UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington,

D.C. 20549

SCHEDULE 13E-3

RULE 13E-3 TRANSACTION STATEMENT

UNDER SECTION 13(E) OF THE SECURITIES EXCHANGE ACT OF 1934

I-MINERALS INC.

(Name of the Issuer)

I-MINERALS INC.

BV NATURAL LLC

ALLEN L. BALL

(Name of Persons Filing Statement)

Common Stock, Without Par Value

(Title of Class of Securities)

795757103

(CUSIP Number of Class of Securities)

John Theobald I-Minerals Inc. Suite 1100 – 1199 West

Hastings Stret Vancouver, BC V6E 3T5 Canada |

|

Courtney Liddiard BV Natural Resource, LLC 2194 Snake River Parkway, Suite 300 Idaho Falls, Idaho, 83402 United

States |

With Copies to: |

Charles Hethey O’Neill Law LLP Suite 704, 595 Howe

Street Vancouver,

BC V6C 2T5 Canada

|

|

Gerald Gaunt McCarthy Tétrault LLP Suite 2400, 745 Thurlow

Street Vancouver,

BC V6E 0C5 Canada

|

|

|

|

|

|

Kris Ormseth Stoel Rives

LLP 101 S. Capitol

Blvd., Suite 1900 Boise, Idaho 83702 United

States |

(Name, Address, and

Telephone Number of Person Authorized to Receive Notices and Communications

on Behalf of the Persons Filing Statement) |

NEITHER THE SECURITIES AND

EXCHANGE COMMISSION NOR ANY STATE SECURITIES COMMISSION HAS APPROVED OR

DISAPPROVED OF THIS TRANSACTION, PASSED UPON THE MERITS OR THE FAIRNESS OF THE

TRANSACTION, OR PASSED UPON THE ADEQUACY OR ACCURACY OF THE INFORMATION

CONTAINED IN THIS DOCUMENT. ANY REPRESENTATION TO THE CONTRARY IS A CRIMINAL

OFFENSE.

This statement is filed in connection with

(check the appropriate box):

a. |

[ X ] The filing of solicitation materials or an information statement subject to Regulation 14A, Regulation 14C or Rule 13e-3(c) under the Securities Exchange Act of 1934. |

b. |

[ ] The filing of a registration statement under the Securities Act of 1933. |

Check the following box if the soliciting

materials or information statement referred to in checking box (a) are

preliminary copies: [ X ]

Check the following box if this is a final

amendment reporting the results of the transaction: [ ]

Table

of Contents

Introduction

This Rule 13e-3 Transaction Statement on Schedule 13E-3 (this

“Schedule 13E-3”) is being filed with the Securities and Exchange Commission

(the “SEC”) pursuant to Section 13(e) of the Securities Exchange Act of 1934,

as amended (the “Exchange Act”), by I-Minerals Inc. (the “Company” or

“I-Minerals”), Allen L. Ball, a former director of the Company, and BV Natural

Resources, LLC (“BV Natural”), which

beneficially owns 39.4% of the Company and is an affiliate of BV Lending, LLC (“BV Lending”), in connection

with the proposed disposition (the “Disposition”) of i-minerals usa, inc. (“i-minerals

USA”). The Disposition will be effective pursuant to a stock purchase agreement

dated September 14, 2022 (the “Stock Purchase Agreement”) among the Company, i-minerals

USA and BV Lending.

This Schedule 13E-3 is being filed with the SEC concurrently with a

preliminary proxy statement (the “Proxy Statement”) filed by the Company

pursuant to Regulation 14A under the Exchange Act pursuant to which the holders

of the Company’s common stock will be given a notice of annual general and

special meeting of shareholders (the “Meeting”) and will be asked to approve,

among other things, the Disposition, and to transact any other business

properly brought before the Meeting. Each of the cross references indicated in

the Items of this Schedule 13E-3 shows the location in the Proxy Statement of

the information required to be included in response to such Item in this

Schedule 13E-3. The information contained in the Proxy Statement, including all

schedules, all exhibits, appendices and annexes thereto is hereby expressly

incorporated herein by reference and the responses to each Item in this

Schedule 13E-3 are qualified in their entirety by the information contained in

this Proxy Statement and the schedules, exhibits, appendices and annexes

thereto. A copy of the Stock Purchase Agreement is attached as Appendix “C” to

the Proxy Statement filed by the Company contemporaneously herewith. The Proxy

Statement is attached hereto as Exhibit (a)(1).

As of the date hereof, the Proxy Statement is in preliminary form

and is subject to completion or amendment. This Schedule 13E-3 will be amended

to reflect such completion or amendment of the Proxy Statement.

Item

1. Summary Term Sheet

The

information set forth in the Proxy Statement under the following caption is

incorporated herein by reference:

“SUMMARY

TERM SHEET”

Item 2. Subject Company Information

(a) |

Name and Address. The following sets forth the name as well as address and telephone number of the principal executive offices of i-minerals USA: |

i-minerals

usa, inc.

1100 –

1199 West Hastings Street

Vancouver,

British Columbia

Canada

V6E 3T5

Telephone:

(887) 303-6573

(b) |

Securities. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“I-MINERALS

INC. MEETING MATTERS – Share Structure of the Company”

(c) |

Trading Market and Price. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“I-MINERALS INC. MEETING MATTERS – Market Price of Common

Stock and Dividends”

(d) |

Dividends. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“I-MINERALS INC. MEETING MATTERS – Market Price of Common

Stock and Dividends”

(e) |

Prior Public Offering. Not Applicable. |

(f) |

Prior stock purchases. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SPECIAL

FACTORS – Transactions in Relation to Shares”

Item 3. Identity and Background of Filing

Person.

(a) |

Name and Address. I-Minerals, BV Natural and Allen L. Ball are the filing persons. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SPECIAL FACTORS – About the Company,

i-minerals USA, BV Natural, BV Lending and Allen L. Ball”

(b) |

Business and Background of Entities. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SPECIAL FACTORS – About the Company,

i-minerals USA, BV Natural, BV Lending and Allen L. Ball”

(c) |

Business and Background of Natural Persons. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SPECIAL FACTORS – About the Company,

i-minerals USA, BV Natural, BV Lending and Allen L. Ball”

Item 4. Terms of the Transaction

(a) |

Material Terms. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

“SUMMARY

TERM SHEET – Background and Purpose of the Disposition”

“SUMMARY

TERM SHEET – Terms and Consideration”

“SUMMARY

TERM SHEET – Fairness; Recommendation of the Board”

“SUMMARY

TERM SHEET – Shareholder and Regulatory Approval; Dissent Rights”

“SPECIAL

FACTORS – Background to the Disposition – Financial Situation of the Company”

“SPECIAL

FACTORS – Background to the Disposition – Proposed Disposition”

“SPECIAL FACTORS – Reasons for the

Recommendation of the Company’s Special Committee and the Company’s Board”

“SPECIAL

FACTORS – Certain effects of the Disposition”

“SPECIAL

FACTORS – Accounting Treatment”

“I-MINERALS

MEETING MATTERS – Shareholder Approvals Required”

“PROPOSAL

NUMBER ONE – THE DISPOSITION”

(c) |

Different Terms. Not Applicable. |

(d) |

Appraisal Rights. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

“SUMMARY

TERM SHEET – Shareholder and Regulatory Approval; Dissent Rights”

“RIGHTS

OF DISSENTING SHAREHOLDERS”

“APPENDIX B –

CANADA BUSINESS CORPORATIONS ACT SECTION 190 – RIGHT TO DISSENT”

(e) |

Provisions for Unaffiliated Security Holders. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

“SPECIAL

FACTORS – Reasons for Recommendations of the Special Committee and the Board –

Substantive Fairness”

Other than

the Fairness Opinion, no provision has been made to grant the Company’s

shareholders access to the corporate files of the Company or any other party to

the merger or to obtain counsel or appraisal services at the expense of the

Company.

(f) |

Eligibility for Listing or Trading. Not Applicable. |

Item 5. Past Contacts, Transactions,

Negotiations and Agreements.

(a) |

Transactions. The information set forth in the Proxy Statement under the following captions is incorporated herein by reference: |

“SPECIAL

FACTORS – Background to the Disposition – Financial Situation of the Company”

“SPECIAL FACTORS – Background to the

Disposition – Proposed Disposition”

“SPECIAL

FACTORS – Background to the Disposition – Discussions with BV”

“CERTAIN RELATIONSHIPS AND RELATED

TRANSACTIONS – Loan Agreements with Directors”

(b) |

Significant Corporate Events. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SPECIAL

FACTORS – Background to the Disposition – Discussions with BV”

(c) |

Negotiations or Contacts. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SPECIAL FACTORS – Background to the

Disposition – Discussions with BV”

(e) |

Agreements Involving the Subject Company’s Securities. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SPECIAL FACTORS –

Transactions in Relation to Shares”

Item 6. Purposes of the Transaction and

Plans or Proposals

(c) |

Plans. The Disposition involves the disposition of all or substantially all of the Company’s assets. Following the Disposition, the Company will be delisted from the OTC Pink marketplace. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SPECIAL FACTORS – Certain Effects of the

Disposition”

“SPECIAL FACTORS – Plans for i-minerals USA After

the Disposition”

Item 7. Purposes, Alternatives, Reasons

and Effects

(a) |

Purposes. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SUMMARY TERM SHEET – Background and Purpose

of the Disposition”

“SPECIAL FACTORS – Background to the

Disposition – Financial Situation of the Company”

“SPECIAL FACTORS – Background to the

Disposition – Discussions with BV”

“SPECIAL FACTORS – Reasons for the

Recommendation of the Company’s Special Committee and the Company’s Board”

(b) |

Alternatives. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SUMMARY TERM SHEET – Fairness;

Recommendation of the Board”

“SPECIAL FACTORS – Reasons for the

Recommendation of the Company’s Special Committee and the Company Board”

(c) |

Reasons. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SUMMARY TERM SHEET – Background and Purpose

of the Disposition”

“SPECIAL FACTORS – Background to the

Disposition – Financial Situation of the Company”

“SPECIAL FACTORS – Background to the

Disposition – Proposed Disposition”

“SPECIAL FACTORS – Reasons for the

Recommendation of the Company’s Special Committee and the Company Board”

(d) |

Effects. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SUMMARY TERM SHEET – Terms and

Consideration”

“SPECIAL FACTORS – Certain Effects of the

Disposition”

“PROPOSAL NUMBER ONE – THE DISPOSITION –

Terms of the Stock Purchase Agreement”

Item 8. Fairness of the Transaction

(a) |

Fairness. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SUMMARY

TERM SHEET – Fairness; Recommendation of the Board”

“SPECIAL

FACTORS – Recommendation of the Company’s Special Committee”

“SPECIAL

FACTORS – Recommendation of the Company’s Board”

“SPECIAL FACTORS – Reasons for the

Recommendation of the Company’s Special Committee and the Company Board –

Substantive Fairness”

“SPECIAL FACTORS – Reasons for the

Recommendation of the Company’s Special Committee and the Company Board –

Procedural Fairness”

(b) |

Factors Considered in Determining Fairness. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SUMMARY

TERM SHEET – Fairness; Recommendation of the Board”

“SPECIAL

FACTORS – Recommendation of the Company’s Special Committee”

“SPECIAL

FACTORS – Recommendation of the Company’s Board”

“SPECIAL FACTORS – Reasons for the

Recommendation of the Company’s Special Committee and the Company Board –

Substantive Fairness”

“SPECIAL FACTORS – Reasons for the

Recommendation of the Company’s Special Committee and the Company Board –

Procedural Fairness”

(c) |

Approval of Security Holders. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SUMMARY TERM SHEET – Shareholder and

Regulatory Approval; Dissent Rights”

“QUESTIONS AND ANSWERS ABOUT THE PROXY

MATERIALS AND THE MEETING – What vote is required to approve each item?”

“I-MINERALS INC. MEETING MATTERS –

Shareholder Approvals Required”

“PROPOSAL NUMBER ONE – THE DISPOSITION –

Required Approvals”

“PROPOSAL NUMBER ONE – THE DISPOSITION –

Requirements of MI 61-101”

(d) |

Unaffiliated Representative. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SUMMARY TERM SHEET – Fairness;

Recommendation of the Board”

“SPECIAL FACTORS – Background to the

Disposition – Discussions with BV’

“SPECIAL FACTORS – Reasons for the

Recommendation of the Company’s Special Committee and the Company Board –

Substantive Fairness”

“APPENDIX “D” – Fairness Opinion”

(e) |

Approval of Directors. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SUMMARY TERM SHEET – Fairness;

Recommendation of the Board”

“SPECIAL FACTORS – Background of the

Disposition – Discussions with BV”

“SPECIAL FACTORS –Recommendation of the

Company’s Special Committee”

“SPECIAL FACTORS –Recommendation of the

Company’s Board”

(f) |

Other Offers. Not Applicable. |

Item 9. Reports, Opinions, Appraisals and

Negotiations

(a) |

Report, Opinion or Appraisal. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SUMMARY TERM SHEET – Fairness;

Recommendation of the Board”

“SPECIAL FACTORS – Background to the

Disposition – Discussions with BV”

“SPECIAL FACTORS – Reasons for the

Recommendation of the Company’s Special Committee and the Company Board –

Substantive Fairness”

“APPENDIX “D” – Fairness Opinion”

(b) |

Preparer and Summary of the Report, Opinion or Appraisal. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SPECIAL FACTORS – Reasons for the

Recommendation of the Company’s Special Committee and the Company Board –

Substantive Fairness”

“APPENDIX “D” – Fairness Opinion”

(c) |

Availability of Documents. The Fairness Opinion will be made available for inspection and copying at the principal executive office of I-Minerals during its regular business hours by any interested equity security holder of I-Minerals or representative who has been so designated in writing. A copy of the Fairness Opinion will be transmitted by I-Minerals to any interested equity security holder of I-Minerals or representative who has been so designated in writing upon written request and at the expense of the requesting security holder. |

Item 10. Source and Amounts of Funds or

Other Consideration

(a) |

Source of Funds. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SUMMARY TERM SHEET – Terms and

Consideration”

“CERTAIN RELATIONSHIPS AND RELATED

TRANSACTIONS – Loan Agreements with Directors”

(b) |

Conditions. Not Applicable. |

(c) |

Expenses. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SPECIAL

FACTORS – Fees and Expenses”

(d) |

Borrowed Funds. Not Applicable. |

Item 11. Interest in

Securities of the Subject Company

(a) |

Securities Ownership. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SPECIAL FACTORS – About the Company,

i-minerals USA, BV Natural, BV Lending and Allen L. Ball”

“I-MINERALS INC. MEETING MATTERS – Principal

Holders of the Company”

(b) |

Securities Transactions. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SPECIAL

FACTORS – Transactions in Relation to Shares”

Item 12. The Solicitation or

Recommendation

(d) |

Intent to Tender or Vote in a Going-Private Transaction.. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“QUESTIONS AND ANSWERS ABOUT THE PROXY

MATERIALS AND THE MEETING – Does the Company’s Board support the Disposition”

“SPECIAL FACTORS – Reasons for the

Recommendation of the Company’s Special Committee and the Company’s Board –

Support of Directors and Senior Officers”

(e) |

Recommendations of Others. The information set forth in the Proxy Statement under the following caption is incorporated herein by reference: |

“SPECIAL

FACTORS – Recommendation of the Company’s Board”

Item 13. Financial Statements

The information set forth in the Proxy Statement under the following

caption is incorporated herein by reference:

“SPECIAL FACTORS – Selected Financial Information”

“SELECTED FINANCIAL INFORMATION”

(a) |

Financial Information. The audited consolidated financial statements of the Company and i-minerals usa for the years ended April 30, 2022 and 2021, the interim financial statements of the Company and i-minerals usa for the periods ended October 31, 2022 and 2021 are incorporated herein by reference from Appendices “F”, “G” and “H” of the Proxy Statement. |

(b) |

Pro Forma Information. The pro forma financial statements of the Company for the year ended April 30, 2022 and the period ended October 31, 2022 are incorporated herein by reference from Appendix “I” of the Proxy Statement. |

Item 14. Persons/Assets, Retained,

Employed, Compensated or Used

(a) |

Solicitations or Recommendation. There are no persons or classes of persons who are directly or indirectly employed, retained, or to be compensated to make solicitations or recommendations in connection with the Disposition. |

(b) |

Employees and Corporate Assets. No officer, class of employees or corporate assets of the Company or its affiliates has been or will be employed or used by the filing persons in connection with the Disposition. |

Item 15. Additional Information

(b) |

Golden Parachute Compensation. Not Applicable. |

(c) |

Other Material Information. The entirety of the Proxy Statement, including all annexes thereto, is incorporated herein by reference. |

Item 16. Exhibits

Exhibit Number |

Description |

(a)(2)(i) |

Preliminary Proxy Statement (incorporated by reference to the

Schedule 14A including all appendices thereto filed concurrently with this

Schedule 13E-3 with the SEC. |

(a)(2)(ii) |

Notice of 2022 Annual General and Special Meeting (incorporated

herein by reference to the Proxy Statement) |

(a)(2)(iii) |

Form of Proxy (incorporated herein by reference to the Proxy Statement) |

(a)(2)(iv) |

Press Release issued by the Company dated September 15, 2022,

incorporated by reference |

(c)(i) |

Fairness Opinion (incorporated herein by reference to Appendix “D”

to the Proxy Statement) |

(d)(i) |

Stock Purchase Agreement dated September 14, 2022 among the

Company, i-minerals usa and BV Lending (incorporated herein by reference to

Appendix “C”) |

(d)(ii) |

Voting Support Agreements dated September 14, 2022 among Barry

Girling, Matthew Anderson, John Theobald, Gary Childress and Wayne Moorhouse |

(f) |

Section 190 of the Canada Business Corporations Act – Right to

Dissent (incorporated by reference to Appendix “B” to the Proxy Statement) |

(g) |

Not Applicable |

107 |

Filing Fee |

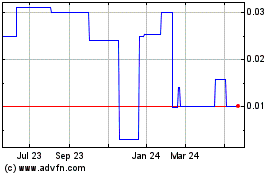

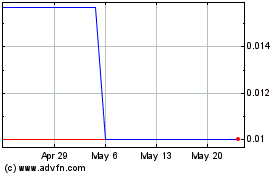

Highcliff Metals (CE) (USOTC:IMAHF)

Historical Stock Chart

From Jun 2024 to Jul 2024

Highcliff Metals (CE) (USOTC:IMAHF)

Historical Stock Chart

From Jul 2023 to Jul 2024