TIDMELLA

RNS Number : 6808J

Ecclesiastical Insurance Office PLC

20 August 2019

2019 INTERIM RESULTS

Ecclesiastical Insurance Office plc 20 August 2019

Ecclesiastical Insurance Office plc ("Ecclesiastical"), the

specialist financial services group, today announces its 2019

interim results. A copy of the 2019 interim results will be

available on the Company's website at www.ecclesiastical.com

Highlights

-- Gross written premiums (GWP) up 7% from the same period last

year at GBP185.0m (H1 2018: GBP172.7m), supported by strong

retention, new propositions and benefiting from favourable foreign

exchange

-- Profit before tax of GBP42.8m (H1 2018: GBP19.4m)

-- Investment returns of GBP42.0m (H1 2018: GBP17.7m), where

markets have recovered since the end of 2018

-- Continuing to see steady measured progress in our insurance

business with underwriting profits* of GBP9.5m giving a combined

operating ratio (COR) of 91.4% (H1 2018: profit of GBP8.0m, COR

92.3%)

-- We will grant a further GBP5m to our charitable owner in

September to give to good causes. This will take us to GBP70m

towards our target of GBP100m in charitable donations by the end of

2020.

Mark Hews, Group Chief Executive Officer of Ecclesiastical,

said: "Our purpose at Ecclesiastical is to contribute to the

greater good of society. By delivering sustainable, profitable,

long-term growth, we are able to support thousands of good causes

across the UK through our charitable giving. I'm very proud that in

April we launched the Movement for Good Awards, giving away GBP1m

to charities in 2019.

"Alongside this we're announcing today a further GBP5m will be

granted to our charitable owner in September. This will bring us to

GBP70m towards our target of GBP100m by the end of 2020.

"This giving is made possible thanks to the hard work and

dedication of everyone at Ecclesiastical. I'm delighted to report a

positive financial performance in the first half of 2019,

underpinned by continued strong underwriting performance. This is a

result of our disciplined underwriting approach, and a benign

environment in the first half of the year. Positive growth in

global stock markets has also delivered strong investment returns,

demonstrating the benefit of our long term equity investment

strategy.

"Our strategic goal is to be the most trusted and ethical

specialist financial services group and we continue to win external

accolades for the way we do business.

"Ecclesiastical home insurance was once again rated first by

Fairer Finance overall and came first for trust and first for

customer happiness. Ecclesiastical Canada was awarded Top Employer

for Young people 2019 for the seventh consecutive year.

"Our reputation for claims excellence was also enhanced with our

UKGI business being the only insurer to win multiple awards at the

Insurance Post Claims Awards."

*The Group uses APMs to help explain performance. More

information on APMs is included in note 12.

Key Financial Performance Data

H1 2019 H1 2018

Gross written premiums GBP185.0m GBP172.7m

Group underwriting result* GBP9.5m GBP8.0m

Group combined operating ratio* 91.4% 92.3%

Investment return GBP42.0m GBP17.7m

Profit before tax GBP42.8m GBP19.4m

30 June 2019 31 Dec 2018

Net asset value GBP617m GBP586m

Solvency II capital cover (solo) 226% 215%

*The Group uses APMs to help explain performance. More

information on APMs is included in note 12.

Interim Management Report

It has been a good first half of the year with a stable

underwriting performance and strong investment returns, with stock

markets recovering from the falls seen at the end of 2018. We

report a profit before tax of GBP42.8m (H1 2018: GBP19.4m).

Our strategy over the medium term continues to deliver moderate

GWP growth, by maintaining our strong underwriting discipline and

focusing on profit over growth. We have deep specialist

capabilities, which we continue to develop through investment in

technology and innovation, and by providing appealing customer

propositions and excellent service.

We have delivered good growth and steady underwriting profits in

the first half with underwriting profit of GBP9.5m (H1 2018:

GBP8.0m). This reflects improved current year performance which

benefited from benign weather and favourable large loss experience

in most of our territories compared with previous years with the

COR of 91.4% (H1 2018: 92.3%).

Gross written premiums grew by 7.1% to GBP185.0m (H2 2018:

GBP172.7m), benefiting from strong retention, new business wins and

favourable currency movements.

Investment markets have partially recovered from a poor Q4 2018

where worldwide markets fell but remain around 3% below half year

2018 levels. Interest rates have been held and there has been less

volatility from quarter to quarter than in the prior year. The

unrealised investment losses we suffered at the end of 2018 were

partially recovered as we have benefited from unrealised gains in

H1 2019. Our overall investment return for the first half of the

year was above our expectations at GBP42.0m (H1 2018: GBP17.7m). We

are expecting further volatility in the second half of the year as

the uncertainty around Brexit and global economic conditions

continues.

These positive half-year results allow us to make a grant of

GBP5m (H2 2018: GBP5m) to our charitable owner, Allchurches Trust,

which has been approved by the Board and will be paid in September

2019.

Strategic Update

Investment in both our business and our people continues under a

broad range of initiatives. Within the UK, a new private client

product has been launched to help capitalise on growth

opportunities available in this market. In May we launched a series

of enhancements to our education proposition with a redesigned

survey report, e-learning support, cyber guidance and a lesson kit

for teachers to assist with the promotion of digital resilience

with primary and secondary pupils. Investment in our staff

continues to take place through our General Insurance Academy and

as part of this a national training plan has been created, focusing

on the continued development of our underwriters.

Investment in new technology is also progressing well: our new

policy administration system for the UK and Ireland is under

development; the UK's new claims workflow and document repository

system is expected to go live shortly; and our Australian

subsidiary has begun development of its new policy administration

system. Our UK broking business has completed a successful trial of

a new claims portal and will begin to roll this out more widely

during 2019.

Our work in innovation and loss prevention continues. The UK has

successfully piloted thermal imaging equipment that identifies

electrical faults before they can cause a fire, with the rollout of

training and equipment now underway. Work continues on the use of

drones and their potential to support our risk management

proposition. The UK has undertaken a series of trial drone flights.

This will enable us to develop our understanding of how this

technology can be embedded within our current survey approach. We

are exploring how connected technology can prevent common losses

thus saving the customer time and expense on the cost of property

maintenance, including a trial of a smart water leak detector and

equipping a heritage property with a wide range of sensors to

identify potential risks.

Our purpose is to contribute to the greater good of society.

Earlier this year we launched our GBP1m Movement for Good Awards,

and recently announced awards of GBP1,000 each to 500 charities.

Further grants totalling GBP500,000 to 10 charities will be

announced during September. We continue to be motivated by our

target to donate GBP100m to charity by the end of 2020 - after the

GBP5m grant, we will have donated GBP70m towards this goal.

Together with our customers and business partners, we are building

a movement for good - championing a more caring, ethical and

trusted way of doing business.

General Insurance - UK and Ireland

UK and Ireland report an underwriting profit of GBP9.2m and a

net combined ratio of 87.8% (H1 2018: GBP11.8m profit, COR 83.8%).

The property result has been better than expected in the first half

of the year due to unusually benign weather and lower than average

large loss experience. The strong performance of our liability

business has continued into 2019 with the current year liability

claims experience similar to last year, but with levels of reserve

releases less than last year. We expect to see this trend of a

reduction in the level of these releases continue as the run-off of

claims in respect of the unprofitable business we exited in 2012

and 2013 is now well progressed.

UK and Ireland GWP grew by 4% to GBP124m in the six months to 30

June 2019 (H1 2018: GBP119.3m). This is driven by particularly

strong growth in our Art & Private Client, Real Estate and

Schemes business together with continued growth in our Heritage

business as we demonstrate our position as a leading insurer of

heritage, listed and period properties.

General Insurance - Canada

Canada reports GWP of GBP25.5m (H1 2018: GBP22.4m), an increase

of 12.5% in local currency. Good progress continues to be made in

strengthening the existing portfolio through rate and retention.

New business production is behind the prior year as we continued to

focus on profitability over growth.

Canada delivered an underwriting profit of GBP0.4m with a net

combined operating ratio of 98.0% (H1 2018: GBP3.7m loss, COR

119.1%) which represented an improved performance in large loss and

catastrophe events compared with both 2018 and 2017 where

underwriting losses were delivered. Although the first few months

saw a higher level of claims from the adverse winter weather, the

last few months have seen the benefit of the rating action and a

return to more normal weather experience.

General Insurance - Australia

Our Australian business continues to be successful in generating

new business which has been a key driver of an 18% increase in GWP

in local currency. After the negative effects of exchange, reported

GWP was up 15% to GBP33.7m (H1 2018: GBP29.4m). We expect to see

growth continue into the second half of the year although the

market is becoming more competitive.

The underwriting loss for the period has remained relatively

stable at GBP0.4m with a net combined ratio of 103.3% (H1 2018:

GBP0.3m loss, COR 103.0%). Australia's gross underwriting results

were significantly impacted by the Townsville floods however, these

events were substantially reinsured and made a minimal impact on

the net results. The small loss is in line with expectations.

Group Investment Returns

Investment performance has performed above our expectations in

the first half of the year, with the markets recovering from a poor

Q4 2018 where worldwide markets fell. There has been less

volatility from quarter to quarter than in the prior year.

Our investment portfolio delivered profit of GBP42.0m (H1 2018:

GBP17.7m). The returns were predominantly driven by fair value

gains and dividend and interest income.

We discount some of our liability claims reserves. The reserves

relate to liability policies, written over many decades, and

represent very long-tail risks. The movement in yields from the

year end has resulted in a negative impact of GBP8.5m in the first

six months of the year, which partially offset the fair value gains

on our financial investments.

We remain cautious on our expectations for investment returns

given continued uncertainty around the UK's exit from the EU and

the US's international trade disputes. Our approach to the

management of risks resulting from the Group's exposure to

financial markets is outlined in note 4 to our latest annual

report.

Asset Management - EdenTree

Fee income grew by 1% reflecting positive market movements and

new flows. Our strategic investment in people and technology has

resulted in lower overall profitability, with EdenTree reporting a

small loss less than GBP0.1m (H1 2018: GBP0.8m).

Total assets under management (AUM) increased by 4% over the six

months to stand at almost GBP2.9bn (H1 2018: GBP2.8bn).

Despite positive market movements, investors remained cautious

during the early part of the year as the industry reported weak

retail inflows and particularly hard hit has been UK equity sector

with many groups suffering net outflows. Against this background

EdenTree were pleased to report OEIC pooled funds delivered

positive flows of GBP24m (H1 2018: GBP94m) into our pooled fund

products. Net inflows were driven by our multi asset product and

bond funds.

Overall net inflows from all sources was GBP25m (H1 2018:

GBP125m).

Broking and Advisory - SEIB Insurance Brokers

SEIB general commission and fees, excluding profit share

commission, has increased by 6% in the first half of the year.

Retention rates remain high but new business in some sectors is

proving to be challenging. SEIB continues to deliver stable returns

to the Group, reporting a half year profit before tax of GBP1.6m

(H1 2018: GBP1.8m).

Life Business

Our life insurance business, which is closed to new business,

reported a profit before tax of GBP0.2m at the half year (H1 2018:

GBP0.4m). Assets and liabilities are well matched, and the small

profit is in line with what we would expect as the business runs

off.

Balance Sheet and Capital Position

Total shareholders' equity increased by GBP30.8m to GBP616.8m in

the first six months of the year. Profits in the period were

partially offset by actuarial losses on retirement benefit plans

and a small exchange loss on overseas operations.

We paid the normal first-half dividend to preference

shareholders of GBP4.6m (H1 2018: GBP4.6m) and also expect to make

a grant of GBP5m (H1 2018: GBP5m) to our charitable owner in

September 2019.

Our Solvency II regulatory capital position remains strong. Own

funds increased in line with profits and our estimated internal

model capital requirement has also increased in line with the

growth in our business. Overall, the level of Solvency II cover is

ahead of the position at the end of 2018 (226% vs 215%), in line

with our expectations.

Principal Risks and Uncertainties

The principal risks and uncertainties faced by the Group and our

approach to managing them are outlined in our latest annual report

and in note 1 to these condensed financial statements.

Group Outlook

We remain confident about future profitability and have

delivered a fifth consecutive year of strong underwriting profits

at the half year, with a greater contribution coming from the

current year performance than we have seen in more recent years.

Our short term underwriting results can be subject to volatile

items such as weather and large losses and we recognise that there

is the potential for challenges in the period ahead.

In the first half of the year we have seen a strong performance

in our investment result, reflecting the recovery seen in

investment markets since the start of the year. We recognise that

there is continued political and economic uncertainty and this has

the potential to create short term volatility in the second half of

the year. We remain well placed to withstand any such volatility

and have substantial headroom over our Solvency II capital

requirement.

Core to our purpose is to deliver strong and sustainable returns

to our ultimate shareholder, and to benefit not only our customers

but also the wider communities we serve. We do this through our

deep understanding and management of risks; by providing trusted

specialist expertise and by maintaining the strength of our capital

base. We benefit from the diversity within our financial services

group which gives us the opportunity us to grow both organically

and inorganically within our chosen markets and remain well placed

to deliver sustainable profitable growth.

By order of the Board

Mark Hews

Group Chief Executive

20 August 2019

CONSOLIDATED INTERIM FINANCIAL STATEMENTS

CONDENSED CONSOLIDATED STATEMENT OF PROFIT OR LOSS

For the 6 months to 30 June 2019

30.06.19 30.06.18 31.12.18

6 months 6 months 12 months

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

Revenue

Gross written premiums 185,002 172,729 356,971

Outward reinsurance premiums (71,172) (66,924) (137,640)

Net change in provision for unearned premium (4,351) (877) (5,241)

Net earned premiums 109,479 104,928 214,090

------------ ------------ ----------

Fee and commission income 30,582 28,994 62,996

Other operating income 339 1,039 1,039

Net investment return 42,017 17,739 3,994

Total revenue 182,417 152,700 282,119

------------ ------------ ----------

Expenses

Claims and change in insurance liabilities (78,962) (67,054) (111,873)

Reinsurance recoveries 31,512 19,493 26,188

Fees, commissions and other acquisition costs (35,165) (32,192) (66,346)

Other operating and administrative expenses (56,705) (53,227) (114,388)

Total operating expenses (139,320) (132,980) (266,419)

------------ ------------ ----------

Operating profit 43,097 19,720 15,700

Finance costs (324) (297) (329)

Profit before tax 42,773 19,423 15,371

Tax expense (6,309) (2,301) (958)

------------ ------------ ----------

Profit for the financial period from continuing

operations attributable to equity holders

of the Parent 36,464 17,122 14,413

------------ ------------ ----------

CONDENSED CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

For the 6 months to 30 June 2019

30.06.19 30.06.18 31.12.18

6 months 6 months 12 months

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

Profit for the period 36,464 17,122 14,413

------------ ------------ ----------

Other comprehensive income

Items that will not be reclassified subsequently

to profit or loss:

Fair value gains on property - - 105

Actuarial (losses)/gains on retirement benefit

plans (1,113) 7,949 4,288

Attributable tax 189 (1,351) (747)

(924) 6,598 3,646

Items that may be reclassified subsequently

to profit or loss:

Gains/(losses) on currency translation differences 1,213 (2,380) (3,082)

(Losses)/gains on net investment hedges (1,643) 1,614 1,692

Attributable tax 292 (436) (187)

(138) (1,202) (1,577)

------------ ------------ ----------

Other comprehensive income (1,062) 5,396 2,069

------------ ------------ ----------

Total comprehensive income attributable to

equity holders of the Parent 35,402 22,518 16,482

------------ ------------ ----------

CONDENSED CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

For the 6 months to 30 June 2019

Translation

Share Share Revaluation and hedging Retained

capital premium reserve reserve earnings Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

2019 (Unaudited)

At 1 January 120,477 4,632 565 19,071 441,259 586,004

Profit for the period - - - - 36,464 36,464

Other comprehensive

income - - - (138) (924) (1,062)

--------- -------- ------------ ------------ --------- ---------

Total comprehensive

income - - - (138) 35,540 35,402

Dividends on preference

shares - - - - (4,591) (4,591)

At 30 June 120,477 4,632 565 18,933 472,208 616,815

--------- -------- ------------ ------------ --------- ---------

2018 (Unaudited)

At 1 January 120,477 4,632 478 20,648 446,238 592,473

Profit for the period - - - - 17,122 17,122

Other comprehensive

income - - - (1,202) 6,598 5,396

--------- -------- ------------ ------------ --------- ---------

Total comprehensive

income - - - (1,202) 23,720 22,518

Dividends on preference

shares - - - - (4,591) (4,591)

At 30 June 120,477 4,632 478 19,446 465,367 610,400

--------- -------- ------------ ------------ --------- ---------

2018 (Audited)

At 1 January 120,477 4,632 478 20,648 446,238 592,473

Profit for the year - - - - 14,413 14,413

Other comprehensive

income - - 87 (1,577) 3,559 2,069

--------- -------- ------------ ------------ --------- ---------

Total comprehensive

income - - 87 (1,577) 17,972 16,482

Dividends on preference

shares - - - - (9,181) (9,181)

Gross charitable grant - - - - (17,000) (17,000)

Tax credit on charitable

grant - - - - 3,230 3,230

At 31 December 120,477 4,632 565 19,071 441,259 586,004

--------- -------- ------------ ------------ --------- ---------

The revaluation reserve represents cumulative net fair value

gains on owner-occupied property. Further details of the

translation and hedging reserve are included in note 8.

CONDENSED CONSOLIDATED STATEMENT OF FINANCIAL POSITION

At 30 June 2019

30.06.19 30.06.18 31.12.18

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

Assets

Goodwill and other intangible assets 33,517 28,288 30,064

Deferred acquisition costs 34,113 30,488 33,907

Deferred tax assets 1,807 1,666 1,749

Retirement benefit asset 14,815 26,823 16,131

Property, plant and equipment 22,214 8,209 8,391

Investment property 152,046 152,238 152,182

Financial investments 851,780 855,366 798,974

Reinsurers' share of contract liabilities 156,359 157,803 140,346

Current tax recoverable 688 222 59

Other assets 169,612 161,225 153,630

Cash and cash equivalents 94,657 90,507 109,417

Total assets 1,531,608 1,512,835 1,444,850

------------ ------------ -----------

Equity

Share capital 120,477 120,477 120,477

Share premium account 4,632 4,632 4,632

Retained earnings and other reserves 491,706 485,291 460,895

Total shareholders' equity 616,815 610,400 586,004

------------ ------------ -----------

Liabilities

Insurance contract liabilities 752,525 750,202 720,049

Lease obligations 14,370 1,592 1,379

Provisions for other liabilities 7,329 7,133 5,216

Retirement benefit obligation 6,102 10,626 5,813

Deferred tax liabilities 35,332 39,886 31,665

Current tax liabilities 585 2,637 2,905

Deferred income 20,623 18,955 19,900

Other liabilities 77,927 71,404 71,919

Total liabilities 914,793 902,435 858,846

------------ ------------ -----------

Total shareholders' equity and liabilities 1,531,608 1,512,835 1,444,850

------------ ------------ -----------

CONDENSED CONSOLIDATED STATEMENT OF CASH FLOWS

For the 6 months to 30 June 2019

30.06.19 30.06.18 31.12.18

6 months 6 months 12 months

GBP000 GBP000 GBP000

(Unaudited) (Unaudited) (Audited)

Profit before tax 42,773 19,423 15,371

Adjustments for:

Depreciation of property, plant and equipment 2,665 1,219 2,437

Revaluation of property, plant and equipment - - (85)

Loss/(profit) on disposal of property, plant

and equipment 94 (11) (3)

Amortisation of intangible assets 501 459 949

Net fair value (gains)/losses on financial

instruments and investment property (34,542) 3,138 35,506

Dividend and interest income (14,263) (13,575) (27,107)

Finance costs 324 297 329

Adjustment for pension funding 511 750 2,931

(1,937) 11,700 30,328

Changes in operating assets and liabilities:

Net increase/(decrease) in insurance contract

liabilities 28,790 (12,990) (42,161)

Net (increase)/decrease in reinsurers' share

of contract liabilities (15,497) (673) 16,431

Net decrease/(increase) in deferred acquisition

costs 141 414 (3,078)

Net increase in other assets (15,005) (12,074) (5,388)

Net increase in operating liabilities 2,012 3,050 5,838

Net increase/(decrease) in other liabilities 3,224 1,654 (286)

Cash generated/(used) by operations 1,728 (8,919) 1,684

Purchases of financial instruments and investment

property (76,741) (61,197) (125,739)

Sale of financial instruments and investment

property 64,644 62,794 149,562

Dividends received 5,396 5,002 9,790

Interest received 8,292 8,278 17,347

Tax paid (5,189) (2,538) (4,998)

Net cash (used by)/from operating activities (1,870) 3,420 47,646

------------ ------------ ----------

Cash flows from investing activities

Purchases of property, plant and equipment (3,593) (566) (1,822)

Proceeds from the sale of property, plant

and equipment - 54 55

Purchases of intangible assets (3,823) (393) (2,371)

Acquisition of business, net of cash acquired - - (225)

Net cash used by investing activities (7,416) (905) (4,363)

------------ ------------ ----------

Cash flows from financing activities

Interest paid (324) (297) (329)

Payment of principal element of lease liabilities (1,447) (169) (346)

Dividends paid to Company's shareholders (4,591) (4,591) (9,181)

Donations paid to ultimate parent undertaking - - (17,000)

Net cash used by financing activities (6,362) (5,057) (26,856)

------------ ------------ ----------

Net (decrease)/increase in cash and cash equivalents (15,648) (2,542) 16,427

Cash and cash equivalents at the beginning

of the period 109,417 93,767 93,767

Exchange gains/(losses) on cash and cash equivalents 888 (718) (777)

Cash and cash equivalents at the end of the

period 94,657 90,507 109,417

------------ ------------ ----------

NOTES TO THE CONDENSED SET OF FINANCIAL STATEMENTS

1. General information

The information for the year ended 31 December 2018 does not

constitute statutory accounts as defined in section 434 of the

Companies Act 2006. A copy of the statutory accounts for that year

has been delivered to the Registrar of Companies. The auditor

reported on those accounts: its report was unqualified, did not

draw attention to any matters by way of emphasis without qualifying

the report, and did not contain a statement under section 498(2) or

(3) of the Companies Act 2006.

The condensed consolidated interim financial statements were

approved by the Board on 20 August 2019. These condensed

consolidated interim financial statements have been reviewed, not

audited.

The principal risks and uncertainties of the Group are in

respect of insurance risk and financial risk. The risk under any

one insurance contract is the possibility that the insured event

occurs and the uncertainty of the amount and timing of the

resulting claim. Factors such as the business and product mix, the

external environment including market competition and reinsurance

capacity all may vary from year to year, along with the actual

frequency, severity and ultimate cost of claims and benefits. The

Group's underwriting strategy is designed to ensure that the

underwritten risks are well diversified in terms of type and amount

of risk and geographical spread. In all operations, pricing

controls are in place, underpinned by sound statistical analysis,

market expertise and appropriate external consultant advice. Gross

and net underwriting exposure is protected through the use of a

comprehensive programme of reinsurance using both proportional and

non-proportional reinsurance and supported by proactive claims

handling. The overall reinsurance structure is regularly reviewed

and modelled to ensure that it remains optimum to the Group's

needs. The optimum reinsurance structure provides the Group with

sustainable, long-term capacity to support its specialist business

strategy, with effective balance sheet and profit and loss

protection at a reasonable cost.

The Group derives insurance premiums from a range of

geographical locations and classes of business. Depending on the

location and class of the risk, there may be a seasonal pattern to

the incidence of claims. However, given the mix of business that

the Group writes, overall the consolidated interim financial

statements are not subject to any significant impact arising from

the seasonality or cyclicality of operations.

The most important components of financial risk are interest

rate risk, credit risk, currency risk and equity price risk. The

Group is exposed to equity price risk because of financial

investments held by the Group which are stated at fair value

through profit or loss. The Group mitigates this risk by holding a

diversified portfolio across geographical regions and market

sectors, and through the use of derivative contracts from time to

time which would limit losses in the event of a fall in equity

markets. The Group's exposure to interest rate risk arises

primarily from movements on financial investments that are measured

at fair value and have fixed interest rates, which represent a

significant proportion of the Group's assets, and from those

insurance liabilities for which discounting is applied at a market

interest rate. The Group's investment strategy is set in order to

control the impact of interest rate risk on anticipated cash flows

and asset and liability values. The fair value of the Group's

investment portfolio of fixed income securities reduces as market

interest rates rise as does the present value of discounted

insurance liabilities, and vice versa. These principal risks and

uncertainties, together with details of the financial risk

management objectives and policies of the Group, are disclosed in

the latest annual report.

The Directors have assessed the going concern of the Group. The

directors have considered the Group's plans and forecasts,

financial resources, investment portfolio and solvency position.

Accordingly, the Directors continue to adopt the going concern

basis in preparing the consolidated interim financial

statements.

2. Accounting policies

Ecclesiastical Insurance Office plc (hereafter referred to as

the "Company"), a public limited company incorporated and domiciled

in England, together with its subsidiaries (collectively the

"Group") operates principally as a provider of general insurance

and in addition offers a range of financial services, with offices

in the UK & Ireland, Australia and Canada.

The annual financial statements are prepared in accordance with

International Financial Reporting Standards (IFRSs) as adopted by

the European Union. The condensed set of financial statements

included in the 2019 interim results has been prepared in

accordance with IAS 34, Interim Financial Reporting.

Other than those detailed below, the same accounting policies

and methods of computation are followed in the consolidated interim

financial statements as applied in the Group's latest audited

annual financial statements.

IFRS 16, Leases

The Group has adopted IFRS 16 from 1 January 2019 using the

modified retrospective approach, as permitted by the standard. The

reclassifications and the adjustments arising from the new leasing

rules are therefore recognised in the opening balance sheet on 1

January 2019. Comparative figures for the 2018 reporting period

have not been restated, as permitted under the specific

transitional provisions in the standard. There was no impact on the

Group's opening equity.

On adoption of IFRS 16, the Group recognised lease liabilities

in relation to leases which had previously been classified as

'operating leases' under the principles of IAS 17, Leases. These

liabilities were measured at the present value of the remaining

lease payments, discounted using the lessee's incremental borrowing

rate as of 1 January 2019. The Group's weighted average lessee's

incremental borrowing rate applied to the lease liabilities on 1

January 2019 was 4.0%.

2019

GBP000

Operating lease commitments disclosed as at 31 December

2018 19,605

Contract elements reassessed as service agreements (1,579)

Payments due in periods covered by extension options that

are included in the lease term 957

Leases committed but not yet commenced at 31 December

2018 (4,969)

Short-term leases, sales taxes and other (1,451)

Discounted using the lessee's incremental borrowing rate

at the date of initial application (1,480)

Finance liabilities recognised as at 31 December 2018 1,379

Lease liability recognised as at 1 January 2019 12,462

--------

Right-of-use assets have been measured at 1 January 2019 at an

amount equal to the lease liability, adjusted by the amount of any

prepaid or accrued lease payments relating to that lease recognised

in the balance sheet as at 31 December 2018.

For leases previously classified as finance leases the Group

recognised the carrying amount of the lease asset and lease

liability immediately before transition as the carrying amount of

the right of use asset and the lease liability at the date of

initial application.

In applying IFRS 16 for the first time, the Group has used the

following practical expedients permitted by the standard:

-- the use of a single discount rate to a portfolio of leases

with reasonably similar characteristics;

-- the accounting for operating leases with a remaining term of

less than 12 months as at 1 January 2019 as short-term leases;

-- the exclusion of initial direct costs for the measurement of

right-of-use assets at the date of initial application; and

-- the use of hindsight in determining the lease term where the

contract contains options to extend or terminate the lease.

The Group has also elected not to reassess whether a contract

is, or contains a lease at the date of initial application.

Instead, for contracts entered into before the transition date the

Group relied on its assessment made applying IAS 17 and IFRIC 4

Determining whether an Arrangement contains a Lease.

The change in accounting policy affected the following items on

the balance sheet on 1 January 2019:

31.12.18 Adjustment 01.01.19

GBP000 GBP000 GBP000

Property, plant and equipment 8,391 10,353 18,744

Other assets 153,630 (447) 153,183

Lease obligations (1,379) (11,083) (12,462)

Provisions for other liabilities (5,216) (503) (5,719)

Other liabilities (71,919) 1,680 (70,239)

From 1 January 2019, leases are recognised as a right-of

use-asset and a corresponding liability at the date at which the

lease asset is available for use by the Group. Each lease payment

is deducted from the lease liability. Finance costs are charged to

the profit and loss over the lease period so as to produce a

constant periodic rate of interest on the remaining balance of the

liability for each period. The right-of-use asset is depreciated

over the shorter of the asset's useful life and the lease term on a

straight-line basis.

Lease liabilities include the net present value of:

-- fixed payments less any lease incentives receivable;

-- variable lease payments that are based on an index or rate;

-- amounts expected to be payable by the lessee under residual value guarantees;

-- the exercise price of an option if the lessee is reasonably

certain to exercise that option; and

-- payments and penalties from terminating the lease, if the

lease term reflects the lessee exercising that option.

Right-of-use assets are measured at cost comprising:

-- the amount of the initial measurement of lease liability;

-- any lease payment made at or before the commencement date,

less any lease incentives received;

-- any initial direct costs; and

-- restoration costs.

Right-of-use assets are presented within property, plant and

equipment in the statement of financial position.

Payments associated with short term leases are recognised on a

straight-line basis as an expense in profit or loss. Short-term

leases are leases with a lease term of 12 months or less.

Other standards adopted since the year end are either outside

the scope of Group transactions or do not significantly impact the

Group.

The following standards were in issue but not yet effective and

have not been applied to these condensed financial statements.

IFRS 9, Financial Instruments, which provides a new model for

the classification and measurement of financial instruments, is

effective for periods beginning on or after 1 January 2018. However

the Group has taken the option available to insurers to defer the

application of IFRS 9 as permitted by IFRS 4, Insurance Contracts.

The Group qualifies for the temporary exemption, which is available

until annual periods beginning on or after 1 January 2021, since at

31 December 2015 greater than 90% of the Group's liabilities were

within the scope of IFRS 4. There has been no significant change to

the Group's operations since that date and, as a result, the Group

continues to apply IAS 39, Financial Instruments.

IFRS 17, Insurance Contracts, was issued in May 2017 and is

effective for periods beginning on or after 1 January 2021. A

one-year deferral has tentatively been proposed by the

International Accounting Standards Board (IASB) subject to due

process. The standard establishes revised principles for the

recognition, measurement, presentation and disclosure of insurance

contracts. The Group has progressed implementation of the standard

in line with expectations.

3. Segment information

The Group segments its business activities on the basis of

differences in the products and services offered and, for general

insurance, the underwriting territory. Expenses relating to Group

management activities are included within 'Corporate costs'. This

reflects the management and internal Group reporting structure.

The activities of each operating segment are described

below.

- General business

United Kingdom and Ireland

The Group's principal general insurance business operation is in the UK, where it operates

under the Ecclesiastical and Ansvar brands. The Group also operates in the Republic of Ireland,

underwriting general insurance business across the whole of Ireland.

Australia

The Group has a wholly-owned subsidiary in Australia underwriting general insurance business

under the Ansvar brand.

Canada

The Group operates a general insurance Ecclesiastical branch in Canada.

Other insurance operations

This includes the Group's internal reinsurance function and operations that are in run-off

or not reportable due to their immateriality.

- Investment management

The Group provides investment management services both internally and to third parties through

EdenTree Investment Management Limited.

- Broking and Advisory

The Group provides insurance broking through South Essex Insurance Brokers Limited, financial

advisory services through Ecclesiastical Financial Advisory Services Limited and risk advisory

services through Ansvar Risk Management Services Pty Limited which operates in Australia.

- Life business

Ecclesiastical Life Limited provides long-term insurance policies to support funeral planning

products. It is closed to new business.

- Corporate costs

This includes costs associated with Group management activities.

Inter-segment and inter-territory transfers or transactions are

entered into under normal commercial terms and conditions that

would also be available to unrelated third parties.

Segment revenue

The Group uses gross written premiums as the measure for

turnover of the general and life insurance business segments.

Turnover of the non-insurance segments comprises fees and

commissions earned in relation to services provided by the Group to

third parties. Segment revenues do not include net investment

return or general business fee and commission income, which are

reported within revenue in the consolidated statement of profit or

loss.

Revenue is attributed to the geographical region in which the

customer is based. Group revenues are not materially concentrated

on any single external customer.

6 months ended 6 months ended

30.06.19 30.06.18

Gross Non- Gross Non-

written insurance written insurance

premiums services Total premiums services Total

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

General business

United Kingdom and

Ireland 123,957 - 123,957 119,292 - 119,292

Australia 33,652 - 33,652 29,420 - 29,420

Canada 25,481 - 25,481 22,353 - 22,353

Other insurance operations 1,911 - 1,911 1,660 - 1,660

Total 185,001 - 185,001 172,725 - 172,725

Life business 1 - 1 4 - 4

Investment management - 6,270 6,270 - 6,185 6,185

Broking and Advisory - 4,776 4,776 - 4,972 4,972

--------- ---------- --------- --------- ---------- ---------

Group revenue 185,002 11,046 196,048 172,729 11,157 183,886

--------- ---------- --------- --------- ---------- ---------

12 months ended

31.12.18

Gross Non-

written insurance

premiums services Total

GBP000 GBP000 GBP000

General business

United Kingdom and

Ireland 242,339 - 242,339

Australia 56,946 - 56,946

Canada 54,158 - 54,158

Other insurance operations 3,507 - 3,507

Total 356,950 - 356,950

Life business 21 - 21

Investment management - 12,601 12,601

Broking and Advisory - 9,049 9,049

--------- ---------- ---------

Group revenue 356,971 21,650 378,621

--------- ---------- ---------

Segment result

General business segment results comprise the insurance

underwriting profit or loss, investment activities and other

expenses of each underwriting territory. The Group uses the

industry standard net combined operating ratio (COR) as a measure

of underwriting efficiency. The COR expresses the total of net

claims costs, commission and underwriting expenses as a percentage

of net earned premiums. Further details on the underwriting profit

or loss and COR, which are alternative performance measures that

are not defined under IFRS, are detailed in note 12.

The life business segment result comprises the profit or loss on

insurance contracts (including return on assets backing liabilities

in the long-term fund), shareholder investment return and other

expenses.

All other segment results consist of the profit or loss before

tax measured in accordance with IFRS.

6 months ended Combined

30 June 2019 operating Insurance Investments Other Total

ratio GBP000 GBP000 GBP000 GBP000

General business

United Kingdom and Ireland 87.8% 9,198 33,345 (158) 42,385

Australia 103.3% (354) 677 (37) 286

Canada 98.0% 434 993 (84) 1,343

Other insurance operations 186 - - 186

---------- ------------ --------- ---------

91.4% 9,464 35,015 (279) 44,200

Life business 241 4,327 - 4,568

Investment management - - (18) (18)

Broking and Advisory - - 1,425 1,425

Corporate costs - - (7,402) (7,402)

Profit before tax 9,705 39,342 (6,274) 42,773

---------- ------------ --------- ---------

6 months ended Combined

30 June 2018 operating Insurance Investments Other Total

ratio GBP000 GBP000 GBP000 GBP000

General business

United Kingdom and Ireland 83.8% 11,826 12,782 (258) 24,350

Australia 103.0% (337) 847 (39) 471

Canada 119.1% (3,653) 569 - (3,084)

Other insurance operations 212 - - 212

---------- ------------ --------- ---------

92.3% 8,048 14,198 (297) 21,949

Life business 429 770 - 1,199

Investment management - - 745 745

Broking and Advisory - - 1,593 1,593

Corporate costs - - (6,063) (6,063)

Profit before tax 8,477 14,968 (4,022) 19,423

---------- ------------ --------- ---------

12 months ended Combined

31 December 2018 operating Insurance Investments Other Total

ratio GBP000 GBP000 GBP000 GBP000

General business

United Kingdom and Ireland 80.2% 29,426 (1,836) (252) 27,338

Australia 93.7% 1,400 2,073 (77) 3,396

Canada 106.5% (2,599) 1,655 - (944)

Other insurance operations 963 - - 963

---------- ------------ --------- ---------

86.4% 29,190 1,892 (329) 30,753

Life business 1,642 (3,181) - (1,539)

Investment management - - 941 941

Broking and Advisory - - 2,045 2,045

Corporate costs - - (16,829) (16,829)

Profit before tax 30,832 (1,289) (14,172) 15,371

---------- ------------ --------- ---------

4. Tax

Income tax for the six month period is calculated at rates

representing the best estimate of the average annual effective

income tax rate expected for the full year, applied to the pre-tax

result of the six month period.

5. Dividends

Interim dividends paid on the 8.625% Non-Cumulative Irredeemable

Preference shares amounted to GBP4.6m (H1 2018: GBP4.6m).

6. Financial instruments' held at fair value disclosures

IAS 34 requires that interim financial statements include

certain of the disclosures about the fair value of financial

instruments set out in IFRS 13, Fair Value Measurement and IFRS 7,

Financial Instruments Disclosures.

The fair value measurement basis used to value those financial

assets and financial liabilities held at fair value is categorised

into a fair value hierarchy as follows:

Level 1: fair values measured using quoted prices (unadjusted)

in active markets for identical assets or liabilities. This

category includes listed equities in active markets, listed debt

securities in active markets and exchange-traded derivatives.

Level 2: fair values measured using inputs other than quoted

prices included within level 1 that are observable for the asset or

liability, either directly (i.e. as prices) or indirectly (i.e.

derived from prices). This category includes listed debt or equity

securities in a market that is not active and derivatives that are

not exchange-traded.

Level 3: fair values measured using inputs for the asset or

liability that are not based on observable market data

(unobservable inputs). This category includes unlisted debt and

equities, including investments in venture capital, and suspended

securities. Where a look-through valuation approach is applied,

underlying net asset values are sourced from the investee,

translated into the Group's functional currency and adjusted to

reflect current market conditions.

There have been no transfers between investment categories in

the current period.

Fair value measurement

at the

end of the reporting period

based on

--------------------------------

Level 1 Level Level Total

2 3

30 June 2019 GBP000 GBP000 GBP000 GBP000

Financial assets at fair value through

profit or loss

Financial investments

Equity securities 279,806 197 63,108 343,111

Debt securities 494,523 1,200 260 495,983

Derivative securities - 2,022 - 2,022

Total financial assets at fair value 774,329 3,419 63,368 841,116

----------- --------- -------- ---------

Financial liabilities at fair value

through profit or loss

Financial liabilities

Derivative securities - (4,261) - (4,261)

- (4,261) - (4,261)

----------- --------- -------- ---------

Financial liabilities at fair value

through other comprehensive income

Other liabilities

Derivative securities - (2,560) - (2,560)

Total financial liabilities at fair

value - (6,821) - (6,821)

----------- --------- -------- ---------

30 June 2018

Financial assets at fair value through

profit or loss

Financial investments

Equity securities 287,383 245 43,725 331,353

Debt securities 509,468 1,282 259 511,009

Derivative securities - 3,053 - 3,053

796,851 4,580 43,984 845,415

--------- -------- -------- ---------

Financial assets at fair value through

other comprehensive income

Financial investments

Derivative securities - 47 - 47

--------- --------

Total financial assets at fair value 796,851 4,627 43,984 845,462

--------- -------- -------- ---------

Financial liabilities at fair value

through profit or loss

Financial liabilities

Derivative securities - (1,115) - (1,115)

- (1,115) - (1,115)

--------- -------- -------- ---------

Financial liabilities at fair value

through other comprehensive income

Other liabilities

Derivative securities - (2,356) - (2,356)

Total financial liabilities at fair

value - (3,471) - (3,471)

--------- -------- -------- ---------

31 December 2018

Financial assets at fair value through

profit or loss

Financial investments

Equity securities 241,115 246 44,773 286,134

Debt securities 495,348 1,233 261 496,842

Derivative securities - 5,331 - 5,331

736,463 6,810 45,034 788,307

--------- -------- -------- ---------

Financial assets at fair value through

other comprehensive income

Financial investments

Derivative securities - 737 - 737

Total financial assets at fair value 736,463 7,547 45,034 789,044

--------- -------- -------- ---------

The derivative liabilities of the Group at the end of the prior

year were measured at fair value through profit or loss and

categorised as level 2.

Fair value measurements in level 3 consist of financial assets,

analysed as follows:

Financial assets at fair

value

through profit or loss

----------------------------------

Equity Debt

securities securities Total

GBP000 GBP000 GBP000

2019

At 1 January 44,773 261 45,034

Total gains recognised in profit or loss 4,342 (1) 4,341

Purchases 13,993 - 13,993

At 30 June 63,108 260 63,368

----------- ----------- --------

Total gains for the period included in profit

or loss for assets held at the end of the

reporting period 4,342 (1) 4,341

----------- ----------- --------

2018

At 1 January 42,279 125 42,404

Total gains recognised in profit or loss 1,580 - 1,580

Transfers (134) 134 -

At 30 June 43,725 259 43,984

----------- ----------- --------

Total gains for the period included in profit

or loss for assets held at the end of the

reporting period 1,608 - 1,608

----------- ----------- --------

2018

At 1 January 42,279 125 42,404

Total gains recognised in profit or loss 2,628 5 2,633

Transfers (134) 134 -

Disposal proceeds - (3) (3)

At 31 December 44,773 261 45,034

----------- ----------- --------

Total gains for the period included in profit

or loss for assets held at the end of the

reporting period 2,656 5 2,661

----------- ----------- --------

All the above gains included in profit or loss for the period

are presented in net investment return within the statement of

profit or loss.

The valuation techniques used for instruments categorised in

Levels 2 and 3 are described below.

Listed debt and equity securities not in active market (Level

2)

These financial assets are valued using third party pricing

information that is regularly reviewed and internally calibrated

based on management's knowledge of the markets. Where material,

these valuations are reviewed by the Group Audit Committee.

Non exchange-traded derivative contracts (Level 2)

The Group's derivative contracts are not traded in active

markets. Foreign currency forward contracts are valued using

observable forward exchange rates corresponding to the maturity of

the contract and the contract forward rate. Over-the-counter equity

or index options and futures are valued by reference to observable

index prices.

Unlisted equity securities (Level 3)

These financial assets are valued using observable net asset

data, adjusted for unobservable inputs including comparable

price-to-book ratios based on similar listed companies, and

management's consideration of constituents as to what exit price

might be obtainable. Where material, these valuations are reviewed

by the Group Audit Committee.

The valuation is most sensitive to the level of underlying net

assets, the Euro exchange rate, the price-to-book ratio chosen, an

illiquidity discount and a credit rating discount applied to the

valuation to account for the risks associated with holding the

asset. If the price-to-book ratio, illiquidity discount and credit

rating discount applied changes by +/-10%, the value of unlisted

equity securities could move by +/-GBP7m (H1 2018: +/-GBP5m). The

range is higher than the half year due to the increase in

value.

The increase in value during the period is the result of a

purchase of additional shares in the current holding and an

increase in the underlying net assets.

Unlisted debt (Level 3)

Unlisted debt is valued using an adjusted net asset method

whereby management uses a look-through approach to the underlying

assets supporting the loan, discounted using observable market

interest rates of similar loans with similar risk, and allowing for

unobservable future transaction costs. Where material, these

valuations are reviewed by the Group Audit Committee.

The valuation is most sensitive to the level of underlying net

assets, but it is also sensitive to the interest rate used for

discounting and the projected date of disposal of the asset, with

the exit costs sensitive to an expected return on capital of any

purchaser and estimated transaction costs. Reasonably likely

changes in unobservable inputs used in the valuation would not have

a significant impact on shareholders' equity or the net result.

7. Changes in estimates

The estimation of the ultimate liability arising from claims

made under general insurance business contracts is a critical

accounting estimate. There are various sources of uncertainty as to

how much the Group will ultimately pay with respect to such

contracts. There is uncertainty as to the total number of claims

made on each class of business, the amounts that such claims will

be settled for and the timing of any payments.

During the six month period, changes to claims reserve estimates

made in prior years as a result of reserve development resulted in

a net release of GBP13.0m (H1 2018: GBP16.8m) offset by a GBP8.5m

increase (H1 2018: GBP2.3m decrease) in reserves due to discount

rate movements.

The estimation of the ultimate liability arising from claims

made under life insurance business contracts is also a critical

accounting estimate. Estimates are made as to the expected number

of deaths in each future year until claims have been paid on all

policies, as well as expected future real investment returns from

assets backing life insurance contracts. During the six month

period there was a GBP2.7m increase (H1 2018: GBP1.0m decrease) in

reserves due to discount rate movements.

8. Translation and hedging reserve

Translation Hedging

reserve reserve Total

GBP000 GBP000 GBP000

2019

At 1 January 14,940 4,131 19,071

Gains on currency translation differences 1,213 - 1,213

Losses on net investment hedges - (1,643) (1,643)

Attributable tax - 292 292

At 30 June 16,153 2,780 18,933

------------ -------- --------

2018

At 1 January 18,022 2,626 20,648

Losses on currency translation differences (2,380) - (2,380)

Gains on net investment hedges - 1,614 1,614

Attributable tax - (436) (436)

At 30 June 15,642 3,804 19,446

------------ -------- --------

2018

At 1 January 18,022 2,626 20,648

Losses on currency translation differences (3,082) - (3,082)

Gains on net investment hedges - 1,692 1,692

Attributable tax - (187) (187)

At 31 December 14,940 4,131 19,071

------------ -------- --------

The translation reserve arises on consolidation of the Group's

foreign operations. The hedging reserve represents the cumulative

amount of gains and losses on hedging instruments in respect of net

investments in foreign operations.

9. Insurance contract liabilities and reinsurers' share of

contract liabilities

30.06.19 30.06.18 31.12.18

6 months 6 months 12 months

GBP000 GBP000 GBP000

Gross

Claims outstanding 481,747 492,359 457,319

Unearned premiums 188,624 173,888 180,766

Life business provision 82,154 83,955 81,964

Total gross insurance contract liabilities 752,525 750,202 720,049

--------- --------- ----------

Recoverable from reinsurers

Claims outstanding 92,354 98,874 78,731

Unearned premiums 64,005 58,929 61,615

Total reinsurers' share of contract liabilities 156,359 157,803 140,346

--------- --------- ----------

Net

Claims outstanding 389,393 393,485 378,588

Unearned premiums 124,619 114,959 119,151

Life business provision 82,154 83,955 81,964

Total net insurance liabilities 596,166 592,399 579,703

--------- --------- ----------

10. Related party transactions

Transactions between the Company and its subsidiaries, which are

related parties, have been eliminated on consolidation.

Charitable grants to the ultimate parent company are disclosed

in the condensed consolidated statement of changes in equity.

There have been no material related party transactions in the

period or changes thereto since the latest annual report which

require disclosure.

11. Holding company

The ultimate holding company is Allchurches Trust Limited, a

company limited by guarantee and a registered charity incorporated

in the United Kingdom.

12. Reconciliation of Alternative Performance Measures

The Group uses alternative performance measures (APM) in

addition to the figures which are prepared in accordance with IFRS.

The financial measures in our key financial performance data

include the combined operating ratio (COR). This measure is

commonly used in the industries we operate in and we believe it

provides useful information and enhances the understanding of our

results.

Users of the accounts should be aware that similarly titled APM

reported by other companies may be calculated differently. For that

reason, the comparability of APM across companies might be

limited.

In line with the European Securities and Markets Authority

guidelines, we provide a reconciliation of the combined operating

ratio to its most directly reconcilable line item in the financial

statements.

30.06.19

Broking

Inv'mnt Inv'mnt and Corporate

Insurance return mngt Advisory costs Total

-------------------

General Life

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Gross written premiums 185,001 1 - - - - 185,002

Outward reinsurance premiums (71,172) - - - - - (71,172)

Net change in provision

for unearned premiums (4,351) - - - - - (4,351)

Net earned premiums [1] 109,478 1 - - - - 109,479

---------- ------- -------- -------- --------- ---------- ----------

Fee and commission income 19,537 - - 6,269 4,776 - 30,582

Other operating income 339 - - - - - 339

Net investment return - 724 40,865 8 420 - 42,017

Total revenue 129,354 725 40,865 6,277 5,196 - 182,417

---------- ------- -------- -------- --------- ---------- ----------

Expenses

Claims and change in insurance

liabilities (78,617) (345) - - - - (78,962)

Reinsurance recoveries 31,512 - - - - - 31,512

Fees, commissions and other

acquisition costs (34,968) - - (410) 213 - (35,165)

Other operating and administrative

expenses (37,817) (139) (1,523) (5,885) (3,939) (7,402) (56,705)

Total operating expenses (119,890) (484) (1,523) (6,295) (3,726) (7,402) (139,320)

---------- ------- -------- -------- --------- ---------- ----------

Operating profit/(loss) [2] 9,464 241 39,342 (18) 1,470 (7,402) 43,097

Finance costs (279) - - - (45) - (324)

---------- ------- -------- -------- --------- ---------- ----------

Profit before tax 9,185 241 39,342 (18) 1,425 (7,402) 42,773

---------- ------- -------- -------- --------- ---------- ----------

Underwriting profit [2] 9,464

Combined operating ratio

( = ( [1] - [2] ) / [1]

) 91.4%

The underwriting profit of the Group is defined as the operating

profit of the general insurance business.

The Group uses the industry standard net combined operating

ratio as a measure of underwriting efficiency. The COR expresses

the total of net claims costs, commission and underwriting expenses

as a percentage of net earned premiums. It is calculated as

( [1] - [2] ) / [1].

30.06.18

Broking

Inv'mnt Inv'mnt and Corporate

Insurance return mngt Advisory costs Total

-------------------

General Life

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Gross written premiums 172,725 4 - - - - 172,729

Outward reinsurance

premiums (66,924) - - - - - (66,924)

Net change in

provision

for unearned premiums (877) - - - - - (877)

Net earned premiums [1] 104,924 4 - - - - 104,928

---------- ------- -------- --------- --------- ---------- ----------

Fee and commission

income 17,837 - - 6,185 4,972 - 28,994

Other operating income 1,039 - - - - - 1,039

Net investment return - 1,019 16,302 4 414 - 17,739

Total revenue 123,800 1,023 16,302 6,189 5,386 - 152,700

---------- ------- -------- --------- --------- ---------- ----------

Expenses

Claims and change in

insurance

liabilities (66,604) (450) - - - - (67,054)

Reinsurance recoveries 19,493 - - - - - 19,493

Fees, commissions and

other

acquisition costs (31,812) - - (468) 88 - (32,192)

Other operating and

administrative

expenses (36,829) (144) (1,334) (4,976) (3,881) (6,063) (53,227)

Total operating

expenses (115,752) (594) (1,334) (5,444) (3,793) (6,063) (132,980)

---------- ------- -------- --------- --------- ---------- ----------

Operating profit [2] 8,048 429 14,968 745 1,593 (6,063) 19,720

Finance costs (297) - - - - - (297)

---------- ------- -------- --------- --------- ---------- ----------

Profit before tax 7,751 429 14,968 745 1,593 (6,063) 19,423

---------- ------- -------- --------- --------- ---------- ----------

Underwriting profit [2] 8,048

Combined operating

ratio

( = ( [1] - [2] )/

[1] ) 92.3%

31.12.18

Broking

Inv'mnt Inv'mnt and Corporate

Insurance return mngt Advisory costs Total

-------------------------------

General Life

GBP000 GBP000 GBP000 GBP000 GBP000 GBP000 GBP000

Revenue

Gross written premiums 356,950 21 - - - - 356,971

Outward reinsurance

premiums (137,640) - - - - - (137,640)

Net change in

provision

for unearned premiums (5,241) - - - - - (5,241)

Net earned

premiums [1] 214,069 21 - - - - 214,090

---------- ------------------- -------- --------- --------- ---------- ----------

Fee and commission

income 41,346 - - 12,601 9,049 - 62,996

Other operating income 1,039 - - - - - 1,039

Net investment return - 1,573 1,600 13 808 - 3,994

Total revenue 256,454 1,594 1,600 12,614 9,857 - 282,119

---------- ------------------- -------- --------- --------- ---------- ----------

Expenses

Claims and change in

insurance

liabilities (112,222) 349 - - - - (111,873)

Reinsurance recoveries 26,188 - - - - - 26,188

Fees, commissions and

other

acquisition costs (65,687) (15) - (943) 299 - (66,346)

Other operating and

administrative

expenses (75,543) (286) (2,889) (10,730) (8,111) (16,829) (114,388)

Total operating

expenses (227,264) 48 (2,889) (11,673) (7,812) (16,829) (266,419)

---------- ------------------- -------- --------- --------- ---------- ----------

Operating

profit [2] 29,190 1,642 (1,289) 941 2,045 (16,829) 15,700

Finance costs (329) - - - - - (329)

---------- ------------------- -------- --------- --------- ---------- ----------

Profit before tax 28,861 1,642 (1,289) 941 2,045 (16,829) 15,371

---------- ------------------- -------- --------- --------- ---------- ----------

Underwriting

profit [2] 29,190

Combined operating

ratio

( = ([1] - [2]) / [1]

) 86.4%

RESPONSIBILITY STATEMENT

We confirm that to the best of our knowledge:

(a) the consolidated interim financial statements have been

prepared in accordance with IAS 34, 'Interim Financial Reporting'

as adopted by the European Union;

(b) the interim management report includes a fair review of the

information required by DTR 4.2.7R (indication of important events

during the first six months and description of principal risks and

uncertainties for the remaining six months of the year); and

(c) the interim management report includes a fair review of the

information required by DTR 4.2.8R (disclosure of related party

transactions and changes therein).

The Board of Directors is as per the latest audited annual

financial statements, with the following changes:

- A. Winther was appointed as a Non-Executive Director on 19

March 2019 and was appointed to the Finance and Investment

Committee and Remuneration Committee on 3 April 2019

- F.X. Boisseau was appointed as a Non-Executive Director on 19

March 2019 and was appointed to the Group Audit Committee and Group

Risk Committee on 3 April 2019

- J.F. Hylands resigned as Chairman on 19 March 2019

- R.D.C. Henderson was appointed as Chairman on 19 March 2019

- C.H. Taylor succeeded R.D.C Henderson as Chair of Remuneration Committee on 21 June 2019

- On 13 June 2019, the Board appointed D.P. Cockrem as an

Executive Director and Group Chief Financial Officer, subject to

regulatory approval

By order of the Board,

Mark Hews David Henderson

Group Chief Executive Chairman

20 August 2019

INDEPENT REVIEW REPORT TO ECCLESIASTICAL INSURANCE OFFICE

PLC

We have been engaged by the company to review the consolidated

interim financial statements in the 2019 interim results report for

the six months ended 30 June 2019 which comprises the condensed

consolidated statement of profit or loss, the condensed

consolidated statement of comprehensive income, the condensed

consolidated statement of changes in equity, the condensed

consolidated statement of financial position, the condensed

consolidated statement of cash flows and related notes 1 to 12. We

have read the other information contained in the 2019 interim

results report and considered whether it contains any apparent

misstatements or material inconsistencies with the information in

the consolidated interim financial statements.

This report is made solely to the company in accordance with

International Standard on Review Engagements (UK and Ireland) 2410

"Review of Interim Financial Information Performed by the

Independent Auditor of the Entity" issued by the Financial

Reporting Council. Our work has been undertaken so that we might

state to the company those matters we are required to state to it

in an independent review report and for no other purpose. To the

fullest extent permitted by law, we do not accept or assume

responsibility to anyone other than the company, for our review

work, for this report, or for the conclusions we have formed.

Directors' responsibilities

The 2019 interim results report is the responsibility of, and

has been approved by, the directors. The directors are responsible

for preparing the 2019 interim results report in accordance with

the Disclosure Guidance and Transparency Rules of the United

Kingdom's Financial Conduct Authority.

As disclosed in note 2, the annual financial statements of the

company are prepared in accordance with IFRSs as adopted by the

European Union. The consolidated interim financial statements

included in this 2019 interim results report have been prepared in

accordance with International Accounting Standard 34 "Interim

Financial Reporting" as adopted by the European Union.

Our responsibility

Our responsibility is to express to the Company a conclusion on

the consolidated interim financial statements in the 2019 interim

results report based on our review.

Scope of review

We conducted our review in accordance with International

Standard on Review Engagements (UK and Ireland) 2410 "Review of

Interim Financial Information Performed by the Independent Auditor

of the Entity" issued by the Financial Reporting Council for use in

the United Kingdom. A review of interim financial information

consists of making inquiries, primarily of persons responsible for

financial and accounting matters, and applying analytical and other

review procedures. A review is substantially less in scope than an

audit conducted in accordance with International Standards on

Auditing (UK) and consequently does not enable us to obtain

assurance that we would become aware of all significant matters

that might be identified in an audit. Accordingly, we do not

express an audit opinion.

Conclusion

Based on our review, nothing has come to our attention that

causes us to believe that the consolidated interim financial

statements in the 2019 interim results report for the six months

ended 30 June 2019 is not prepared, in all material respects, in

accordance with International Accounting Standard 34 as adopted by

the European Union and the Disclosure Guidance and Transparency

Rules of the United Kingdom's Financial Conduct Authority.

Deloitte LLP

Statutory Auditor

London, United Kingdom

20 August 2019

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

END

IR ZBLFLKVFLBBX

(END) Dow Jones Newswires

August 20, 2019 10:36 ET (14:36 GMT)

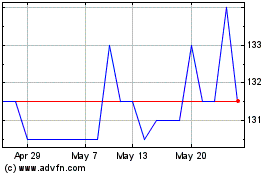

Ecclesiastl.8fe (LSE:ELLA)

Historical Stock Chart

From May 2024 to Jun 2024

Ecclesiastl.8fe (LSE:ELLA)

Historical Stock Chart

From Jun 2023 to Jun 2024