RSA Insurance Group Limited RSA FY21 Preliminary Results (5552E)

12 March 2022 - 3:25AM

UK Regulatory

TIDMRSAB

RNS Number : 5552E

RSA Insurance Group Limited

11 March 2022

RSA Insurance Group Limited

(the "Group")

2021 Preliminary Results

RSA Insurance Group Limited, formerly RSA Insurance Group plc,

was re-registered as a private limited company on 26 May 2021 and

100% of its ordinary share capital was purchased by Regent Bidco

Limited, a wholly owned subsidiary of Intact Financial Corporation

(IFC or Intact), on 1 June 2021 (the Acquisition). On 1 June 2021,

the Group disposed of its operations in Scandinavia (Codan A/S) and

Canada (Roins Holdings Limited), and these have been classified as

discontinued operations (refer to note 7 Discontinued operations of

the financial statements for further information).

Trading performance

The Group reports a profit before tax of GBP4,332m for the year

ended 31 December 2021, of which continuing operations contributed

a loss of GBP228m and discontinued operations a profit of GBP4,560m

(31 December 2020: GBP17m loss and GBP500m profit

respectively).

Continuing losses before tax of GBP228m consisted of GBP137m

underwriting losses (2020: GBP33m profit), GBP110m investment

result (2020: GBP110m), GBP11m central costs (2020: GBP12m) and

GBP190m of other charges (2020: GBP148m).

On the same continuing basis, profitable current year

underwriting performance was outweighed by reserve and margin

strengthening of approximately GBP180m, to reflect evolving

estimation uncertainty and to align to IFC practices. The

underwriting result was further impacted by a GBP72m write-down of

software assets and a GBP34m net impact relating to a r einsurance

contract purchase for adverse development cover (which will reduce

the potential volatility in the Group's historical claims

liabilities), including partial offset from reduced reserve margin

in light of the increased reinsurance protection . Other charges

were also impacted, with GBP136m acquisition and integration costs,

and GBP53 m debt buyback costs.

Profit from discontinued operations before tax included a

GBP4,393m gain on the disposal of the Group's operations in

Scandinavia and Canada.

Net written premiums were GBP4,474m of which GBP3,293m were in

respect of continuing operations and GBP1,181m from discontinued

(2020: GBP3,038m and GBP3,185m respectively).

Net assets of the Group are GBP3,091m (2020: GBP4,730m).

Commenting on the Group's 2021 full year financial results, RSA

CEO Ken Norgrove, said:

"It's fantastic to see that the hard work and customer focus of

all the teams across our business is paying off and delivering

results. Whilst impacted by specific items associated with the

takeover transaction, we've delivered a strong performance across

UK&I - with particular progress made in our UK Commercial Lines

and Specialty portfolios, and our flagship Home and Pet

businesses.

I'd like to thank Scott Egan and Charlotte Jones for leading RSA

through the complexities of 2021 and to all my colleagues, as well

as our brokers, partners and customers for choosing RSA for their

ongoing support .

My focus in 2022 is to work with the teams across RSA and Intact

to build on our continued progress and chart a course to

outperformance."

Further details of the Group's 2021 Preliminary Results are

available on the Group's website www.rsagroup.com.

Enquiries:

Alexander Jones Natalie Whitty

Head of External Communications Group Communications

Director

RSA Insurance Group Limited RSA Insurance group Limited

Alexander.z.jones@uk.rsagroup.com

Natalie.whitty@gcc.rsagroup.com

Statement in accordance with section 435 of the Companies Act

2006

Neither the financial information set out in this announcement

nor the preliminary financial statements published on the Group's

website includes an auditor's report or constitutes statutory

accounts of the RSA Insurance Group Limited for the years ended 31

December 2021 or 31 December 2020, however such information is

derived from those statutory accounts. Statutory accounts for 2020

have been delivered to the Registrar of Companies, and those for

2021 will be delivered in due course. RSA Insurance Group Limited's

auditors have reported on those statutory accounts, and their

reports (i) were unqualified, (ii) did not include reference to any

matters to which the auditors drew attention by way of emphasis

without qualifying their report and (iii) did not include a

statement under section 498(2) or section 498(3) of the Companies

Act 2006.

The above statement is also disclosed as a note at the end of

the preliminary financial statements published online.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

DOCMZGMFVMDGZZM

(END) Dow Jones Newswires

March 11, 2022 11:25 ET (16:25 GMT)

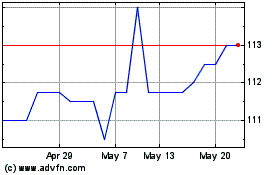

Rsa Ins. 7te%pf (LSE:RSAB)

Historical Stock Chart

From May 2024 to Jun 2024

Rsa Ins. 7te%pf (LSE:RSAB)

Historical Stock Chart

From Jun 2023 to Jun 2024