AS FILED WITH THE SECURITIES AND EXCHANGE COMMISSION ON May 1, 2018

REGISTRATION NO.

333-

UNITED STATES

SECURITIES

AND EXCHANGE COMMISSION

Washington, D.C. 20549

FORM

S-3

REGISTRATION STATEMENT

UNDER

THE

SECURITIES ACT OF 1933

NOBILIS HEALTH CORP.

(Exact name of registrant as specified in its charter)

British

Columbia

(State or other jurisdiction of incorporation or organization)

98-1188172

I.R.S. Employer Identification Number

Harry Fleming

Chief

Executive Officer

Nobilis Health Corp.

11700 Katy Freeway

Suite

300

Houston, Texas 77079

Telephone: (713)

355-8614

(Address, including zip code, and telephone number, including area code of registrant’s principal executive offices)

Copy to:

Janet

A. Spreen

Baker & Hostetler LLP

Key Tower, 127 Public Square

Suite 2000

Cleveland,

Ohio 44114-1214

Telephone: (216)

621-0200

Facsimile: (216)

696-0740

Approximate date of commencement of proposed sale to the public: From time to time after the effective date of this registration statement.

If the only securities being registered on this Form are being offered pursuant to dividend or interest reinvestment plans, please check the following

box: ☐

If any of the securities being registered on this Form are to be offered on a delayed or continuous basis pursuant to Rule 415

under the Securities Act of 1933, as amended (the “Securities Act”) other than securities offered only in connection with dividend or interest reinvestment plants, check the following box: ☒

If this Form is filed to register additional securities for an offering pursuant to Rule 462(b) under the Securities Act, please check the following and list

the Securities Act registration statement number of the earlier effective registration statement for the same offering. ☐

If this Form

is a post-effective amendment filed pursuant to Rule 462(c) under the Securities Act, check the following box and list the Securities Act registration statement number of the earlier effective registration statement for the same

offering. ☐

If this Form is a registration statement pursuant to General Instruction I.D. or a post-effective amendment thereto that

shall become effective upon filing with the Commission pursuant to Rule 462(e) under the Securities Act, check the following box. ☐

If

this Form is a post-effective amendment to a registration statement filed pursuant to General Instruction I.D. filed to register additional securities or additional classes of securities pursuant to Rule 413(b) under the Securities Act, check the

following box. ☐

Indicate by check mark whether the registrant is a large accelerated filer, an accelerated filer, a

non-accelerated

filer, a smaller reporting company, or an emerging growth company. See the definitions of “large accelerated filer,” “accelerated filer,” “smaller reporting company,”

and “emerging growth company” in Rule

12b-2

of the Exchange Act. (Check one):

|

|

|

|

|

|

|

|

|

Large accelerated filer

|

|

☐

|

|

Accelerated filer

|

|

☒

|

|

|

|

|

|

|

Non-accelerated

filer

|

|

☐ (Do not check if a smaller reporting company)

|

|

Smaller reporting company

|

|

☐

|

|

|

|

|

|

|

|

|

|

|

Emerging growth company

|

|

☒

|

If an emerging growth company, indicate by check mark if the registrant has elected not to use the extended transition period

for complying with any new or revised financial accounting standards provided pursuant to Section 7(a)(2)(B) of Securities Act. ☐

|

|

|

|

|

|

|

|

|

|

|

|

Title of each class of

securities to be registered

|

|

Amount

to be

registered(2)

|

|

Proposed

maximum

offering price

per share

|

|

Proposed

maximum

aggregate

offering price

|

|

Amount of

registration fee

|

|

Common Shares, no par value (1)

|

|

2,608,087

|

|

$1.53(3)

|

|

$3,990,373.11(3)

|

|

$496.81

|

|

|

|

|

|

(1)

|

Consists of (i) 378,788 outstanding shares and (ii) 2,229,299 shares issuable upon conversion of a convertible note. The number of conversion shares issuable under the terms of the notes fluctuates based on the market

price at the time of conversion and has been estimated for purposes hereof based upon the principal amount outstanding of $3.5 million and a conversion price of the volume-weighted average closing price of the common shares over the seven

trading days ending on April 25, 2018 of $1.57.

|

|

(2)

|

Pursuant to Rule 416 under the Securities Act this registration statement shall be deemed to cover an indeterminate number of additional securities to be offered as a result of stock splits, stock dividends or similar

transactions.

|

|

(3)

|

Pursuant to Rule 457(c) under the Securities Act, and solely for the purpose of calculating the registration fee, the proposed maximum offering price is $1.53, which is the average of the high and low prices of the

registrant’s common shares on April 25, 2018 on the NYSE American (“NYSE American”).

|

The Registrant hereby amends

this registration statement on the date or dates as may be necessary to delay its effective date until the Registrant shall file a further amendment which specifically states that this registration statement shall thereafter become effective in

accordance with Section 8(a) of the Securities Act of 1933, as amended, or until the registration statement shall become effective on a date as the Securities and Exchange Commission, acting pursuant to Section 8(a), may determine.

|

|

|

The information in this prospectus is not complete and may be changed. The selling securityholders may not sell these securities until the registration statement filed with

the Securities and Exchange Commission is effective. This prospectus is not an offer to sell these securities and we are not soliciting offers to buy these securities in any state where the offer or sale is not permitted.

|

SUBJECT TO COMPLETION, DATED MAY 1, 2018

NOBILIS HEALTH CORP.

2,608,087 Common Shares

This prospectus

relates to the resale of up to 2,608,087 common shares, no par value (the “Shares”), of Nobilis Health Corp. (the “Company”) by the selling securityholders, representing (i) 378,788 outstanding Shares, and (ii) up to

2,229,299 Shares issuable upon conversion of a $3.5 million convertible promissory note issued by the Company (the “Convertible Note”). The Convertible Note and the Shares were issued in connection with the Company’s acquisition

of a 50.1% ownership interest in four privately-held entities in November 2017.

The selling securityholders may offer and sell the Shares

from time to time in amounts, at prices and on terms that will be determined at the time of the offering, which may be determined by prevailing market prices or in negotiated transactions. See “Plan of Distribution” beginning on page 7. We

will not receive any of the proceeds from the resale of the Shares by the selling securityholders. However, the issuance of the Shares upon conversion of the Convertible Note would be in satisfaction of our obligation for the principal amount

payable thereunder.

You should carefully read this prospectus and any accompanying prospectus supplement, together with the documents we

incorporate by reference, before you invest in the Shares.

Our common shares are presently quoted on the NYSE American under the symbol

“HLTH” and on the Aequitas NEO Exchange under the symbol “HLTH”. On April 30, 2018, the last sale price of our common shares as reported on the NYSE American was $1.50 per share.

Investing in our common shares involves substantial risk. Please read “

Risk Factors

” beginning on page

4 of this prospectus and any risk factors described in any applicable prospectus supplement and in the documents we incorporate by reference.

Neither the Securities and Exchange Commission nor any state securities commission has approved or disapproved of these securities or

determined if this prospectus is truthful or complete. Any representation to the contrary is a criminal offense.

Prospectus

dated

, 2018

TABLE OF CONTENTS

i

ABOUT THIS PROSPECTUS

Unless otherwise indicated or the context otherwise requires, references in this prospectus to the “Company,” “Nobilis,”

“we,” “us” and “our” refer to Nobilis Health Corp. and its subsidiaries.

This prospectus is part of

registration statements that we filed with the Securities and Exchange Commission (the “Commission”). Under the registration process, the selling securityholders may, from time to time, offer and sell the Shares described in this

prospectus in one or more offerings. This prospectus provides you with a general description of the Shares that the selling securityholders may offer. Each time the selling securityholders sell securities under this registration statement, we may

provide a prospectus supplement that will contain additional information about the terms of that offering. The prospectus supplement may also add, update or change information contained in this prospectus. Any statement that we make in this

prospectus will be modified or superseded by any inconsistent statement made by us in a prospectus supplement.

You should read this

prospectus and any applicable prospectus supplement, together with the information incorporated herein by reference as described under the heading “Information Incorporated by Reference.”

You should rely only on the information that we have provided or incorporated by reference in this prospectus and any applicable prospectus

supplement. We have not authorized any dealer, salesman or other person to give any information or to make any representation other than those contained or incorporated by reference in this prospectus or any applicable prospectus supplement. You

should not rely upon any information or representation not contained or incorporated by reference in this prospectus or the accompanying prospectus supplement. We take no responsibility for, and can provide no assurance as to the reliability of, any

other information that others may give you.

This prospectus and any accompanying prospectus supplement do not constitute an offer to sell

or the solicitation of an offer to buy any securities other than the registered securities to which they relate, nor do this prospectus and any accompanying prospectus supplement constitute an offer to sell or the solicitation of an offer to buy

securities in any jurisdiction to any person to whom it is unlawful to make such offer or solicitation in such jurisdiction. You should not assume that the information contained in this prospectus or any applicable prospectus supplement is accurate

on any date subsequent to the date set forth on the front of the document or that any information we have incorporated by reference is correct on any date subsequent to the date of the document incorporated by reference, even though this prospectus

or any applicable prospectus supplement is delivered or securities are sold on a later date.

1

SUMMARY

This summary highlights certain information appearing elsewhere in this prospectus and in the documents we incorporate by reference into

this prospectus. The summary is not complete and does not contain all of the information that you should consider before investing in our common shares. After you read this summary, you should read and consider carefully the entire prospectus and

any prospectus supplement and the more detailed information and financial statements and related notes that are incorporated by reference into this prospectus and any prospectus supplement. If you invest in our common shares, you are assuming a high

degree of risk.

Our Company

Nobilis Health Corp. (“Nobilis” or the “Company”) was incorporated on March 16, 2007 under the name “Northstar

Healthcare Inc.” pursuant to the provisions of the British Columbia

Business Corporations Act

. On December 5, 2014, Northstar Healthcare Inc. changed its name to Nobilis Health Corp. Prior to December 1, 2014, our business was

solely the ownership, operation and management of outpatient surgery centers and specialty surgical hospitals (the “Medical Segment”). On December 1, 2014, we completed the acquisition of Athas Health, LLC. This acquisition added

marketing services as a stand-alone business line, which is now a separate reportable business segment (the “Marketing Segment”). In addition to providing services to third parties, our unique

direct-to-patient

marketing and proprietary technology serves our own healthcare facilities.

Our

portfolio of specialty surgical hospitals, ambulatory surgical centers (ASCs), and multi-specialty clinics is complemented by our Marketing Segment, which allows us to operate those facilities in many instances with few, if any, physician partners.

Our differentiated business strategy provides value to patients, physicians and payors, and enables us to capitalize on recent trends in the healthcare industry, particularly with regard to increased consumerism in the healthcare space. As a result,

we believe we are positioned for continued growth.

As of December 31, 2017, there are 33 locations across Texas and Arizona,

including specialty surgical hospitals, ASCs and multi-specialty clinics. Additionally, Nobilis partnered with another 34 facilities across the country, and marketed 9 independent brands. We provide care across a variety of specialties in our

facilities including, pain management, spine surgery, orthopedic surgery, bariatric surgery, plastic surgery, ear nose and throat (ENT), podiatric surgery, vein and vascular, and other general surgery.

Many of our surgical patients require additional complementary healthcare services and Nobilis has spent the last two years developing a full

suite of ancillary services that we offer patients treated in our facilities. To date, Nobilis is able to provide a variety of

in-house

ancillary services, such as Anesthesia, Surgical Assist, and

Intraoperative Neuromonitoring. The addition of the ancillary services has helped us successfully expand our continuum of care, increase facility efficiency, improve our coordination of the various services they require, enhance the quality of our

patients’ clinical outcomes as well as their overall experience.

On October 28, 2016 and March 8, 2017, we purchased

Arizona Vein and Vascular Center, LLC and its four affiliated surgery centers operating as Arizona Center for Minimally Invasive Surgery, LLC and Hamilton Vein Center brand and associated assets, respectively. These acquisitions expanded our

specialty mix to include the treatment of venous diseases with little modification to our existing infrastructure of specialty surgical hospitals and ASCs. Our facilities will be able to offer a range of treatments, both surgical and

non-surgical,

for those patients suffering from venous diseases, which today affect more than 30 million Americans.

In addition to our vein and vascular business acquisitions, on September 13, 2017, we purchased DeRosa Medical, P.C.

(“DeRosa”). DeRosa is a primary care practice that specializes in health and wellness, medically supervised weight loss, women’s health, and chronic health condition management. The practice operates three multi-specialty clinics

within the Phoenix, Arizona metropolitan area, specifically in Scottsdale, Chandler, and Glendale. The acquisition of DeRosa allows the Company to expand its continuum of care by providing additional healthcare services at the primary care level.

On November 15, 2017, the Company purchased 50.1% ownership interests in Elite Sinus Spine and Ortho LLC, Elite Center for Minimally

Invasive Surgery, LLC, Houston Metro Ortho and Spine Surgery Center, LLC and Elite Hospital Management, LLC (collectively the “Management Companies” or collectively, “Elite”) that manage three ASCs and one specialty surgical

hospital in Houston, TX. Elite provides healthcare management services to these facilities, which generate 100%

in-network

revenue to the Nobilis system. This acquisition represents a strategic opportunity to

enhance Nobilis’

in-network

revenue and adds 76 physician partners to our existing network of surgeons in the Houston market. We will also have the opportunity to leverage best practices from both

companies, generate operational efficiencies, further improve our case conversion through a substantial increase in referral-based business and provide the Company additional resources to strengthen Nobilis’ footprint within the Houston market.

2

On November 15, 2017, Northstar Healthcare Surgery Center – Houston, LLC, a subsidiary of the Company

(“Northstar”), acquired a 50.1% ownership interest in Houston Metro Ortho and Spine Surgery Center LLC, a Texas limited liability company, Elite Hospital Management LLC, a Texas limited liability company, Elite Center for Minimally

Invasive Surgery LLC, a Texas limited liability company, and Elite Sinus Spine and Ortho LLC, a Texas limited liability company (collectively, “Elite”) that manage three ASCs and one specialty surgical hospital in Houston, Texas (the

“Transaction”). Elite provides healthcare management services to these facilities, which generate 100%

in-network

revenue to the Nobilis system. This acquisition represents a strategic opportunity to

enhance Nobilis’

in-network

revenue and adds 76 physician partners to our existing network of surgeons in the Houston market. We will also have the opportunity to leverage best practices from both

companies, generate operational efficiencies, further improve our case conversion through a substantial increase in referral-based business and provide the Company additional resources to strengthen Nobilis’ footprint within the Houston market.

Our principal executive offices are located at 11700 Katy Freeway, Suite 300, Houston, Texas. Our telephone number is (713)

355-8614.

Our website address is

www.nobilishealth.com

. Information on our website is not part of this prospectus.

The Offering

This

prospectus relates to the resale of up to 2,608,087 Shares of the Company by the selling securityholders, representing (i) 378,788 outstanding Shares, and (ii) up to 2,229,299 Shares issuable upon conversion of the Convertible Note.

Such Shares and the Convertible Note were issued pursuant to the Transaction. At the closing, the Company and Northstar paid the sellers

approximately $60.1 million, comprised of $53.6 million in cash, $3.5 million in the form of the Convertible Note, $2.5 million in the form of an unfunded escrow and 378,788 Shares to an agent of the sellers.

The Convertible Note bears interest at 6.75% per annum and is payable in three installments over a two year period. The Convertible Note

(outstanding principal plus any accrued but unpaid interest, collection and enforcements costs, and any other amounts or charges incurred under thereunder) may be converted into Shares upon the occurrence of both (i) default, and (ii) the

election of the note holder. The number of Shares issued will equal to the quotient obtained by dividing the conversion amount by the lessor of (i) the closing bid price of the Shares on the trading day immediately prior to the conversion date,

or (ii) the volume weighted average price of the common shares on NYSE American in the trailing ten trading days prior to the maturity date. In addition, if, within three business days of the transmittal of the notice of conversion to the

Company, the Shares have a closing bid price that is 5% or lower than the conversion price set forth in the notice of conversion, the conversion price shall be the average closing bid price of the Shares during such three-business day period. We

have estimated the number of Shares issuable upon conversion of the Company’s Convertible Note based upon the $3.5 million principal amount and a conversion price equal to the volume-weighted average price over the seven trading days

ending April 25, 2018, which equals $1.57.

|

|

|

|

|

Securities Offered

|

|

|

|

|

|

|

Shares outstanding prior to this offering

|

|

78,183,802 Shares.

|

|

|

|

|

Shares to be offered by the selling securityholders

|

|

2,608,087 Shares, consisting of 378,788 outstanding Shares and up to 2,229,299 Shares issuable upon conversion of the Convertible Note held by the selling securityholder.

|

|

|

|

|

Shares outstanding after this offering

|

|

80,413,101 Shares, which includes up to 2,229,299 Shares that may be issued upon conversion of the Convertible Note held by the selling securityholder.

|

|

|

|

|

Use of Proceeds

|

|

We will not receive any of the proceeds from the sale by the selling securityholders of Shares in this offering. All proceeds from the sale of the Shares will be paid directly to the selling securityholders.

|

|

|

|

|

NYSE American symbol

|

|

“HLTH”

|

3

RISK FACTORS

Investing in our common shares involves a high degree of risk. You should carefully consider and evaluate the risk factors included in our

most recent Annual Report on Form

10-K

and subsequent Quarterly Reports on Form

10-Q

that we file with the Commission, which are incorporated herein by reference,

together with the risk factors and other information contained in or incorporated by reference into any prospectus supplement, before making an investment decision. The occurrence of any of these risks and uncertainties could harm our business,

financial condition, results of operations or growth prospects. As a result, the trading price of our common shares could decline, and you could lose all or part of your investment.

SPECIAL NOTE REGARDING FORWARD-LOOKING STATEMENTS

Information set forth in this prospectus and any prospectus supplement and the information it incorporates by reference contain certain

forward-looking statements within the meaning of Canadian and United States securities laws, including the safe harbor for forward-looking statements contained in the Private Securities Litigation Reform Act of 1995, as amended. Forward-looking

statements include all statements that do not relate solely to historical or current facts and may be identified by the use of words including, but not limited to the following: “may,” “believe,” “will,”

“expect,” “project,” “estimate,” “anticipate,” “plan,” “continue” or the negative thereof or other variations thereon or comparable terminology, or by discussions of strategy. These

forward-looking statements are based on the Company’s current plans and expectations and are subject to a number of risks, uncertainties and other factors that could significantly affect current plans and expectations and our future financial

condition and results. These factors, which could cause actual results, performance and achievements to differ materially from those anticipated, include, but are not limited to the following:

|

|

•

|

|

our ability to successfully maintain effective internal controls over financial reporting;

|

|

|

•

|

|

our ability to implement our business strategy, manage the growth in our business, and integrate acquired businesses;

|

|

|

•

|

|

the risk of litigation and investigations, and liability claims for damages and other expenses not covered by insurance;

|

|

|

•

|

|

the risk that payments from third-party payers, including government healthcare programs, may decrease or not increase as costs increase;

|

|

|

•

|

|

adverse developments affecting the medical practices of our physician limited partners;

|

|

|

•

|

|

our ability to maintain favorable relations with our physician limited partners;

|

|

|

•

|

|

our ability to grow revenues by increasing case and procedure volume while maintaining profitability;

|

|

|

•

|

|

failure to timely or accurately bill for services;

|

|

|

•

|

|

our ability to compete for physician partners, patients and strategic relationships;

|

|

|

•

|

|

the risk of changes in patient volume and patient mix;

|

|

|

•

|

|

the risk that laws and regulations that regulate payments for medical services made by government healthcare programs could cause our revenues to decrease;

|

|

|

•

|

|

the risk that contracts are cancelled or not renewed or that we are not able to enter into additional contracts under terms that are acceptable to us; and

|

|

|

•

|

|

the risk of potential decreases in our reimbursement rates.

|

Other factors include the risk

factors set forth elsewhere in this prospectus under the heading “Risk Factors” beginning on page 4 of this prospectus, in any applicable prospectus supplement and in our Annual Report on Form

10-K

for the fiscal year ended December 31, 2017, filed on March 12, 2018, as updated by other filings with the Commission.

This

prospectus, any prospectus supplement and the information incorporated herein and therein by reference should be read completely and with the understanding that actual future results may be materially different from what we may expect. Readers are

cautioned not to place undue reliance on forward-looking statements, which speak only as of the date of the

4

document in which they are made or, if a date is specified, as of such date, when evaluating the information presented in this prospectus or other disclosures because current plans, anticipated

actions, and future financial conditions and results may differ from those expressed in any forward-looking statements made by or on behalf of the Company.

Except as required by law, we assume no obligation to update these forward-looking statements publicly or to update the reasons actual results

could differ materially from those anticipated in these forward-looking statements, even if new information becomes available in the future.

USE OF PROCEEDS

This prospectus relates to Shares that may be offered and sold from time to time by the selling securityholders. We will not receive any of

the proceeds resulting from the sale of Shares by the selling securityholders. The selling securityholders will receive all of the proceeds from this offering. However, the issuance of the Shares upon conversion of the Convertible Note would be in

satisfaction of our obligation for the principal amount payable thereunder.

5

SELLING SECURITYHOLDERS

This prospectus includes the resale of up to 2,608,087 Shares of the Company by the selling securityholders, representing (i) 378,788

outstanding Shares, and (ii) up to 2,229,299 Shares issuable upon conversion of the Convertible Note.

The following table sets

forth, based on information provided to us by the selling securityholders or known to us, the names of the selling securityholders, the nature of any position, office or other material relationship, if any, which the selling securityholder has had,

within the past three years, with us or with any of our predecessors or affiliates, and the number of Shares beneficially owned by the selling securityholders before this offering. The number of Shares owned are those beneficially owned, as

determined under the rules of the Commission, and the information is not necessarily indicative of beneficial ownership for any other purpose. Under these rules, beneficial ownership includes any common shares as to which a person has sole or shared

voting power or investment power and any common shares which the person has the right to acquire within 60 days through the exercise of any option, warrant or right, through conversion of any security or pursuant to the automatic termination of a

power of attorney or revocation of a trust, discretionary account or similar arrangement. Except as set forth below, none of the selling securityholders is a broker-dealer or an affiliate of a broker-dealer. As of May 1, 2018, there were

78,183,802 common shares issued and outstanding.

We have assumed all Shares reflected on the table will be sold from time to time in the

offering covered by this prospectus. Because the selling securityholders may offer all or any portions of the Shares listed in the table below, no estimate can be given as to the actual amount of Shares covered by this prospectus that will be held

by the selling securityholders upon the termination of the offering.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Name of Selling Securityholder

|

|

Number of

Shares

Beneficially

Owned

Before

Offering

|

|

|

Number of

Shares

Offered

|

|

|

Number of

Shares

Owned

After

Offering

|

|

|

Percentage

of Shares

Beneficially

Owned

After

Offering

|

|

|

Elite Ambulatory Surgery Centers, LLC

(1)

|

|

|

0

|

|

|

|

2,229,299

|

(2)

|

|

|

0

|

(2)

|

|

|

0

|

|

|

PC Advisors LLC

(3)

|

|

|

378,788

|

|

|

|

378,788

|

|

|

|

0

|

|

|

|

0

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

Total

|

|

|

378,788

|

|

|

|

2,608,087

|

|

|

|

0

|

|

|

|

0

|

|

|

(1)

|

The address for Elite Ambulatory Surgery Centers, LLC, a Texas limited liability company doing business as Elite Surgical Affiliates, is 2100 West Loop South, Suite 1200, Houston, Texas 77027.

|

|

(2)

|

Represents the estimated number of Shares issuable upon conversion of the Convertible Note, calculated based on the principal amount outstanding of $3.5 million and assuming that the conversion price is equal to

the volume-weighted average price over the seven trading days ending on April 25, 2018, which was $1.57.

|

|

(3)

|

The address for PC Advisors LLC is 8222 Douglas Ave Suite 200, Dallas, Texas 75225.

|

6

PLAN OF DISTRIBUTION

The selling securityholders, which as used herein includes donees, pledgees, transferees or other

successors-in-interest

selling Shares or interests in Shares received after the date of this prospectus from a selling securityholder as a gift, pledge, partnership distribution or other transfer, may, from

time to time, sell, transfer or otherwise dispose of any or all of their Shares or interests in Shares on any stock exchange, market or trading facility on which the Shares are traded or in private transactions. These dispositions may be at fixed

prices, at prevailing market prices at the time of sale, at prices related to the prevailing market price, at varying prices determined at the time of sale, or at negotiated prices.

The selling securityholders may use any one or more of the following methods when disposing of Shares or interests therein:

|

|

•

|

|

ordinary brokerage transactions and transactions in which the broker-dealer solicits purchasers;

|

|

|

•

|

|

block trades in which the broker-dealer will attempt to sell the Shares as agent, but may position and resell a portion of the block as principal to facilitate the transaction;

|

|

|

•

|

|

purchases by a broker-dealer as principal and resale by the broker-dealer for its account;

|

|

|

•

|

|

an exchange distribution in accordance with the rules of the applicable exchange;

|

|

|

•

|

|

privately negotiated transactions;

|

|

|

•

|

|

short sales effected after the date the registration statement of which this prospectus is a part is declared effective by the Commission;

|

|

|

•

|

|

through the writing or settlement of options or other hedging transactions, whether through an options exchange or otherwise;

|

|

|

•

|

|

a combination of any such methods of sale; and

|

|

|

•

|

|

any other method permitted by applicable law.

|

The selling securityholders may, from time to

time, pledge or grant a security interest in some or all of the Shares owned by them and, if they default in the performance of their secured obligations, the pledgees or secured parties may offer and sell the Shares, from time to time, under this

prospectus, or under an amendment to this prospectus under Rule 424(b)(3) or other applicable provision of the Securities Act of 1933, as amended (“Securities Act”), amending the list of selling securityholders to include the pledgee,

transferee or other successors in interest as selling securityholders under this prospectus. The selling securityholders also may transfer or Shares in other circumstances, in which case the transferees, pledgees or other successors in interest will

be the selling beneficial owners for purposes of this prospectus.

In connection with the sale of our Shares or interests therein, the

selling securityholders may enter into hedging transactions with broker-dealers or other financial institutions, which may in turn engage in short sales of the Shares in the course of hedging the positions they assume. The selling securityholders

may also sell the Shares short and deliver these Shares to close out their short positions, or loan or pledge the Shares to broker-dealers that in turn may sell these Shares. The selling securityholders may also enter into option or other

transactions with broker-dealers or other financial institutions or the creation of one or more derivative securities which require the delivery to such broker-dealer or other financial institution of the Shares offered by this prospectus, which

Shares such broker-dealer or other financial institution may resell pursuant to this prospectus (as supplemented or amended to reflect such transaction).

The selling securityholders also may resell all or a portion of the Shares in open market transactions in reliance upon Rule 144 under the

Securities Act, provided that they meet the criteria and conform to the requirements of that Rule.

The selling securityholders and any

underwriters, broker-dealers or agents that participate in the sale of the Shares or interests therein may be “underwriters” within the meaning of Section 2(11) of the Securities Act. Any discounts, commissions, concessions or profit

they earn on any resale of the Shares may be underwriting discounts and commissions under the Securities Act. Selling securityholders who are “underwriters” within the meaning of Section 2(11) of the Securities Act will be subject to

the prospectus delivery requirements of the Securities Act.

7

To the extent required, the Shares to be sold, the names of the selling securityholders, the

respective purchase prices and public offering prices, the names of any agent, dealer or underwriter, or any applicable commissions or discounts with respect to a particular offer will be set forth in an accompanying prospectus supplement or, if

appropriate, a post-effective amendment to the registration statement that includes this prospectus.

In order to comply with the

securities laws of some states, if applicable, the Shares may be sold in these jurisdictions only through registered or licensed brokers or dealers.

The selling securityholders and any other person participating in such distribution will be subject to applicable provisions of the Securities

Exchange Act of 1934, as amended (“Exchange Act”), and the rules and regulations thereunder, including, without limitation, to the extent applicable, Regulation M of the Exchange Act, which may limit the timing of purchases and sales of

any of the Shares by the selling security holders and any other participating person. To the extent applicable, Regulation M may also restrict the ability of any person engaged in the distribution of the Shares to engage in market-making activities

with respect to the Shares. All of the foregoing may affect the marketability of the Shares and the ability of any person or entity to engage in market-making activities with respect to the Shares.

The selling securityholders may agree to indemnify any agent, dealer, or broker-dealer that participates in transactions involving sales of

the Shares if liabilities are imposed on that person by the Securities Act.

We will bear all expenses of the registration of the Shares

covered by this prospectus.

We have agreed to keep this registration statement of which this prospectus is a part effective for a period

equal to the term of the Note, which has a maturity date of November 15, 2019.

LEGAL MATTERS

The validity of the Shares offered hereby and certain other legal matters will be passed upon for us by the law firm of Macdonald Tuskey.

EXPERTS

The financial statements incorporated in this Prospectus by reference to the Annual Report on Form 10-K for the year ended December 31,

2017 have been incorporated in reliance on the report of Crowe Horwath LLP, an independent registered accounting firm, given on the authority of said firm as experts in accounting and auditing.

WHERE YOU CAN FIND MORE INFORMATION

We file annual, quarterly and special reports, along with other information with the Commission (“SEC Filings”). Our SEC Filings are

available to the public over the Internet at the Commission’s website at

http://www.sec.gov

. You may also read and copy any document we file at the Commission’s Public Reference Room at 100 F Street, NE, Washington, D.C. 20549.

Please call the Commission at

1-800-SEC-0330

for further information on the Public Reference Room.

This prospectus and any applicable prospectus supplement is part of a registration statement on Form

S-3

that we filed with the Commission to register the securities offered hereby under the Securities Act. This prospectus does not contain all of the information included in the registration statement,

including certain exhibits and schedules. You may obtain the registration statement and exhibits to the registration statement from the Commission at the address listed above or from the Commission’s internet site.

INCORPORATION OF DOCUMENTS BY REFERENCE

The Commission allows us to “incorporate by reference” information into this prospectus. This means that we can disclose important

information to you by referring you to another document filed separately with the Commission. The information that we incorporate by reference is considered to be part of this prospectus. Because we are incorporating by reference our future filings

with the Commission, this prospectus is continually updated and those future filings may modify or supersede some or all of the information included or incorporated in this prospectus. This means that you must look at all of the SEC Filings that we

incorporate by reference to determine if any of the statements in this prospectus or in any document previously incorporated by reference have been modified or superseded. This prospectus incorporates by reference the

8

documents listed below and any future filings we will make with the Commission under Sections 13(a), 14 or 15(d) of the Exchange Act, (i) after the date of the initial registration statement

and prior to effectiveness of the registration statement, and (ii) after the date of this prospectus, until the selling securityholders sell all of our securities registered under this prospectus:

|

|

•

|

|

Our Annual Report on Form

10-K

for the year ended December 31, 2017, filed with the Commission on March 12, 2018, and our Current Reports on Form

8-K

filed with the Commission on January 25, 2018, January 29, 2018, January 30, 2018 and March 20, 2018;

|

|

|

•

|

|

the description of our registered securities contained in our Current Report on Form

8-A

filed with the Commission on April 14, 2015 (File

No. 001-37349),

including any amendment or report filed for the purpose of updating such description; and

|

|

|

•

|

|

all reports and other documents subsequently filed by us pursuant to Sections 13(a), 13(c), 14 and 15(d) of the Exchange Act after the date of this prospectus and prior to the termination of this offering.

|

Notwithstanding the foregoing, information furnished under Items 2.02 and 7.01 of any Current Report on Form

8-K,

including the related exhibits, is not incorporated by reference in this prospectus.

The

information about us contained in this prospectus should be read together with the information in the documents incorporated by reference. You may request a copy of any or all of these filings, at no cost, by writing or telephoning us at: Nobilis

Health Corp., 11700 Katy Freeway, Suite 300, Houston, Texas, telephone number (713)

355-8614.

9

PART II

INFORMATION NOT REQUIRED IN THE PROSPECTUS

|

Item 14.

|

Other Expenses of Issuance and Distribution.

|

We will pay all expenses in connection

with the registration and sale of the Shares. The estimated expenses of issuance and distribution are set forth below.

|

|

|

|

|

|

|

SEC Filing fee

|

|

$

|

500

|

*

|

|

Legal expenses

|

|

$

|

35,000

|

*

|

|

Accounting expenses

|

|

$

|

15,000

|

*

|

|

Miscellaneous

|

|

$

|

14,500

|

*

|

|

|

|

|

|

|

|

Total

|

|

$

|

65,000

|

*

|

|

|

|

|

|

|

|

Item 15.

|

Indemnification of Directors and Officers.

|

The

Business Corporations Act

(British Columbia) (“BCBCA”) provides that a company may:

|

|

•

|

|

indemnify an eligible party against all judgments, penalties or fines awarded or imposed in, or amounts paid in settlement of, an eligible proceeding, to which the eligible party is or may be liable; and

|

|

|

•

|

|

after the final disposition of an eligible proceeding, pay the “expenses” (which includes costs, charges and expenses (including legal fees) but excludes judgments, penalties, fines or amounts paid in

settlement of a proceeding) actually and reasonably incurred by an eligible party in respect of that proceeding.

|

However,

after the final disposition of an eligible proceeding, a company must pay expenses actually and reasonably incurred by an eligible party in respect of that proceeding if the eligible party (i) has not been reimbursed for those expenses, and

(ii) is wholly successful, on the merits or otherwise, or is substantially successful on the merits, in the outcome of the proceeding. The BCBCA also provides that a company may pay the expenses as they are incurred in advance of the final

disposition of an eligible proceeding if the company first receives from the eligible party a written undertaking that, if it is ultimately determined that the payment of expenses is prohibited under the BCBCA, the eligible party will repay the

amounts advanced.

For the purpose of the BCBCA, an “eligible party,” in relation to a company, means an individual who:

|

|

•

|

|

is or was a director or officer of the company;

|

|

|

•

|

|

is or was a director or officer of another corporation at a time when the corporation is or was an affiliate of the company;

|

|

|

•

|

|

at the request of the company, is or was, or holds or held a position equivalent to that of, a director or officer of a partnership, trust, joint venture or other unincorporated entity;

|

|

|

•

|

|

and includes, with some exceptions, the heirs and personal or other legal representatives of that individual.

|

An “eligible proceeding” under the BCBCA is a proceeding in which an eligible party or any of the heirs and personal or other legal

representatives of the eligible party, by reason of the eligible party being or having been a director or officer of, or holding or having held a position equivalent to that of a director or officer of, the company or an associated corporation

(i) is or may be joined as a party, or (ii) is or may be liable for or in respect of a judgment, penalty or fine in, or expenses related to, the proceeding. A “proceeding” includes any legal proceeding or investigative action,

whether current, threatened, pending or completed.

Notwithstanding the foregoing, the BCBCA prohibits indemnifying an eligible party or

paying the expenses of an eligible party if any of the following conditions apply:

II-0

|

|

•

|

|

if the indemnity or payment is made under an earlier agreement to indemnify or pay expenses and, at the time that such agreement was made, the company was prohibited from giving the indemnity or paying the expenses by

its memorandum or articles;

|

|

|

•

|

|

if the indemnity or payment is made otherwise than under an earlier agreement to indemnify or pay expenses and, at the time that the indemnity or payment is made, the company is prohibited from giving the indemnity or

paying the expenses by its memorandum or articles;

|

|

|

•

|

|

if, in relation to the subject matter of the eligible proceeding, the eligible party did not act honestly and in good faith with a view to the best interests of the company or the associated corporation, or as the case

may be; or

|

|

|

•

|

|

in the case of an eligible proceeding other than a civil proceeding, if the eligible party did not have reasonable grounds for believing that the eligible party’s conduct in respect of which the proceeding was

brought was lawful.

|

Additionally, if an eligible proceeding is brought against an eligible party by or on behalf of the

company or by or on behalf of an associated corporation, the company must not (i) indemnify the eligible party in respect of the proceeding; or (ii) pay the expenses of the eligible party in respect of the proceeding.

Whether or not payment of expenses or indemnification has been sought, authorized or declined under the BCBCA, on the application of a company

or an eligible party, the Supreme Court of British Columbia may do one or more of the following:

|

|

•

|

|

order a company to indemnify an eligible party against any liability incurred by the eligible party in respect of an eligible proceeding;

|

|

|

•

|

|

order a company to pay some or all of the expenses incurred by an eligible party in respect of an eligible proceeding;

|

|

|

•

|

|

order the enforcement of, or any payment under, an agreement of indemnification entered into by a company;

|

|

|

•

|

|

order a company to pay some or all of the expenses actually and reasonably incurred by any person in obtaining an order under the courted order indemnity section of the BCBCA; or

|

|

|

•

|

|

make any other order the court considers appropriate.

|

The BCBCA provides that a company may

purchase and maintain insurance for the benefit of an eligible party or the heirs and personal or other legal representatives of the eligible party against any liability that may be incurred by reason of the eligible party being or having been a

director or officer of, or holding or having held a position equivalent to that of a director or officer of, the company or an associated corporation.

|

|

|

|

|

Exhibit No.

|

|

Description

|

|

|

|

|

2.1

|

|

Membership Interest Purchase Agreement by and between Northstar Healthcare Surgery Center—Houston, LLC, Nobilis Health Corp., and Elite Center

for Minimally Invasive Surgery LLC dated as of November 15, 2017 (incorporated by reference to Exhibit 10.1 to the Current Report on Form

8-K

filed by the Company on November 21, 2017)

|

|

|

|

|

2.2

|

|

Membership Interest Purchase Agreement by and between Northstar Healthcare Surgery Center—Houston, LLC, Nobilis Health Corp., and Houston Metro

Ortho and Spine Surgery Center LLC dated as of November 15, 2017 (incorporated by reference to Exhibit 10.2 to the Current Report on Form

8-K

filed by the Company on November 21, 2017)

|

|

|

|

|

2.3

|

|

Membership Interest Purchase Agreement by and between Northstar Healthcare Surgery Center—Houston, LLC, Nobilis Health Corp., and Elite Hospital

Management LLC dated as of November 15, 2017 (incorporated by reference to Exhibit 10.3 to the Current Report on Form

8-K

filed by the Company on November 21, 2017)

|

|

|

|

|

2.4

|

|

Membership Interest Purchase Agreement by and between Northstar Healthcare Surgery Center—Houston, LLC, Nobilis Health Corp., and Elite

Sinus Spine and Ortho LLC dated as of November 15, 2017 (incorporated by reference to Exhibit 10.4 to the Current Report on Form

8-K

filed by the Company on November 21, 2017)

|

|

|

|

|

3.1

|

|

Certificate of Incorporation (incorporated by reference to Exhibit 3.1 to Nobilis Health Corp.’s Registration Statement on Form 10 filed by

the Company on August 26, 2014)

|

II-1

1. The undersigned registrant hereby undertakes to file, during any

period in which offers or sales are being made, a post-effective amendment to this registration statement:

(i) To include any prospectus

required by Section 10(a)(3) of the Securities Act of 1933.

(ii) To reflect in the prospectus any facts or events arising after the

effective date of the registration statement (or the most recent post-effective amendment thereof) which, individually or in the aggregate, represent a fundamental change in the information set forth in the registration statement. Notwithstanding

the foregoing, any increase or decrease in volume of securities offered (if the total dollar value of securities offered would not exceed that which was registered) and any deviation from the low or high end of the estimated maximum offering range

may be reflected in the form of prospectus filed with the Commission pursuant to Rule 424(b) if, in the aggregate, the changes in volume and price represent no more than 20 percent change in the maximum aggregate offering price set forth in the

“Calculation of Registration Fee” table in the effective registration statement.

(iii) To include any material information with

respect to the plan of distribution not previously disclosed in the registration statement or any material change to such information in the registration statement.

Provided, however, that paragraphs (1)(i), (ii) and (iii) of this section do not apply if the information required to be included in a

post-effective amendment by those paragraphs is contained in reports filed with or furnished to the Commission by the registrant pursuant to Section 13 or Section 15(d) of the Exchange Act that are incorporated by reference in the

registration statement, or is contained in a form of prospectus filed pursuant to Rule 424(b) that is part of the registration statement.

2. The undersigned registrant hereby undertakes that, for the purpose of determining any liability under the Securities Act of 1933, as

amended, each such post-effective amendment shall be deemed to be a new registration statement relating to the securities offered therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

3. The undersigned registrant hereby undertakes to remove from registration by means of a post-effective amendment any of the securities

being registered that remain unsold at the termination of the offering.

4. The undersigned registrant hereby undertakes that, for the

purposes of determining liability to any purchaser:

(i) If the registrant is relying on Rule 430B:

II-2

(A) For purposes of determining liability under the Securities Act of 1933, each

prospectus filed by the registrant pursuant to Rule 424(b)(3) shall be deemed to be part of the registration statement as of the date the filed prospectus was deemed part of and included in the registration statement; and

(B) Each prospectus required to be filed pursuant to Rule 424(b)(2), (b)(5), or (b)(7) as part of a registration statement in

reliance on Rule 430B relating to an offering made pursuant to Rule 415(a)(1)(i), (vii), or (x) for the purpose of providing the information required by section 10(a) of the Securities Act of 1933 shall be deemed to be part of and included in

the registration statement as of the earlier of the date such form of prospectus is first used after effectiveness or the date of the first contract of sale of securities in the offering described in the prospectus. As provided in Rule 430B, for

liability purposes of the issuer and any person that is at that date an underwriter, such date shall be deemed to be a new effective date of the registration statement relating to the securities in the registration statement to which that prospectus

relates, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or

made in a document incorporated or deemed incorporated by reference in the registration statement or prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such effective date,

supersede or modify any statement that was made in the registration statement or prospectus that was part of the registration statement or made in any such document immediately prior to such effective date; or

(ii) If the registrant is subject to Rule 430C, each prospectus filed pursuant to Rule 424(b) as part of a registration statement relating to

an offering, other than registration statements relying on Rule 430B or other than prospectuses filed in reliance on Rule 430A, shall be deemed to be part of and included in the registration statement as of the date it is first used after

effectiveness. Provided, however, that no statement made in a registration statement or prospectus that is part of the registration statement or made in a document incorporated or deemed incorporated by reference into the registration statement or

prospectus that is part of the registration statement will, as to a purchaser with a time of contract of sale prior to such first use, supersede or modify any statement that was made in the registration statement or prospectus that was part of the

registration statement or made in any such document immediately prior to such date of first use.

The undersigned registrant hereby

undertakes that, for purposes of determining any liability under the Securities Act, each filing of the registrant’s annual report pursuant to Section 13(a) or Section 15(d) of the Exchange Act (and, where applicable, each filing of

an employee benefit plan’s annual report pursuant to Section 15(d) of the Exchange Act) that is incorporated by reference in the registration statement shall be deemed to be a new registration statement relating to the securities offered

therein, and the offering of such securities at that time shall be deemed to be the initial bona fide offering thereof.

Insofar as

indemnification for liabilities arising under the Securities Act of 1933, as amended, may be permitted to directors, officers and controlling persons of the undersigned registrant according the foregoing provisions, or otherwise, the undersigned

registrant has been advised that in the opinion of the Securities and Exchange Commission such indemnification is against public policy as expressed in the Act and is, therefore, unenforceable. In the event that a claim for indemnification against

such liabilities (other than the payment by the Registrant of expenses incurred or paid by a director, officer or controlling person of the registrant in the successful defense of any action, suit or proceeding) is asserted by such director, officer

or controlling person in connection with the securities being registered, the registrant will, unless in the opinion of its counsel the matter has been settled by controlling precedent, submit to a court of appropriate jurisdiction the question

whether such indemnification by it is against public policy as expressed in the Securities Act of 1933, as amended, and will be governed by the final adjudication of such issue.

II-3

SIGNATURES

Pursuant to the requirements of the Securities Act of 1933, the registrant certifies that it has reasonable grounds to believe that it meets

all of the requirements for filing Form

S-3

and has duly caused this registration statement to be signed on its behalf by the undersigned, thereunto duly authorized, in Houston, Texas, on May 1, 2018.

|

|

|

|

|

NOBILIS HEALTH CORP.

|

|

|

|

|

By:

|

|

/s/

Harry Fleming

|

|

|

|

Harry Fleming

|

|

Its:

|

|

Chief Executive Officer, Chairman of the Board and Director

(Principal Executive Officer)

|

|

|

|

|

By:

|

|

/s/

David Young

|

|

|

|

David Young

|

|

Its:

|

|

Chief Financial Officer

(Principal Financial

Officer)

|

Each person whose signature appears below constitutes and appoints Harry Fleming and David Young, and

each of them singly, as his true and lawful attorney in fact and agent, with full powers of substitution and resubstitution, for him and in his name, place and stead, in any and all capacities, to sign any or all amendments (including any

pre-effective

and post-effective amendments) to this Registration Statement, and to sign any registration statement for the same offering covered by this Registration Statement that is to be effective upon filing

pursuant to Rule 462(b) under the Securities Act of 1933, as amended, and all post-effective amendments thereto, and to file the same, with all exhibits thereto, and all documents in connection therewith, with the Securities and Exchange Commission,

granting unto said

attorney-in-fact

and agent, each acting alone, full power and authority to do and perform each and every act and thing requisite and necessary to be

done in and about the premises, as fully to all intents and purposes as he or she might or could do in person, hereby ratifying and confirming all that said

attorney-in-fact

and agent, each acting alone, or his or her substitute or substitutes, may lawfully do or cause to be done by virtue hereof.

Pursuant to the requirements of the Securities Act of 1933, this registration statement has been signed below by the following persons in the

capacities and on the dates indicated.

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Harry Fleming

|

|

|

|

|

|

May 1, 2018

|

|

Harry Fleming

|

|

|

|

|

|

|

|

Chief Executive Officer, Chairman of the Board and Director

(Principal Executive Officer)

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ David Young

|

|

|

|

|

|

May 1, 2018

|

|

David Young

|

|

|

|

|

|

|

|

Chief Financial Officer

(Principal Financial Officer)

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Steven Ozonian

|

|

|

|

|

|

May 1, 2018

|

|

Steven Ozonian

|

|

|

|

|

|

|

|

Director

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Neil Badlani, M.D.

|

|

|

|

|

|

May 1, 2018

|

|

Neil Badlani, M.D.

|

|

|

|

|

|

|

|

Director

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Mike Nichols

|

|

|

|

|

|

May 1, 2018

|

|

Mike Nichols

|

|

|

|

|

|

|

|

Director

|

|

|

|

|

|

|

II-4

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Tom Foster

|

|

|

|

|

|

May 1, 2018

|

|

Tom Foster

|

|

|

|

|

|

|

|

Director

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

/s/ Susan Watt

|

|

|

|

|

|

May 1, 2018

|

|

Susan Watt

|

|

|

|

|

|

|

|

Director

|

|

|

|

|

|

|

II-5

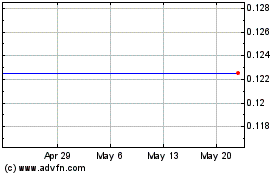

Nobilis Health (AMEX:HLTH)

Historical Stock Chart

From Jun 2024 to Jul 2024

Nobilis Health (AMEX:HLTH)

Historical Stock Chart

From Jul 2023 to Jul 2024