National Australia Bank Confirms IPO Plan for CYBG

27 November 2015 - 7:41PM

Dow Jones News

By Ian Walker

LONDON--National Australia Bank Ltd. (NAV.AU) confirmed on

Friday that it is planning a demerger and initial public offering

to institutional investors of CYBG PLC, the holding company of

Clydesdale Bank PLC and Yorkshire Bank in the U.K.

The Australian bank said last month it planned to float

Clydesdale Bank, which was established in Glasgow in 1838, on the

London Stock Exchange in February. As part of the plan, it will

demerge CYBG, issue 75% of the stock to existing shareholders and

float the rest through an initial public offering.

CYBG will have its main listing in London with a CHESS

depositary interest listing on the Australian Securities Exchange,

NAB said on Oct. 28.

The proposed demerger and IPO are subject to various court and

regulatory approvals, and NAB shareholder approval, the Australian

bank said. Shareholder approval will be sought at a meeting

expected to be in late January 2016, it added.

Detailed information, including the impact on the parent and

CYBG, is expected to be issued with the scheme booklet in the week

starting Dec. 7, NAB said.

Write to Ian Walker at ian.walker@wsj.com; @IanWalk40289749

Subscribe to WSJ: http://online.wsj.com?mod=djnwires

(END) Dow Jones Newswires

November 27, 2015 03:26 ET (08:26 GMT)

Copyright (c) 2015 Dow Jones & Company, Inc.

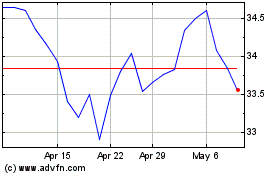

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Mar 2024 to Apr 2024

National Australia Bank (ASX:NAB)

Historical Stock Chart

From Apr 2023 to Apr 2024