AGG vs. BND: Which Bond ETF Do You Choose? - ETF News And Commentary

23 January 2013 - 12:01AM

Zacks

While corporate bonds are increasingly popular among

investors—along with junk securities due to their outsized yield—a

broad bond approach is taken by many as well. For ETFs that target

this broad fixed income space, generally investors focus in on two

ultra-popular ETFs; the Vanguard Total Bond Market ETF (BND) and

the iShares Core Total U.S. Bond Market ETF (AGG).

These two giants combine to take up over $30 billion in total

assets, making them both among the top five bond ETFs by total AUM.

Furthermore they both track the same benchmark, the Barclays

Capital U.S. Aggregate Bond Index, so exposure is going to be quite

similar (see Target Date Bond ETFs Best or Worst Fixed Income

Funds?).

So how do investors pick between the two?

Well, although they are very similar, there are actually some

key differences between the two and their fund holdings, expenses,

and tradability. So while they might appear identical, some

differences in sampling and other important factors should be known

by investors before deciding between either of these for their

portfolio:

Vanguard Total Bond Market ETF (BND)

This ETF is the slightly more popular of the two, having amassed

over $17 billion in total assets. Volume is also a tad better for

this fund, but both see more than one million shares move hands on

a daily basis so bid ask spreads shouldn’t be too much of a

concern.

In terms of exposure, it is well spread out with intermediate

term bonds accounting for roughly 40% of assets, long term another

40%, and short term the rest. Meanwhile from a bond type look,

federal debt accounts for about 45% of the product, with corporates

and collateralized securities accounting for the rest (see Seven

Biggest Bond ETFs by AUM).

Performance has also been strong in this ETF, with more than

29.8% gains in the trailing five year period. Yields, however, are

a little light thanks to the heavy government bond component,

helping to push the 30-Day SEC yield to just 1.67%.

iShares Core Total U.S. Bond Market ETF

(AGG)

While this ETF may not be as popular or widely traded as BND, it

is older than its Vanguard counterpart, and thanks to its

rebranding, is now cheaper too. In fact, the ETF charges investors

just eight basis points a year in fees, beating out BND by two

basis points a year.

The ETF also has a bit more of a long-term focus, as these

securities account for roughly 55% of assets, followed by just 27%

for intermediate term notes. Meanwhile, federal debt only takes up

about one-third of the assets, putting collateralized debt at

roughly half the portfolio, and corporates with nearly all of the

rest, according to XTF.com.

In addition to having a lower expense ratio, AGG also has a

slightly lower yield, just four basis points lower than BND in

fact. However, performance in this iShares ETF has been better over

the long-term as in the trailing five year period the fund has

gained 28.9% (also see Forget Interest Rate Risk with These Bond

ETFs).

The Bottom Line

So while AGG and BND both offer up quality exposure across the

various types of fixed income securities in the U.S. market, they

do so in slightly different ways with different levels of both

liquidity and fees.

Although these differences might not appear to be much at first

glance, these issues can definitely influence returns and should be

something to note by investors before deciding which of the two to

purchase during these uncertain market times.

|

|

BND

|

AGG

|

|

Expense Ratio

|

0.10%

|

0.08%

|

|

Total Holdings

|

4,500+

|

1,666

|

|

30-Day SEC Yield

|

1.7%

|

1.6%

|

|

Treasury Component

|

36%

|

32%

|

|

Top Holding

|

T-Bill, due 2017 (12.2% of fund)

|

T-Bill, due 2014 (2.4% of fund)

|

|

Five Year Performance (XTF.com)

|

29.7%

|

28.9%

|

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30

Days. Click to get this free report >>

ISHARS-BR AG BD (AGG): ETF Research Reports

VANGD-TOT BOND (BND): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

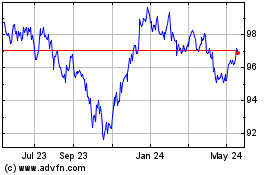

US Aggregate (AMEX:AGG)

Historical Stock Chart

From Feb 2025 to Mar 2025

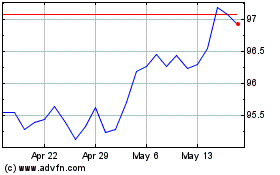

US Aggregate (AMEX:AGG)

Historical Stock Chart

From Mar 2024 to Mar 2025