The Marketing Alliance, Inc. (Pink Sheets: MAAL) (�TMA� or the

�Company�), a consortium of independent life insurance brokerage

general agencies located throughout the United States, today

announced financial results for its fiscal 2007 third quarter ended

December 31, 2006 (see attached tables). Timothy M. Klusas, TMA�s

President, stated, �As reflected in our third quarter results, TMA

is beginning to recognize the cost benefits of a number of the

initiatives we implemented over the past year. In the first half of

calendar 2006, we relocated our corporate headquarters and annuity

business to St. Louis in an effort to consolidate operations and

establish an infrastructure to better manage the growth and balance

of insurance products through the Company�s distributors. We also

hired key members of management to serve our member agencies and

increase new business opportunities on both the distributor and

carrier levels. After TMA incurred start-up costs in line with

these initiatives, we feel that the Company is better positioned to

capitalize on opportunities in the changing insurance marketplace.�

Mr. Klusas continued, �While we are pleased with these quarterly

results and the direction of the Company, we recognize there is

still much to be done. Let me address a few specific factors

relating to our business, our financial position and methods in

which we are enhancing the value of TMA for our shareholders: One

of the main catalysts for our Company�s future growth is through

the addition of new insurance carriers. By adding a new carrier to

TMA�s network, the Company can provide a broader range of insurance

products for our independent agent distributors to choose from and

then, in turn, offer to their customers. This chain is the core of

our business. In the past year, TMA has signed three new carriers,

ING, Met Life and Aviva / AmerUs Indianapolis Life, whose products

are now being sold through our Company. However, there is a certain

amount of integration time once a carrier joins our network,

usually about 6-9 months before TMA begins recognizing revenues

from the sales of their products. This is due to the synthesizing

of the carrier�s products into our distribution system, instructing

our sales force, introducing this product expansion to our

distributors, and subsequently having these distributors sell the

products to customers. The addition of each strategic carrier helps

to expand the capabilities of what our current members can offer to

consumers in a competitive marketplace, and makes the TMA network a

more attractive value proposition for new potential distributors.

In June 2006, we relocated our subsidiary, TMA Marketing, Inc.

(�TMAM�), from Philadelphia to our corporate headquarters to St.

Louis. TMAM�s primary focus is to provide our distributors an

annuity marketing, service and support program from our existing

carriers. TMAM allows the Company�s independent distributors who

are not currently marketing annuity products to do so, thereby

establishing a new profit center for their agency, without

incurring significant start-up costs and capital investment. We

appointed Laura Hahn, an industry veteran with over 27 years of

experience, as Managing Director of TMAM�s Annuity Sales and

Service Center, and have positioned the business to ensure that TMA

continues to expand its independent agencies� market presence.

Financial flexibility, while a sound business objective in its own

right, is also a distinct competitive advantage. TMA�s solid

financial position should produce lasting benefits and enhance the

positive impact of higher profitability going forward. The

Company�s balance sheet at December 31, 2006 reflected working

capital of $3.3 million, shareholders� equity of $3.7 million and

no long-term debt. We believe that the capital structure we now

have in place is sufficient to fund our growth plans for the

foreseeable future. We feel an appropriate way to have TMA�s

investors participate in our success, given the amount of free cash

flow we generate, is through the payment of dividends. TMA has a

long dividend history, having paid a total of approximately $3.4

million to our shareholders since 1999. Our intent is to provide

our shareholders with a meaningful current return while at the same

time retaining sufficient earnings to maintain our strong capital

base and take advantage of growth opportunities. On January 31,

2007, the Company paid a $0.17 per share cash dividend for

shareholders of record on December 1, 2006. This is the latest

dividend payment to shareholders and an increase of 13% over last

year�s cash dividend of $0.15 per share.� Mr. Klusas concluded,

�Our primary objective for our 2007 fiscal year is to continue the

progress we have made in streamlining our operations, leverage our

infrastructure, and concentrate on laying a foundation for top-line

growth. We feel that our long-term investments are beginning to

gain traction. We look forward to our near and long-term future

with confidence.� FISCAL 2007 THIRD QUARTER REVIEW Revenues

reported by the Company for the three-month period ended December

31, 2006, were $4.2 million versus $4.3 million in same period for

the prior year. The decrease was due to the consolidation of

certain insurance carriers whose products are distributed through

TMA. The Company reported a $566,609 increase in operating income

to $179,107 in its fiscal 2007 third quarter versus an operating

loss of ($387,502) in the same period for the prior year. This

increase is largely due to higher net operating revenues and

significantly lower operating expenses. These expenses decreased by

37% due to improved operating efficiencies related to the

consolidation of its corporate offices and TMAM into a new,

centralized headquarters in St. Louis. As a result of the above

factors, TMA reported a $315,082 improvement in net income to

$156,956, or $0.08 per share, for the fiscal 2007 third quarter,

versus a net loss of ($158,126), or ($0.08) per share, for the

prior year period. This increase is primarily due to higher

operating income as a result of the factors outlined above. FISCAL

2007 NINE MONTH REVIEW Total revenues for the first nine months of

fiscal 2007 were $11.8 million versus $12.4 million for the same

period in fiscal 2006. Fiscal 2007 nine month operating income was

$407,251 versus $109,225 for the first nine months of fiscal 2006.

TMA reported net income of $251,451, or $0.12 per share, for fiscal

2007 nine month period, versus net income of $283,865, or $0.14 per

share, in the prior year period, the difference largely due to

realized and unrealized gains and losses on investments. ABOUT THE

MARKETING ALLIANCE, INC. Headquartered in St. Louis, MO, TMA is one

of the largest organizations providing support to independent

insurance brokerage agencies, with a goal of providing members

value-added services on a more efficient basis than they can

achieve individually. TMA�s network is comprised of independent

life brokerage and general agencies in 43 states. Investor

information can be accessed through the shareholder section of

TMA�s website at http://www.themarketingalliance.com/si_who.cfm.

TMA stock is traded in the �pink sheets� (www.pinksheets.com) under

the symbol �MAAL�. These shares may be purchased or sold through

any broker, or through a market-maker in TMA stock, such as Robotti

& Company. FORWARD LOOKING STATEMENT Investors are cautioned

that forward-looking statements involve risks and uncertainties

that may affect TMA's business and prospects. Any forward-looking

statements contained in this press release represent our estimates

only as of the date hereof, or as of such earlier dates as are

indicated, and should not be relied upon as representing our

estimates as of any subsequent date. These statements involve a

number of risks and uncertainties, including, but not limited to,

general changes in economic conditions. While we may elect to

update forward-looking statements at some point in the future, we

specifically disclaim any obligation to do so. Consolidated

Statement of Operations � Quarter Ended Year to Date 9 Months Ended

12/31/2006� 12/31/2005� 12/31/2006� 12/31/2005� � Revenues $

4,237,426� $ 4,346,960� $ 11,802,741� $ 12,367,057� � Distributor

Related Expenses Distributor bonus & commissions paid $

2,731,741� 3,133,427� 7,273,794� 7,939,115� Distributor benefits

& processing � 668,295� � 699,807� � 2,014,812� � 1,968,589�

Total � 3,400,036� � 3,833,234� � 9,288,606� � 9,907,704� � Net

Operating Revenue 837,390� 513,726� 2,514,135� 2,459,353� �

Operating Expenses � 658,283� � 901,228� � 2,106,884� � 2,350,128�

� Operating Income (Loss) 179,107� (387,502) 407,251� 109,225� �

Other Income (Expense) Interest & dividend Income (net) 14,399�

38,926� 30,137� 65,138� Realized & unrealized gains [losses] on

investments (net) � � 72,778� 72,111� (5,529) 334,127� Interest

expense � (5,328) � (661) � (14,408) � (4,625) � Income (Loss)

Before Provision for Income Tax 260,956� (277,126) 417,451�

503,865� � Benefit (provision) for income taxes � (104,000) �

119,000� � (166,000) � (220,000) � Net Income (Loss) � 156,956� �

(158,126) $ 251,451� $ 283,865� � Shares Outstanding 2,036,247�

2,036,747� 2,036,247� 2,036,747� � Operating Income (Loss) per

Share $ 0.09� $ (0.19) $ 0.20� $ 0.05� Net Income (Loss) per Share

$ 0.08� $ (0.08) $ 0.12� $ 0.14� � � � Consolidated Selected

Balance Sheet Items � As of � Assets 12/31/2006� 3/31/2006� Current

Assets Cash $ 656,182� $ 89,440� Receivables 4,995,949� 4,878,709�

Investments 2,699,871� 2,963,394� Other � 188,264� � 525,035� Total

Current Assets 8,540,266� 8,456,578� � Other Non Current Assets �

378,102� � 462,480� � Total Assets $ 8,918,368� $ 8,919,058� �

Liabilities & Stockholders' Equity � Total Current Liabilities

$ 5,260,694� $ 5,196,537� � Total Liabilities 5,260,694� 5,196,537�

� Stockholders' Equity � 3,657,674� � 3,722,521� � Liabilities

& Stockholders' Equity $ 8,918,368� $ 8,919,058�

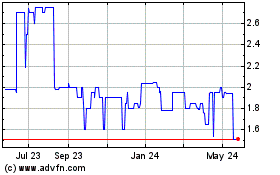

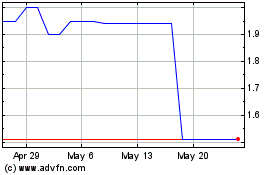

Marketing Alliance (PK) (USOTC:MAAL)

Historical Stock Chart

From Jun 2024 to Jul 2024

Marketing Alliance (PK) (USOTC:MAAL)

Historical Stock Chart

From Jul 2023 to Jul 2024