2013 was pretty bumpy for interest-rate sensitive sectors like

Master Limited Partnerships (MLPs) thanks to the Fed tapering talks

which pushed up rates. Despite this sluggish trend, MLPs emerged as

solid performers, and ended the year with decent average gains of

about 16%.

With the Fed finally deciding on a soft QE cut-back (worth $10

billion per month) from January, investors appeared apprehensive

about MLP performance heading into 2014. However, the trend doesn’t

seem to be slowing down by any means (read: MLP ETFs: Still Good

for Income Investors?).

In fact, the decent run in 2013, braving the rate issues, might

have encouraged fund issuers like Direxion to roll out a new MLP

ETF in the market. The issuer’s new MLP product called Zacks MLP

High Income Shares ZMLP hit the market on January 23, 2014.

Zacks MLP High Income Shares: ZMLP

This ETF looks to track the Zacks MLP Index which is a benchmark of

master limited partnerships engaged in the transportation, storage,

processing, refining, marketing, exploration, production, and

mining of natural resources and trades on North American stock

exchanges.

The index rules out companies not having at least $300,000,000 of

market capitalization. The index follows a quantitative rule-based

strategy and takes value, liquidity, short interest, dividend yield

and other factors into consideration for inclusion in its

portfolio.

Currently, the MLP ETF holds 25 firms in its basket. The components

of the portfolio are equal weighted each having about 4% exposure

of the total. In terms of individual holdings, Hi-Crush Partners LP

(4.82%), Alon USA Partners, LP (4.71%), and NuStar Energy L.P.

(4.55%) take up the top three spots.

The portfolio is inclined toward smaller capitalization levels as

these take up about half of the exposure followed by mid caps which

account for one-fourth of the total assets (see more on ETFs in the

Zacks ETF Center).

Investors should also note that ZMLP is tilted toward oil & gas

pipelines (44%). Energy exploration, and oil refining and marketing

also account for decent allocations at 17% and 16%, respectively.

Rounding out the portfolio is an 8% allocation to natural gas

utilities, 7% to coal & alternative energy, 5% to metal and

mining and 4% to agricultural chemicals.

ZMLP charges an expense ratio of 65 basis points and looks to

deliver a dividend yield of 7%. Another important trait of this

product is its structure as an ETF.

Also, the product is built as a C-Corporation which takes care of

the K-1 headache of investors. However, before shareholders get

paid out, the C-Corp has to pay taxes, reducing the size of

distributions but eliminating the tax disclosure issue.

How Does It Fit in a Portfolio?

This ETF could be an interesting choice for investors seeking broad

exposure to the MLP space with a focus on income. Moreover, the use

of an equal weight strategy could keep the portfolio balanced among

various companies and help in avoiding heavy concentration

risk.

The product is reasonably priced at 65 bps, though not extremely

cheap, as the average expense ratio of the MLP ETFs space stands at

80 bps a year. ZMLP is also one of the highest income

generating instruments in the space. Hence, the fund carries the

potential to attract investors (read: Boost Income and Growth with

MLP ETFs).

Investors should realize that the product’s major focus on smaller

caps equities will likely help it to trend higher in a reviving

U.S. economy and deliver increased capital appreciation along with

higher income payouts. All these could make ZMLP an interesting

choice.

Can it Succeed?

At present, the MLP ETF space is overcrowded with

Alerian

MLP ETF (AMLP) topping the list having amassed about $7.58

billion in assets.

Alerian MLP Index ETN

(AMJ) and

E-TRACS Alerian MLP Infrastructure Index

(MLPI) round the top

three positions with, respectively, $5.8 billion and $1.6 billion

in assets. This will make it somewhat hard for ZMLP to attract huge

onlookers without some solid outperformance (read: Barclays Debuts

New MLP ETF (ATMP)).

One good point is that these three have expense ratios at 0.85%

which is way higher than what the newly launched ZMLP is charging

now. Also, AMLP has some significant concentration risks in its top

10 holdings.

And when it comes to dividend yield, ZMLP might steal the show in

the space because only one product

Cushing MLP High Income

Index ETN (MLPY)

provides a better yield at 7.46%.

Apart from MLPY, at present no other MLP product can beat the yield

of ZMLP. So, it is pretty clear that the new Direxion product will

be contending its peers primarily on yield and to some extent on

price and equal-weight strategy (read: High Dividend ETFs to Buy

Even If the Fed Tapers).

Bottom Line

We expect the segment and the newly introduced fund to hold up well

in 2014. Investors worrying about rate hikes should note that the

Fed’s decision for a further taper in 2014 will depend on whether

inflation and employment perk up at a desired pace.

That means that a gradual interest rate rise in a modestly

inflationary environment may not prove that bad for the

rate-sensitive sectors, suggesting that investors may want to take

a closer look at this interesting corner of the market for picks in

2014.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

Disclosure: Zacks manages the index underlying ZMLP.

JPM-ALERN MLP (AMJ): ETF Research Reports

ALERIAN-MLP (AMLP): ETF Research Reports

E-TRC UBS ALERN (MLPI): ETF Research Reports

MS-CUSH MLP HI (MLPY): ETF Research Reports

DIR-ZAC MLP HIS (ZMLP): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

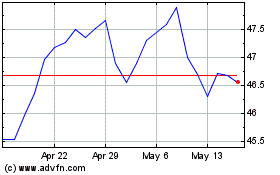

Alerian MLP (AMEX:AMLP)

Historical Stock Chart

From Jan 2025 to Feb 2025

Alerian MLP (AMEX:AMLP)

Historical Stock Chart

From Feb 2024 to Feb 2025