Porsche Says US Law Doesn't Apply To Investor Claims

01 September 2010 - 7:39PM

Dow Jones News

German sports-car maker Porsche Automobil Holding SE (PAH3.XE)

has asked a New York court to dismiss claims filed by a total of 39

hedge funds alleging market manipulation and securities fraud,

because the U.S. Securities Exchange Act doesn't apply to the

plaintiffs' claims, Porsche said in memorandum released

Wednesday.

"Plaintiffs chose to speculate on German share prices and all

the misstatements and market manipulation they allege occurred

outside the United States, but they attempt to invoke U.S. law by

asserting claims under Section 10(b) of the Securities Exchange Act

of 1934...Their attempt fails because Section 10(b) does not apply

to their patently foreign claims," the Stuttgart, Germany-based

carmaker said in a memorandum submitted to the court.

Porsche said "Germany is the appropriate forum" for any court

action since the case, which is related to Porsche's stake-building

at Volkswagen AG (VOW.XE), involves German law, securities,

markets, and conduct.

"Adjudicating plaintiffs' claims in the United States would run

the risk of inconsistent judgments and encourage forum shopping by

potential plaintiffs," Porsche said.

The company further said that the plaintiffs' claims don't

sufficiently allege that Porsche made actionable misstatements, and

their case fails to allege a market manipulation claim.

-By Harriet Torry, Dow Jones Newswires: +49 69 29725 511:

harriet.torry@dowjones.com

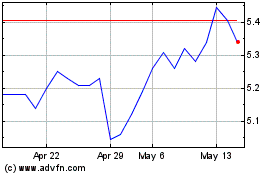

Porsche Automobile (PK) (USOTC:POAHY)

Historical Stock Chart

From Jun 2024 to Jul 2024

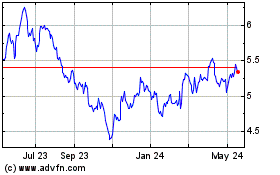

Porsche Automobile (PK) (USOTC:POAHY)

Historical Stock Chart

From Jul 2023 to Jul 2024

Real-Time news about Porsche Automobile Holding SE (PK) (OTCMarkets): 0 recent articles

More Porsche Automobil Holding SE ADS News Articles