U.S. Dollar Rises On Fed's Rate Hike Speculation

23 April 2015 - 3:49PM

RTTF2

The U.S. dollar strengthened against the other major currencies

in the Asian session on Thursday amid speculation about the Federal

Reserve's rate hike this year, in the wake of some upbeat economic

data from the U.S.

Data from the National Association of Realtors or NAR showed

that the existing home sales in the U.S. increased much more than

expected in March, jumping to its highest rate in 18 months.

NAR said existing home sales surged 6.1 percent to an annual

rate of 5.19 million in March from a revised 4.89 million in

February. Economists expected existing home sales to climb to a

rate of 5.05 million from the 4.88 million originally reported for

the previous month.

Some analysts expect the Fed to act in September of this

year.

The lingering Greek worries also raised the appeal of the

safe-haven currency. Wednesday, the U.S. dollar showed mixed

trading against its major rivals. While the U.S. dollar fell

against the Euro and the pound, it rose against the Yen and the

Swiss franc.

In the Asian trading today, the U.S. dollar rose to a 9-day high

of 120.08 against the yen, an 8-day high of 0.7564 against the NZ

dollar and a 2-day high of 1.0691 against the euro, from

yesterday's closing quotes of 119.89, 0.7664 and 1.0722,

respectively. If the greenback extends its uptrend, it is likely to

find resistance around 121.00 against the yen, 0.73 against the

kiwi and 1.04 against the euro.

Moving away from an early low of 0.9687 against the Swiss franc,

the greenback advanced to an 8-day high of 0.9718. The greenback

may test resistance near the 0.99 region.

The greenback edged up to 1.5014 against the pound, from

yesterday's closing value of 1.5033. On the upside, 1.45 is seen as

the next resistance levels for the greenback.

Against the Australia and the Canadian dollars, the greenback

edged up to 0.7718 and 1.2268 from yesterday's closing quotes of

0.7750 and 1.2235, respectively. It is likely to find resistance

near 0.75 against the aussie and 1.26 against the loonie.

Looking ahead, Swiss trade data for March is due to be released

at 2:00 am ET.

In the European session, PMI reports for April from major

European economies and U.K. public sector finance data and retail

sales data for March are slated for release.

At 3:45 am ET, European Central Bank board member Peter Praet is

expected to speak at the "World monetary conference" in Berlin.

In the New York session, U.S. weekly jobless claims for the week

ended April 18, U.S. Markit's manufacturing PMI for April and U.S.

new home sales data for March are set to be published.

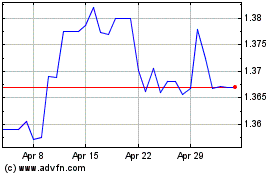

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Mar 2024 to Apr 2024

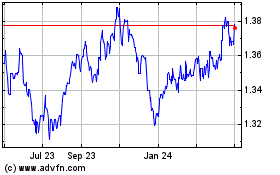

US Dollar vs CAD (FX:USDCAD)

Forex Chart

From Apr 2023 to Apr 2024