TIDMRC2

RNS Number : 5869T

Reconstruction Capital II Ltd

06 October 2014

6 October 2014

Reconstruction Capital II Limited (the "Company")

Proposed issue of EUR8,450,000 nominal value Convertible Loan

Notes

Continuation of the life of the Company

Notice of Extraordinary General Meeting

Reconstruction Capital II Ltd ("RC2, the "Company" or the

"Group"), announces that it is today posting an explanatory

circular (the "Circular") to the shareholders of the Company

incorporating formal notice of a general meeting (the "General

Meeting") to seek the approval of Shareholders for a proposed issue

of EUR8,450,000 nominal value Convertible Loan Notes (the "Notes")

together with the continuation of the life of the Company (the

"Continuation"). The General Meeting will be held at 10.00 a.m. on

29 October 2014 at the offices of Sanne Fiduciary Services Limited

at 13 Castle Street, St Helier, Jersey JE4 5UT.

The Circular together with the Notice of General Meeting will

shortly be made available on the Company's website at

www.reconstructioncapital2.com.

Highlights

-- The Company proposes to issue a EUR8,450,000 secured

convertible bond in order to meet substantially all of the

Company's liabilities and to provide additional working capital for

the following twelve months.

-- Assuming no further issues of Ordinary Shares, if Conversion

were to occur in full, the Company would have an enlarged share

capital comprising 162,614,500 Ordinary Shares and any Shareholder

who does not subscribe for the Convertible Loan Notes would on

Conversion suffer an immediate maximum dilution of approximately

38.50 per cent. to their shareholdings in the Company.

-- The Notes attract simple interest at 10 per cent. per annum,

which will accrue from the Issue Date until the Repayment Date. The

Term of the Notes is three years.

-- The Notes will be secured by first ranking securities granted

by the Company over the shareholdings in and intercompany

indebtedness owed to the Company by its direct subsidiaries, RC2

(Cyprus) Limited and Glasro Holdings Limited (being SPVs which hold

the majority of the Company's investments).

-- The Company proposes to extend the life of the Company for a

further two years until the Annual General Meeting to be convened

in 2016.

-- As at the date of the Circular, the Company has received

applications from certain existing Shareholders to take up

EUR2,188,000 in aggregate of the Convertible Loan Notes. Ion

Florescu has undertaken to subscribe for the balance of the Issue

immediately following the EGM.

-- The Company has also received irrevocable commitments from

existing Shareholders to vote in favour of the Resolutions in

respect of 41,867,122 Ordinary Shares representing approximately

41.87 per cent. of the Ordinary Shares in issue at the date of the

Circular. Subject to the passing of the Resolutions, the Directors

expect to constitute and issue the Convertible Loan Notes on 31

October 2014 following the EGM to such of those persons who have

validly applied for them as the Directors then determine.

Extracts from certain parts of the circular are set out

below.

Event Time and/or date

Publication of this Circular and announcement 6 October 2014

of the Proposals

Latest time and date for receipt of Forms 10.00 a.m. on 27 October

of Proxy for the EGM 2014

Extraordinary General Meeting 10.00 a.m. on 29 October

2014

Results announced through a Regulatory 29 October 2014

Information Service

Despatch of definitive Convertible Loan By 7 November 2014

Note certificates

Each of the times and dates in the above timetable are London

times, unless otherwise stated and are subject to change at the

absolute discretion of the Company. Any such change will be

notified by an announcement on a Regulatory Information

Service.

KEY STATISTICS

Number of Existing Ordinary Shares as

at the date of this Circular 100,000,000

Nominal value of the Convertible Loan

Notes EUR8,450,000

Estimated net proceeds of the Proposals EUR8,233,000

Simple interest rate per annum of the 10 per cent.

Convertible Loan Notes

Maximum amount repayable on the Repayment

Date EUR10,985,000

Maximum number of New Ordinary Shares

to be issued upon conversion of all the

Convertible Loan Notes 62,614,500

Enlarged ordinary share capital assuming

conversion of all the Convertible Loan

Notes 162,614,500

Percentage of the enlarged ordinary share 38.50 per cent.

capital represented by the New Ordinary

Shares issued upon conversion of the

Convertible Loan Notes on the Repayment

Date

For further information, please contact:

Reconstruction Capital II Limited

Ion Florescu / Anca Moraru

Tel: +44 (0) 207 244 0088/ +40 21 3167680

Grant Thornton UK LLP (Nominated Adviser)

Philip Secrett / David Hignell / Edward Thomas

Tel: +44 (0) 20 7383 5100

1. INTRODUCTION

On 1 April 2014, RC2 announced that the Board had decided to

start a period of consultations with Shareholders relating to the

issuance of a secured convertible bond in order to meet

substantially all of the Company's liabilities and provide

additional working capital for the following twelve months.

Having consulted a number of the Company's major Shareholders,

the Board is now making proposals to Shareholders to issue the

Convertible Loan Notes, and to extend the life of the Company for

another two years, in order to provide more time for the asset

divestment process.

The purpose of this Circular is to give you further information

regarding the Proposals, to explain why your Board considers that

they are in the best interests of the Shareholders and to seek your

approval of certain Resolutions to be proposed at the EGM.

2. BACKGROUND TO AND REASONS FOR THE PROPOSALS

On 14 December 2012, the Company held an Annual General Meeting

at which its life was extended for two years in order to allow for

the orderly sale of investments. Subsequently, the Investment Team

initiated the sales process for certain investee companies and

their underlying assets. Unfortunately, the exit process coincided

with one of the worst periods for Foreign Direct Investment into

South East Europe, and the efforts did not result in any

substantial disposals.

Meanwhile, the Company continued to accrue liabilities as it was

unable to pay its running costs. Initially these were primarily

financed by the Investment Team agreeing to postpone the payment of

their management and advisory fees, as well as by Director loans.

However, this was not sufficient to meet all of the Company's

needs. Consequently, in April 2012 the Company arranged a EUR3

million loan from a shareholder which was due for repayment in

April 2014. The cost of this loan was high but it was expected to

be temporary, based on the expectation that at least one divestment

would occur during its term.

Whilst the Company started to receive dividends from certain of

its investee companies in 2013, and managed to refinance loans it

had made to some of its investee companies, it was not able to

effect any substantial disposals of its assets prior to the

repayment date of the shareholder loan.

On 1 April 2014, the Board announced that it had secured a

Bridge Loan from Ion Florescu, at the time a Director of the

Company. The Bridge Loan has been applied to repay the prior

shareholder loan and some other accrued liabilities, and to provide

working capital for the Company. The Bridge Loan is for a seven

month term with repayment due on 31 October 2014 and is seen by the

Board as a short term funding solution for the Company.

Although the asset divestment process is ongoing, in the absence

of any firm commitments from buyers to acquire any of the investee

companies, the Board considered that it was necessary to put the

finances of the Company on a more stable footing by the issuance of

an instrument which the Directors believe will provide sufficient

funds to meet substantially all of the Company's liabilities, and

the Company's working capital needs for the next twelve months.

The Board has considered several funding options for the Company

and believes that the issuance of the Convertible Loan Notes will

provide RC2 with financial stability over the term of the

Notes.

As at the date of this Circular, the Company has received

applications from certain existing Shareholders to take up

EUR2,188,000 in aggregate of the Convertible Loan Notes. Subject to

the Resolutions being agreed by Shareholders at the EGM Ion

Florescu has provided an undertaking that, should there be

insufficient demand for the Convertible Loan Notes, he or entities

related to him would invest up to the amount of the Bridge Loan in

Convertible Loan Notes.

3. OVERVIEW OF THE PRINCIPAL TERMS OF THE PROPOSALS

A summary of the principal terms and conditions of the

Convertible Loan Notes is contained in Part 2 of this Circular.

The Company will use all reasonable endeavours to procure that

any New Ordinary Shares issued upon conversion of the Convertible

Loan Note are admitted to trading on AIM as soon as practicable

following conversion.

4. Effect of the Proposals on the Shareholders

Assuming no further issues of Ordinary Shares, if Conversion

were to occur in full, the Company would have an enlarged share

capital comprising 162,614,500 Ordinary Shares and any Shareholder

who does not subscribe for the Convertible Loan Notes would on

Conversion suffer an immediate maximum dilution of approximately

38.5 per cent. to their shareholdings in the Company.

5. RELATED PARTY TRANSACTION

Certain Directors, namely Howard I. Golden, Dirk Van den Broeck

and Markus Winkler have subscribed for Notes to the value of

EUR151,000, EUR202,000 and EUR110,000 respectively. Ion Florescu, a

former Director has provided an undertaking that he or entities

related to him would invest up to the amount of the Bridge Loan in

Convertible Loan Notes. The Directors subscribing for Notes and Ion

Florescu are related parties of the Company (as defined under the

AIM Rules) and accordingly their participation in the Issue

constitutes a related party transaction for the purposes of Rule 13

of the AIM Rules.

Mihai Radoi, who is not subscribing for Notes and is therefore

an independent Director for these purposes, having consulted with

the Company's nominated adviser, Grant Thornton, considers the

participation by the other Directors and Ion Florescu in the Issue

to be fair and reasonable insofar as Shareholders are

concerned.

6. CURRENT TRADING

On 1 October 2014, the Company announced that the unaudited NAV

per Ordinary Share as at 31 August 2014 was EUR0.3669, which

represents an increase of 3.59 per cent. from the 30 June 2014

figure of EUR0.3542 per Ordinary Shares, which was announced as

part of the Company's Interim Results on 22 August 2014.

In May 2014, RC2 exchanged half of its shareholder loans to Klas

(the bakery division of East Point Holdings Limited) for a 40.9 per

cent. shareholding in the company, increasing its shareholding to

52 per cent.. Accordingly, the value of the shareholding in Klas as

at 30 June 2014 increased to EUR1,666,836, having previously been

valued at EUR677,100.

Policolor S.A., the largest investment of the Company, has

agreed to sell its Bucharest site for EUR18.3 million, which is to

be received over the next three years. The deal should generate net

proceeds of EUR6.6 million for Policolor over the coming three

years, after deducting the costs of building a new factory on which

to relocate Policolor's production (estimated at EUR8.0 million),

the demolition and environmental clean-up costs for the site

(estimated at EUR1.0 million), and the estimated capital gains tax

on the sale (EUR2.7 million).

Albalact SA and Top Factoring posted strong results in the first

semester of 2014, with Albalact increasing its euro-denominated

sales revenue by 10 per cent. and its recurring EBITDA following a

similar trend. Top Factoring's EBITDA improved from EUR1.4 million

to EUR2.4 million, largely due to the write-up of the valuation of

its proprietary portfolios pursuant to quarterly impairment

tests.

7. CONTINUATION OF THE COMPANY

At the Company's Annual General Meeting in December 2012,

Shareholders voted in favour of the life of the Company being

continued for a further two years, during which time there would be

an orderly realisation of the Company's current investments with no

new investments being made.

At that time, the Board stated that due to the highly illiquid

nature of the Company's private equity investments and the possible

complexity of divestments, it was difficult to provide Shareholders

with any certainty regarding the timetable for realisation, but did

estimate that it could be approximately two to four years.

The Board, assisted by the Investment Team, has undertaken an

exercise to estimate a realisation timetable. Although Shareholders

should place only limited reliance on this information it is the

Board's current estimate that the overall timetable for realisation

will be a further two to three years. The Board therefore believes

that the issuance of the Convertible Loan Notes represents an

appropriate juncture at which to seek Shareholders' approval to

continue the Company, as it is presently constituted, for a further

two years.

It is therefore proposed that Resolution 1 will be put to

Shareholders at the Extraordinary General Meeting to seek

Shareholders' approval to continue the Company, as it is presently

constituted, for a further two years until the Annual General

Meeting to be convened in 2016.

8. relationship agreement

Ion Florescu is currently the beneficial owner either directly

or indirectly of 28,297,656 Ordinary Shares, representing

approximately 28.3 per cent. of the voting rights of the Company.

Should there be insufficient demand for the Notes, Ion Florescu has

provided an undertaking that he or entities related to him would

invest up to the amount of the Bridge Loan in Convertible Loan

Notes, subject to the terms being those presented to Shareholders

at the EGM. On the basis that Ion Florescu subscribes for EUR6.26

million of the Notes, being the amount not subscribed for by other

investors, and based on the number of Ordinary Shares in issue and

Notes to be issued as detailed in this Circular, Ion Florescu would

be the beneficial owner, either directly or indirectly, of

approximately 45.94 per cent. of the voting rights of the Enlarged

Ordinary Share Capital of the Company on conversion of the Notes

into Ordinary Shares.

As a consequence Ion Florescu would be able to exercise

controlling influence on the business of the Company and may cause

or take actions that are not in, or may conflict with, the best

interests of the Company or its Shareholders as a whole.

Accordingly, the Company and Ion Florescu have entered into a

relationship agreement dated 3 October 2014 which is conditional on

Ion Florescu and his connected persons holding, at any time,

Ordinary Shares representing 30 per cent. or more of the issued

share capital and which regulates the relationship between the

Company and Ion Florescu and his connected persons. Under the terms

of the relationship agreement, Ion Florescu agrees not to carry on

any activity in conflict with those of the Company which may lead

to transactions and relationships between the Company and Ion

Florescu and his connected persons which are not at an arm's length

or on a normal commercial basis. Accordingly, Ion Florescu

undertakes that to the extent that he or his connected persons are

on the Board, he shall and shall procure that his connected persons

abstain from voting at any meeting of the Board in relation to any

matter in which he or his connected persons may be interested other

by virtue of holding Shares and not prejudice the rights of

minority Shareholders in a manner which does not affect him in the

same way.

9. EXTRAORDINARY GENERAL MEETING

A notice convening an Extraordinary General Meeting to be held

at the offices of Sanne Fiduciary Services Limited at 13 Castle

Street, St Helier, Jersey JE4 5UT at 10.00 a.m. on 29 October 2014

is set out at the back of this Circular. Set out below is a summary

of the Resolutions which are to be proposed at the Extraordinary

General Meeting. Resolution 1 will be proposed as an extraordinary

resolution and Resolution 2 will be proposed as an ordinary

resolution. The vote on Resolution 1 will be taken on a poll and

will be deemed not to have passed if the votes against the

Resolution constitute a majority against the Resolution and

represent at least 25 per cent. of the total number of votes

capable of being cast on that Resolution. Resolution 2 will be

deemed not to have passed unless a majority of the votes cast are

in favour of the Resolution.

Resolution 1 - Continuation of the Company

Resolution 1 is being proposed to continue the Company as

presently constituted for a further two years until the Annual

General Meeting to be convened in 2016.

Resolution 2 - Authority to allot securities in connection with

the Issue

Resolution 2 is being proposed to authorise the Directors to be

authorised to issue Convertible Loan Notes up to an aggregate

nominal amount of EUR8,450,000 including the right to convert the

amounts outstanding on the basis of 7.41 New Ordinary Shares for

every EUR1.00 of outstanding amount of principal of Convertible

Loan Notes (or as the conversion ratio may be adjusted under the

anti-dilution provisions of the Convertible Loan Notes).

Save in respect of the allotment of any New Ordinary Shares that

may need to be issued pursuant to the terms of the Convertible Loan

Notes, the Directors currently have no plans to issue any New

Ordinary Shares.

10. ACTION TO BE TAKEN iN RESPECT OF THE EGM

Shareholders will find enclosed with this Circular a Form of

Proxy for use at the EGM. The Form of Proxy should be completed and

returned in accordance with the instructions printed thereon so as

to arrive at the Company's Registrars, Sanne Fiduciary Services

Limited, 13 Castle Street, St Helier, Jersey JE4 5UT as soon as

possible and in any event not later than 10.00 a.m. on 27 October

2014.

If the Form of Proxy is not returned by 10.00 a.m. on 27 October

2014, your vote will not count.

11. APPLICATIONS TO SUBSCRIBE FOR CONVERTIBLE LOAN NOTES

As at the date of this Circular, the Company has received

applications from certain existing Shareholders to take up

EUR2,188,000 in aggregate of the Convertible Loan Notes. Ion

Florescu has undertaken to subscribe for the balance of the Issue

immediately following the EGM. The Company has also received

irrevocable commitments from existing Shareholders to vote in

favour of the Resolutions in respect of 41,867,122 Ordinary Shares

representing approximately 41.87 per cent. of the Ordinary Shares

in issue at the date of this Circular. Subject to the passing of

the Resolutions, the Directors expect to constitute and issue the

Convertible Loan Notes on 31 October 2014 following the EGM to such

of those persons who have validly applied for them as the Directors

then determine.

12. RECOMMENDATION

The Directors, certain of whom have subscribed for Notes as set

out in paragraph 5, believe that the Resolutions are fair and

reasonable and in the best interests of the Shareholders of the

Company as a whole. The Directors recommend that Shareholders vote

in favour of the Resolutions as they intend to do so in respect of

their aggregate holdings of 4,096,563 Ordinary Shares, equivalent

to approximately 4.10 per cent. of the Existing Ordinary

Shares.

13. GLOSSARY

Issuer: The Company.

Security Trustee: Josedo Limited, a company created

by SMP Partners.

Securities Offered: EUR8,450,000 principal amount of 10

per cent. convertible secured loan

notes due 2017 of the Company (the

"Notes").

Issue Price: At par.

Issue Date: 31 October 2014.

Coupon: Simple interest at 10 per cent. per

annum will accrue from the Issue Date

until the Repayment Date.

Security: The Notes will be secured by first

ranking securities granted by the

Company over the shareholdings in

and intercompany indebtedness owed

to the Company by its direct subsidiaries,

RC2 (Cyprus) Limited and Glasro Holdings

Limited (being SPVs which hold the

majority of the Company's investments).

The security will be granted in favour

of the Security Trustee on behalf

of the Noteholders under a security

trust deed in standard form. Instructions

will be given to the Security Trustee,

where required, by an extraordinary

resolution of the Noteholders on which

75 per cent. of the votes cast are

in favour ("Extraordinary Resolution").

Ranking: The Notes will rank in priority to

all unsecured creditors. Without prior

Noteholder consent by a resolution

on which at least two-thirds of the

votes cast are in favour, no dividends,

returns of capital or other payments

shall be made to any shareholder in

respect of its shares until the Notes

have been repaid in full.

Repayment Date: 30 October 2017.

Mandatory Repayment: Customary early repayment provisions

to apply, including on a takeover

of the Company. In addition, at least

75 per cent. of the net proceeds received

by the Company of a disposal of any

investment held by the Company from

time to time must be applied to redeem

the outstanding Convertible Loan Notes

(and any such disposal of an investment

will result in the release of the

security granted by the Company over

that asset pursuant to the security

trust deed).

Early Prepayment: At any time on not less than 45 days'

prior written notice by the Company

to the holders. No early repayment

penalties apply unless the repayment

occurs prior to the date falling 6

months after the Issue Date in which

case the repayment amount shall include

a minimum interest accrual equal to

the interest which would otherwise

have accrued between the Issue Date

and the date falling 6 months after

the Issue Date.

Prepayment to be pro rata amongst

holders by reference to principal

amount held.

Repayment Amount: At the principal plus accrued but

unpaid interest as of the date of

repayment.

Conversion: Notes will be convertible at the option

of the Noteholders at any time (including

prior to any proposed repayment of

Notes or equity issuance) on giving

15 days' prior written notice to the

Company on the basis of:

7.41 new ordinary shares of EUR0.01

each in the capital of the Company

for every EUR1.00 of principal of

Notes (equivalent to a conversion

price of EUR0.135 per new ordinary

share)

Any unpaid accrued interest on the

Notes will be disregarded for the

purposes of conversion and shall be

cancelled.

Fractional entitlements will be rounded

down to the nearest whole share.

Anti-dilution: Customary anti-dilution provisions

in respect of issues of new shares

at below the conversion price per

share, bonus issues, consolidation,

conversion, etc.

Noteholders will be given the opportunity

to convert their Notes into shares

in the event of any equity issuance

or a takeover offer being made for

the Company.

Covenants: Without prior Noteholder consent by

a resolution on which at least two-thirds

of the votes cast are in favour, no

dividends, returns of capital or other

payments shall be made to any shareholder

in respect of its shares until the

Notes have been repaid in full.

Without prior Noteholder consent by

Extraordinary Resolution:

* No further debt may be incurred ranking ahead of or

pari passu with the Notes

* No new investments (other than follow-on investments

in existing investments as permitted by the Company's

investment policy)

Provision of Information The Company will provide information

to Noteholders at the same time and

on the basis as it is provided to

shareholders (if a Noteholder is not

also a shareholder).

Events of Default:

* Failure to pay on due date (subject to grace period

of 14 days to cure)

* Insolvency

* Breach of terms of the Notes (subject to grace period

of 14 days to cure)

* Failure to have authority to issue new shares in the

Issuer on Conversion (subject to grace period of 14

days to cure)

* Change of the Company's investment policy without

prior Noteholder consent by Extraordinary Resolution

* Any resolution to continue the life of the Company

beyond the Repayment Date not being approved by

shareholders

Transferable: The Notes are transferable. The Notes

will not however be listed on any

exchange.

Conditions to Issue:

* Shareholder approval of the issue of the Notes

* Shareholder approval of the continuation of the

Company until at least the Annual General Meeting of

the Company to be held in 2016

Governing law: English law.

This information is provided by RNS

The company news service from the London Stock Exchange

END

MSCEAXEKEEDLFFF

Reconstruction Capital Ii (LSE:RC2)

Historical Stock Chart

From Jun 2024 to Jul 2024

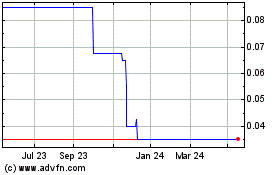

Reconstruction Capital Ii (LSE:RC2)

Historical Stock Chart

From Jul 2023 to Jul 2024