UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

WASHINGTON, D.C. 20549

FORM 8-K

CURRENT REPORT

PURSUANT

TO SECTION 13 OR 15(d) OF THE

SECURITIES EXCHANGE ACT OF 1934

Date of report (Date of earliest event reported): February 10, 2016

Vantage Drilling Company

(Exact name of registrant as specified in its charter)

|

|

|

|

|

| Cayman Islands |

|

1-34094 |

|

N/A |

| (State or Other Jurisdiction

of Incorporation) |

|

(Commission

File Number) |

|

(IRS Employer

Identification No.) |

|

| c/o KPMG, P.O. Box 493

Century Yard, Cricket Square

Grand Cayman KY1-1106

Cayman Islands |

| (Address of principal executive offices) (Zip Code) |

(345) 949-4800

(Registrant’s telephone number, including area code)

777 Post Oak Boulevard, Suite 800

Houston, TX 77056

(Former

name or former address, if changed since last report)

Check the appropriate box below

if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions (see General Instruction A.2 below):

| ¨ |

Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

| ¨ |

Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

| ¨ |

Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

| ¨ |

Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| Item 1.03. |

Bankruptcy or Receivership. |

As previously disclosed, on December 3, 2015, Offshore Group

Investment Limited, a Cayman Islands exempted company (“OGIL”), a wholly-owned subsidiary of Vantage Drilling Company (the “Company”), and certain subsidiaries of OGIL (together with OGIL, the

“Vantage Debtors”) filed voluntary petitions (“Bankruptcy Petitions”) in the United States Bankruptcy Court for the District of Delaware (the “Bankruptcy Court”) seeking relief

under the provisions of chapter 11 of title 11 of the United States Code (the “Bankruptcy Code”) to pursue a pre-packaged chapter 11 plan of reorganization (the “Plan”). During the pendency of the

Bankruptcy Petitions, the Vantage Debtors continued to operate their business as debtors-in-possession under the jurisdiction of the Bankruptcy Court and in accordance with the applicable provisions of the Bankruptcy Code.

On January 15, 2016, the Bankruptcy Court entered an order confirming the Plan. The JOLs (as defined below) have been advised by the Vantage Debtors that

the Vantage Debtors closed the refinancing transactions under the Plan, and the Plan became effective on February 10, 2016. As a result of the effectiveness of the Plan, the Vantage Debtors, including OGIL, are no longer subsidiaries of the

Company.

The Company’s previously reported liquidation proceedings in the Cayman Islands are continuing, and on January 18, 2016, the Grand

Court of the Cayman Islands (the “Cayman Court”) appointed Alex Lawson and Kris Beighton of KPMG in the Cayman Islands as joint official liquidators (“JOLs”) of the Company.

| Item 5.02. |

Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers. |

Effective February 10, 2016, the Company received resignations from (1) all of the directors of the Company, (2) the principal executive officer

and president of the Company, (3) the principal financial and accounting officer of the Company, (4) the principal operating officer of the Company and (5) each other named executive officer of the Company.

As a result of the Cayman Court’s order on January 18, 2016, the JOLs will manage the Company’s liquidation and have assumed full control of

the Company’s affairs subject to the Cayman Court’s supervision. The JOLs have full authority to act on behalf of the Company, including the signing of periodic reports to the Securities and Exchange Commission.

| Item 7.01. |

Regulation FD Disclosures. |

The information set forth above in Item 1.03 and Item 5.02 of this

Form 8-K is incorporated herein by reference.

On February 10, 2016, in connection with the Plan, OGIL issued a press release, a copy of which is

filed herewith as Exhibit 99.1.

In accordance with General Instruction B.2 to Form 8-K, the information provided under this Item 7.01 shall be

deemed to be “furnished” and shall not be deemed to be “filed” for purposes of Section 18 of the Securities Exchange Act of 1934, as amended (the “Exchange Act”), or otherwise subject to the

liabilities of that section, nor shall it be deemed incorporated by reference in any filing under the Securities Act of 1933, as amended (the “Securities Act”). The Company does not undertake to update the information as

posted on its website; however, it may post additional information included in future press releases and Forms 8-K, as well as posting its periodic Exchange Act reports.

Forward-Looking Statements

This Current Report on Form

8-K contains forward-looking statements within the meaning of Section 27A of the Securities Act and Section 21E of the Exchange Act. These forward-looking statements relate to the Company’s plans, goals, strategies, intent,

beliefs and current expectations. These statements are expressed in good faith and based upon a reasonable basis when made, but there can be no assurance that these expectations will be achieved or accomplished. These forward-looking statements

reflect the Company’s current views with respect to future events

and are based on assumptions and subject to risks and uncertainties. Items contemplating or making assumptions about the Company’s industry, business strategy, goals, expectations concerning

the Company’s market position, future operations, margins, profitability, capital expenditures, liquidity and capital resources and other financial and operating information also constitute such forward-looking statements. You should not place

undue reliance on these forward-looking statements.

These forward-looking statements can be identified by the use of terms and phrases such as

“believe,” “plan,” “intend,” “anticipate,” “target,” “estimate,” “expect” and the like, and/or future tense or conditional constructions (“will,” “may,”

“could,” “should,” etc.). The Company’s actual results could differ materially from those anticipated in these forward-looking statements.

| Item 9.01. |

Financial Statements and Exhibits. |

(d) Exhibits.

|

|

|

| Exhibit

Number |

|

Description of Exhibit |

|

|

| 99.1 |

|

Press Release of OGIL, dated February 10, 2016. |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned

hereunto duly authorized.

Date: February 10, 2016

|

| VANTAGE DRILLING COMPANY |

| (in official liquidation) |

|

| /S/ Alexander Lawson |

| Alexander Lawson

Joint Official Liquidator and Authorized Signatory |

INDEX TO EXHIBITS

|

|

|

| Exhibit

Number |

|

Description of Exhibit |

|

|

| 99.1 |

|

Press Release of OGIL dated February 10, 2016. |

Exhibit 99.1

Offshore Group Investment Limited (Now Known as Vantage Drilling International) Successfully Completes Prepackaged Restructuring

Emerges From Chapter 11 with $75 Million in New Financing

HOUSTON, TX – February 10, 2016 – Offshore Group Investment Limited (“OGIL” or the “Company”)

today announced that it has successfully completed its prepackaged restructuring and recapitalization and emerged from chapter 11 bankruptcy protection.

Through its prepackaged chapter 11 plan, OGIL eliminated more than $1.5 billion of senior secured debt and most cash interest and received $75 million in new

exit financing. The Company believes its new capital structure creates a strong foundation for long-term success.

“Today marks the completion of a

restructuring and recapitalization that allows the Company to move forward with a solid financial foundation from which we expect to continue to operate successfully and grow,” said Paul Bragg, Chief Executive Officer. “We now have the

financial flexibility to continue to provide our customers with industry-leading expertise and safe, efficient drilling services, as is our norm. On behalf of the management team, I would like to extend my gratitude to our employees for their hard

work and dedication and to our customers, suppliers, and stakeholders for their support during this process.”

The Company also announced today a

newly constituted Board of Directors, effective in conjunction with the Company’s emergence from chapter 11:

| |

• |

|

Nils E. Larsen – Senior Operating Adviser working with The Carlyle Group’s U.S. Equity Opportunities Fund. Prior to partnering with The Carlyle Group, Mr. Larsen served in a variety of senior

executive positions with Tribune Company, including as President and Chief Executive Officer of Tribune Broadcasting and as Co-President of Tribune Company. |

| |

• |

|

L. Spencer Wells – Founder and Partner of Drivetrain Advisors, a provider of fiduciary services to members of the alternative investment community, with a particular expertise in restructuring and

turnarounds. Previously, Mr. Wells served as senior advisor and partner with TPG Special Situations Partner. |

| |

• |

|

Esa Ikaheimonen – Former Executive Vice President and Chief Financial Officer of Transocean Ltd. Mr. Ikaheimonen previously served as Chief Executive Officer of Seadrill’s Asia Offshore Drilling

subsidiary and Senior Vice President and Chief Financial Officer of Seadrill Ltd. He has served on the board of directors of Transocean Partners, LLC, as Chairman of the Board, and as an independent director of Ahlstrom Plc where he served as

Chairman of the Audit Committee. |

| |

• |

|

Matthew Bonanno – Partner of York Capital Management and currently a member of the Board, in his capacity as a York employee, of Rever Offshore AS and all entities incorporated pursuant to York’s

partnership with Costamare Inc. and Augustea Bunge Maritime. |

| |

• |

|

Paul A. Bragg – With the Company since its inception in 2006 as its Chief Executive Officer. Before then, Mr. Bragg was employed by Pride International, Inc., which was one of the world’s largest

international drilling and oilfield services companies prior to being acquired by Ensco plc. At Pride, Mr. Bragg served as Chief Executive Officer from 1999 through 2005, Chief Operating Officer from 1997 through 1999, and Vice President and

Chief Financial Officer from 1993 through 1997. As a result of his three decades in offshore drilling, Mr. Bragg is experienced in operational, financial, and marketing strategies relating to the industry. |

After the Company’s emergence from chapter 11, two additional directors will be appointed:

| |

• |

|

Scott McCarty – Partner of Q Investments and with Q since 2002. Prior to his current position as manager of the venture capital, private equity, and distressed investment groups, he was a portfolio manager.

Before joining Q Investments, Mr. McCarty was a captain in the United States Army and worked in the office of United States Senator Kay Bailey Hutchison. |

| |

• |

|

Tom Bates – Has 40 years of operational experience in the oil and gas industry, having held executive leadership positions at several major energy companies. He previously served as group president at Baker

Hughes, chief executive officer at Weatherford-Enterra, and president of the Anadrill division of Schlumberger. A current director of TETRA Technologies, Mr. Bates also has served as Chairman of the Board of Hercules Offshore, Inc. in addition

to serving on several other public company energy-related boards. He also was managing director and then senior advisor at Lime Rock Partners, an energy-focused private equity investment firm. Mr. Bates has a doctorate in mechanical engineering

from the University of Michigan. He is currently an adjunct professor and co-chair of the advisory board for the Energy MBA Program at the Neeley School of Business at Texas Christian University in Fort Worth. |

Mr. Bragg said, “Our newly constituted Board includes a diverse group of individuals with a range of experience and expertise who will bring fresh

perspective to the Company. We look forward to benefitting from their guidance as we embark on our new beginning.”

The Company further announced

that it has changed its name to Vantage Drilling International effective upon the completion of the restructuring and recapitalization.

As previously

announced, the Company’s prepackaged chapter 11 plan was confirmed by the United States Bankruptcy Court for the District of Delaware on January 15, 2016.

Weil, Gotshal & Manges LLP served as legal counsel and Lazard Frères & Co. LLC served as investment banker to the Company.

Alvarez & Marsal North America, LLC served as financial adviser to the Company.

About OGIL

The Company, a Cayman Islands exempted company, is an offshore drilling contractor, with an owned fleet of three ultra-deepwater drillships—the Platinum

Explorer, the Titanium Explorer,

and the Tungsten Explorer—as well as four Baker Marine Pacific Class 375 ultra-premium jackup drilling rigs. The Company’s primary business is to contract drilling units, related

equipment, and work crews primarily on a dayrate basis to drill oil and natural gas wells. The Company also provides construction supervision services for, and will operate and manage, drilling units owned by others. Through its fleet of seven owned

drilling units, the Company is a provider of offshore contract drilling services globally to major, national, and large independent oil and natural gas companies.

Forward-Looking Statements

The information above

includes forward-looking statements within the meaning of the Securities Act of 1933 and the Securities Exchange Act of 1934. These forward-looking statements are subject to certain risks, uncertainties, and assumptions identified above or as

disclosed from time to time in the filings with the Securities and Exchange Commission by the Company or its former parent, Vantage Drilling Company. As a result of these factors, actual results may differ materially from those indicated or implied

by such forward-looking statements.

CONTACT INFORMATION

Public & Investor Relations Contact:

Paul A.

Bragg

Chief Executive Officer

Offshore Group Investment

Limited

(now known as Vantage Drilling International)

(281)

404-4700

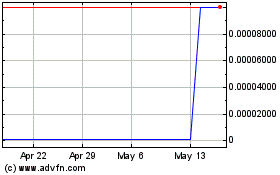

Vantage Drilling (CE) (USOTC:VTGDF)

Historical Stock Chart

From May 2024 to Jun 2024

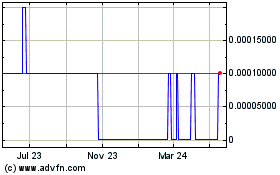

Vantage Drilling (CE) (USOTC:VTGDF)

Historical Stock Chart

From Jun 2023 to Jun 2024