The Marketing Alliance Announces Transitional Financial Results for the Quarterly Period Ended March 31, 2005

03 August 2005 - 1:28AM

Business Wire

Highlights for the three-month period ended March 31, 2005 --

Company changes fiscal year end to March 31st -- Net income of

$384,000, or $0.19 per share -- Revenues increase 5% to $3.9

million -- Balance sheet remains solid with $2.5 million of working

capital and no long-term debt. The Marketing Alliance, Inc. (Pink

Sheets: MAAL) ("TMA"), a consortium of independent life insurance

brokerage general agencies located throughout the United States,

today announced financial results for the three months ended March

31, 2005. As previously announced, TMA's Board of Directors

approved a change in the Company's fiscal year to the period ending

March 31st from a calendar year ending on December 31st. The

Company decided to make this change as a means of better aligning

its fiscal year with the business cycle of its member agencies. The

next quarterly period the Company will report will be its fiscal

first quarter ended June 30, 2005. Revenues for the three-month

period ended March 31, 2005 increased to $3.9 million from $3.7

million in the same period last year, largely due to internal

growth among TMA's member agencies. Net operating revenue, or gross

profit, for the three months ended March 31, 2005 was $1.7 million,

or 44% of revenues, down slightly from the $1.8 million, or 48% of

revenues, reported in the same period last year, due primarily to

increased bonuses earned by TMA distributors. Operating expenses

for the three-month period ended March 31, 2005 rose 25% to

$930,000 from the same prior year period. This increase was largely

due to severance packages given to the Company's former CEO and

other personnel, and start-up costs relating to the Company's TMA

Marketing, Inc. subsidiary, which provides annuity products to TMA

member agencies. Despite these non-recurring charges, TMA reported

operating income of $775,000 in the three-month period ended March

31, 2005, as compared to operating income of $1.0 million in the

comparable prior year period. The Company reported net income of

$384,000, or $0.19 per share, in the three month period ended March

31, 2005, versus net income of $721,000, or $0.35 per share, for

the same period last year. The primary reason for this decline is a

realized and unrealized loss on investments during the period. In

April 2005, the Company reassessed its investment strategy, which

previously consisted of a portfolio largely containing equity

investments in regional banks. TMA has now shifted a large majority

of its investment portfolio to third-party financial managers, with

a focus on steady, long-term growth consistent with TMA's working

capital needs. Ronald D. Verzone, Chairman of TMA, stated, "Our

focus over the past year has been to aggressively address potential

areas of growth for the Company, while still adhering to our core

philosophy of providing our independent member agencies with the

means to compete within their marketplace. One of TMA's initiatives

was the opening of the Omaha Business Center in May 2004. The

Business Center offers TMA's distributors increased efficiency

levels for each transaction, as all aspects of the application

processing cycle are handled internally. This allows our

independent agents to allocate more time and resources to growing

their business. With the growth of the business center, we are

optimistic that we can continue to attract new agencies to our

expanding network." Mr. Verzone concluded, "We enter our next

fiscal year with a great opportunity to leverage our investments in

the Business Center and TMA Marketing Inc., which allows our

distributors that do not presently market annuity products to enter

a new profit center without any start-up costs. We are pleased to

have successfully completed both of these initiatives without

incurring any long-term debt, and feel that by continuing to

enhance the available products and capabilities of our

distributors, we are fueling TMA's growth." ABOUT THE MARKETING

ALLIANCE, INC. Headquartered in Pittsburgh, PA, TMA is one the

largest organizations providing support to independent insurance

brokerage agencies, with a goal of providing members value-added

services on a more efficient basis than they can achieve

individually. TMA's network is comprised of approximately 150

independent life brokerage and general agencies in 43 states.

Investor information can be accessed through the shareholder

section of TMA's website at

http://www.themarketingalliance.com/si_who.cfm. FORWARD LOOKING

STATEMENT Investors are cautioned that forward-looking statements

involve risks and uncertainties that may affect TMA's business and

prospects. Any forward-looking statements contained in this press

release represent our estimates only as of the date hereof, or as

of such earlier dates as are indicated, and should not be relied

upon as representing our estimates as of any subsequent date. These

statements involve a number of risks and uncertainties, including,

but not limited to, general changes in economic conditions. While

we may elect to update forward-looking statements at some point in

the future, we specifically disclaim any obligation to do so. -0-

*T Consolidated Statement of Operations Quarter Ended 3/31/2005

3/31/2004 Revenues $3,877,316 $3,689,554 ------------ -----------

Distributor Related Expenses Distributor bonus & commissions

paid 1,473,294 1,129,338 Distributor benefits & processing

698,858 772,380 ------------ ----------- Total 2,172,152 1,901,718

------------ ----------- Net Operating Revenue 1,705,164 1,787,836

Operating Expenses 930,446 742,444 ------------ -----------

Operating Income 774,718 1,045,392 Other Income (Expense) Interest

& dividend Income (net) 9,087 5,811 Realized & unrealized

gains (losses) on investments (net) (223,678) 205,827 Interest

expense (3,059) (6,925) Other (20,373) (18,454) ------------

----------- Income Before Provision for Income Tax 536,695

1,231,651 Provision for income taxes (152,778) (510,558)

------------ ----------- Net Income $ 383,917 $ 721,093

============ =========== Shares Outstanding 2,036,747 2,036,747

Operating Income per Share $ 0.38 $ 0.51 Net Income per Share $

0.19 $ 0.35 Consolidated Selected Balance Sheet Items As of Assets

3/31/2005 12/31/2004 Current Assets Cash $ 451,228 $ 354,640

Receivables 4,776,861 2,538,925 Investments 1,929,600 4,861,673

Other 287,826 273,542 ------------ ----------- Total Current Assets

7,445,515 8,028,780 Other Non Current Assets 460,754 490,563

------------ ----------- Total Assets $7,906,269 $8,519,343

============ =========== Liabilities & Stockholders' Equity

Total Current Liabilities $4,941,478 $5,938,469 ------------

----------- Total Liabilities 4,941,478 5,938,469 Stockholders'

Equity 2,964,791 2,580,874 ------------ ----------- Liabilities

& Stockholders' Equity $7,906,269 $8,519,343 ============

=========== *T

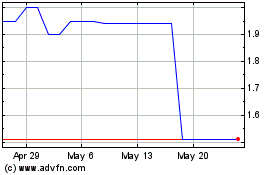

Marketing Alliance (PK) (USOTC:MAAL)

Historical Stock Chart

From Jun 2024 to Jul 2024

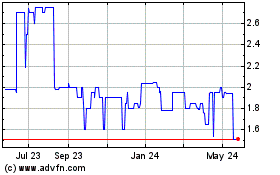

Marketing Alliance (PK) (USOTC:MAAL)

Historical Stock Chart

From Jul 2023 to Jul 2024