Central Fund Enters Into a US$320 Million Underwriting Agreement

31 March 2011 - 12:03AM

Marketwired

Central Fund of Canada Limited ("Central Fund") (TSX: CEF.A)(TSX:

CEF.U)(NYSE Amex: CEF) of Calgary, Alberta announced today that it

has entered into an underwriting agreement with CIBC World Markets

Inc., as lead underwriter, and Credit Suisse Securities (Canada)

Inc. (the "Underwriters"), under which the Underwriters have agreed

to buy and sell to the public, in Canada (except Quebec) and in the

United States under the multijurisdictional disclosure system,

14,350,000 Class A Shares of Central Fund. The Underwriters have

been granted the right to increase the size of the offering (the

"Right") by up to an additional 1,800,000 Class A Shares,

exercisable in whole or in part, at any point prior to 4:00 pm

(EST) on March 30, 2011. The offering will be made under a third

prospectus supplement to Central Fund's U.S.$1,000,000,000 base

shelf prospectus dated September 8, 2009.

The purchase price of U.S.$22.30 per Class A Share is expected

to result in gross proceeds of U.S.$320,005,000. Substantially all

the net proceeds of the offering have been committed to purchase

gold and silver bullion for settlement at closing, in keeping with

the asset allocation policies established by the Board of Directors

of Central Fund. Any additional capital raised by this offering is

expected to assist in reducing the annual expense ratio in favour

of the Shareholders of Central Fund.

Closing is expected to occur on or about April 6, 2011.

Central Fund has filed a base shelf prospectus and registration

statement with the Canadian securities regulatory authorities

(except Quebec) and the United States Securities and Exchange

Commission ("SEC") for the offering to which this communication

relates. Before you invest, you should read the base shelf

prospectus and prospectus supplement, when filed, and any other

documents Central Fund has filed with the securities commissions in

each of the provinces and territories of Canada, except Quebec, and

the SEC for more complete information about Central Fund and this

offering. You may obtain a copy of the base shelf prospectus filed

in the United States from CIBC World Markets Corp., 425 Lexington

Avenue, 5th Floor, New York, New York, 10017, by fax at

212-667-6303 or by e-mail at useprospectus@us.cibc.com. You may

obtain a copy of the base shelf prospectus filed in Canada from

CIBC, fax 416-594-7242 or request a copy by telephone at

416-594-7270. When filed, the United States and Canadian prospectus

supplements for the offering may be obtained in the same manner as

the base prospectus.

Statements contained in this release that are not historical

facts are forward-looking statements that involve risks and

uncertainties. Central Fund's actual results could differ

materially from those expressed or implied by such forward-looking

statements. Factors that could cause or contribute to such

differences include, but are not limited to, those risks detailed

in Central Fund's filings with the Canadian securities regulatory

authorities and the SEC.

Central Fund of Canada Limited (est. 1961) is an

exchange-tradeable, refined gold and silver bullion holding

company. Class A Shares are qualified for inclusion in many North

American regulated accounts. Central Fund's bullion holdings are

stored unencumbered in allocated and segregated safekeeping in

Canada, in the treasury vaults of the Canadian Imperial Bank of

Commerce. The gold and silver bullion are physically inspected by

Ernst & Young LLP in the presence of Central Fund's Directors

and Officers as well as bank officials. Class A Shares are quoted

on the NYSE Amex LLC, symbol CEF and on the TSX, symbols CEF.A

(Cdn. $) and CEF.U (U.S. $).

Contacts: Central Fund of Canada Limited J.C. Stefan Spicer

President and CEO 905-648-7878 info@centralfund.com

www.centralfund.com

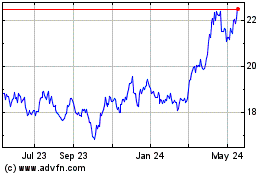

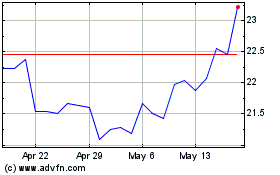

Sprott Physical Gold and... (AMEX:CEF)

Historical Stock Chart

From Nov 2024 to Dec 2024

Sprott Physical Gold and... (AMEX:CEF)

Historical Stock Chart

From Dec 2023 to Dec 2024