Gold miners have been extremely volatile as of late as gold prices

have wildly oscillated. And since miners often trade as a more

explosive play on the underlying metal, there have definitely been

some big moves in the miner ETF world recently.

This is particularly true when investors look to the leveraged gold

miner ETF space, with products like

Daily Gold Miners Bull

3x Shares (NUGT) and

Daily Gold Miners Bear 3x

Shares (DUST). These two products—which look to take 300%

daily moves of their underlying NYSE Arca Gold Miners Index—have

seen truly astounding performances lately with DUST adding 41% in

the past month, and NUGT losing a similar amount over the past 30

days (see all the leveraged equity ETFs here).

Clearly, big moves can happen in leveraged products targeting this

space, making ETFs like this very interesting plays for short term

traders in the metals space. And now, given the volatility and the

heavy trader interest, it appears as if Direxion isn’t stopping at

just the ‘regular’ gold miners, and that it is now expanding its

leveraged and inverse lineup to the junior gold miners space

too.

Junior Gold Miners in Focus

Stocks in this segment are even more volatile than their large cap

counterparts, and can see even bigger moves when gold prices are

either soaring or sliding. This makes these stocks great choices

for those seeking big bang for your buck plays on a move in

gold.

Currently, the space is dominated by the

Market Vectors

Junior Gold Miners ETF (GDXJ), an unleveraged ETF that has

about $1.75 billion in assets, and sees volume of about one million

shares a day. This fund now has some leveraged and inverse

counterparts though, as Direxion has just released its

Daily Junior Gold Miners Index Bull 3x Shares

(JNUG) and the

Daily Junior Gold Miners Index Bear

3x Shares (JDST).

These ETFs look to act as daily rebalancing cousins to GDXJ,

tracking the same index but using 300% leverage. These give JNUG

and JDST exposure to about 70 companies, with a focus on small caps

(see 3 Small Cap Stocks Leading the Market Higher).

In terms of national exposure, Canada takes up nearly 60%, while

Australia (20%), and the U.S. (9%) round out the top three

countries.

For individual companies, no single firm makes up more than 6% of

assets, while LionGold, Argonaut Gold, and Torex Gold Resources

account for the current top three.

Both funds look to have net expense ratios of 95 basis points a

year, putting them in line with many other leveraged and inverse

ETFs, but quite a bit pricier than GDXJ’s 54 basis point cost per

year.

How Do They Fit in a Portfolio?

These ETFs could be interesting picks for short-term traders who

want to make a directional bet on small cap gold miners. Both JNUG

and JDST look to have extreme levels of volatility, and huge moves

should be expected in the funds (also see Why I Hate Volatility

ETFs).

These ETFs shouldn’t be used by long term investors though, as the

daily rebalancing and triple leverage make these inappropriate for

buy-and-hold types. Additionally, bid ask spreads may be a bit wide

in the beginning, especially if volume levels and assets are low

initially.

Either way, these two represent more solid options in the gold

mining space, and could be invaluable ways for traders to get a

different type of exposure in the market.

“At a time when a growing number of investors are expressing

interest in exposure to companies engaged in the exploration and

production of gold, we are offering liquid exposure to this sector

with the benefit of added leverage,” said Eric Falkeis, President

of Direxion in a press release. “These two Funds are designed for

traders that wish to take a bullish or bearish stance on the

gold-mining industry.”

Bottom Line

Both NUGT and DUST have been very popular with investors, as both

see millions of shares move hands every day. These have undoubtedly

attracted interest thanks to their huge moves, and their ability to

play off of gold in a big way (see Time to Buy Covered Call Gold

and Silver ETFs?).

Both JNUG and JDST look to do the same thing, and if anything, will

probably have bigger moves than their large cap-focused

counterparts. This could make them very popular in short order,

though buyers should definitely use extreme caution before diving

into either one of these geared ETFs.

Want the latest recommendations from Zacks Investment Research?

Today, you can download

7 Best Stocks for the Next 30

Days. Click to get this free report >>

DIR-D GM BR 3X (DUST): ETF Research Reports

MKT VEC-GOLD MI (GDX): ETF Research Reports

MKT VEC-JR GOLD (GDXJ): ETF Research Reports

DIR-DJGMI BR 3X (JDST): ETF Research Reports

DIR-DJGMI BL 3X (JNUG): ETF Research Reports

DIR-D GM BL 3X (NUGT): ETF Research Reports

To read this article on Zacks.com click here.

Zacks Investment Research

Want the latest recommendations from Zacks Investment Research?

Today, you can download 7 Best Stocks for the Next 30 Days. Click

to get this free report

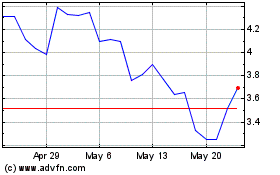

Direxion Daily Junior Go... (AMEX:JDST)

Historical Stock Chart

From Feb 2025 to Mar 2025

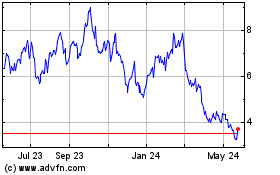

Direxion Daily Junior Go... (AMEX:JDST)

Historical Stock Chart

From Mar 2024 to Mar 2025