UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d)

OF THE SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): January 15, 2016

Vantage Drilling Company

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Cayman Islands |

|

1-34094 |

|

N/A |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

777 Post Oak Boulevard, Suite 800

Houston, TX 77056

(Address of principal executive offices) (Zip Code)

(281) 404-4700

(Registrant’s telephone number, including area code)

(Not applicable)

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

Item 7.01 Regulation FD Disclosure

On January 15, 2016, Offshore Group Investment Limited (“OGIL”), a wholly-owned subsidiary of Vantage Drilling Company, and certain of

its subsidiaries received court approval for their prepackaged restructuring and recapitalization plan pursuant to an order dated January 15, 2016 issued by the the United States Bankruptcy Court for the District of Delaware.

On January 15, 2016, in connection with the bankruptcy order, OGIL issued a press release, a copy of which is filed herewith as Exhibit 99.1.

In accordance with General Instruction B.2 to Form 8-K, the information provided under this Item 7.01 and in Exhibit 99.1 shall be deemed to be

“furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended, or otherwise subject to the liabilities of that section, nor shall it be deemed incorporated by

reference in any filing under the Securities Act of 1933, as amended.

Item 9.01. Financial Statements and Exhibits.

|

|

|

| Exhibit

Number |

|

Description of Exhibit |

|

|

| 99.1 |

|

Press Release dated January 15, 2016. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: January 15, 2016

|

| VANTAGE DRILLING COMPANY |

|

| /s/ DOUGLAS G.

SMITH |

| Douglas G. Smith

Chief Financial Officer and Treasurer |

INDEX TO EXHIBITS

|

|

|

| Exhibit

Number |

|

Description of Exhibit |

|

|

| 99.1 |

|

Press Release dated January 15, 2016. |

Exhibit 99.1

FOR IMMEDIATE RELEASE

Offshore Group

Investment Limited (also known as Vantage Drilling) Receives Court Approval of Prepackaged Restructuring and Recapitalization Plan

HOUSTON, TX –

January 15, 2016 – Offshore Group Investment Limited (“OGIL” or the “Company”) today announced that the Company and its affiliated chapter 11 debtors have received court approval of their

prepackaged restructuring and recapitalization plan (the “Prepackaged Plan”) pursuant to an order dated January 15, 2016.

“The Court’s confirmation of our Prepackaged Plan marks an important milestone in our path to emerge from chapter 11 and secure our future as a

robust, well-capitalized offshore drilling services provider. We will continue to provide our customers with industry-leading expertise and safe, efficient drilling services, as is our norm,” said Paul Bragg, Chief Executive Officer. “The

senior management team and I sincerely appreciate the ongoing support of our customers, suppliers, and stakeholders, as well as the unrelenting dedication of our employees, which together have allowed us to continue our operations in the normal

course throughout this process.”

Among other things, the Prepackaged Plan eliminates more than $1.5 billion of senior secured debt and most cash

interest. More specifically, the Prepackaged Plan provides for a debt-for-equity swap that will result in existing term loan lenders and secured noteholders converting their loans and notes into equity and a pro rata share of $750 million of senior

subordinated convertible notes. The new notes will pay interest through the issuance of additional notes (PIK notes) and will have no cash interest burden. Holders of indebtedness under OGIL’s asset-backed revolving credit facility will execute

an amended and restated senior secured term loan and letter of credit facility and will receive a payment of $7 million in cash. OGIL also completed a fully backstopped rights offering of senior secured second lien notes with an aggregate offering

amount of up to $75 million. All customer, vendor, and employee obligations associated with the ongoing business will remain unaffected.

Additional

information regarding OGIL’s restructuring is available at http://dm.epiq11.com/OGI/Project# or the Company’s website at http://vantagedrilling.com/investor-relations/restructuring-information.

Weil, Gotshal & Manges LLP is serving as legal counsel and Lazard Frères & Co. LLC is serving as investment banker to OGIL.

Alvarez & Marsal North America, LLC is serving as financial adviser to OGIL.

About OGIL

OGIL, a Cayman Islands exempted company, is an offshore drilling contractor, with an owned fleet of three ultra-deepwater drillships the Platinum Explorer, the

Titanium Explorer, and the Tungsten Explorer, as well as four Baker Marine Pacific Class 375 ultra-premium jackup drilling rigs. OGIL’s primary business is to contract drilling units, related equipment, and work crews primarily on a dayrate

basis to drill oil and natural gas wells. OGIL also provides construction supervision services for, and will operate and manage, drilling units owned by others. Through its fleet of seven owned drilling units, OGIL is a provider of offshore contract

drilling services globally to major, national, and large independent oil and natural gas companies.

Forward-Looking Statements

The information above includes forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. These

forward-looking statements are subject to certain risks, uncertainties, and assumptions identified above or as disclosed from time to time in the Company’s filings with the Securities and Exchange Commission. As a result of these factors,

actual results may differ materially from those indicated or implied by such forward-looking statements.

Public & Investor Relations Contact:

Paul A. Bragg

Chairman & Chief Executive

Officer

Offshore Group Investment Limited

(281) 404-4700

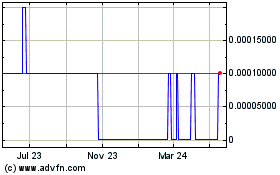

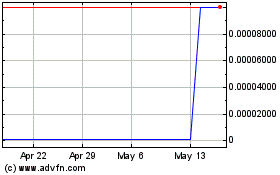

Vantage Drilling (CE) (USOTC:VTGDF)

Historical Stock Chart

From May 2024 to Jun 2024

Vantage Drilling (CE) (USOTC:VTGDF)

Historical Stock Chart

From Jun 2023 to Jun 2024