rodriguez

|

|

|

|

President and Chief Executive Officer

|

Exhibit

A

Exhibit

A

Certificate of

Amendment to Articles of Incorporation

For Nevada Profit

Corporations

(Pursuant

to NRS 78.385 and 78.390 - After Issuance of Stock)

|

1. Name of corporation:

|

|

|

|

|

|

|

|

Avalon Oil & Gas, Inc.

|

|

|

|

|

|

|

|

2. The articles have been amended as follows: (provide article numbers, if available)

|

|

|

|

Articles First is amended to read as follows:

|

|

|

|

“Article First. The name of the Company is Groove Botanicals, Inc.

|

|

|

|

|

|

3. The vote by which the stockholders holding shares in the corporation entitling them to exercise at least

a majority of the voting power, or such greater proportion of the voting power as may be required in the case of a vote by

classes or series, or as may be required by the provisions of the articles of incorporation* have voted in favor of the amendment

is:

51

|

|

|

|

4. Effective date and time of filing: (optional)

|

Date:

|

Time:

|

|

|

(must not be later than 90 days after the certificate is filed)

|

|

5. Signature: (required)

|

|

|

|

|

|

|

|

X

|

|

|

|

Signature of Officer

|

|

|

|

|

|

|

|

* If any proposed amendment would alter of change any preference or any relative or other right given to

any class or series of outstanding shares, then the amendment must be approved by the vote, in addition to the

affirmative vote otherwise required, of the holders of shares representing a majority of the voting power of each class or

series affected by the amendment regardless to limitations or restrictions on the voting power thereof.

|

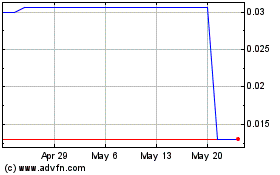

Groove Botanicals (PK) (USOTC:GRVE)

Historical Stock Chart

From May 2024 to Jun 2024

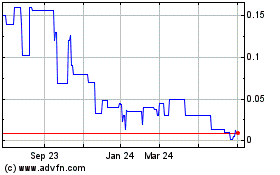

Groove Botanicals (PK) (USOTC:GRVE)

Historical Stock Chart

From Jun 2023 to Jun 2024