TIDMIRON

RNS Number : 6715U

Ironveld PLC

30 March 2023

30 March 2023

IRONVELD PLC

("Ironveld" or the "Company")

Interim results for the six months ended 31 December 2022

Ironveld plc, the owner of a High Purity Iron ("HPI"), Vanadium

and Titanium project located on the Northern Limb of the Bushveld

Complex in Limpopo Province, South Africa (the "Project") is

pleased to announce its interim results for the six months ended 31

December 2022 ("the period").

Highlights

-- A transformative period for the Company saw the acquisition

and commencement of refurbishment of the smelter facility at

Rustenburg, from August 2022 onwards;

-- Acquisition and refurbishment funded by an equity Placing of

GBP4.50 million, which completed in August 2022;

-- First mining activities also commenced prior to period end,

to ensure consistent supply of magnetite ore to the smelter;

and

-- Post period end saw first production from the smelter, an

additional GBP2.0 million fundraising from shareholders and the

smelter acquisition becoming unconditional.

Outlook

-- First sales on track for Q2 2023 in line with original plans;

-- Smelter anticipated to ramp up to full production capacity by

mid 2023 with strong demand for Ironveld's suite of speciality

metal products; and

-- Additional revenues expected from DMS Magnetite joint venture, also due around mid 2023.

Martin Eales, CEO, said: "I am very pleased with the progress we

made over the half year period to December 2022 and have already

made so far this year. The coming months are due to bring many more

positive developments as we build up production at the smelter and

make progress with our other projects."

For further information, please contact:

Ironveld plc c/o BlytheRay

Martin Eales, Chief Executive Officer 020 7138 3204

finnCap (Nomad and Broker)

Christopher Raggett/Charlie Beeson 020 7220 0500

Turner Pope (Joint Broker)

Andy Thacker/James Pope 020 3657 0050

BlytheRay

Megan Ray/Tim Blythe 020 7138 3204

Notes to Editors:

Ironveld (IRON.LN) is the owner of Mining Rights over

approximately 28 kilometres of outcropping Bushveld magnetite with

a SAMREC compliant ore resource of some 56 million tons of ore

grading 1,12% V2O5, 68,6% Fe2O3 and 14,7% TiO2.

In 2022 Ironveld agreed to acquire and refurbish a smelter

facility in Rustenburg, South Africa, in which it can process its

magnetite ore into the marketable products of high purity iron,

titanium slag and vanadium slag. This transaction became

unconditional in March 2023.

Ironveld is an AIM traded company. For further information on

Ironveld please refer to www.ironveld.com .

Chairman's Statement:

This was a transformational period for the Company. In July

2022, Ironveld announced that it had conditionally raised gross

proceeds of GBP4.50 million via a Placing of new ordinary shares at

0.30 pence per share and the transaction was approved by

shareholders in August 2022. The net funds from the Placing were

applied to the acquisition out of Business Rescue and refurbishment

of the smelter facility in Rustenburg, South Africa, previously

owned by Ferrochrome Furnaces (Pty) Limited ("FCF"), for which the

Company had agreed purchase terms in May 2022. The Sale and

Purchase Agreement in respect of the acquisition was signed on 31

August 2022 and the Debt Purchase Agreement with the sole creditor

was signed on 1 November 2022. The acquisition became unconditional

on 29 March 2023.

In mid-August 2022, Ironveld's team commenced its six to nine

month work programme to refurbish the smelter and the Company was

able to announce that production from the first of three planned

operating furnaces had been achieved in January 2023. Alongside the

rapid progress at the smelter, Ironveld's subsidiary, Ironveld

Mining (Pty) Limited ("Ironveld Mining"), commenced preparatory

work for mining activities in the fourth quarter of 2022, and

operations are now underway to provide required magnetite ore to

the smelter on a continuous basis.

The total number of employees across the Ironveld Group

reflected this rapid expansion in activities, increasing from 9

South Africa based employees as at 30 June 2022 to 130 as at 31

December 2022, a development of which we are justifiably proud.

We remain committed to operating responsibly, working closely

with stakeholders and local communities at grassroots level to

improve standards of living. Under the terms of the 'Social and

Labour Plans' ("SLPs") that Ironveld Mining has had approved by the

South African Department of Mineral Resources and Energy alongside

our existing mining rights, Ironveld Mining has undertaken to fund

and address local infrastructure requirements in the areas in which

we operate. These improvements include: water supply to local

municipalities; electrification and electricity upgrades; and roads

and stormwater infrastructure. In addition, Ironveld Mining has

committed to provide training, bursaries and employment to the

various host communities.

Financial

Administrative expenses totalling GBP581,000 (H1 2021:

GBP384,000) were incurred in the period reflecting a return to

normalised levels of expenditure compared to the comparable period,

the commencement of operational activities in the fourth quarter of

2022 and the costs associated with a General Meeting requisitioned

by a shareholder.

The Group recorded a loss before tax of GBP522,000 (H1 2021:

loss of GBP382,000), broadly in line with Administrative expenses.

The Company does not plan to pay a dividend for the six months

ended 31 December 2022.

There were no borrowings at the period end (30 June 2022:

borrowings of GBP499,000) as all outstanding balances were settled

either in cash or by the issue of new shares in August 2022.

Post Period End Events

As noted above, first production was achieved at the Rustenburg

smelter in January 2023.

In February 2023, the Company announced an equity Placing to

raise gross proceeds of GBP2.0 million at a price of 0.30p, and

this was approved by shareholders in March 2023.

In March 2023 the Company announced that the acquisition of FCF

had become unconditional.

Transactions with Grosvenor

Ironveld announced two agreed investment transactions with

Grosvenor Resources (Pty) Limited ("Grosvenor") in late 2021.

Company updates since that date have noted that Grosvenor was in

talks to finalise its own funding to complete the agreed

transactions, and that Grosvenor has also been in regular and open

dialogue with the Company. As at today's date, the Company is aware

that talks with potential funders remain ongoing and the Board

believes that a financing offer has a good chance of being made

however, given the changes in Ironveld's position since the

original agreements with Grosvenor were signed, any financing offer

will be assessed on its merits and its potential to create value

for all shareholders.

Going concern

Given the recent cash inflow from the equity Placing and the

commencement of sales from the smelter, the Directors have a

reasonable expectation that the Group will have adequate resources

to continue in operational existence for the foreseeable future

being 12 months from the date of the approval of these interim

financial statements in the absence of any further funding and

therefore present these accounts on a Going Concern basis.

Outlook

There is a great deal to look forward to in 2023. We anticipate

securing first sales from the smelter in the second quarter and

reaching full operational production capacity around the middle of

the year, with the Company now fully funded to achieve this. There

is strong demand from customers for all of our three products of

high purity iron, vanadium slag and titanium slag. In addition,

Ironveld Mining will benefit from its joint venture with Pace SA to

produce and sell DMS grade magnetite from the mine in mid 2023.

In due course the Company also anticipates investing in further

equipment at the smelter to upgrade the high purity iron product to

powder form, which will significantly enhance revenues, and is

seeking innovative ways to finance this expansion.

We would like to thank all of our shareholders for their

continuing support for both the Company and the Project and we look

forward to providing further updates in the near future.

Giles Clarke

Chairman

30 March 2023

IRONVELD PLC

CONSOLIDATED INCOME STATEMENT

FOR THE PERIODED 31 DECEMBER 2022

6 Months 6 Months 12 Months

ended ended ended

31.12.22 31.12.21 30.06.22

GBP'000 GBP'000 GBP'000

Administrative expenses (581) (384) (798)

--------- --------- ----------

Operating loss (581) (384) (798)

Other gains and losses 47 - -

Investment revenues 23 2 4

Finance costs (11) - (17)

--------- --------- ----------

Loss before taxation (522) (382) (811)

Taxation - - -

--------- --------- ----------

Loss for the period (522) (382) (811)

Attributable to owners

of the company (520) (379) (806)

Non-controlling interests (2) (3) (5)

--------- --------- ----------

(522) (382) (811)

--------- --------- ----------

Loss per share (pence)

Basic (0.02p) (0.03p) (0.06p)

Diluted n/a n/a n/a

--------- --------- ----------

The accompanying notes form an integral part

of these financial statements.

IRONVELD PLC

CONSOLIDATED STATEMENT OF COMPREHENSIVE INCOME

FOR THE PERIODED 31 DECEMBER 2022

6 Months 6 Months 12 Months

ended Ended ended

31.12.22 31.12.21 30.06.22

GBP'000 GBP'000 GBP'000

Loss for the period (522) (382) (811)

Exchange differences on the

translation of foreign operations (576) (1,795) (199)

Total comprehensive loss for

the period (1,098) (2,177) (1,010)

--------- --------- ----------

Attributable to:

Owners of the company (1,015) (1,894) (974)

Non-controlling interest (83) (283) (36)

(1,098) (2,177) (1,010)

---------- ---------- ----------

The accompanying notes for an integral part of these financial

statements.

IRONVELD PLC

CONSOLIDATED BALANCE SHEET

AS AT 31 DECEMBER 2022

As at As at

31.12.22 30.06.22

GBP'000 GBP'000

Non-current assets

Exploration and evaluation 26,634 26,350

Property, plant and equipment 1,212 2

Other receivables 6 3

--------- ---------

27,852 26,355

Current assets

Trade and other receivables 507 198

Cash and bank balances 779 17

--------- ---------

1,286 215

Total assets 29,138 26,570

--------- ---------

Current liabilities

Trade and other payables (508) (619)

Borrowings - (499)

--------- ---------

(508) (1,118)

--------- ---------

Non-current liabilities

Lease liabilities (46) -

Deferred tax liabilities (4,616) (4,730)

--------- ---------

(4,662) (4,730)

--------- ---------

Total liabilities (5,170) (5,848)

Net assets 23,968 20,722

--------- ---------

Equity

Share capital 12,013 10,453

Share premium 24,101 21,379

Other reserve 74 12

Retained earnings reserve (8,941) (8,421)

Foreign currency translation

reserve (6,540) (6,045)

--------- ---------

Equity attributable to owners

of the company 20,707 17,378

Non-controlling interests 3,261 3,344

Total equity 23,968 20,722

--------- ---------

The accompanying notes form an integral part of these financial

statements.

IRONVELD PLC

CONSOLIDATED STATEMENT OF CHANGES IN EQUITY

FOR THE PERIODED 31 DECEMBER 2022

Attributable

Foreign to the

currency owners

Share Share Retained translation Other of the Non-controlling Total

capital premium earnings reserve reserve company interests equity

GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000 GBP'000

Balance at 1 July 2021 10,436 21,261 (7,618) (5,877) 15 18,217 3,380 21,597

Loss for the year - - (806) - - (806) (5) (811)

Exchange differences on translation

of foreign operations - - - (168) - (168) (31) (199)

Issue of shares 17 118 - - - 135 - 135

Exercise of share warrants - - 3 - (3) - - -

Balance at 30 June 2022 10,453 21,379 (8,421) (6,045) 12 17,378 3,344 20,722

--------- -------------------------------------------------------------- --------- ------------- ------------- ------------- ---------------- ------------

Loss for the period - - (520) - - (520) (2) (522)

Issue of shares and warrants 1,560 2,722 - - 62 4,344 - 4,344

Exchange differences on translation

of foreign operations - - - (495) - (495) (81) (576)

--------- -------------------------------------------------------------- --------- ------------- ------------- ------------- ---------------- ------------

Balance at 31 December 2022 12,013 24,101 (8,941) (6,540) 74 20,707 3,261 23,968

--------- -------------------------------------------------------------- --------- ------------- ------------- ------------- ---------------- ------------

IRONVELD PLC

CONSOLIDATED CASH FLOW STATEMENT

FOR THE PERIODED 31 DECEMBER 2022

6 Months 6 Months 12 Months

Ended Ended Ended

31.12.22 31.12.21 30.06.22

GBP'000 GBP'000 GBP'000

Net cash from operating activities (799) (48) (337)

--------- --------- ----------

Investing activities

Interest received 23 2 4

Purchase of property, plant and

equipment (1,172) - (1)

Purchase of exploration and evaluation

assets (917) (198) (396)

--------- --------- ----------

Net cash used in investing activities (2,066) (196) (393)

--------- --------- ----------

Financing activities

Proceeds on issue of equity (net 4,031 - -

of costs)

Proceeds from new loans - - 482

Repayment of loans (403) - -

--------- --------- ----------

Net cash generated in financing

activities 3,628 - 482

--------- --------- ----------

Net increase/ (decrease) in

cash and cash equivalents 763 (244) (248)

--------- --------- ----------

Cash and cash equivalents at

the start of the period 17 270 270

Effect of foreign exchange rates (1) (2) (5)

--------- --------- ----------

Cash and cash equivalents at

end of period 779 24 17

--------- --------- ----------

Note to the cash flow statement

Operating loss (581) (384) (798)

Depreciation on property, plant

and equipment 6 1 1

Foreign exchange differences (50) - -

Share based payments 60 - 100

--------- --------- ----------

Operating cash flows before movements

in working capital (565) (383) (697)

Movement in receivables (316) 27 (8)

Movement in payables 82 308 368

--------- --------- ----------

Net cash from operating activities (799) (48) (337)

--------- --------- ----------

The accompanying notes form an integral part of these financial

statements.

IRONVELD PLC

NOTES TO THE FINANCIAL STATEMENTS

FOR THE PERIOD ENDED 31 DECEMBER 2022

1 Basis of preparation and accounting policies

The results for the six months to 31 December 2022 have been

prepared under International Financial Reporting Standards (IFRS)

as adopted by the EU and International Accounting Standards

Board.

The accounting policies are consistent with those of the annual

financial statements for the year ended 30 June 2022, as described

in those financial statements.

The financial information does not constitute statutory accounts

as defined by section 435 of the Companies Act 2006. Full accounts

of the company for the year ended 30 June 2022 on which the

Auditors gave an unqualified report, have been delivered to the

Registrar of Companies.

2 Loss per share

The calculation of basic and diluted loss per share is based

upon the loss for the period and the weighted average number of

ordinary shares in issue during the period.

6 Months 6 Months 12 Months

to 31.12.22 to 31.12.21 to 30.06.22

'000 '000 '000

Weighted average number of

shares 2,628,958 1,316,440 1,322,832

Options/warrants - dilution - - -

------------ ------------ ------------

2,628,958 1,316,440 1,322,832

============ ============ ============

Pence Pence Pence

Basic loss per share - continuing (0.02) (0.03) (0.06)

Diluted earnings per share n/a n/a n/a

============ ============ ============

Where the Group reports a loss for any period, then in

accordance with IAS 33, the share options and warrants in issue are

not considered dilutive.

3 Registered office and copies of the report

The registered office is Ironveld plc, Unit D De Clare House Sir

Alfred Owen Way, Pontygwindy Industrial Estate, Caerphilly, Wales,

CF83 3HU and copies of this report are available from the

registered office.

IRONVELD PLC

OFFICERS, ADVISORS AND AGENTS

Directors: Giles Clarke (Chairman)

Martin Eales (Chief Executive Officer)

Nick Harrison (Non-Executive Director)

Peter Cox (Technical Director)

John Wardle (Non-Executive Director)

Secretary: Brian James

Company Number: 04095614 (England and Wales)

Registered Office: Ironveld Plc

Unit D De Clare House Sir Alfred Owen Way

Pontygwindy Industrial Estate

Caerphilly Wales CF83 3HU

Nominated Advisor finnCap Ltd

One Bartholomew Close

London EC1A 7BL

Joint Broker finnCap Ltd

One Bartholomew Close

London EC1A 7BL

Joint Broker Turner Pope

8 Frederick's Place

London EC2R 8AB

Solicitors: Kuit Steinart Levy LLP

3 St Marys Parsonage

Manchester M3 2RD

Auditors: Crowe U.K. LLP

55 Ludgate Hill

London EC4M 7JW

Bankers: HSBC

97 Bute Street

Cardiff CF10 5NA

Registrars: Link Asset Services

10(th) Floor Central Square

29 Wellington Street

Leeds LS1 4DL

Financial PR BlytheRay

4 - 5 Castle Court

London EC3V 9DL

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

IR NKCBPPBKDDNB

(END) Dow Jones Newswires

March 30, 2023 02:00 ET (06:00 GMT)

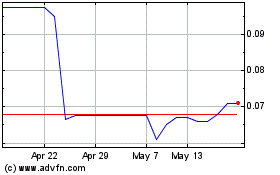

Ironveld (LSE:IRON)

Historical Stock Chart

From Jun 2024 to Jul 2024

Ironveld (LSE:IRON)

Historical Stock Chart

From Jul 2023 to Jul 2024