Searchlight Minerals Corp. - Current report filing (8-K)

03 January 2008 - 10:15PM

Edgar (US Regulatory)

UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM 8-K

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the

Securities Exchange Act of 1934

December 26, 2007

Date of Report (Date

of earliest event reported)

SEARCHLIGHT MINERALS CORP.

(Exact name of registrant as specified in its charter)

|

NEVADA

|

000-30995

|

98-0232244

|

|

(State or other jurisdiction of

|

(Commission File

|

(IRS Employer Identification No.)

|

|

incorporation)

|

Number)

|

|

|

#120 - 2441 W. Horizon Ridge Pkwy

|

|

|

Henderson, NV

|

89052

|

|

(Address of principal executive offices)

|

(Zip Code)

|

(702) 939-5247

Registrant's telephone number,

including area code

N/A

(Former name or former address, if

changed since last report)

Check the appropriate box below if the Form 8-K filing is

intended to simultaneously satisfy the filing obligation of the

registrant

under any of the following provisions:

____ Written communications pursuant to Rule 425 under the

Securities Act (17 CFR 230.425)

____ Soliciting material pursuant to Rule 14a-12 under the

Exchange Act (17 CFR 240.14a -12)

____ Pre-commencement communications pursuant to Rule 14d-2(b)

under the Exchange Act (17 CFR 240.14d -2(b))

____ Pre-commencement communications pursuant to Rule 13e-4(c)

under the Exchange Act (17 CFR 240.13e -4(c))

SECTION 3 – CORPORATE GOVERNANCE AND MANAGEMENT

ITEM 3.02

UNREGISTERED SALES OF EQUITY SECURITIES.

On December 26, 2007, Searchlight Minerals Corp. (the “Company”)

completed a private placement to the Arlington Group Limited of a total of 3,125,000

units at a price of $1.60 per unit for total proceeds of $5,000,000. Each unit

is comprised of one share of the Company’s common stock and one-half of

one share purchase warrant. Each whole share purchase warrant entitles the holder

to purchase one additional share of the Company’s common stock at a price

of $2.40 per share for a period of two years from the date of issuance. In addition

to issuing the subscribed for units, the Company has issued an additional 156,250

shares of its common stock to the Arlington Group Limited, equal to 5% of the

total number of units subscribed for by the Arlington Group Limited. Including

the shares issued as a commission, the Company has issued an aggregate of 3,281,250

shares of its common stock and 1,562,500 share purchase warrants to the Arlington

Group Limited under the private placement.

This private placement was completed pursuant to the provisions

of Regulation S promulgated under the Securities Act of 1933. The Company did

not engage in a distribution of this offering in the United States. The

Arlington Group Limited has represented to the Company that it is not a US

person as defined in Regulation S, and has provided representations indicating

that it was acquiring the Company’s securities for investment purposes only and

not with a view towards distribution.

A copy of the news release announcing the completion of the

private placement described above is attached as an exhibit hereto.

ITEM 7.01

REGULATION FD DISCLOSURE.

Searchlight Minerals Corp. (the “Company”) has approved a

private placement offering for 1,250,000 units (the “Foreign Offering”), to be

completed pursuant to the provisions of Regulation S of the Securities Act of

1933 (the “Securities Act”), and a private placement offering of 1,875,000 units

(the “US Offering”), to be completed pursuant to the provisions of Regulation D

of the Securities Act. The Foreign Offering and the US Offering were approved by

the Company’s Board of Directors on December 12, 2007, at the same time that

they approved the private placement offering to the Arlington Group Limited,

which was completed on December 26, 2007. Each unit to be sold under the Foreign

Offering and the US Offering will be sold at a price of $1.60 per unit, equal to

a 10% discount on the volume weighted average of the Company’s share price for

the 10 days prior to December 12, 2007. Each unit will consist of one share of

the Company’s common stock and one-half of one share purchase warrant, with each

whole share purchase warrant entitling the holder to purchase one additional

share of common stock at a price of $2.40 for a period of two years from the

date of issuance. In connection with both the Foreign Offering and the US

Offering, the Company may issue to licensed brokers or investment dealers, or

other qualified finders, (a “Finder”) shares of the Company’s common stock equal

to 5% of the total number of units sold by such Finders, as a commission.

The total potential gross proceeds to the Company, if the full

amount of securities being offered under both the Foreign Offering and the US

Offering are sold, will be $5,000,000. The Company has not yet completed the

sale of any securities under the Foreign Offering or the US Offering and there

are no assurances that the Company will be able to complete the sale of any of

the securities being offered.

2

ITEM 9.01

FINANCIAL STATEMENTS AND EXHIBITS.

(c)

Exhibits

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of

1934, the registrant has duly caused this report to be signed on its behalf by

the undersigned hereunto duly authorized.

|

|

SEARCHLIGHT MINERALS CORP.

|

|

Date: January 2, 2008

|

|

|

|

|

By:

|

|

|

|

|

/s/ Carl S. Ager

|

|

|

|

CARL S. AGER, SECRETARY

|

3

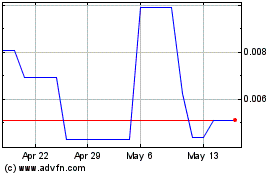

Searchlight Minerals (PK) (USOTC:SRCH)

Historical Stock Chart

From Jun 2024 to Jul 2024

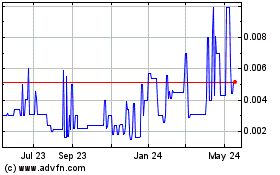

Searchlight Minerals (PK) (USOTC:SRCH)

Historical Stock Chart

From Jul 2023 to Jul 2024

Real-Time news about Searchlight Minerals Corp (PK) (OTCMarkets): 0 recent articles

More Searchlight Minerals Corp. News Articles