Corbion first half 2018 results

08 August 2018 - 3:00PM

Corbion reported H1 2018 sales of € 439.2 million,

a decrease of 4.9% compared to H1 2017, entirely due to negative

currency effects. Organic sales growth was 3.1%. EBITDA excluding

one-off items in H1 2018 decreased by 19.0% to € 71.5 million due

to negative currency effects and the inclusion of the Algae

Ingredients business. Organic EBITDA excluding one-off items

increased by 1.2% in H1 2018.

"I am happy to report that we have seen a

continuation of improving organic sales growth rates in our Food

business segment which returned to growth in Q2 after a challenging

period. In the first half year, Corbion performed within the sales

growth rate target bandwidth of our Creating Sustainable Growth

strategy. Margins in Ingredient Solutions remained at a healthy

level of around 20%. As expected, our profitability in Innovation

Platforms is adversely impacted by the inclusion of the newly

acquired Algae Ingredients business which is in an early stage of

development. We believe that this platform offers many exciting

growth opportunities for Corbion, leveraging our expertise of

running industrial scale organic acid operations", comments Tjerk

de Ruiter, CEO.

Key financial highlights

first half of 2018*:

-

Net sales organic growth was 3.1%;

volume growth was 6.6%

-

EBITDA excluding one-off items was €

71.5 million (H1 2017: € 88.3 million)

-

EBITDA margin before one-off items was

16.3% (H1 2017: 19.1%)

-

One-off items at EBITDA level of € -1.8

million

-

Operating result was € 50.2

million

-

Free cash flow was € -16.3 million (H1

2017: €2.3 million). The decline is mostly due to investments in

the Total Corbion PLA and SB Renewable Oils joint ventures

-

Net debt/EBITDA at half year end was

1.8x (year-end 2017: 1.0x)

|

€ million |

YTD 2018 |

YTD 2017 |

Total growth |

Organic growth |

|

Net sales |

439.2 |

461.9 |

-4.9% |

3.1% |

|

EBITDA excluding one-off items |

71.5 |

88.3 |

-19.0% |

1.2% |

|

EBITDA margin excluding one-off items |

16.3% |

19.1% |

|

|

|

Operating result |

50.2 |

73.1 |

-31.3% |

-7.7% |

|

ROCE |

13.0% |

21.4% |

|

|

*For Non-GAAP definitions

see page 21

20180808 PR 2Q18 ENG

Final

This

announcement is distributed by Nasdaq Corporate Solutions on behalf

of Nasdaq Corporate Solutions clients.

The issuer of this announcement warrants that they are solely

responsible for the content, accuracy and originality of the

information contained therein.

Source: Corbion via Globenewswire

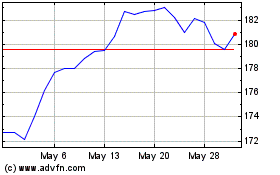

iShares MSCI ACWI Low Ca... (AMEX:CRBN)

Historical Stock Chart

From Nov 2024 to Dec 2024

iShares MSCI ACWI Low Ca... (AMEX:CRBN)

Historical Stock Chart

From Dec 2023 to Dec 2024