Kellogg Says Cereal Sales Will Rise in 2016 -- Update

12 February 2016 - 7:22AM

Dow Jones News

By Annie Gasparro and Chelsey Dulaney

Kellogg Co. said its U.S. cereal sales will rise this year and

that a cost-cutting initiative helped it post a narrower

fourth-quarter loss--signs of early progress in the breakfast

company's rebuilding effort.

Kellogg shares jumped 4% and reached a 52-week high--bucking

sharp declines in global stock markets--after the maker of Frosted

Flakes cereal and Eggo waffles notched adjusted earnings that

topped analysts' expectations.

Chief Executive John Bryant said Kellogg's business continues to

improve as it revamps cereal and snack brands to be more relevant

to today's shoppers--whether that means removing artificial colors

or adding ingredients viewed as healthier, such as sprouted grains.

The company has grappled with several years of weaker sales, hurt

in part by U.S. consumers shunning carbohydrate-dense cereals and

milk for higher-protein, portable meals such as egg sandwiches.

"The key is to have great food that's on trend. Where we have

that, we're growing strongly," Mr. Bryant said on a conference call

with analysts Thursday. "Some of our foods, though, are not on

trends as they need to be."

The company is working on revitalizing sluggish brands such as

Special K by launching chewy nut bars and a cereal with quinoa.

After years of declines, "we actually expect our U.S. cereal

business to grow slightly--a couple percent--in 2016," Mr. Bryant

said, citing changes to its products and its sales team.

Last year, the Battle Creek, Mich., company became the latest

big U.S. food maker to adopt a financial tool known as zero-base

budgeting, which has grown popular as a result of the need to slash

costs amid weak demand for traditional packaged foods. The tool

requires managers to build budgets from scratch each year rather

than using prior-year spending as a base.

In the fourth quarter, Kellogg's selling, general and

administrative expenses fell 22% from a year earlier to $1

billion.

In an interview, Mr. Bryant said that zero-base budgeting allows

Kellogg to "come back and challenge old beliefs and old

systems...and that's incredibly productive."

For the quarter ended Jan. 2, the company reported a loss of $41

million, or 12 cents a share, compared with a loss of $293 million,

or 82 cents a share, a year earlier.

Excluding mark-to-market costs and restructuring charges,

per-share earnings were 79 cents, beating analysts' expectations of

74 cents a share, according to a poll by Thomson Reuters.

Revenue fell 11% to $3.14 billion, below the $3.16 billion

analysts had expected. Excluding currency swings, comparable sales

rose 4.2%.

Kellogg's largest division, U.S. morning foods, posted sales

growth of 1.5%, led by improvements in cereal.

North America sales overall fell 8% in the quarter. In its

international division, growth in snacks such as Pringles chips

helped drive 1.6% core sales growth in Europe. Sales in the Asia

Pacific business increased 3.3% on a comparable basis in the

quarter.

The company backed its guidance for the year.

Write to Annie Gasparro at annie.gasparro@wsj.com and Chelsey

Dulaney at Chelsey.Dulaney@wsj.com

(END) Dow Jones Newswires

February 11, 2016 15:07 ET (20:07 GMT)

Copyright (c) 2016 Dow Jones & Company, Inc.

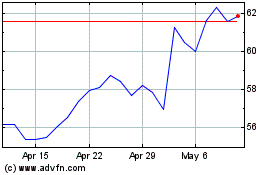

Kellanova (NYSE:K)

Historical Stock Chart

From Apr 2024 to May 2024

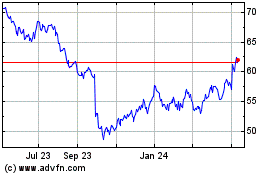

Kellanova (NYSE:K)

Historical Stock Chart

From May 2023 to May 2024