TIDMSPO

RNS Number : 8343M

Sportech PLC

19 September 2023

19 September 2023

SPORTECH PLC

('Sportech' or the 'Group')

Publication of Circular and Notice of General Meeting

Further to the announcement on 11 September 2023, Sportech, an

international betting and technology business, announces that a

circular (the "Circular") and notice of general meeting will be

posted to shareholders today.

The Circular is in relation to the proposed cancellation of

admission of Sportech's ordinary shares of 10p each to trading on

AIM (the "Cancellation"), re-registration as a private limited

company (the "Re-registration") and adoption of new articles of

association (the "New Articles") announced on 11 September 2023.

The Circular also contains a notice convening a general meeting

(the "General Meeting") at which Shareholders are invited to

consider and, if thought fit, approve the proposed Cancellation,

Re-registration and associated adoption of the New Articles.

To be passed, the Cancellation Resolution requires, pursuant to

Rule 41 of the AIM Rules, the approval of not less than 75 per

cent. of the votes cast by Shareholders at the General Meeting. The

Re-registration Resolution (which includes the adoption of the New

Articles) also requires the approval of not less than 75 per cent.

of the votes cast by Shareholders at the General Meeting.

A copy of the Circular and the New Articles will be made

available on the Company's website at www.sportechplc.com later

today.

The General Meeting will be held on 5 October 2023 at 9.00 a.m.

at the offices of Dickson Minto, 16 Charlotte Square, Edinburgh,

EH2 4DF.

Certain extracts of the Circular, providing further details of

the proposals, are set out in the Appendix. Capitalised terms used

in this announcement and the Appendix have the meanings set out in

the Circular unless otherwise defined.

EXPECTED TIMETABLE OF PROPOSED DE-LISTING

Event Time and/or date

Notice provided to the London 14 September 2023

Stock Exchange to notify it

of the proposed Cancellation

Publication and posting of the 19 September 2023

Circular

Latest time for receipt of proxy 9.00 a.m. on 3 October 2023

appointments in respect of the

General Meeting

General Meeting 9.00 a.m. on 5 October 2023

Last day of dealings in Ordinary 16 October 2023

Shares on AIM

Cancellation 7.00 a.m. on 17 October 2023

Re-registration week commencing 23 October 2023

For further information, please contact:

Sportech PLC enquiries@sportechplc.com

Richard McGuire, Executive Chairman

Clive Whiley, Senior Independent

Director

Peel Hunt (Nominated Adviser Tel: +44 (0) 20 7418 8900

& Broker)

George Sellar

Andrew Clark

Lalit Bose

APPIX

Background to and reasons for the Cancellation and Re-registration

As Shareholders will be aware, the Company undertook a share

consolidation and subdivision and capital distribution in

July 2023 (the "Share Capital Reorganisation"). Following

the Share Capital Reorganisation becoming effective, the Board

undertook a thorough review of the corporate costs being borne

by the Company as a result of its status as a publicly traded

company.

Following that review, the Board has concluded that the Company's

continued status as a publicly traded company is not appropriate

given the scale of i ts business and, accordingly, the Cancellation

and Re-registration are in the best interests of the Company

and its Shareholders as a whole for reasons including those

set out below.

* Costs and regulatory burden : The considerable cost

and management time and the legal and regulatory

burden associated with maintaining the Company's

admission to trading on AIM is, in the Board's

opinion, disproportionate to the benefits of the

Company's continued admission to trading on AIM.

These costs: (a) amounted to approximately GBP450,000

in the year ended 31 December 2022; (b) contributed

to the Group's pre-tax loss of GBP934,000 in that

period to a material extent; and (c) represented

approximately 28 per cent. of the Group' s adjusted

EBITDA of GBP1.6 million in that period. Given the

lower costs associated with private limited company

status, it is estimated that the Cancellation and

Re-registration will materially reduce the Company's

recurring administrative and adviser costs by

approximately GBP450,000 per annum, which the Board

believes can be better spent supporting and investing

in the Group's business.

* Lack of liquidity : Notwithstanding the Share Capital

Reorganisation, there continues to be limited

liquidity in the Ordinary Shares. As a result, the

Board believes that Shareholders are not provided

with the opportunities to trade in meaningful volumes

or with frequency in an active market in Ordinary

Shares.

* Market volatility : As a result of the limited

liquidity in Ordinary Shares described above, small

trades in Ordinary Shares can have a significant

impact on price and, therefore, market valuation,

which, the Board believes, in turn has a materially

adverse impact on: (a) the Company's status within

its industry; (b) the perception of the Company

amongst its customers, suppliers and other partners;

(c) staff morale; and (d) the Company's ability to

seek appropriate financing or realise an appropriate

value for any material future disposal(s).

* Challenges related to the Company's position as a

micro-cap stock : Growing the Company, a UK micro-cap

stock, comes with a range of challenges, which, in

the Board's view, stem from the Company's small

market valuation, limited resources, and the dynamic

nature of the market. These challenges include, but

are not limited to: (a) access to capital; (b) a lack

of visibility among analysts, media and potential

investors; (c) increased volatility in Company

valuation unrelated to company performance leading to

higher risk perception; and (d) an aversion from

potential investors, seeking stability and a

valuation that aligns with Company performance.

* Strategic flexibility : The Board believes that a

private limited company can take and implement

strategic decisions more quickly than a company which

is publicly traded as a result of the more flexible

regulatory regime that is applicable to a private

company.

Therefore, following careful consideration, the Board believes

that it is in the best interests of the Company and Shareholders

to seek the proposed Cancellation, Re-registration and associated

adoption of the New Articles.

PROCESS FOR, AND PRINCIPAL EFFECTS OF, THE CANCELLATION

Under the AIM Rules, the Company is required to give at least

20 Business Days' notice of the Cancellation. Additionally,

the Cancellation will not take effect until at least five

Business Days have passed following the passing of the Cancellation

Resolution. If the Cancellation Resolution is passed at the

General Meeting, it is proposed that the last day of trading

in Ordinary Shares on AIM will be 1 6 October 2023 and that

the Cancellation will take effect at 7.00 a.m. on 1 7 October

2023.

The Directors are aware that certain Shareholders may be unable

or unwilling to hold Ordinary Shares in the event that the

Cancellation is approved and becomes effective. Such Shareholders

should consider selling their interests in the market prior

to the Cancellation becoming effective.

The principal effects of the Cancellation will include the

following:

* there will cease to be a formal market mechanism

enabling Shareholders to trade Ordinary Shares (other

than any limited off-market mechanism provided by the

Matched Bargain Facility);

* it is possible that, following the publication of the

Circular, the liquidity and marketability of the

Ordinary Shares is reduced and their value adversely

affected (however, as set out above, the Directors

believe that the existing liquidity in the Ordinary

Shares is, in any event, limited);

* the Ordinary Shares may be more difficult to sell

compared to shares of companies traded on AIM (or any

other recognised market or trading exchange);

* in the absence of a formal market and quoted price,

it may be difficult for Shareholders to determine the

market value of their investment in the Company at

any given time;

* the regulatory and financial reporting regime

applicable to companies whose shares are admitted to

trading on AIM will no longer apply;

* Shareholders will no longer be afforded the

protections given by the AIM Rules, such as the

requirement to be notified of price sensitive

information or certain events and the requirement

that the Company seek shareholder approval for

certain corporate actions, where applicable,

including substantial transactions, reverse takeovers,

related party transactions and fundamental changes in

the Company's business, including certain

acquisitions and disposals;

* the levels of disclosure and corporate governance

within the Company may not be as stringent as for a

company quoted on AIM;

* the Company will no longer be subject to UK MAR

regulating inside information and other matters;

* the Company will no longer be required to disclose

publicly any change in its major shareholdings under

the Disclosure Guidance and Transparency Rules;

* Peel Hunt LLP will cease to be nominated adviser and

broker to the Company;

* whilst the Company's CREST facility will remain in

place immediately following the Cancellation, the

Company's CREST facility may be cancelled in the

future and, although the Ordinary Shares will remain

transferable, they may cease to be transferable

through CREST (in which case, Shareholders who hold

Ordinary Shares in CREST will receive share

certificates);

* stamp duty will be due on transfers of shares and

agreements to transfer shares unless a relevant

exemption or relief applies to a particular transfer;

and

* the Cancellation and Re-registration may have

taxation consequences for Shareholders. Shareholders

who are in any doubt about their tax position should

consult their own professional independent tax

adviser.

The above considerations are not exhaustive, and Shareholders

should seek their own independent advice when assessing the

likely impact of the Cancellation on them.

For the avoidance of doubt, the Company will remain registered

with the Registrar of Companies in Scotland in accordance

with, and subject to, the Companies Act, notwithstanding the

Cancellation and Re-registration.

The Resolutions to be proposed at the General Meeting include

the adoption of the New Articles, which reflect the change

in the Company's status to a private limited company with

effect from the Re-registration. A summary of the principal

differences between the Current Articles and the proposed

New Articles is included in Part 2 of the Circular. A copy

of the New Articles can be viewed at https://www.sportechplc.com.

Board composition and provision of information, SERVICES

AND FACILITATES following the Cancellation

Board composition

There will be no change to the composition of the Board immediately

following the Cancellation and Re-registration although the

Board intends to keep its composition under review following

the Cancellation and Re-registration. In particular, the Company

is mindful of the need for its Board to be representative

of its operating divisions and geographic operating areas

and for the Company to take advantage of the flexibility which

its status as a private limited company will allow.

As described in the Circular (and, in particular, paragraph

8 of Part 1 of the Circular and Part 3 of the Circular), the

Takeover Code will continue to apply to the Company for a

period of at least 10 years from the date of Cancellation

if the Company is considered by the Panel to have its place

of central management and control in the United Kingdom, the

Channel Islands or the Isle of Man. This is known as the "residency

test". In determining whether the residency test is satisfied,

the Panel has regard primarily to whether a majority of a

company's directors are resident in these jurisdictions. If,

following any changes to the Board's composition, the residency

test is no longer considered by the Company to be met, the

Company will seek a determination from the Panel on the continued

applicability of the Takeover Code to the Company. In the

event that the Panel advises the Company that the "residency

test" is no longer met, the Company will seek to inform Shareholders

of this outcome.

Provision of information, services and facilities following

the Cancellation

The Company currently intends to continue to provide certain

information, services and facilities to Shareholders following

the Cancellation. The Company will:

* continue to communicate information about the Company

(including annual accounts) to its Shareholders, as

required by the Companies Act;

* continue, for at least 12 months following the

Cancellation, to maintain its website,

https://www.sportechplc.com (albeit the domain name

may be altered as a result of changes to the

Company's name in connection with the Cancellation

and Re-registration) and to post updates on the

website from time to time, although Shareholders

should be aware that there will be no obligation on

the Company to include all of the information

required under the Disclosure Guidance and

Transparency Rules, AIM Rule 26 or to update the

website as required by the AIM Rules; and

* make available to Shareholders, through JP Jenkins,

the Matched Bargain Facility (as further described in

paragraph 5.2 of Part 1 of the Circular) which will

allow Shareholders to buy and sell Ordinary Shares on

a matched bargain basis following the Cancellation.

Transactions in the Ordinary Shares prior to and FOLLOWING

the Cancellation

Transactions prior to the Cancellation

Shareholders should note that they are able to continue trading

in the Ordinary Shares on AIM prior to the Cancellation.

If Shareholders wish to buy or sell Ordinary Shares on AIM

they must do so prior to the Cancellation becoming effective.

As noted above, in the event that Shareholders approve the

Cancellation, it is anticipated that the last day of dealings

in the Ordinary Shares on AIM will be 16 October 2023 and

that the effective date of the Cancellation will be on 17

October 2023.

Transactions following the Cancellation

The Directors are aware that Shareholders may wish to acquire

or dispose of Ordinary Shares in the Company following the

Cancellation. Should the Cancellation be approved by Shareholders

at the General Meeting, the Company will implement a matched

bargain facility with JP Jenkins which will allow Shareholders

to buy and sell Ordinary Shares on a matched bargain basis

following the Cancellation (the "Matched Bargain Facility").

Under the Matched Bargain Facility, Shareholders (or persons

wishing to acquire Ordinary Shares) will be able to provide

an indication to JP Jenkins, through their stockbroker (JP

Jenkins is unable to deal directly with individuals), of the

number of Ordinary Shares that they are willing to buy or

sell and the price at which they are willing to do so. In

the event that JP Jenkins is able to match that buy or sell

order with an opposite sell or buy instruction, JP Jenkins

would contact both parties and carry out the trade.

Should the Cancellation become effective, details of the Matched

Bargain Facility will be made available on the Company's website.

The Matched Bargain Facility is expected to operate for a

minimum period of twelve months from the Cancellation. The

Directors' current intention is that it will continue beyond

that time but Shareholders should note that it could be withdrawn

and, therefore, inhibit the ability to trade the Ordinary

Shares. Further details will be communicated to Shareholders

via the Company's website at the relevant time.

Current Trading

On 11 September 2023, the Company released a trading update

for the six months ended 30 June 2023 which contained the

following information.

"The Group has continued to deliver solid operational performance,

marked by stable revenue growth and a renewed emphasis on

margin enhancement. This strategic approach has led to a 7.2%

increase in gross profit and a notably improved Adjusted EBITDA

performance, in comparison to the same period of the previous

year.

The Group's Adjusted EBITDA demonstrated positive momentum,

reaching GBP0.9 million (GBP0.4 million in H1 2022). This

improvement was fuelled by several key factors, most notably

growth in contributions from US gaming and a sustained focus

on optimizing operational and corporate costs."

Re-registration

As set out above, following the Cancellation, the Directors

believe that the requirements and associated costs of the

Company maintaining its public company status will be difficult

to justify and that the Company will benefit from the more

flexible requirements and lower costs associated with private

limited company status. It is, therefore, proposed to re-register

the Company as a private limited company. In connection with

the Re-registration, it is proposed that the New Articles

be adopted to reflect the change in the Company's status to

a private limited company. The principal effects of the Re-registration

and the adoption of the New Articles on the rights and obligations

of Shareholders and the Company are summarised in Part 2 of

the Circular.

An application will be made to the Registrar of Companies

for the Company to be re-registered as a private limited company.

Re-registration will take effect when the Registrar of Companies

issues a Certificate of Incorporation on Re-registration.

The Registrar of Companies will issue the Certificate of Incorporation

on Re-registration when it is satisfied that no valid application

can be made to cancel the resolution to re-register as a private

limited company or that any such application to cancel the

resolution to re-register as a private limited company has

been determined and confirmed by a court of competent jurisdiction.

Takeover Code

Notwithstanding the Cancellation and Re-registration, the

Company will continue to be subject to the terms of the Takeover

Code for a period of at least 10 years following the Cancellation

(subject to the Re-registration occurring). However, the Takeover

Code may cease to apply earlier, if a majority of the directors

of the Company cease to be resident in the United Kingdom,

the Channel Islands or the Isle of Man.

The Takeover Code applies to all offers for companies which

have their registered offices in the United Kingdom, the Channel

Islands or the Isle of Man if any of their equity share capital

or other transferable securities carrying voting rights are

admitted to trading on a regulated market or a multilateral

trading facility in the United Kingdom or on any stock exchange

in the Channel Islands or the Isle of Man.

The Takeover Code also applies to all offers for companies

(both public and private) which have their registered offices

in the United Kingdom, the Channel Islands or the Isle of

Man and which are considered by the Panel to have their place

of central management and control in the United Kingdom, the

Channel Islands or the Isle of Man, but in relation to private

companies only if one of a number of conditions are met, including

that any of the company's equity share capital or other transferable

securities carrying voting rights have been admitted to trading

on a regulated market or a multilateral trading facility in

the United Kingdom or on any stock exchange in the Channel

Islands or the Isle of Man at any time in the preceding 10

years.

If the Cancellation and Re-registration are approved by Shareholders

at the General Meeting, the Company will be re-registered

as a private company and its securities will no longer be

admitted to trading on a regulated market or a multilateral

trading facility in the United Kingdom. In these circumstances,

the Takeover Code will only apply to the Company if it is

considered by the Panel to have its place of central management

and control in the United Kingdom, the Channel Islands or

the Isle of Man. This is known as the "residency test". In

determining whether the residency test is satisfied, the Panel

has regard primarily to whether a majority of a company's

directors are resident in these jurisdictions.

On the basis of the current residency of the Directors, the

Company will have its place of central management and control

in the United Kingdom following the Cancellation. In light

of the Re-registration, and provided that the Company's place

of central management and control continues to be considered

by the Panel to be in the United Kingdom, the Takeover Code

will continue to apply to the Company for the period of 10

years following the Cancellation, including the requirement

for a mandatory cash offer to be made if either:

* a person acquires an interest in shares which, when

taken together with the shares in which persons

acting in concert with it are interested, increases

the percentage of shares carrying voting rights in

which it is interested to 30 per cent. or more; or

* a person, together with persons acting in concert

with it, is interested in shares which in the

aggregate carry not less than 30 per cent. of the

voting rights of a company but does not hold shares

carrying more than 50 per cent. of such voting rights

and such person, or any person acting in concert with

it, acquires an interest in any other shares which

increases the percentage of shares carrying voting

rights in which it is interested.

In particular, under Rule 9 of the Takeover Code, when any

person or group of persons acting in concert, individually

or collectively, are interested in shares which in aggregate

carry not less than 30 per cent. of the voting rights of a

company but do not hold shares carrying more than 50 per cent.

of the voting rights of a company and such person or any person

acting in concert with him acquires an interest in any other

shares, which increases the percentage of the shares carrying

voting rights in which he is interested, then that person

or group of persons is normally required by the Panel to make

a general offer in cash to all shareholders of that company

at the highest price paid by them for any interest in shares

in that company during the previous 12 months. Rule 9 of the

Takeover Code further provides that where any person, together

with persons acting in concert with him, holds over 50 per

cent. of the voting rights of a company to which the Takeover

Code applies and acquires additional shares which carry voting

rights, then that person will not generally be required to

make a general offer to the other shareholders to acquire

the balance of the shares not held by that person or his concert

parties.

Following the expiry of the 10 year period from the date of

the Cancellation (subject to the Re-registration occurring),

or such other date on which the Takeover Code ceases to apply

to the Company, the Company will no longer be subject to the

provisions of the Takeover Code.

Brief details of the Panel, and of the protections afforded

to Shareholders by the Takeover Code are set out in Part 3

of the Circular.

Process for Cancellation

Under the AIM Rules, it is a requirement that the Cancellation

must be approved by Shareholders holding not less than 75

per cent. of votes cast by Shareholders at the General Meeting.

Accordingly, the Notice of General Meeting set out in Part

4 of the Circular contains a special resolution to approve

the Cancellation.

Furthermore, Rule 41 of the AIM Rules requires any AIM company

that wishes the London Stock Exchange to cancel the admission

of its shares to trading on AIM to notify shareholders and

to separately inform the London Stock Exchange of its preferred

cancellation date at least 20 Business Days prior to such

date. In accordance with AIM Rule 41, the Directors have notified

the London Stock Exchange of the Company's intention, subject

to the Cancellation Resolution being passed at the General

Meeting, to cancel the Company's admission of the Ordinary

Shares to trading on AIM on 17 October 2023. Accordingly,

if the Cancellation Resolution is passed, the Cancellation

will become effective at 7.00 a.m. on 17 October 2023. If

the Cancellation becomes effective, Peel Hunt LLP will cease

to be nominated adviser and broker to the Company and the

Company will no longer be required to comply with the AIM

Rules.

ACTION TO BE TAKEN IN RELATION TO THE GENERAL MEETING

In line with the Company's approach at annual general meetings,

hard copy proxy forms are not being sent to Shareholders in

connection with the General Meeting. The Company would like

to encourage shareholders to vote electronically or appoint

a proxy electronically, which can be done via www.signalshares.com,

via the LinkVote+ app or, where Ordinary Shares are held in

CREST, via CREST. Certain shareholders may also be able to

appoint a proxy electronically via the Proximity platform.

Shareholders may also request a hard copy form of proxy directly

from the Company's registrar, Link Group, by calling 0371

664 0300 or by emailing shareholderenquiries@linkgroup.co.uk.

Notwithstanding the method of appointment, proxy appointments

must be received by Link Group by 9.00 a.m. on 3 October 2023,

being 48 hours before the time fixed for the General Meeting.

Further details of the proxy appointment methods are set out

in the Notice of General Meeting in Part 4 of the Circular.

Shareholders are encouraged to appoint the chair of the General

Meeting as their proxy with directions as to how to cast their

vote on the Resolutions proposed. For further details on how

to submit a proxy vote, see the notes to the Notice of General

Meeting at Part 4 of the Circular.

The appointment of a proxy will not preclude Shareholders

from attending and voting at the General Meeting in person

should they so wish. All Shareholders planning to attend the

General Meeting in person are, however, requested to confirm

their attendance by emailing ir@sportechplc.com (marked for

the attention of the Company Secretary) by no later than 9.00

a.m. on 3 October 2023.

RECOMMENDATION

The Directors consider that each of the Cancellation Resolution

and the Re-registration Resolution is in the best interests

of the Company and its shareholders as a whole. Accordingly,

the Directors unanimously recommend that Shareholders vote

in favour of the resolutions at the General Meeting as Richard

McGuire and Clive Whiley (being the only Directors who are

interested in Ordinary Shares) intend to do in respect of

their own beneficial holdings, insofar as they are able to

control or direct the exercise of the voting rights attaching

to the relevant Ordinary Shares.

This information is provided by RNS, the news service of the

London Stock Exchange. RNS is approved by the Financial Conduct

Authority to act as a Primary Information Provider in the United

Kingdom. Terms and conditions relating to the use and distribution

of this information may apply. For further information, please

contact rns@lseg.com or visit www.rns.com.

RNS may use your IP address to confirm compliance with the terms

and conditions, to analyse how you engage with the information

contained in this communication, and to share such analysis on an

anonymised basis with others as part of our commercial services.

For further information about how RNS and the London Stock Exchange

use the personal data you provide us, please see our Privacy

Policy.

END

NOGNKFBKCBKDACD

(END) Dow Jones Newswires

September 19, 2023 02:00 ET (06:00 GMT)

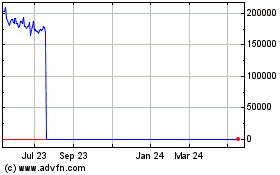

Sportech (LSE:SPO)

Historical Stock Chart

From Oct 2024 to Nov 2024

Sportech (LSE:SPO)

Historical Stock Chart

From Nov 2023 to Nov 2024