0001996862false00019968622024-05-152024-05-16

UNITED STATES SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

___________________________________

FORM 8-K

___________________________________

CURRENT REPORT

Pursuant to Section 13 or 15(d) of the Securities Exchange Act of 1934

May 15, 2024

Date of Report (date of earliest event reported)

___________________________________

BUNGE GLOBAL SA

(Exact name of registrant as specified in its charter)

___________________________________

| | |

Switzerland (State of Incorporation) |

| | | | | | | | |

000-56607 (Commission File Number) | | 98-1743397 (IRS Employer Identification Number) |

| | |

Route de Florissant 13, 1206 Geneva, Switzerland | | N.A |

(Address of registered office and principal executive office) | | (Zip Code) |

| | |

1391 Timberlake Manor Parkway Chesterfield, MO | | 63017 |

(Address of corporate headquarters ) | | (Zip Code) |

| | |

(314) 292-2000 |

(Registrant's telephone number, including area code) |

| | |

| N/A |

| (Former name or former address, if changed since last report) |

Check the appropriate box below if the Form 8-K filing is intended to simultaneously satisfy the filing obligation of the registrant under any of the following provisions:

| | | | | |

☐ | Written communications pursuant to Rule 425 under the Securities Act (17 CFR 230.425) |

☐ | Soliciting material pursuant to Rule 14a-12 under the Exchange Act (17 CFR 240.14a-12) |

☐ | Pre-commencement communications pursuant to Rule 14d-2(b) under the Exchange Act (17 CFR 240.14d-2(b)) |

☐ | Pre-commencement communications pursuant to Rule 13e-4(c) under the Exchange Act (17 CFR 240.13e-4(c)) |

| | | | | | | | |

Securities registered pursuant to Section 12(b) of the Act: |

Title of each class | Trading Symbol | Name of each exchange on which registered |

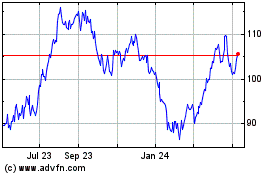

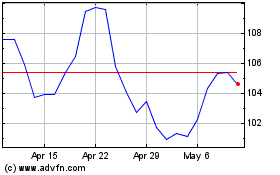

| Registered Shares, $0.01 par value per share | BG | New York Stock Exchange |

Indicate by check mark whether the registrant is an emerging growth company as defined in Rule 405 of the Securities Act of 1933 (§230.405 of this chapter) or Rule 12b-2 of the Securities Exchange Act of 1934 (§240.12b-2 of this chapter).

Emerging growth company ☐

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period for complying with any new or revised financial accounting standards provided pursuant to Section 13(a) of the Exchange Act. ☐

Item 5.02 - Departure of Directors or Certain Officers; Election of Directors; Appointment of Certain Officers; Compensatory Arrangements of Certain Officers.

At the 2024 Annual General Meeting of Shareholders of Bunge Global SA (the “Company”) held on May 15, 2024 (the “AGM”), shareholders of the Company approved the Company's 2024 Long-Term Incentive Plan (the “LTIP"), to replace the Company's 2016 Equity Incentive Plan. As approved by shareholders, the LTIP reserves an additional 5,000,000 shares, par value $0.01 per share, issuable pursuant to awards granted thereunder.

The summary of the changes to the LTIP is subject to and qualified in its entirety by reference to the full text of the LTIP, which is attached hereto as Exhibit 10.1 and is incorporated herein by reference.

Item 5.07 - Submission of Matters to a Vote of Security Holders

At the AGM, the Company's shareholders voted on the proposals set forth below, each of which is described in the Company's proxy statement for the 2024 annual general meeting:

1.The shareholders approved the Swiss statutory consolidated financial statements and Swiss standalone financial statements of the Company for the year ended December 31, 2023. The tabulation of votes on this matter was as follows:

| | | | | | | | | | | | | | | | | |

| Votes For | | Votes Against | | Abstentions | |

| 115,170,907 | | 52,825 | | 427,479 | |

2. The shareholders approved the appropriation of earnings for fiscal year 2023. The tabulation of votes on this matter was as follows:

| | | | | | | | | | | | | | | | | |

| Votes For | | Votes Against | | Abstentions | |

| 115,468,056 | | 36,427 | | 146,728 | |

3. The shareholders approved a cash dividend in the aggregate amount of U.S. $2.72 per outstanding share out of the Company's reserve from capital contributions in four equal installments. The tabulation of votes on this matter was as follows:

| | | | | | | | | | | | | | | | | |

| Votes For | | Votes Against | | Abstentions | |

| 115,450,866 | | 88,580 | | 111,765 | |

4 The shareholders approved the discharge of the members of the Board and the Executive Management Team from liability for activities during fiscal year 2023. The tabulation of votes on this matter was as follows:

| | | | | | | | | | | | | | | | | | | | |

| Votes For | | Votes Against | | Abstentions | | Broker Non-Votes |

| 108,056,783 | | 888,619 | | 435,986 | | 6,269,823 |

5. The shareholders reelected the following 10 individuals listed below as directors, each for a term extending until completion of the 2025 annual general meeting. The tabulation of votes with respect to the re-election of the directors below was as follows:

| | | | | | | | | | | | | | | | | |

| Nominee | Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 5a. | Eliane Aleixo Lustosa de Andrade | 108,479,370 | 811,847 | 90,171 | 6,269,823 |

| 5b. | Sheila Bair | 107,876,244 | 1,384,363 | 120,781 | 6,269,823 |

| 5c. | Carol M. Browner | 102,259,760 | 6,980,686 | 140,942 | 6,269,823 |

| 5d. | Gregory A. Heckman | 108,512,694 | 753,346 | 115,348 | 6,269,823 |

| 5e. | Bernardo Hees | 108,390,957 | 813,106 | 177,325 | 6,269,823 |

| 5f. | Michael Kobori | 108,416,498 | 869,559 | 95,331 | 6,269,823 |

| 5g. | Monica McGurk | 107,936,421 | 1,306,725 | 138,242 | 6,269,823 |

| | | | | | | | | | | | | | | | | |

| 5h. | Kenneth Simril | 108,217,690 | 985,187 | 178,511 | 6,269,823 |

| 5i. | Henry (Jay) Winship | 107,674,974 | 1,528,687 | 177,727 | 6,269,823 |

| 5j. | Mark N. Zenuk | 107,197,526 | 2,056,422 | 127,440 | 6,269,823 |

The shareholders elected the following 4 individuals listed below as directors, each for a term extending until completion of the 2025 annual general meeting, subject to and contingent upon the closing of the acquisition of Viterra Limited, as further described in the Company's 2024 Proxy statement. The tabulation of votes with respect to the election of the directors below was as follows:

| | | | | | | | | | | | | | | | | |

| Nominee | Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 5k. | Adrian Isman | 109,092,803 | 79,826 | 208,759 | 6,269,823 |

| 5l. | Anne Jensen | 109,090,587 | 83,645 | 207,156 | 6,269,823 |

| 5m. | Christopher Mahoney | 109,092,596 | 79,369 | 209,423 | 6,269,823 |

| 5n. | Markus Walt | 109,105,453 | 130,318 | 145,617 | 6,269,823 |

6. The shareholders reelected Mark Zenuk as the Chair of the Board. The tabulation of votes with respect to the reelection of the Chair of the Board was as follows:

| | | | | | | | | | | |

| Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 108,263,590 | 976,526 | 141,272 | 6,269,823 |

7. The shareholders reelected each of the members of the Human Resources and Compensation Committee. The tabulation of votes with respect to the reelection of the members of the Human Resources and Compensation Committee was as follows:

| | | | | | | | | | | | | | | | | |

| Nominee | Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 7a. | Bernardo Hees | 108,572,572 | 617,763 | 191,053 | 6,269,823 |

| 7b. | Kenneth Simril | 108,580,399 | 609,050 | 191,939 | 6,269,823 |

| 7c. | Henry “Jay” Winship | 107,803,638 | 1,386,604 | 191,146 | 6,269,823 |

8. The shareholders approved the 2024 Long-Term Incentive Plan. The tabulation of votes with respect to this matter was as follows:

| | | | | | | | | | | |

| Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 106,639,164 | 2,620,701 | 121,523 | 6,269,823 |

9. The shareholders passed an advisory vote to approve the Named Executive Officers' compensation under U.S. securities law requirements. The tabulation of votes with respect to this matter was as follows:

| | | | | | | | | | | |

| Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 105,647,812 | 3,591,495 | 142,081 | 6,269,823 |

10a. The shareholders approved the maximum aggregate compensation of the Board for the period between the 2024 annual general meeting and the 2025 annual general meeting. The tabulation of votes with respect to this matter was as follows:

| | | | | | | | | | | |

| Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 108,748,937 | 484,100 | 148,351 | 6,269,823 |

10b. The shareholders approved the maximum aggregate compensation of the Executive Management Team for the fiscal year 2025. The tabulation of votes with respect to this matter was as follows:

| | | | | | | | | | | |

| Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 107,151,167 | 2,076,301 | 153,920 | 6,269,823 |

10c. The shareholders passed an advisory vote on the Swiss Compensation Report. The tabulation of votes with respect to this matter was as follows:

| | | | | | | | | | | |

| Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 105,641,316 | 3,559,140 | 180,932 | 6,269,823 |

11. The shareholders passed an advisory vote on the Swiss Statutory Non-Financial Matters Report. The tabulation of votes with respect to this matter was as follows:

| | | | | | | | | | | |

| Votes For | Votes Against | Abstentions | Broker Non-Votes |

| 106,988,498 | 1,937,309 | 455,581 | 6,269,823 |

12. The shareholders elected the Swiss Statutory Independent Voting Representative. The tabulation of votes with respect to this matter was as follows:

| | | | | | | | | | | | | | | | | |

| Votes For | | Votes Against | | Abstentions | |

| 115,336,767 | | 72,570 | | 241,874 | |

13. The shareholders reelected the independent auditor for U.S. securities law purposes and the statutory auditor for Swiss law purposes. The tabulation of votes with respect to this matter was as follows:

| | | | | | | | | | | | | | | | | |

| Votes For | | Votes Against | | Abstentions | |

| 108,129,589 | | 7,360,004 | | 161,618 | |

Item 9.01 - Financial Statements and Exhibits

(d): Exhibits.

| | | | | | | | |

| Exhibit No. | | Description |

| | Bunge 2024 Long-Term Incentive Plan |

104 | | Cover Page Interactive Data File (embedded within the Inline XBRL document) |

SIGNATURE

Pursuant to the requirements of the Securities Exchange Act of 1934, as amended, the Registrant has duly caused this report to be signed on its behalf by the undersigned hereunto duly authorized.

Date: May 16, 2024

| | | | | |

| BUNGE GLOBAL SA |

| |

By: | /s/ Lisa Ware-Alexander |

Name: | Lisa Ware-Alexander |

Title: | Secretary |

BUNGE 2024 LONG-TERM INCENTIVE PLAN

Effective May 15, 2024

Article 1. Establishment, Purpose and Duration

1.1. Establishment of the Plan. Bunge Global SA hereby establishes the Bunge 2024 Long-Term Incentive Plan (the "Plan"). Except as otherwise indicated, capitalized terms are defined in Article 16 below.

1.2. Purposes of the Plan. The purposes of the Plan are to (i) attract, retain and motivate key employees, consultants, and independent contractors; (ii) compensate them for their contributions to the growth and profitability of the Company; (iii) to encourage ownership of Common Stock in order to align their interests with those of shareholders; and (iv) promote the sustained long-term performance of the Company and the creation of shareholder value. The Plan seeks to achieve these purposes by providing for discretionary long term incentive Awards in the form of Options, Restricted Stock Units, SARs, Performance Units, and other stock or cash awards.

1.3. Prior Plan. The Plan replaces the Bunge 2016 Equity Incentive Plan (the “Prior Plan”). No Awards will be granted under the Prior Plan on or after the Effective Date, but the Prior Plan will remain in effect with respect to outstanding awards granted prior to the Effective Date.

1.4. Duration of the Plan. The Plan shall be effective on the Effective Date. The Plan shall terminate on the day before the tenth anniversary of the Plan and may be terminated earlier pursuant to Article 12. Any Awards that are outstanding upon termination of the Plan shall remain in force and effect in accordance with the terms of the Plan and any applicable Award Agreement.

Article 2. Administration

2.1. The Committee. The Plan shall be administered by the Committee. The Committee shall be comprised solely of Directors who are: (a) "non-employee directors" as contemplated by Rule 16b-3 under the Exchange Act; and (b) "independent directors" as contemplated by Section 303A.02 of the New York Stock Exchange Listed Company Manual.

2.2. Authority of the Committee. Subject to the terms and conditions of the Plan, the Committee shall have full power and discretionary authority to:

(a) designate the Participants;

(b) determine the size and types of Awards;

(c) approve forms of Award Agreements for use under the Plan;

(d) determine the terms and conditions of each Award, including without limitation, and to the extent applicable, the Exercise Price, the Exercise Period, vesting conditions, Performance Goals, Performance Periods, any vesting acceleration, waiver of forfeiture restrictions, and any other term or condition regarding any Award or its related Shares (including subjecting the Award or its related Shares to compliance with restrictive covenants), in each case, subject to the limitations of Section 9.5;

(e) construe and interpret the Plan and any agreement or instrument entered into pursuant to the Plan;

(f) establish, amend or waive rules and regulations for the Plan's administration;

(g) amend the terms and conditions of any outstanding Award and any instrument or agreement relating to an Award (subject to the provisions of Article 12);

(h) delay issuance of Shares or suspend a Participant's right to exercise an Award as deemed necessary to comply with applicable laws;

(i) determine the duration and purposes of leaves of absence that may be granted to a Participant without constituting termination of his or her employment or service for Plan purposes;

(j) authorize any person to execute, on behalf of the Company, any agreement or instrument required to carry out the Plan purposes;

(k) correct any defect, supply any omission, or reconcile any inconsistency in the Plan, any Award, or any instrument or agreement relating to an Award, in the manner and to the extent it shall deem desirable to carry the Plan into effect;

(l) adopt such plans or subplans as may be deemed necessary or appropriate to comply with the laws of other countries, allow for tax-preferred treatment of Awards or otherwise provide for the participation by Participants who reside outside of the U.S.; and

(m) make any and all determinations which it determines to be necessary or advisable for the Plan administration.

2.3. Delegation. Except to the extent prohibited by applicable law or the applicable rules and regulations of any securities exchange or inter-dealer quotation system on which the Shares are listed or traded, the Committee may allocate all or any portion of its responsibilities and powers to any one or more of its members and may delegate all or any part of its responsibilities and powers to any person or persons selected by it. Any such allocation or delegation may be revoked by the Committee at any time. Without limiting the generality of the foregoing, the Committee may delegate to one or more officers of the Company or any Subsidiary the authority to act on behalf of the Committee with respect to any matter, right, obligation, or election which is the responsibility of or which is allocated to the Committee herein, and which may be so delegated as a matter of law, except for grants of Awards to persons who are subject to Section 16 of the Exchange Act.

2.4. Decisions Binding. All determinations and decisions made by the Committee pursuant to the Plan and all related orders or resolutions of the Board shall be final, conclusive and binding on all persons interested in the Plan or an Award. The Committee shall consider such factors as it deems relevant to making its decisions, determinations and interpretations including, without limitation, the recommendations or advice of any Director, officer or employee of the Company or a Subsidiary and such agents, attorneys, consultants and accountants as it may select. The Committee's determinations under the Plan need not be the same for all persons. A Participant or other holder of an Award may contest a decision or action by the Committee with respect to such person or Award and only on the grounds that such decision or action was arbitrary or capricious or was unlawful.

2.5. Indemnification. No member of the Committee, the Board or any person to whom authority was delegated in accordance with Section 2.3 above (each such person, an "Indemnifiable Person") shall be liable for any action taken or omitted to be taken or any determination made with respect to the Plan or any Award (unless constituting fraud or a willful criminal act or omission). Each Indemnifiable Person shall be indemnified and held harmless by the Company against and from any loss, cost, liability, or expense (including attorneys' fees) that may be imposed upon or incurred by such Indemnifiable Person in the manner provided in the Company's articles of association as may be amended from time to time or in any indemnification agreement of the Company with such Indemnifiable Person. In the performance of their responsibilities with respect to the Plan, such individuals shall be entitled to rely upon information and advice furnished by the Company's officers, agents, attorneys, consultants and accountants and any other party deemed necessary or appropriate, and no such individual shall be liable for any action taken or not taken in reliance upon any such advice. The foregoing right of indemnification shall not be exclusive of any other rights of indemnification to which an Indemnifiable Person may be entitled, or any power that the Company may have to indemnify them or hold them harmless.

2.6. Construction and Interpretation. Unless otherwise expressly provided in the Plan, all designations, determinations, interpretations, and other decisions under or with respect to the Plan, any Award or any Award Agreement shall be within the sole and complete discretion of the Committee.

2.7. Action by the Board. Notwithstanding anything in the Plan to the contrary, any authority or responsibility, which, under the terms of the Plan, may be exercised by the Committee may alternatively be exercised by the Board.

Article 3. Shares Subject to the Plan

3.1. Number of Shares. Subject to adjustments as provided in Section 3.3 below, the maximum aggregate number of Shares that may be issued for all purposes under this Plan shall be 5.0 million Shares. Shares issued under the Plan may consist, in whole or in part, of Shares issued out of the capital band or the conditional share capital of the Company, Shares held by the Company or any of its subsidiaries in treasury or Shares reacquired by the Company in any manner, or a combination thereof.

3.2. Share Counting. The number of Shares remaining available for issuance shall be reduced by the number of Shares subject to outstanding Awards and, for Awards that are not denominated by Shares, by the number of Shares actually delivered upon settlement or payment of the Award. Notwithstanding anything in the Plan to the contrary, Shares subject to an Award will again be available for grant and issuance pursuant to the Plan to the extent: (a) the relevant Awards terminate by expiration, forfeiture, cancellation, or otherwise without the issuance of Shares, (b) the relevant Awards are settled in cash in lieu of Shares, (c) the relevant Awards are surrendered pursuant to an Exchange Program, or (d) such Shares are withheld by the Company to cover taxes incurred in connection with other stock-settled Awards. Shares subject to an Award may not again be made available for grant and issuance pursuant to the Plan if such Shares are: (x) subject to an Option or a stock-settled SAR and were not issued upon the net settlement or net exercise of such Option or SAR, (y) delivered to, or withheld by, the Company to pay the Exercise Price or the withholding taxes due with respect to an Option or SAR, or (z) repurchased on the open market with the proceeds of an Option exercise. In addition, to the extent not prohibited by applicable law, rule or regulation, Shares delivered or deliverable in connection with any Substitute Award shall not reduce the number of Shares authorized for grant pursuant to Section 3.1 above.

3.3. Adjustments in Authorized Shares and Awards. In the event of any merger, amalgamation, reorganization, consolidation, recapitalization, stock dividend, bonus issues, extraordinary cash dividend, stock split, reverse stock split, share consolidation or subdivision, spin-off, split-off or similar transaction or other change in corporate structure affecting the Shares, such adjustments and other substitutions shall be made to the Plan and to Awards as the Committee deems equitable or appropriate, including, without limitation, such adjustments in the aggregate number, class and kind of securities that may be delivered, in the aggregate or to any Participant, in the number, class, kind and option or Exercise Price of securities subject to outstanding Awards as the Committee may determine to be appropriate; provided, however, that the number of Shares subject to any Award shall always be a whole number and further provided that in no event may any change be made to an ISO which would constitute a modification within the meaning of Section 424(h)(3) of the Code. Moreover, notwithstanding anything in the Plan to the contrary, an adjustment to an Award may not be made in a manner that would result in adverse tax consequences under Section 409A.

Article 4. Eligibility

The Committee may select any Employee or Consultant to receive an Award; provided, however, that ISOs shall only be granted to Employees in accordance with Section 422 of the Code.

Article 5. Restricted Stock Units

5.1. Award of Restricted Stock Units. The Committee may grant Restricted Stock Units to an Employee or Consultant with such terms and provisions that the Committee shall determine.

5.2. Terms of Restricted Stock Units. Each Award of RSUs shall be subject to an Award Agreement that shall set forth (a) the number or a formula for determining the number of Shares subject to the Award, (b) the terms and conditions regarding the grant, vesting and forfeiture of the RSUs and (c) such other terms and conditions as may be appropriate.

5.3. Vesting Conditions. The Committee shall determine the vesting schedule for each Award of RSUs. Vesting shall occur, in full or in installments, upon satisfaction of the terms and conditions specified in the Award Agreement. The Committee shall have the right to make the vesting of RSUs subject to the continued employment or service of a Participant, passage of time or such performance criteria as deemed appropriate by the Committee, which criteria may be based on financial performance and personal performance evaluations.

5.4. Settlement of Restricted Stock Units. Earned RSUs shall be settled in a lump sum or in installments on or after the date(s) set forth in the Award Agreement. The Committee may settle earned RSUs in cash, Shares, or a combination of both. Distribution may occur or commence when the vesting conditions applicable to a RSU have been satisfied or, if the Committee so provides in an Award Agreement, it may be deferred in accordance with applicable law, to a later date. The Committee may also permit a Participant to defer payment of Shares related to a RSU provided that the terms of the RSU and any deferral satisfy the requirements of applicable law and the deferral is pursuant to a deferred compensation plan offered by the Company or a Subsidiary.

Article 6. Performance Units

6.1. Award of Performance Units. The Committee may grant Performance Units to an Employee or Consultant with such terms and provisions that the Committee shall determine.

6.2. Terms of Performance Units. Each Award of Performance Units shall be subject to an Award Agreement that shall set forth (a) the number of Performance Units granted or a formula for determining the number of Performance Units subject to the Award, (b) the initial value (if applicable) of the Performance Units, (c) the Performance Goals and level of attainment that shall determine the number of Performance Units to be paid out, (d) such terms and conditions regarding the grant, vesting and forfeiture of the Performance Units and (e) such other terms and conditions as may be appropriate.

6.3. Earning of Performance Units. After completion of an applicable Performance Period, the holder of Performance Units shall be entitled to receive a payout with respect to the Performance Units earned by the Participant over the Performance Period. Payment shall be determined by the Committee based on the extent to which the Performance Goals have been achieved and together with the satisfaction of any other terms and conditions set forth in the Plan and the applicable Award Agreement. No payment shall be made with respect to a Performance Unit prior to certification by the Committee that the Performance Goals have been achieved.

6.4. Settlement of Performance Units. Earned Performance Units shall be settled in a lump sum or in installments after the date(s) set forth in the Award Agreement. The Committee may settle earned Performance Units in cash or in Shares (or in a combination thereof), which have an aggregate Fair Market Value equal to the value of the earned Performance Units. Distribution may occur or commence after completion of the applicable Performance Period and the satisfaction of any applicable vesting conditions or, if the Committee so provides in an Award Agreement, it may be deferred, in accordance with applicable law, to a later date. The Committee may also permit a Participant to defer settlement of Shares related to a Performance Unit to a date or dates after the Performance Unit is earned provided that the terms of the Performance Unit and any deferral satisfy the requirements of applicable law and the deferral is pursuant to a deferred compensation plan offered by the Company or a Subsidiary.

Article 7. Stock Options and Stock Appreciation Rights

7.1. Award of Options and SARs. The Committee may grant Options, SARs or both, to an Employee or Consultant with such terms and provisions that the Committee shall determine.

7.2. Terms of Options and SARs. Each Award of Options or SARs shall be subject to an Award Agreement that shall set forth (a) the term or duration of the Options or SARs, (b) the number of Shares subject to the Options or SARs, (c) the Exercise Price, (d) the Exercise Period and (e) such other terms and conditions as may be appropriate. The Committee may grant Options in the form of ISOs, NQSOs or a combination thereof. Each Award Agreement also shall specify whether the Options are intended to be an ISO or a NQSO.

7.3. Duration of Options and SARs. Each Option or SAR shall expire at such time as the Committee shall determine at the time the Award is granted; provided, however, that no Option or SAR shall be exercisable later than the tenth (10th) anniversary of its date of grant.

7.4. Exercise of and Payment for Options and SARs. Options and SARs shall be exercisable at such times and be subject to such terms and conditions as the Committee shall approve, which need not be the same for each Award or for each Participant. Options and SARs shall be exercised by the delivery of a written notice of exercise to

the Company or its designated agent, setting forth the number of Shares to be exercised with respect to the Options or SARs, and, in the case of Options, accompanied by full payment for the Shares.

The Exercise Price upon exercise of any Option shall be payable to the Company in full either: (a) in cash or its equivalent, (b) by tendering, either by actual or constructive delivery, previously acquired Shares having an aggregate Fair Market Value at the time of exercise equal to the Exercise Price, (c) by net Share settlement or similar procedure involving the cancellation of a portion of the Option representing Shares with an aggregate Fair Market Value at the time of exercise equal to the Exercise Price or (d) by any combination thereof. To the extent not prohibited by Section 402 of the Sarbanes-Oxley Act of 2002, the Committee also may allow cashless exercise as permitted under Federal Reserve Board's Regulation T, subject to applicable securities law restrictions, or by any other means which the Committee determines to be consistent with the Plan's purpose and applicable law.

As soon as practicable after receipt of a written notification of exercise of an Option and provisions for full payment for an Option, the Company shall issue to the Participant an appropriate number of Shares based upon the number of Shares purchased under the Option.

Upon exercise of a SAR, a Participant shall be entitled to receive payment from the Company in an amount equal to the product of: (a) the excess of (i) the Fair Market Value of a Share on the date of exercise over (ii) the Exercise Price of the SAR, multiplied by (b) the number of Shares with respect to which the SAR is exercised. At the discretion of the Committee, payment upon the exercise of a SAR may be in cash, in Shares of equivalent value or in a combination thereof. The Committee's determination regarding the form of SAR payout shall be set forth in an applicable Award Agreement.

7.5. Automatic Exercise. The Committee may provide that, in the event that (i) an Option or SAR is not exercised or settled by the last day of the Exercise Period, (ii) the Participant is legally precluded from otherwise exercising such Option or SAR before the last day of the Exercise Period due to legal restrictions or Company policy (including policies on trading in Shares), and (iii) the Exercise Price of such Option or SAR is below the Fair Market Value of a Share on the last day of the Exercise Period, as determined by the Committee, then the Option or SAR may be deemed exercised on such date, with no action required on the part of the Participant, with a spread equal to the Fair Market Value of the Shares subject to the Award on such date minus the Exercise Price for those Shares. The resulting proceeds net of any required tax withholding and any applicable costs shall be paid to the Participant or the Participant's legal representative.

7.6. Restrictions on Repricing, Repurchases, and Discounts. Other than in connection with a transaction described in Section 3.3, without shareholder approval, (i) the Exercise Price of an Option or SAR may not be reduced, directly or indirectly, after the grant of the Award; (ii) an Option or SAR may not be cancelled in exchange for cash, other Awards, or Options or SARs with an Exercise Price that is less than the Exercise Price of the original Option or SAR; and (iii) the Company may not repurchase an Option or SAR for value (in cash, substitutions, cash buyouts, or otherwise) at any time when the Exercise Price of a Stock Option or SAR is above the Fair Market Value of a Share. In no event shall the Exercise Price of an Option or the grant price per Share of a SAR be less than 100% of the Fair Market Value of a Share on the date of grant; provided , however that the Exercise Price of a Substitute Award granted as an Option shall be determined in accordance with Section 409A and may be less than 100% of the Fair Market Value.

7.7 Incentive Stock Options. The Exercise Price of an ISO shall be fixed by the Committee at the time of grant or shall be determined by a method specified by the Committee at the time of grant, but in no event shall the Exercise Price be less than the minimum Exercise Price specified in Section 7.6. No ISO may be issued to any individual who, at the time the ISO is granted, owns stock possessing more than 10% of the total combined voting power of all classes of stock of the Company or any of its Subsidiaries, unless (i) the Exercise Price determined as of the date of grant is at least 110% of the Fair Market Value on the date of grant of the Shares subject to such ISO and (ii) the ISO is not exercisable more than five years from the date of grant thereof. No Participant shall be granted any ISO which would result in such Participant receiving a grant of ISO that would have an aggregate Fair Market Value in excess of $100,000, determined as of the time of grant, that would be exercisable for the first time by such Participant during any calendar year. Any grants in excess of this limit shall be treated as NQSOs. No ISO may be granted under the Plan after the tenth anniversary of the Effective Date. The terms of any ISO granted under the Plan shall comply in all respects with the provisions of Section 422 of the Code, or any successor provision thereto, as amended from time to time.

Article 8. Other Awards

Subject to limitations under applicable law, the Committee may grant such other Awards to Employees and Consultants that may be denominated or payable in, valued in whole or in part by reference to, or otherwise based on, or related to, Shares as deemed by the Committee to be consistent with the purposes of the Plan. The Committee may also grant Shares as a bonus, or may grant other Awards in lieu of obligations of the Company or a Subsidiary to pay cash or deliver other property under the Plan or under other plans or compensatory arrangements. The terms and conditions applicable to such other Awards shall be determined from time to time by the Committee and set forth in an applicable Award Agreement.

Article 9. General Provisions Applicable to Awards

9.1. Limits on Awards. Subject to any adjustments described in Section 3.3 the following limits shall apply to Awards:

(a) No more than an aggregate of 1,000,000 Shares may be issued under ISOs;

(b) The maximum number of Shares subject to RSUs that may be granted to a Participant during any one calendar year is 1,000,000;

(c) The maximum number of Shares subject to Performance Units that may be granted to a Participant during any one calendar year is 1,000,000;

(d) The maximum number of Shares subject to either Options or SARs that may be granted to a Participant during any one calendar year is 1,000,000;

(e) The maximum amount of cash-denominated Other Awards that may be granted to a Participant during any one calendar year is $2,500,000; and

(f) The maximum number of Shares subject to share-denominated Other Awards that may be granted to a Participant during any one calendar year is 1,000,000.

To the extent not prohibited by applicable laws, rules and regulations, any Shares underlying Substitute Awards shall not be counted against the number of Shares remaining for issuance and shall not be subject to the individual limits contained in Section 3.1 or this Section 9.1.

9.2 Restrictions on Transfers of Awards. Except as may be provided by the Committee, no Award and no right under any such Award, shall be assignable, alienable, saleable, or transferable by a Participant otherwise than by will or by the laws of descent and distribution or, except in the case of an ISO, pursuant to a domestic relations order, as the case may be; provided , however , that the Committee may, subject to applicable laws, rules and regulations and such terms and conditions as it shall specify, permit the transfer of an Award, other than an ISO, for no consideration to a permitted transferee. Each Award, and each right under any Award, shall be exercisable, during the Participant's lifetime, only by the Participant or, if permissible under applicable law, by the Participant's guardian or legal representative. No Award and no right under any such Award, may be pledged, alienated, attached, or otherwise encumbered, and any purported pledge, alienation, attachment, or encumbrance thereof shall be void and unenforceable against the Company or any Subsidiary.

9.3. Restrictions on Transfers of Shares. The Committee may impose such restrictions on any Shares acquired pursuant to an Award as it may deem advisable, including, without limitation, restrictions to comply with applicable Federal securities laws, with the requirements of any stock exchange upon which such Shares are then listed and with any blue sky or state securities laws applicable to such Shares.

9.4. Additional Restrictions on Awards and Shares. Either at the time an Award is granted or by subsequent action, the Committee may, but need not, impose such restrictions, conditions or limitations as it determines appropriate on the Award, any Shares issued under an Award, or both, including, without limitation, (a) restrictions under an insider trading policy, (b) any compensation recovery policy or policies established by the Company as such policy or policies may be amended from time to time, (c) share retention guidelines, minimum

holding requirements and other restrictions designed to delay or coordinate the timing and manner of sales, (d) restrictions as to the use of a specified brokerage firm for receipt, resales or other transfers of such Shares, (e) restrictions relating to a Participant's activities following termination of employment or service, including but not limited to, competition against the Company, disclosure of Company confidential information, and solicitation of Company employees and/or customers, and (f) other policies that may be implemented by the Board from time to time.

9.5. Minimum Vesting Period. All Awards shall have a vesting period of not less than one year from date of grant, including those Awards that are subject to Performance Goals or other performance-based objectives; provided, however, that Awards that result in the issuance of an aggregate of up to 5% of the Shares available pursuant to Section 3.1 may be granted to any one or more Participants without respect to such minimum vesting provisions. Notwithstanding anything in this Plan to the contrary, Substitute Awards shall not be subject to the minimum vesting provisions of this Section 9.5.

9.6. Shareholder Rights; Dividend Equivalents. Except as provided in the Plan or an Award Agreement, no Participant shall have any Shares subject to an Award and any of the rights of a shareholder unless and until such Participant has satisfied all requirements for exercise or vesting of the Award pursuant to its terms, Shares have actually been issued, restrictions imposed on the Shares, if any, have been removed, and the Shares are entered upon the records of the duly authorized transfer agent of the Company. The recipient of a Award (other than Options and SARs) may be entitled to receive Dividend Equivalents, and the Committee may provide that such amounts (if any) shall be deemed to have been reinvested in additional Shares or otherwise reinvested and subject to vesting and forfeiture to the same extent as the underlying Award; provided, however, that Dividend Equivalents shall only become payable if and to the extent the underlying Award vests, regardless of whether or not vesting is contingent upon continued employment, the achievement of Performance Goals, or both.

9.7. Termination of Employment or Service. Each Award Agreement shall set forth the terms relating to the treatment of an Award in the event of a Participant's termination of employment or service, including, without limitation, the extent to which the right to vest, exercise or receive payout of an Award may continue following termination of the Participant's employment or service with the Company and its Subsidiaries, including due to death or Disability, and any forfeiture provisions. Such provisions shall be determined by the Committee in its discretion, shall be included in the Award Agreement applicable to a Participant, need not be uniform among all Awards or among all Participants and may reflect distinctions based on the reasons for termination of employment or service.

9.8. Effect of Change in Status. The Committee shall have the discretion to determine the effect upon an Award, in the case of (i) any individual who is employed with, or engaged by, an entity that ceases to be a Subsidiary, (ii) any leave of absence approved by the Company or a Subsidiary, (iii) any change in the Participant's status from an Employee to a Consultant, or vice versa, and (iv) at the request of the Company or a Subsidiary, any Participant who becomes employed by any partnership, joint venture, corporation or other entity not meeting the requirements of a Subsidiary.

Article 10. Change of Control

Unless specifically prohibited by the Plan or unless the Committee provides otherwise prior to the Change of Control, upon the occurrence of a Change of Control and a termination of a Participant's employment or service with the Company or a Subsidiary without Cause on or before the occurrence of the two year anniversary of the occurrence of a Change of Control:

(a) Any restrictions imposed on RSUs shall be deemed to have expired;

(b) With respect to all outstanding Awards of Performance Units and other performance-based Awards, the Committee (i) shall determine the greater of (x) the payout at the target number of Performance Units granted for the entire Performance Period and (y) the payout based upon the actual performance level attained as of the last day of the calendar quarter immediately prior to the date of the Participant's termination without Cause, in either case, after giving effect to the accumulation of Dividend Equivalents, and (ii) shall pay to the Participant the greater of such amounts, prorated based upon the number of complete and partial calendar months within the

Performance Period which have elapsed as of the date of the Participant's termination without Cause. Payment shall be made in cash or in shares, as determined by the Committee;

(c) Any and all outstanding and unvested Options and SARs shall become immediately exercisable; and

(d) Any restrictions imposed on any and all outstanding and unvested Other Awards shall be deemed to have expired.

Article 11. Corporate Transactions.

11.1. Assumption or Replacement of Awards by Successor. In the event of a Change of Control, any or all outstanding Awards may be assumed or replaced by the successor entity, which assumption or replacement shall be binding on all Participants. In the alternative, the successor entity may substitute equivalent Awards or provide substantially similar consideration to Participants as was provided to shareholders of the Company (after taking into account the existing provisions of the Awards). In the event such successor entity refuses to assume, replace or substitute Awards, as provided above, pursuant to a Change of Control, then notwithstanding any other provision in this Plan to the contrary, such Awards shall have their vesting accelerate as to all Shares subject to such Awards immediately prior to the Change of Control unless otherwise determined by the Board and then such Awards will terminate. In addition, in the event such successor entity refuses to assume, replace or substitute Awards, as provided above, the Committee will notify Participants in writing that such Awards will be exercisable for a period of time determined by the Committee in its discretion, and such Awards will terminate upon the expiration of such period. Awards need not be treated similarly in a Change of Control. Except as provided in Article 10 and in this Section 11.1, the vesting, payment, purchase or distribution of an Award may not be accelerated by reason of a Change of Control.

11.2. Assumption of Awards by the Company. The Company, from time to time, also may substitute or assume outstanding awards granted by another company, whether in connection with an acquisition of such other company or otherwise, by either; (a) granting a Substitute Award; or (b) assuming such award as if it had been granted under this Plan if the terms of such assumed award could be applied to an Award granted under this Plan.

Article 12. Amendment, Modification and Termination

12.1. Amendment, Modification and Termination. The Board may, at any time and from time to time, alter, amend, suspend or terminate the Plan in whole or in part; provided, however, that no amendment which requires shareholder approval in order for the Plan to comply with Section 422 of the Code, Section 303A.08 of the New York Stock Exchange Listed Company Manual, or any other applicable law, regulation or rule, shall be effective unless such amendment shall be approved by the requisite vote of the shareholders.

12.2. Awards Previously Made. No termination, amendment or modification of the Plan shall adversely affect in any material way any outstanding Award, without the written consent of the Participant holding such Award unless such termination, modification or amendment is required by applicable law.

Article 13. Tax Withholding

The Company or a Subsidiary, as appropriate, may require any individual entitled to receive a payment of an Award to remit to the Company, prior to payment, an amount sufficient to satisfy any applicable tax withholding requirements. In the case of an Award payable in Shares, the Company or a Subsidiary, as appropriate, may permit or require a Participant to satisfy, in whole or in part, the obligation to remit taxes by directing the Company to withhold Shares that would otherwise be received by the individual, or may repurchase Shares that were issued to the Participant, to satisfy any applicable federal, state, local or foreign tax withholding requirements, including up to the maximum permissible statutory tax rate for the applicable tax jurisdiction, in accordance with applicable law and pursuant to any rules that the Company may establish from time to time. The Company may establish procedures to allow Participants to satisfy such withholding obligations through a net share settlement procedure or the withholding of Shares subject to the applicable Award. The Company or a Subsidiary, as appropriate, shall also have the right to deduct from all cash payments made to a Participant (whether or not the payment is made in connection with an Award) any applicable taxes required to be withheld with respect to payments under the Plan.

Article 14. General Provisions

14.1. Gender and Number. Except where otherwise indicated by the context, any masculine term used herein also shall be deemed gender-neutral (i.e., inclusive of all genders, gender identities or expressions of gender), the plural shall include the singular and the singular shall include the plural.

14.2. Headings and Severability. The headings of Articles and Sections herein are included solely for convenience of reference and shall not affect the meaning of any of the provisions of the Plan. In the event any Plan provision shall be held illegal or invalid for any reason, the illegality or invalidity shall not affect the remaining Plan provisions, and the Plan shall be construed and enforced as if the illegal or invalid provision had not been included.

14.3. Successors. All Company obligations with respect to Awards, shall be binding on any successor to the Company, whether the existence of such successor is the result of a direct or indirect purchase, merger, consolidation or otherwise, of all or substantially all of the business or assets of the Company.

14.4. No Right to Employment or Engagement. Nothing in the Plan shall interfere with or limit in any way the right of the Company to terminate any Participant's employment or engagement at any time, for any reason or no reason in the Company's discretion, nor confer upon any Participant any right to continue in the employ or service of the Company or any Subsidiary.

14.5. Participation. No Employee shall have the right to be selected to receive an Award, or, having been so selected, to be selected to receive a future Award.

14.6. Requirements of Law. The making of Awards and the issuance of Shares shall be subject to all applicable laws, rules and regulations, and to such approvals by any governmental agencies or national securities exchanges as may be required. The Company shall not be required to issue or deliver any certificates or make any book entries evidencing Shares pursuant to the exercise or vesting of any Award, unless and until the Board or the Committee has determined, with advice of counsel, that the issuance of such Shares is in compliance with all applicable laws, regulations of governmental authorities and, if applicable, the requirements of any exchange on which the Shares are listed or traded, and the Shares are covered by an effective registration statement or applicable exemption from registration. In addition to the terms and conditions provided in the Plan, the Board or the Committee may require that a holder make such reasonable covenants, agreements, and representations as the Board or the Committee deems advisable in order to comply with any such laws, regulations, or requirements.

Notwithstanding any other provision set forth in the Plan, if required by the then-current Section 16 of the Exchange Act, any "derivative security" or "equity security" offered pursuant to the Plan to any Insider may not be sold or transferred within the minimum time limits specified or required in such rule, except to the extent Rule 16b-3 exempts any such sale or transfer from the restrictions of Section 16 of the Exchange Act. The terms "equity security" and "derivative security" shall have the meanings ascribed to them in the then-current Rule 16a-1 under the Exchange Act.

14.7. Securities Law Compliance. With respect to Insiders, Plan transactions are intended to comply with all applicable conditions of the Federal securities laws. To the extent any Plan provision or action by the Committee fails to so comply, it shall be deemed null and void, to the extent permitted by law and deemed advisable by the Committee.

14.8. Governing Law. To the extent not preempted by Federal law, the Plan, the Award Agreements and all agreements thereunder, shall be construed in accordance with, and subject to, the laws of the State of Missouri applicable to contracts made and to be entirely performed in Missouri and wholly disregarding any choice of law provisions that might otherwise be contrary to this express intent.

14.9. Effect on Other Benefits. No payment pursuant to the Plan shall be taken into account in determining any benefits under any pension, retirement, savings, profit sharing, group insurance, welfare or other benefit plan of the Company or any affiliate except to the extent otherwise expressly provided in writing in such other plan or an agreement thereunder.

14.10. Unfunded Plan. The Plan is intended to be an unfunded plan for incentive compensation. With respect to any payments not yet made to a holder pursuant to an Award, nothing contained in the Plan or any Award Agreement shall give the holder any rights that are greater than those of a general creditor of the Company or any affiliate.

14.11. Recoupment.

(a) Notwithstanding anything in the Plan to the contrary, all Awards shall be subject to the Company’s Executive Compensation Recoupment Policy, to the extent applicable, and any other applicable clawback, recoupment or other similar policy that the Board or Committee may adopt at any time (each, a “Policy”), notwithstanding any provision of an employment agreement or other agreement to the contrary. All Awards shall be subject to potential cancellation, recoupment, rescission, payback or other action in accordance with the terms of such Policy. To the extent that the terms of this Plan and such Policy conflict, the terms of such Policy shall prevail.

(b) Unless otherwise set forth in the applicable Award Agreement, by accepting an Award under the Plan, the Participant thereby: (i) agrees to be bound by the terms and conditions of any confidentiality, nonsolicitation, noncompetition or invention assignment provisions in the applicable Award Agreement, (ii) acknowledges and agrees that the Company would have not granted such Award in the absence such terms and conditions, (iii) represents and warrants that the Participant will remain in full compliance with such terms and conditions, (iv) agrees to make or cause to be made any payments required pursuant to a Policy, (v) agrees that the Company may deduct from, and set-off against, any amounts owed to the Participant by the Company or any Subsidiary (including, without limitation, amounts owed as wages, bonuses, severance, or other fringe benefits) to the extent of the amount owed by the Participant to the Company pursuant to a Policy and (vi) agrees and consents to the Company’s application, implementation and enforcement of (A) any Policy established by the Company that may apply to the Participant and (B) any provisions of applicable law relating to cancellation, rescission, payback or recoupment of compensation, and expressly agrees that the Company and the Committee or Board may take such actions as are necessary to effectuate any Policy or applicable law without further consent or action being required by the Participant.

(c) An Award Agreement evidencing an Award under the Plan as to which this Section 14.11 applies shall provide the applicable Participant with a reasonable period of time following the date of such Participant’s receipt of such Award Agreement to refuse acceptance of such Award if the Participant disagrees with any of the terms and conditions of this Section 14.11. If a Participant refuses acceptance of an Award, the Award will be immediately forfeited, the Participant will have no further rights with respect to such Award, and the shares of Common Stock underlying such Award shall again be available for grant under the Plan.

14.12. Award Agreement. In the event of any conflict or inconsistency between the Plan and any Award Agreement, the Plan shall govern and the Award Agreement shall be interpreted to minimize or eliminate any such conflict or inconsistency.

Article 15. Compliance with Section 409A of the Code.

The parties intend that Plan payments and benefits comply with Section 409A to the extent it applies or an exemption therefrom, and, accordingly, to the maximum extent permitted, the Plan shall be interpreted and be administered to be in compliance therewith. Any payments described in the Plan that are due within the "short-term deferral period" as defined in Section 409A shall be paid prior to the 15th day of the third month of the calendar year immediately following the calendar year in which any applicable restrictions lapse and shall not be treated as deferred compensation unless applicable law requires otherwise. Notwithstanding anything to the contrary in the Plan: (i) no payment or distribution under this Plan that constitutes an item of deferred compensation under Section 409A and becomes payable by reason of a Participant's termination of employment or service with the Company will be made to such Participant until such Participant's termination of employment or service constitutes a "separation from service" under Section 409A; and (ii) to the extent required in order to comply with Section 409A, amounts that would otherwise be payable and benefits that would otherwise be provided during the six (6) month period immediately following the Participant's termination of employment shall instead be paid on the first business day after the date that is six (6) months following the Participant's separation from service (or upon the Participant's death, if earlier). In addition, for Plan purposes, each amount to be paid or benefit to be provided to the Participant pursuant to the Plan, which constitute deferred compensation subject to Section 409A, shall be construed as a

separate identified payment for purposes of Section 409A. For any Plan payment that constitutes "non-qualified deferred compensation" under Section 409A, to the extent required to comply with Section 409A, a Change of Control shall be deemed to have occurred with respect to such payment only if a change in the ownership or effective control of the Company or a change in ownership of a substantial portion of the assets of the Company shall also be deemed to have occurred under Section 409A. The Company makes no representation that any or all of the payments or benefits described in this Plan will be exempt from or comply with Section 409A and makes no undertaking to preclude Section 409A from applying to any such payment. A Participant shall be solely responsible for the payment of any taxes and penalties incurred under Section 409A.

Article 16. Definitions

Whenever used in the Plan, the following terms shall have the meanings set forth below and, when such meaning is intended, the initial letter of the word is capitalized:

"Approved Member" shall mean the individuals who, as of the Effective Date, constitute the Board and subsequently elected members of the Board whose election is approved or recommended by at least a majority of such current members or their successors whose election was so approved or recommended (other than any subsequently elected members whose initial assumption of office occurs as a result of an actual or threatened election contest with respect to the election or removal of directors or other actual or threatened solicitation of proxies or consents by or on behalf of a Person other than the Board).

"Award" shall mean, individually or collectively, an Award of RSUs, Performance Units, NQSOs, ISOs, SARs or any other type of Award permitted under Article 8.

"Award Agreement" shall mean any written or electronic agreement or document evidencing any Award granted by the Committee, which may, but need not, be signed or acknowledged by the Company or a Participant as determined by the Committee. Award Agreements shall, in the discretion of the Committee, contain such terms and conditions that are not inconsistent with the terms of the Plan.

"Board" shall mean the Board of Directors of the Company.

"Cause" shall mean (unless otherwise expressly provided in the applicable Award Agreement, or another applicable contract with the Participant that defines such term for purposes of determining the effect that a "for cause" termination has on the Participant's Awards) the termination of a Participant's employment or service with the Company in connection with:

(a) any willful and continued failure or refusal of a Participant to substantially perform the duties required of the Participant as an employee of the Company (other than any such failure resulting from the Participant’s Disability or incapacity due to bodily injury or physical or mental illness), except that the Company’s failure to achieve performance or strategic targets, goals or initiatives cannot be the sole factor in determining the Participant’s failure to substantially perform Participant’s duties;

(b) a Participant's conviction of, or a plea of nolo contendere to, a felony or misdemeanor involving moral turpitude (other than any traffic-related offense); or

(c) any willful and material violation by the Participant of any law or material written policy of the Company that could reasonably be expected to have a substantial adverse impact on the business of the Company or any of its Subsidiaries;

provided that in all events the Company must provide the Participant written notice of the alleged existence of Cause within 45 days following the event or condition allegedly constituting Cause and Cause will only be deemed to exist if the relevant event or condition is not substantially cured (if susceptible of cure) within 30 days following the Participant’s receipt of such notice, or in the event such Cause is not susceptible to cure within such 30-day period, the Company reasonably determines that the Participant has not taken all reasonable steps within such 30-day period to cure such Cause as promptly as practicable thereafter. No act or failure to act on the Participant’s part will be considered “willful” unless it is done or omitted by the Participant in bad faith or without reasonable belief that the Participant’s action or omission was in, and not opposed to, the best interests of the Company. Any

determinations made by the Committee under the Plan with respect to the existence of Cause shall be subject to de novo review in the event of any legal proceeding between the Company or any Subsidiary and Participant and any determinations made by the Committee under the Plan with respect to the existence of Cause shall be made by the Committee reasonably and in good faith. A termination for Cause shall be deemed to occur (subject to reinstatement upon a contrary final determination by the Committee) on the later of (i) the date on which the Company or any affiliate first gives written notice to the Participant of a finding of termination for Cause or (ii) the expiration of any applicable cure period during which the Participant fails to remedy the circumstances triggering Cause.

"Change of Control" shall mean the occurrence of any of the following events.

(a) the acquisition by any Person of beneficial ownership (within the meaning of Rule 13d-3 promulgated under the Exchange Act and the applicable rulings and regulations thereunder) of 35% or more of the Common Stock;

(b) the consummation after approval by the shareholders of the Company of either (i) a plan of complete liquidation or dissolution of the Company or (ii) a merger, amalgamation or consolidation of the Company with any other corporation, the issuance of voting securities of the Company in connection with a merger, amalgamation or consolidation of the Company, a sale or other disposition of all or substantially all of the assets of the Company or the acquisition of assets of another corporation (each, a "Business Combination"), unless, in each case of a Business Combination, immediately following such Business Combination, all or substantially all of the individuals and entities who were the beneficial owners of the Common Stock issued and outstanding immediately prior to such Business Combination beneficially own, directly or indirectly, more than 50% of the then outstanding shares of common stock and more than 50% of the combined voting power of the then outstanding voting securities entitled to vote generally in the election of directors, as the case may be, of the entity resulting from such Business Combination (including, without limitation, an entity which as a result of such transaction owns the Company or all or substantially all of the Company's assets either directly or through one or more subsidiaries) in substantially the same proportions as their ownership, immediately prior to such Business Combination, of the Common Stock; or

(c) the failure for any reason of the Approved Members to constitute at least a majority of the Board.

With respect to any Award that is subject to Section 409A and payment is to be accelerated in connection with the Change of Control, solely for purposes of determining the timing of payment, no event(s) set forth in clauses (a), (b) or (c) above shall constitute a Change of Control for purposes of this Plan unless such event(s) also constitutes a "change in the ownership", "change in the effective control" or a "change in the ownership of a substantial portion of the assets" of the Company as defined under Section 409A.

For purposes of the definition of "Change of Control," a "Person" shall mean any person, entity or "group" within the meaning of Section 13(d)(3) or Section 14(d)(2) of the Exchange Act, except that such term shall not include (a) Bunge International Limited, (b) any member of the Company and its Subsidiaries, (c) a trustee or other fiduciary holding securities under an employee benefit plan of any member of the Company and its Subsidiaries, (d) an underwriter temporarily holding securities pursuant to an offering of such securities or (e) an entity owned, directly or indirectly, by the shareholders of the Company in substantially the same proportions as their ownership of shares of the Company

"Code" shall mean the Internal Revenue Code of 1986, as such is amended from time to time, including any applicable regulations, and any reference to a section of the Code shall include any successor provision of the Code.

"Committee" means the Compensation Committee of the Board.

"Common Stock" means the common registered shares of the Company, par value $.01 per share.

"Company" means Bunge Global SA, a Swiss company, or any successor thereto as provided in Section 14.3.

"Consultant" shall mean any natural person engaged by the Company or a Subsidiary to render services, but who is not an Employee provided, that a Consultant will include only those persons to whom the issuance of Common Stock may be registered under Form S-8 under the Securities Act.

"Director" means any individual who is a member of the Board.

"Disability" mean for (a) Participants covered by the long term disability plan of the Company or a Subsidiary, disability as defined in such plan; and (b) for all other Participants, a physical or mental condition of the Participant resulting from bodily injury, disease or mental disorder which renders the Participant incapable of continuing the Participant's usual or customary employment or service with the Participant's employer or service recipient for a period of not less than six consecutive months. The disability of the Participant shall be determined by the Committee in good faith after reasonable medical inquiry, including consultation with a licensed physician as chosen by the Committee, and a fair evaluation of the Participant's ability to perform his or her duties. Notwithstanding the previous two sentences, with respect to an Award that is subject to Section 409A where the payment or settlement of the Award will accelerate upon termination of employment or service as a result of the Participant's Disability, solely for purposes of determining the timing of payment, no such termination will constitute a Disability for purposes of the Plan or any Award Document unless such event also constitutes a "disability" as defined under Section 409A.

"Dividend Equivalent" means, with respect to Shares subject to Awards, a right to an amount equal to dividends declared on an equal number of issued and outstanding Shares.

"Effective Date" was originally effective as of May 26, 2016. The current amendment and restatement of the Plan became effective on May 21, 2020, subject to approval by the shareholders at the 2020 Annual Meeting.

"Employee" means each employee of the Company or any Subsidiary.

"Exchange Act" means the Securities Exchange Act of 1934, as amended from time to time, or any successor act thereto.

"Exchange Program" means a program pursuant to which outstanding Awards are surrendered, cancelled or exchanged for cash, the same type of Award or a different Award (or combination thereof).

"Exercise Period" means the period during which a SAR or Option is exercisable, as set forth in the related Award Agreement.

"Exercise Price" means the price at which a Share may be purchased by a Participant pursuant to an Option or SAR, as determined by the Committee and set forth in an Award Agreement. Other than in connection with Substitute Awards, the exercise price per Share shall not be less than 100% of the Fair Market Value of a Share on the date an Option or SAR is granted.

"Fair Market Value" of a Share as of any date means the average of the highest and lowest sale prices of the Common Stock n the date of determination (or the mean of the closing bid and asked prices for the Common Stock if no sales were reported) as reported by the New York Stock Exchange or other domestic stock exchange on which the Common Stock is listed. If the Common Stock is not listed on a domestic stock exchange, Fair Market Value will be determined by such other method as the Committee determines in good faith to be reasonable and in compliance with Section 409A. If the determination date for the Fair Market Value occurs on a weekend, holiday or other non-Trading Day, the Fair Market Value will be the price as determined above on the immediately preceding Trading Day, unless otherwise determined by the Committee. The determination of Fair Market Value for purposes of tax withholding may be made in the discretion of the Committee subject to applicable laws and is not required to be consistent with the determination of Fair Market Value for other purposes. For purposes of achieving an exemption from Section 409A in the case of affected Participants subject to Section 409A, Fair Market Value shall be determined in a manner consistent with Section 409A.

"Indemnifiable Person" shall have the meaning set forth in Section 2.5.

"Incentive Stock Option" or "ISO" means an option to purchase Shares, granted under Article 7, which is designated as an ISO and satisfies the requirements of Section 422 of the Code.

"Insider" means an Employee who is, on the relevant date, an officer, Director or ten percent (10%) beneficial owner of the common shares, as contemplated by Section 16 of the Exchange Act.

"Nonqualified Stock Option" or "NQSO" means an option to purchase Shares, granted under Article 7, which is not intended to be an ISO.

"Option" means an ISO or a NQSO.

"Participant" means an Employee or Consultant who holds an outstanding Award.

"Performance Goals" means, any of the general performance objectives, selected by the Committee and specified in an Award Agreement, from among the performance criteria set forth on Schedule A hereto, either individually, alternatively or in any combination, applied to the Company as a whole or any Subsidiary, business unit, division, segment, product line, or function or any combination of the foregoing, either individually, alternatively, or in any combination, on a GAAP or non-GAAP basis, and measured, to the extent applicable, on an absolute basis or relative to a pre-established target, to determine whether the performance goals established by the Committee with respect to an applicable Award has been achieved. The Performance Goals shall be determined in accordance with generally accepted accounting principles (subject to adjustments and modifications for specified types of events or circumstances approved by the Committee in advance) consistently applied on a Subsidiary, business unit, division, segment, product line, function or consolidated basis or any combination thereof. Adjustment events include (i) asset write-downs; (ii) litigation or claim judgments or settlements; (iii) the effect of changes in tax laws, accounting principles or other laws or provisions affecting reported results; (iv) charges for any reorganization and restructuring programs; (v) unusual or infrequent charges or losses as described in Accounting Standards Codification 225-20-20 or elements of adjusted income in the management's discussion and analysis of financial condition and results of operations appearing in the Company's annual report to shareholders for the applicable year; (vi) the impact of acquisitions or divestitures; (vii) foreign exchange gains and losses and (viii) gains or losses on asset sales.

"Performance Period" means the period of time during which the Performance Goals will be measured to determine what, if any, Performance Units have been earned. A Performance Period shall, in all cases, be at least twelve (12) months in length.

"Performance Unit" means the right of a Participant to receive cash or Shares, upon achievement of the Performance Goals, in accordance with the Plan.

"Restricted Stock Unit" or "RSU" means an Award to a Participant covering a number of Shares that at a later date may be settled in cash, or by issuance of those Shares.

"Section 409A" means Section 409A of the Code.

"Share" means a share of Common Stock.

"Stock Appreciation Right" or "SAR" means a right, granted alone or in connection with a related Option, designated as a SAR, to receive a payment on the day the right is exercised, pursuant to Article 7. Each SAR shall be denominated in terms of one Share.

"Subsidiary" means any corporation that is a "subsidiary corporation" of the Company as that term is defined in Section 424(f) of the Code.

"Substitute Awards" shall mean Awards granted or Shares issued by the Company in assumption of, or in substitution or exchange for, awards previously granted, or the right or obligation to make future awards, by a company acquired by the Company or any Subsidiary or with which the Company or any Subsidiary combines.

Schedule A

| | | | | |

| FINANCIAL PERFORMANCE MEASURES |

accounts payable

accounts receivable

cash flow

cash-flow return on investment

cash value added

days cash cycle

days sales outstanding

debt

earnings before interest and tax (EBIT)

earnings before interest, tax depreciation and

amortization (EBITDA)

earnings per share

earnings per share from continuing operations

economic value added

effective tax rate

free cash flow

impairment write offs

income from continuing operations (net income

after minority interests) interest coverage | margin

market capitalization

net financial debt

net sales

operating cash flow

operating earnings before asset impairment

operating profit

pre-tax income

return on equity

return on invested capital

return on net assets

return on tangible net assets

return on tangible net worth

revenue growth

selling general and administrative expenses

share price

total shareholder return

relative total shareholder return

value at risk

working capital |

| NON-FINANCIAL PERFORMANCE MEASURES |

amount of inventory

brand recognition

customer/supplier satisfaction

days of inventory

diversity and/or succession goals or implementation

employee turnover

energy usage

headcount

product quality | loading time/days loading

market share

productivity/efficiency quality

recruiting

risk management safety/environment satisfaction indexes talent development turn around time volumes |

v3.24.1.1.u2

| X |

- DefinitionBoolean flag that is true when the XBRL content amends previously-filed or accepted submission.

| Name: |

dei_AmendmentFlag |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionFor the EDGAR submission types of Form 8-K: the date of the report, the date of the earliest event reported; for the EDGAR submission types of Form N-1A: the filing date; for all other submission types: the end of the reporting or transition period. The format of the date is YYYY-MM-DD.

| Name: |

dei_DocumentPeriodEndDate |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:dateItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionThe type of document being provided (such as 10-K, 10-Q, 485BPOS, etc). The document type is limited to the same value as the supporting SEC submission type, or the word 'Other'.

| Name: |

dei_DocumentType |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:submissionTypeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionAddress Line 1 such as Attn, Building Name, Street Name

| Name: |

dei_EntityAddressAddressLine1 |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- Definition

+ References

+ Details

| Name: |

dei_EntityAddressCityOrTown |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionISO 3166-1 alpha-2 country code.

| Name: |

dei_EntityAddressCountry |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:countryCodeItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionCode for the postal or zip code

| Name: |

dei_EntityAddressPostalZipCode |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:normalizedStringItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionA unique 10-digit SEC-issued value to identify entities that have filed disclosures with the SEC. It is commonly abbreviated as CIK. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityCentralIndexKey |

| Namespace Prefix: |

dei_ |

| Data Type: |

dei:centralIndexKeyItemType |

| Balance Type: |

na |

| Period Type: |

duration |

|

| X |

- DefinitionIndicate if registrant meets the emerging growth company criteria. Reference 1: http://www.xbrl.org/2003/role/presentationRef

-Publisher SEC

-Name Exchange Act

-Number 240

-Section 12

-Subsection b-2

| Name: |

dei_EntityEmergingGrowthCompany |

| Namespace Prefix: |

dei_ |

| Data Type: |

xbrli:booleanItemType |

| Balance Type: |

na |

| Period Type: |

duration |